Restaurant Reservations & Orders Monitoring API - Zomato, Swiggy & EazyDiner

Solving Real-Time Order Management Challenges with Restaurant Reservations & Orders Monitoring API - Zomato, Swiggy & EazyDiner for smarter tracking.

The U.S. baby care market on Amazon has shown steady expansion, driven by rising birth rates in select regions, premiumization of baby products, and growing trust in online shopping for essential goods. This research focuses on Top Baby Brands Analysis on Amazon, offering deep insights into discounts, availability, and brand performance across the platform. Using Amazon.com Bestselling Baby Brands Analytics Pampers, the report evaluates how leading brands compete on pricing, maintain stock consistency, and influence consumer trust through reviews. By analyzing trends from 2020 to 2026, this report enables brands, retailers, and investors to understand category dynamics and identify data-driven growth opportunities.

The baby care category is highly competitive, with global brands and private labels battling for visibility. Through Baby Brands Competitor Benchmarking on Amazon, combined with Amazon Bestselling Brands Analytics, this section evaluates how top brands performed over time.

| Year | Brands Analyzed | Avg Price ($) | Avg Rating |

|---|---|---|---|

| 2020 | 30 | 18.50 | 4.3 |

| 2021 | 34 | 19.80 | 4.4 |

| 2022 | 38 | 21.10 | 4.4 |

| 2023 | 42 | 22.60 | 4.5 |

| 2024 | 46 | 23.90 | 4.6 |

| 2025 | 50 | 25.20 | 4.6 |

| 2026 | 55 | 26.80 | 4.7 |

The data reveals that brands with consistent pricing strategies and high ratings sustained their bestseller status. Competitive benchmarking allowed brands to adjust product assortments, bundle offerings, and refine pricing without losing customer trust.

Consumer demand for baby products is influenced by safety concerns, sustainability, and convenience. Using a Real-Time Baby Brands Category Trends Scraper on Amazon, supported by advanced E-commerce Analytics, this section highlights demand evolution.

| Year | Category Growth (%) | Seasonal Peaks | New SKUs Added |

|---|---|---|---|

| 2020 | 10 | Q2, Q4 | 2,500 |

| 2021 | 12 | Q2 | 3,000 |

| 2022 | 15 | Q1, Q4 | 3,800 |

| 2023 | 18 | Q2 | 4,500 |

| 2024 | 20 | Q1, Q3 | 5,200 |

| 2025 | 22 | Multi-season | 6,000 |

| 2026 | 24 | Multi-season | 6,800 |

Brands that monitored category trends in real time responded faster to demand spikes, launching region-specific SKUs and optimizing inventory allocation during high-growth periods.

Pricing sensitivity is high in baby care, as parents prioritize value and trust. Through Top Baby Brands Sales Analytics on Amazon, combined with Price Benchmarking, this section examines pricing and revenue trends.

| Year | Avg List Price ($) | Avg Discount (%) | Revenue Growth (%) |

|---|---|---|---|

| 2020 | 21 | 10 | 7 |

| 2021 | 22 | 12 | 9 |

| 2022 | 23 | 14 | 11 |

| 2023 | 24 | 16 | 13 |

| 2024 | 25 | 18 | 15 |

| 2025 | 26 | 20 | 17 |

| 2026 | 27 | 21 | 19 |

The data indicates that controlled discounting drove higher revenue growth than aggressive price cuts. Brands leveraging price benchmarking maintained profitability while remaining competitive across Amazon listings.

Customer reviews significantly influence purchase decisions in baby care. Using Extract Top Baby Brands Price & Review on Amazon, supported by Brand Competition Analysis, this section explores sentiment trends.

| Year | Avg Reviews per SKU | Avg Rating | Conversion Impact (%) |

|---|---|---|---|

| 2020 | 1,400 | 4.3 | 20 |

| 2021 | 1,700 | 4.4 | 22 |

| 2022 | 2,100 | 4.5 | 24 |

| 2023 | 2,600 | 4.6 | 26 |

| 2024 | 3,100 | 4.6 | 28 |

| 2025 | 3,700 | 4.7 | 30 |

| 2026 | 4,300 | 4.8 | 32 |

Brands with higher review velocity and consistent ratings benefited from improved visibility and Buy Box performance. Review analytics helped identify quality issues early and improve customer satisfaction.

Sustained category leadership requires continuous monitoring. Through Top Baby Brands Data Monitoring on Amazon, along with Brand Competition Analysis, brands tracked listing changes and competitor movements.

| Year | SKUs Tracked | Listing Changes/Month | Accuracy (%) |

|---|---|---|---|

| 2020 | 6,000 | 12 | 83 |

| 2021 | 7,500 | 14 | 86 |

| 2022 | 9,000 | 16 | 88 |

| 2023 | 11,000 | 18 | 90 |

| 2024 | 13,500 | 21 | 92 |

| 2025 | 15,500 | 24 | 94 |

| 2026 | 18,000 | 27 | 96 |

Automated data monitoring reduced manual errors and enabled brands to react quickly to competitor pricing changes, improving overall marketplace resilience.

Availability and discount timing are critical in baby essentials. Using Real-Time Amazon Baby Brands Price & Discount Tracking, combined with Product Data Tracking, this section evaluates stock health.

| Year | Avg Discount (%) | Stock-Out Rate (%) | Lost Sales (%) |

|---|---|---|---|

| 2020 | 11 | 13 | 9 |

| 2021 | 13 | 12 | 8 |

| 2022 | 15 | 11 | 7 |

| 2023 | 17 | 10 | 6 |

| 2024 | 18 | 9 | 5 |

| 2025 | 20 | 8 | 4 |

| 2026 | 21 | 7 | 3 |

Brands with real-time visibility reduced stock-outs and optimized discount timing, improving revenue and customer trust during peak demand periods.

Actowiz Metrics delivers enterprise-grade retail intelligence through Baby Care SKU-Level Data Extraction from Amazon, enabling brands to monitor pricing, availability, customer reviews, and promotional activity at scale. Our solutions integrate historical datasets with real-time tracking to provide complete visibility into brand and competitor performance. By automating data collection and analysis, Actowiz Metrics supports faster, more accurate decision-making while improving compliance with pricing and availability standards. With scalable infrastructure, customizable dashboards, and API-ready data feeds, businesses can align strategies across sales, marketing, and supply chain teams. Actowiz Metrics empowers brands to remain competitive, identify growth opportunities, and respond proactively to market changes across Amazon’s rapidly evolving baby care marketplace.

The Amazon baby care category continues to evolve rapidly, driven by pricing dynamics, shifting consumer expectations, and inventory performance. Leveraging Top Baby Brands Analysis on Amazon, businesses gain actionable insights into competitive positioning, discount strategies, availability trends, and brand leadership. Actowiz Metrics transforms complex Amazon data into strategic intelligence that supports smarter decisions, reduced operational risk, and sustainable growth. By combining real-time monitoring with historical trend analysis, brands can optimize pricing, improve product visibility, and enhance customer trust. As competition intensifies, data-driven insights become essential for maintaining market relevance and achieving long-term success in the highly competitive Amazon baby care ecosystem.

Partner with Actowiz Metrics today to unlock real-time Amazon baby care insights and stay ahead in a highly competitive marketplace.

Case Study on how we enhanced pricing accuracy and local market insights using Extract API for Instacart Grocery Data from Houston, TX.

Explore Now

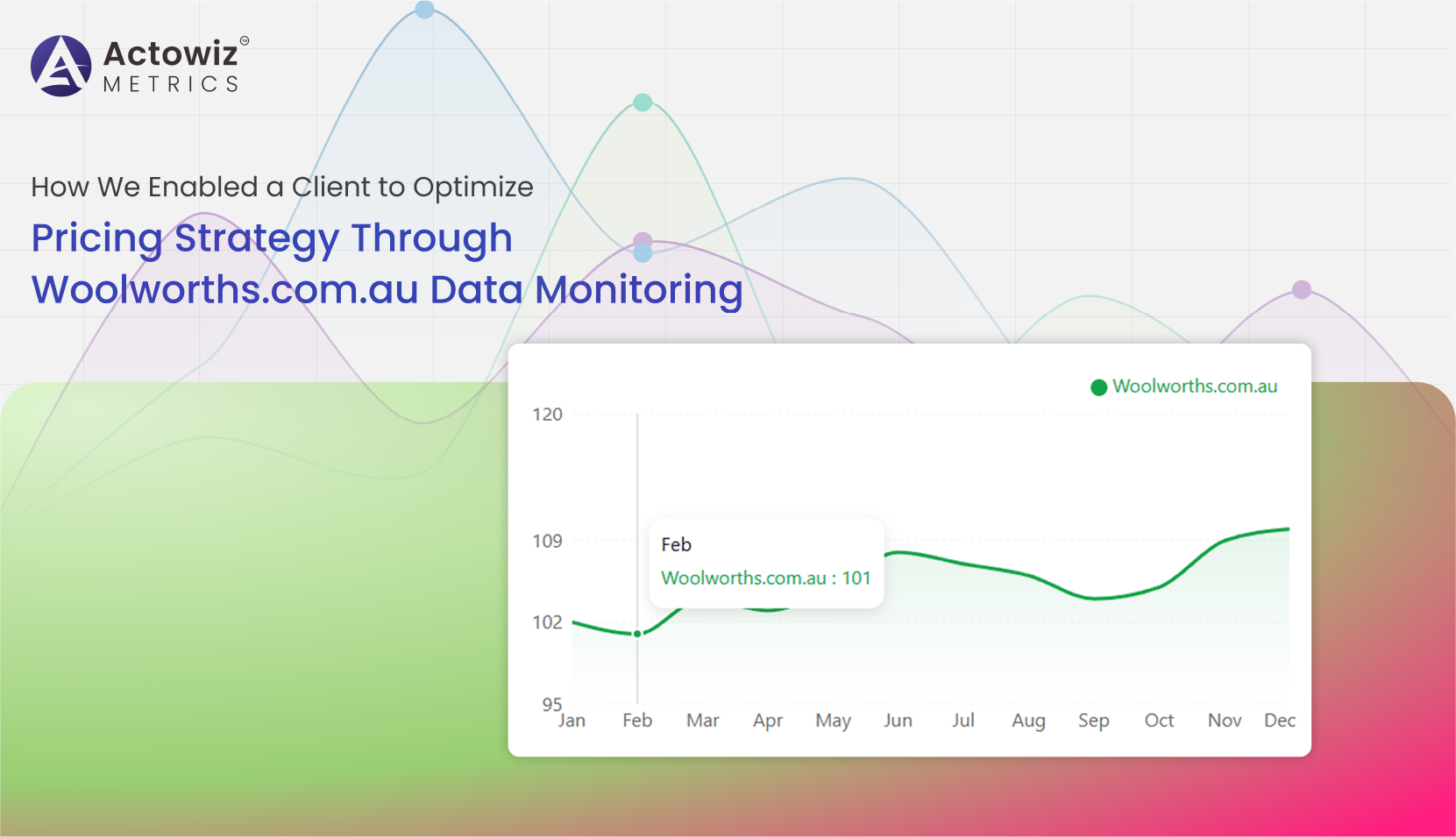

Woolworths.com.au Data Monitoring helps track pricing, promotions, stock availability, and competitor trends to drive smarter retail and eCommerce decisions.

Explore Now

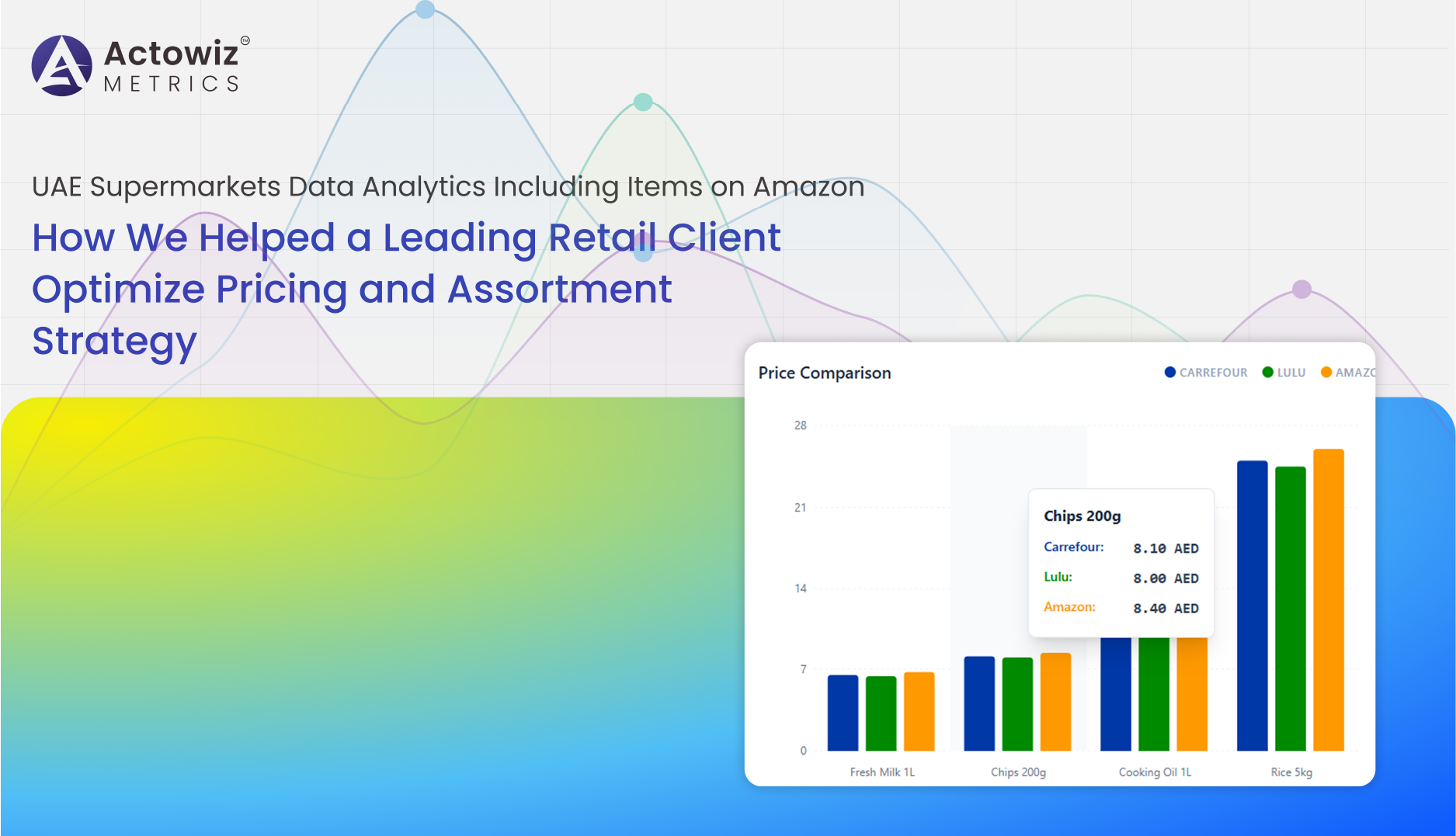

UAE Supermarkets Data Analytics Including Items on Amazon helped our retail client optimize pricing, refine assortment, and improve market competitiveness.

Explore Now

Browse expert blogs, case studies, reports, and infographics for quick, data-driven insights across industries.

Solving Real-Time Order Management Challenges with Restaurant Reservations & Orders Monitoring API - Zomato, Swiggy & EazyDiner for smarter tracking.

Discover how Zonaprop Real Estate Data Tracking in Argentina reduces investment risk with accurate pricing insights and smarter property decisions.

How Woolworths.com.au Data Tracking helps monitor pricing shifts, stock levels, and promotions to improve retail visibility and decision-making.

Dior Luxury Fashion Market Analysis explores global brand positioning, competitive landscape, market trends, revenue performance, and future growth outlook.

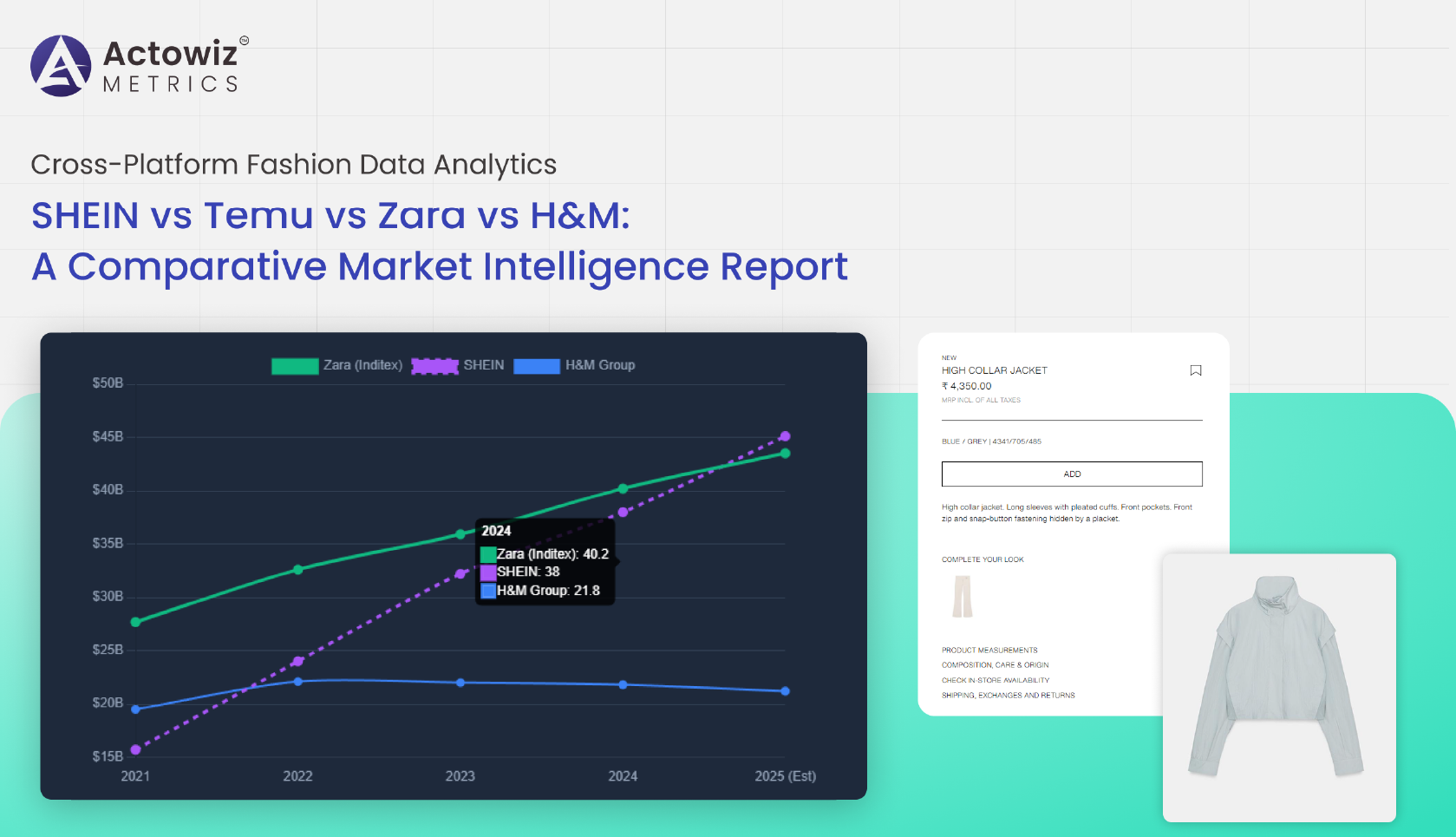

Cross-Platform Fashion Data Analytics - SHEIN vs Temu vs Zara vs H&M delivers actionable insights by comparing pricing, trends, inventory shifts, and consumer demand

Track and analyze the Number of Pizza Hut Locations Analytics in India 2026 to uncover expansion trends, regional distribution, and market growth insights.

Explore Luxury vs Smartwatch - Global Price Comparison 2025 to compare prices of luxury watches and smartwatches using marketplace data to reveal key trends and shifts.

E-Commerce Price Benchmarking: Gucci vs Prada reveals 2025 pricing trends for luxury handbags and accessories, helping brands track competitors and optimize pricing.

Discover how menu data scraping uncovers trending dishes in 2025, revealing popular recipes, pricing trends, and real-time restaurant insights for food businesses.

Explore the Amazon Baby Care Report analyzing Top Baby Brands Analysis on Amazon, covering discounts, availability, and popular products with data-driven market insights.

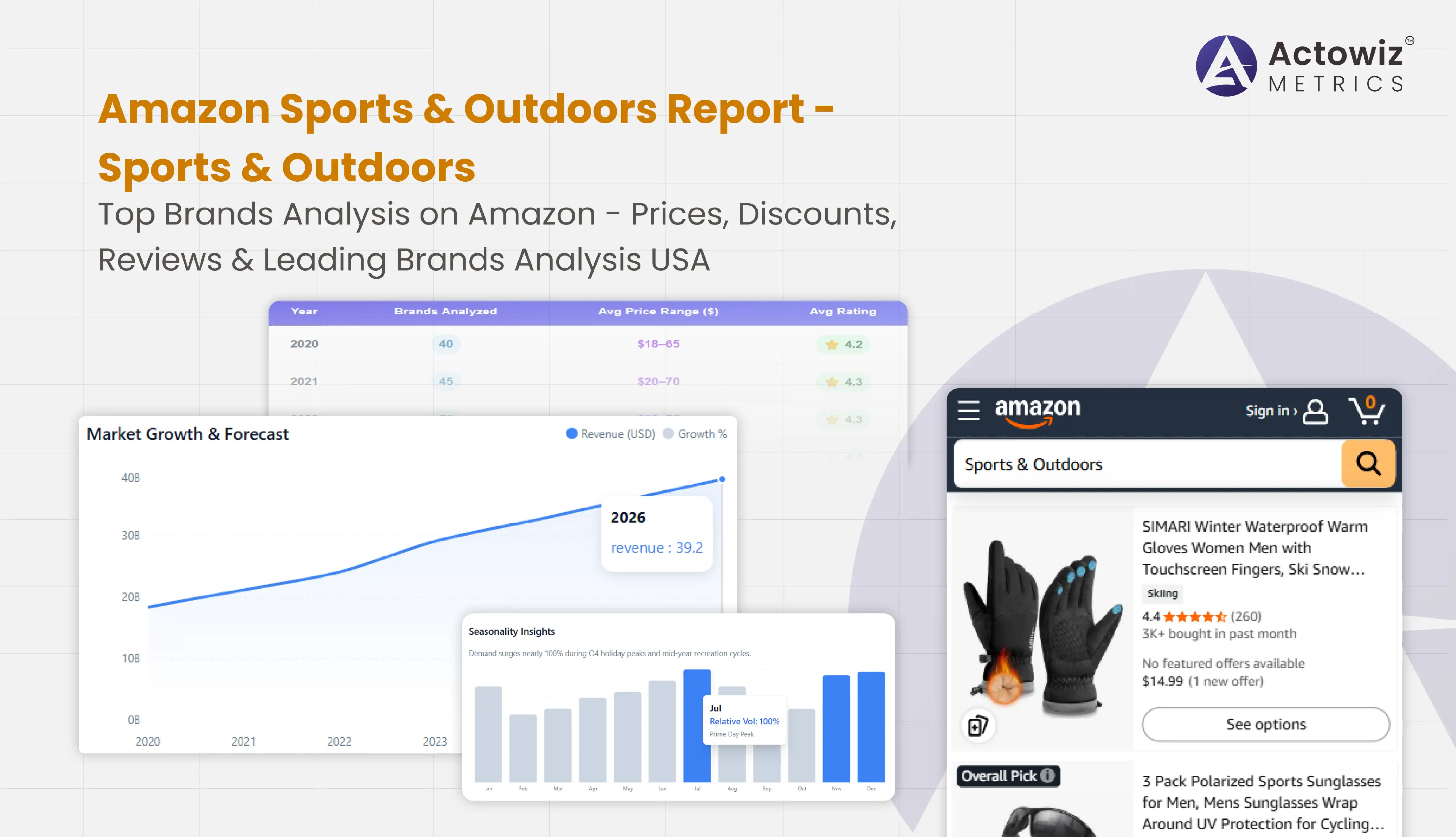

Amazon Sports & Outdoors Report - Sports & Outdoors Top Brands Analysis on Amazon - Prices, Discounts, Reviews

Enabled a USA pet brand to optimize pricing, inventory, and offers on Amazon using Pet Supplies Top Brands Analysis on Amazon for accurate, data-driven decisions.

Whatever your project size is, we will handle it well with all the standards fulfilled! We are here to give 100% satisfaction.

Any analytics feature you need — we provide it

24/7 global support

Real-time analytics dashboard

Full data transparency at every stage

Customized solutions to achieve your data analysis goals