Amazon Product Data Analytics by ASIN Number

Amazon Product Data Analytics by ASIN Number helps scrape Amazon store data using ASINs to track pricing, reviews, rankings, and product insights efficiently.

Quick commerce (Q-commerce) has transformed the grocery retail sector with ultra-fast delivery models and hyper-localized inventory. Brands are now challenged to deliver consistent stock availability, accurate pricing, and on-demand promotional visibility. This is where Digital Shelf analytics for Q-Commerce becomes essential.

The surge in eCommerce grocery apps and real-time micro-fulfillment hubs demands that brands adopt intelligent monitoring tools. With fragmented online shelf spaces across marketplaces and delivery apps, tracking dynamic prices, promotions, and availability is no longer optional—it's mission-critical.

According to industry data, over 62% of grocery Q-commerce sales in 2024 were influenced by digital shelf visibility, and SKU-level disruptions rose by 23% from 2020 to 2025 across top platforms. Tools like grocery delivery app shelf monitoring and Q-commerce grocery stock tracking are helping brands stay competitive with 24/7 insights.

This report outlines how Q-commerce leaders are turning to Lazada Product Data Scraper, AI analytics, and Digital Shelf analytics for Q-Commerce to unlock real-time agility and market edge.

The speed of Q-commerce demands real-time promotional precision. With AI-Driven grocery Promotional data analysis, brands can now monitor discount trends, flash sale timings, and promotional compliance across apps like Zepto, Blinkit, and Getir.

Promotional effectiveness often hinges on timing and visibility. Poorly executed promotions lead to lost margins and underperformance. Advanced AI analytics provides dashboards that monitor in-app placements, track compliance with planned discounts, and alert teams to discrepancies in real time.

| Year | Promo Compliance Rate (%) | Lost Revenue Due to Promo Errors (USD Million) |

|---|---|---|

| 2020 | 84% | $310 |

| 2021 | 81% | $350 |

| 2022 | 78% | $430 |

| 2023 | 76% | $490 |

| 2024 | 80% | $410 |

| 2025 | 82% (projected) | $370 (projected) |

With predictive promotion mapping, brands can avoid margin leakage, correct pricing errors instantly, and evaluate campaign ROI in real time. These insights help brands plan efficient promotions and assess their competitors’ campaign success, enabling better budget allocation and more impactful flash sales.

In the high-velocity world of Q-commerce, product unavailability is not just a temporary inconvenience—it’s a recurring revenue drain. Grocery product availability tracking has become a critical capability for modern grocery brands operating on platforms like Blinkit, Instamart, and Zepto. Real-time monitoring of stock levels across dark stores, micro-fulfillment centers, and partner vendors ensures brands can proactively mitigate out-of-stock (OOS) situations before they impact customer loyalty.

| Year | Avg. Stockout Rate (%) | Brands Using Availability Trackers (%) |

|---|---|---|

| 2020 | 11.3% | 18% |

| 2021 | 10.6% | 25% |

| 2022 | 9.4% | 36% |

| 2023 | 8.2% | 49% |

| 2024 | 7.7% | 61% |

| 2025 | 6.5% (est.) | 72% (est.) |

From 2020 to 2024, the average stockout rate has steadily declined, thanks to the adoption of real-time Digital Shelf analytics for Q-Commerce. Brands using availability trackers have grown from just 18% in 2020 to a projected 72% by 2025. This adoption aligns with the growing consumer expectation for on-demand fulfillment.

With real-time Q-commerce Analytics, brands can:

For example, a leading FMCG brand leveraging real-time inventory tracking on Swiggy Instamart reduced its weekly stockouts by 27% within just two months. This led to a 12% uplift in fulfilled orders and over 8% improvement in customer retention metrics.

This transformation is further powered by Q-commerce grocery stock tracking tools that integrate APIs directly with retailer systems. These tools provide:

As Q-commerce players reduce delivery times to under 15 minutes, the pressure on brands to never miss peak demand has intensified. Missing shelf presence for even a few hours can mean losing hundreds of orders, especially during weekends or flash sales.

By investing in Digital Shelf analytics for Q-Commerce, brands can stay ahead of demand, ensure operational agility, and protect market share in an ultra-competitive grocery delivery landscape.

In the ultra-fast Q-commerce ecosystem, data that’s even a few hours old becomes obsolete. Grocery brands are now realizing that real-time Q-commerce Analytics is no longer optional—it’s a fundamental necessity. Whether it's dynamic pricing, last-mile fulfillment efficiency, or competitor tracking, acting on live data is the only way to maintain visibility and control in such a volatile, app-driven environment.

From dark store stock levels to price fluctuations on Zepto and Instamart, the industry has shifted from daily updates to minute-level decisions. Without real-time monitoring, brands risk delayed responses to stockouts, uncompetitive pricing, and missed promotional windows.

| Metric | 2020 | 2025 (Projected) |

|---|---|---|

| Avg. Update Latency (min) | 120 | 5 |

| Fulfillment Accuracy (%) | 89% | 97% |

| Real-time Decisions (%) | 22% | 79% |

In 2020, the average update latency for Q-commerce brands was two hours. By 2025, that window is projected to shrink to just 5 minutes. Fulfillment accuracy is expected to climb from 89% to 97%, largely due to better access to live data across the digital shelf.

Platforms are updating their assortment, prices, and availability several times a day. Without Digital Shelf analytics for Q-Commerce, brands lag behind, often making decisions based on outdated snapshots. That’s where real-time dashboards and data feeds from Lazada app product data and other global sources come into play.

By leveraging grocery delivery app shelf monitoring tools powered by AI, brands can automatically adapt their assortment and pricing in response to competitor behavior or sudden spikes in demand. These insights feed directly into supply chain, marketing, and product teams for coordinated execution.

One fast-moving brand used real-time Q-commerce Analytics to identify a sudden competitor stockout during a city-wide flash sale. Within minutes, they increased visibility and ad spend on that SKU in the affected zone—resulting in a 40% spike in sales that day.

This is the pace of modern Q-commerce. Brands that continue to rely on static dashboards or post-mortem reports are bound to lose to faster, data-equipped competitors. In the realm of grocery delivery, real-time visibility equals real-time advantage.

Understanding what’s available on the Q-commerce shelf, where, and why, is fundamental to staying relevant across cities. With Q-commerce assortment & availability insights, brands can benchmark their product availability across various markets, identifying duplicates, gaps, and local mismatches that affect revenue.

Assortment visibility provides detailed intelligence on:

| City | SKUs Available | Unique Listings | Price Variance (%) |

|---|---|---|---|

| Mumbai | 8,320 | 7,850 | 13% |

| Delhi | 7,960 | 7,340 | 16% |

| Bengaluru | 7,410 | 6,920 | 11% |

| Chennai | 6,980 | 6,530 | 10% |

Brands deploying SKU-level tracking for grocery brands can tailor strategies based on hyperlocal preferences. For example, a SKU that sells well in Mumbai might underperform in Chennai due to lack of relevance, supply chain delays, or competitor pricing.

This granular view allows for:

Using Lazada app data extraction, brands can collect and analyze assortment data from a region-specific lens—helping them identify unique or duplicated listings, pricing differences, or missed category opportunities. Especially for startups entering Southeast Asian markets or replicating Q-commerce playbooks in the U.S., this level of insight informs not just retail strategy but also product innovation and demand forecasting.

Q-commerce thrives on rapid decisions. With multiple pricing events per day—driven by flash sales, competitor movements, and customer demand—brands must adopt a Dynamic pricing strategy for quick commerce. Static pricing models simply can’t keep up.

| Year | Brands Using Dynamic Pricing (%) | Avg. Revenue Growth (%) |

|---|---|---|

| 2020 | 14% | 3.5% |

| 2022 | 33% | 5.9% |

| 2025 | 61% (projected) | 9.3% (projected) |

Brands that dynamically adjust prices in real-time see higher margins, fewer cart abandonments, and increased conversions. AI tools can monitor:

When combined with grocery delivery app shelf monitoring, brands can execute price changes directly on the platforms or via product feeds. This immediate alignment with market behavior minimizes lost sales and strengthens visibility during peak buying windows.

Platforms like Zepto and Lazada change pricing several times per day. By using solutions like Lazada Product Data Scraper and integrating with a Lazada Data Scraping API, brands receive real-time alerts on these changes—empowering them to auto-adjust and stay competitive.

The result? More efficient promotions, higher ROI per SKU, and better alignment with customer expectations across every zone of operation.

In Q-commerce, you’re not just fighting for price—you’re competing on product visibility, reviews, availability, and even delivery time. That’s why brands now Scrape Competitor Digital Shelf data to decode market movement across apps like Blinkit, Dunzo, and Lazada.

Competitor scraping reveals:

Benefits include:

By leveraging Q-commerce grocery stock tracking, brands gain visibility into SKU fluctuations at a city or even ZIP-code level. Say a major competitor goes out of stock in Bengaluru for a trending snack item—brands with real-time shelf tracking can respond with promotions or increase their ad bids to capture demand.

American startups expanding into Asia can now access Lazada data for U.S. startups, enabling them to mimic successful product mixes and avoid oversaturated categories. With Lazada analytics for startup market research, they get strategic insights into what’s working at a hyperlocal level—even before entering a new market.

Integrating Web Scraping Lazada Data into a centralized platform empowers these businesses to make high-confidence decisions across merchandising, digital marketing, and logistics.

Actowiz Metrics provides AI-powered Web Scraping Services and Digital Shelf analytics for Q-Commerce, offering enterprise-grade tracking solutions for grocery brands. With tools like:

Actowiz enables brands to access deep product analytics, real-time shelf monitoring, and predictive price trends across hundreds of grocery delivery apps. Whether you aim to optimize promotions, reduce stockouts, or implement a dynamic pricing engine, we provide end-to-end support powered by the Power of Lazada API Data Sets and market-driven intelligence.

The competitive edge in 2025 lies in visibility. Brands that embrace Digital Shelf analytics for Q-Commerce are outperforming peers through intelligent stock management, optimized pricing, and hyper-targeted promotions. With grocery delivery app shelf monitoring and real-time dashboards, decision-makers now act in minutes—not days. At Actowiz Metrics, we empower grocery brands to lead in the Q-commerce race using real-time analytics, API integrations, and Web Scraping lazada Data solutions. Start leveraging actionable insights today. Ready to scrape smarter, optimize faster, and win in the world of Q-Commerce? Contact Actowiz Metrics for a tailored demo now!

Discover how our Beauty & Personal Care Discount Tracker enabled a leading brand to monitor promotions, optimize pricing, and gain a competitive advantage in real time.

Explore NowChristmas Luxury Price Surge Detection Using Price Tracking for Designer Bags & Shoes on Christmas reveals pricing spikes and demand trends across 1M+ luxury listings.

Explore NowChristmas Luxury Price Surge Detection Using Price Tracking for Designer Bags & Shoes on Christmas reveals pricing spikes and demand trends across 1M+ luxury listings.

Explore Now

Browse expert blogs, case studies, reports, and infographics for quick, data-driven insights across industries.

Amazon Product Data Analytics by ASIN Number helps scrape Amazon store data using ASINs to track pricing, reviews, rankings, and product insights efficiently.

Discover pricing gaps, demand trends, and buyer value with Brand New vs Refurbished vs Used iPhones Data Analytics on eBay for real-time product and market insights.

Christmas 2025 Grocery Price Wars Data Analytics comparing USA, UK, Canada, Europe, and Philippines grocery prices. Explore trends, demand shifts, and festive pricing changes.

Top 100 Christmas Gifts 2025 Data Analytics analyzes 1M product listings to rank top gifts, pricing trends, demand signals, and seasonal buying behavior.

Holiday Flash Sale Benchmarking – Farfetch vs MyTheresa vs Net-A-Porter analyzes real-time discounts, price shifts, stock trends, and luxury e-commerce sale strategies.

A 2025 luxury market study using Gucci vs Prada Luxury Product Data Analytics to compare pricing, demand, assortment depth & digital retail performance.

Explore Luxury vs Smartwatch - Global Price Comparison 2025 to compare prices of luxury watches and smartwatches using marketplace data to reveal key trends and shifts.

E-Commerce Price Benchmarking: Gucci vs Prada reveals 2025 pricing trends for luxury handbags and accessories, helping brands track competitors and optimize pricing.

Discover how menu data scraping uncovers trending dishes in 2025, revealing popular recipes, pricing trends, and real-time restaurant insights for food businesses.

USA market insights featuring Toys & Games Top Brands Analysis on Amazon, including pricing, discounts, ratings, reviews, and brand performance trends.

Discover pricing, ratings, stock, and brand trends in our Amazon Health & Household Report 2025 with detailed Health & Household Brands Analysis on Amazon.

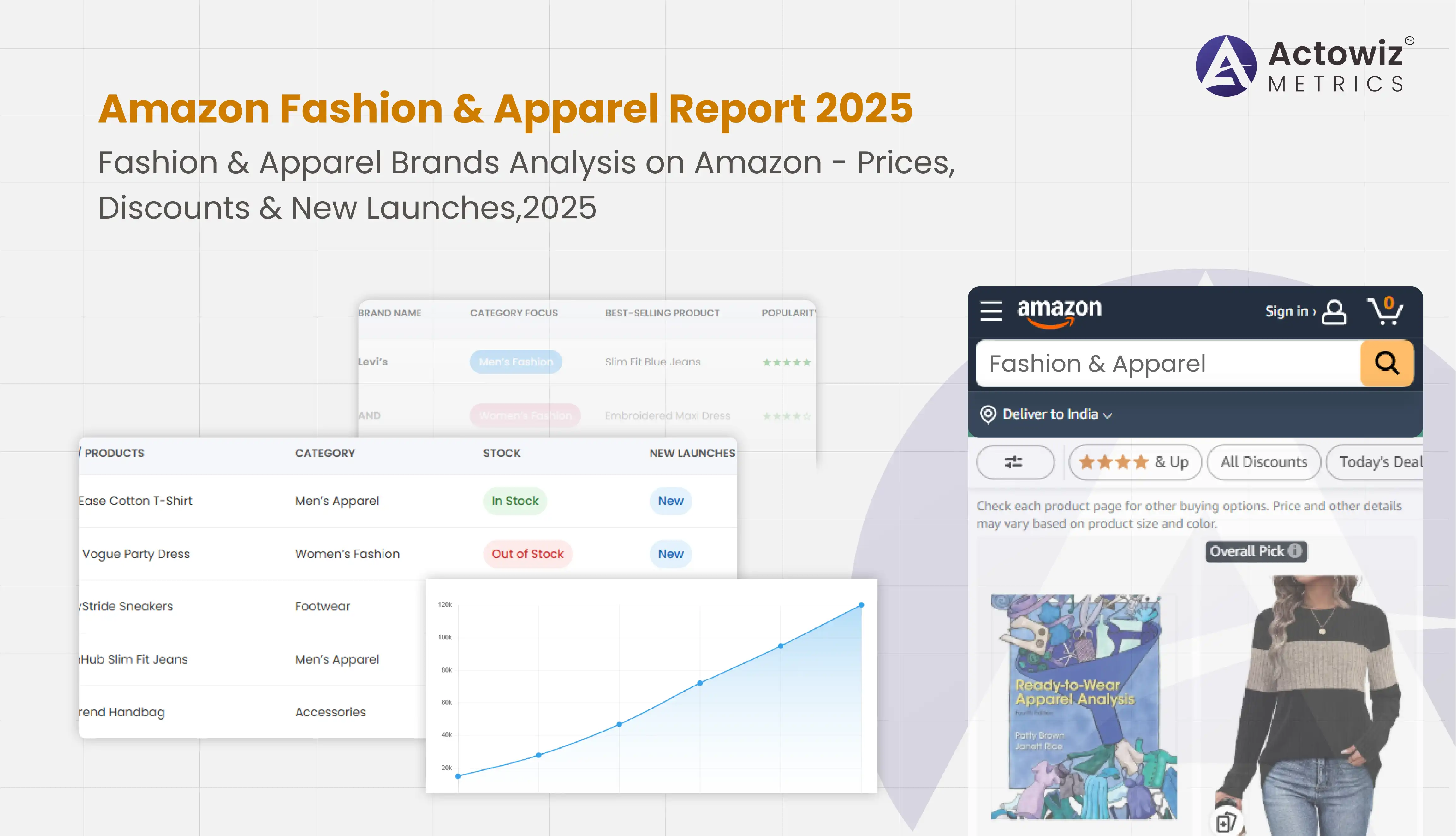

Amazon Fashion & Apparel Report 2025: Fashion & Apparel Brands Analysis on Amazon, tracking prices, discounts, new launches, and trends.

Whatever your project size is, we will handle it well with all the standards fulfilled! We are here to give 100% satisfaction.

Any analytics feature you need — we provide it

24/7 global support

Real-time analytics dashboard

Full data transparency at every stage

Customized solutions to achieve your data analysis goals

Browse expert blogs, case studies, reports, and infographics for quick, data-driven insights across industries.

Learn how Amazon MAP Enforcement protects brand value, ensures fair pricing, and helps sellers maintain margins with consistent policy compliance strategies.

Explore How Travel data analytics for OTAs helps drive smarter decisions, refine pricing, improves customer targeting & boost efficiency across travel platforms.

Unlock smarter decisions with E-commerce Data Analytics. Track trends, pricing, and performance to grow your e-commerce brand efficiently.

Discover how Fast Food data analytics helped an American fast food chain increase sales by leveraging real-time insights into menu trends and customer behavior.

Explore how U.S. real estate data scraping empowered a leading property brand to analyze regional demand and make data-driven expansion decisions.

Discover how a leading supermarket chain used Grocery Data Analytics to track inventory, optimize pricing, and boost sales by 27% through smart, data-driven insights.

Explore how Target’s private label thrives through Good & Gather Brand Loyalty Analytics —uncover data-driven insights shaping consumer trust and long-term loyalty.

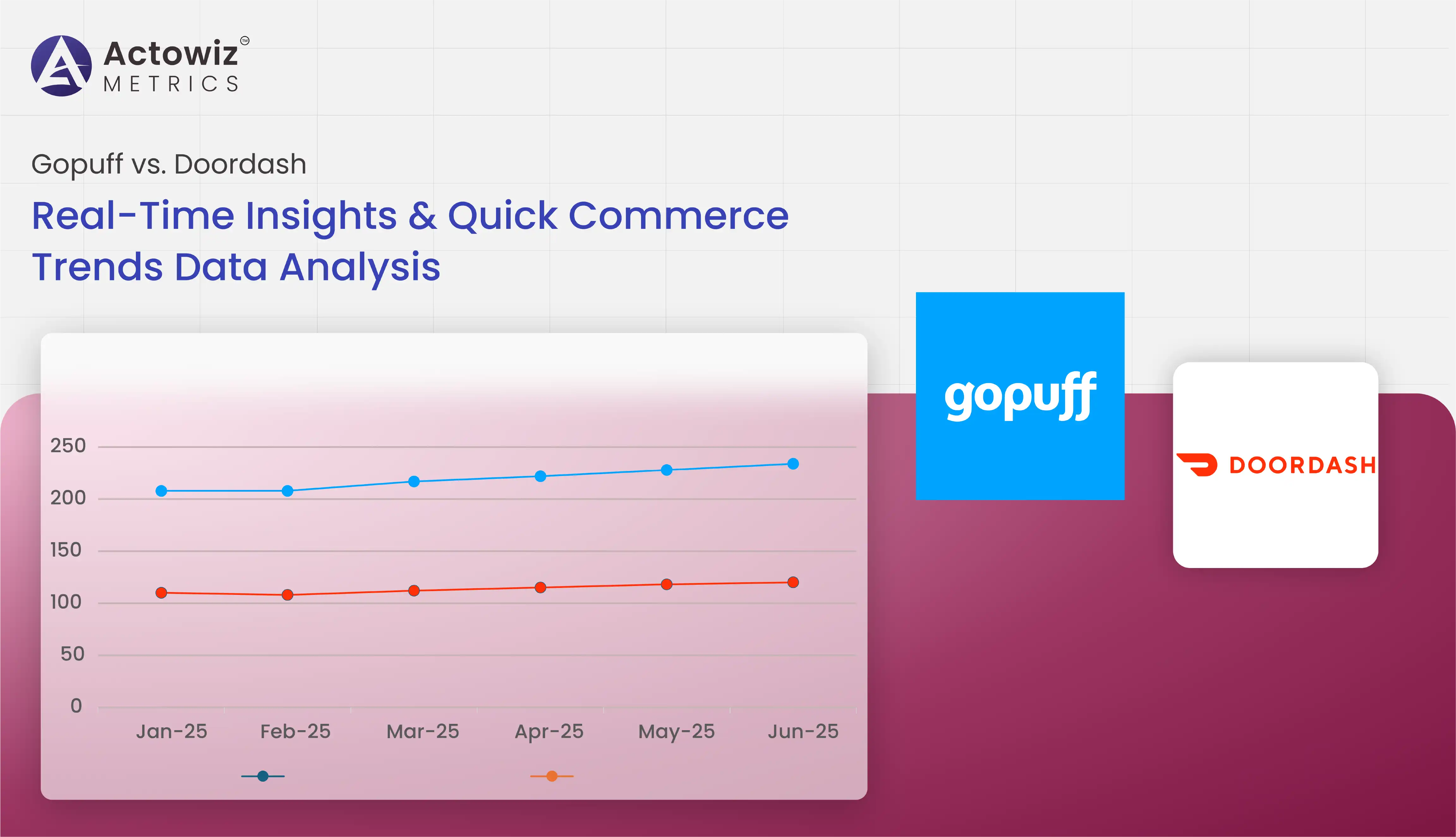

Explore Gopuff vs. Doordash through Quick Commerce Trends Data Analysis. Gain real-time insights into delivery speed, pricing, and consumer behavior in Q-commerce.

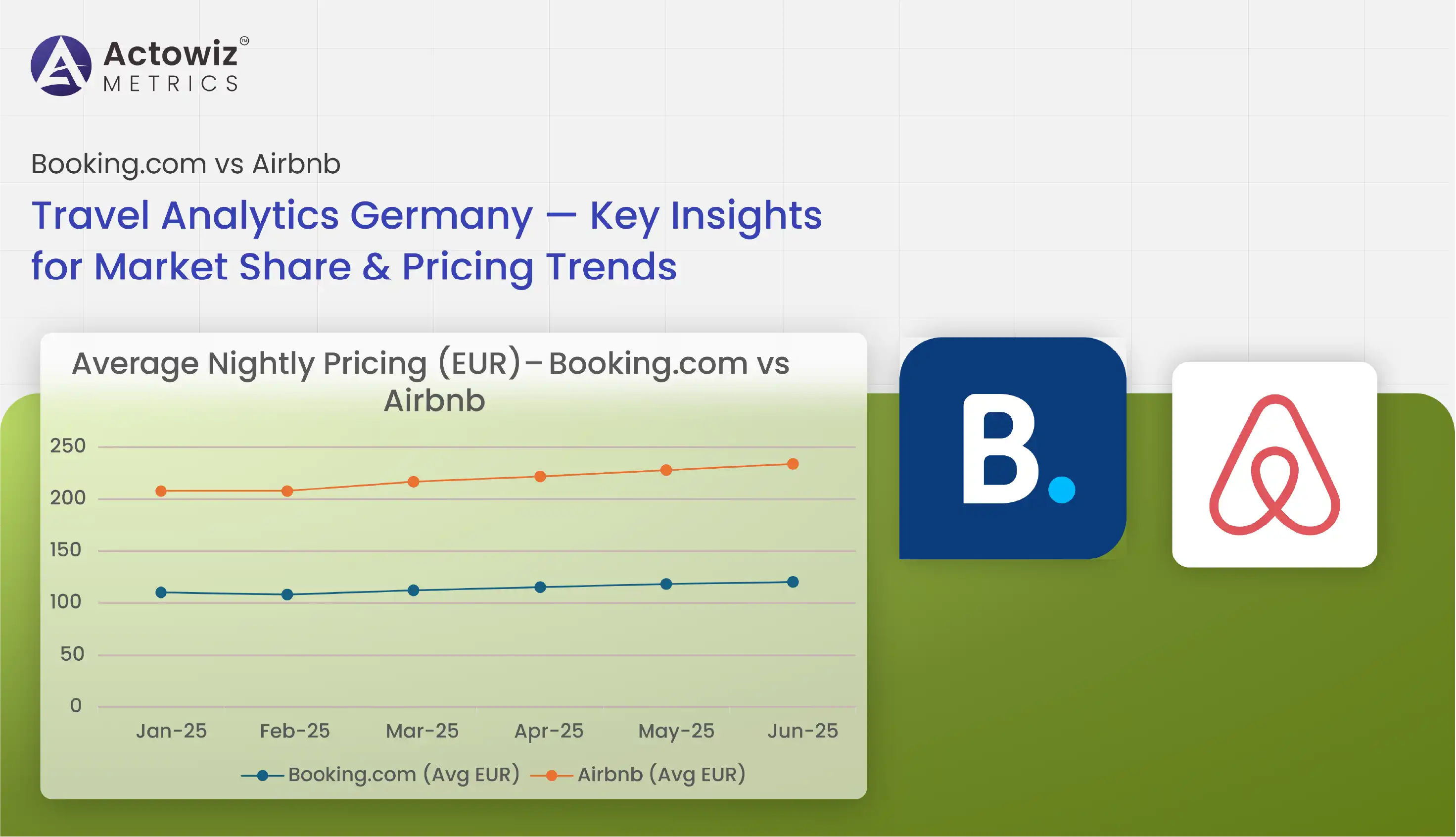

Discover Booking.com vs Airbnb Travel Analytics Germany trends, market share shifts, and pricing insights to plan smarter, compete better, and grow in 2025.

Discover how our Beauty & Personal Care Discount Tracker enabled a leading brand to monitor promotions, optimize pricing, and gain a competitive advantage in real time.

Explore NowChristmas Luxury Price Surge Detection Using Price Tracking for Designer Bags & Shoes on Christmas reveals pricing spikes and demand trends across 1M+ luxury listings.

Explore NowChristmas Luxury Price Surge Detection Using Price Tracking for Designer Bags & Shoes on Christmas reveals pricing spikes and demand trends across 1M+ luxury listings.

Explore Now

Browse expert blogs, case studies, reports, and infographics for quick, data-driven insights across industries.

Amazon Product Data Analytics by ASIN Number helps scrape Amazon store data using ASINs to track pricing, reviews, rankings, and product insights efficiently.

Discover pricing gaps, demand trends, and buyer value with Brand New vs Refurbished vs Used iPhones Data Analytics on eBay for real-time product and market insights.

Christmas 2025 Grocery Price Wars Data Analytics comparing USA, UK, Canada, Europe, and Philippines grocery prices. Explore trends, demand shifts, and festive pricing changes.

Top 100 Christmas Gifts 2025 Data Analytics analyzes 1M product listings to rank top gifts, pricing trends, demand signals, and seasonal buying behavior.

Holiday Flash Sale Benchmarking – Farfetch vs MyTheresa vs Net-A-Porter analyzes real-time discounts, price shifts, stock trends, and luxury e-commerce sale strategies.

A 2025 luxury market study using Gucci vs Prada Luxury Product Data Analytics to compare pricing, demand, assortment depth & digital retail performance.

Explore Luxury vs Smartwatch - Global Price Comparison 2025 to compare prices of luxury watches and smartwatches using marketplace data to reveal key trends and shifts.

E-Commerce Price Benchmarking: Gucci vs Prada reveals 2025 pricing trends for luxury handbags and accessories, helping brands track competitors and optimize pricing.

Discover how menu data scraping uncovers trending dishes in 2025, revealing popular recipes, pricing trends, and real-time restaurant insights for food businesses.

USA market insights featuring Toys & Games Top Brands Analysis on Amazon, including pricing, discounts, ratings, reviews, and brand performance trends.

Discover pricing, ratings, stock, and brand trends in our Amazon Health & Household Report 2025 with detailed Health & Household Brands Analysis on Amazon.

Amazon Fashion & Apparel Report 2025: Fashion & Apparel Brands Analysis on Amazon, tracking prices, discounts, new launches, and trends.

Whatever your project size is, we will handle it well with all the standards fulfilled! We are here to give 100% satisfaction.

Any analytics feature you need — we provide it

24/7 global support

Real-time analytics dashboard

Full data transparency at every stage

Customized solutions to achieve your data analysis goals