Leveraging Poizon Product Stock, Listing & Price Tracking

Leverage Poizon Product Stock, Listing & Price Tracking to gain competitive insights, optimize pricing strategies, and drive sustainable revenue growth.

The US Toys & Games category on Amazon has evolved rapidly over the past decade, driven by changing consumer behavior, seasonal demand spikes, and increased competition among global and private-label brands. This research report by Actowiz Metrics presents an in-depth view of brand performance, pricing trends, availability, and customer sentiment in the Toys & Games segment. Leveraging advanced Toys & Games Top Brands Analysis on Amazon and robust E-commerce Analytics, this report uncovers how leading brands have adapted between 2020 and 2026. The analysis is designed to support brands, retailers, and investors seeking data-backed insights into pricing strategies, stock planning, and competitive positioning. By combining historical trends with near real-time intelligence, Actowiz Metrics delivers actionable insights that help stakeholders anticipate demand, optimize pricing, and track brand momentum across Amazon’s dynamic US marketplace.

Amazon’s Toys & Games category has seen steady growth, with price sensitivity varying sharply by age group, seasonality, and brand strength. Using the Real-Time Toys & Games Category Trends Scraper on Amazon, Actowiz Metrics identified clear pricing patterns and conducted detailed Price Benchmarking across top-performing SKUs.

Between 2020 and 2026, average toy prices increased due to supply chain costs, while discount frequency rose during peak seasons such as Q4 and Prime Day.

| Year | Avg. Price | Avg. Discount % |

|---|---|---|

| 2020 | 18.4 | 21% |

| 2021 | 19.1 | 19% |

| 2022 | 20.3 | 22% |

| 2023 | 21.6 | 24% |

| 2024 | 22.8 | 23% |

| 2025 | 23.9 | 25% |

| 2026* | 25.1 | 26% |

Premium brands maintained stable pricing, while mass-market brands relied heavily on discounting to protect volume. Real-time tracking helped identify short-lived price drops that significantly boosted sales velocity.

Sales distribution in the Toys & Games category is highly concentrated, with the top 15 brands accounting for over 60% of total category revenue. Actowiz Metrics applied Toys & Games Top Brands Sales Analytics on Amazon to evaluate long-term performance, growth consistency, and seasonal spikes.

| Year | Top 5 Brands | Top 10 Brands | Others |

|---|---|---|---|

| 2020 | 42% | 58% | 42% |

| 2022 | 45% | 61% | 39% |

| 2024 | 47% | 63% | 37% |

| 2026* | 49% | 65% | 35% |

Brands with strong IP-based toys and licensed products consistently outperformed generic competitors. Actowiz analysis also revealed that brands investing in frequent catalog refreshes experienced higher year-over-year sales growth compared to static portfolios.

The Toys & Games category is intensely competitive, with dozens of brands often targeting the same age group and price range. Through the Multi-Brand Toys & Games Comparison Scraper on Amazon, Actowiz Metrics enabled detailed Brand Competition Analysis across price, ratings, and SKU depth.

Competition intensified post-2022 as new D2C brands entered Amazon, increasing price pressure in mid-tier segments. Established brands defended share by leveraging brand trust, higher ratings, and better review velocity.

| Price Band | Avg. Brands Competing |

|---|---|

| <$15 | 35+ |

| $15–$30 | 28 |

| $30–$50 | 17 |

| >$50 | 9 |

Brands positioned above $50 benefited from lower competition but required strong ratings and premium positioning to sustain volume.

Customer perception plays a decisive role in Toys & Games purchases, especially for parents. Actowiz Metrics used Extract Top Toys & Games Brands Price & Review on Amazon to correlate pricing with ratings and review counts.

| Year | Avg. Rating | Avg. Reviews per SKU |

|---|---|---|

| 2020 | 4.18 | 520 |

| 2022 | 4.22 | 680 |

| 2024 | 4.26 | 840 |

| 2026* | 4.30 | 1,020 |

Higher-rated products consistently commanded price premiums of 8–12%. Negative review spikes were closely linked to stockouts and fulfillment delays rather than product quality alone, highlighting the importance of supply reliability.

Sustained success on Amazon requires constant visibility into pricing, reviews, and availability. Using Top Toys & Games Brands Data Monitoring on Amazon, Actowiz Metrics tracked long-term brand health indicators.

Brands that adjusted pricing dynamically based on competitor movements maintained better Buy Box retention. Monitoring also revealed that brands responding to negative reviews within 48 hours saw faster rating recovery. Continuous data tracking enabled early detection of declining SKUs and emerging high-growth products, allowing brands to reallocate inventory and ad spend effectively.

Stock availability directly impacts ranking, reviews, and conversion rates. Actowiz Metrics applied Amazon Toys & Games stock availability Analytics combined with advanced Product Data Tracking to measure inventory consistency.

| Year | Top Brands | Mid-Tier Brands |

|---|---|---|

| 2020 | 92% | 84% |

| 2022 | 94% | 86% |

| 2024 | 96% | 88% |

| 2026* | 97% | 90% |

Top brands invested heavily in demand forecasting, reducing stockouts during peak seasons. Even a 5% improvement in availability correlated with higher category rankings and stronger review velocity.

Actowiz Metrics delivers enterprise-grade insights through advanced Amazon.com Bestselling Toys & Games Brands Analytics and in-depth Toys & Games Top Brands Analysis on Amazon. Our platform integrates large-scale data collection, real-time monitoring, and historical trend analysis to support smarter, faster decision-making. Clients gain access to scalable dashboards, customizable datasets, and actionable intelligence aligned with specific business goals. With proven expertise across pricing dynamics, customer reviews, inventory performance, and brand competition, Actowiz Metrics empowers brands, retailers, and analysts to stay competitive and data-driven in Amazon’s rapidly evolving Toys & Games marketplace.

This research report highlights how data-driven intelligence can transform strategic planning in the US Toys & Games category. By leveraging Amazon Bestselling Brands Analytics, Actowiz Metrics enables brands to optimize pricing strategies, closely monitor competitors, and improve stock availability with greater confidence. The insights derived from real-time and historical data help businesses anticipate trends, reduce risks, and identify growth opportunities on Amazon. Partner with Actowiz Metrics today to unlock deeper Amazon insights, strengthen competitive positioning, and convert marketplace data into long-term, sustainable advantage using proven Toys & Games Top Brands Analysis on Amazon!

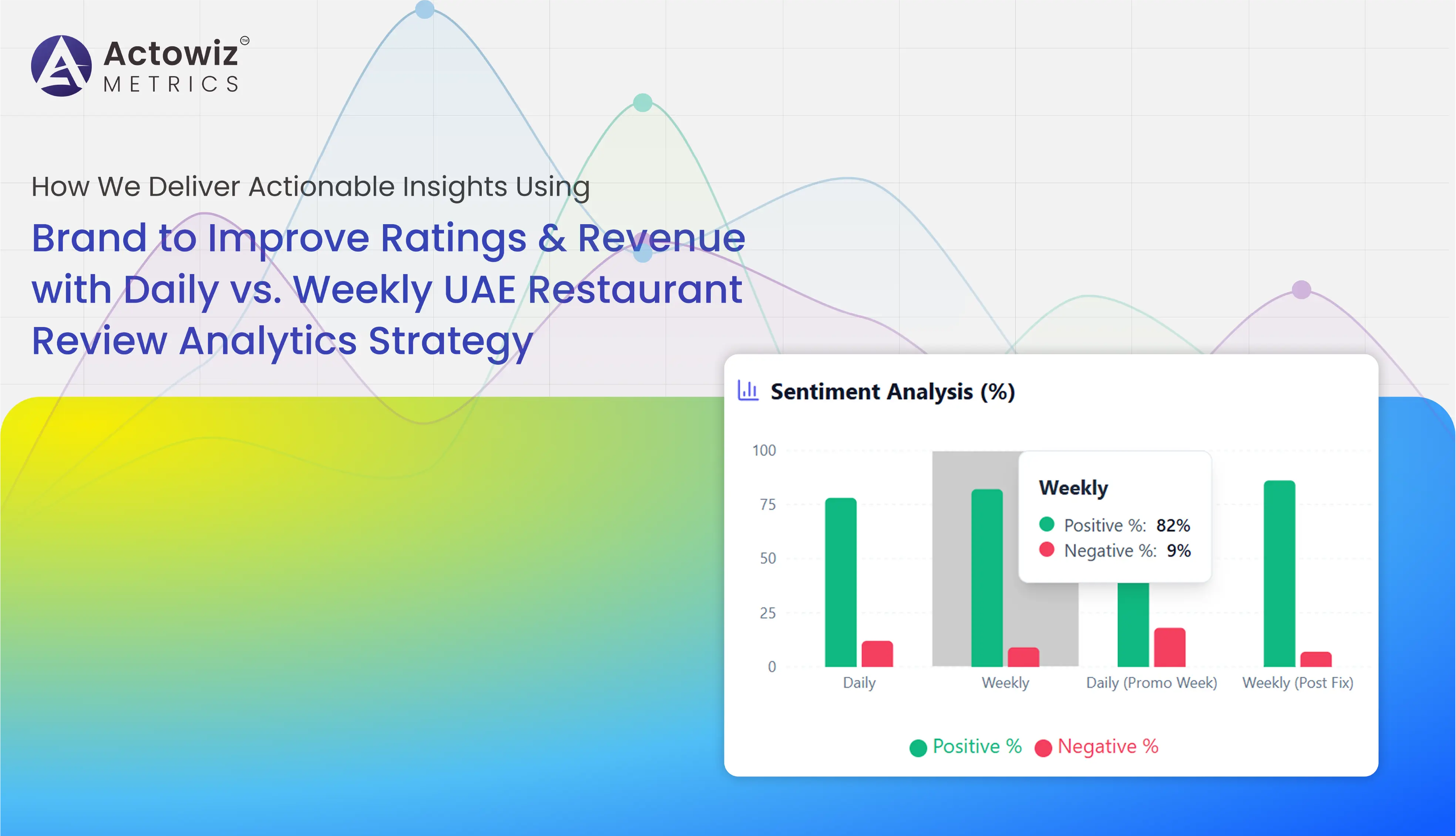

Compare daily vs. weekly UAE restaurant review analytics to uncover trends, track sentiment shifts, and optimize brand performance faster and smarter.

Explore Now

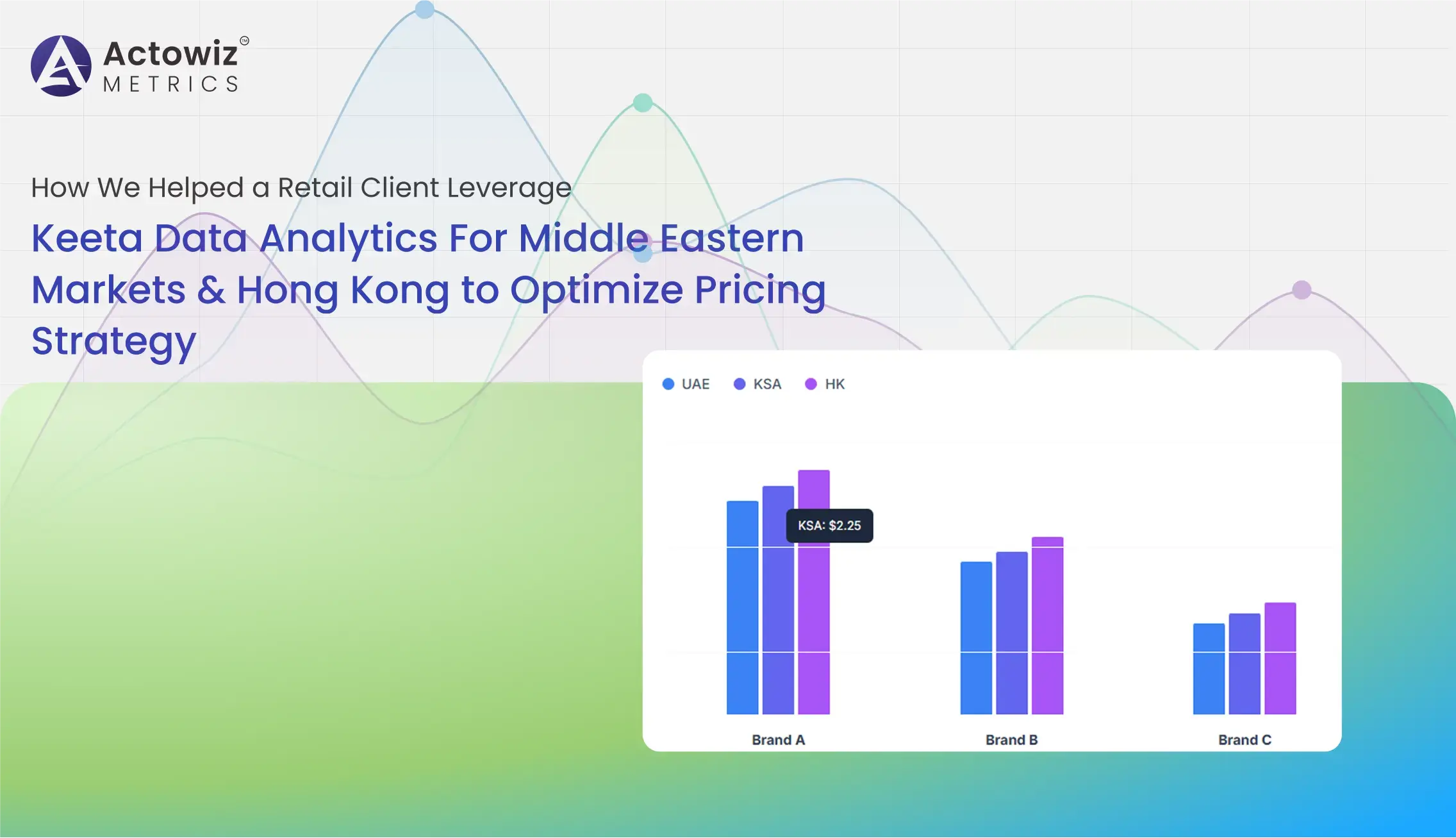

How we helped a retail client use Keeta Data Analytics For Middle Eastern Markets & Hong Kong to optimize pricing, demand tracking, and growth.

Explore Now

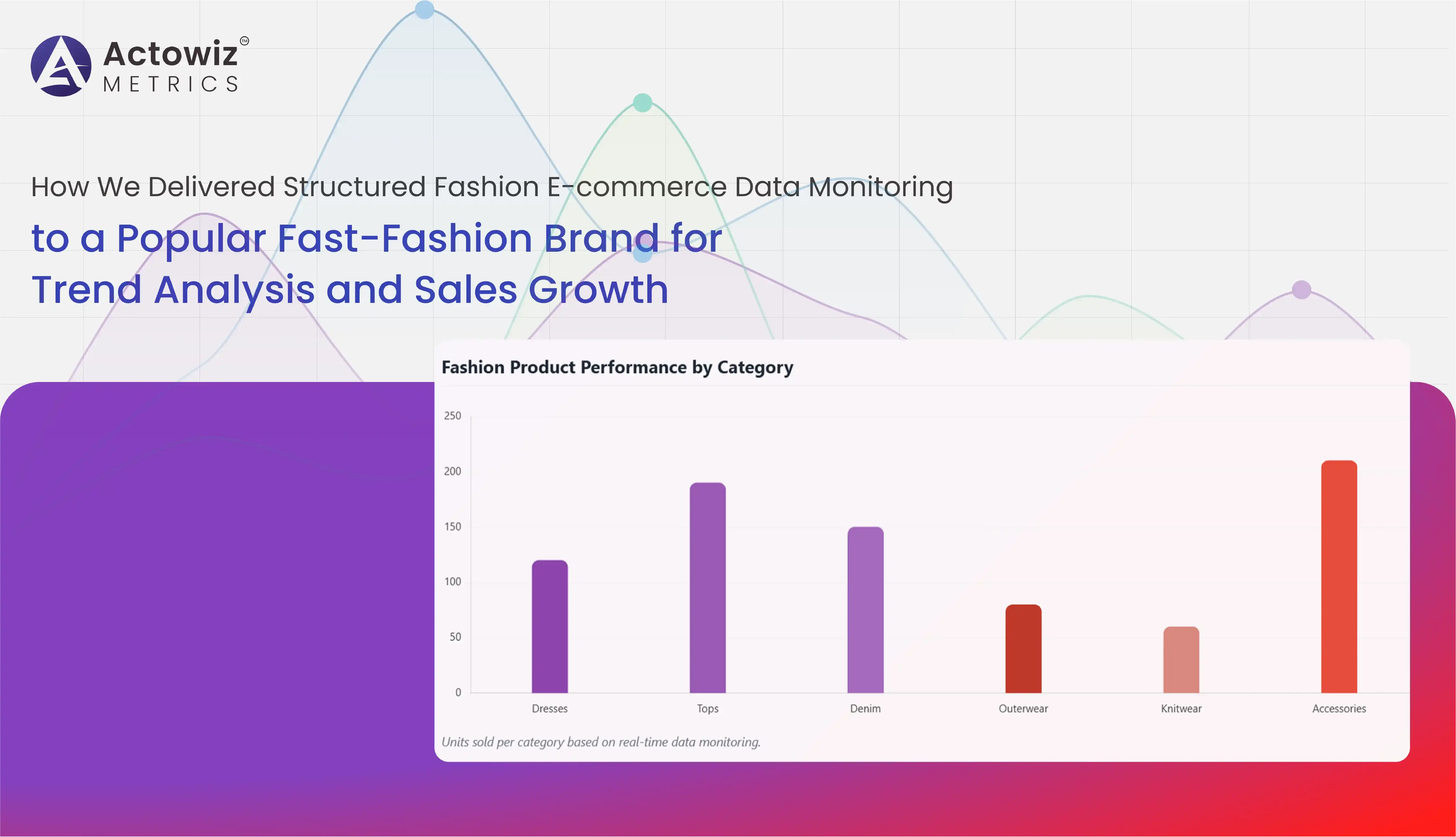

Discover how Structured Fashion E-commerce Data Monitoring helps brands track products, pricing, and trends in real time, optimizing inventory, sales, and competitive strategy.

Explore Now

Browse expert blogs, case studies, reports, and infographics for quick, data-driven insights across industries.

Leverage Poizon Product Stock, Listing & Price Tracking to gain competitive insights, optimize pricing strategies, and drive sustainable revenue growth.

Fix data gaps, improve accuracy, and turn Dewu website product data tracking into actionable insights that drive smarter eCommerce decisions.

Scrape Electronics Data from E-commerce Websites - Pricing & Specifications to monitor price trends, compare specs, and gain real-time market insights efficiently.

Chinese E-Commerce Websites Data Tracking - POIZON & DEWU delivers insights on pricing trends, product demand, brand performance, and market competition in China.

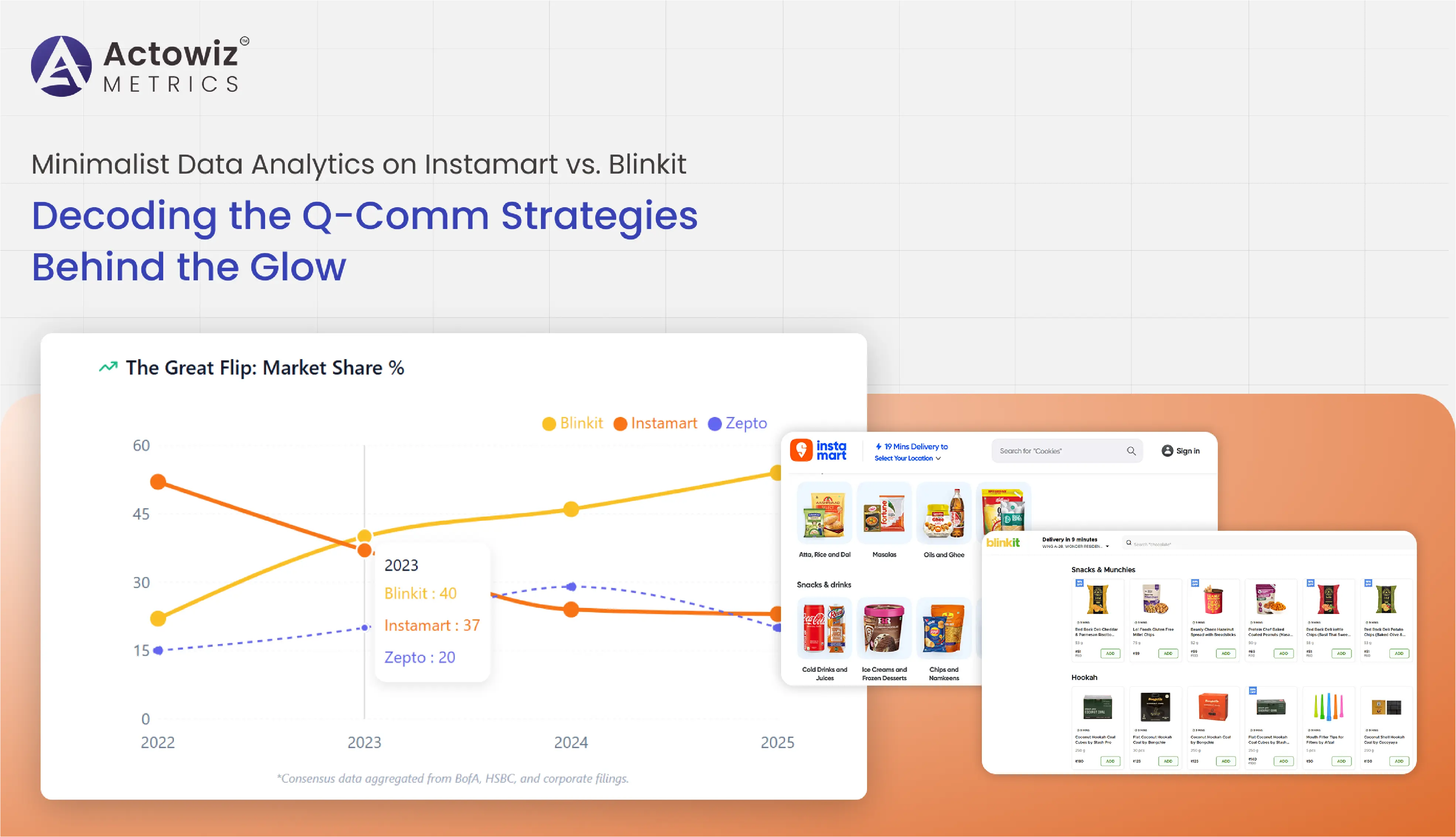

Minimalist Data Analytics on Instamart vs. Blinkit: Compare delivery speed, prices, item availability, order trends & fees to find the best quick grocery

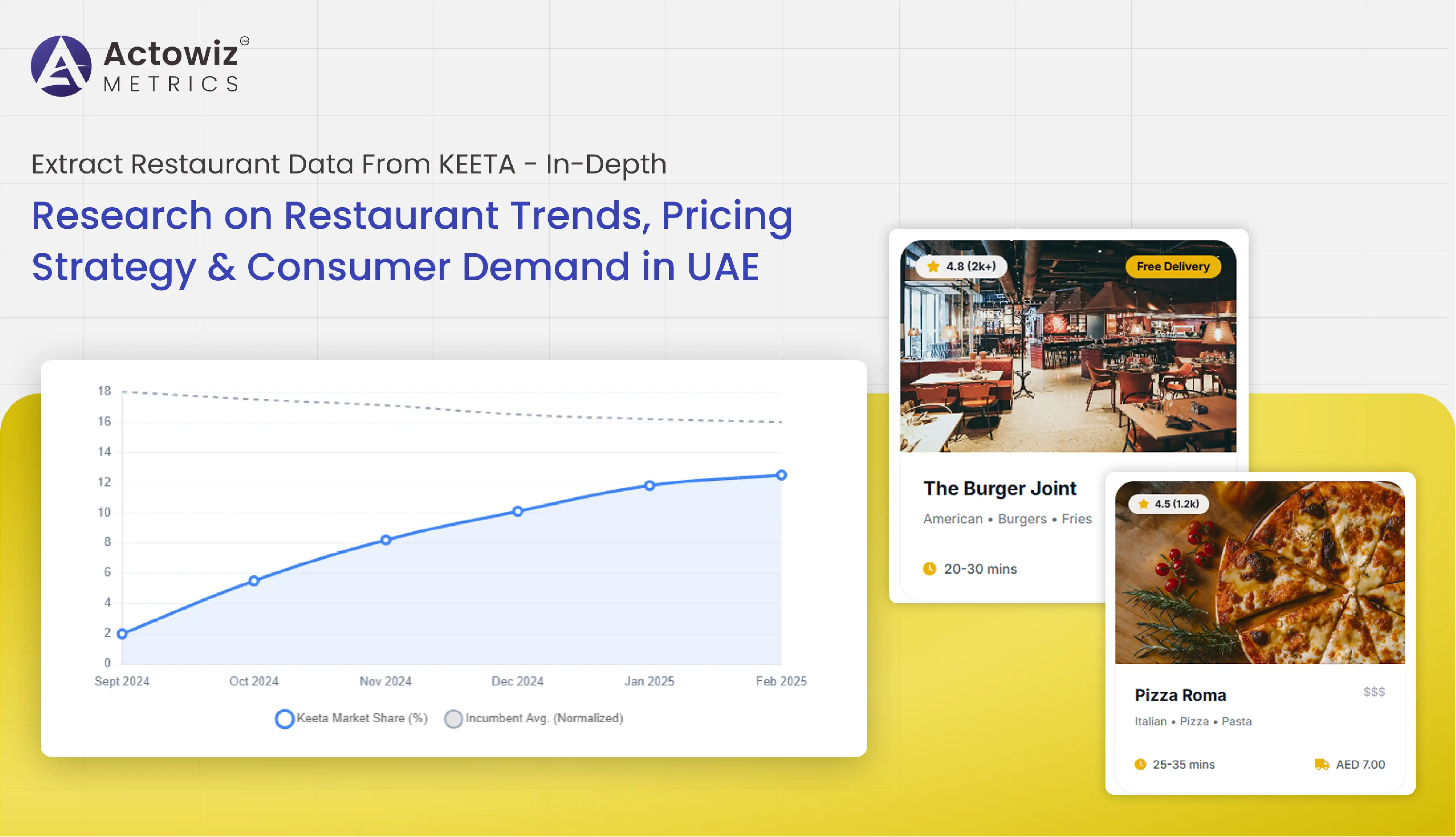

Research report to extract restaurant data from KEETA, uncovering UAE trends, pricing strategies, consumer demand shifts and competitive insights.

This SMP tracks pricing, visibility, and Skittles Trends Market Performance And Demand to help brands optimize retail strategy and boost growth.

Explore Luxury vs Smartwatch - Global Price Comparison 2025 to compare prices of luxury watches and smartwatches using marketplace data to reveal key trends and shifts.

E-Commerce Price Benchmarking: Gucci vs Prada reveals 2025 pricing trends for luxury handbags and accessories, helping brands track competitors and optimize pricing.

Explore the Amazon Baby Care Report analyzing Top Baby Brands Analysis on Amazon, covering discounts, availability, and popular products with data-driven market insights.

Amazon Sports & Outdoors Report - Sports & Outdoors Top Brands Analysis on Amazon - Prices, Discounts, Reviews

Enabled a USA pet brand to optimize pricing, inventory, and offers on Amazon using Pet Supplies Top Brands Analysis on Amazon for accurate, data-driven decisions.

Whatever your project size is, we will handle it well with all the standards fulfilled! We are here to give 100% satisfaction.

Any analytics feature you need — we provide it

24/7 global support

Real-time analytics dashboard

Full data transparency at every stage

Customized solutions to achieve your data analysis goals