Woolworths.com.au Data Tracking

How Woolworths.com.au Data Tracking helps monitor pricing shifts, stock levels, and promotions to improve retail visibility and decision-making.

The German grocery retail market is one of the most competitive landscapes in Europe, with leading players such as REWE and Lidl shaping customer choices through pricing, promotions, and product assortment. In recent years, the importance of REWE & Lidl Grocery Data Scraping has grown significantly, enabling retailers, FMCG brands, and analysts to access accurate, real-time information for better decision-making. By collecting structured pricing, promotions, and assortment data from digital platforms, businesses can track trends, identify opportunities, and stay ahead of competitors.

According to Statista, the German grocery market revenue is projected to reach €338 billion in 2025, up from €307 billion in 2020. With consumer buying patterns shifting toward online channels, the demand for digital grocery analytics has also accelerated. This transformation is driving the adoption of web scraping technologies to track competitive pricing strategies, optimize promotions, and refine inventory planning.

In this blog, we will explore how retailers in Germany are using REWE & Lidl Grocery Data Scraping across six problem-solving areas, supported by insights and statistics from 2020 to 2025, before showcasing how Actowiz Metrics can help retailers gain a data-driven edge.

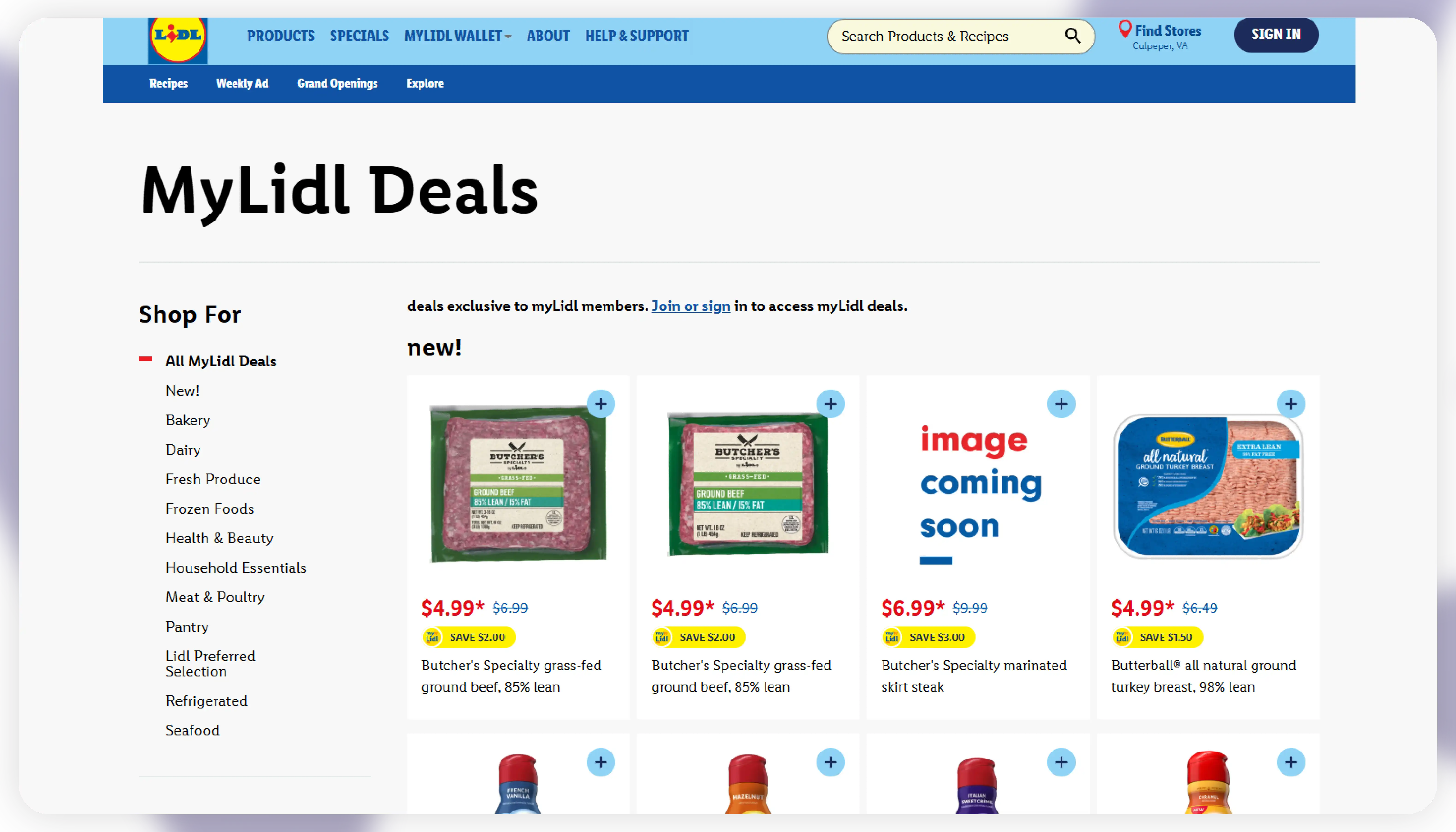

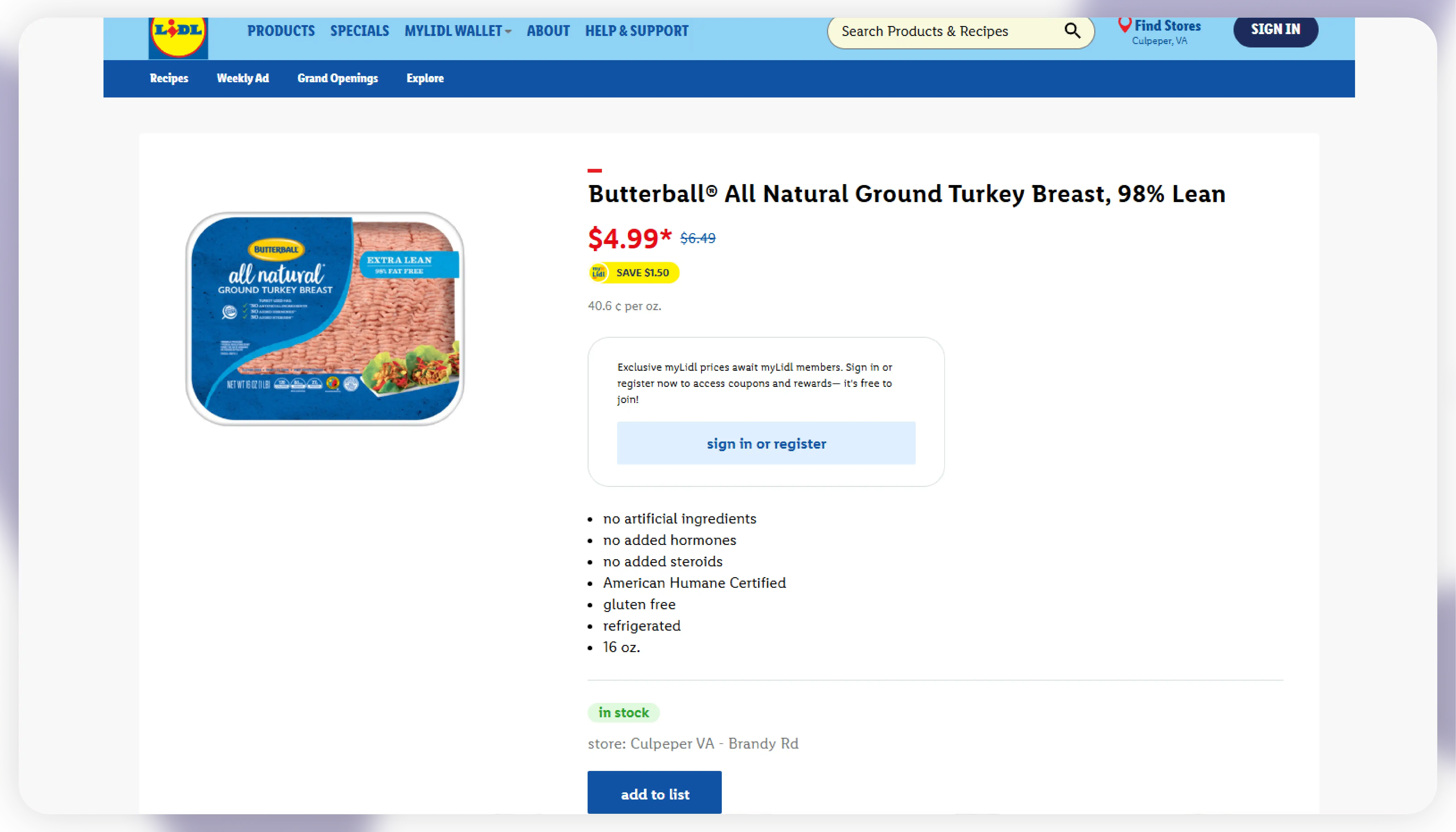

Mobile apps have become a primary channel for capturing retailer pricing, promotions, and loyalty incentives — and Lidl is no exception. The Lidl Plus app (Lidl’s loyalty/offers app) grew substantially in the early 2020s: Sensor Tower reported weekly downloads for Lidl Plus in Germany rising through 2024, with active-user snapshots in the low millions during strong quarters, reflecting how app data became a rich source for price and promotion signals.

Retailers (and data vendors) scrape Lidl Grocery app data to obtain: weekly leaflet prices, app-only coupons, store-specific availability flags, and promotional start/end timestamps. App scraping provides three practical advantages: (1) timeliness — app offers often appear before paper leaflets hit shelves; (2) personalization signals — regional or customer-segmented coupons reveal targeted promotion strategies; (3) availability & stock cues — many apps flag low-stock or “sold out” states for high-demand SKUs. Combining those signals helps competitors anticipate price wars on staples such as milk, bread, and private-label goods.

Between 2020 and 2025, app-driven shopping behaviour rose as consumers sought convenience and savings: after pandemic peaks in online grocery demand (2020–2021), app usage stabilized but remained elevated versus pre-2020 baselines — NielsenIQ and market trackers noted that average unit prices and app promotion use shifted markedly across 2022–2024. For example, Lidl’s app promotions played a visible role in preserving customer footfall during 2022–2023 inflation spikes, where German food inflation peaked in 2022 (monthly spikes and elevated YOY increases).

Real-life example : a competing chain that monitors Lidl app coupons for a branded breakfast cereal can detect a 20–30% app-only discount appearing across several German regions. By capturing the timestamp, the competitor can decide to run synchronized loss-leader offers or change shelf-price tags the same week, protecting basket share. Scraped coupon metadata (coupon ID, SKU, discount %, start/end) lets analysts compute “promotion depth” and frequency per SKU across time (2020–2025), revealing whether Lidl shifted to more frequent shallow discounts or fewer deep discounts during inflationary years.

Analytical outputs from app-scraped data typically include : time series of price, promotion depth distribution, regional availability heatmaps, and uplift estimates (expected sales lift from coupon). When combined with weekly sales panels or POS feeds, app scraping converts an otherwise latent digital signal into an actionable retail playbook: set competitor-matched prices, adjust promo timing, or prioritize private-label merchandising in regions where Lidl’s app shows aggressive discount density.

REWE & Lidl Grocery Data : Scraping is therefore a frontline instrument for any retailer wanting to read Lidl’s immediate promotional intent, especially during volatile 2020–2025 years where app behaviour amplified short-term price moves.

Germany’s grocery market is remarkably heterogenous — a REWE in an affluent Berlin district may run different promos than one in a small town. That’s why many players extract REWE Hyperlocal Grocery Data: scraping REWE’s store pages, local circulars, and delivery slot inventories yields store-level price and assortment snapshots that national averages hide. REWE’s 2024/2025 strategic reports emphasize digitalization and investments in IT/logistics precisely to enable localized offerings.

What does hyperlocal extraction capture? Typical elements include the local price for a SKU, promotional badges (e.g., “Angebot”), local inventory/availability for online pickup or delivery, and store-specific private-label assortment differences. Across 2020–2025, this store-level lens exposed systematic shifts: retailers increased localized promotions during the high-inflation years of 2022–2023 to defend low-income catchment areas, then refined assortments 2024–2025 as inflation eased. Destatis and market monitors showed substantial food price volatility across that period, underlining why store-level prices mattered more than ever.

Real-world example: A national competitor monitored REWE store pages in three German cities from 2021–2024 and found that REWE’s organic dairy promotion cadence differed by up to 40% between urban and semi-urban stores. That insight led to targeted marketing in urban areas where REWE’s organic depth was higher, and to price-matching tactics in semi-urban zones where REWE focused on staple discounts. The competitor calculated promotion frequency per SKU (2020: 3.2 promotions/year average → 2022: 5.4 promotions/year at peak inflation → 2024: 4.1) to quantify REWE’s tactical shifts.

Hyperlocal extraction also surfaces delivery-slot constraints and online assortment gaps: during 2020 (pandemic onset) and the 2022 inflation shock, REWE’s delivery inventories tightened in high-demand urban centers, signaling supply-side pressure for perishables. Retailers scraping these signals could preempt SKU outages by shifting sourcing or reassigning regional inventory.

From an analytics perspective, REWE hyperlocal data enables clustering of stores by price-level and promo behaviour, building “store personas” (e.g., premium urban, value suburban, convenience commuter). These personas then feed assortment optimization and dynamic price rules. Metrics tracked across 2020–2025 include average local price variance (across stores) for 50 representative SKUs — this variance rose notably in 2022 and compressed in 2024 as markets stabilized, a pattern consistent with wider CPI food swings.

A practical output for a price-sensitive retailer: a weekly store-level dashboard flagging top 20 SKUs with the biggest local price gaps vs. a target peer set (including REWE). That list helped field managers decide where to adjust in-store price cards or run immediate localized promotions to reduce lost basket share. For retailers focused on regional strategies, REWE & Lidl Grocery Data Scraping at hyperlocal granularity became a must-have capability in 2020–2025 — converting national trends into store-specific action.

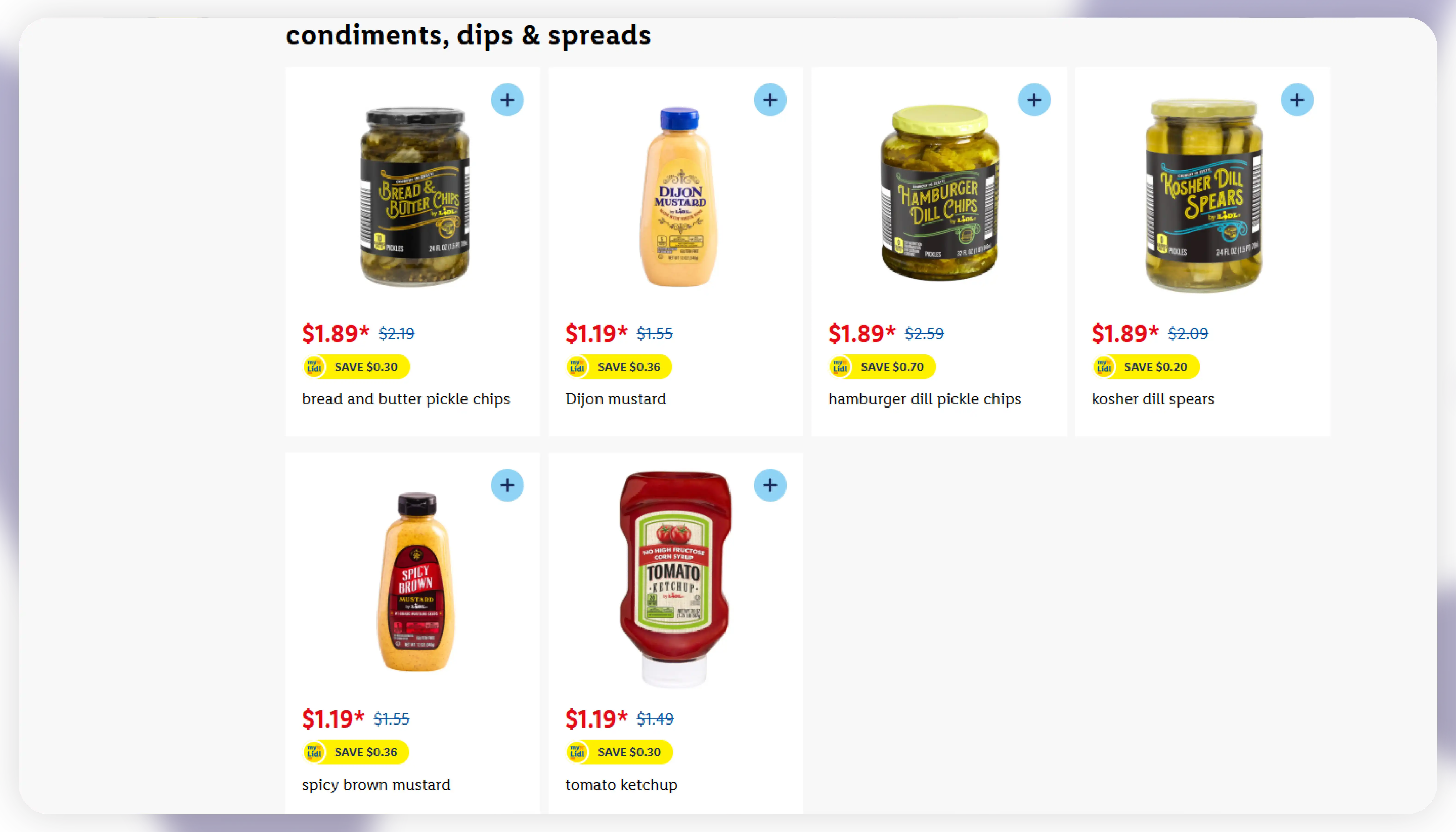

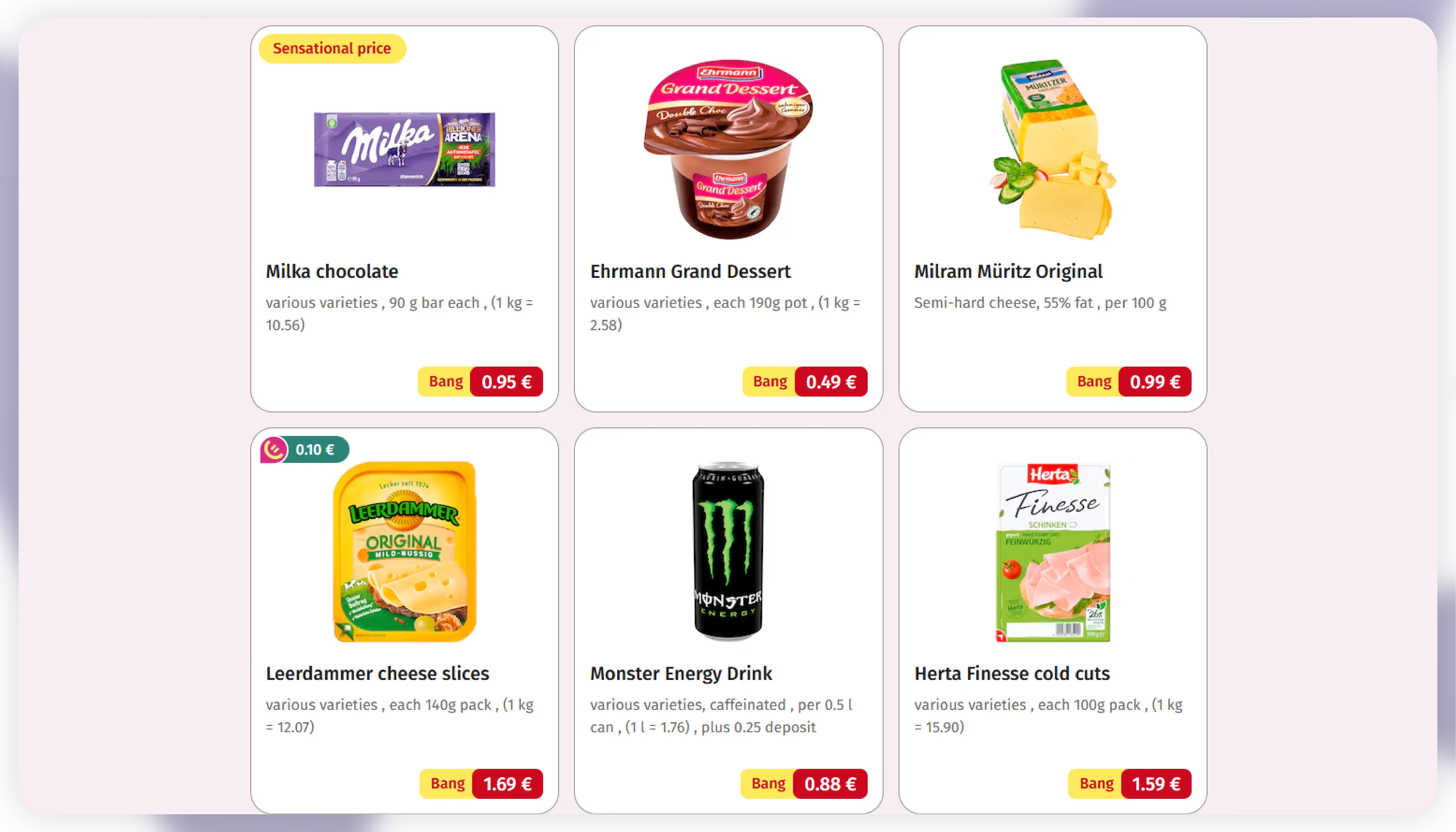

Price analytics derived from rich scraped feeds allow retailers to quantify competitor positioning and understand how Lidl uses pricing to attract different shopper cohorts. Lidl grocery price analytics revolves around tracking per-SKU list price, promo depth, frequency, private-label vs. branded mix, and regional differences — then combining that with elasticity models built on historical 2020–2025 behaviour. NielsenIQ and other industry trackers highlighted that unit prices surged in 2022 and moderation followed in 2024, which made price analytics critical to margin management across the period. /p>

Operationally, analytics pipelines ingest scraped Lidl prices (app, web, leaflet) and compute: (a) competitor price index per category; (b) promo-to-nonpromo uplift estimates; (c) private-label cannibalization ratios; and (d) temporal volatility measures (rolling 4-week and 12-week volatilities). For example, during the 2022 food-price surge, many staples showed higher weekly volatility (spikes in price and promo frequency), and Lidl’s private labels often absorbed more of the promotion load to maintain overall basket price competitiveness./p>

Real case: in 2022–2023 a mid-sized German discounter used Lidl price analytics to uncover that Lidl increased rotation of regional “themed weeks” (fish, Italian week, etc.) with deep promo depths for event SKUs. The discounter modeled the uplift for these event SKUs and decided to respond by boosting complementary categories (e.g., pasta when “Italian week” ran) rather than direct price matching — protecting margins while capturing cross-sell. This nuanced answer was only possible because scraped pricing and promo timestamps produced the event-detection signal./p>

Quantitative signals (2020–2025) used in analytics models typically include: year-over-year change in average unit price (2020→2022 saw double-digit YOY rises in many categories due to inflation spikes), promo share (percentage of weeks a SKU was on promo), and private-label share of promo depth. TradingEconomics and Destatis record food inflation peaks (notably 2022) that directly increased the importance of sophisticated price analytics. /p>

A common analytical deliverable from Lidl price analytics is a SKU heatmap showing: current Lidl price vs. retailer price, last promo date, promo depth average (2020–2025), and recommended price action (match, undercut, ignore). This supports fast tactical decisions — e.g., if Lidl’s promo cadence for a commodity SKU jumps from 4→8 promotions/year (observed for certain staples during 2021–2023), analytics flags it as high-risk for churn and recommends immediate competitive repricing or bundle offers./p>

Ultimately, REWE & Lidl Grocery Data Scraping fuels Lidl grocery price analytics that turns raw app and leaflet captures into margin-protecting decisions and smarter assortment plays, a capability that became increasingly valuable across the turbulent 2020–2025 window. /p>

Continuous surveillance of competitor prices is now table stakes — especially in Germany where price sensitivity rose sharply during the inflation cycle of 2021–2023. Grocery price monitoring in Germany involves automated scraping of price sources (Lidl app, REWE store pages, online shops, weekly leaflets) and aggregation into daily market maps that show headline SKU movements, regional outliers, and emerging price wars. Destatis and market reports documented strong food-price swings during 2022, motivating many retailers to move from weekly to daily or even intra-day monitoring.

A monitoring system typically provides: (1) a price parity index (retailer vs. peer median per SKU); (2) promo radar (new promotions detected in past 24–72 hours); (3) regional heatmaps; and (4) volatility dashboards. Between 2020 and 2025, retailers using these systems reported they could shorten reaction time from “one week” to “same day” for category resets — a competitive advantage in hyper-competitive categories like dairy, bread, and packaged meats.

Real example: during October–December 2022 — a period of elevated food inflation and consumer pressure — a German supermarket chain’s price-monitoring pipeline detected an abrupt nationwide promo blitz by a rival on baby formula. By capturing the promo metadata (start date, discount %, store cluster), the chain reacted within 48 hours by matching the staple price for loyalty-card members in vulnerable regions, preventing anticipated churn among young families.

Concrete stats (2020–2025) used in monitoring reports include: weekly promo counts per category (observed to rise sharply in 2022), average promo depth per SKU (which increased for private-label categories during 2022–2023), and share of SKUs with price changes in the past 30 days (a volatility metric that spiked in 2022). TradingEconomics shows pronounced food inflation volatility in 2022 which correlates with spikes in pricing activity captured by monitoring systems.

Monitoring outputs also support pricing experiments: A/B price tests informed by the market map determine whether to match a competitor discount for all customers, or limit to loyalty segments. In 2023–2024, as inflation eased, many retailers used monitoring signals to transition back toward targeted price-promotions (loyalty app coupons) instead of broad storewide discounts.

From a tooling standpoint, integration of scraped feeds with POS or customer-panel data allows retailers to estimate short-term sales impact: e.g., a promo flagged on a competitor’s SKU can be translated into an estimated 5–12% short-term displacement in category sales (figures varying by category and period; uplifts were higher during 2022 when shoppers were most price-sensitive). These empirically grounded estimates turned monitoring from passive intelligence into an operational lever to defend baskets across the 2020–2025 period.

To sum: Grocery price monitoring in Germany turned scraped REWE and Lidl signals into daily market maps that directly informed rapid tactical actions during the most volatile years between 2020 and 2025.

REWE’s digital expansion (investments announced for 2024–2028) and its online channels create rich data surfaces for analytics. REWE grocery data analytics uses scraped REWE prices, promo schedules, and assortment changes combined with panel or POS data to measure promotion ROI, cannibalization, and category elasticities over 2020–2025. REWE Group’s annual reporting highlights the focus on digitalization and store modernization — investments that make REWE’s online footprints more analyzable and valuable to competitive intelligence.

Key analytic themes for REWE data include: promotion effectiveness (sales uplift vs. discount depth), halo and cannibalization effects (does a discounted SKU pull sales from full-price SKUs in the same category?), and assortment optimization (which private-label items are gaining share?). Across 2020–2025, analytics teams tracked structural changes: 2020–2021 saw a spike in online orders (pandemic-driven), 2022 introduced inflation-driven shifts in promo mix, and 2023–2025 saw refinement of loyalty-based targeted discounts.

Concrete analytic outputs and 2020–2025 signals:

Real case: A national FMCG brand used scraped REWE promo data from 2020–2024 to identify that REWE’s promotional intensity for its flagship SKU increased by ~30% in 2022 compared with 2020, but the incremental sales per promo decreased — a classic sign of promo saturation. The brand adjusted by negotiating fewer but deeper promotions and executed targeted co-marketing offers in REWE stores where private-label competition was highest.

Analysts often benchmark REWE’s behavior against discounters (Lidl) to decide whether to prioritize price matching or differentiation. For instance, if REWE runs “premium assortment” promotions in affluent urban clusters while Lidl focuses on deep staple discounts, a rival may choose to compete on convenience and assortment rather than price in those urban clusters. These behaviors were visible in scraped feeds collected across 2020–2025.

Quantitative references: REWE Group revenue and digital investments (2024) underscore the retailer’s scale and data availability for analytics; public figures and annual reports document the group’s revenue growth and its push into digitalization during the period.

A practical output of REWE grocery data analytics: a monthly “promo elasticity matrix” (by category and region) that guides whether a promotion will be broad or loyalty-only, and quantifies expected margin impact. During peak volatility years (2021–2023), those matrices were critical to preserving both sales and profitability.

Track Germany grocery prices strategically by combining REWE scraped intelligence with internal sales data to ensure promotional spend is efficient and aligned with regional shopper behaviour — an approach that matured across 2020–2025 into a core planning capability.

The intersection of promotion tracking, price fluctuation analysis, and basket-level study produces the richest commercial insights. Two tightly linked practices are REWE grocery promotion tracking and Lidl Grocery price fluctuation analysis — both are key inputs to Germany Grocery market basket analysis that explains shifting consumer purchasing bundles across 2020–2025. Multiply these with broader food inflation context (2022 peak) and you have the strategic picture retailers needed.

Promotion tracking captures the who/what/when of discounting: which SKUs were discounted, by how much, for how long, and in which stores. Fluctuation analysis computes volatility metrics (rolling standard deviation of price, frequency of price change per SKU, and amplitude of promo depths). Market-basket analysis links these price dynamics to co-purchase patterns — answering questions such as: “When price of bread increased 8% in 2022, did shoppers reduce fresh spreads or cut back on premium meats?” Panel and POS studies during 2020–2025 show category substitutions and changes in bundle preferences.

Real example (2020–2025 patterns): During 2022’s sharp food inflation, German shoppers traded down from branded packaged goods to discounter private labels and shifted toward larger pack sizes to reduce unit cost — a behaviour reflected in basket analytics. Simultaneously, promotion trackers noticed an uptick in “bundled” promotions (buy-one-get-one or multi-pack deals) for staples, indicating retailers’ preference for volume-based promos to preserve per-basket value. Industry trackers and press coverage across 2022 documented these substitution effects.

From an applied analytics standpoint, linking promo and fluctuation data to basket composition yields actionable metrics such as:

A German grocer’s 2023 internal analysis (informed by scraped competitor promos) found that when Lidl ran weekly discount bundles on breakfast cereals, average basket size rose 6–9% in affected stores, but the margin per basket fell; the grocer used this to design targeted loyalty coupons that preserved margin while capturing the volume uplift.

Germany Grocery market basket analysis across 2020–2025 also revealed longer-term structural shifts: growth in health-oriented bundles (plant-based proteins + gluten-free items) and increased share of private-label bundles in 2022–2024 as value became central to purchase decisions. These trends were measurable via repeated basket analyses tied to promo flags captured through scraping.

In short, integrated tracking of REWE promotions and Lidl price fluctuations — converted into market-basket analytics — allowed retailers to predict substitution, design profitable bundle offers, and target loyalty incentives precisely. This integrated capability was indispensable during the volatile 2020–2025 period, converting reactive price defense into proactive assortment and promo strategy.

Actowiz Metrics specializes in providing custom web scraping and grocery analytics solutions for retailers, brands, and market research firms. By automating the extraction of structured data from REWE and Lidl platforms, Actowiz enables businesses to track product pricing, availability, and promotions in real time.

Our solutions offer:

Whether you’re aiming to optimize pricing, monitor competitors, or identify consumer trends, Actowiz Metrics delivers the actionable insights needed to gain an edge in Germany’s fast-evolving grocery market.

The German grocery market is entering a transformative era where digital-first consumer behavior, hyperlocal trends, and pricing competition are shaping the future. Retailers who embrace REWE & Lidl Grocery Data Scraping can stay ahead by leveraging insights into promotions, pricing strategies, and consumer basket patterns.

By adopting advanced data scraping and analytics, businesses not only track Germany grocery prices but also strengthen decision-making for long-term growth.

Partner with Actowiz Metrics today and unlock the power of grocery data scraping to stay ahead in the competitive German retail market!

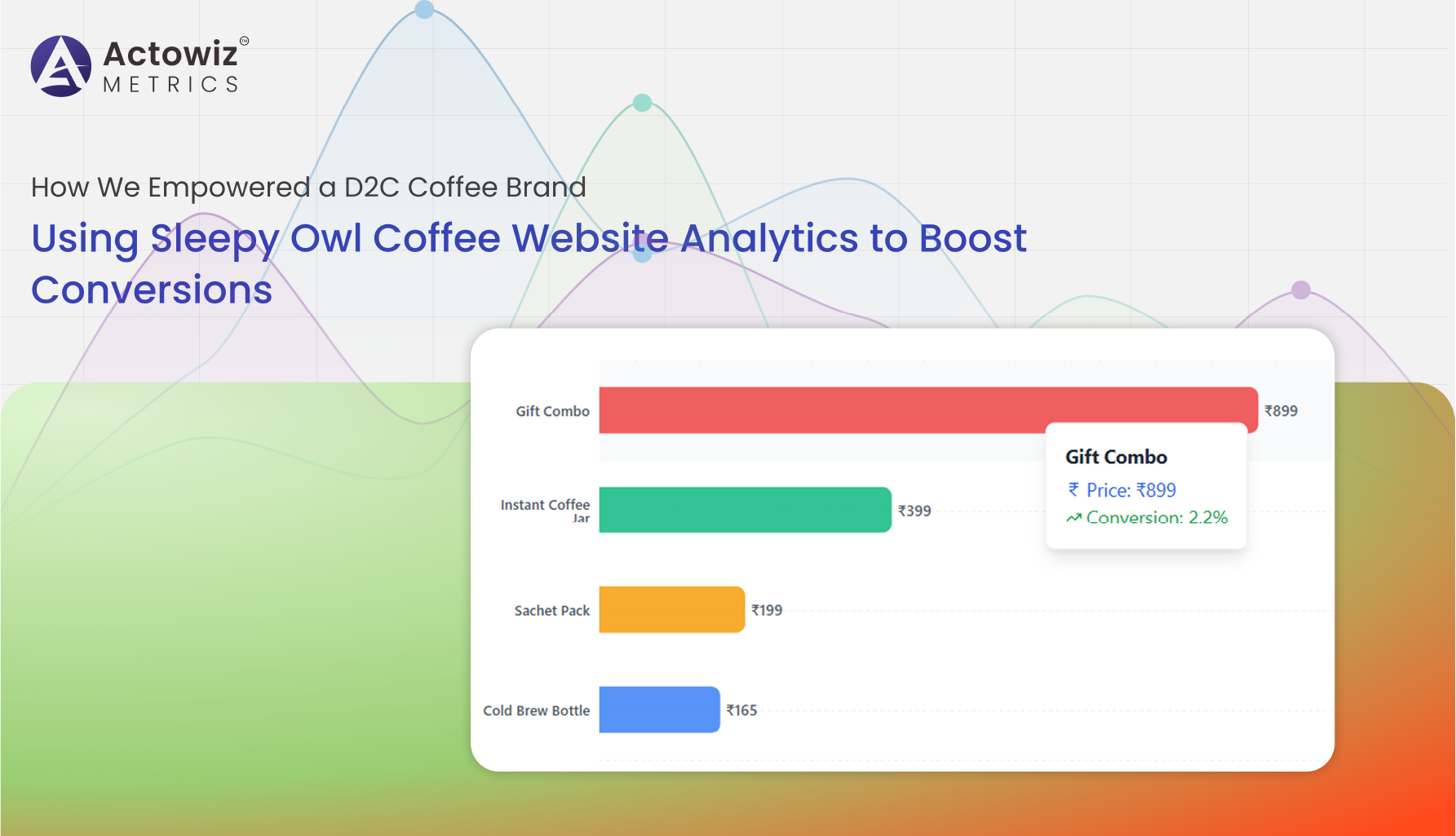

Sleepy Owl Coffee Website Analytics delivering insights on traffic, conversions, pricing trends, and digital performance optimization.

Explore Now

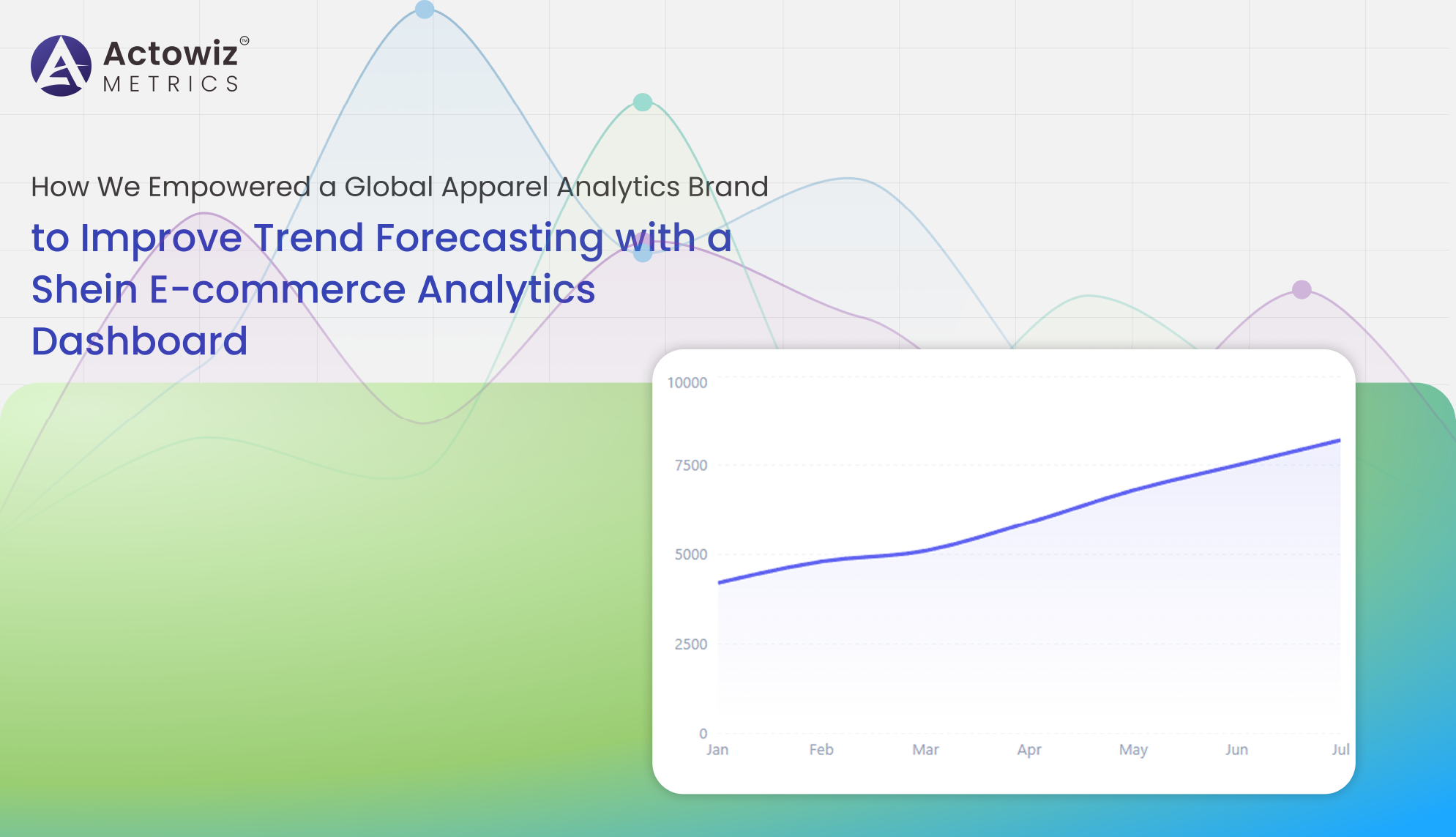

Shein E-commerce Analytics Dashboard delivers real-time pricing, trend, and competitor insights to optimize fashion strategy and boost performance.

Explore Now

Live Data Tracking Dashboard for Keeta Food Delivery App enables real-time order, pricing, and restaurant insights to optimize performance and decisions.

Explore NowBrowse expert blogs, case studies, reports, and infographics for quick, data-driven insights across industries.

How Woolworths.com.au Data Tracking helps monitor pricing shifts, stock levels, and promotions to improve retail visibility and decision-making.

Myntra Fashion Category Data Monitoring helps track trends, pricing, stock levels, and category performance to optimize sales and boost growth.

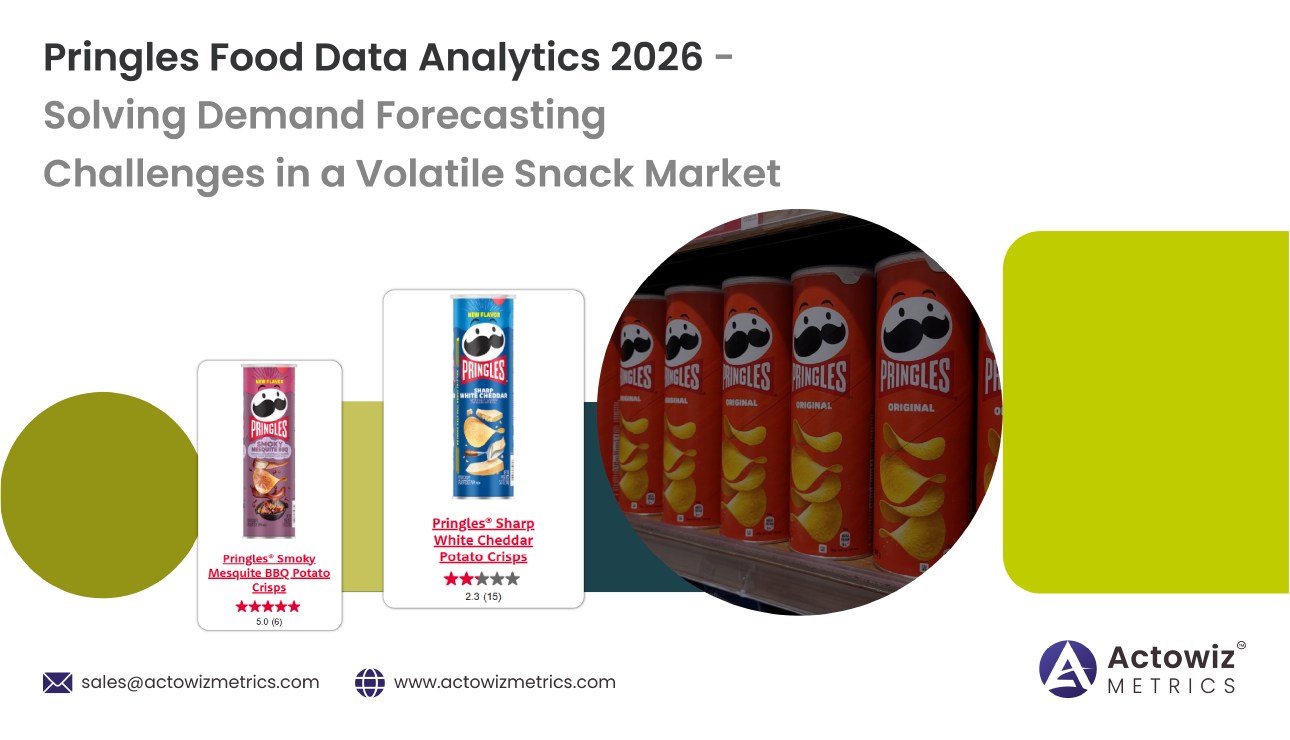

Pringles Food Data Analytics 2026 reveals how data-driven insights improve pricing, demand forecasting, and supply chain efficiency in a dynamic snack market.

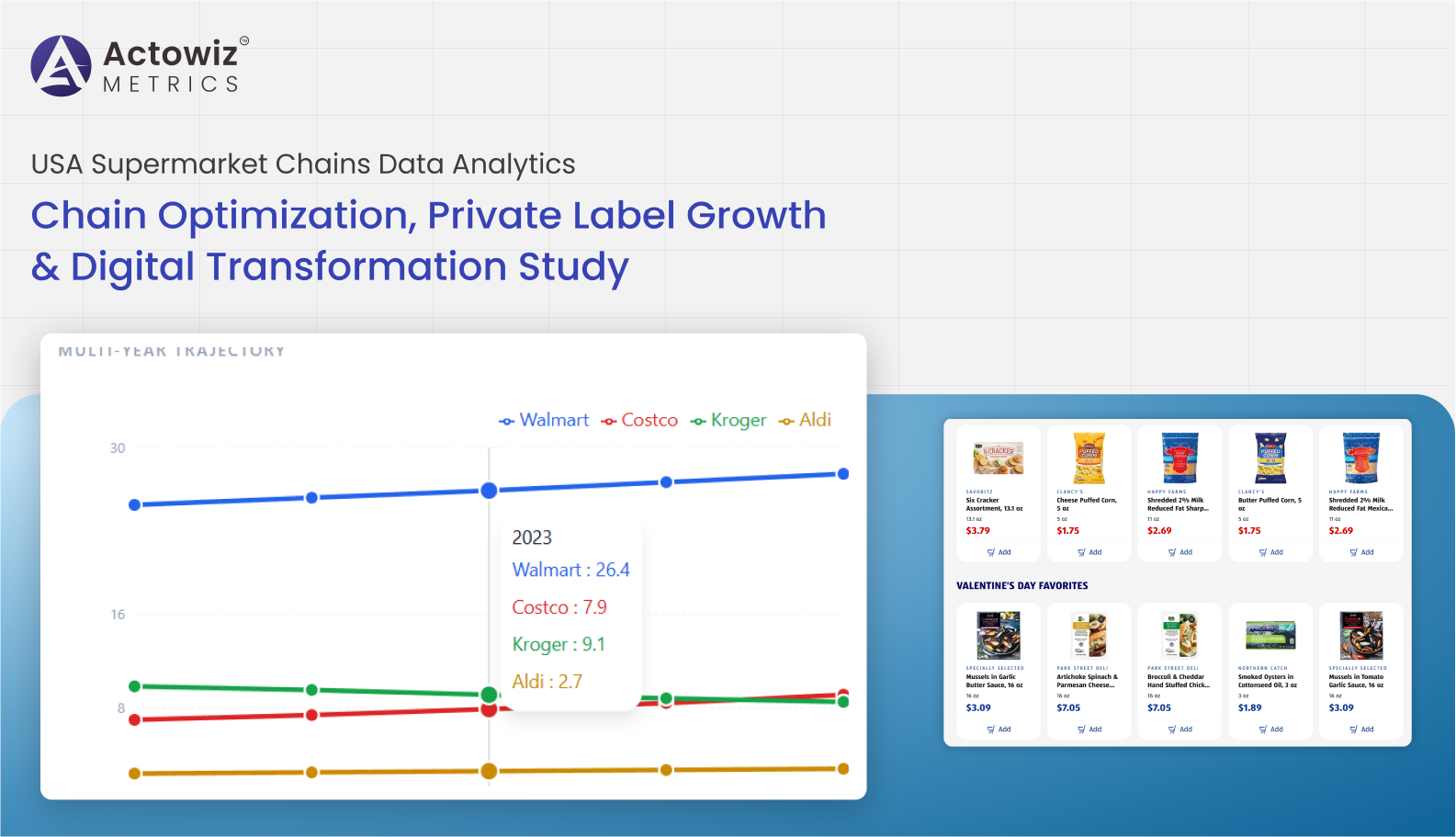

Research Report on USA Supermarket Chains Data Analytics covering chain optimization, private label growth, pricing trends, and digital transformation insights.

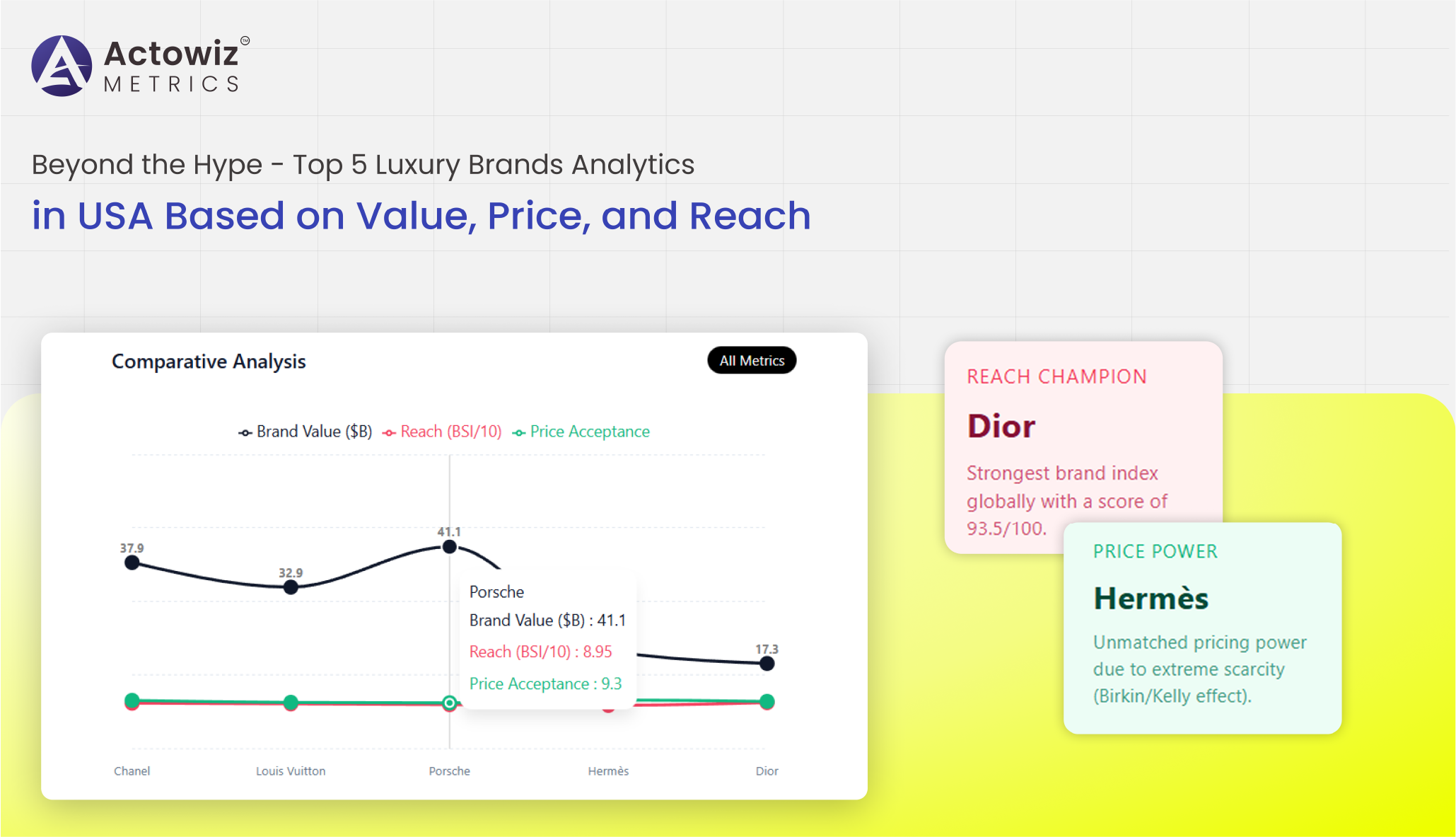

Top 5 Luxury Brands Analytics in USA delivering advanced market insights, consumer trends, and performance intelligence to drive premium brand growth.

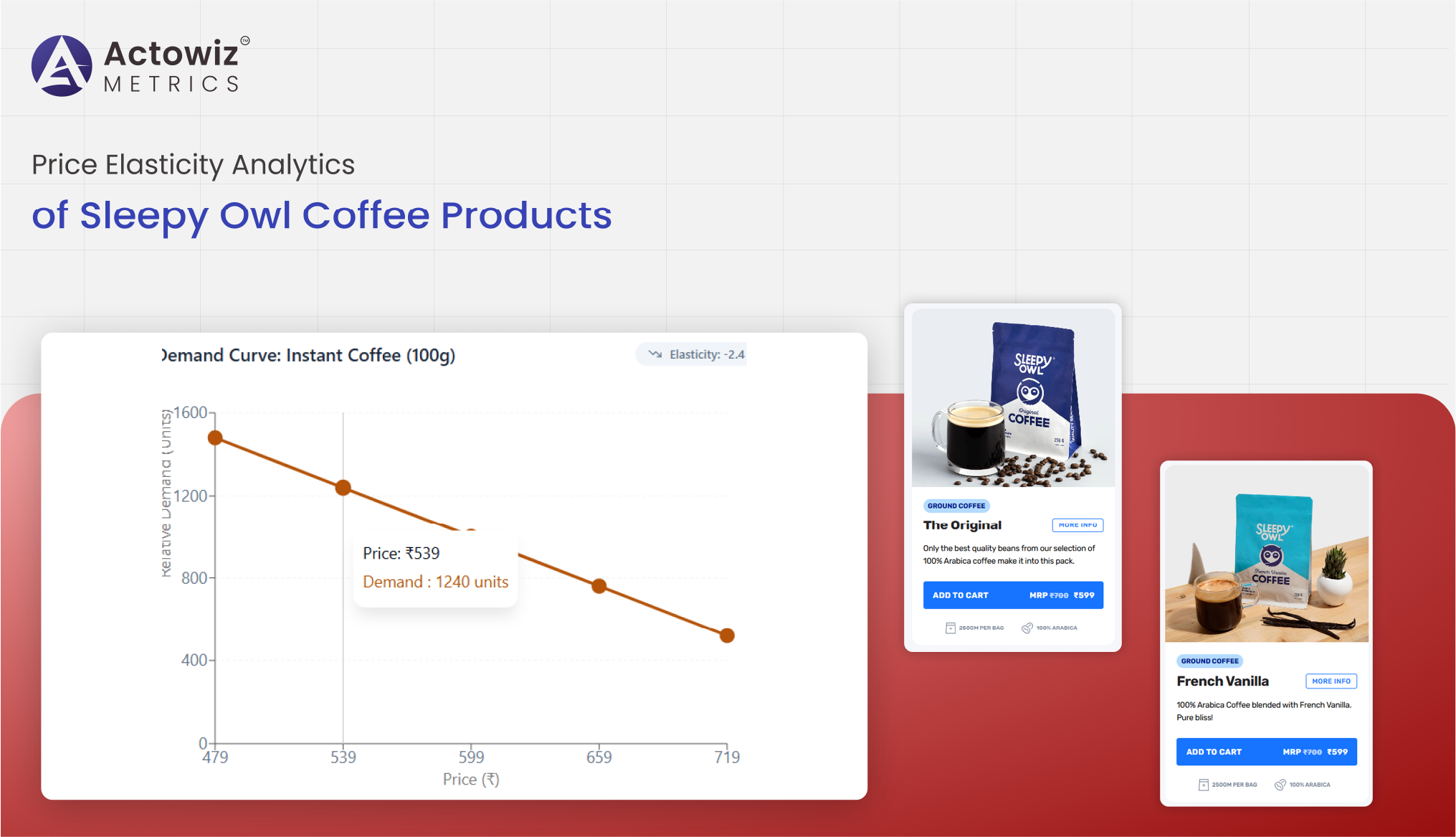

Price Elasticity Analytics of Sleepy Owl Coffee Products revealing demand sensitivity, pricing impact, and revenue optimization insights across channels.

Explore Luxury vs Smartwatch - Global Price Comparison 2025 to compare prices of luxury watches and smartwatches using marketplace data to reveal key trends and shifts.

E-Commerce Price Benchmarking: Gucci vs Prada reveals 2025 pricing trends for luxury handbags and accessories, helping brands track competitors and optimize pricing.

Discover how menu data scraping uncovers trending dishes in 2025, revealing popular recipes, pricing trends, and real-time restaurant insights for food businesses.

Explore the Amazon Baby Care Report analyzing Top Baby Brands Analysis on Amazon, covering discounts, availability, and popular products with data-driven market insights.

Amazon Sports & Outdoors Report - Sports & Outdoors Top Brands Analysis on Amazon - Prices, Discounts, Reviews

Enabled a USA pet brand to optimize pricing, inventory, and offers on Amazon using Pet Supplies Top Brands Analysis on Amazon for accurate, data-driven decisions.

Whatever your project size is, we will handle it well with all the standards fulfilled! We are here to give 100% satisfaction.

Any analytics feature you need — we provide it

24/7 global support

Real-time analytics dashboard

Full data transparency at every stage

Customized solutions to achieve your data analysis goals