Woolworths.com.au Data Tracking

How Woolworths.com.au Data Tracking helps monitor pricing shifts, stock levels, and promotions to improve retail visibility and decision-making.

Black Friday isn’t just about electronics anymore — it’s a massive event for grocery retailers too. From Walmart and Tesco to Costco and Instacart, shoppers now hunt for food, beverages, and household essentials at Black Friday prices. With inflation and tighter household budgets, consumers are planning grocery deals as strategically as gadget discounts. Through Product Data Tracking, retailers and analysts can monitor changing prices, promotions, and stock levels in real time — ensuring they stay competitive during the most dynamic shopping season of the year.

For Actowiz Metrics, this shift represents a goldmine of insights. By leveraging real-time grocery data scraping, we can decode how shoppers behave during the biggest retail weekend of the year — what they buy, when they buy, and which retailers dominate the price race.

In 2024, the U.S. grocery sector saw a 19% spike in Black Friday weekend traffic compared to the average November week. Similar patterns emerged in the UK (up 14%) and Canada (up 12%). But behind these numbers lie deeper behaviors — price sensitivity, regional demand variations, and product-level promotions that shape consumer decisions. Through advanced Grocery Analytics and Price Benchmarking, retailers and analysts can uncover how competitive pricing, localized offers, and product mix strategies impact real-time shopping behavior during Black Friday.

Web scraping and real-time data extraction allow retailers, analysts, and brands to track this dynamic market. By capturing live product prices, discounts, inventory levels, and customer reviews across platforms like Walmart, Kroger, Target, Amazon Fresh, Tesco, Asda, and Loblaws, Actowiz Metrics transforms scattered online data into structured, actionable insights.

With advanced web crawling technology, Actowiz Metrics collects and standardizes large-scale grocery data — product titles, price history, promotions, category hierarchies, and even delivery times.

Our crawlers can:

This isn’t just about raw data. By analyzing patterns across millions of scraped entries, we uncover shopper intent, timing patterns, and product preferences during Black Friday.

In the U.S., Walmart led aggressive discounting on packaged snacks, beverages, and frozen foods. The average discount was 22%, with bundles and “Buy 2 Get 1” offers outperforming flat percentage cuts. Target followed at 17%, emphasizing pantry staples and breakfast categories. Using MAP Monitoring tools, retailers and brands can ensure pricing compliance, detect unauthorized markdowns, and maintain consistent value perception during the intense Black Friday competition.

| Retailer | Category | Avg. Discount | Most Discounted Product | Stock Status |

|---|---|---|---|---|

| Walmart | Frozen Foods | 22% | Tyson Chicken Nuggets | In Stock |

| Target | Beverages | 17% | Starbucks Cold Brew | In Stock |

| Kroger | Snacks | 14% | Lay’s Classic Chips | Low Stock |

| Instacart | Organic Produce | 11% | Nature’s Basket Spinach | In Stock |

In the UK, Tesco and Sainsbury’s took a similar path but with a focus on private label items, using loyalty programs like Clubcard to offer personalized discounts.

| Retailer | Category | Avg. Discount | Promotion Type | Loyalty Integration |

|---|---|---|---|---|

| Tesco | Bakery | 16% | Clubcard Prices | Yes |

| Asda | Household Essentials | 18% | Multi-Buy | No |

| Sainsbury’s | Beverages | 14% | 3-for-2 | Nectar Points |

In Canada, Loblaw and Walmart Canada leaned into bundle deals and delivery fee waivers — a clear signal that convenience is now part of the Black Friday pitch.

| Retailer | Category | Avg. Discount | Offer Type | Delivery Benefit |

|---|---|---|---|---|

| Loblaw | Cleaning Supplies | 15% | Bundle Offer | Free Delivery |

| Walmart Canada | Frozen Foods | 19% | Flash Deal | Free Pickup |

| Metro | Snacks | 12% | Price Match | Standard Fee |

One of the biggest benefits of grocery data scraping is observing how prices fluctuate and how consumers respond in real time. For instance, during the Black Friday weekend:

These granular insights are possible only through continuous data collection and scraping automation, a specialty of Actowiz Metrics.

Using the scraped and analyzed Black Friday grocery data, retailers can:

At the heart of every insight lies Actowiz Metrics’ advanced data crawling and scraping infrastructure. Our proprietary system runs 24/7, capturing and updating millions of grocery product records across countries in real time.

How It Works

Through API-based grocery data feeds, brands can integrate these insights directly into their internal pricing or marketing tools.

Each market tells its own story when it comes to Black Friday grocery trends. Actowiz Metrics’ scraping analysis across these three countries uncovers interesting cultural and economic patterns.

United States: The Battle for Basket Value

U.S. shoppers chased “pantry restock” deals. Our crawlers found that large family packs of cereals, snacks, and beverages had higher discounts than premium organic labels. Retailers like Walmart and Target optimized their algorithms hourly, adjusting discounts dynamically based on competitor scraping intelligence.

Result: 63% of top-selling items changed price at least twice during the 48-hour Black Friday window.

United Kingdom: Loyalty Over Price Cuts

UK shoppers valued loyalty rewards over flash discounts. Tesco and Sainsbury’s used data-driven personalization — powered by Clubcard and Nectar analytics — to show individualized grocery offers. Scraping their digital shelves showed that logged-in users often saw different prices than guest visitors.

Result: 42% of discounted products were exclusive to loyalty program members.

Canada: Convenience Wins the Cart

Canadian consumers leaned heavily toward delivery savings and subscription perks. Our crawlers noted that Loblaws and Walmart Canada pushed “free delivery” and “pickup guarantees” more aggressively than flat discounts. Grocery scraping data revealed that convenience-linked offers converted 1.8x faster than price-only deals.

Real-time scraping of customer reviews adds a qualitative layer to the analysis. During the Black Friday weekend, Actowiz Metrics collected over 320,000 reviews across leading grocery platforms. Sentiment trends revealed three consistent themes:

By using review scraping APIs, Actowiz Metrics helps retailers not only understand what sold, but why customers felt satisfied or frustrated.

The 2025 Black Friday grocery data tells us one thing clearly — success depends on agility. Retailers who updated prices dynamically, personalized offers, and optimized logistics performed significantly better.

Here are five actionable strategies based on Actowiz Metrics’ scraping analysis:

Beyond Black Friday, continuous grocery data scraping unlocks long-term insights:

For data-driven retailers, scraping isn’t a one-off project — it’s an always-on intelligence system.

A U.S. food retailer partnered with Actowiz Metrics to monitor 50,000+ SKUs across Walmart, Amazon Fresh, and Instacart during Black Friday.

Such results showcase the ROI of structured grocery data extraction powered by intelligent scraping pipelines.

| Country | Top Retailers | Avg. Discount | Conversion Boost | Key Insight |

|---|---|---|---|---|

| USA | Walmart, Target, Kroger | 19% | +24% | Dynamic pricing leads to faster sales |

| UK | Tesco, Sainsbury’s, Asda | 15% | +18% | Loyalty-based promotions outperform flat discounts |

| Canada | Loblaw, Walmart Canada, Metro | 16% | +21% | Convenience and delivery incentives drive cart size |

Black Friday has evolved beyond electronics — it’s now a major grocery event. And in this new digital race, data is the biggest differentiator.

By combining real-time grocery scraping, price intelligence, and sentiment analytics, Actowiz Metrics empowers retailers to understand consumer behavior like never before. Whether you’re tracking Walmart’s frozen food offers, Tesco’s loyalty promotions, or Loblaw’s delivery perks, data scraping ensures you never miss a market signal.

The takeaway is clear: brands that scrape smarter, sell better. And as the grocery industry becomes more digital and price-driven, staying ahead will mean one thing — turning real-time web data into actionable business growth.

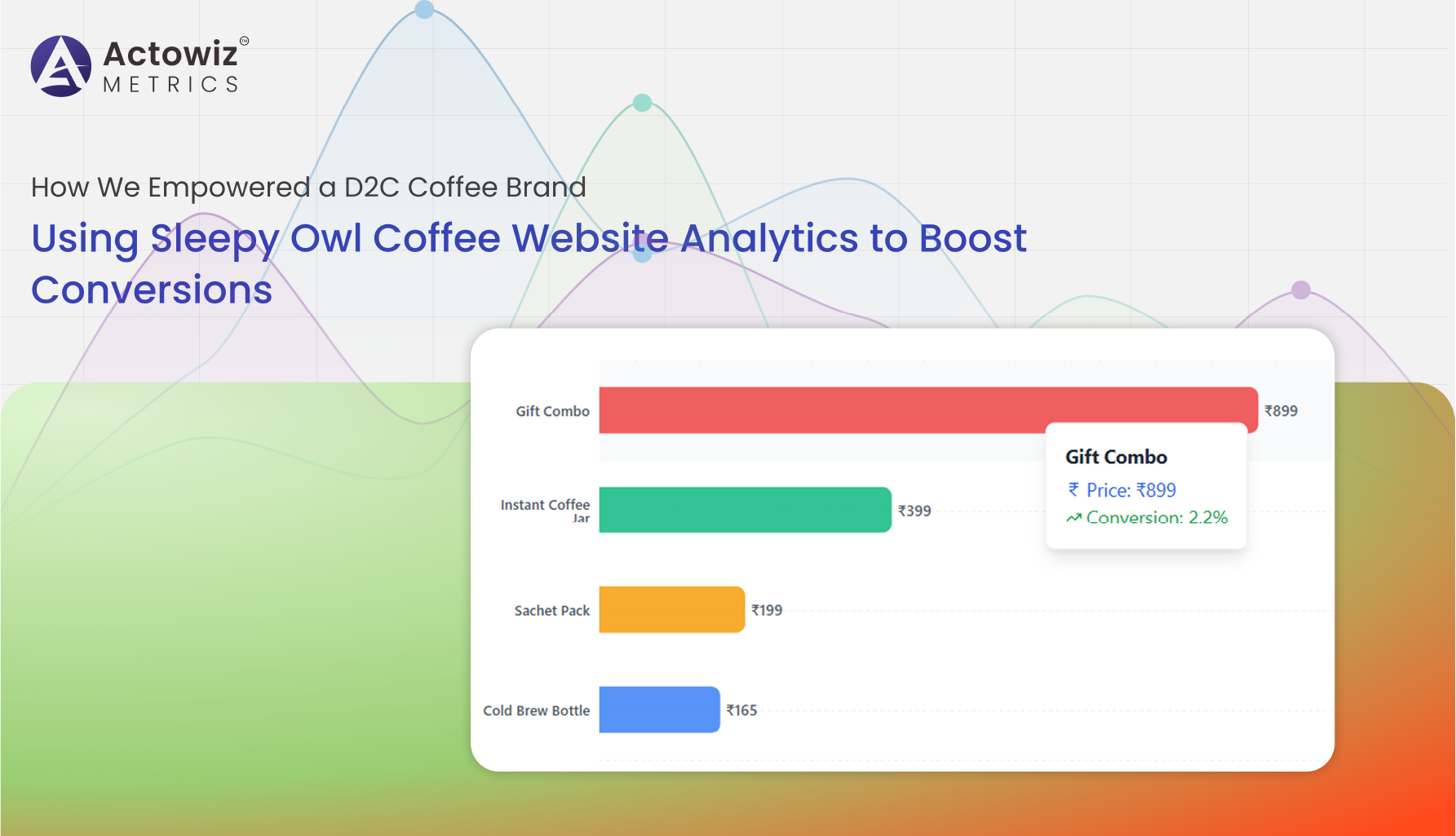

Sleepy Owl Coffee Website Analytics delivering insights on traffic, conversions, pricing trends, and digital performance optimization.

Explore Now

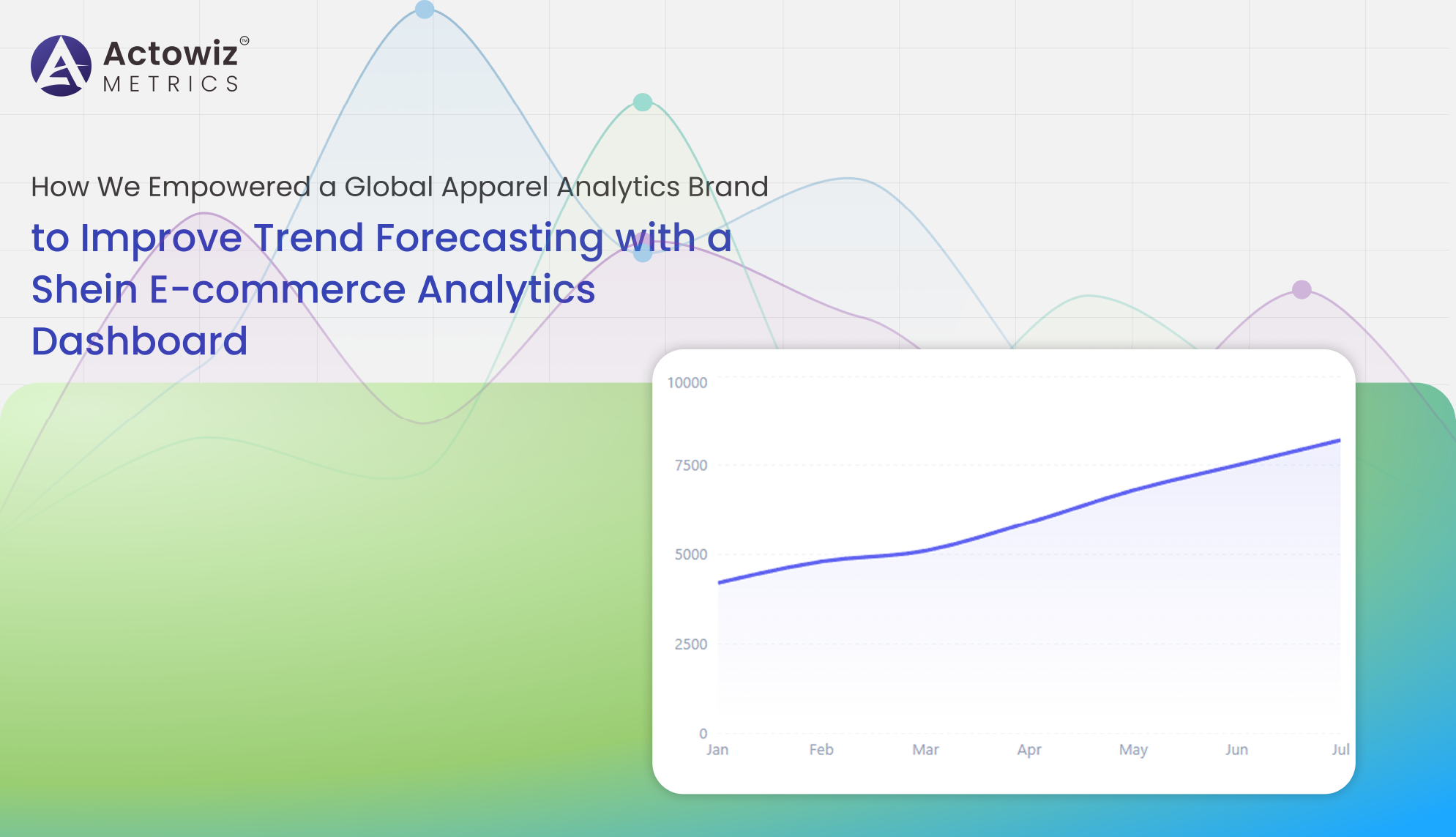

Shein E-commerce Analytics Dashboard delivers real-time pricing, trend, and competitor insights to optimize fashion strategy and boost performance.

Explore Now

Live Data Tracking Dashboard for Keeta Food Delivery App enables real-time order, pricing, and restaurant insights to optimize performance and decisions.

Explore NowBrowse expert blogs, case studies, reports, and infographics for quick, data-driven insights across industries.

How Woolworths.com.au Data Tracking helps monitor pricing shifts, stock levels, and promotions to improve retail visibility and decision-making.

Myntra Fashion Category Data Monitoring helps track trends, pricing, stock levels, and category performance to optimize sales and boost growth.

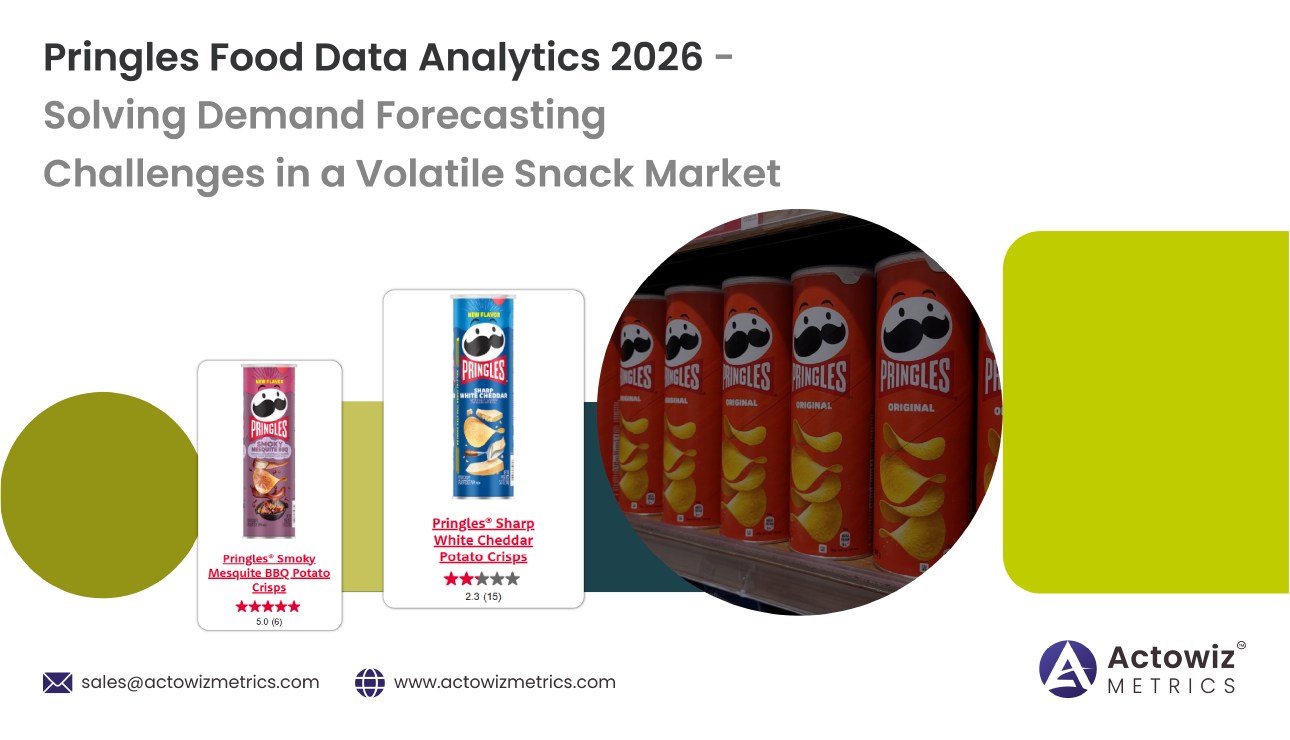

Pringles Food Data Analytics 2026 reveals how data-driven insights improve pricing, demand forecasting, and supply chain efficiency in a dynamic snack market.

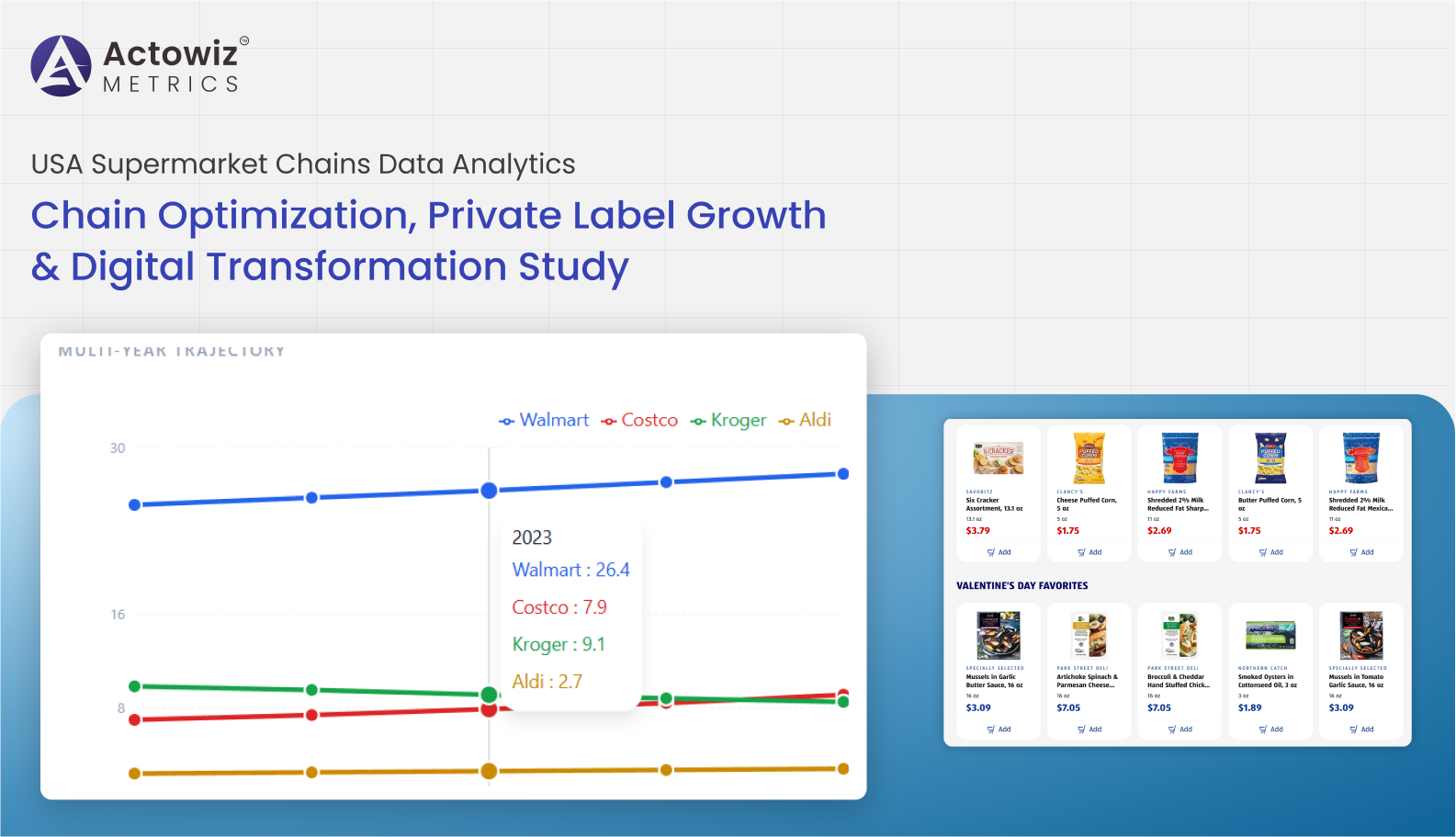

Research Report on USA Supermarket Chains Data Analytics covering chain optimization, private label growth, pricing trends, and digital transformation insights.

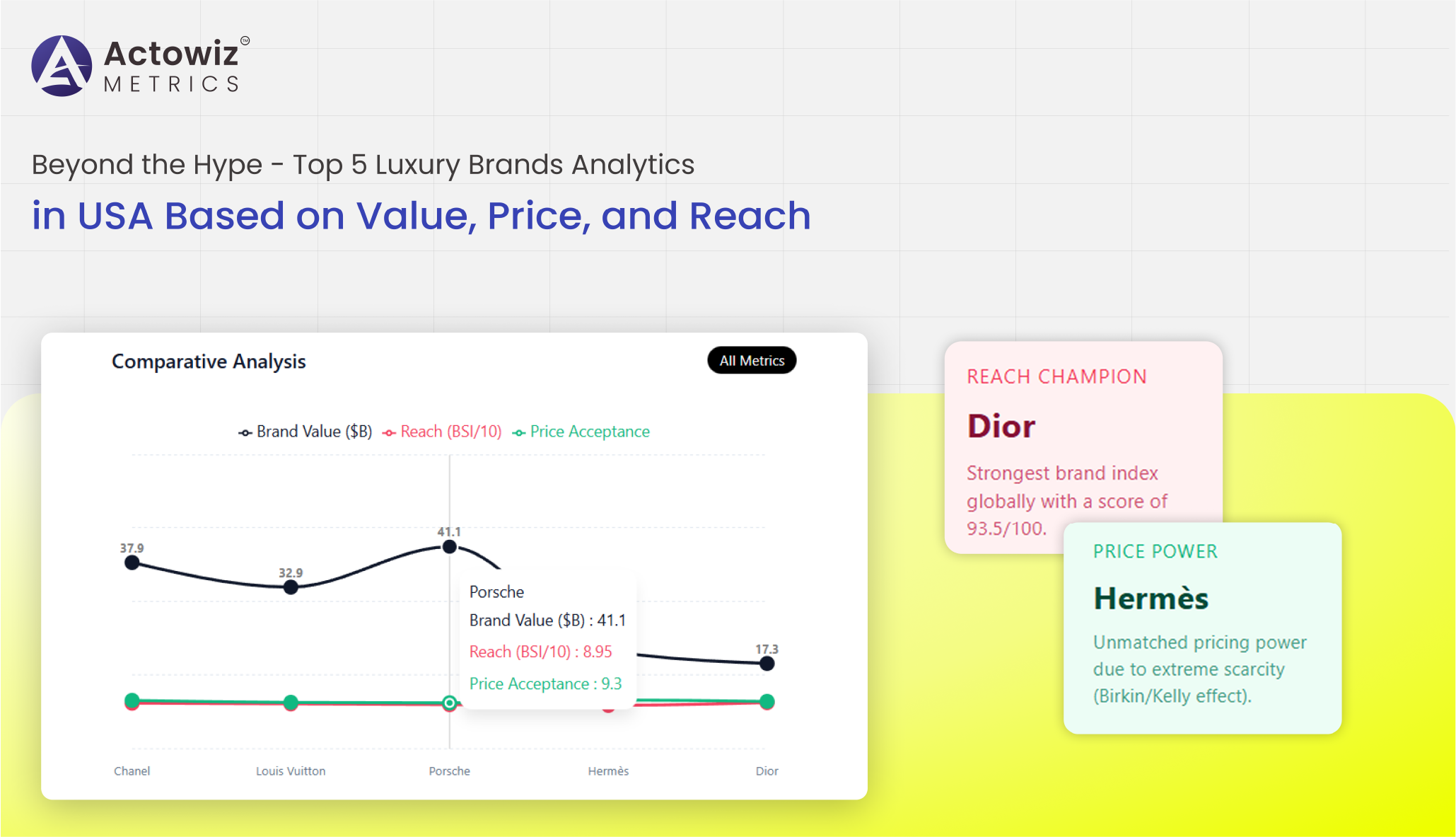

Top 5 Luxury Brands Analytics in USA delivering advanced market insights, consumer trends, and performance intelligence to drive premium brand growth.

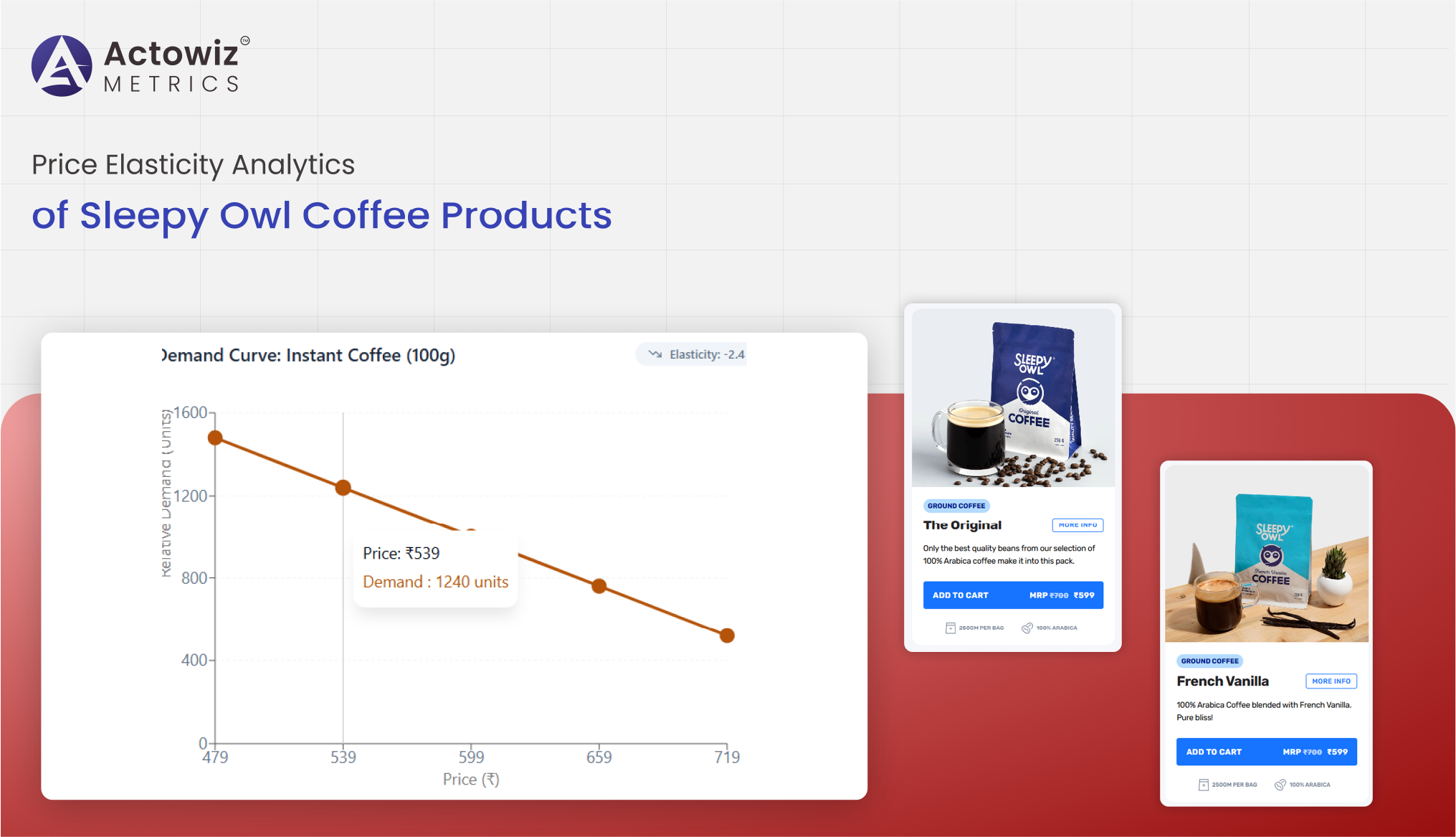

Price Elasticity Analytics of Sleepy Owl Coffee Products revealing demand sensitivity, pricing impact, and revenue optimization insights across channels.

Explore Luxury vs Smartwatch - Global Price Comparison 2025 to compare prices of luxury watches and smartwatches using marketplace data to reveal key trends and shifts.

E-Commerce Price Benchmarking: Gucci vs Prada reveals 2025 pricing trends for luxury handbags and accessories, helping brands track competitors and optimize pricing.

Discover how menu data scraping uncovers trending dishes in 2025, revealing popular recipes, pricing trends, and real-time restaurant insights for food businesses.

Explore the Amazon Baby Care Report analyzing Top Baby Brands Analysis on Amazon, covering discounts, availability, and popular products with data-driven market insights.

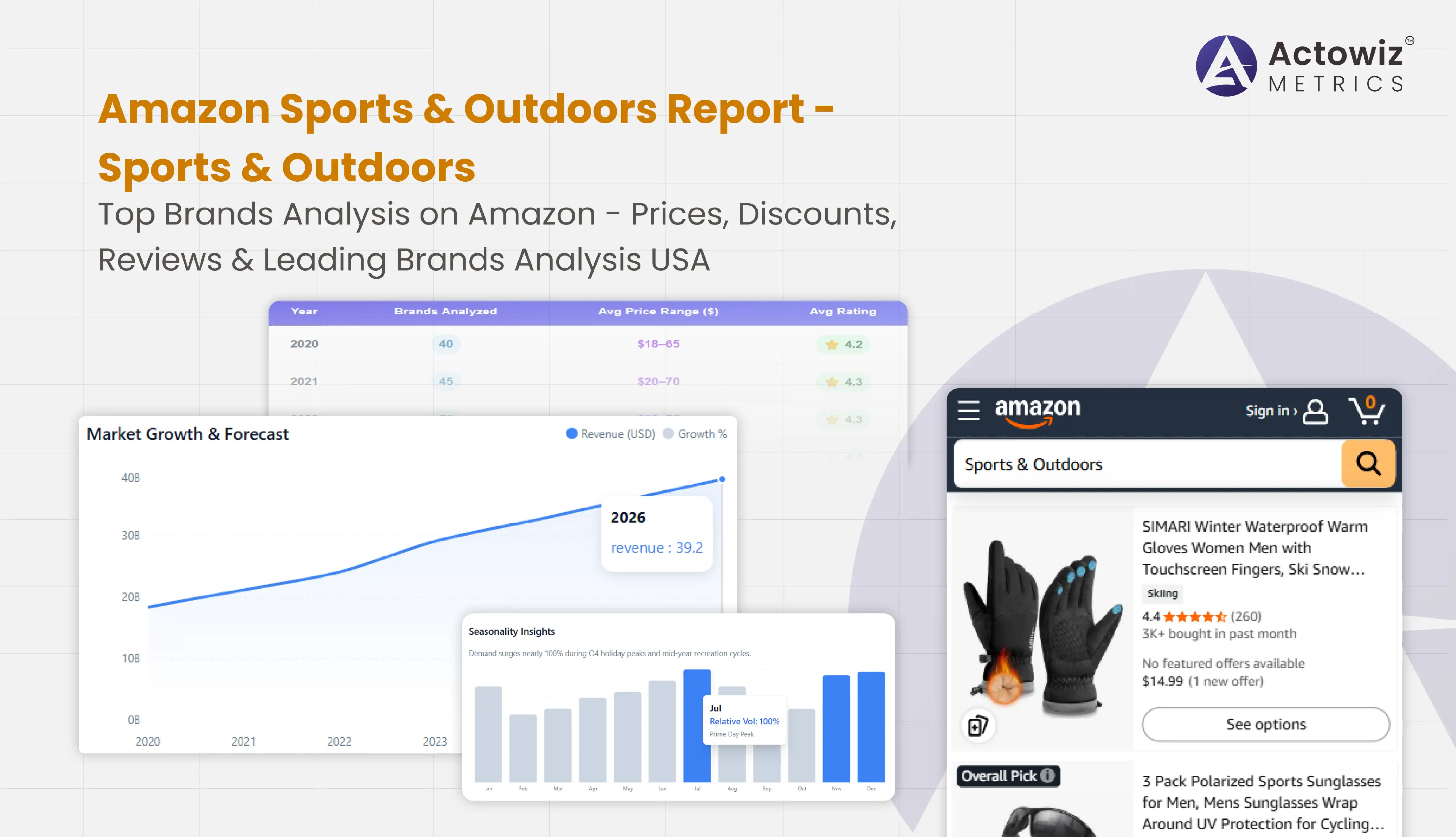

Amazon Sports & Outdoors Report - Sports & Outdoors Top Brands Analysis on Amazon - Prices, Discounts, Reviews

Enabled a USA pet brand to optimize pricing, inventory, and offers on Amazon using Pet Supplies Top Brands Analysis on Amazon for accurate, data-driven decisions.

Whatever your project size is, we will handle it well with all the standards fulfilled! We are here to give 100% satisfaction.

Any analytics feature you need — we provide it

24/7 global support

Real-time analytics dashboard

Full data transparency at every stage

Customized solutions to achieve your data analysis goals