Zonaprop Real Estate Data Tracking in Argentina

Discover how Zonaprop Real Estate Data Tracking in Argentina reduces investment risk with accurate pricing insights and smarter property decisions.

Argentina’s real estate market has undergone dramatic structural shifts between 2020 and 2026. Inflationary cycles, currency devaluation, regulatory changes, and shifting buyer behavior have reshaped property valuations and rental performance across major cities. Investors are no longer just evaluating square meters and location—they are assessing liquidity risk, rental stability, supply-demand gaps, and micro-market volatility.

To navigate this complexity, data visibility becomes critical. Zonaprop Real Estate Data Tracking in Argentina enables investors, agencies, developers, and proptech firms to monitor thousands of listings in real time, identify pricing trends, and detect neighborhood-level shifts before they impact portfolio returns. Combined with structured Marketplace Data Tracking, businesses gain access to daily updates on listing volumes, price movements, amenities, seller activity, and rental indicators.

Rather than relying on quarterly reports or manual research, real-time data infrastructure empowers stakeholders to make fast, informed decisions. This blog explores how structured data extraction, price monitoring, and advanced analytics between 2020 and 2026 reduce uncertainty and enhance investment confidence in Argentina’s evolving property landscape.

Reliable investment decisions begin with accurate and comprehensive data. Zonaprop Real Estate Data Scraping Argentina allows automated extraction of property attributes including price, size, property type, listing duration, location, amenities, seller type, and price history.

Between 2020 and 2026, listing volumes expanded steadily across Argentina’s primary urban hubs:

| Year | Buenos Aires | Córdoba | Rosario | Mendoza |

|---|---|---|---|---|

| 2020 | 112,000 | 38,500 | 21,300 | 18,700 |

| 2021 | 118,400 | 40,200 | 22,800 | 19,900 |

| 2022 | 126,700 | 44,900 | 25,100 | 22,300 |

| 2023 | 133,900 | 48,300 | 27,600 | 24,600 |

| 2024 | 141,200 | 51,700 | 29,400 | 26,800 |

| 2025 | 149,600 | 54,800 | 31,200 | 29,100 |

| 2026 | 158,300 | 58,100 | 33,500 | 31,400 |

Key Observations:

With structured datasets, investors can assess market saturation, detect overbuilding risk, and evaluate long-term appreciation potential.

Liquidity is a major risk factor in volatile markets. When properties remain unsold for extended periods, holding costs increase. Using tools to Scrape Zonaprop Property Listings Argentina, investors can analyze listing lifecycle data, including additions, removals, and relistings.

| Year | Avg. Days on Market |

|---|---|

| 2020 | 124 |

| 2021 | 131 |

| 2022 | 118 |

| 2023 | 103 |

| 2024 | 97 |

| 2025 | 91 |

| 2026 | 86 |

Insights:

Tracking turnover rates helps investors forecast capital lock-in periods and adjust acquisition timing accordingly.

National price averages often conceal neighborhood volatility. A Zonaprop Real Estate Listings Scraper Argentina enables granular segmentation by district and property type.

| Year | Palermo | Recoleta | Belgrano | Caballito |

|---|---|---|---|---|

| 2020 | 2,350 | 2,480 | 2,210 | 1,980 |

| 2021 | 2,300 | 2,420 | 2,180 | 1,950 |

| 2022 | 2,420 | 2,550 | 2,300 | 2,040 |

| 2023 | 2,650 | 2,720 | 2,480 | 2,180 |

| 2024 | 2,810 | 2,900 | 2,640 | 2,330 |

| 2025 | 2,950 | 3,040 | 2,780 | 2,480 |

| 2026 | 3,120 | 3,210 | 2,940 | 2,620 |

Key Takeaways:

Granular analytics reduce overpayment risk and uncover undervalued neighborhoods poised for growth.

Real-time pricing intelligence prevents delayed investment decisions. Zonaprop Real Estate Price Monitoring Argentina tracks listing price changes, reductions, and reactivations.

| Year | Avg. Change % |

|---|---|

| 2020 | -4.2% |

| 2021 | -2.8% |

| 2022 | +5.1% |

| 2023 | +9.3% |

| 2024 | +6.7% |

| 2025 | +4.8% |

| 2026 | +3.9% |

Analysis:

Continuous monitoring identifies distressed sellers and price adjustment patterns, minimizing entry risk.

Capital appreciation is only one side of investment returns. Rental income stability significantly reduces overall risk exposure. The Zonaprop Property Market Intelligence API enables automated integration of rental data into financial dashboards.

| Year | Buenos Aires | Córdoba |

|---|---|---|

| 2020 | 2.9% | 3.2% |

| 2021 | 3.1% | 3.4% |

| 2022 | 3.8% | 4.0% |

| 2023 | 4.4% | 4.6% |

| 2024 | 4.7% | 4.9% |

| 2025 | 4.9% | 5.2% |

| 2026 | 5.1% | 5.4% |

Key Points:

API-based integration enables automated ROI forecasting and sensitivity analysis.

Advanced Zonaprop Property Listings Analytics transforms historical datasets into predictive insights, forecasting supply-demand balance and future pricing behavior.

| Year | Demand Index | Supply Index |

|---|---|---|

| 2020 | 68 | 92 |

| 2021 | 64 | 95 |

| 2022 | 78 | 88 |

| 2023 | 84 | 82 |

| 2024 | 89 | 80 |

| 2025 | 92 | 78 |

| 2026 | 95 | 76 |

Findings:

Predictive modeling reduces speculative decisions and improves portfolio allocation efficiency.

Beyond pricing and yields, structured data also supports:

Investors leveraging continuous data feeds gain earlier access to market signals compared to traditional investors relying on lagging indicators.

Actowiz Metrics delivers enterprise-grade Real Estate Analytics solutions tailored to Argentina’s dynamic property market. By integrating automated extraction, structured data pipelines, and AI-based forecasting models, businesses gain full-cycle property intelligence.

Through scalable systems supporting Zonaprop Real Estate Data Tracking in Argentina, Actowiz Metrics provides:

These capabilities allow investors to reduce capital exposure, improve timing precision, and enhance long-term profitability.

Argentina’s property market between 2020 and 2026 demonstrates how volatility and opportunity coexist. Investors who operate without real-time intelligence face pricing errors, liquidity challenges, and missed growth opportunities. Data-driven strategies offer a measurable competitive advantage.

By combining structured Price Benchmarking with scalable Zonaprop Real Estate Data Tracking in Argentina, investors can monitor trends, forecast demand shifts, and optimize acquisition timing with confidence.

Reducing investment risk is no longer about reacting to market changes—it’s about anticipating them through intelligent data systems.

Partner with Actowiz Metrics today and transform real estate uncertainty into predictive, data-driven investment success.

UAE Supermarkets Data Analytics Including Items on Amazon helped our retail client optimize pricing, refine assortment, and improve market competitiveness.

Explore Now

Boosted qualified B2B leads for a manufacturing brand using IndiaMART Buyer & Seller Data Scraper with accurate buyer insights and targeting.

Explore Now

How we helped a leading industrial supplies brand optimize pricing, inventory, and product strategy using Grainger Catalog Data Analytics.

Explore Now

Browse expert blogs, case studies, reports, and infographics for quick, data-driven insights across industries.

Discover how Zonaprop Real Estate Data Tracking in Argentina reduces investment risk with accurate pricing insights and smarter property decisions.

How Woolworths.com.au Data Tracking helps monitor pricing shifts, stock levels, and promotions to improve retail visibility and decision-making.

Myntra Fashion Category Data Monitoring helps track trends, pricing, stock levels, and category performance to optimize sales and boost growth.

Track and analyze the Number of Pizza Hut Locations Analytics in India 2026 to uncover expansion trends, regional distribution, and market growth insights.

Research Report on Real-Time Price Analytics on Shopee vs Lazada to reduce margin leakage and prevent competitive undercutting using data insights.

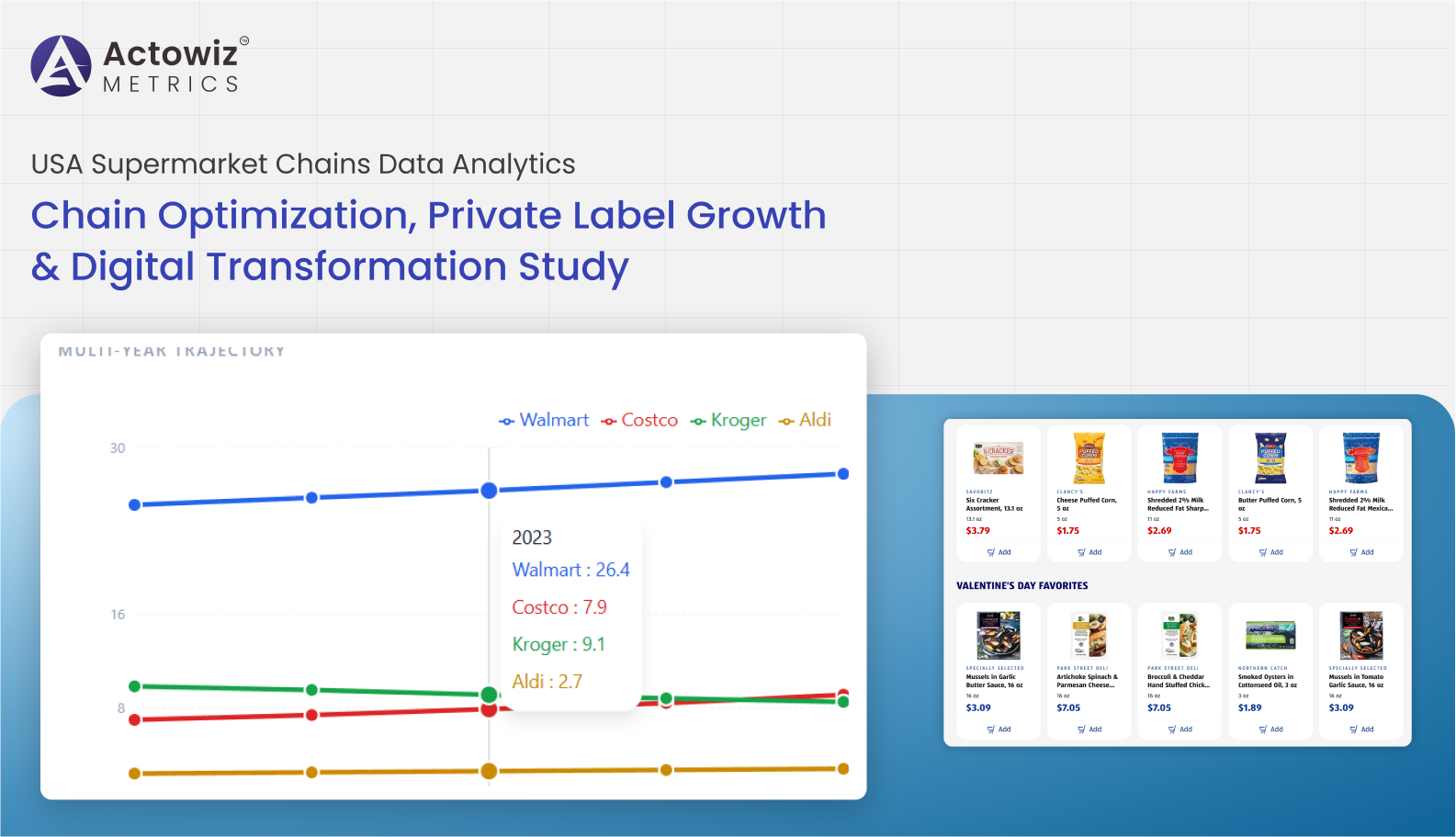

Research Report on USA Supermarket Chains Data Analytics covering chain optimization, private label growth, pricing trends, and digital transformation insights.

Explore Luxury vs Smartwatch - Global Price Comparison 2025 to compare prices of luxury watches and smartwatches using marketplace data to reveal key trends and shifts.

E-Commerce Price Benchmarking: Gucci vs Prada reveals 2025 pricing trends for luxury handbags and accessories, helping brands track competitors and optimize pricing.

Discover how menu data scraping uncovers trending dishes in 2025, revealing popular recipes, pricing trends, and real-time restaurant insights for food businesses.

Explore the Amazon Baby Care Report analyzing Top Baby Brands Analysis on Amazon, covering discounts, availability, and popular products with data-driven market insights.

Amazon Sports & Outdoors Report - Sports & Outdoors Top Brands Analysis on Amazon - Prices, Discounts, Reviews

Enabled a USA pet brand to optimize pricing, inventory, and offers on Amazon using Pet Supplies Top Brands Analysis on Amazon for accurate, data-driven decisions.

Whatever your project size is, we will handle it well with all the standards fulfilled! We are here to give 100% satisfaction.

Any analytics feature you need — we provide it

24/7 global support

Real-time analytics dashboard

Full data transparency at every stage

Customized solutions to achieve your data analysis goals