Protein Bar Demand Analytics on Zepto & Blinkit – Bangalore

Pringles Food Data Analytics 2026 reveals how data-driven insights improve pricing, demand forecasting, and supply chain efficiency in a dynamic snack market.

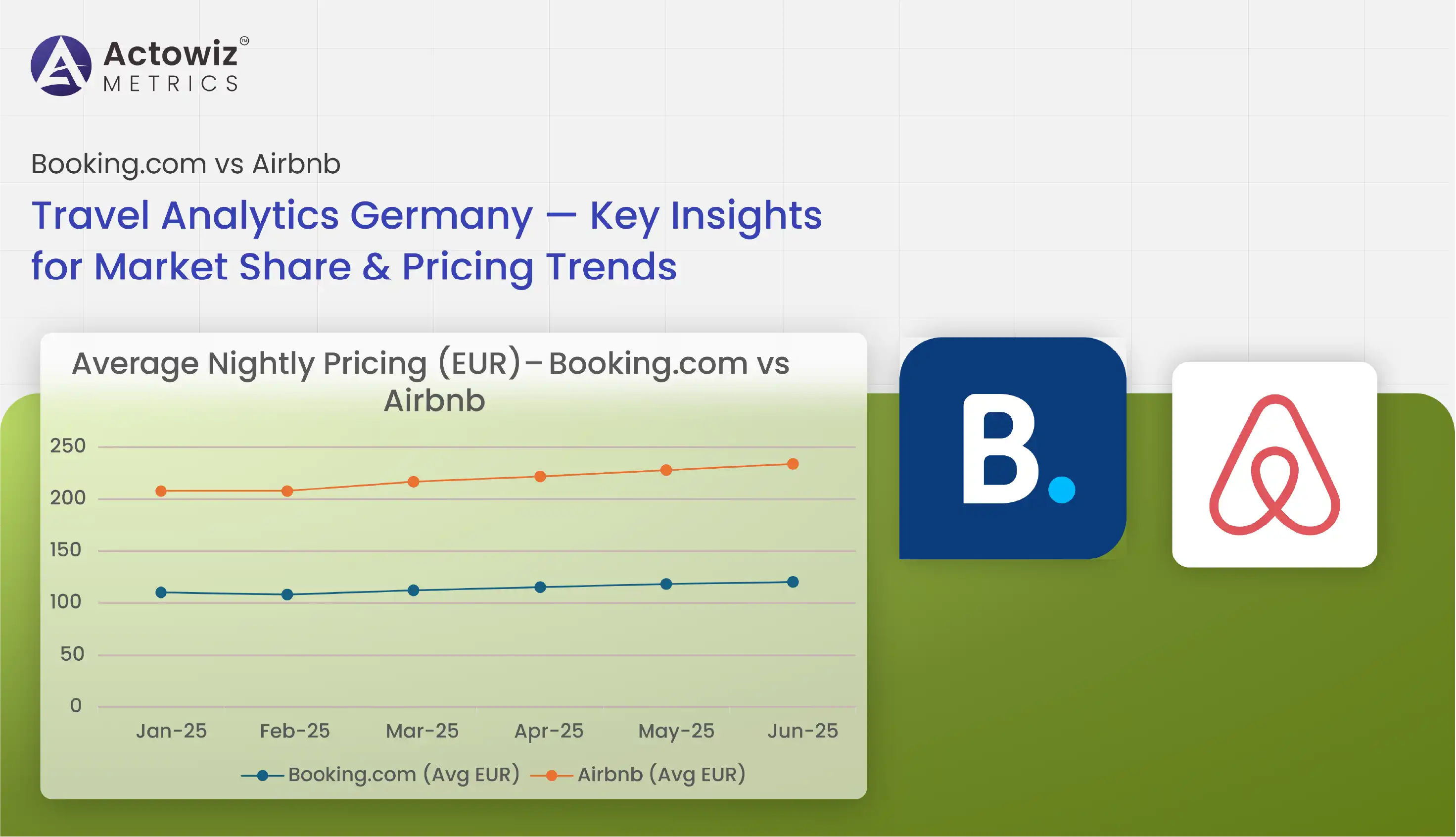

The travel accommodation market in Germany has evolved rapidly over the past five years, fueled by shifting traveler habits, the rise of short-term rentals, and growing competition among Online Travel Agencies (OTAs). Understanding Booking.com vs Airbnb Travel Analytics is now critical for Germany hoteliers, property managers, investors, and tourism strategists who need to navigate this dynamic space.

Germany’s tourism industry ranks among Europe’s strongest, with over 450 million overnight stays in 2023 alone (DESTATIS). Travelers’ preferences are split between traditional hotels and increasingly popular vacation rentals — making the Booking.com vs Airbnb Travel Analytics debate essential for market forecasting.

The insights gained through Germany travel data analytics, Germany Travel Trends Scraping, and modern Predictive analytics for OTAs reveal how platforms like Airbnb and Booking.com differ in demand patterns, pricing behavior, seasonal surges, and promotional strategies.

This Actowiz Metrics Research Report unpacks the story behind Booking.com vs Airbnb Travel Analytics of Germany from 2020–2025. It explores how German travelers choose between hotels and private rentals, analyzes city-level pricing shifts, and explains how scraping and analytics tools like Airbnb booking trends analysis and Extract Booking.com promotional data empower smarter decisions.

| Year | % Hotel Stays | % Short-Term Rentals |

|---|---|---|

| 2020 | 78% | 22% |

| 2021 | 75% | 25% |

| 2022 | 70% | 30% |

| 2023 | 68% | 32% |

| 2024 | 66% | 34% |

| 2025 (est.) | 65% | 35% |

Insight: Vacation rentals’ share of overnight stays in Germany is projected to reach 35% by 2025, according to Germany vacation rental data insights. This means hotel brands must adapt, offering apartment-style rooms or partnering with OTAs for extended-stay offerings.

With Germany Hotel booking trends and real-time analytics, operators adjust room types, amenities, and cancellation policies to stay relevant in a short-term rental world.

Airbnb vs Booking.com demand analysis shows that short-term rental rates are often more flexible — spiking during local events but dropping sharply off-season. Hotels listed on Booking.com follow steadier pricing bands, especially chains.

| Month | Avg. Airbnb Nightly Rate (€) | Avg. Hotel Nightly Rate (€) |

|---|---|---|

| Jan | €72 | €89 |

| Jun | €105 | €100 |

| Sep | €120 | €115 |

| Dec | €110 | €120 |

Insight: Using Airbnb booking trends analysis and Germany Travel Trends Scraping, hosts and hoteliers can see that Airbnb rates swing up to 60% between January and September. Hotels keep prices more stable but run aggressive promotions, which scraping tools like Extract Booking.com promotional data can track daily.

City-level trends show sharp variations in the Booking.com vs Airbnb Travel Analytics Germany story. Cities with major trade fairs (Frankfurt, Düsseldorf) see Booking.com hotel surges. Cultural hubs (Berlin, Hamburg) see Airbnb dominance.

| City | Airbnb Avg. Occupancy | Booking.com Avg. Occupancy |

|---|---|---|

| Berlin | 78% | 72% |

| Munich | 70% | 80% |

| Hamburg | 75% | 74% |

| Frankfurt | 62% | 85% |

Insight: According to Travel data insights Germany, major trade events spike hotel bookings by up to 40%, so predictive tools and Germany travel data analytics help adjust inventory and rates in advance.

Event calendars shape local supply and demand. Oktoberfest, Christmas Markets, and international conferences shift rates and occupancy dramatically.

| Event | Airbnb Price Spike | Booking.com Price Spike |

|---|---|---|

| Oktoberfest | +55% | +35% |

| Berlin Film Festival | +40% | +25% |

| Hanover Messe | +30% | +50% |

Insight: These surges highlight the value of Predictive analytics for OTAs — they let property owners prepare well in advance, adjust cancellation terms, and bundle services to attract travelers during competitive windows.

Modern OTAs and hosts rely on scrape Airbnb Germany rental data to pull competitor prices, occupancy trends, and listing details at scale.

| Year | Properties Monitored | Avg. Price Change |

|---|---|---|

| 2020 | 5,000 | 3% |

| 2021 | 8,500 | 4% |

| 2022 | 12,000 | 5% |

| 2023 | 15,000 | 6% |

| 2024 | 18,500 | 7% |

| 2025 (est.) | 20,000+ | 8% |

Insight: Hosts using Germany Travel Trends Scraping and daily updates optimize listing prices dynamically — boosting average yield by up to 15% compared to static pricing.

Travel brands, hosts, and revenue managers now invest in tools like Germany travel data analytics, Airbnb vs Booking.com demand analysis, and Predictive analytics for OTAs to keep up with changing consumer behavior.

| Metric | 2020 | 2025 (Est.) |

|---|---|---|

| OTA Market Share | 68% | 76% |

| Direct Booking Share | 32% | 24% |

| % of Hosts Using Dynamic Pricing | 45% | 70% |

Insight: Automated pricing, scraping, and Travel data insights Germany will become standard. This means that static rate cards will fade — and real-time data will power profits.

Actowiz Metrics empowers property managers, travel brands, and analysts to thrive with powerful Booking.com vs Airbnb Travel Analytics solutions. Our scraping engines deliver clean, structured data on occupancy, rates, promotions, reviews, and demand — all in real time.

We help you:

Our end-to-end solutions mean less manual research, faster insights, and bigger revenue for hosts, hotels, and travel strategists alike.

The fight for travelers in Germany’s booming accommodation market will only intensify. Winners won’t just guess — they’ll use real data to act faster and price smarter. Whether you’re a hotel, an independent host, or an investor, mastering Booking.com vs Airbnb Travel Analytics in Germany can transform your occupancy rates and profits.

Don’t leave your bookings to chance. Contact Actowiz Metrics today to unlock your custom travel data feeds, track your market, and stay two steps ahead in Germany’s competitive travel sector!

Live Data Tracking Dashboard for Keeta Food Delivery App enables real-time order, pricing, and restaurant insights to optimize performance and decisions.

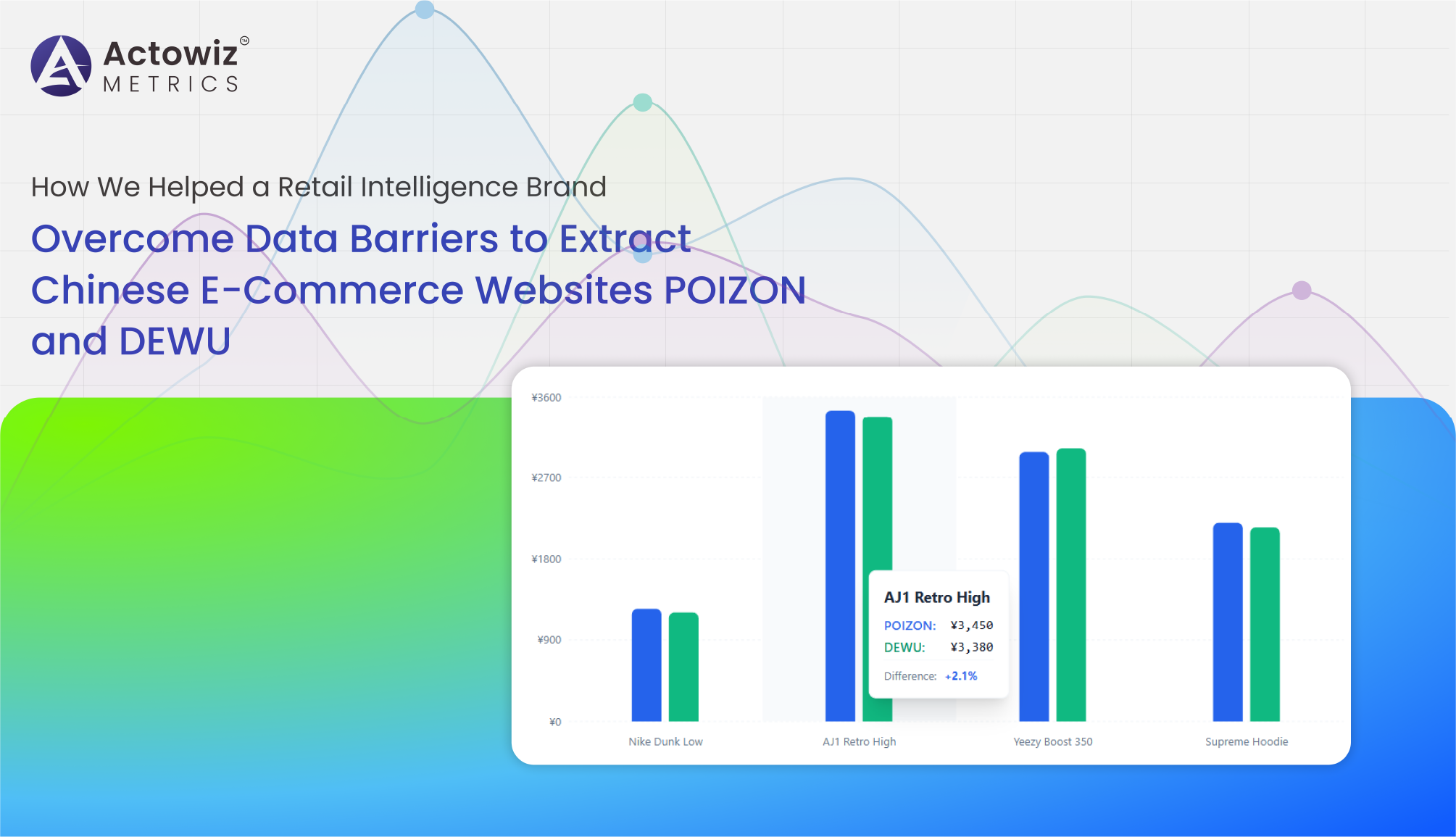

Explore NowHow We Helped a Retail Intelligence Brand Overcome Data Barriers to Extract Chinese E-Commerce Websites POIZON and DEWU for real-time pricing and market insights.

Explore Now

Price Changes Data Monitoring For Amazon & OnBuy UK enables real-time tracking of price movements to optimize promotions, protect margins, and improve pricing decisions.

Explore Now

Browse expert blogs, case studies, reports, and infographics for quick, data-driven insights across industries.

Pringles Food Data Analytics 2026 reveals how data-driven insights improve pricing, demand forecasting, and supply chain efficiency in a dynamic snack market.

KitKat Flavor and Product Trend Data Analysis uncovers consumer flavor preferences, product performance, and innovation trends across key markets.

Gain insights with Size-Level Availability & Demand Data Analytics for Apparel & Accessories to optimize inventory, track trends, and boost sales performance.

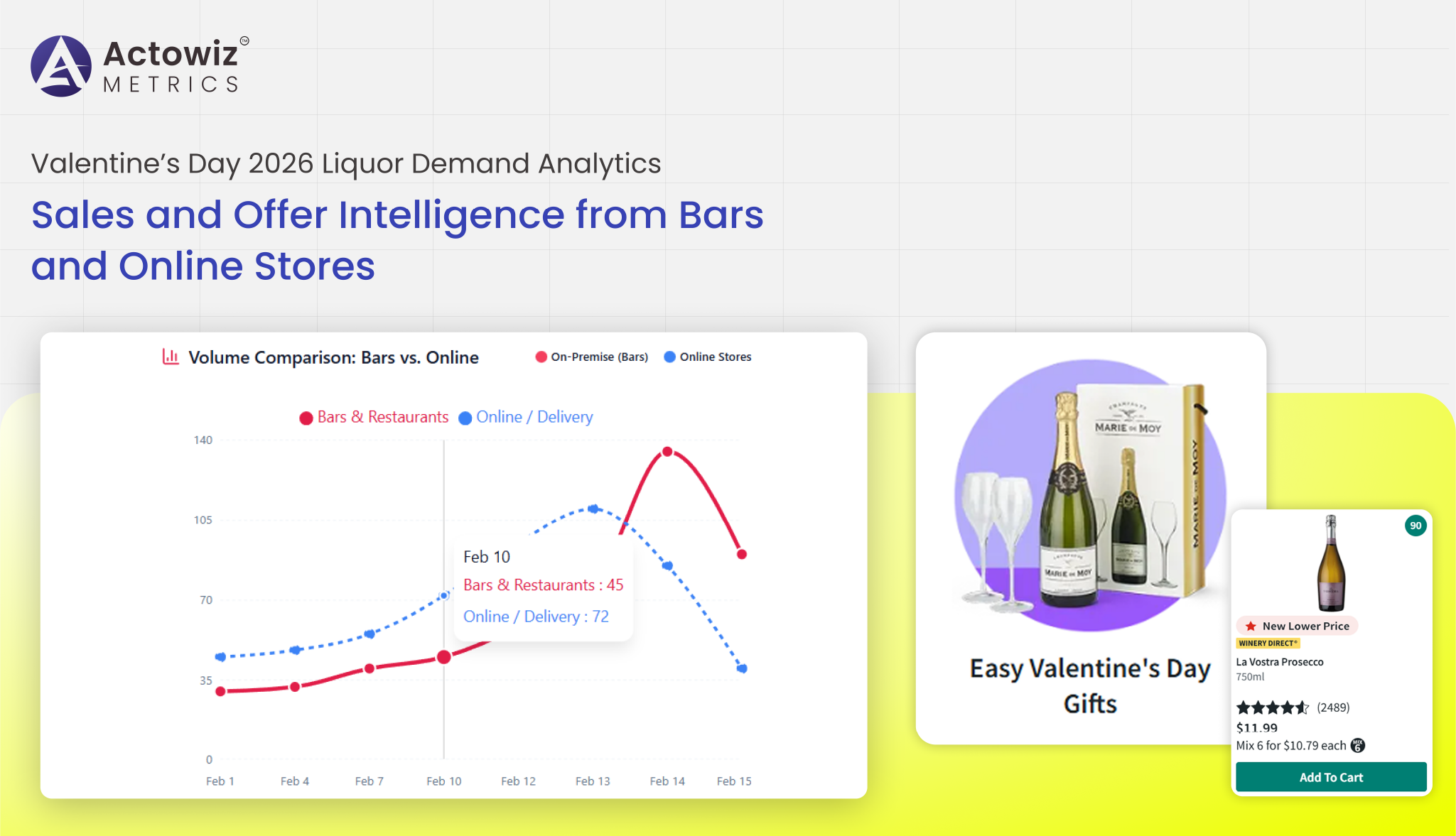

Valentine’s Day 2026 Liquor Demand Analytics highlight growing demand for premium wines, craft spirits, and curated alcohol gifting trends worldwide.

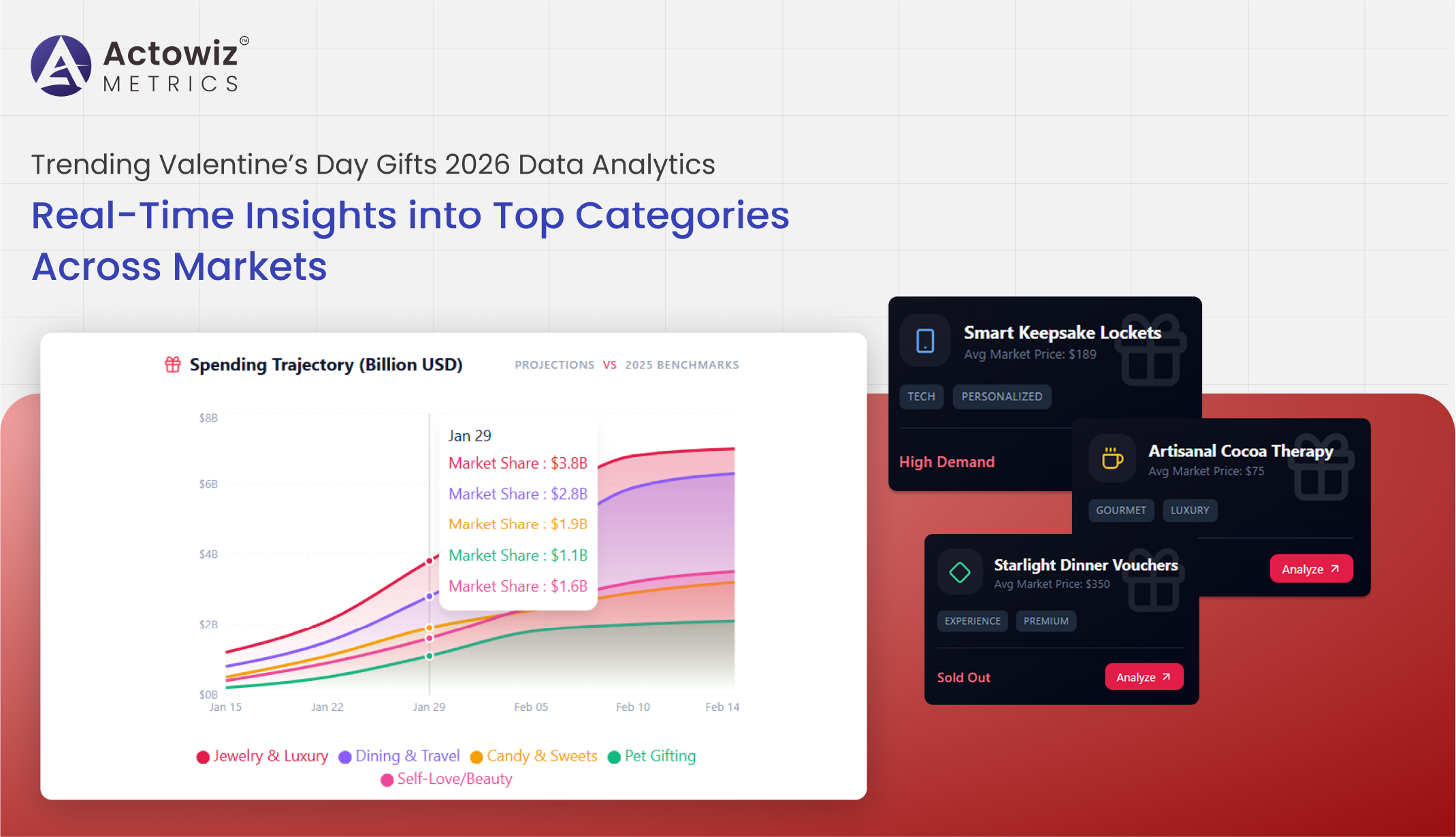

Analyze top-selling items with Trending Valentine’s Day Gifts 2026 Data Analytics to track demand, optimize inventory, and boost e-commerce sales.

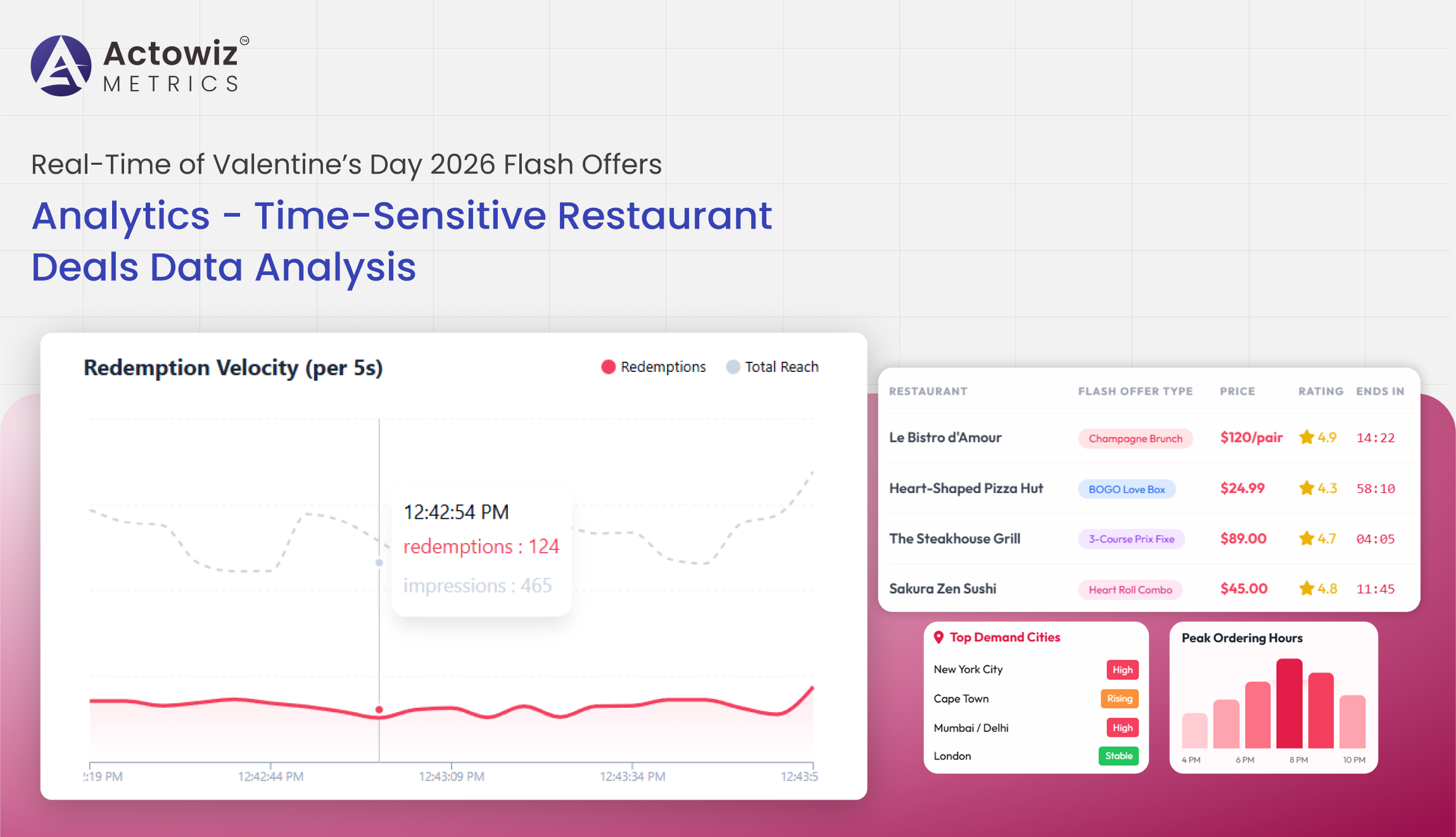

Real-Time of Valentine’s Day 2026 Flash Offers Analytics delivers instant insights on discounts, pricing trends, and offer performance across platforms.

Explore Luxury vs Smartwatch - Global Price Comparison 2025 to compare prices of luxury watches and smartwatches using marketplace data to reveal key trends and shifts.

E-Commerce Price Benchmarking: Gucci vs Prada reveals 2025 pricing trends for luxury handbags and accessories, helping brands track competitors and optimize pricing.

Discover how menu data scraping uncovers trending dishes in 2025, revealing popular recipes, pricing trends, and real-time restaurant insights for food businesses.

Explore the Amazon Baby Care Report analyzing Top Baby Brands Analysis on Amazon, covering discounts, availability, and popular products with data-driven market insights.

Amazon Sports & Outdoors Report - Sports & Outdoors Top Brands Analysis on Amazon - Prices, Discounts, Reviews

Enabled a USA pet brand to optimize pricing, inventory, and offers on Amazon using Pet Supplies Top Brands Analysis on Amazon for accurate, data-driven decisions.

Whatever your project size is, we will handle it well with all the standards fulfilled! We are here to give 100% satisfaction.

Any analytics feature you need — we provide it

24/7 global support

Real-time analytics dashboard

Full data transparency at every stage

Customized solutions to achieve your data analysis goals