Restaurant Reservations & Orders Monitoring API - Zomato, Swiggy & EazyDiner

Solving Real-Time Order Management Challenges with Restaurant Reservations & Orders Monitoring API - Zomato, Swiggy & EazyDiner for smarter tracking.

Today’s online retail game is a race to win price-sensitive shoppers — and no platform tests this better than Walmart’s massive online shelf. In the age of dynamic promotions, fast competitor moves, and real-time price drops, mastering Walmart pricing and promotion Analysis is what separates top sellers from the rest.

For any brand selling on Walmart, it’s no longer enough to guess where discounts work. You need daily visibility into pricing, promotions, discounts, and competitive shelf placement to shape smart pricing strategies that win buyers, boost conversion, and grow sales — all with maximum margin protection.

Let’s break down how Walmart pricing and promotion Analysis unlocks data-driven growth — and how Actowiz Metrics makes it practical.

Retailers who master Walmart pricing and promotion Analysis can quickly detect where they’re losing share to undercutting rivals or aggressive promotions. An AI-driven look at pricing and promo trends exposes gaps in your discount calendar and reveals which SKUs should get deeper discounts or more ad spend.

Using a Dynamic pricing strategy Walmart brands can align daily shelf price changes with real-time demand. With Real-time Walmart price scraping, you see exactly when competitors drop a price on a top-selling product, so you can match or counter it instantly.

Paired with Walmart promotion tracking and Walmart discount trend analysis, brands understand which promo types work best — multi-buy offers, flash sales, or limited-time discounts. This turns static pricing into a nimble playbook that responds faster than rivals.

| Year | Avg. Promo Overlap with Competitors | SKU-Level Price Changes | Avg. Margin Improvement |

|---|---|---|---|

| 2020 | 52% | 500K | +4% |

| 2021 | 58% | 700K | +6% |

| 2022 | 65% | 950K | +8% |

| 2023 | 72% | 1.2M | +10% |

| 2024 | 79% | 1.5M | +12% |

| 2025 | 85% (est.) | 1.8M (est.) | +14% (est.) |

Analysis: Sellers who automate daily pricing adjustments close margin gaps faster and maintain buyer loyalty even when rivals run discounts.

One-size-fits-all promotions often fail in Walmart’s fast-paced eCommerce environment. Smart brands use AI-based promotion analytics to test which discounts convert — and for which shopper segments.

Actowiz Metrics connects Real-time Walmart price scraping with AI that spots hidden opportunities: when to launch flash discounts, which regions react best, and how to sync promos with supply levels.

By layering this with U.S Walmart analytics tools, brands can benchmark against category peers — asking, How does my price compare to the average? Are my discounts deep enough to move the needle? When do my competitors run back-to-back promotions to squeeze my sales?

This intelligence powers precise Walmart Online shelf Analytics, where you monitor not just price tags but product placement, reviews, and buy-box wins in real time.

| Year | Promo ROI Lift | AI-Based Discount Campaigns | Avg. Cart Value Growth |

|---|---|---|---|

| 2020 | +5% | 150K | +4% |

| 2021 | +7% | 250K | +6% |

| 2022 | +10% | 400K | +8% |

| 2023 | +13% | 550K | +10% |

| 2024 | +16% | 750K | +13% |

| 2025 | +18% (est.) | 900K (est.) | +15% (est.) |

Analysis: AI-based promotion testing drives smarter discount spend and increases average order value by targeting buyers with offers that convert.

Data without action is wasted. Leading sellers bring all these insights together on a Real-time Walmart analytics dashboard. With Actowiz, brands visualize daily price shifts, competitor promos, and discount wins in one place — then act fast.

This dashboard feeds Walmart eCommerce trends analysis straight into your pricing and promotions team. The result? Quicker campaigns, less margin leakage, and proactive pricing updates that align with actual shopper behavior.

Combined with Walmart promotion tracking and Real-time Walmart price scraping, teams know exactly which SKUs need attention today — and which to push with ads or roll back to protect profit.

| Year | Avg. Dashboard Logins/Month | SKU-Level Actions Automated | Decision-Making Speed (Days to Hours) |

|---|---|---|---|

| 2020 | 15 | 100K | 3 days → 1 day |

| 2021 | 30 | 200K | 1 day → 12 hours |

| 2022 | 45 | 350K | 12 hours → 6 hours |

| 2023 | 60 | 500K | 6 hours → 2 hours |

| 2024 | 75 | 700K | 2 hours → 1 hour |

| 2025 | 90 (est.) | 900K (est.) | 1 hour → near real time |

Analysis: Centralized dashboards slash manual checks and keep pricing teams ahead of sudden shifts.

Your Walmart channel is not static — shopper demand, seasonality, and competitor aggression all shift constantly. Walmart eCommerce trends analysis gives your team the big-picture context for daily pricing and promotions decisions.

By watching trends in real-time, brands detect when shoppers pivot — for example, from big brands to private label, or from everyday low pricing to flash deals. With Actowiz, you plug trend signals into your dynamic pricing strategy Walmart, ensuring prices stay competitive but margins remain strong.

| Year | Seasonal Promo Spend (%) | New SKUs Monitored | YOY Market Share Gain |

|---|---|---|---|

| 2020 | 15% | 100K | +2% |

| 2021 | 18% | 200K | +3% |

| 2022 | 22% | 300K | +4% |

| 2023 | 26% | 400K | +5% |

| 2024 | 30% | 500K | +6% |

| 2025 | 34% (est.) | 600K (est.) | +7% (est.) |

Analysis: More brands now align pricing and promo calendars with live market trend signals — maximizing sales during peak demand.

Walmart, as one of the world’s largest retailers, sets the benchmark for pricing and promotional strategies that directly shape online sales growth. Through deep pricing and promotion analysis, Walmart can respond dynamically to market shifts, competitor price changes, and seasonal demand surges — giving both established and emerging brands a strong advantage.

With multiple categories stocked at Walmart — from personal care to household products — P&G constantly tracks Walmart’s pricing models to maintain its share in a highly competitive shelf space. Real-time price monitoring ensures P&G can align promotional discounts with Walmart’s rollback pricing or flash sales, maximizing volume while staying profitable.

Unilever uses Walmart’s pricing data to test regional promotions for brands like Dove and Axe. By analyzing which Walmart stores or online regions respond best to combo offers or multi-pack discounts, Unilever refines its broader eCommerce pricing strategies for other major retailers too.

The company is behind brands like Lysol and Dettol. During the pandemic, Reckitt leveraged Walmart’s pricing data to adjust price points for sanitizers and disinfectants based on real-time demand spikes, ensuring products remained competitively priced but also profitable despite supply chain challenges.

Nestlé, a leading FMCG brand, uses Walmart’s promotion trends to test new snack pack sizes or bundle offers for its coffee and confectionery lines. By tracking Walmart’s weekly rollbacks, Nestlé can align digital ads and Amazon listings to stay competitive across marketplaces.

With its toothpaste and oral care range, Colgate-Palmolive uses Walmart data to benchmark against store brands and competing players like Crest. If Crest launches a deep discount, Colgate can plan digital couponing or in-store shelf promotions quickly.

Brands like PepsiCo and Coca-Cola use Walmart sales data to test co-branded promotions with snacks and drinks, boosting basket size and repeat purchases. This granular view of pricing elasticity means they can push volume without eroding brand value.

Kimberly-Clark analyzes Walmart’s real-time price changes on diapers and tissues to stay ahead of value brand competition. With insights into which promotions drive bulk purchases, they can target families with personalized digital offers.

With its personal care and baby products, Johnson & Johnson uses Walmart’s sales data to fine-tune seasonal promotions. For instance, baby wipes or sunscreens see spikes during travel months — timing a rollback or BOGO offer maximizes sell-through.

Premium brands like L’Oréal study Walmart’s pricing data to protect brand positioning while tapping Walmart’s massive online reach. They balance discounts carefully to attract price-sensitive buyers without diluting premium perception.

Below is a snapshot of Top 10 Brands at Walmart with estimated online share, average price range, and top promotion strategies:

| Brand | Online Market Share (%) | Avg. Price Range ($) | Top Promotion Strategy |

|---|---|---|---|

| P&G | 12% | $4–$25 | Combo packs, digital coupons |

| Unilever | 9% | $3–$20 | Multi-pack discounts, seasonal offers |

| Reckitt Benckiser | 7% | $5–$15 | Rollbacks, bundle deals |

| Nestlé | 6% | $2–$18 | Snack bundles, free samples |

| Colgate-Palmolive | 5% | $3–$12 | Flash discounts, digital couponing |

| PepsiCo | 8% | $5–$25 | Cross-brand bundles with snacks |

| Coca-Cola | 8% | $5–$25 | Seasonal multi-pack rollbacks |

| Kimberly-Clark | 4% | $4–$30 | Bulk discounts, loyalty offers |

| Johnson & Johnson | 5% | $4–$22 | BOGO offers, seasonal promotions |

| L’Oréal | 3% | $8–$35 | Limited-time discounts, gift packs |

For brands selling on Walmart Marketplace or Walmart.com, real-time pricing and promotion analysis unlocks an edge — it means knowing exactly when to launch a discount, test bundles, or run digital ads that sync with Walmart’s price moves.

Actowiz Metrics helps brands tap into Walmart’s dynamic pricing ecosystem with advanced scraping and analytics dashboards — ensuring your products stay visible, competitive, and profitable across every channel.

Price is just half the battle — the other half is your digital shelf. Walmart Online Shelf Analytics shows exactly where your products appear, which items win the buy box, and how your share of search stacks up.

With Actowiz, brands integrate shelf metrics with Real-time Walmart analytics dashboard feeds — so you see how price changes impact your shelf rank daily. Together with Walmart promotion tracking, this means you control both price AND placement.

| Year | Avg. Search Rank Boost | Buy Box Win Rate | Promo Visibility Uplift |

|---|---|---|---|

| 2020 | +5 positions | 52% | +6% |

| 2021 | +8 positions | 58% | +9% |

| 2022 | +12 positions | 65% | +12% |

| 2023 | +15 positions | 71% | +15% |

| 2024 | +18 positions | 76% | +18% |

| 2025 | +20 positions (est.) | 80% (est.) | +20% (est.) |

Analysis: Brands that align pricing moves with shelf analytics lift search rank and boost promo ROI.

Your ads convert best when your price is right. Using Real-time Walmart price scraping, brands sync ad bids with competitive price changes, so they don’t waste budget promoting outpriced SKUs.

Combining Walmart discount trend analysis with ad data means every dollar works harder — targeting the right shopper, at the right price point, at the right time.

| Year | Avg. Ad ROAS Boost | Ads Paused Due to Poor Price | Cost per Conversion Drop |

|---|---|---|---|

| 2020 | +8% | 100K | -5% |

| 2021 | +12% | 150K | -8% |

| 2022 | +15% | 220K | -11% |

| 2023 | +18% | 300K | -14% |

| 2024 | +22% | 400K | -17% |

| 2025 | +25% (est.) | 500K (est.) | -20% (est.) |

Analysis: Connecting pricing feeds to ad bidding delivers instant ROI gains and eliminates wasted spend.

Competitors rarely announce price cuts — they just do them. That’s why a dynamic pricing strategy Walmart must watch multiple categories daily.

Actowiz’s tools monitor thousands of SKUs for sudden undercutting, matching them with Walmart promotion tracking to show how deep the discount goes — and for how long. Your team gets instant alerts so they can counter it with price drops, bundle offers, or smart discount matching.

| Year | Competitor Moves Detected | Counter-Promos Launched | Margin Saved |

|---|---|---|---|

| 2020 | 200K | 50K | +4% |

| 2021 | 350K | 120K | +6% |

| 2022 | 500K | 200K | +8% |

| 2023 | 700K | 300K | +10% |

| 2024 | 900K | 400K | +12% |

| 2025 | 1.1M (est.) | 500K (est.) | +14% (est.) |

Analysis: Real-time competitor monitoring is the backbone of pricing agility and profit protection.

Finally, once you master Walmart’s top categories, scaling becomes easy. A Real-time Walmart analytics dashboard lets you replicate your winning pricing playbook to new categories, new SKUs, and even new marketplaces.

Tie it together with AI-based promotion analytics and your pricing team won’t just react — they’ll predict where the next big wins come from.

| Year | New Categories Onboarded | SKUs Added to Price Tracking | YOY Category Revenue Lift |

|---|---|---|---|

| 2020 | 5 | 50K | +5% |

| 2021 | 8 | 100K | +8% |

| 2022 | 12 | 200K | +12% |

| 2023 | 16 | 300K | +15% |

| 2024 | 20 | 450K | +20% |

| 2025 | 25 (est.) | 600K (est.) | +25% (est.) |

Analysis: Expanding Walmart pricing playbooks across more SKUs drives sustained eCommerce growth at scale.

Actowiz Metrics simplifies every piece of the puzzle. We deliver Walmart pricing and promotion Analysis through smart APIs, Real-time Walmart price scraping, and custom dashboards that plug into your existing tools.

Need Walmart discount trend analysis? Or help designing a dynamic pricing strategy Walmart? We’ve done it for top U.S. sellers. With our U.S Walmart analytics tools, you’ll never fly blind — you’ll know when, where, and how to adjust prices and promotions in real time.

Winning on Walmart’s digital shelf means knowing your prices, your discounts, and your competitors — daily. Walmart pricing and promotion Analysis from Actowiz turns raw data into profit-driving actions. Book a demo today and see how real-time Walmart pricing insights transform your eCommerce sales, protect margins, and fuel growth!

Case Study on how we enhanced pricing accuracy and local market insights using Extract API for Instacart Grocery Data from Houston, TX.

Explore Now

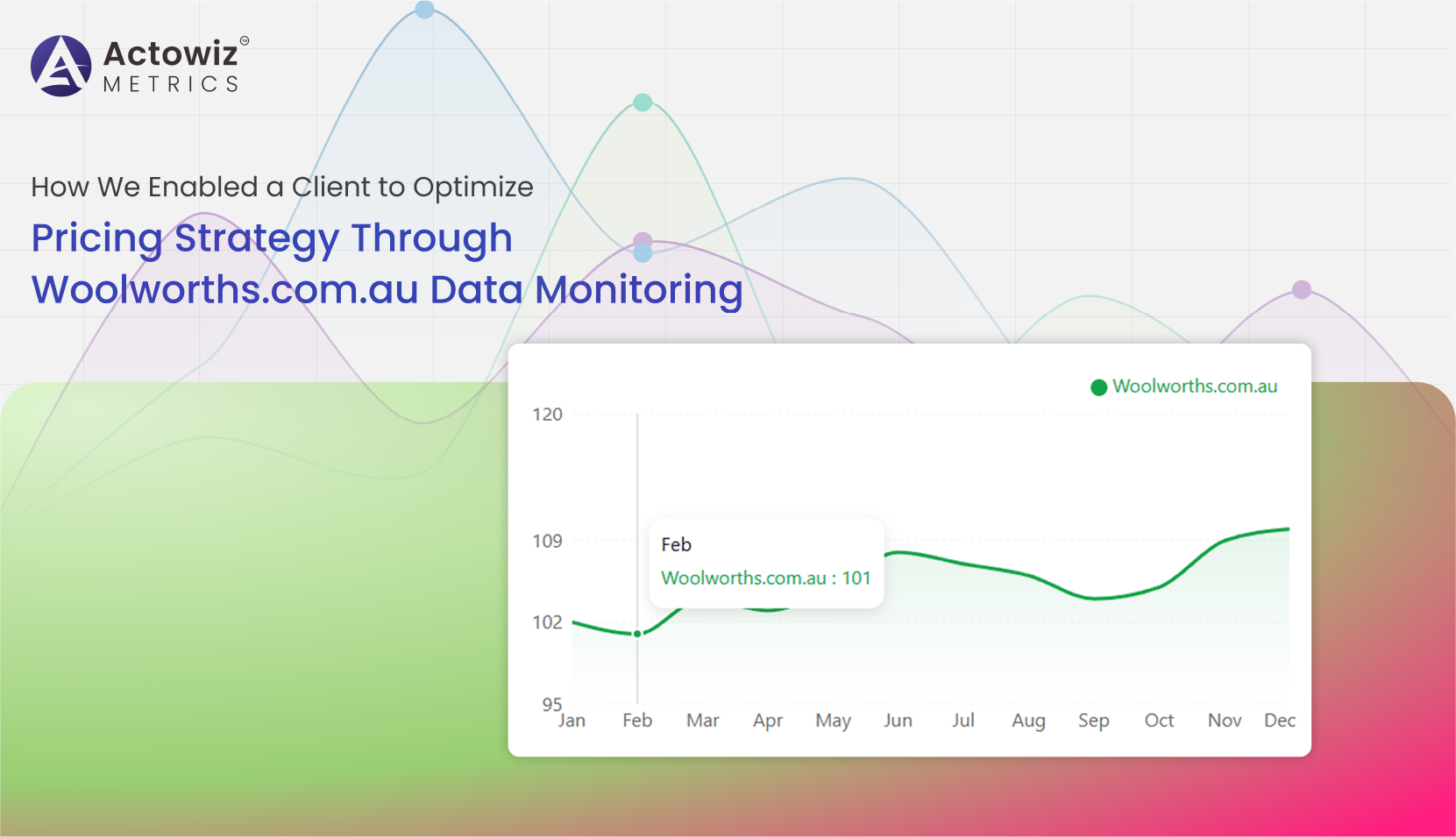

Woolworths.com.au Data Monitoring helps track pricing, promotions, stock availability, and competitor trends to drive smarter retail and eCommerce decisions.

Explore Now

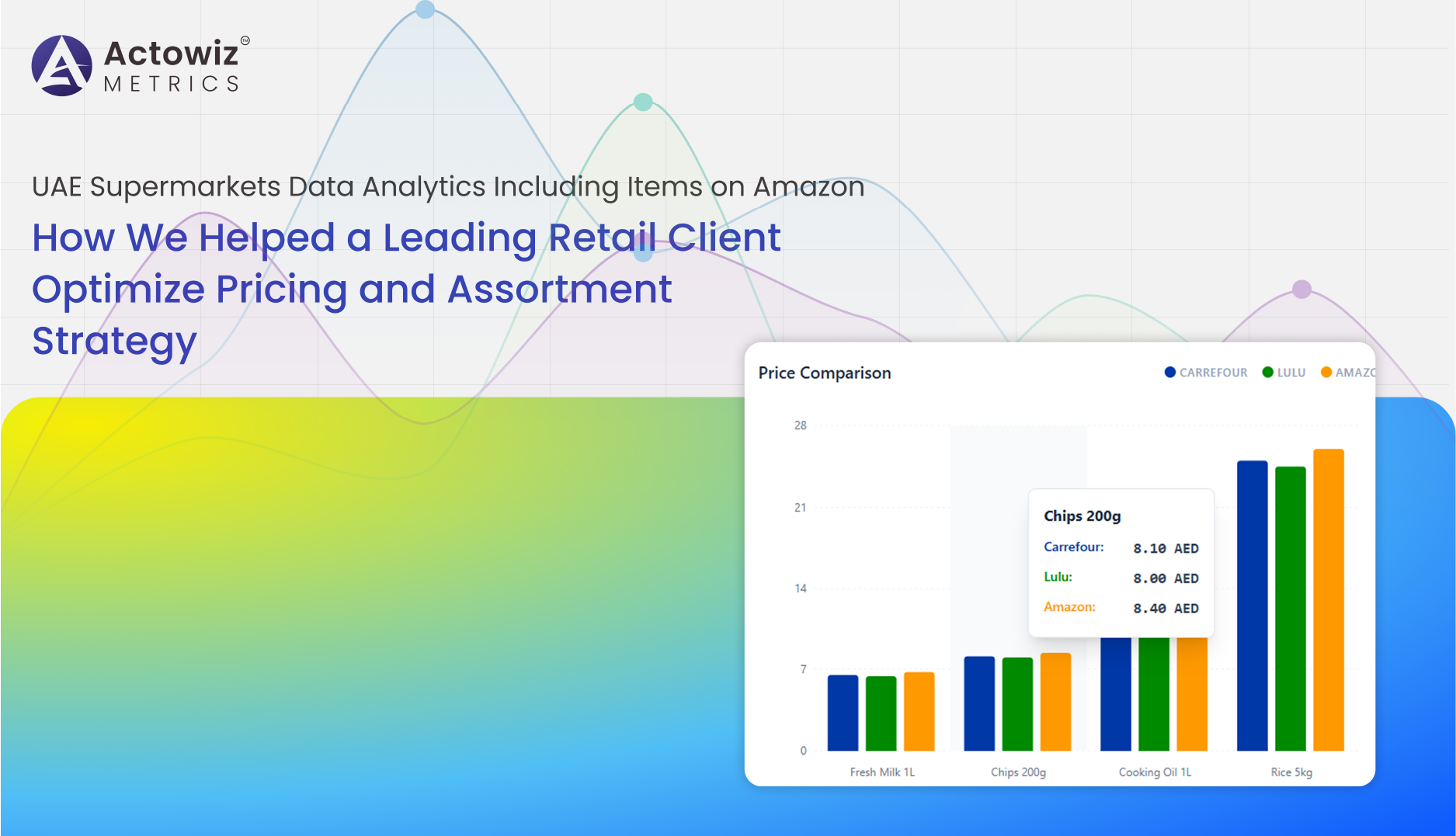

UAE Supermarkets Data Analytics Including Items on Amazon helped our retail client optimize pricing, refine assortment, and improve market competitiveness.

Explore Now

Browse expert blogs, case studies, reports, and infographics for quick, data-driven insights across industries.

Solving Real-Time Order Management Challenges with Restaurant Reservations & Orders Monitoring API - Zomato, Swiggy & EazyDiner for smarter tracking.

Discover how Zonaprop Real Estate Data Tracking in Argentina reduces investment risk with accurate pricing insights and smarter property decisions.

How Woolworths.com.au Data Tracking helps monitor pricing shifts, stock levels, and promotions to improve retail visibility and decision-making.

Dior Luxury Fashion Market Analysis explores global brand positioning, competitive landscape, market trends, revenue performance, and future growth outlook.

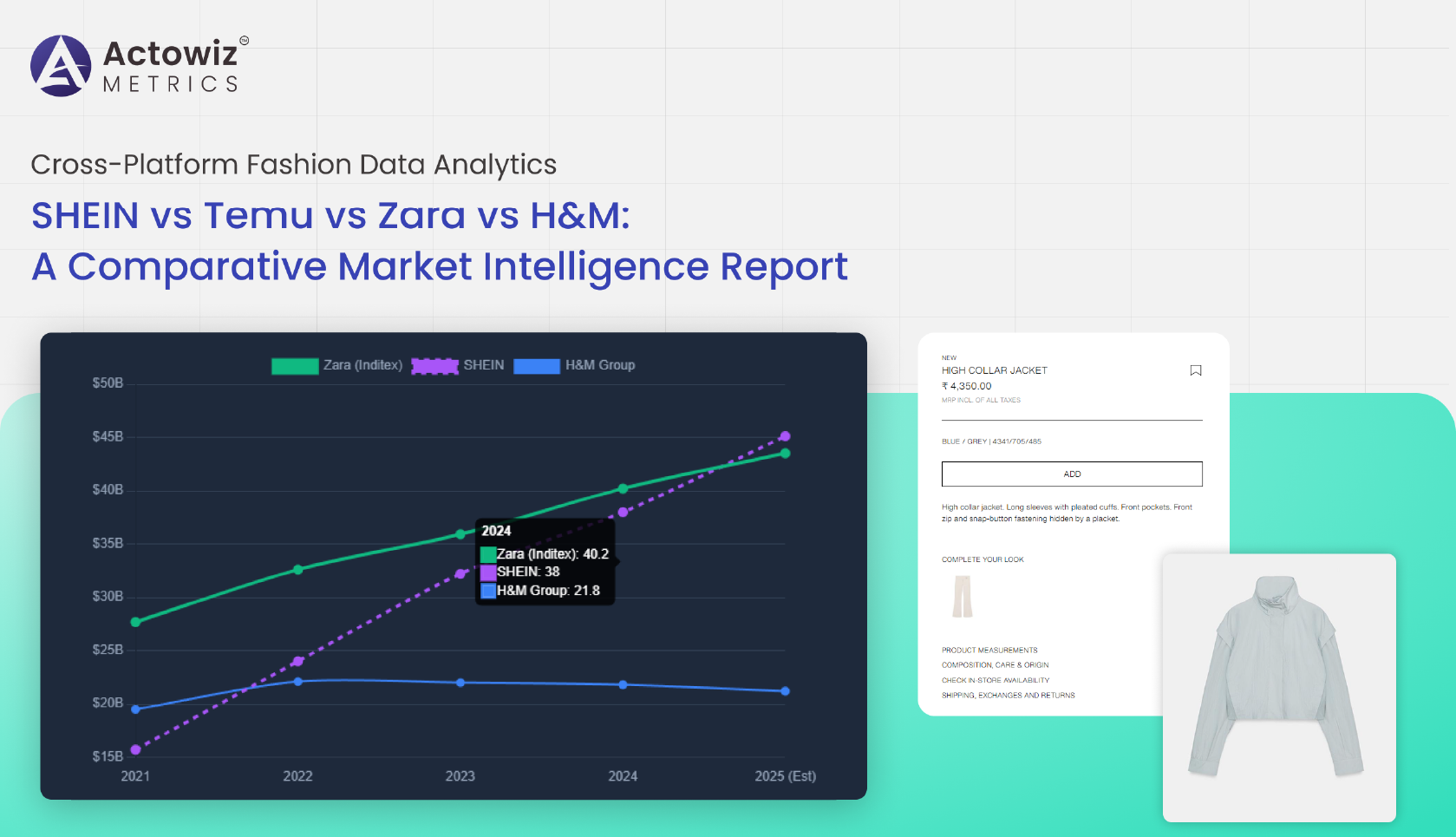

Cross-Platform Fashion Data Analytics - SHEIN vs Temu vs Zara vs H&M delivers actionable insights by comparing pricing, trends, inventory shifts, and consumer demand

Track and analyze the Number of Pizza Hut Locations Analytics in India 2026 to uncover expansion trends, regional distribution, and market growth insights.

Explore Luxury vs Smartwatch - Global Price Comparison 2025 to compare prices of luxury watches and smartwatches using marketplace data to reveal key trends and shifts.

E-Commerce Price Benchmarking: Gucci vs Prada reveals 2025 pricing trends for luxury handbags and accessories, helping brands track competitors and optimize pricing.

Discover how menu data scraping uncovers trending dishes in 2025, revealing popular recipes, pricing trends, and real-time restaurant insights for food businesses.

Explore the Amazon Baby Care Report analyzing Top Baby Brands Analysis on Amazon, covering discounts, availability, and popular products with data-driven market insights.

Amazon Sports & Outdoors Report - Sports & Outdoors Top Brands Analysis on Amazon - Prices, Discounts, Reviews

Enabled a USA pet brand to optimize pricing, inventory, and offers on Amazon using Pet Supplies Top Brands Analysis on Amazon for accurate, data-driven decisions.

Whatever your project size is, we will handle it well with all the standards fulfilled! We are here to give 100% satisfaction.

Any analytics feature you need — we provide it

24/7 global support

Real-time analytics dashboard

Full data transparency at every stage

Customized solutions to achieve your data analysis goals

Browse expert blogs, case studies, reports, and infographics for quick, data-driven insights across industries.

Learn how Amazon MAP Enforcement protects brand value, ensures fair pricing, and helps sellers maintain margins with consistent policy compliance strategies.

Explore How Travel data analytics for OTAs helps drive smarter decisions, refine pricing, improves customer targeting & boost efficiency across travel platforms.

Unlock smarter decisions with E-commerce Data Analytics. Track trends, pricing, and performance to grow your e-commerce brand efficiently.

Discover how Fast Food data analytics helped an American fast food chain increase sales by leveraging real-time insights into menu trends and customer behavior.

Explore how U.S. real estate data scraping empowered a leading property brand to analyze regional demand and make data-driven expansion decisions.

Discover how a leading supermarket chain used Grocery Data Analytics to track inventory, optimize pricing, and boost sales by 27% through smart, data-driven insights.

Explore how Target’s private label thrives through Good & Gather Brand Loyalty Analytics —uncover data-driven insights shaping consumer trust and long-term loyalty.

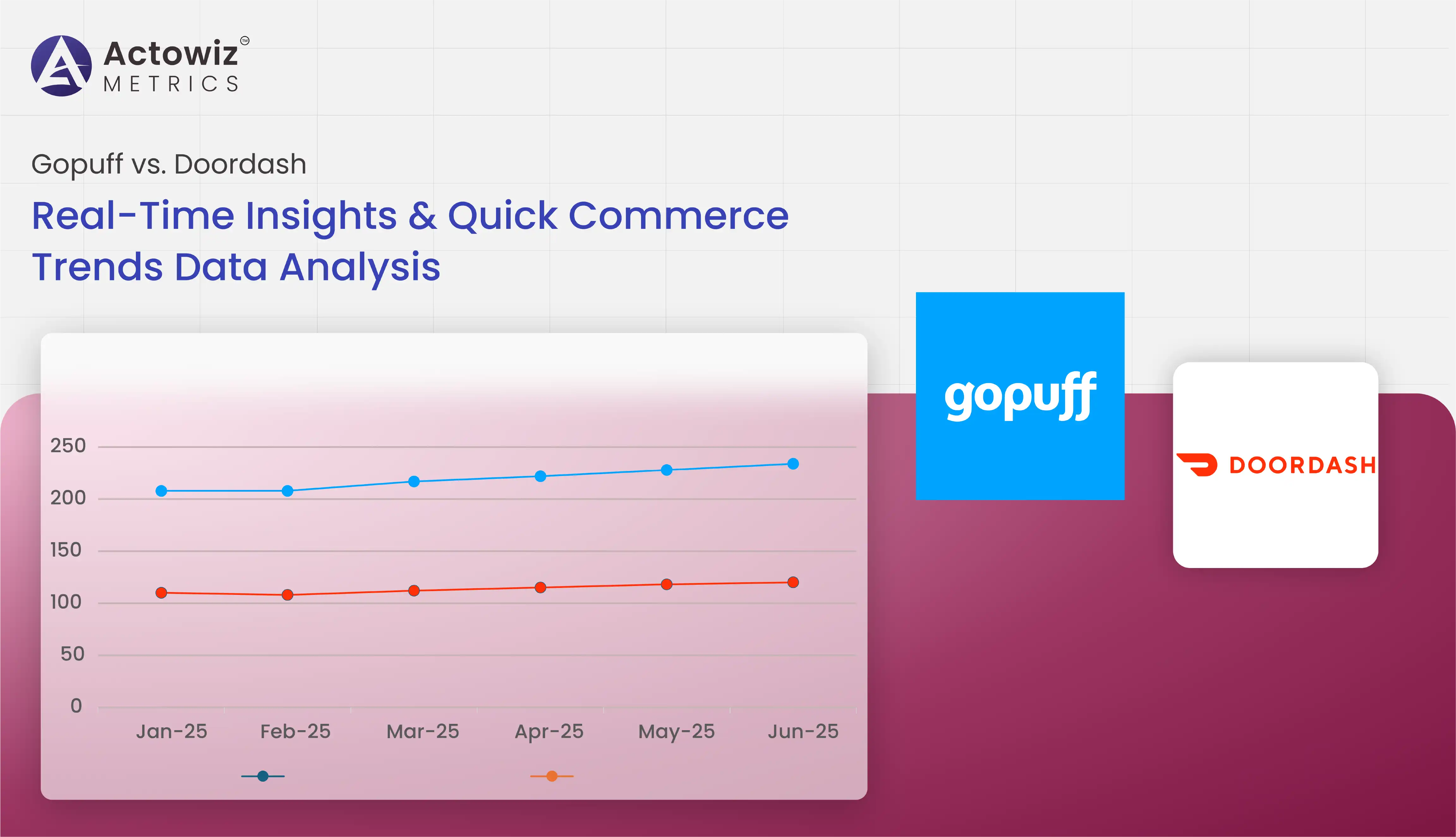

Explore Gopuff vs. Doordash through Quick Commerce Trends Data Analysis. Gain real-time insights into delivery speed, pricing, and consumer behavior in Q-commerce.

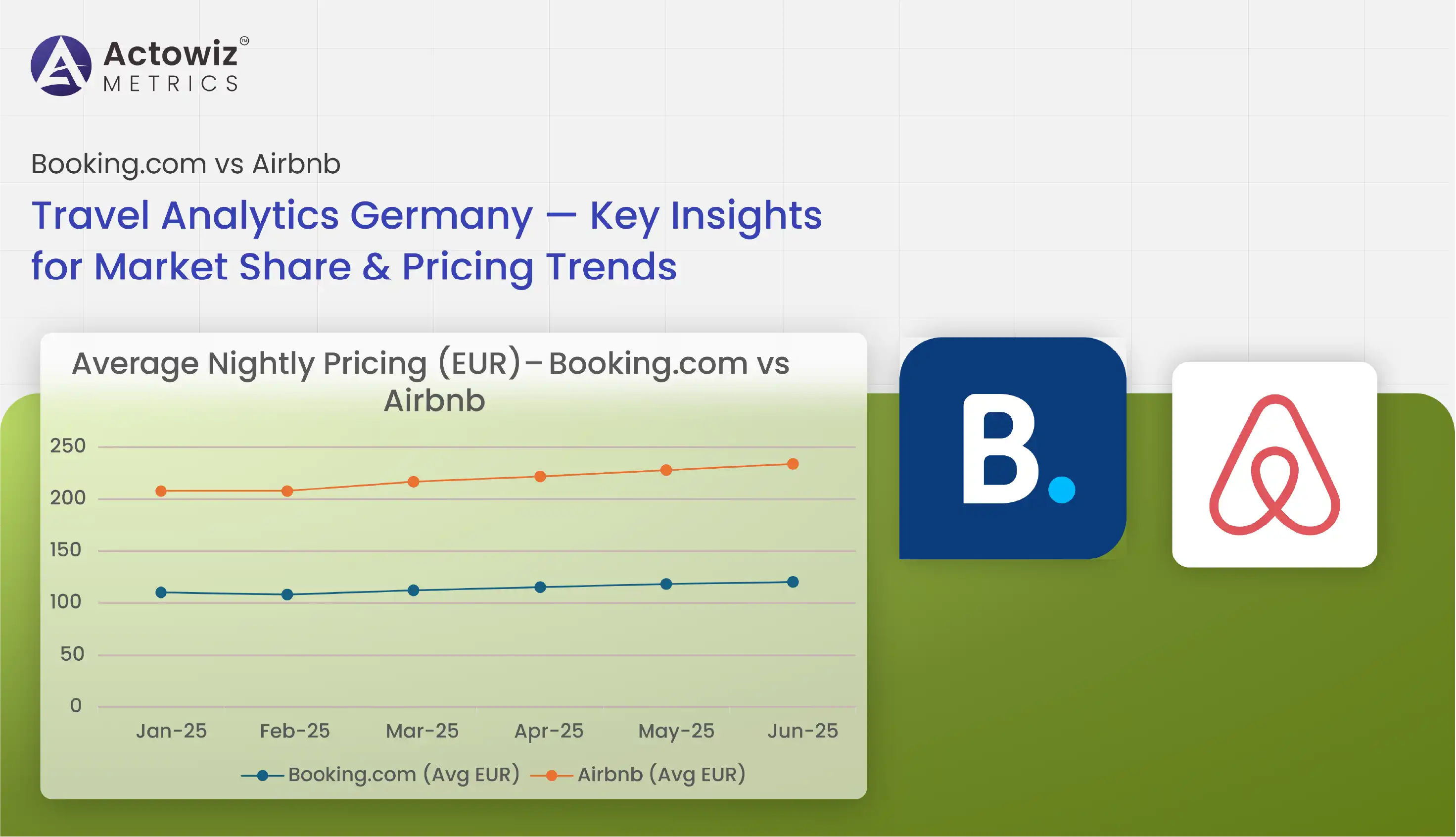

Discover Booking.com vs Airbnb Travel Analytics Germany trends, market share shifts, and pricing insights to plan smarter, compete better, and grow in 2025.

Case Study on how we enhanced pricing accuracy and local market insights using Extract API for Instacart Grocery Data from Houston, TX.

Explore Now

Woolworths.com.au Data Monitoring helps track pricing, promotions, stock availability, and competitor trends to drive smarter retail and eCommerce decisions.

Explore Now

UAE Supermarkets Data Analytics Including Items on Amazon helped our retail client optimize pricing, refine assortment, and improve market competitiveness.

Explore Now

Browse expert blogs, case studies, reports, and infographics for quick, data-driven insights across industries.

Solving Real-Time Order Management Challenges with Restaurant Reservations & Orders Monitoring API - Zomato, Swiggy & EazyDiner for smarter tracking.

Discover how Zonaprop Real Estate Data Tracking in Argentina reduces investment risk with accurate pricing insights and smarter property decisions.

How Woolworths.com.au Data Tracking helps monitor pricing shifts, stock levels, and promotions to improve retail visibility and decision-making.

Dior Luxury Fashion Market Analysis explores global brand positioning, competitive landscape, market trends, revenue performance, and future growth outlook.

Cross-Platform Fashion Data Analytics - SHEIN vs Temu vs Zara vs H&M delivers actionable insights by comparing pricing, trends, inventory shifts, and consumer demand

Track and analyze the Number of Pizza Hut Locations Analytics in India 2026 to uncover expansion trends, regional distribution, and market growth insights.

Explore Luxury vs Smartwatch - Global Price Comparison 2025 to compare prices of luxury watches and smartwatches using marketplace data to reveal key trends and shifts.

E-Commerce Price Benchmarking: Gucci vs Prada reveals 2025 pricing trends for luxury handbags and accessories, helping brands track competitors and optimize pricing.

Discover how menu data scraping uncovers trending dishes in 2025, revealing popular recipes, pricing trends, and real-time restaurant insights for food businesses.

Explore the Amazon Baby Care Report analyzing Top Baby Brands Analysis on Amazon, covering discounts, availability, and popular products with data-driven market insights.

Amazon Sports & Outdoors Report - Sports & Outdoors Top Brands Analysis on Amazon - Prices, Discounts, Reviews

Enabled a USA pet brand to optimize pricing, inventory, and offers on Amazon using Pet Supplies Top Brands Analysis on Amazon for accurate, data-driven decisions.

Whatever your project size is, we will handle it well with all the standards fulfilled! We are here to give 100% satisfaction.

Any analytics feature you need — we provide it

24/7 global support

Real-time analytics dashboard

Full data transparency at every stage

Customized solutions to achieve your data analysis goals