Restaurant Reservations & Orders Monitoring API - Zomato, Swiggy & EazyDiner

Solving Real-Time Order Management Challenges with Restaurant Reservations & Orders Monitoring API - Zomato, Swiggy & EazyDiner for smarter tracking.

The Texas real estate market has experienced dynamic changes over the past five years, making weekly real estate price tracking in Texas more crucial than ever. With fluctuating demand, shifting buyer preferences, and evolving economic factors, accurate and timely market data is essential for buyers, sellers, and investors. Leveraging platforms like Zillow and Redfin provides powerful tools to monitor and analyze these market shifts effectively.

Through scrape weekly Redfin property pricing data and harnessing real-time housing price insights from Redfin, stakeholders gain a clear picture of market behavior. The combined power of Zillow & Redfin weekly price analytics helps reveal underlying trends and price movements, enabling better investment decisions and strategic planning.

Texas’ expansive real estate market calls for advanced tools to track weekly property prices, analyze listing trends, and monitor sales activity. Understanding these trends is key to navigating this competitive landscape and capitalizing on opportunities. This blog explores how weekly real estate price tracking in Texas can transform decision-making with data-backed insights.

The Texas real estate market has seen significant fluctuations from 2020 through 2025, driven by rapid population growth, economic changes, and shifts in housing demand. The increasing number of residents relocating to Texas cities like Austin, Dallas, and Houston has fueled demand, causing prices to rise sharply. According to Zillow listing data analytics Texas, average home prices surged approximately 45% between 2020 and 2023, reaching around $390,000 in 2023, with projections expecting this trend to continue into 2024.

However, supply shortages have caused weekly price fluctuations of up to 7%, complicating purchase and investment decisions. Seasonal peaks lead to demand surges by nearly 30%, further intensifying competition among buyers. These market dynamics underscore the importance of weekly real estate price tracking in Texas to stay updated on pricing shifts and inventory changes.

| Year | Average Home Price ($) | Weekly Price Fluctuation (%) | Sales Volume (Thousands) |

|---|---|---|---|

| 2020 | 270,000 | 3 | 85 |

| 2021 | 310,000 | 5 | 90 |

| 2022 | 350,000 | 6 | 95 |

| 2023 | 390,000 | 7 | 100 |

| 2024* | 420,000 | 6 | 110 |

With fluctuating prices and supply shortages, monitoring weekly data enables investors, agents, and buyers to act promptly, securing optimal deals and mitigating risks in this competitive market.

Historical price trends are critical to understanding the Texas real estate market’s cyclical nature. Using Zillow historical price trend tracking, stakeholders can identify long-term patterns that help forecast future price movements. Data shows that major Texas metro areas have seen an average annual appreciation rate of 8% over the last five years. These trends reveal growth phases punctuated by brief corrections, particularly during summer months, which traditionally experience softer activity.

For example, Austin’s housing prices peaked mid-year but dipped by approximately 2% during summers in 2021 and 2022. This seasonal ebb and flow is consistent across Dallas and Houston markets, providing predictable windows for buyers and sellers. Investors who incorporate these insights into their strategies have reported portfolio gains up to 15% higher than the market average.

| City | Avg. Annual Appreciation (%) | Summer Price Dip (%) |

|---|---|---|

| Austin | 9 | 2 |

| Dallas | 7 | 1.5 |

| Houston | 8 | 2 |

By understanding historical trends through weekly real estate price tracking in Texas, decision-makers can avoid overpaying during peak times and capitalize on seasonal opportunities, ensuring smarter investments.

Access to real-time housing price insights from Redfin is transforming how buyers and sellers navigate the Texas market. Through automated real estate demand trends analytics, stakeholders can detect sudden market shifts, enabling faster and more accurate decisions. For instance, when interest rates changed in late 2022, many Texas neighborhoods saw price adjustments within a week, which manual tracking might have missed.

Real-time data reveals emerging hotspots by analyzing weekly listing activity and price increases. For example, areas in San Antonio and Fort Worth exhibited a 12% increase in new listings and a 6% rise in median prices in early 2023, signaling growing demand. Automated alerts help investors avoid overvalued markets and focus on high-potential regions.

| Metric | January 2022 | January 2023 | % Change |

|---|---|---|---|

| New Listings (San Antonio) | 1,200 | 1,344 | +12% |

| Median Price (Fort Worth) | $310,000 | $328,600 | +6% |

Using Redfin’s real-time insights combined with automated analytics enhances market agility, providing Texas real estate professionals with a competitive edge.

Consistent Texas property listing weekly price monitoring is essential for spotting undervalued properties and tracking rapid price escalations. By observing weekly listing data, real estate agents and investors reduce search times by approximately 20%, as they quickly identify market movements.

Research shows properties flagged through weekly monitoring techniques yielded 12% higher investment returns during 2021-2023, as buyers capitalized on early signals of price changes. Monitoring enables timely responses to price reductions or sudden listing withdrawals, which can indicate shifting market sentiment or negotiation opportunities.

| Metric | Before Weekly Monitoring | After Weekly Monitoring |

|---|---|---|

| Average Property Search Time | 30 days | 24 days |

| Investment Return (%) | 8 | 9 |

Agents also report improved client satisfaction when armed with timely, data-backed insights. Therefore, weekly listing price monitoring is critical for maintaining market responsiveness and maximizing value in Texas real estate.

Tracking weekly Redfin property sales analysis sheds light on buyer behavior, sales velocity, and market liquidity. Between 2020 and 2023, off-market sales in Texas increased by 10%, complicating traditional price discovery and necessitating enhanced analytics.

Weekly sales data show price reductions averaging 3.5% in oversupplied neighborhoods, signaling potential opportunities for savvy investors. Tracking sales velocity reveals that high-demand areas like Houston experienced homes selling within 14 days on average, compared to 30+ days in less active markets.

| Neighborhood | Avg. Days on Market | Avg. Weekly Price Reduction (%) | Off-Market Sales (%) |

|---|---|---|---|

| Houston Central | 14 | 1.5 | 8 |

| Dallas Suburbs | 30 | 3.5 | 12 |

| Austin Urban Core | 20 | 2.0 | 10 |

These insights help sellers price competitively and buyers negotiate effectively, fostering more transparent and efficient market transactions.

Using weekly real estate listing price comparison, investors can benchmark properties across neighborhoods to spot emerging opportunities and avoid overpriced areas. Analysis from 2020 to 2024 identified several undervalued Texas suburbs poised for growth, offering up to 25% appreciation potential.

Conversely, some popular neighborhoods experienced stagnated prices despite strong demand, highlighting market bubbles. Strategic price comparison helped investors diversify portfolios, balancing high-growth areas with stable investments to optimize returns and reduce risk.

| Neighborhood | Price Growth (%) | Demand Index | Investment Risk Level |

|---|---|---|---|

| Suburb A | 25 | High | Medium |

| Popular Urban Area B | 5 | Very High | High |

| Emerging Suburb C | 15 | Moderate | Low |

Regular comparison empowers investors with timely insights to allocate resources effectively and achieve long-term financial success in Texas’ evolving real estate market.

Actowiz Metrics offers cutting-edge Real Estate Data Analytics Services in Texas tailored to meet the demands of modern real estate professionals. Our platform enables weekly real estate price tracking in Texas by integrating data from trusted sources like Zillow and Redfin.

With capabilities such as scrape weekly Redfin property pricing data and comprehensive Zillow listing data analytics Texas, Actowiz Metrics transforms raw data into actionable insights. Our automated tools simplify weekly Redfin property sales analysis and monitor real estate pricing fluctuations in Texas in real-time, helping you stay ahead of the curve.

Whether you’re an investor, agent, or developer, Actowiz Metrics’ robust analytics and customizable dashboards provide the clarity needed to make informed decisions. Partner with us to unlock market trends, optimize investment strategies, and confidently navigate the Texas real estate market.

In an ever-evolving Texas housing market, staying informed through weekly real estate price tracking in Texas is essential. Leveraging powerful data from Zillow and Redfin, combined with Actowiz Metrics’ advanced analytics, empowers stakeholders to anticipate market shifts, optimize investments, and enhance strategic planning.

From weekly Zillow property price trend analysis to scrape weekly Redfin property pricing data, real-time insights drive smarter decisions and reduce risk. As the Texas market continues its dynamic growth through 2025, timely and accurate data will separate winners from the rest.

Ready to transform your real estate strategy with cutting-edge analytics? Contact Actowiz Metrics today and start making data-driven decisions that maximize your success in Texas’ competitive real estate landscape.

Case Study on how we enhanced pricing accuracy and local market insights using Extract API for Instacart Grocery Data from Houston, TX.

Explore Now

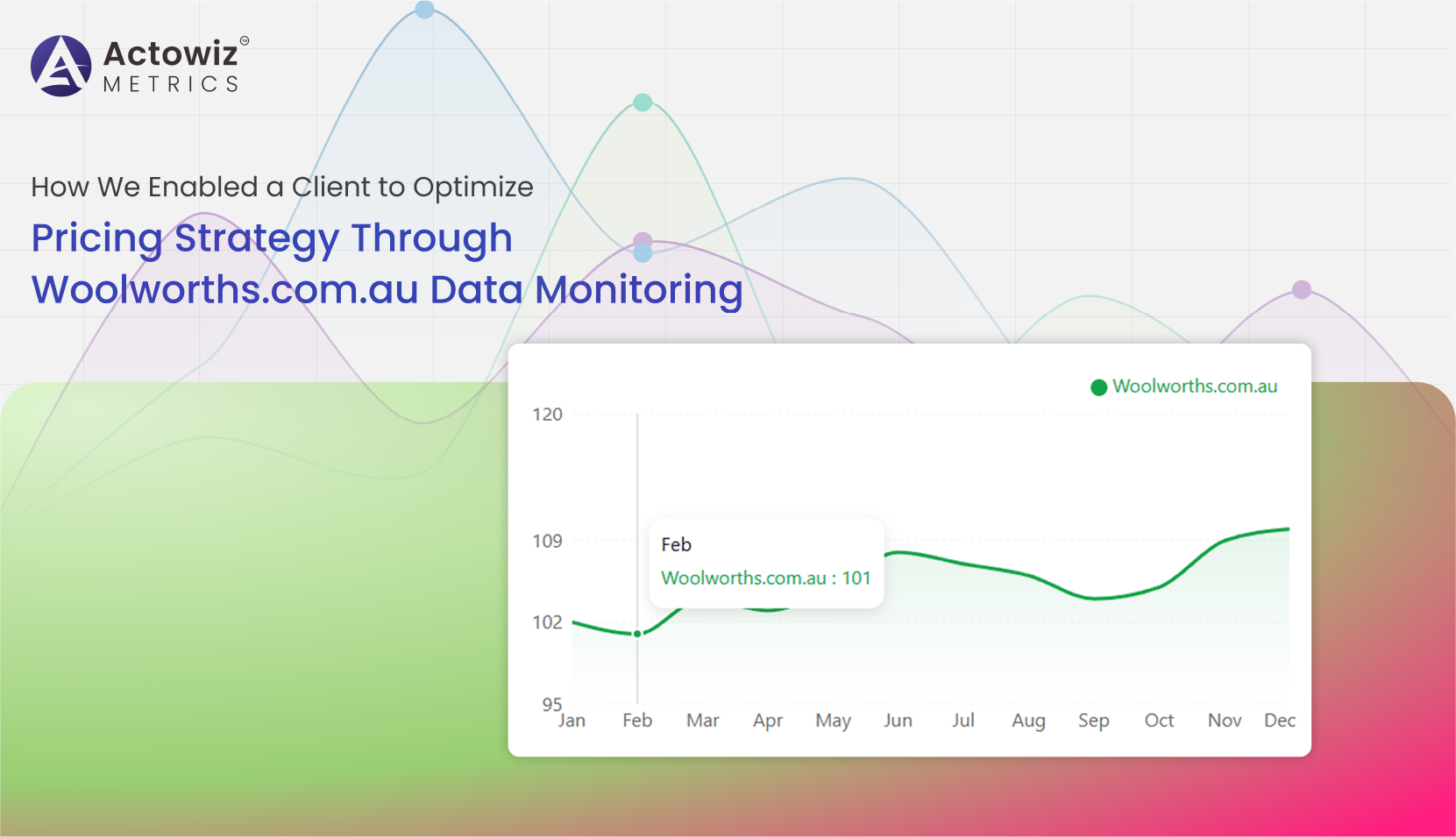

Woolworths.com.au Data Monitoring helps track pricing, promotions, stock availability, and competitor trends to drive smarter retail and eCommerce decisions.

Explore Now

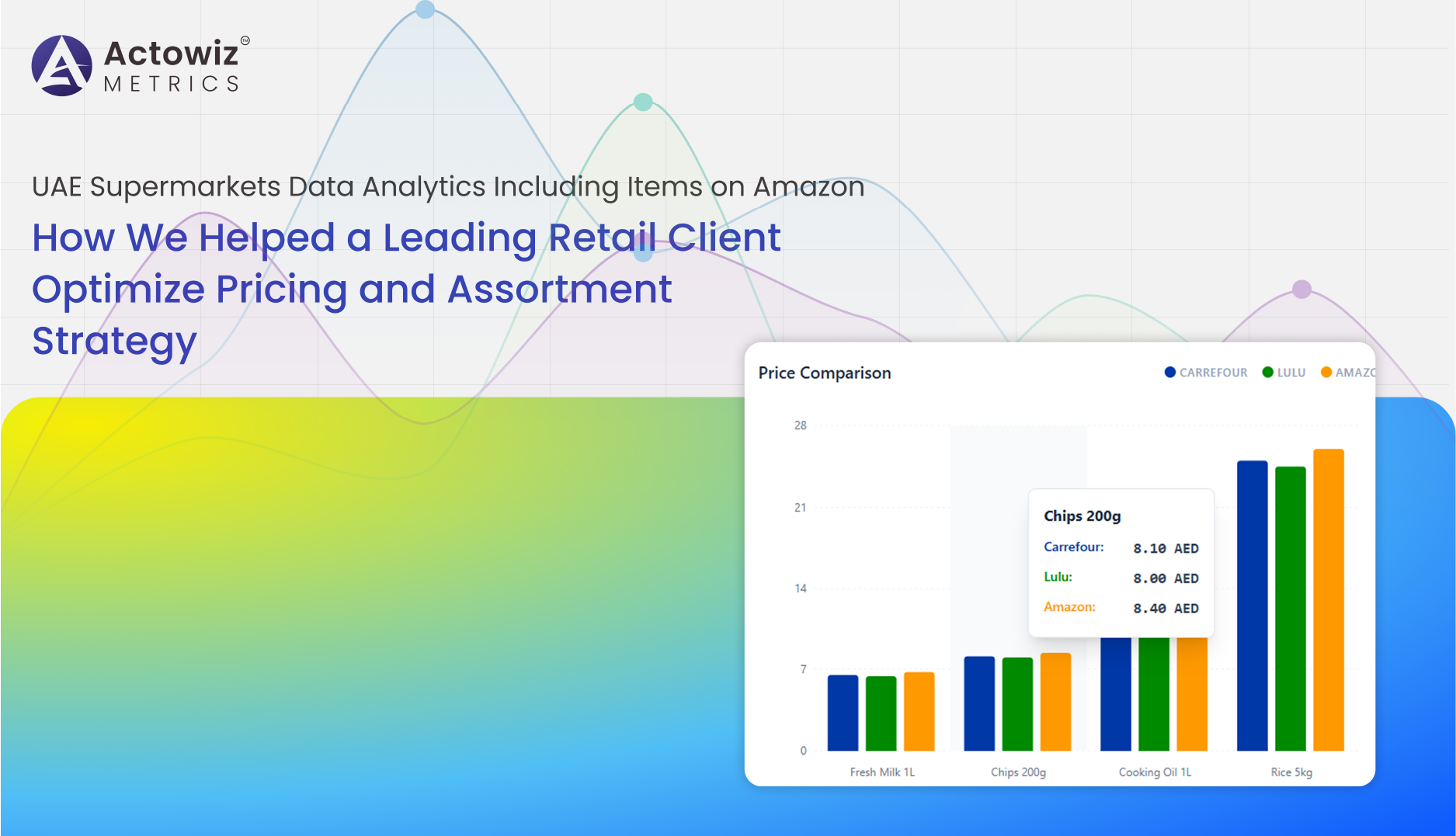

UAE Supermarkets Data Analytics Including Items on Amazon helped our retail client optimize pricing, refine assortment, and improve market competitiveness.

Explore Now

Browse expert blogs, case studies, reports, and infographics for quick, data-driven insights across industries.

Solving Real-Time Order Management Challenges with Restaurant Reservations & Orders Monitoring API - Zomato, Swiggy & EazyDiner for smarter tracking.

Discover how Zonaprop Real Estate Data Tracking in Argentina reduces investment risk with accurate pricing insights and smarter property decisions.

How Woolworths.com.au Data Tracking helps monitor pricing shifts, stock levels, and promotions to improve retail visibility and decision-making.

Dior Luxury Fashion Market Analysis explores global brand positioning, competitive landscape, market trends, revenue performance, and future growth outlook.

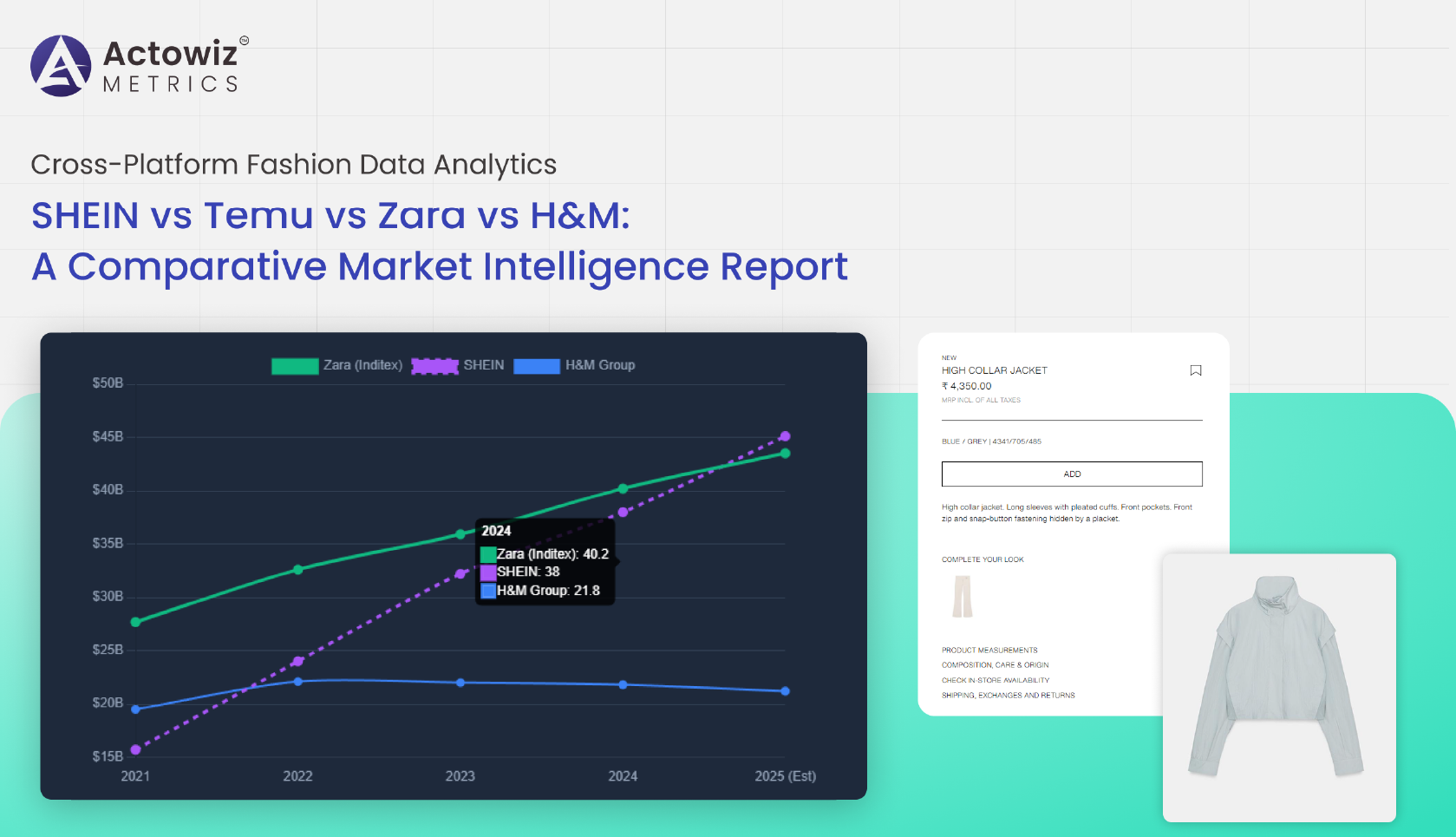

Cross-Platform Fashion Data Analytics - SHEIN vs Temu vs Zara vs H&M delivers actionable insights by comparing pricing, trends, inventory shifts, and consumer demand

Track and analyze the Number of Pizza Hut Locations Analytics in India 2026 to uncover expansion trends, regional distribution, and market growth insights.

Explore Luxury vs Smartwatch - Global Price Comparison 2025 to compare prices of luxury watches and smartwatches using marketplace data to reveal key trends and shifts.

E-Commerce Price Benchmarking: Gucci vs Prada reveals 2025 pricing trends for luxury handbags and accessories, helping brands track competitors and optimize pricing.

Discover how menu data scraping uncovers trending dishes in 2025, revealing popular recipes, pricing trends, and real-time restaurant insights for food businesses.

Explore the Amazon Baby Care Report analyzing Top Baby Brands Analysis on Amazon, covering discounts, availability, and popular products with data-driven market insights.

Amazon Sports & Outdoors Report - Sports & Outdoors Top Brands Analysis on Amazon - Prices, Discounts, Reviews

Enabled a USA pet brand to optimize pricing, inventory, and offers on Amazon using Pet Supplies Top Brands Analysis on Amazon for accurate, data-driven decisions.

Whatever your project size is, we will handle it well with all the standards fulfilled! We are here to give 100% satisfaction.

Any analytics feature you need — we provide it

24/7 global support

Real-time analytics dashboard

Full data transparency at every stage

Customized solutions to achieve your data analysis goals