Protein Bar Demand Analytics on Zepto & Blinkit – Bangalore

Pringles Food Data Analytics 2026 reveals how data-driven insights improve pricing, demand forecasting, and supply chain efficiency in a dynamic snack market.

The U.S. pet supplies market has witnessed rapid digital growth, driven by increasing pet ownership and a strong shift toward online shopping. Amazon has emerged as the dominant marketplace where pricing competitiveness, inventory availability, and brand visibility directly impact sales performance. However, navigating thousands of SKUs, frequent price changes, and fluctuating stock levels presents major challenges for pet brands. This research report explores how a data-driven approach using Pet Supplies Top Brands Analysis on Amazon combined with Amazon Bestselling Brands Analytics helped a U.S.-based pet supplies brand optimize pricing strategies, improve inventory accuracy, and strengthen competitive positioning. By leveraging advanced analytics and continuous monitoring, the brand transformed raw marketplace data into actionable insights, enabling smarter decisions across pricing, stock planning, and brand benchmarking from 2020 through projected trends in 2026.

Competition within Amazon’s pet supplies category intensified significantly between 2020 and 2026, with private labels and established brands competing aggressively on price and visibility. To navigate this environment, the brand adopted Pet Supplies Competitor Benchmarking on Amazon, supported by structured Price Benchmarking workflows. This allowed systematic comparison of prices, pack sizes, promotions, and seller strategies across top competitors.

| Year | Avg Competitor Price Variance | Promo Frequency |

|---|---|---|

| 2020 | 18% | Low |

| 2022 | 14% | Medium |

| 2024 | 9% | High |

| 2026* | 6% | Very High |

By analyzing competitor movements, the brand reduced overpricing risks while avoiding unnecessary discounting. Insights into pricing corridors enabled dynamic adjustments aligned with market conditions, leading to improved conversion rates and margin stability. Competitive benchmarking shifted from reactive checks to proactive strategy execution.

Inventory misalignment was a critical pain point, with stockouts leading to lost sales and overstock tying up capital. Using Pet Supplies Inventory Monitoring on Amazon integrated with advanced E-commerce Analytics, the brand gained real-time visibility into stock levels, fulfillment status, and replenishment cycles.

| Year | Stock Accuracy | Stockout Incidents |

|---|---|---|

| 2020 | 72% | High |

| 2022 | 80% | Medium |

| 2024 | 88% | Low |

| 2026* | 93% | Minimal |

This approach enabled predictive replenishment by correlating sales velocity with inventory trends. As a result, the brand reduced stockouts, improved order fulfillment consistency, and enhanced customer satisfaction. Inventory monitoring evolved into a strategic capability rather than a reactive operational task.

Consumer preferences within pet supplies categories change rapidly due to seasonality, pet health trends, and promotional cycles. The brand leveraged a Real-Time Pet Supplies Category Trends Scraper on Amazon to identify emerging demand patterns, supported by Brand Competition Analysis for contextual insights.

| Year | Trending Subcategories | Demand Growth |

|---|---|---|

| 2020 | Pet Food, Treats | Moderate |

| 2022 | Supplements, Grooming | High |

| 2024 | Eco-Friendly Products | Very High |

| 2026* | Functional Nutrition | Predictive |

By tracking real-time signals, the brand optimized assortment planning and marketing focus. This enabled faster response to emerging trends, ensuring listings aligned with evolving customer demand while staying competitive against category leaders.

Understanding which brands dominate sales rankings provides valuable context for pricing, promotions, and product development. Through Pet Supplies Top Brands Sales Analytics on Amazon, the brand analyzed bestseller rankings, review velocity, and offer consistency across leading competitors.

| Year | Avg Bestseller Rank | Review Growth Rate |

|---|---|---|

| 2020 | Top 30 | Slow |

| 2022 | Top 20 | Moderate |

| 2024 | Top 10 | High |

| 2026* | Top 5 | Predictive |

Price alone does not determine purchase decisions; reviews and ratings heavily influence buyer trust. By implementing Extract Top Pet Supplies Brands Price & Review on Amazon, the brand gained a holistic view of how pricing strategies correlated with customer sentiment.

| Price Range | Avg Rating | Conversion Impact |

|---|---|---|

| Low | 4.2 | Moderate |

| Mid | 4.5 | High |

| Premium | 4.7 | Very High |

Combining price and review analytics enabled smarter pricing tiers without sacrificing perceived quality. The brand adjusted pricing to align with rating benchmarks, improving both conversion rates and long-term brand trust.

Sustainable success required ongoing visibility rather than one-time analysis. Using Top Pet Supplies Brands Data Monitoring on Amazon supported by robust Product Data Tracking, the brand established continuous monitoring across prices, stock, reviews, and rankings.

| Year | Monitoring Frequency | Decision Speed |

|---|---|---|

| 2020 | Weekly | Slow |

| 2022 | Daily | Moderate |

| 2024 | Hourly | Fast |

| 2026* | Real-Time | Instant |

This framework enabled faster decisions, reduced blind spots, and supported scalable growth across expanding product lines. Continuous monitoring became a core competitive advantage.

Actowiz Metrics empowers brands with data-driven clarity in highly competitive Amazon marketplaces. Our solutions deliver accurate, scalable, and real-time insights that help businesses optimize pricing, inventory, and brand positioning. With advanced automation, customizable datasets, and analytics-ready outputs, we ensure faster decision-making and reduced operational risks. By leveraging Amazon Pet Supplies stock availability Analytics, we help brands maintain optimal stock levels, prevent revenue loss from stockouts, and improve fulfillment performance. Our expertise, secure infrastructure, and dedicated support make Actowiz Metrics a trusted partner for sustainable eCommerce growth and competitive intelligence.

Optimizing pricing and inventory on Amazon requires more than intuition—it demands data-driven precision. By leveraging Amazon.com Bestselling Pet Supply Brands Analytics and Pet Supplies Top Brands Analysis on Amazon, the USA brand achieved stronger pricing alignment, improved stock accuracy, and enhanced competitive positioning. Actowiz Metrics helps brands convert complex marketplace data into measurable performance gains.

Contact Actowiz Metrics today to unlock smarter pricing, inventory, and competitive insights for Amazon pet supplies!

Live Data Tracking Dashboard for Keeta Food Delivery App enables real-time order, pricing, and restaurant insights to optimize performance and decisions.

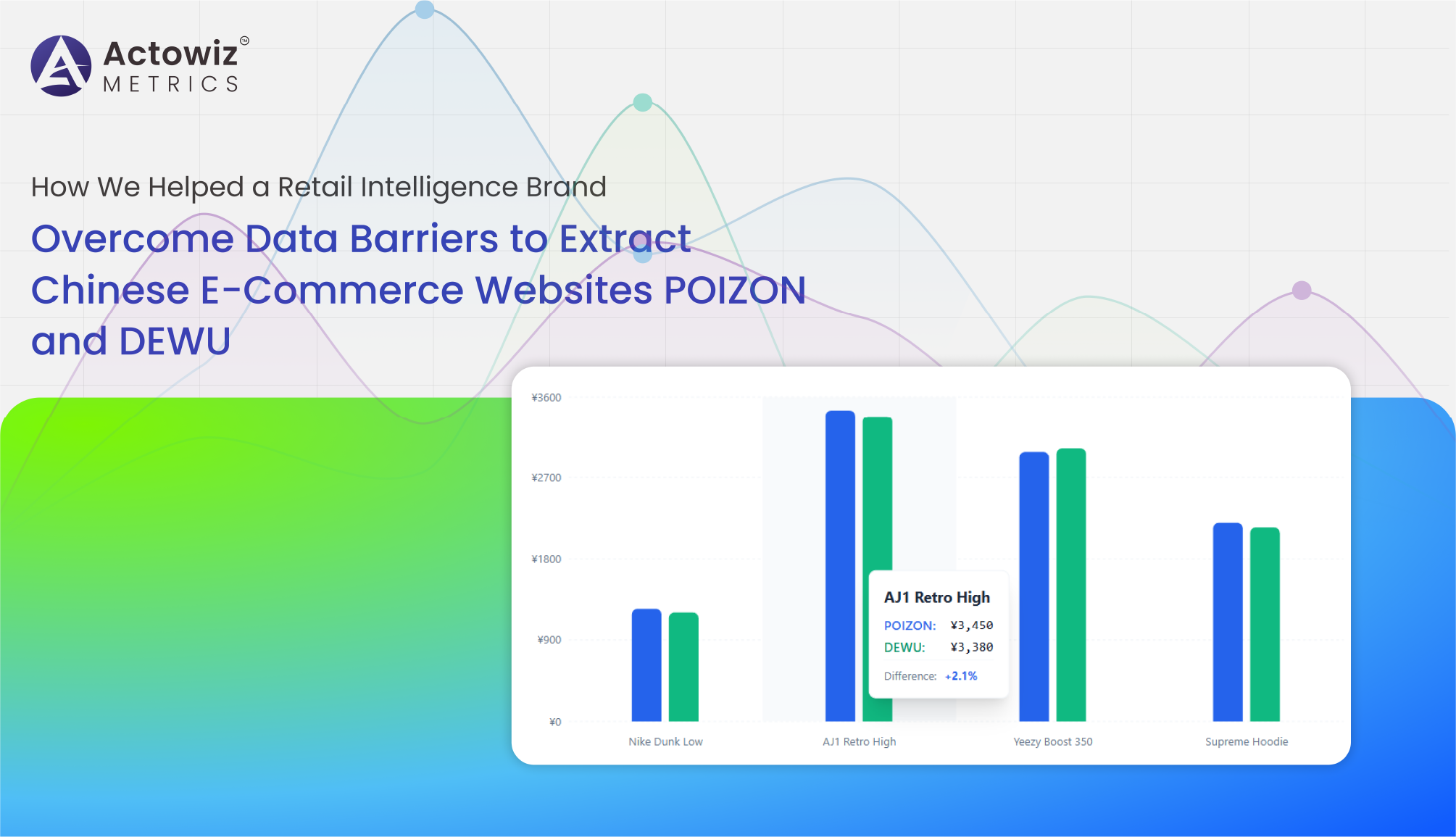

Explore NowHow We Helped a Retail Intelligence Brand Overcome Data Barriers to Extract Chinese E-Commerce Websites POIZON and DEWU for real-time pricing and market insights.

Explore Now

Price Changes Data Monitoring For Amazon & OnBuy UK enables real-time tracking of price movements to optimize promotions, protect margins, and improve pricing decisions.

Explore Now

Browse expert blogs, case studies, reports, and infographics for quick, data-driven insights across industries.

Pringles Food Data Analytics 2026 reveals how data-driven insights improve pricing, demand forecasting, and supply chain efficiency in a dynamic snack market.

KitKat Flavor and Product Trend Data Analysis uncovers consumer flavor preferences, product performance, and innovation trends across key markets.

Gain insights with Size-Level Availability & Demand Data Analytics for Apparel & Accessories to optimize inventory, track trends, and boost sales performance.

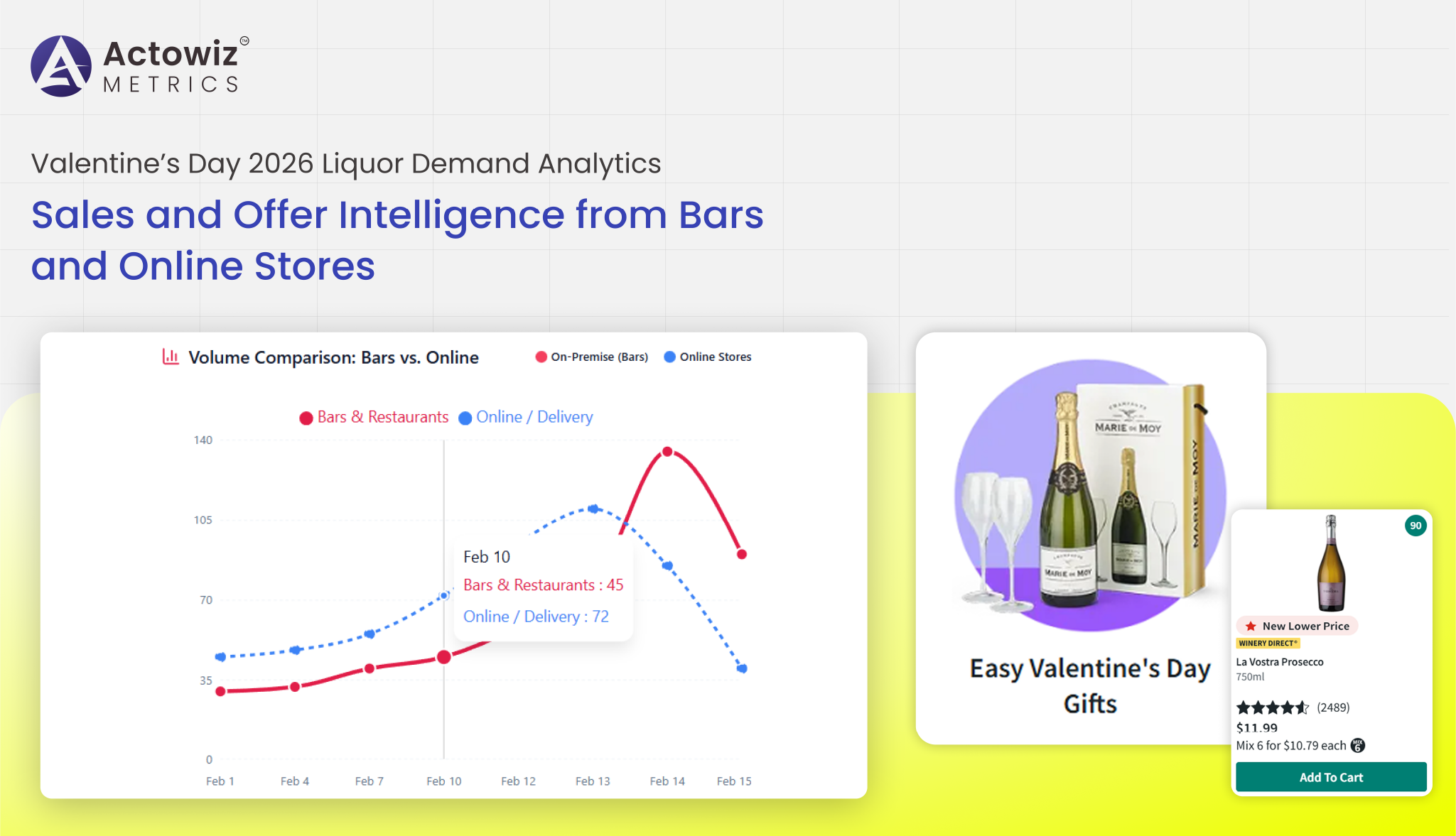

Valentine’s Day 2026 Liquor Demand Analytics highlight growing demand for premium wines, craft spirits, and curated alcohol gifting trends worldwide.

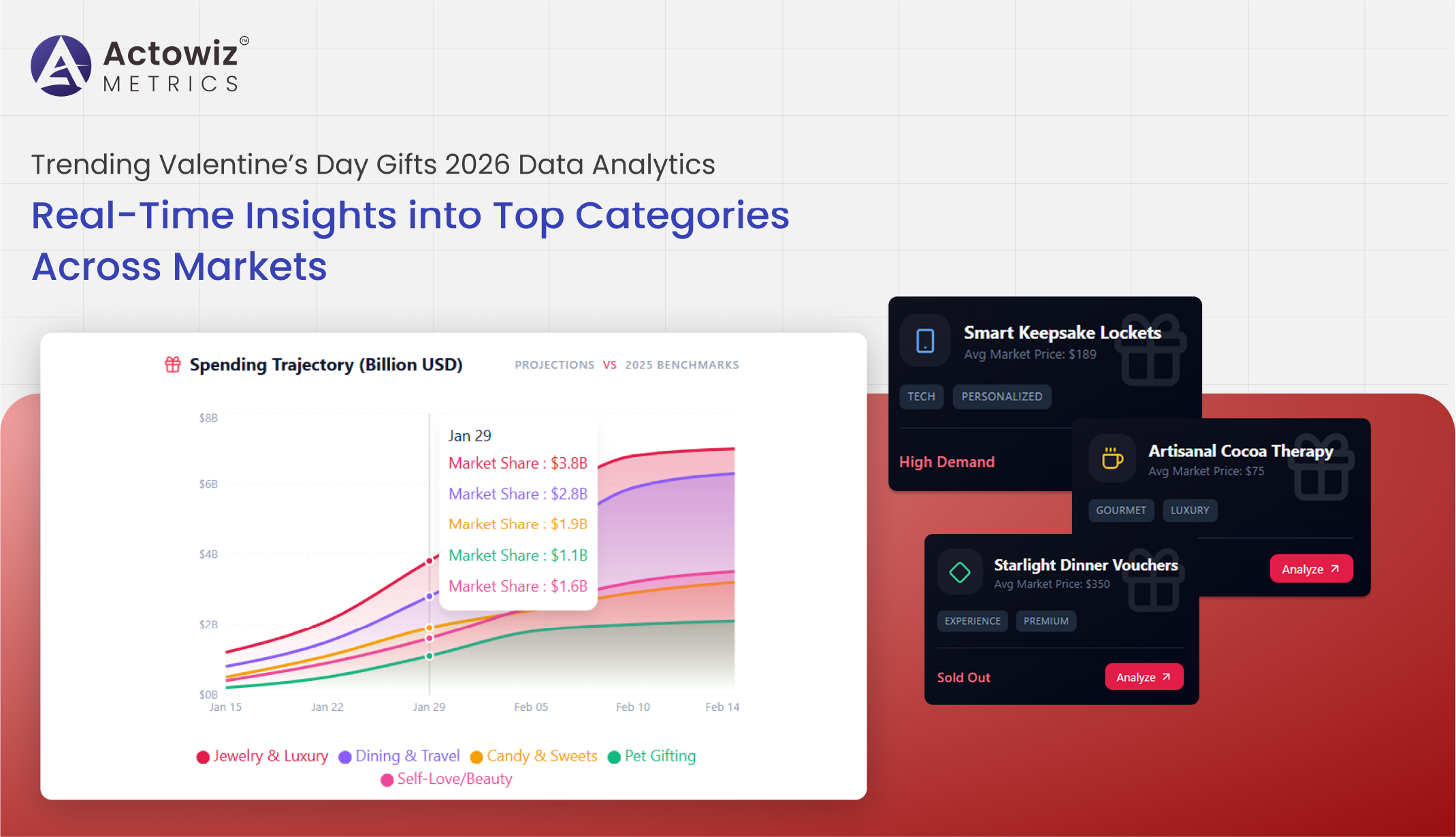

Analyze top-selling items with Trending Valentine’s Day Gifts 2026 Data Analytics to track demand, optimize inventory, and boost e-commerce sales.

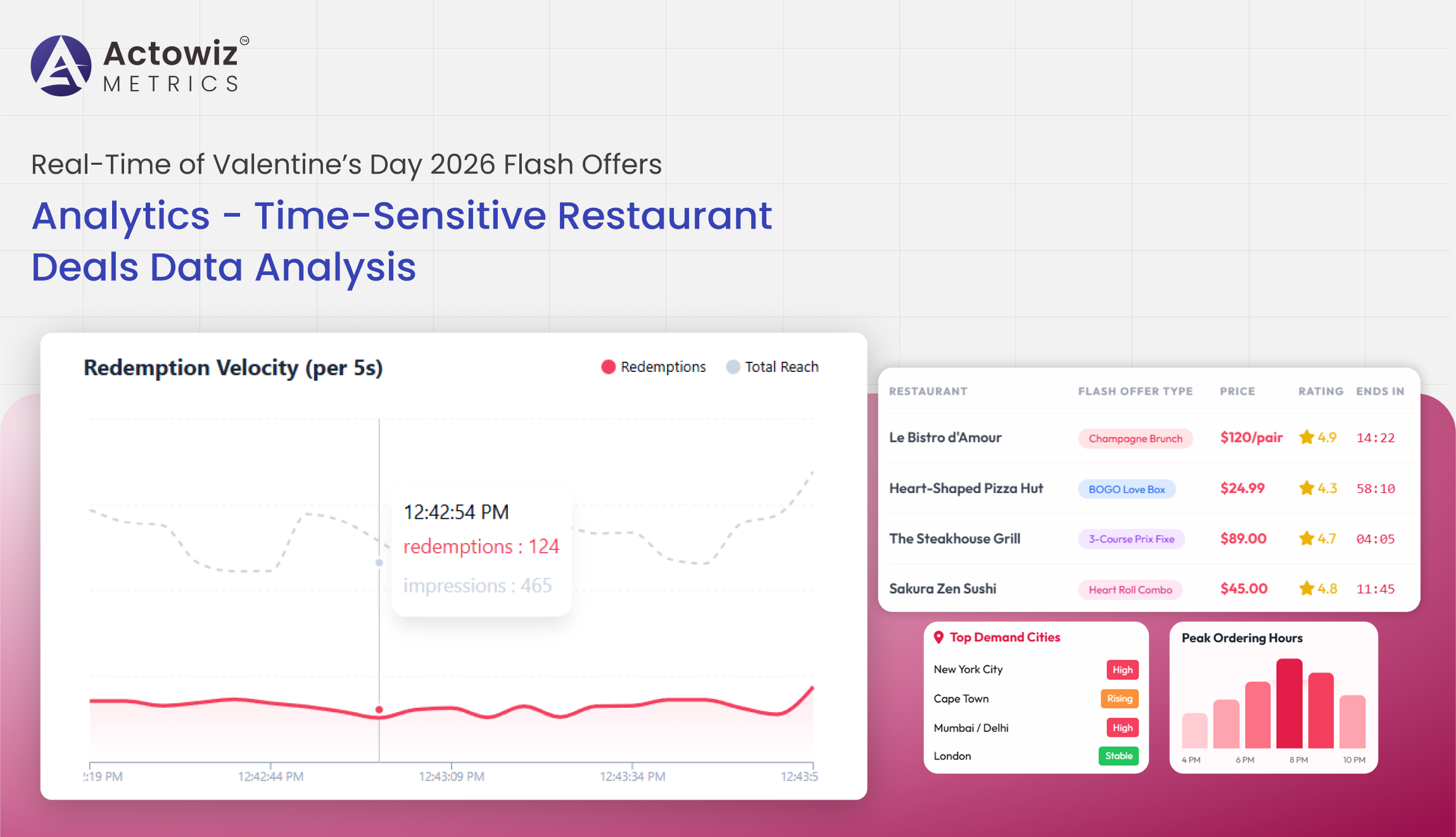

Real-Time of Valentine’s Day 2026 Flash Offers Analytics delivers instant insights on discounts, pricing trends, and offer performance across platforms.

Explore Luxury vs Smartwatch - Global Price Comparison 2025 to compare prices of luxury watches and smartwatches using marketplace data to reveal key trends and shifts.

E-Commerce Price Benchmarking: Gucci vs Prada reveals 2025 pricing trends for luxury handbags and accessories, helping brands track competitors and optimize pricing.

Discover how menu data scraping uncovers trending dishes in 2025, revealing popular recipes, pricing trends, and real-time restaurant insights for food businesses.

Explore the Amazon Baby Care Report analyzing Top Baby Brands Analysis on Amazon, covering discounts, availability, and popular products with data-driven market insights.

Amazon Sports & Outdoors Report - Sports & Outdoors Top Brands Analysis on Amazon - Prices, Discounts, Reviews

Enabled a USA pet brand to optimize pricing, inventory, and offers on Amazon using Pet Supplies Top Brands Analysis on Amazon for accurate, data-driven decisions.

Whatever your project size is, we will handle it well with all the standards fulfilled! We are here to give 100% satisfaction.

Any analytics feature you need — we provide it

24/7 global support

Real-time analytics dashboard

Full data transparency at every stage

Customized solutions to achieve your data analysis goals