Restaurant Reservations & Orders Monitoring API - Zomato, Swiggy & EazyDiner

Solving Real-Time Order Management Challenges with Restaurant Reservations & Orders Monitoring API - Zomato, Swiggy & EazyDiner for smarter tracking.

In the dynamic landscape of UK retail, pricing consistency across digital and physical stores has become a key factor in consumer trust and competitiveness. This case study explores how Actowiz Metrics helped leading FMCG analysts conduct Tesco vs Asda Omnichannel Price Drop Tracking to uncover real-time variations in grocery prices across online and offline channels. Leveraging Tesco grocery price drop insights and UK Omnichannel grocery price trend analysis, Actowiz Metrics enabled comprehensive visibility into price fluctuations, promotional patterns, and brand positioning. The client used these insights to understand how discounts, flash offers, and in-store pricing impacted overall market competitiveness. Through advanced data extraction techniques like Extract Tesco & Asda digital shelf pricing data, the client gained detailed insights into SKU-level changes. The combination of Digital Shelf Analytics and Grocery Analytics empowered the client to track competitive dynamics, optimize pricing strategies, and enhance their overall promotional efficiency.

The client is a UK-based retail intelligence agency that monitors leading supermarkets and FMCG brands to provide actionable market insights. Their focus is on tracking pricing, promotions, and assortment trends across multiple channels to support retail manufacturers and consumer brands. With increasing competition between UK supermarkets, particularly Tesco and Asda, the client aimed to establish a comprehensive Live Tesco vs Asda FMCG Price Tracker for real-time monitoring. They required continuous visibility into digital shelf pricing, promotions, and in-store variations. Using Actowiz’s Tesco vs Asda Omnichannel Price Drop Tracking framework, the client sought to bridge the data gap between online listings and physical store pricing. Actowiz Metrics enabled the client to Extract Tesco & Asda digital shelf pricing data and monitor thousands of SKUs daily. This collaboration provided the analytical backbone for Tesco Grocery Brands Analytics and allowed for accurate competitive benchmarking across key product categories.

The client faced several challenges in achieving real-time accuracy for their Tesco vs Asda Omnichannel Price Drop Tracking initiative. Price fluctuations in FMCG and grocery segments occur multiple times a day, influenced by flash sales, in-store promotions, and online-exclusive discounts. Manual tracking was not only time-consuming but also error-prone, making it difficult to compare online and in-store prices simultaneously. Gathering Tesco grocery price drop insights at a granular level was difficult without automated scraping infrastructure. Similarly, tracking Scrape Asda Price Fluctuation data across multiple categories required scalable and consistent data feeds.

Moreover, aligning data from two different omnichannel ecosystems presented technical complexity. Both retailers use different catalog structures, discount mechanisms, and pricing APIs. Without a standardized tracking model, the client risked inconsistent comparisons across SKUs and categories. The challenge was also to maintain historical pricing data to enable UK Omnichannel grocery price trend analysis, helping identify seasonality and promotional patterns over time. Data delays or inconsistencies could distort competitive insights and impact decision-making for FMCG clients relying on accurate price tracking for dynamic pricing, Pricing and Promotion Strategies, and competitor benchmarking.

Actowiz Metrics implemented a robust and automated solution to address the client’s complex tracking needs. Using advanced web scraping technologies, the team deployed customized crawlers to Extract Tesco & Asda digital shelf pricing data in real time. By integrating Tesco vs Asda Omnichannel Price Drop Tracking workflows, data was continuously captured from both online listings and in-store sources, including promotional banners and shelf tags. The Real-time price tracking for UK supermarkets system enabled daily monitoring of pricing changes across thousands of SKUs.

A dedicated Live Tesco vs Asda FMCG Price Tracker dashboard was developed to visualize pricing trends, identify anomalies, and generate actionable reports. For category-level analysis, Tesco Grocery Brands Analytics was embedded to track leading grocery brands’ price positioning, discount frequency, and elasticity. Parallelly, Scrape Asda Price Fluctuation data allowed the client to monitor Asda’s response to Tesco’s pricing strategies, helping them understand market reaction cycles.

Actowiz also provided a Digital Shelf Analytics module to analyze shelf visibility, price depth, and product ranking across categories. The Grocery Analytics system offered weekly and monthly summaries for trend forecasting and competitive intelligence. Combining automation, scalability, and precision, Actowiz Metrics enabled the client to develop data-backed Pricing and Promotion Strategies, ensuring competitive advantage for their retail partners in the highly volatile UK grocery market.

“Partnering with Actowiz Metrics revolutionized our retail monitoring process. Their Tesco vs Asda Omnichannel Price Drop Tracking solution gave us unmatched visibility into daily pricing shifts and promotional strategies. With accurate Real-time price tracking for UK supermarkets, we could confidently deliver actionable insights to our FMCG clients. The integration of Tesco Grocery Brands Analytics and Digital Shelf Analytics enhanced our understanding of how leading brands perform online and in-store. Actowiz’s responsive team and reliable data quality allowed us to move from reactive tracking to proactive strategy-building.”

—Head of Retail Insights, UK Retail Intelligence Agency

Actowiz Metrics empowered the client with a scalable, data-driven pricing intelligence system tailored to monitor Tesco vs Asda Omnichannel Price Drop Tracking across the UK. With automated tools for Extract Tesco & Asda digital shelf pricing data and Scrape Asda Price Fluctuation data, the client achieved complete visibility into dynamic price variations, promotional frequency, and market positioning. Using UK Omnichannel grocery price trend analysis and Grocery Analytics, they could forecast trends and align pricing strategies with evolving consumer behavior.

By integrating Tesco grocery price drop insights, Tesco Grocery Brands Analytics, and Digital Shelf Analytics, Actowiz Metrics enabled the client to deliver precise, real-time competitive intelligence. This case reinforces Actowiz’s expertise in Pricing and Promotion Strategies for omnichannel retailers, helping businesses make smarter, faster, and data-backed pricing decisions in a highly competitive UK retail ecosystem.

Case Study on how we enhanced pricing accuracy and local market insights using Extract API for Instacart Grocery Data from Houston, TX.

Explore Now

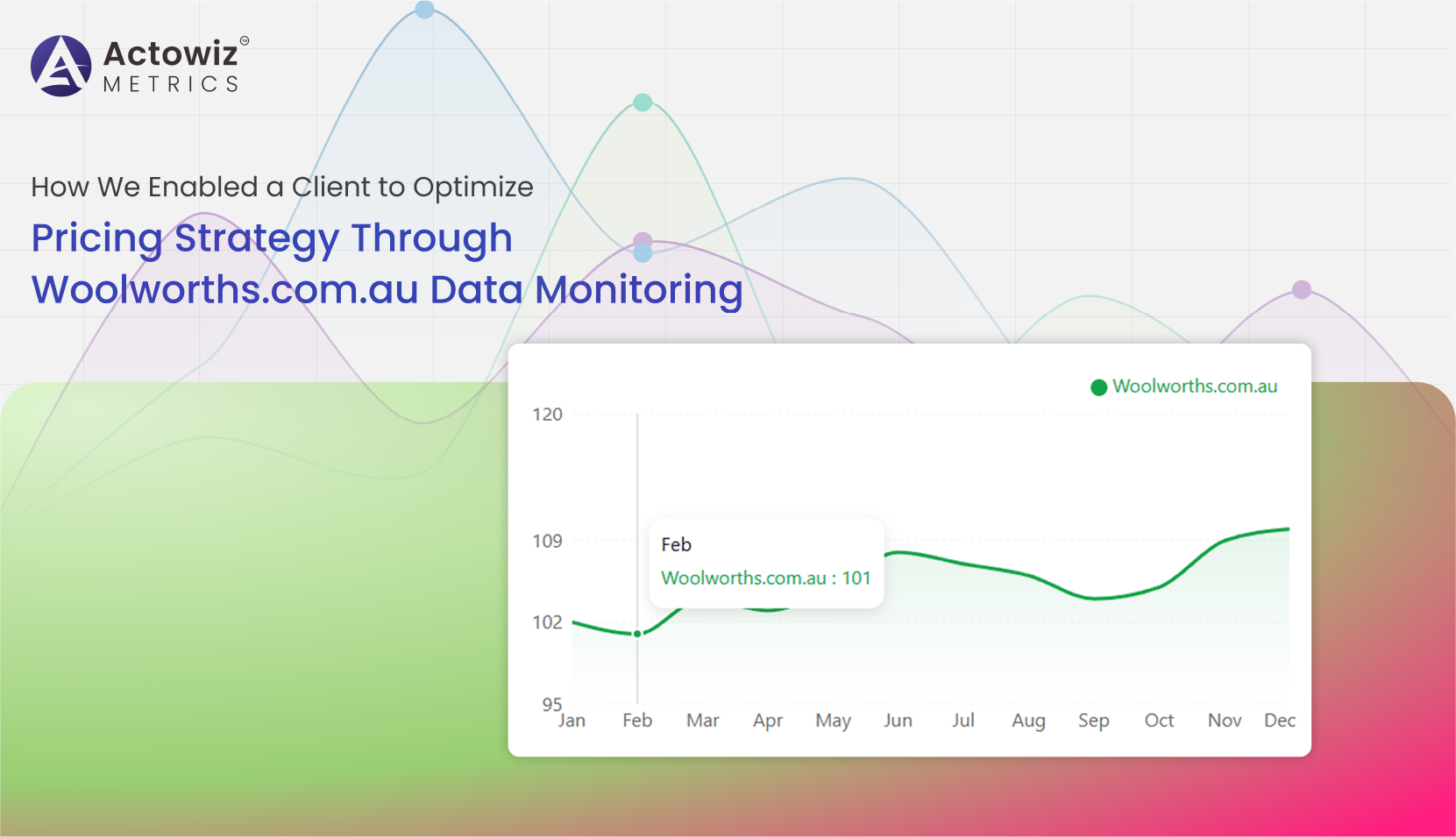

Woolworths.com.au Data Monitoring helps track pricing, promotions, stock availability, and competitor trends to drive smarter retail and eCommerce decisions.

Explore Now

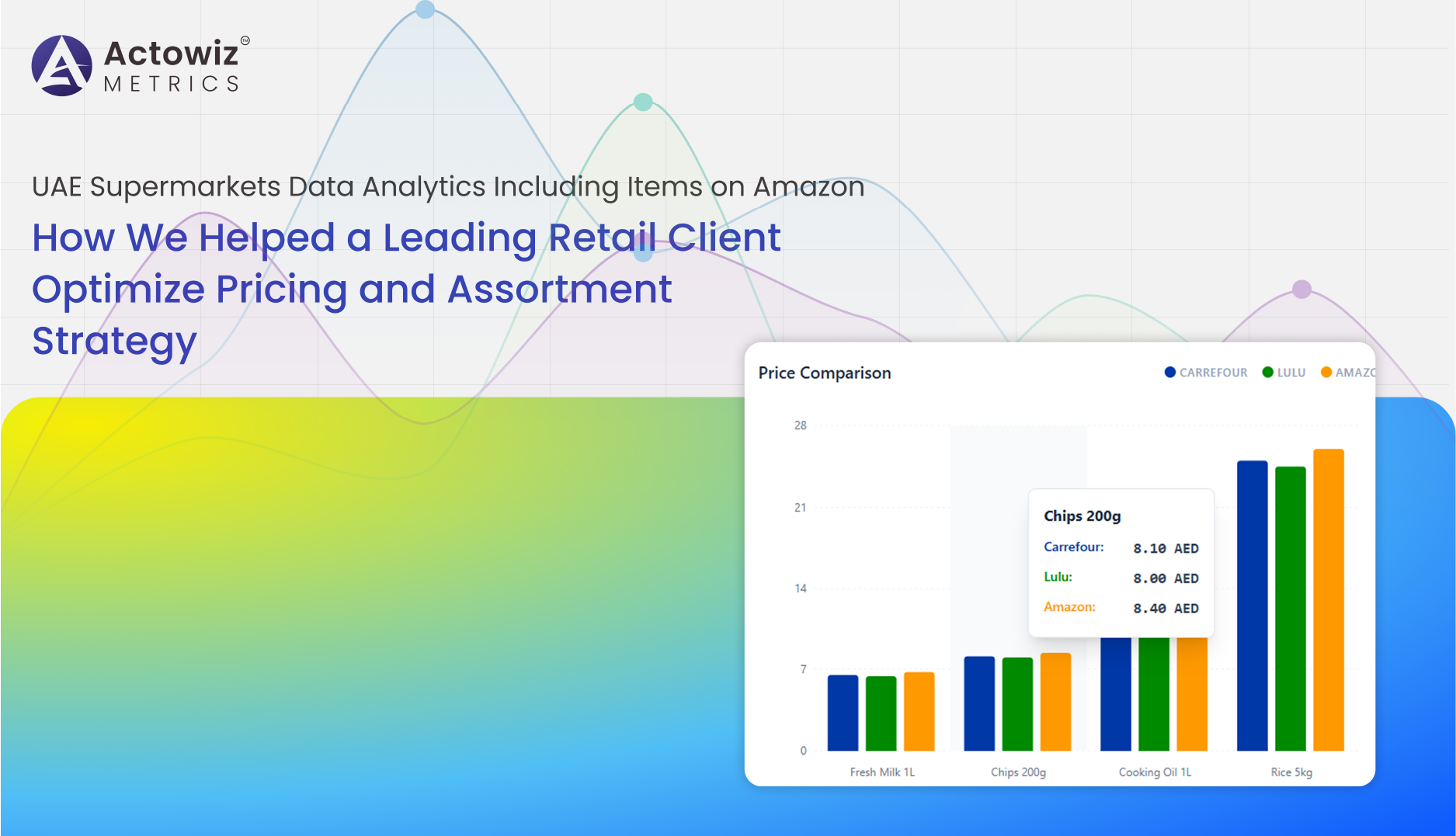

UAE Supermarkets Data Analytics Including Items on Amazon helped our retail client optimize pricing, refine assortment, and improve market competitiveness.

Explore Now

Browse expert blogs, case studies, reports, and infographics for quick, data-driven insights across industries.

Solving Real-Time Order Management Challenges with Restaurant Reservations & Orders Monitoring API - Zomato, Swiggy & EazyDiner for smarter tracking.

Discover how Zonaprop Real Estate Data Tracking in Argentina reduces investment risk with accurate pricing insights and smarter property decisions.

How Woolworths.com.au Data Tracking helps monitor pricing shifts, stock levels, and promotions to improve retail visibility and decision-making.

Dior Luxury Fashion Market Analysis explores global brand positioning, competitive landscape, market trends, revenue performance, and future growth outlook.

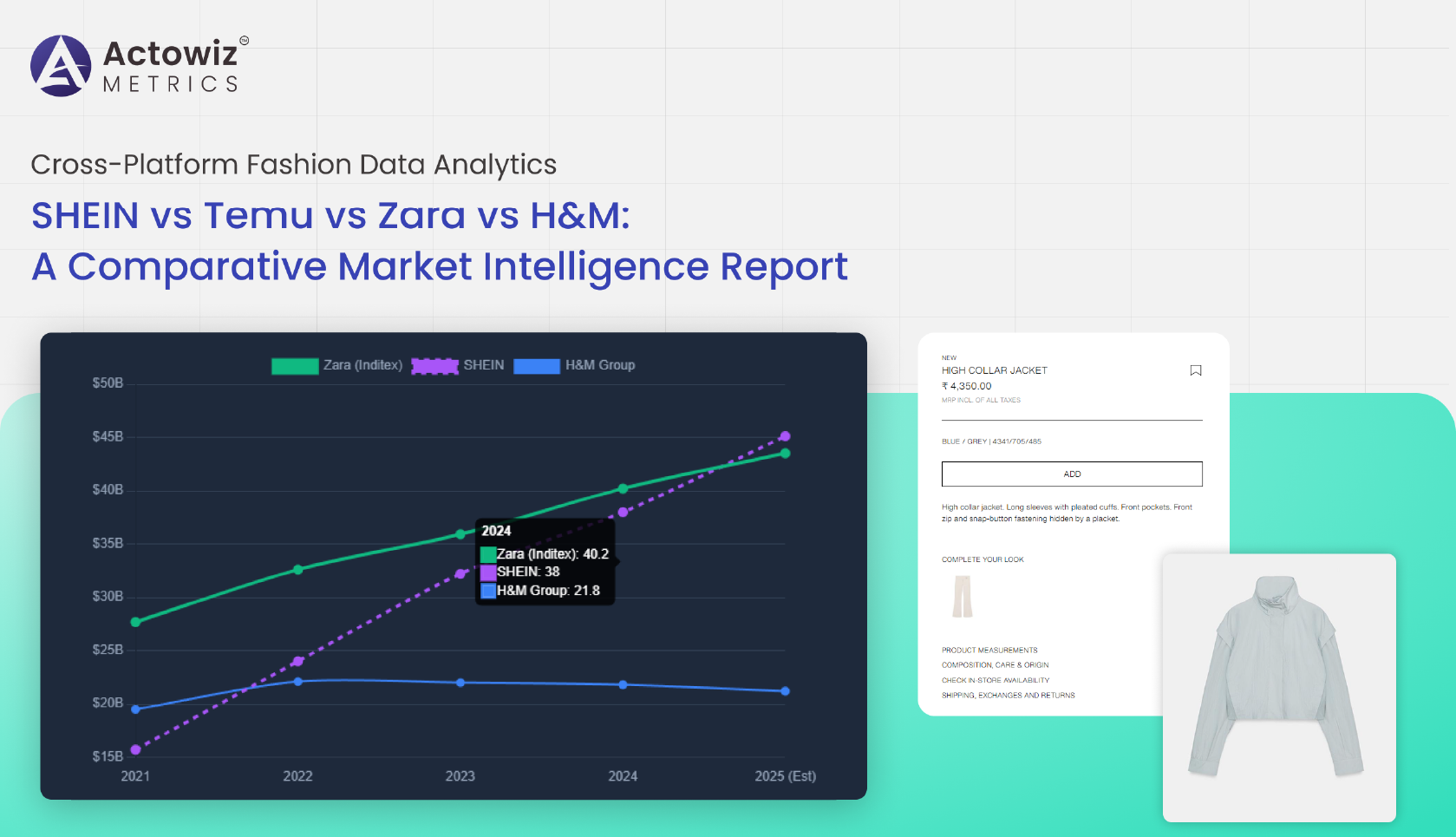

Cross-Platform Fashion Data Analytics - SHEIN vs Temu vs Zara vs H&M delivers actionable insights by comparing pricing, trends, inventory shifts, and consumer demand

Track and analyze the Number of Pizza Hut Locations Analytics in India 2026 to uncover expansion trends, regional distribution, and market growth insights.

Explore Luxury vs Smartwatch - Global Price Comparison 2025 to compare prices of luxury watches and smartwatches using marketplace data to reveal key trends and shifts.

E-Commerce Price Benchmarking: Gucci vs Prada reveals 2025 pricing trends for luxury handbags and accessories, helping brands track competitors and optimize pricing.

Discover how menu data scraping uncovers trending dishes in 2025, revealing popular recipes, pricing trends, and real-time restaurant insights for food businesses.

Explore the Amazon Baby Care Report analyzing Top Baby Brands Analysis on Amazon, covering discounts, availability, and popular products with data-driven market insights.

Amazon Sports & Outdoors Report - Sports & Outdoors Top Brands Analysis on Amazon - Prices, Discounts, Reviews

Enabled a USA pet brand to optimize pricing, inventory, and offers on Amazon using Pet Supplies Top Brands Analysis on Amazon for accurate, data-driven decisions.

Whatever your project size is, we will handle it well with all the standards fulfilled! We are here to give 100% satisfaction.

Any analytics feature you need — we provide it

24/7 global support

Real-time analytics dashboard

Full data transparency at every stage

Customized solutions to achieve your data analysis goals