Woolworths.com.au Data Tracking

How Woolworths.com.au Data Tracking helps monitor pricing shifts, stock levels, and promotions to improve retail visibility and decision-making.

The modern hospitality industry is more competitive than ever. With travelers instantly comparing prices across online travel agencies (OTAs), even minor discrepancies can impact bookings. Hotels today are not only competing on amenities and brand recognition—they are competing minute by minute on pricing. Leveraging Competitor Price Tracking from Expedia & Booking.com is no longer optional; it is a critical driver of profitability.

Hotels often struggle with inconsistent pricing due to promotions, dynamic rate changes, and multi-channel distribution, creating revenue leakage. Brand Competition Analysis enables hotels to identify pricing gaps, anticipate competitor moves, and respond with data-driven rate adjustments. By analyzing real-time data from Expedia and Booking.com, revenue managers can optimize occupancy, increase average daily rate (ADR), and protect revenue per available room (RevPAR).

This whitepaper-style blog explores how structured competitor monitoring improves revenue by 18%, reduces pricing errors, and strengthens decision-making across room types, regions, and booking windows. We also discuss analytics frameworks, automated monitoring solutions, and actionable insights that support revenue growth across the hotel portfolio.

Hotels often assume their rates are uniform across OTAs, but in practice, frequent variances occur. Using Extract Expedia vs Booking.com Price Comparison Data, hotels can detect discrepancies due to different markup strategies, promotions, currency conversions, and last-minute price adjustments.

| Year | Avg. Price Variance (%) | Booking Conversion Impact |

|---|---|---|

| 2020 | 6% | Low |

| 2021 | 9% | Moderate |

| 2022 | 12% | High |

| 2023 | 14% | High |

| 2024 | 15% | Very High |

| 2025* | 16% | Very High |

| 2026* | 18% | Critical |

Hotels failing to monitor these variances lose bookings to competitors offering slightly lower rates. Extracting price data across OTAs allows revenue managers to identify patterns, such as price drops on weekdays or high-demand periods, and adjust rates dynamically. Seasonal trends further highlight the importance of monitoring, with summer peaks, holiday periods, and event-driven spikes affecting ADR by 10–25% in major cities.

Manual rate checks are insufficient in a market where prices can change multiple times per day. Scrape Expedia & Booking.com Hotel Prices, Marketplace Data Tracking enables automated, near-real-time visibility into competitor pricing.

| Platform | Avg. Daily Price Changes | Peak Season Fluctuations |

|---|---|---|

| Expedia | 5–8 | +15% |

| Booking.com | 6–9 | +18% |

Real-time intelligence helps hotels respond instantly to competitor rate changes, flash discounts, and last-minute availability shifts. By tracking room types, length of stay, and promotional activity, hotels can optimize yield for each booking window. For example, a mid-tier hotel in New York City observed a 12% increase in revenue by dynamically adjusting weekend rates based on competitor pricing patterns captured from Expedia and Booking.com.

Pricing strategically is more important than simply being the cheapest. Hotel Price Benchmarking Across Expedia and Booking.com allows hotels to compare their rates with peers across regions, star categories, and property types.

| Metric | Without Benchmarking | With Benchmarking |

|---|---|---|

| Avg. Daily Rate Growth | 4% | 9% |

| Occupancy Rate | 68% | 76% |

| Revenue per Available Room | Moderate | +18% |

Benchmarking identifies opportunities to increase rates during high-demand periods or to strategically undercut competitors in low-demand segments. It also highlights underpriced inventory that could be leveraged to improve RevPAR without impacting bookings negatively.

The hospitality market reacts to events, local festivals, and competitor actions instantly. Travel Portal Competitor Price Tracking ensures hotels maintain an edge by continuously observing rate changes and occupancy patterns across Expedia and Booking.com.

| Feature | Business Outcome |

|---|---|

| Real-Time Alerts | Faster response to competitor price changes |

| Historical Trend Analysis | Improved forecasting accuracy |

| Parity Monitoring | Reduced revenue leakage |

Continuous monitoring empowers hotels to optimize pricing proactively, resulting in better occupancy distribution, reduced risk of undercutting, and higher overall revenue.

Data analytics ensures compliance with rate parity agreements and enables revenue optimization. Expedia Travel Data Analytics, MAP Monitoring helps hotels detect unauthorized discounts, over-discounted listings, or third-party undercutting.

| KPI | Before Analytics | After Analytics |

|---|---|---|

| Rate Parity Violations | High | Reduced by 35% |

| Revenue Leakage | Moderate | Minimized |

| Brand Perception | Neutral | Strengthened |

By integrating historical data and trend analysis, hotels can make predictive decisions, such as when to adjust rates ahead of peak booking periods or react to competitor campaigns, thereby improving both profitability and brand trust.

Booking.com Travel Data Analytics provides insights into traveler behavior, cancellation patterns, and promotion effectiveness. This data, combined with competitor pricing intelligence, enables hotels to fine-tune their revenue strategies.

| Insight Area | Optimization Benefit |

|---|---|

| Cancellation Trends | Adaptive rate strategies |

| Advance Booking Windows | Dynamic pricing for early vs late bookers |

| Promotion Performance | Smarter discounting and package offers |

Hotels can now align pricing with customer behavior patterns, maximizing occupancy while maintaining target ADR.

Actowiz Metrics delivers actionable Travel Analytics solutions that empower hotels to gain complete visibility into OTA pricing dynamics. With advanced tools for Competitor Price Tracking from Expedia & Booking.com, hotels can detect undercutting, benchmark performance, and optimize pricing strategies across multiple regions.

Key benefits include:

By integrating competitor intelligence with operational data, Actowiz Metrics enables hotels to implement proactive pricing, improve RevPAR, and reduce revenue leakage by up to 18%.

In today’s hyper-competitive hotel market, Price Benchmarking and Competitor Price Tracking from Expedia & Booking.com are essential to maximize revenue and occupancy. Hotels that fail to monitor competitors in real time risk losing bookings, eroding margins, and missing optimization opportunities.

Automated monitoring, advanced analytics, and predictive insights empower revenue managers to act decisively, ensuring rates are aligned with market demand while protecting brand value. Real-time tracking, combined with historical data analysis, allows for smarter promotional planning, dynamic rate adjustments, and stronger positioning across multiple OTAs.

Unlock the full potential of OTA intelligence—partner with Actowiz Metrics today to turn competitor insights into revenue growth, operational efficiency, and strategic advantage.

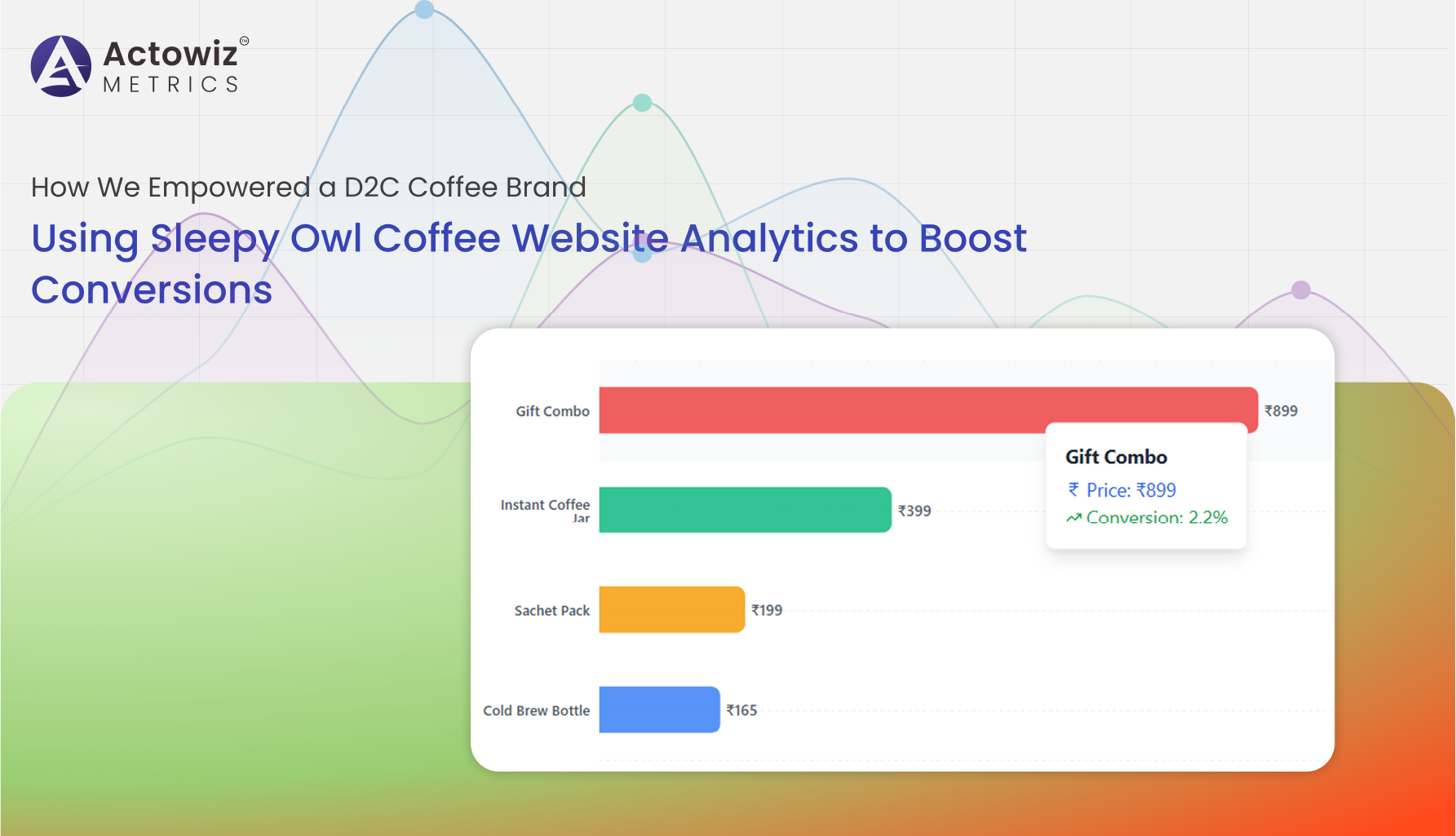

Sleepy Owl Coffee Website Analytics delivering insights on traffic, conversions, pricing trends, and digital performance optimization.

Explore Now

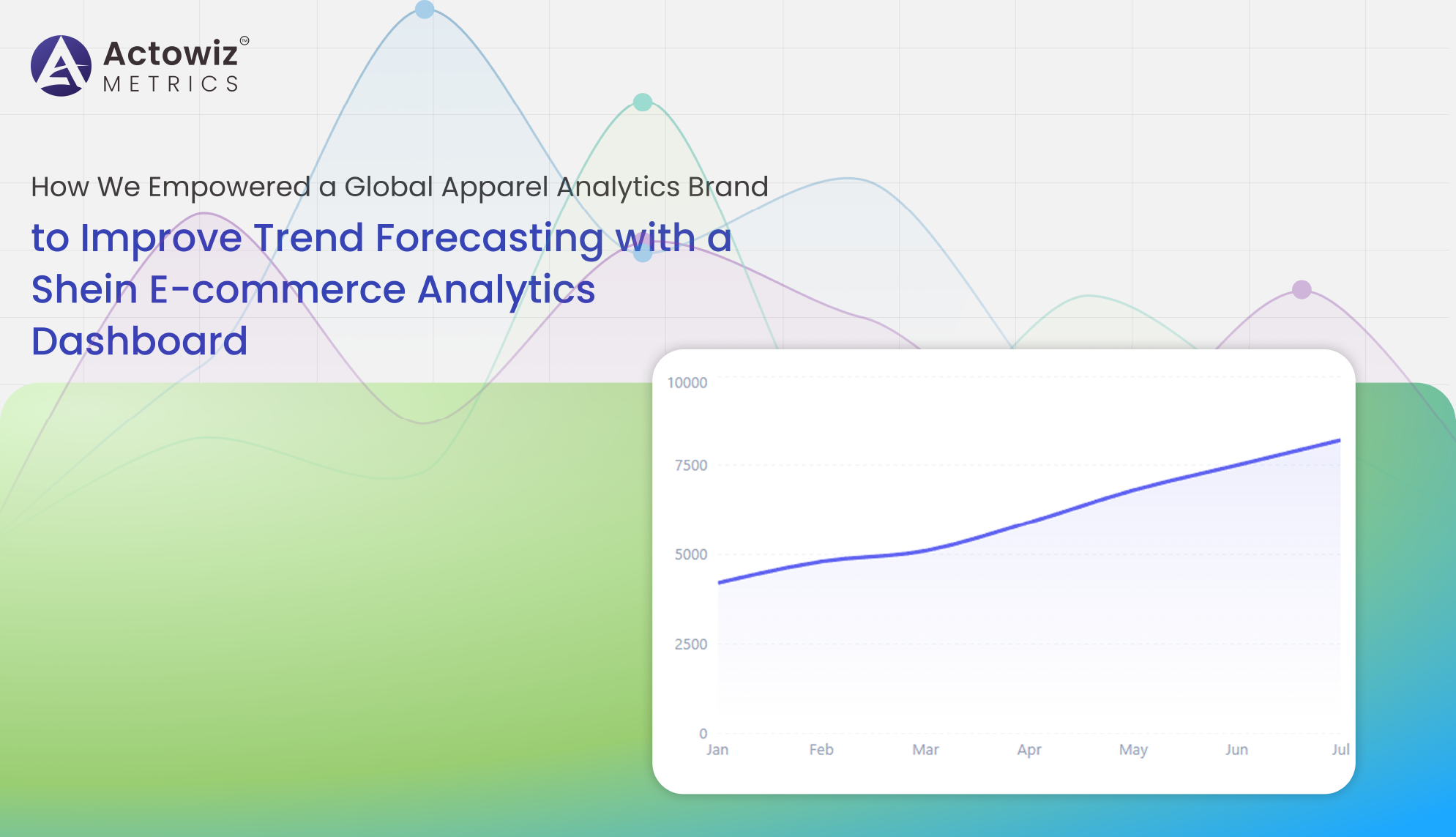

Shein E-commerce Analytics Dashboard delivers real-time pricing, trend, and competitor insights to optimize fashion strategy and boost performance.

Explore Now

Live Data Tracking Dashboard for Keeta Food Delivery App enables real-time order, pricing, and restaurant insights to optimize performance and decisions.

Explore NowBrowse expert blogs, case studies, reports, and infographics for quick, data-driven insights across industries.

How Woolworths.com.au Data Tracking helps monitor pricing shifts, stock levels, and promotions to improve retail visibility and decision-making.

Myntra Fashion Category Data Monitoring helps track trends, pricing, stock levels, and category performance to optimize sales and boost growth.

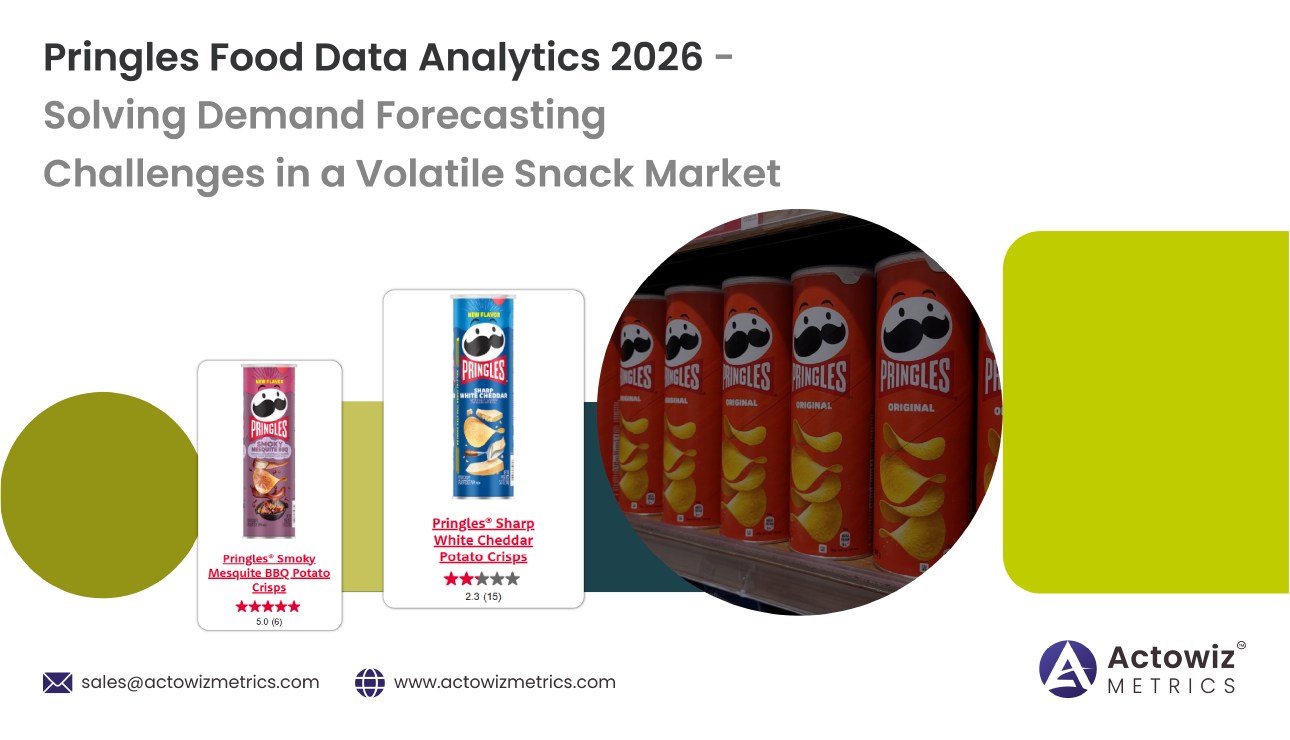

Pringles Food Data Analytics 2026 reveals how data-driven insights improve pricing, demand forecasting, and supply chain efficiency in a dynamic snack market.

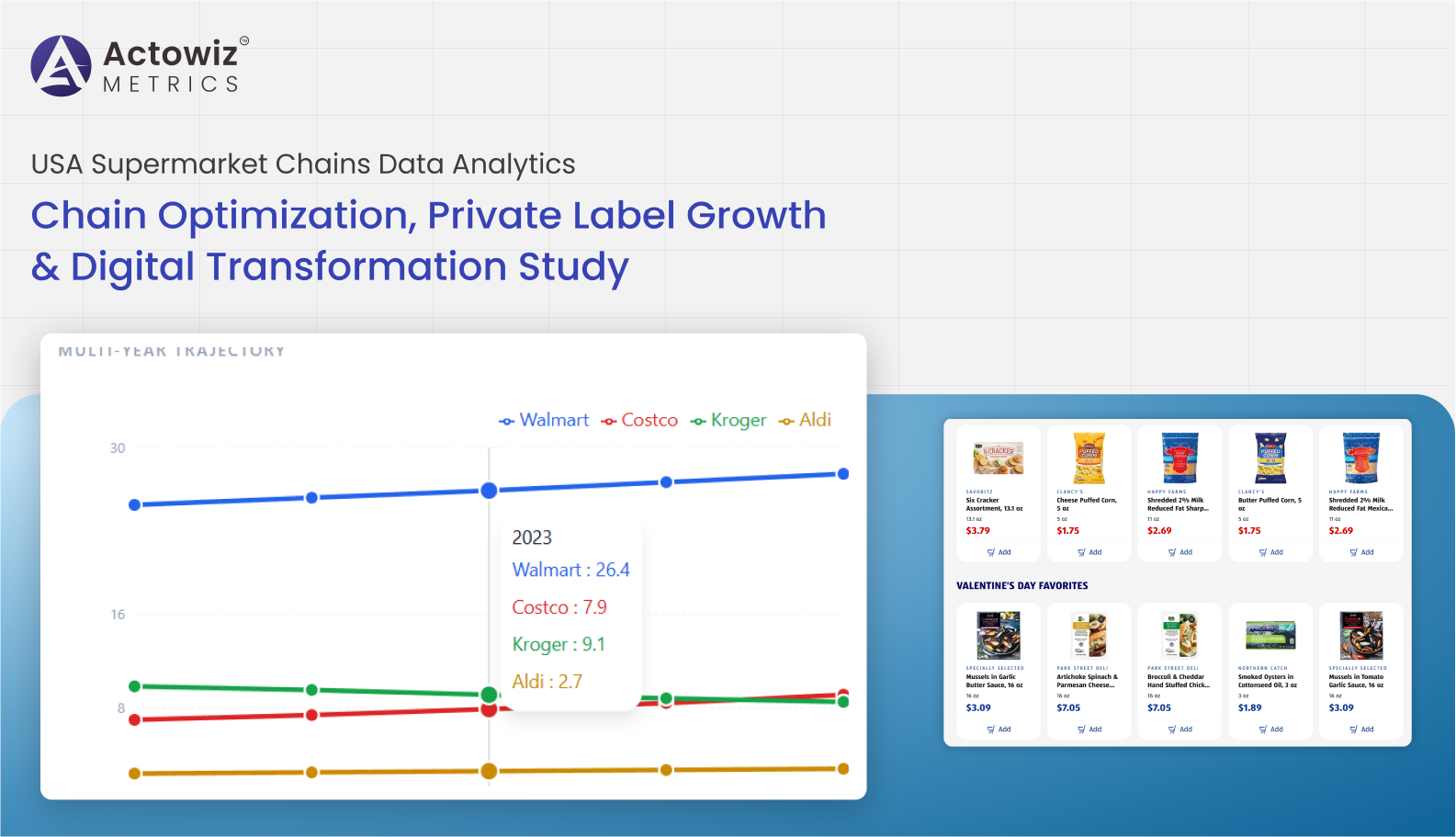

Research Report on USA Supermarket Chains Data Analytics covering chain optimization, private label growth, pricing trends, and digital transformation insights.

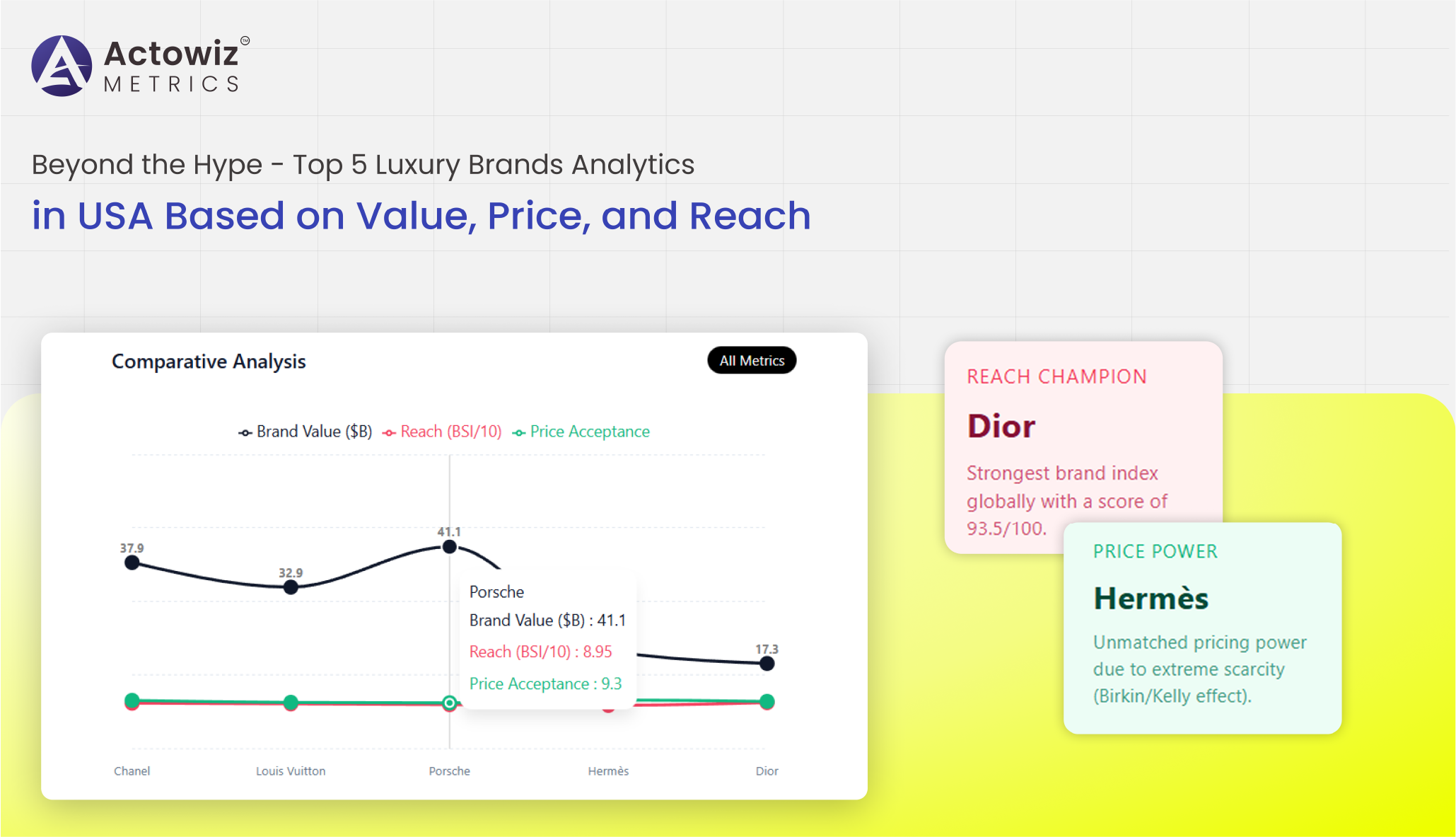

Top 5 Luxury Brands Analytics in USA delivering advanced market insights, consumer trends, and performance intelligence to drive premium brand growth.

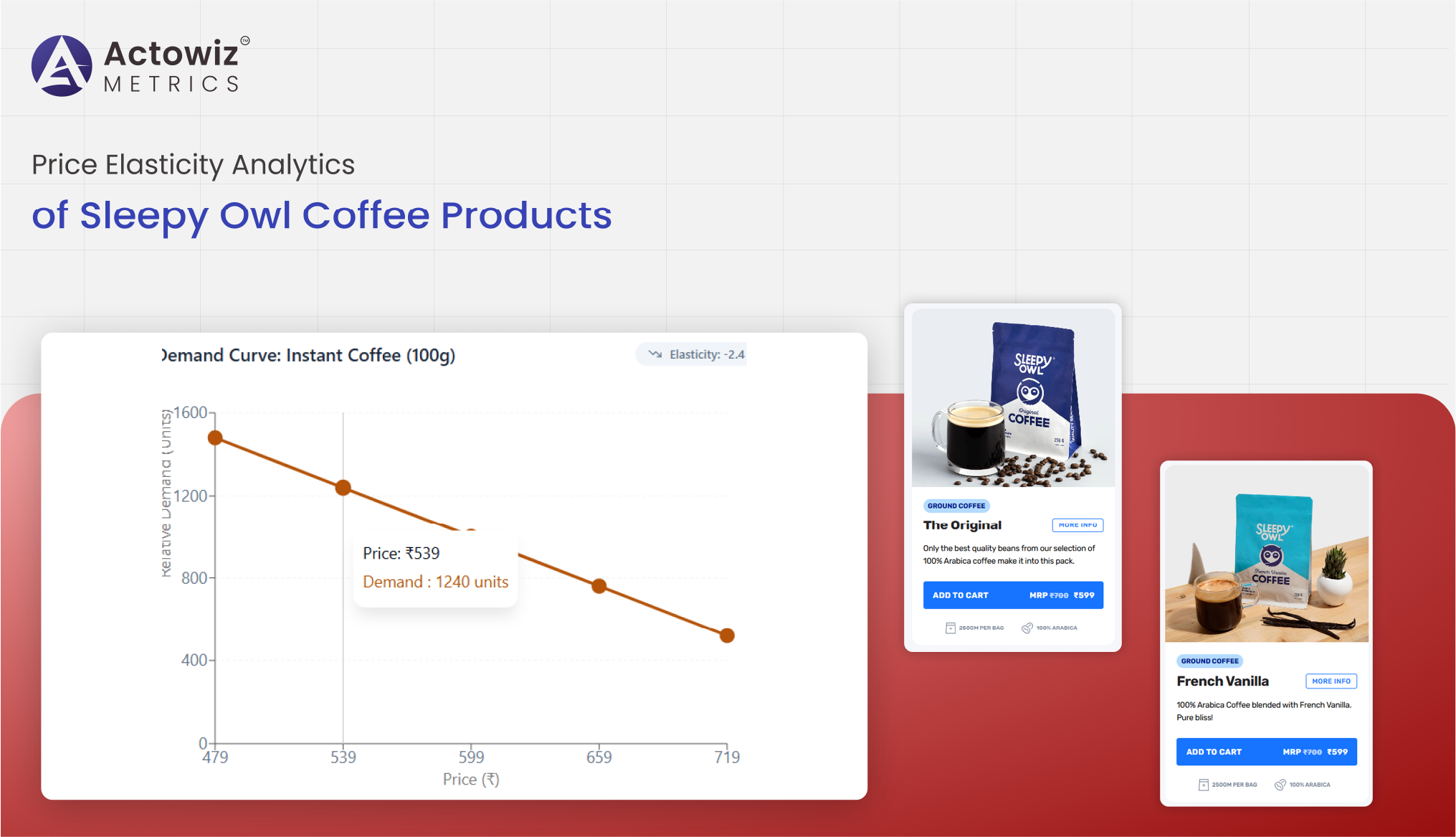

Price Elasticity Analytics of Sleepy Owl Coffee Products revealing demand sensitivity, pricing impact, and revenue optimization insights across channels.

Explore Luxury vs Smartwatch - Global Price Comparison 2025 to compare prices of luxury watches and smartwatches using marketplace data to reveal key trends and shifts.

E-Commerce Price Benchmarking: Gucci vs Prada reveals 2025 pricing trends for luxury handbags and accessories, helping brands track competitors and optimize pricing.

Discover how menu data scraping uncovers trending dishes in 2025, revealing popular recipes, pricing trends, and real-time restaurant insights for food businesses.

Explore the Amazon Baby Care Report analyzing Top Baby Brands Analysis on Amazon, covering discounts, availability, and popular products with data-driven market insights.

Amazon Sports & Outdoors Report - Sports & Outdoors Top Brands Analysis on Amazon - Prices, Discounts, Reviews

Enabled a USA pet brand to optimize pricing, inventory, and offers on Amazon using Pet Supplies Top Brands Analysis on Amazon for accurate, data-driven decisions.

Whatever your project size is, we will handle it well with all the standards fulfilled! We are here to give 100% satisfaction.

Any analytics feature you need — we provide it

24/7 global support

Real-time analytics dashboard

Full data transparency at every stage

Customized solutions to achieve your data analysis goals