Restaurant Reservations & Orders Monitoring API - Zomato, Swiggy & EazyDiner

Solving Real-Time Order Management Challenges with Restaurant Reservations & Orders Monitoring API - Zomato, Swiggy & EazyDiner for smarter tracking.

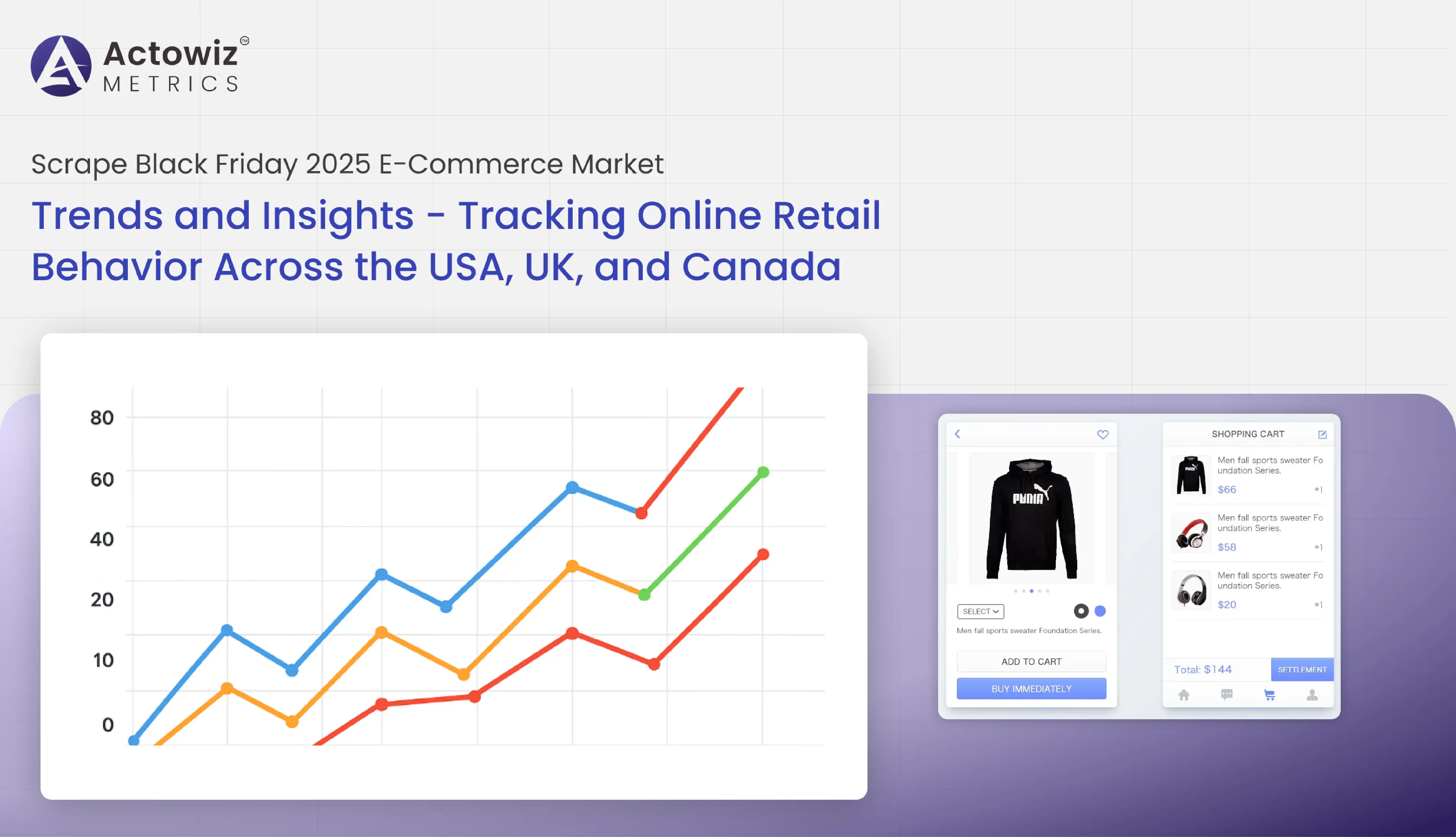

The holiday shopping season is a critical period for online retailers, and Black Friday 2025 is expected to generate record-breaking e-commerce sales. This report leverages Scrape Black Friday 2025 E-Commerce Market Trends and Insights to examine consumer behavior, sales patterns, and promotional strategies across top markets. By Tracking Online Retail Behavior Across the USA, UK, and Canada, we uncover actionable insights that help retailers optimize pricing, inventory, and marketing campaigns. The report highlights trends from 2020 to 2025, including shifts in consumer demand, mobile commerce adoption, and category-specific sales surges. Retailers who leverage data-driven strategies gain a competitive edge during the high-intensity Black Friday period, ensuring higher conversion rates, better customer engagement, and maximized revenue.

Black Friday online sales have surged steadily over the past five years. Using Extract Online Retail Behavior Data for Black Friday 2025, we found that the USA market grew from $9B in 2020 to $12.3B in 2023, and is projected to reach $14B by 2025. The UK grew from $1.2B to $1.8B, while Canada rose from $0.9B to $1.3B. Mobile-first purchases now account for 65% of all transactions, driven by app-based shopping and optimized mobile checkout.

| Year | USA | UK | Canada |

|---|---|---|---|

| 2020 | 9.0 | 1.2 | 0.9 |

| 2021 | 10.2 | 1.4 | 1.0 |

| 2022 | 11.5 | 1.6 | 1.2 |

| 2023 | 12.3 | 1.8 | 1.3 |

| 2024 | 13.2 | 1.9 | 1.4 |

| 2025 | 14.0 | 2.1 | 1.5 |

Analysis:

Sales are expanding steadily due to increased mobile adoption and early-bird promotions. Brands investing in real-time monitoring can optimize inventory and marketing to capture maximum sales during peak periods.

Electronics, fashion, and home appliances dominate Black Friday online sales. Web Scraping E-Commerce Data for Black Friday 2025 shows that in 2024, electronics contributed 38% of total sales, fashion 27%, and home appliances 18%. Wellness and smart home categories are rising fast, with 9–10% projected contribution by 2025. Average cart sizes for electronics increased 12% YoY, reflecting higher-value purchases.

| Category | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 (Proj) |

|---|---|---|---|---|---|---|

| Electronics | 35 | 36 | 37 | 37 | 38 | 39 |

| Fashion | 25 | 26 | 26 | 27 | 27 | 28 |

| Home Appliances | 18 | 18 | 18 | 18 | 18 | 19 |

| Wellness | 5 | 6 | 7 | 8 | 9 | 10 |

| Others | 17 | 14 | 12 | 10 | 8 | 4 |

Analysis:

Electronics continue to dominate due to high-value items and flash sales. Emerging categories like wellness indicate changing consumer priorities, requiring strategic marketing and inventory allocation.

Consumer behavior is evolving rapidly. Using Scrape Online Retail Trends During Black Friday 2025, we found 70% of shoppers start browsing on mobile before completing purchases on desktop. Early-bird purchases account for 25% of total revenue, while impulse buying influenced by social media is up 18% YoY. Cross-border purchases in the UK and Canada are increasing, highlighting the importance of multi-currency pricing.

| Region | Mobile | Desktop | Tablet |

|---|---|---|---|

| USA | 65 | 30 | 5 |

| UK | 60 | 35 | 5 |

| Canada | 62 | 33 | 5 |

Analysis:

Brands must optimize mobile experiences, tailor early-bird promotions, and consider international shipping options to capture cross-border buyers efficiently.

Promotions are the backbone of Black Friday success. E-Commerce Industry Analytics for Black Friday 2025 show electronics discounts average 22–28%, apparel 15–20%, and flash sales contribute 30% of peak-hour revenue. Personalized campaigns based on browsing history improve engagement by 18%. Bundled offers and multi-buy discounts encourage larger cart sizes.

| Category | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 (Proj) |

|---|---|---|---|---|---|---|

| Electronics | 20 | 21 | 22 | 23 | 25 | 26 |

| Apparel | 12 | 13 | 14 | 15 | 16 | 17 |

| Home Appliances | 15 | 16 | 17 | 17 | 18 | 18 |

Analysis:

Strategic discounting, coupled with targeted campaigns, maximizes conversions and boosts average order value. Timing, bundling, and personalization are key.

Price tracking is crucial for competitiveness. Real-time Price Benchmarking reveals up to 12% variation across retailers for high-demand products. Laptops, smartphones, and smartwatches are most affected. Dynamic pricing during peak hours improves conversion rates 15–20%, while price transparency increases consumer trust.

| Product | USA | UK | Canada |

|---|---|---|---|

| Laptop | 10 | 12 | 11 |

| Smartphone | 8 | 9 | 10 |

| Smartwatch | 7 | 8 | 9 |

| Headphones | 12 | 10 | 11 |

Analysis:

Price monitoring allows brands to respond to competitor actions in real time, optimize discounting, and increase ROI while maintaining market share.

Regional trends vary significantly. The USA drives 70% of total Black Friday sales, with UK at 15% and Canada at 10%. Mobile purchases are highest in urban areas, accounting for 65–70% of transactions. Geo-targeted campaigns and location-specific offers improve engagement 20%, as revealed by Extract Online Retail Behavior Data for Black Friday 2025.

| Region | Mobile | Desktop |

|---|---|---|

| USA | 68 | 32 |

| UK | 63 | 37 |

| Canada | 65 | 35 |

Analysis:

Brands optimizing for regional variations, peak-hour traffic, and device-specific shopping achieve higher conversions. International promotions capture cross-border buyers efficiently, ensuring maximum revenue.

Actowiz offers E-commerce Analytics to monitor consumer behavior, sales trends, and pricing in real time, enabling brands to make data-driven decisions during peak shopping events like Black Friday. Our Digital Shelf Analytics tools provide detailed insights into product visibility, competitor promotions, and category performance across multiple platforms. By leveraging advanced Price Benchmarking, retailers can optimize pricing strategies, respond quickly to competitor actions, maximize conversion rates, and uncover new growth opportunities. These capabilities empower brands to enhance operational efficiency, improve promotional effectiveness, and gain a competitive advantage in dynamic online retail markets across the USA, UK, and Canada.

With Brand Competition Analysis and Product Data Tracking, Actowiz Metrics delivers actionable insights to maximize Black Friday sales. Leverage our solutions to monitor trends, optimize pricing, and gain a competitive advantage in the USA, UK, and Canada. Act today to turn data into revenue this holiday season!

Case Study on how we enhanced pricing accuracy and local market insights using Extract API for Instacart Grocery Data from Houston, TX.

Explore Now

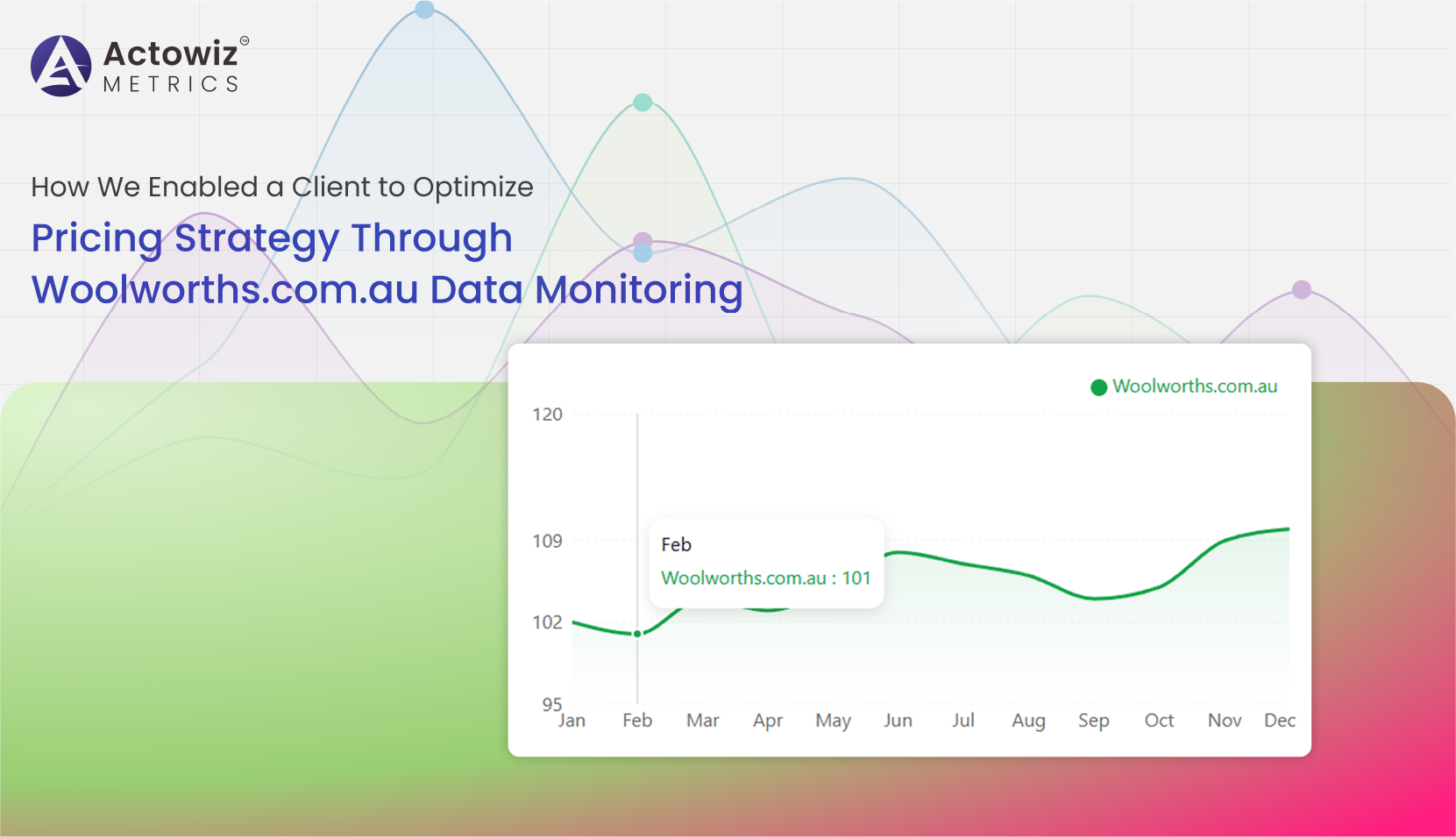

Woolworths.com.au Data Monitoring helps track pricing, promotions, stock availability, and competitor trends to drive smarter retail and eCommerce decisions.

Explore Now

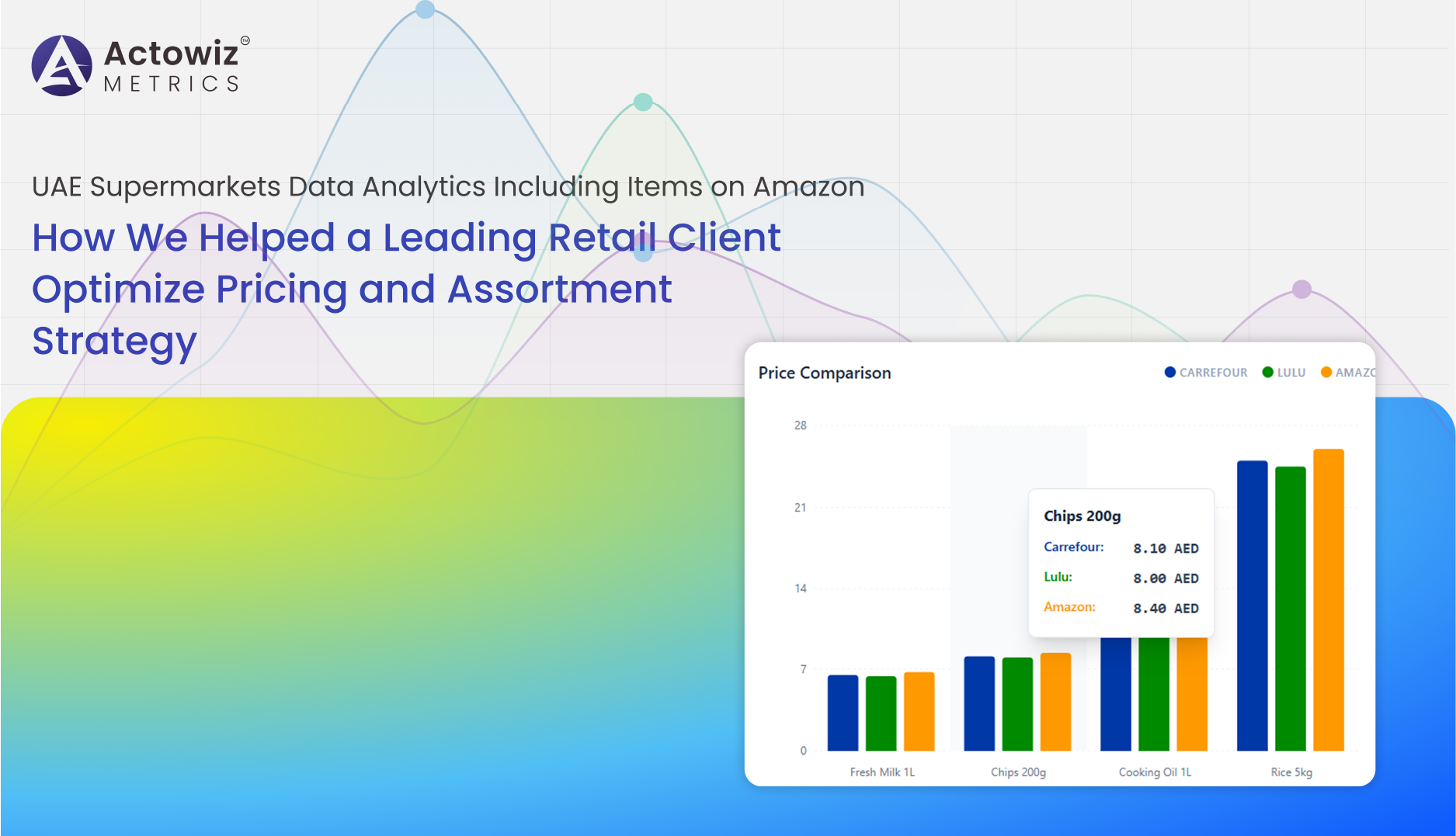

UAE Supermarkets Data Analytics Including Items on Amazon helped our retail client optimize pricing, refine assortment, and improve market competitiveness.

Explore Now

Browse expert blogs, case studies, reports, and infographics for quick, data-driven insights across industries.

Solving Real-Time Order Management Challenges with Restaurant Reservations & Orders Monitoring API - Zomato, Swiggy & EazyDiner for smarter tracking.

Discover how Zonaprop Real Estate Data Tracking in Argentina reduces investment risk with accurate pricing insights and smarter property decisions.

How Woolworths.com.au Data Tracking helps monitor pricing shifts, stock levels, and promotions to improve retail visibility and decision-making.

Dior Luxury Fashion Market Analysis explores global brand positioning, competitive landscape, market trends, revenue performance, and future growth outlook.

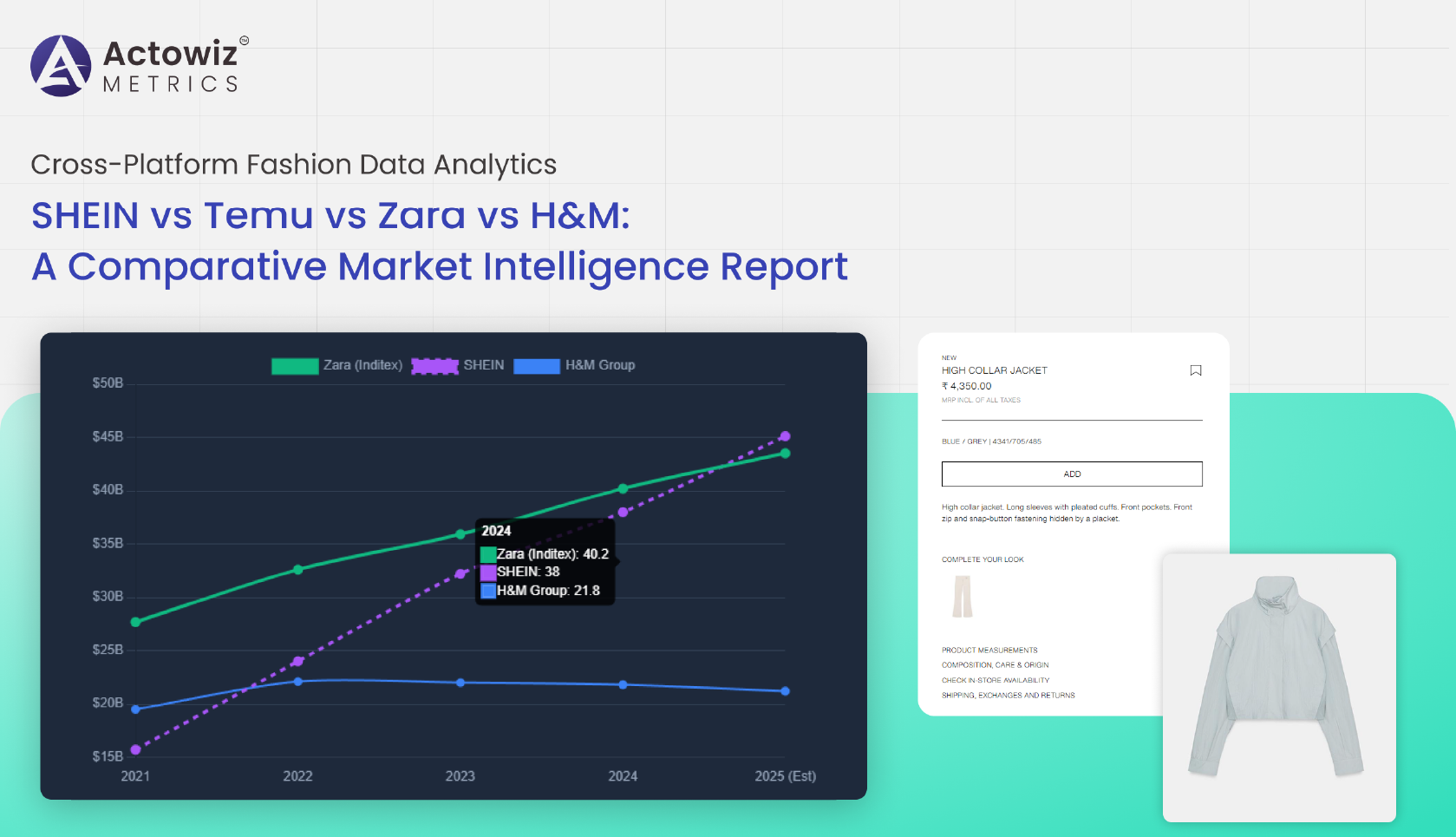

Cross-Platform Fashion Data Analytics - SHEIN vs Temu vs Zara vs H&M delivers actionable insights by comparing pricing, trends, inventory shifts, and consumer demand

Track and analyze the Number of Pizza Hut Locations Analytics in India 2026 to uncover expansion trends, regional distribution, and market growth insights.

Explore Luxury vs Smartwatch - Global Price Comparison 2025 to compare prices of luxury watches and smartwatches using marketplace data to reveal key trends and shifts.

E-Commerce Price Benchmarking: Gucci vs Prada reveals 2025 pricing trends for luxury handbags and accessories, helping brands track competitors and optimize pricing.

Discover how menu data scraping uncovers trending dishes in 2025, revealing popular recipes, pricing trends, and real-time restaurant insights for food businesses.

Explore the Amazon Baby Care Report analyzing Top Baby Brands Analysis on Amazon, covering discounts, availability, and popular products with data-driven market insights.

Amazon Sports & Outdoors Report - Sports & Outdoors Top Brands Analysis on Amazon - Prices, Discounts, Reviews

Enabled a USA pet brand to optimize pricing, inventory, and offers on Amazon using Pet Supplies Top Brands Analysis on Amazon for accurate, data-driven decisions.

Whatever your project size is, we will handle it well with all the standards fulfilled! We are here to give 100% satisfaction.

Any analytics feature you need — we provide it

24/7 global support

Real-time analytics dashboard

Full data transparency at every stage

Customized solutions to achieve your data analysis goals