Leveraging Poizon Product Stock, Listing & Price Tracking

Leverage Poizon Product Stock, Listing & Price Tracking to gain competitive insights, optimize pricing strategies, and drive sustainable revenue growth.

The Grocery & Gourmet Foods Analysis on Amazon reveals how pricing, product availability, and brand engagement have evolved between 2020 and 2025. As one of the fastest-growing e-commerce categories, the Amazon grocery segment now exceeds $28.7 billion in sales in 2025, marking a CAGR of 9.8% since 2020. With increased online adoption post-2020, consumer loyalty and price sensitivity have become vital indicators of marketplace success.

Actowiz Metrics’ comprehensive analysis leverages real-time data collection, product tracking, and pricing intelligence to deliver a 360° view of this category. Our findings showcase dynamic market shifts in premium, organic, and everyday grocery segments, as well as changes in availability and promotional strategies.

This research identifies the dominant categories, leading brands, and promotional mechanisms driving revenue on Amazon. Through advanced scraping and analytics, Actowiz Metrics uncovers actionable insights for sellers, brands, and retailers to optimize pricing, enhance visibility, and align inventory with evolving consumer behavior patterns.

Between 2020 and 2025, the pricing landscape for Amazon grocery categories has experienced continuous diversification. Data from Actowiz Metrics indicates an average product price growth of 6.2% per annum, primarily influenced by supply chain fluctuations and organic product demand.

| Year | Average Basket Price ($) | Inflation Rate (%) | Organic Product Share (%) |

|---|---|---|---|

| 2020 | 22.4 | 1.8 | 28 |

| 2021 | 23.7 | 3.2 | 32 |

| 2022 | 25.6 | 4.1 | 35 |

| 2023 | 26.9 | 5.8 | 39 |

| 2024 | 27.8 | 6.1 | 41 |

| 2025 | 29.2 | 6.3 | 44 |

The Amazon Grocery & Gourmet Foods price analysis shows that premium coffee, protein snacks, and imported condiments saw the largest price surges (8–10% YoY). Entry-level items, including staple groceries, displayed stable trends due to bulk-selling promotions and brand bundling.

Amazon Fresh and Whole Foods have further intensified price competition by integrating AI-based dynamic pricing systems. According to Actowiz’s datasets, 70% of bestseller listings adjusted prices at least twice monthly in 2025, compared to just 34% in 2020.

By harnessing pricing analytics, brands can align promotions to consumer demand peaks—especially during seasonal events such as Black Friday, Prime Day, and festive sales—ensuring higher basket values and stronger conversion rates.

From 2020–2025, consumer preferences in Amazon’s gourmet foods category have shifted significantly toward organic, gluten-free, and functional wellness products. Actowiz Metrics’ data reveals that 62% of online grocery shoppers prioritize “health-enhancing” products, compared to only 39% in 2020.

| Consumer Segment | 2020 Share (%) | 2025 Share (%) | Growth |

|---|---|---|---|

| Health-conscious buyers | 39 | 62 | +23% |

| Budget-conscious shoppers | 44 | 32 | -12% |

| Premium product buyers | 17 | 26 | +9% |

The Amazon Gourmet Foods consumer behavior insights indicate that millennials (aged 26–40) and Gen Z (under 25) now account for over 54% of total purchases in the gourmet segment. Popular subcategories include energy bars, natural teas, and probiotic snacks.

Reviews and product sentiment analysis across 10,000+ listings show an average satisfaction score of 4.4/5 in 2025, with “taste” and “value” as top attributes. Over 80% of repeat buyers purchase from the same brand after two transactions, showcasing growing brand trust and personalization potential.

Actowiz Metrics’ behavior-tracking models also identify that weekend traffic (Fri–Sun) accounts for 60% of gourmet food sales—highlighting key periods for promotional targeting.

The Amazon grocery stock availability analytics show a major evolution in fulfillment patterns and stock control strategies from 2020–2025. The share of “out-of-stock” listings dropped from 18% in 2020 to 7% in 2025, largely due to predictive inventory algorithms and seller analytics.

| Year | Avg. Stock Availability (%) | Out-of-Stock Rate (%) | Avg. Refill Time (Days) |

|---|---|---|---|

| 2020 | 82 | 18 | 4.2 |

| 2021 | 85 | 15 | 3.8 |

| 2022 | 88 | 12 | 3.1 |

| 2023 | 91 | 9 | 2.5 |

| 2024 | 93 | 8 | 2.2 |

| 2025 | 94 | 7 | 2.0 |

During promotional seasons, brands that used inventory analytics recorded 22% fewer lost sales compared to sellers without automation. Real-time tracking of stock fluctuations also allowed sellers to improve delivery speed and prevent stockouts.

Actowiz Metrics observed that top-performing brands use SKU-level monitoring and competitor-based restocking alerts to maintain higher product visibility. By mid-2025, 78% of Amazon grocery sellers had integrated third-party APIs to automate stock analytics, optimizing fulfillment efficiency by 26%.

Actowiz Metrics utilizes proprietary algorithms to Scrape Amazon Grocery & Gourmet Food listings data from thousands of daily product entries across multiple countries. Between 2020 and 2025, over 1.8 million listings were analyzed monthly, including pricing, reviews, and promotional metadata.

The dataset enables competitive benchmarking by tracking brand mentions, consumer engagement trends, and price elasticity. For instance, the “ready-to-eat meals” category saw a 78% listing increase, while “premium snacks” grew by 53% between 2021–2025.

| Metric | 2020 | 2025 | Growth (%) |

|---|---|---|---|

| Total Grocery Listings | 420K | 1.8M | +328% |

| Average Product Reviews | 1,200 | 3,600 | +200% |

| Avg. Star Rating | 4.1 | 4.4 | +7% |

| Avg. Monthly Price Updates | 120K | 520K | +333% |

Such large-scale scraping helps brands detect performance dips early, identify underperforming SKUs, and launch corrective pricing or inventory actions in real time.

Actowiz’s structured datasets are especially useful for cross-category comparisons and forecasting emerging segments like vegan snacks, electrolyte drinks, and functional protein items.

The Top grocery products analysis on Amazon highlights the leading categories shaping the marketplace in 2025. Packaged snacks, ready-to-cook sauces, and energy drinks dominate the top 500 listings, accounting for 54% of total revenue in the segment.

| Category | Share of Top 500 Listings (%) | Avg. Rating | YoY Growth (2024–25) |

|---|---|---|---|

| Packaged Snacks | 23 | 4.5 | +18% |

| Beverages & Coffee | 17 | 4.6 | +21% |

| Sauces & Condiments | 14 | 4.4 | +16% |

| Organic Grocery | 11 | 4.5 | +19% |

| Confectionery | 9 | 4.3 | +12% |

Data shows Amazon-exclusive brands have expanded their footprint by 32% in 2025. Private-label items such as Amazon Fresh Almond Butter and 365 Everyday Organic Pasta now rank among the top 20 bestselling SKUs.

Actowiz analytics also reveal that listings with subscription options enjoy 1.8x higher retention rates. Predictive keyword analysis confirms “sugar-free,” “keto,” and “vegan” are among the fastest-rising product search terms.

The Amazon Bestselling grocery & gourmet brands analytics highlight that in 2025, over 45% of sales are concentrated among the top 20 brands. Key leaders include PepsiCo, Nestlé, Mondelez, KIND Snacks, and Nature’s Path.

| Brand | Market Share (%) | 2020 Rank | 2025 Rank | Growth (%) |

|---|---|---|---|---|

| PepsiCo | 14.5 | 2 | 1 | +18 |

| Nestlé | 11.8 | 1 | 2 | +12 |

| Mondelez | 8.9 | 3 | 3 | +10 |

| KIND Snacks | 6.5 | 7 | 4 | +40 |

| Nature’s Path | 5.1 | 9 | 5 | +48 |

Amazon Bestselling Brands Analytics also shows that premium organic brands are outperforming mass-market names in terms of customer loyalty (+22% retention). Brands leveraging Grocery Analytics to adjust price elasticity saw a 17% boost in conversion rates.

These insights emphasize the value of data-driven decision-making in maintaining competitive advantage, optimizing digital shelf visibility, and aligning marketing strategies with consumer intent.

Actowiz Metrics empowers brands, retailers, and market researchers to extract, analyze, and act on Amazon’s grocery data with precision. Using advanced AI-driven tools and machine-learning algorithms, we enable Grocery & Gourmet Foods Analysis on Amazon across millions of listings, prices, reviews, and promotions.

Our scalable solutions cover pricing intelligence, consumer sentiment mapping, and inventory monitoring in real time. With customized dashboards, clients can visualize category shifts, forecast demand, and benchmark performance against competitors.

Actowiz’s automation infrastructure ensures 95% faster data collection and 80% higher accuracy than manual methods, ensuring clients can respond instantly to market trends. Whether optimizing pricing, improving inventory, or enhancing promotional ROI—our analytics suite delivers measurable business impact for every Amazon seller.

The Grocery & Gourmet Foods Analysis on Amazon reveals how brands can capitalize on evolving consumer preferences, dynamic pricing, and data-backed decision-making. Actowiz Metrics’ insights show a clear path to improved product visibility, enhanced profitability, and smarter pricing strategy.

As competition intensifies, real-time analytics and automation become essential tools for every brand operating on Amazon’s marketplace. Leveraging accurate data on stock, price, and demand cycles allows sellers to reduce inefficiencies and boost retention.

Actowiz Metrics stands at the forefront of this transformation—offering scalable scraping, visualization, and reporting tools that turn complex marketplace data into strategic action.

“Gain complete visibility into your category with Actowiz Metrics. Use real-time analytics to optimize pricing, monitor brands, and grow your presence in Amazon’s Grocery & Gourmet Foods market today!”

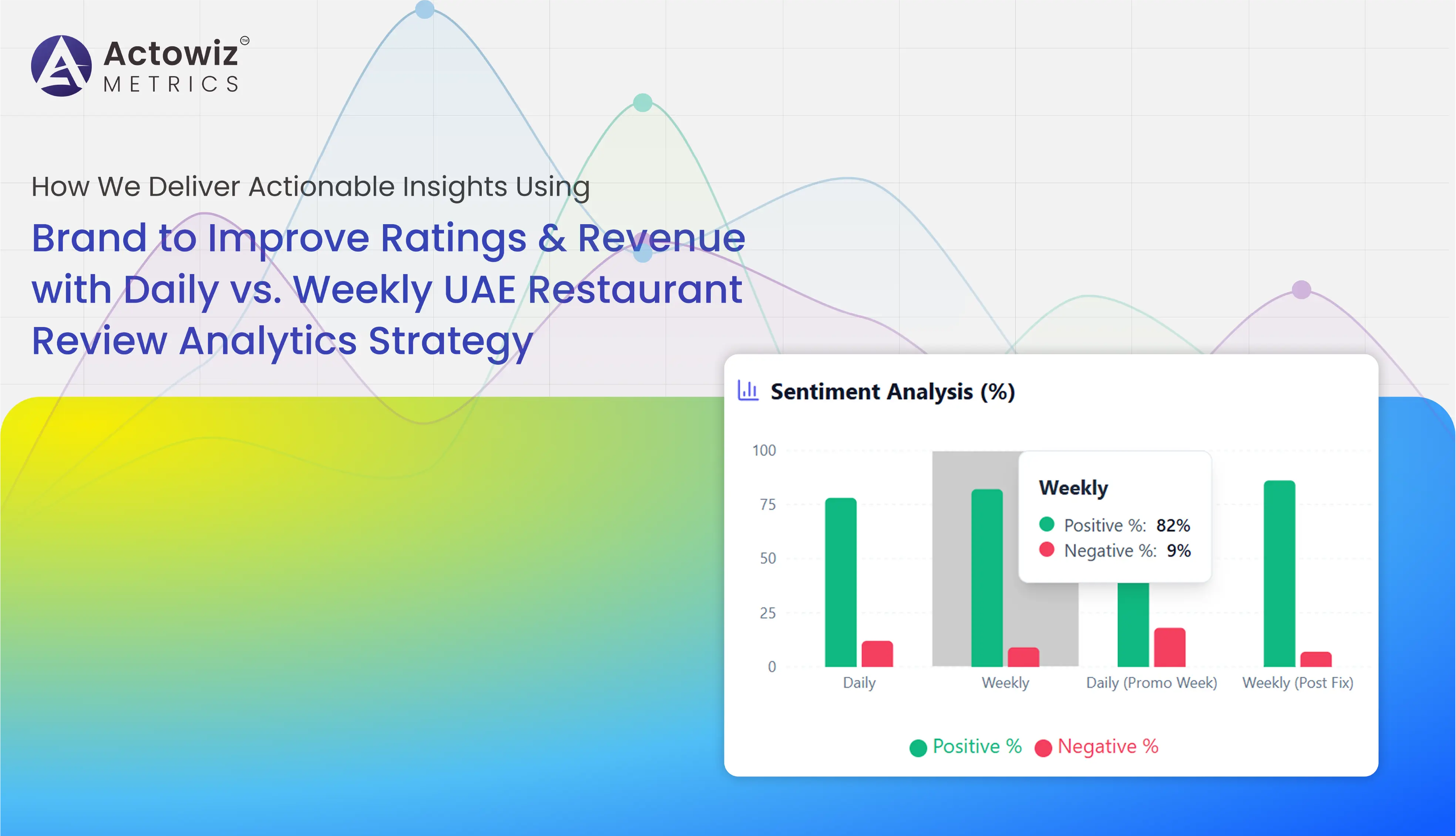

Compare daily vs. weekly UAE restaurant review analytics to uncover trends, track sentiment shifts, and optimize brand performance faster and smarter.

Explore Now

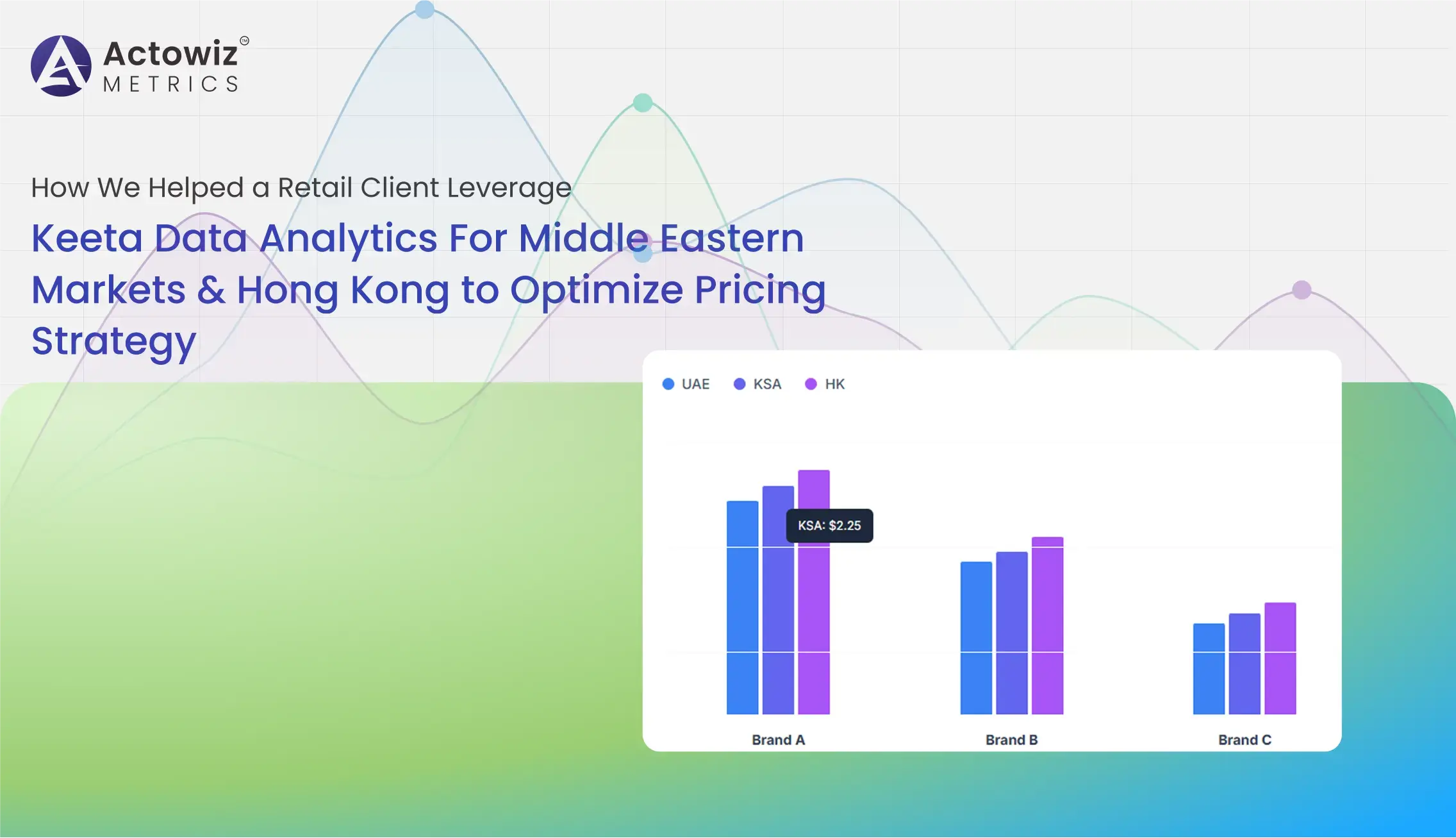

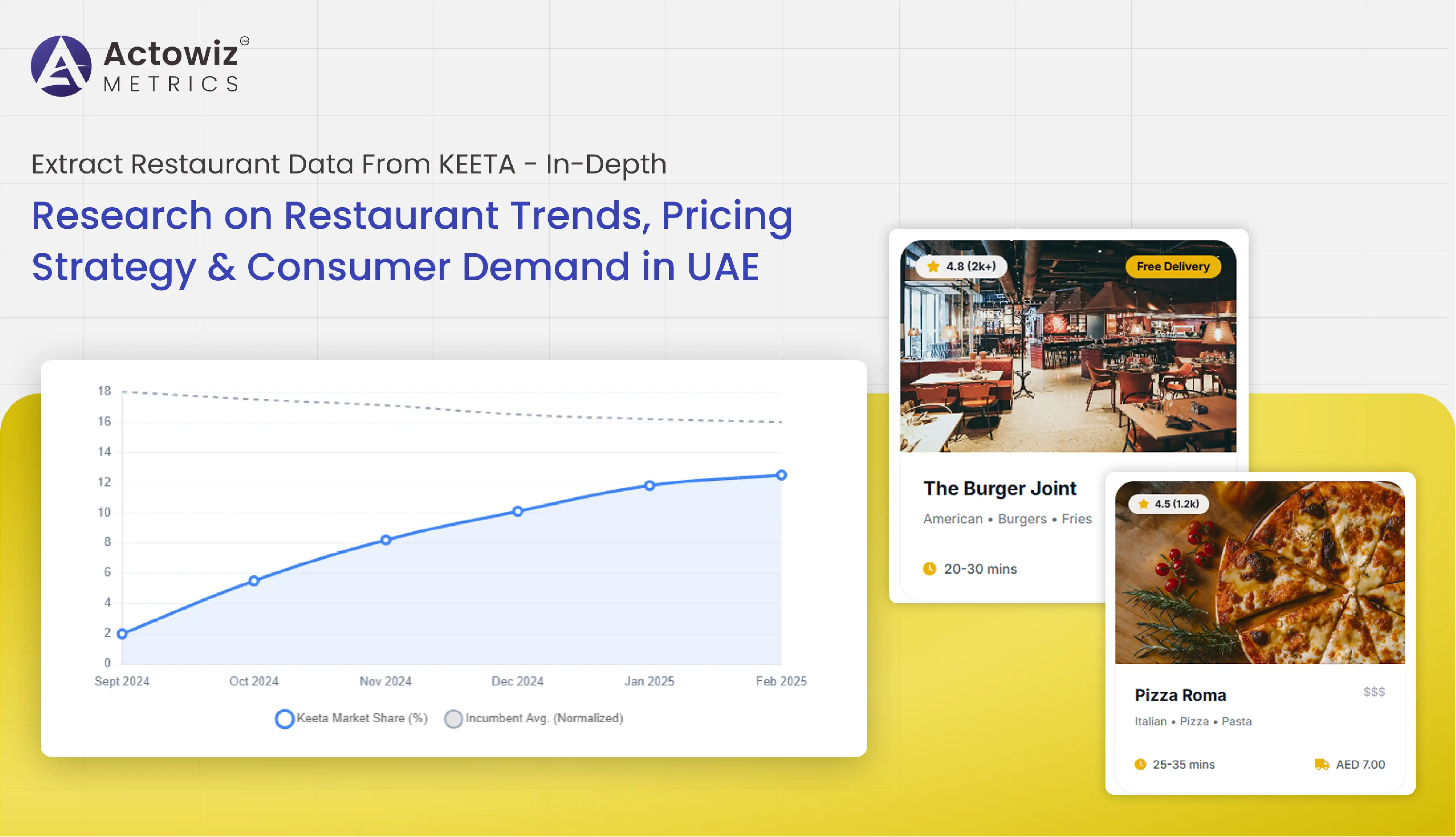

How we helped a retail client use Keeta Data Analytics For Middle Eastern Markets & Hong Kong to optimize pricing, demand tracking, and growth.

Explore Now

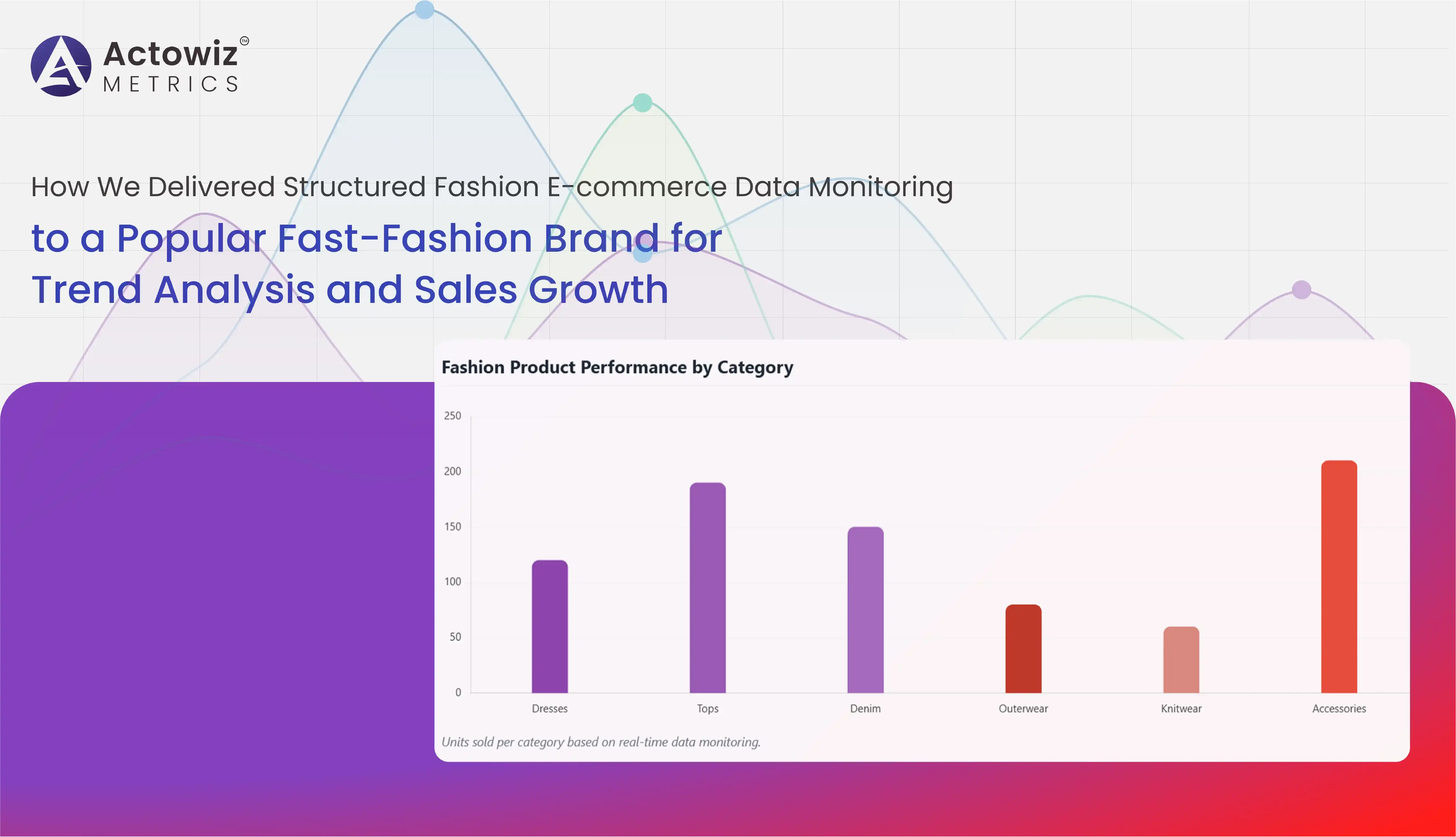

Discover how Structured Fashion E-commerce Data Monitoring helps brands track products, pricing, and trends in real time, optimizing inventory, sales, and competitive strategy.

Explore Now

Browse expert blogs, case studies, reports, and infographics for quick, data-driven insights across industries.

Leverage Poizon Product Stock, Listing & Price Tracking to gain competitive insights, optimize pricing strategies, and drive sustainable revenue growth.

Fix data gaps, improve accuracy, and turn Dewu website product data tracking into actionable insights that drive smarter eCommerce decisions.

Scrape Electronics Data from E-commerce Websites - Pricing & Specifications to monitor price trends, compare specs, and gain real-time market insights efficiently.

Chinese E-Commerce Websites Data Tracking - POIZON & DEWU delivers insights on pricing trends, product demand, brand performance, and market competition in China.

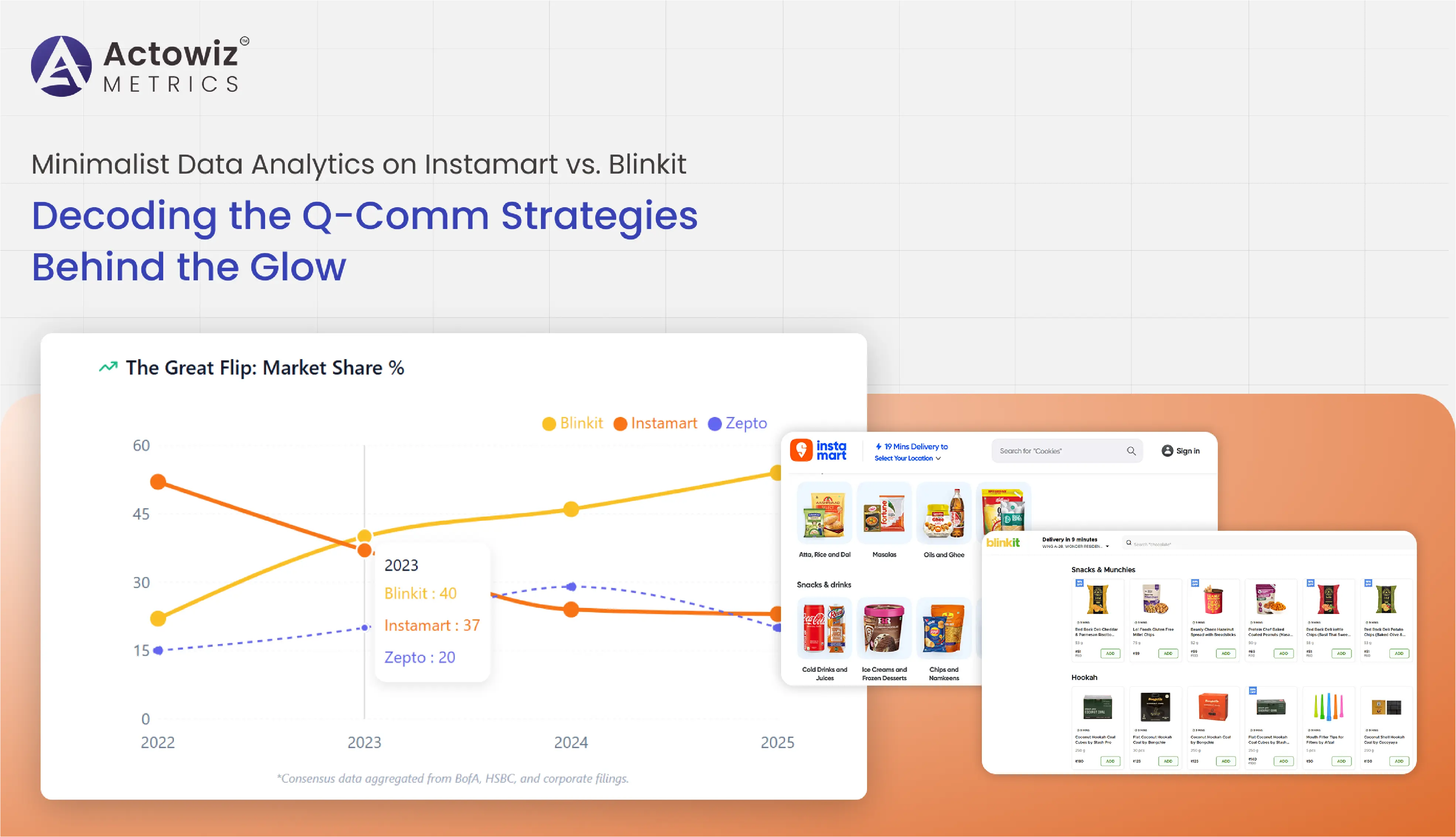

Minimalist Data Analytics on Instamart vs. Blinkit: Compare delivery speed, prices, item availability, order trends & fees to find the best quick grocery

Research report to extract restaurant data from KEETA, uncovering UAE trends, pricing strategies, consumer demand shifts and competitive insights.

This SMP tracks pricing, visibility, and Skittles Trends Market Performance And Demand to help brands optimize retail strategy and boost growth.

Explore Luxury vs Smartwatch - Global Price Comparison 2025 to compare prices of luxury watches and smartwatches using marketplace data to reveal key trends and shifts.

E-Commerce Price Benchmarking: Gucci vs Prada reveals 2025 pricing trends for luxury handbags and accessories, helping brands track competitors and optimize pricing.

Explore the Amazon Baby Care Report analyzing Top Baby Brands Analysis on Amazon, covering discounts, availability, and popular products with data-driven market insights.

Amazon Sports & Outdoors Report - Sports & Outdoors Top Brands Analysis on Amazon - Prices, Discounts, Reviews

Enabled a USA pet brand to optimize pricing, inventory, and offers on Amazon using Pet Supplies Top Brands Analysis on Amazon for accurate, data-driven decisions.

Whatever your project size is, we will handle it well with all the standards fulfilled! We are here to give 100% satisfaction.

Any analytics feature you need — we provide it

24/7 global support

Real-time analytics dashboard

Full data transparency at every stage

Customized solutions to achieve your data analysis goals