Restaurant Reservations & Orders Monitoring API - Zomato, Swiggy & EazyDiner

Solving Real-Time Order Management Challenges with Restaurant Reservations & Orders Monitoring API - Zomato, Swiggy & EazyDiner for smarter tracking.

The e-commerce landscape is evolving rapidly, and Black Friday continues to be one of the most crucial periods for online retailers. Our research report, E-Commerce Deals Data Analytics for Black Friday 2025: Insights from Amazon, Tesco, and Walmart, delves into critical trends across three major e-commerce platforms, tracking deals, promotions, pricing, and consumer behavior from 2020 to 2025. The study highlights how retailers strategize discounts and offers to attract customers during peak shopping seasons.

Using Web Scraping Black Friday 2025 E-Commerce Deals Data, we collected structured information from thousands of product listings, including price fluctuations, promotional campaigns, and stock availability. This report provides actionable insights for pricing optimization, competitive benchmarking, and product performance monitoring, empowering brands and retailers to make data-driven decisions for upcoming Black Friday campaigns.

This report emphasizes trends, patterns, and analytics that can be leveraged for predictive modeling and strategic planning for e-commerce stakeholders.

Price competition is at the heart of Black Friday strategies. Using Web Scraping Black Friday 2025 E-Commerce Deals Data, we analyzed thousands of products across Amazon, Tesco, and Walmart from 2020 to 2025.

| Year | Amazon Avg Discount | Tesco Avg Discount | Walmart Avg Discount |

|---|---|---|---|

| 2020 | 22% | 18% | 20% |

| 2021 | 24% | 20% | 22% |

| 2022 | 25% | 21% | 23% |

| 2023 | 27% | 23% | 25% |

| 2024 | 28% | 24% | 26% |

| 2025 | 30% | 26% | 28% |

Over the last five years, Amazon led in offering deeper discounts, averaging 30% in 2025, followed closely by Walmart and Tesco. Price-sensitive categories such as electronics and home appliances witnessed the highest markdowns. Insights derived from E-Commerce Deals Data Analytics for Black Friday 2025: Insights from Amazon, Tesco, and Walmart indicate a steady rise in discount percentages across product categories to attract more online shoppers.

Retailers now focus on targeted promotions to boost conversion. Our Scrape Black Friday Product Deals and Pricing Insights 2025 revealed patterns in category-specific deals.

| Category | 2020 Deals | 2025 Deals | % Growth |

|---|---|---|---|

| Electronics | 12,500 | 22,300 | 78% |

| Fashion & Apparel | 9,800 | 18,500 | 89% |

| Grocery & Household | 4,500 | 9,200 | 104% |

The findings from E-Commerce Deals Data Analytics for Black Friday 2025: Insights from Amazon, Tesco, and Walmart show that retailers are increasingly personalizing offers and using real-time analytics to optimize deals by category and stock availability.

Tracking dynamic pricing is crucial for competitive positioning. Using Black Friday E-Commerce Data Extraction for Price Analysis, we monitored day-by-day price changes during the Black Friday weeks (2019–2025).

Key Insights:

| Platform | Avg Daily Price Changes | Avg Max Discount | Avg Min Discount |

|---|---|---|---|

| Amazon | 10 | 30% | 15% |

| Tesco | 5 | 26% | 12% |

| Walmart | 8 | 28% | 14% |

The report highlights that E-Commerce Deals Data Analytics for Black Friday 2025: Insights from Amazon, Tesco, and Walmart can help brands benchmark prices, react in real-time, and optimize promotional strategies efficiently.

Retailers are increasingly using data-driven strategies to manage inventory and promotions. Through Extract E-Commerce Offers and Promotions During Black Friday, we analyzed how deal coverage varied across categories.

| Platform | Categories Covered | Avg Deals per Category |

|---|---|---|

| Amazon | 10 | 1,500 |

| Tesco | 10 | 1,200 |

| Walmart | 10 | 1,350 |

The insights demonstrate that structured e-commerce data extraction is critical to understanding deal saturation and category prioritization for maximum ROI.

Understanding customer engagement through discounts can drive higher conversion. Using Black Friday Data Scraping for E-Commerce Discount Analytics, we analyzed historical engagement metrics:

These trends confirm that E-Commerce Deals Data Analytics for Black Friday 2025: Insights from Amazon, Tesco, and Walmart provides actionable intelligence for optimizing promotions and improving customer engagement.

Finally, our report leverages E-commerce Analytics to track long-term trends, predictive modeling, and category-specific performance.

Key Highlights:

| Category | YoY Discount Growth | Avg Basket Increase | Repeat Purchase Rate |

|---|---|---|---|

| Electronics | 4% | 18% | 32% |

| Grocery | 3% | 10% | 28% |

| Fashion | 5% | 22% | 30% |

The data demonstrates the importance of using structured insights from E-Commerce Deals Data Analytics for Black Friday 2025: Insights from Amazon, Tesco, and Walmart to drive informed merchandising and pricing strategies.

Actowiz leverages advanced Digital Shelf Analytics, Price Benchmarking, and Brand Competition Analysis to empower retailers with real-time insights. Using proprietary data pipelines and automated scraping, we help track deals, promotions, and pricing trends. Our Product Data Tracking solution ensures that brands can monitor competitors, adjust strategies dynamically, and optimize campaigns for peak sales periods such as Black Friday.

The findings from this report underscore the importance of structured data collection, competitor monitoring, and predictive analytics for Black Friday success. By using solutions like Digital Shelf Analytics, Price Benchmarking, Brand Competition Analysis, and Product Data Tracking, retailers can drive better deals, improve customer engagement, and maximize revenue. Actowiz Metrics helps brands stay ahead with automated, real-time e-commerce insights—ensuring strategic decisions are data-driven and actionable.

Case Study on how we enhanced pricing accuracy and local market insights using Extract API for Instacart Grocery Data from Houston, TX.

Explore Now

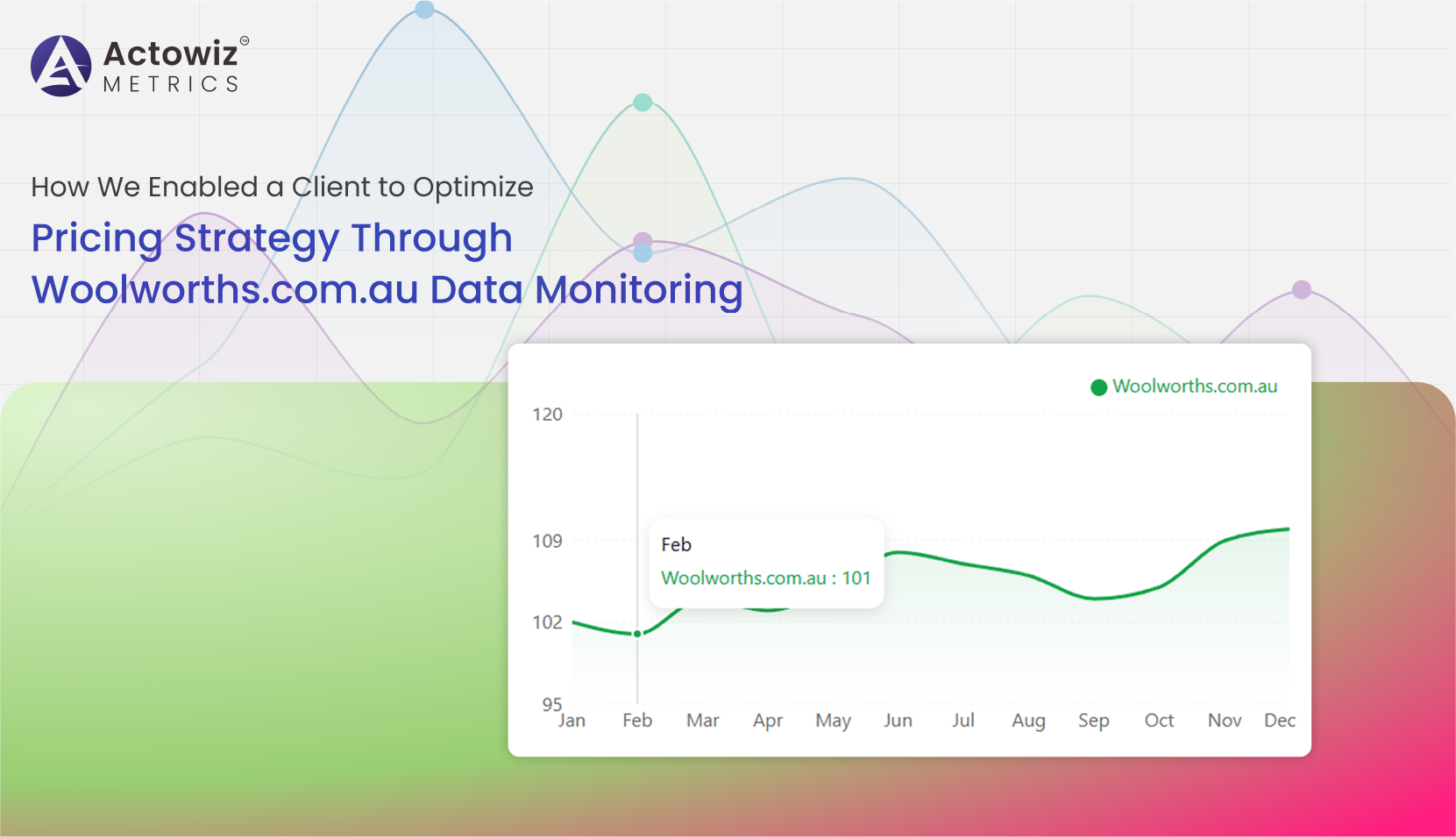

Woolworths.com.au Data Monitoring helps track pricing, promotions, stock availability, and competitor trends to drive smarter retail and eCommerce decisions.

Explore Now

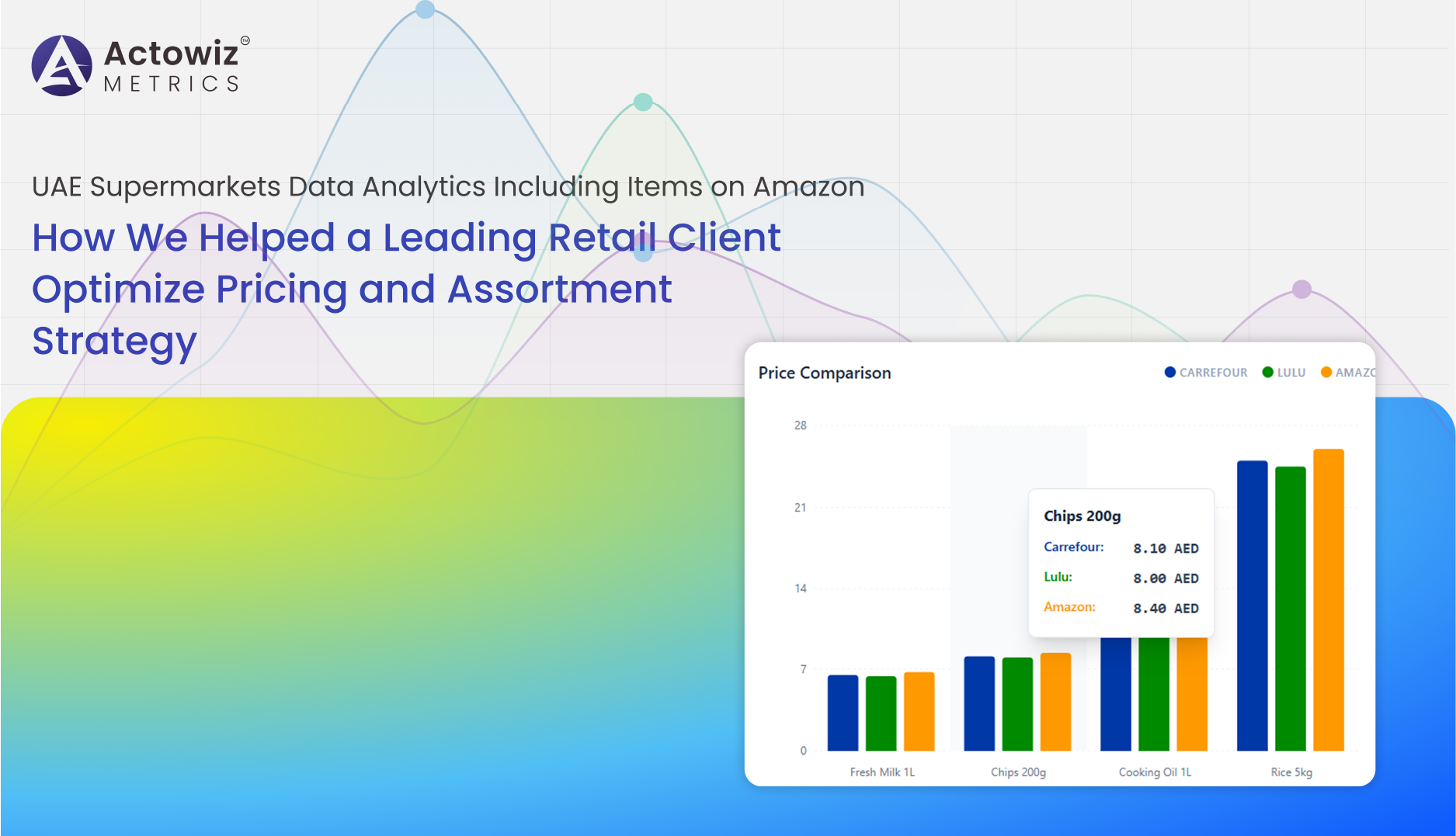

UAE Supermarkets Data Analytics Including Items on Amazon helped our retail client optimize pricing, refine assortment, and improve market competitiveness.

Explore Now

Browse expert blogs, case studies, reports, and infographics for quick, data-driven insights across industries.

Solving Real-Time Order Management Challenges with Restaurant Reservations & Orders Monitoring API - Zomato, Swiggy & EazyDiner for smarter tracking.

Discover how Zonaprop Real Estate Data Tracking in Argentina reduces investment risk with accurate pricing insights and smarter property decisions.

How Woolworths.com.au Data Tracking helps monitor pricing shifts, stock levels, and promotions to improve retail visibility and decision-making.

Dior Luxury Fashion Market Analysis explores global brand positioning, competitive landscape, market trends, revenue performance, and future growth outlook.

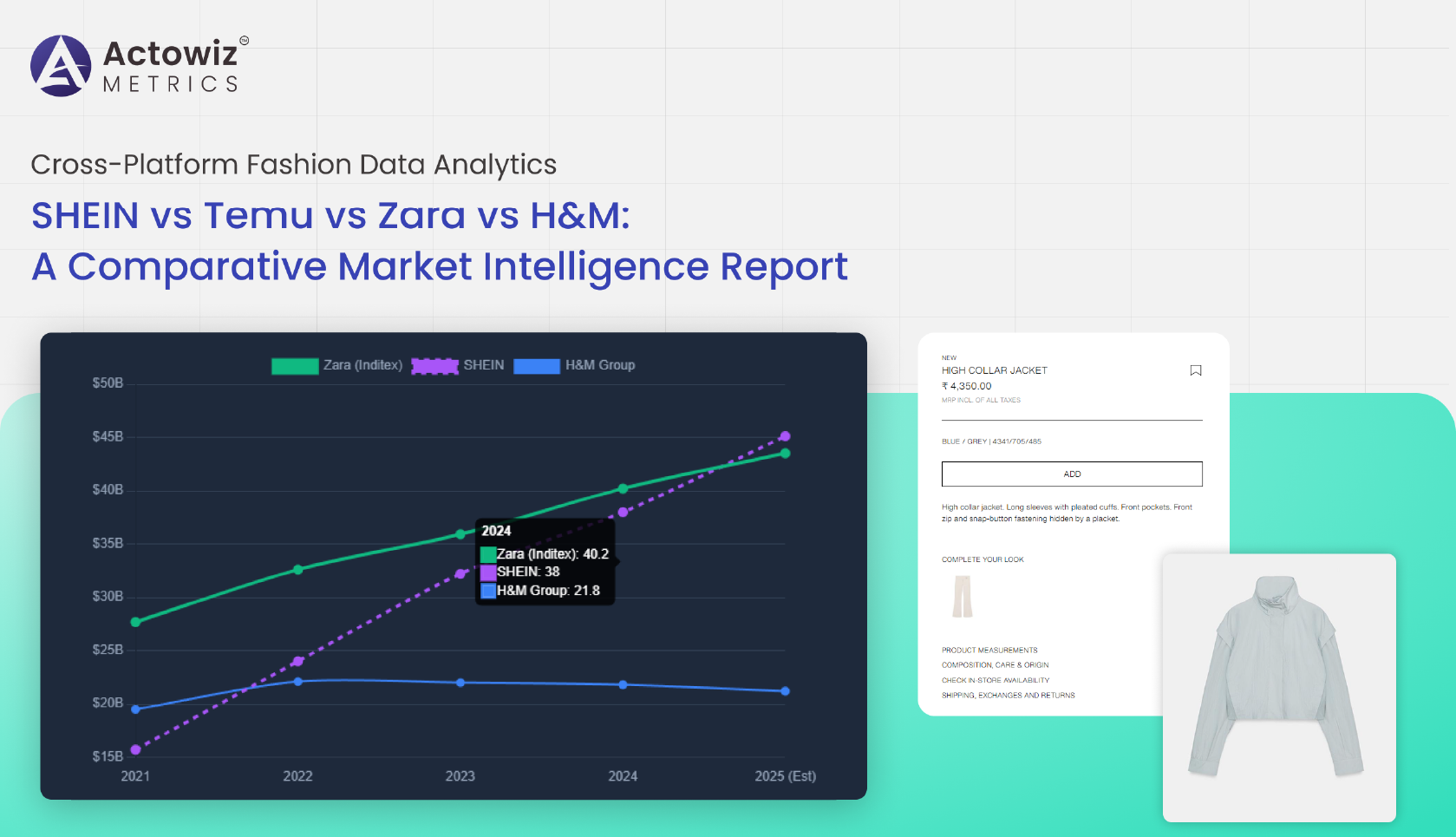

Cross-Platform Fashion Data Analytics - SHEIN vs Temu vs Zara vs H&M delivers actionable insights by comparing pricing, trends, inventory shifts, and consumer demand

Track and analyze the Number of Pizza Hut Locations Analytics in India 2026 to uncover expansion trends, regional distribution, and market growth insights.

Explore Luxury vs Smartwatch - Global Price Comparison 2025 to compare prices of luxury watches and smartwatches using marketplace data to reveal key trends and shifts.

E-Commerce Price Benchmarking: Gucci vs Prada reveals 2025 pricing trends for luxury handbags and accessories, helping brands track competitors and optimize pricing.

Discover how menu data scraping uncovers trending dishes in 2025, revealing popular recipes, pricing trends, and real-time restaurant insights for food businesses.

Explore the Amazon Baby Care Report analyzing Top Baby Brands Analysis on Amazon, covering discounts, availability, and popular products with data-driven market insights.

Amazon Sports & Outdoors Report - Sports & Outdoors Top Brands Analysis on Amazon - Prices, Discounts, Reviews

Enabled a USA pet brand to optimize pricing, inventory, and offers on Amazon using Pet Supplies Top Brands Analysis on Amazon for accurate, data-driven decisions.

Whatever your project size is, we will handle it well with all the standards fulfilled! We are here to give 100% satisfaction.

Any analytics feature you need — we provide it

24/7 global support

Real-time analytics dashboard

Full data transparency at every stage

Customized solutions to achieve your data analysis goals