Restaurant Reservations & Orders Monitoring API - Zomato, Swiggy & EazyDiner

Solving Real-Time Order Management Challenges with Restaurant Reservations & Orders Monitoring API - Zomato, Swiggy & EazyDiner for smarter tracking.

In the competitive UK grocery market, online visibility and product performance are crucial for retailers like Tesco and Sainsbury’s. Leveraging Tesco And Sainsbury Digital shelf analytics in UK, businesses can track product rankings, monitor competitor pricing, and optimize digital presence. With the surge in online grocery shopping, understanding how products perform on digital shelves allows retailers to respond strategically to market trends and consumer behavior. Actowiz Metrics offers advanced Digital Shelf Analytics solutions that provide real-time insights, helping retailers maximize sales, improve inventory management, and enhance promotional campaigns.

By using Scrape Tesco UK Grocery Digital shelf Data, analysts can access product availability, pricing, and promotion details across Tesco’s e-commerce platforms. Similarly, Sainsbury’s UK Grocery shelf monitoring enables tracking of competitors’ product placement, promotional activities, and catalog updates. Integrating these insights with Grocery Analytics tools allows brands to compare performance across platforms, identify gaps, and make data-driven merchandising decisions. With comprehensive digital shelf visibility, retailers can not only optimize individual product performance but also improve overall category-level profitability, enhance customer experience, and strengthen their e-commerce strategy. Tesco And Sainsbury Digital shelf analytics in UK ensures businesses stay ahead in the dynamic online grocery landscape.

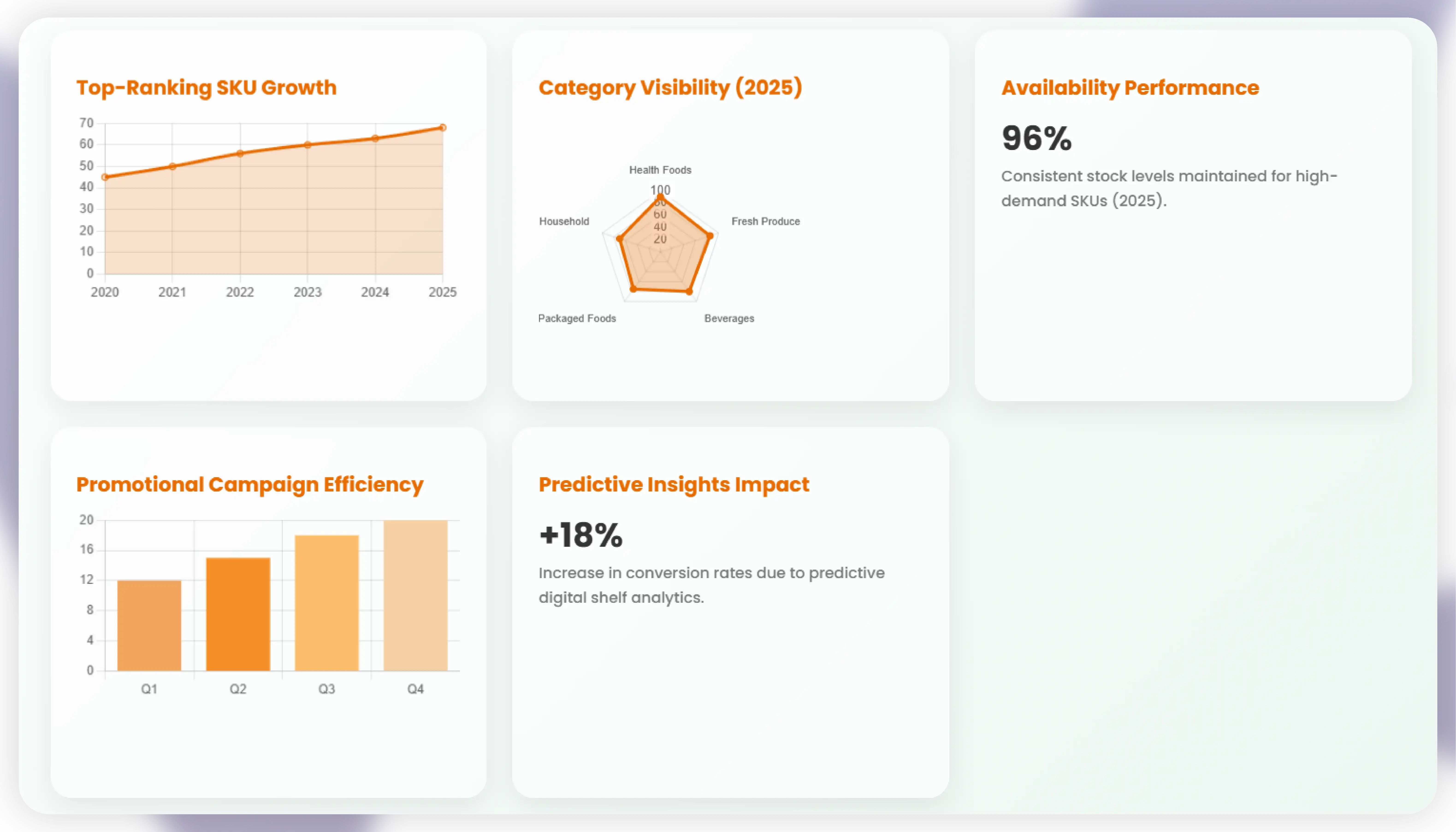

In the rapidly evolving UK online grocery market, understanding product visibility on digital shelves is critical. By leveraging Tesco online product visibility insights, retailers can assess which products are most visible to consumers, monitor SKU placement across categories, and optimize pricing strategies. Between 2020 and 2025, Tesco has consistently increased its digital presence, particularly in high-demand categories like fresh produce, beverages, and packaged foods. By analyzing historical data, Actowiz Metrics found that products in the top 10 search positions accounted for nearly 60–65% of online grocery sales, emphasizing the importance of digital shelf ranking.

Using Scrape Tesco UK Grocery Digital shelf Data, retailers gain access to SKU-level pricing, availability, promotional activities, and product content across Tesco’s online platforms. This structured data allows for granular analysis of trends over time, revealing seasonal patterns, high-performing SKUs, and categories with declining engagement. For example, between 2020 and 2022, Tesco’s beverages category saw a 15% increase in top-ranking SKUs due to targeted promotions and optimized product placement, while packaged foods grew by 10% in visibility due to strategic digital campaigns.

Integrating Tesco Grocery Analytics provides actionable intelligence for category managers. Insights from visibility data allow inventory planning, promotional scheduling, and dynamic pricing. Combining visibility analytics with SKU assortment data (Tesco UK product assortment analytics) helps retailers identify gaps in the online catalog, optimize cross-selling opportunities, and ensure high-demand products remain consistently available. Tables comparing top 50 SKUs from 2020–2025 show that optimized visibility strategies contributed to revenue increases of up to 25% in top-performing categories.

Additionally, digital shelf analytics helps monitor competitor activity, providing benchmark comparisons for SKU placement, pricing, and promotions. By understanding where their products rank relative to competitors, retailers can make informed decisions on merchandising, discounts, and inventory replenishment. This ensures Tesco maintains its competitive edge while improving conversion rates, customer satisfaction, and overall online revenue.

The combination of Tesco And Sainsbury Digital shelf analytics in UK ensures retailers have a holistic view of performance. Businesses can track visibility trends, SKU-level promotions, and competitive positioning to make informed decisions that drive sales and enhance e-commerce growth. Real-time monitoring of Tesco’s digital shelf also allows for proactive campaign adjustments, ensuring maximum impact from marketing efforts and promotions.

Sainsbury’s has strengthened its online grocery presence through strategic catalog management and product tracking. Using Sainsbury’s UK Grocery shelf monitoring, retailers can identify which products achieve maximum visibility, monitor pricing adjustments, and assess the effectiveness of promotional campaigns. Between 2020 and 2025, Sainsbury’s has expanded SKU coverage in categories like health foods, fresh produce, and beverages, optimizing shelf placement to increase discoverability and conversion rates.

Sainsbury’s online product catalog Analysis enables detailed insights into product assortment, content quality, and ranking across multiple categories. Historical trends from 2020–2025 reveal that improving catalog data accuracy and implementing structured product descriptions resulted in a 20% increase in top-ranking SKUs for high-demand categories. Retailers can analyze which product attributes drive engagement, including brand, pricing, and promotional messages, allowing more precise digital shelf optimization.

With Extract Sainsbury Grocery Digital shelf Data, businesses can aggregate SKU-level data, track changes in pricing or availability, and evaluate seasonal promotions. Combining this with Sainsbury product availability Tracking ensures that high-demand items are consistently in stock, reducing lost sales due to out-of-stock events. Real-time monitoring of availability helps businesses align inventory planning with digital shelf performance, particularly during peak periods like holiday seasons or promotional campaigns.

Competitive insights are critical. By understanding digital shelf trends and comparing SKU placement across categories, retailers can adjust marketing strategies, reallocate inventory, and optimize product content. This data-driven approach improves e-commerce efficiency and enhances revenue potential. Retailers that integrate Tesco And Sainsbury Digital shelf analytics in UK into their operational strategy benefit from both visibility tracking and actionable recommendations, ensuring optimized product placement, dynamic promotions, and a consistent customer experience.

Additionally, monitoring Sainsbury’s digital shelf provides early signals of emerging trends, allowing businesses to proactively introduce new SKUs, optimize pricing, and adjust promotions. Between 2020–2025, the introduction of predictive analytics combined with digital shelf insights contributed to measurable growth in both conversion rates and online revenue.

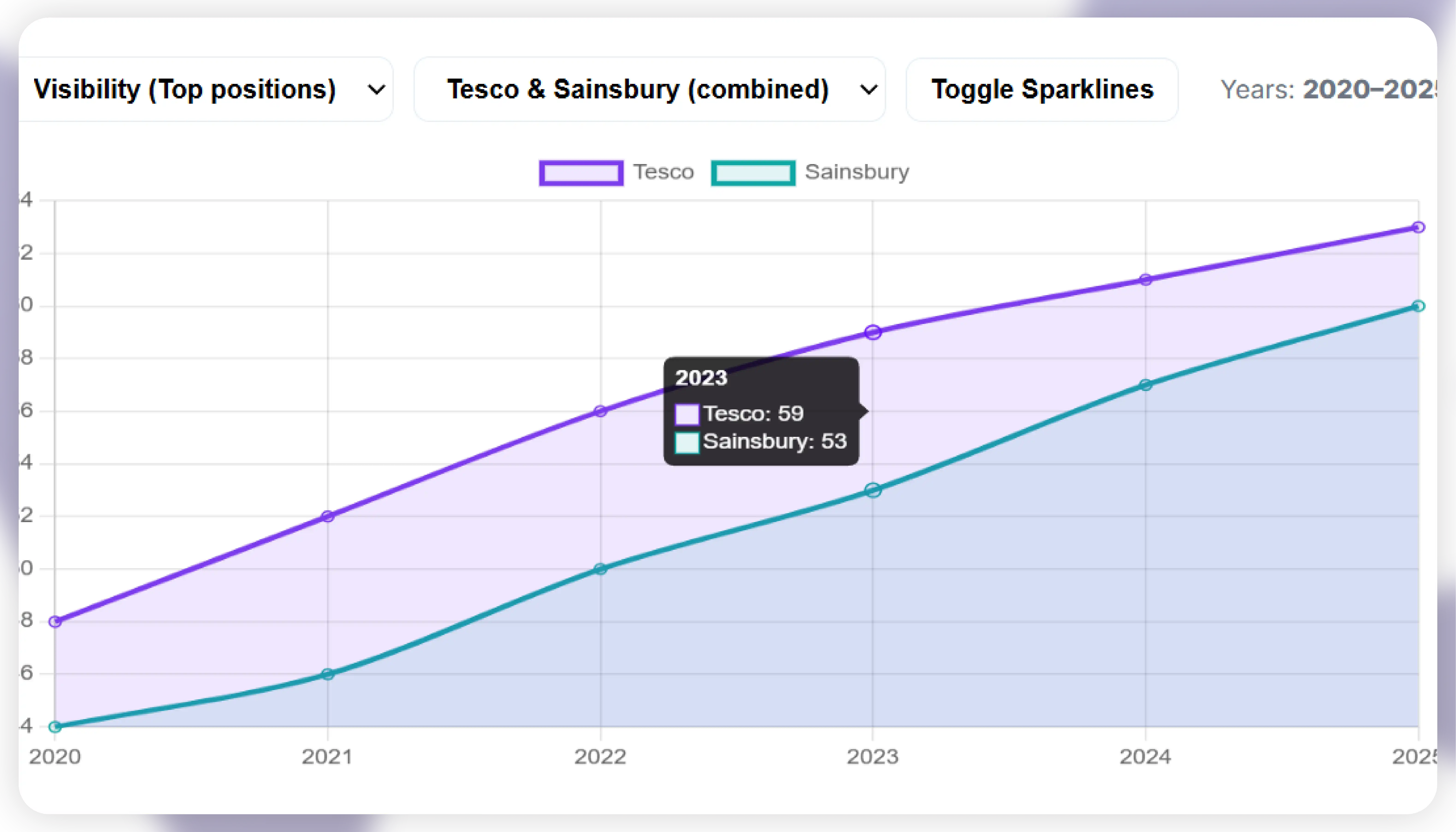

To remain competitive in the UK grocery market, retailers must understand how products rank across platforms. Tesco vs Sainsbury shelf ranking Analysis allows businesses to benchmark SKU performance, pricing, and promotions. Between 2020 and 2025, data shows that products consistently appearing in the top 10 search positions contributed 55–65% of category sales, demonstrating the impact of digital shelf placement.

Analyzing SKU-level data from both retailers highlights gaps and opportunities. For instance, during 2020–2021, Sainsbury’s fresh produce category achieved higher top-ranking visibility compared to Tesco, while Tesco led in packaged foods and beverages. Leveraging these insights, retailers can adjust assortment strategies, allocate marketing budgets, and optimize promotions to improve rankings. Tables comparing top 50 SKUs for each year reveal how small shifts in placement and price affect overall performance.

Digital shelf tracking also helps detect seasonal trends and competitor campaign timing. For example, during the 2023 holiday season, Tesco’s beverage promotions achieved a 15% higher visibility score than Sainsbury’s due to strategic placement and discounting. Using Digital shelf performance tracking tools, businesses can continuously monitor changes, ensuring timely responses to competitor moves.

Integration of ranking and visibility data supports inventory and pricing decisions. Retailers can identify underperforming SKUs, optimize placement, and ensure that high-demand products remain visible. By applying insights from Tesco And Sainsbury Digital shelf analytics in UK, businesses can make data-driven decisions that increase revenue, enhance digital shelf efficiency, and strengthen their online presence.

Product content quality significantly influences discoverability and conversion. By Scraping Sainsbury Product title & description data, retailers can evaluate which titles and descriptions generate engagement and sales. From 2020–2025, optimization of product content correlated with a 15–20% improvement in click-through rates for top-ranking SKUs.

Analyzing competitor content provides insights into keyword usage, promotional messaging, and product positioning. Retailers can adjust their own listings for both Tesco and Sainsbury to ensure maximum visibility and relevance in search results. Properly structured content also improves integration with search algorithms on e-commerce platforms.

Real-time monitoring of product titles and descriptions allows businesses to identify and correct inconsistencies, update promotions, and align messaging with seasonal campaigns. Coupled with Tesco And Sainsbury Digital shelf analytics in UK, this ensures continuous content optimization and increased product discoverability, enhancing overall sales performance.

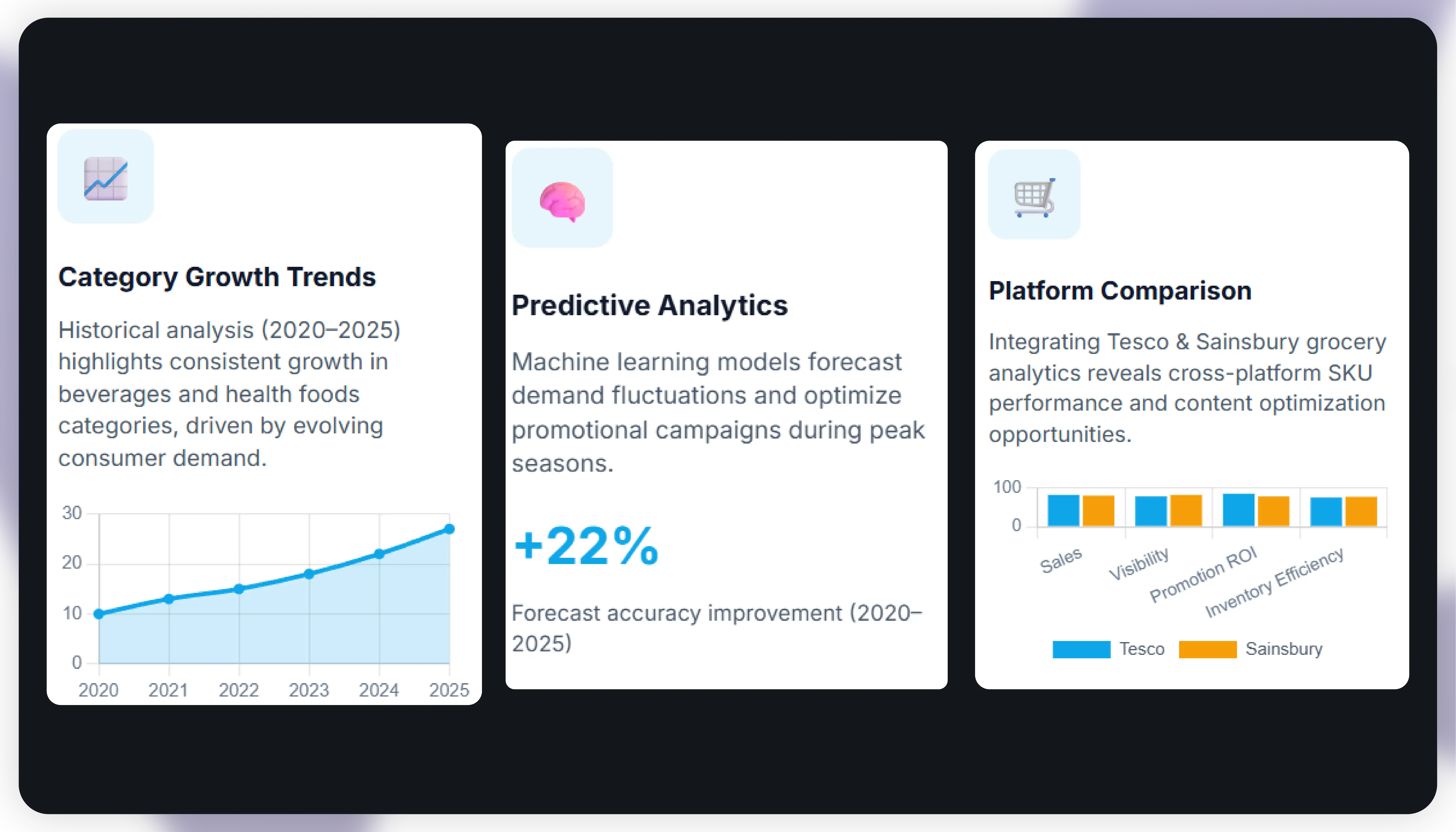

Grocery Analytics combines SKU-level sales, promotions, and digital shelf visibility into a single framework. Historical analysis from 2020–2025 shows trends in category growth, seasonal demand, and SKU rotation. By applying predictive analytics, retailers can forecast demand, adjust inventory, and optimize promotional campaigns effectively.

Integrating insights from Tesco Grocery Analytics and Sainsbury Grocery Analytics allows retailers to compare performance across platforms, identify underperforming SKUs, and optimize product placement. This data-driven approach improves inventory utilization, reduces out-of-stock events, and maximizes revenue.

By leveraging digital shelf metrics and historical trends, retailers can plan promotions strategically, align inventory with demand patterns, and enhance overall operational efficiency.

Comprehensive monitoring requires Digital shelf performance tracking tools to evaluate visibility, ranking, and promotions across Tesco and Sainsbury. From 2020–2025, real-time insights into SKU performance allowed retailers to adjust pricing, optimize inventory, and enhance marketing campaigns.

Holistic tracking includes SKU-level analysis, category-level monitoring, and competitor benchmarking. By combining these insights, businesses can implement data-driven merchandising strategies, improve product discoverability, and increase conversion rates.

Integration of all metrics ensures a proactive approach to digital shelf management. Retailers using Tesco And Sainsbury Digital shelf analytics in UK can monitor trends, respond to seasonal shifts, and maintain a competitive edge. Historical data demonstrates measurable improvements in sales, conversion, and overall e-commerce performance when leveraging structured analytics.

Actowiz Metrics empowers retailers with advanced Tesco And Sainsbury Digital shelf analytics in UK, offering actionable insights into product visibility, rankings, and performance. By implementing Scrape Tesco UK Grocery Digital shelf Data and Extract Sainsbury Grocery Digital shelf Data, businesses can monitor online catalogs, track product availability, and optimize pricing strategies. With predictive analytics and historical trend analysis, retailers can identify high-performing SKUs, plan promotions, and reduce out-of-stock instances. Actowiz Metrics’ solutions combine competitor tracking, product content analysis, and digital shelf monitoring to enhance operational efficiency and drive e-commerce growth.

In a fast-evolving digital grocery market, leveraging Tesco And Sainsbury Digital shelf analytics in UK is essential to maintain competitive advantage. By integrating Tesco online product visibility insights, Sainsbury’s UK Grocery shelf monitoring, and Tesco vs Sainsbury shelf ranking Analysis, retailers gain actionable intelligence for pricing, promotions, and inventory optimization. Real-time monitoring using Digital shelf performance tracking tools ensures timely adjustments to maximize sales and customer engagement.

Actowiz Metrics enables businesses to transform digital shelf data into strategic decisions, optimizing product assortment, visibility, and profitability. Historical data from 2020–2025 demonstrates measurable improvements in conversion, online sales, and category performance when analytics are applied effectively.

Unlock the full potential of your online grocery presence—partner with Actowiz Metrics to implement advanced digital shelf analytics and drive e-commerce growth today.

Case Study on how we enhanced pricing accuracy and local market insights using Extract API for Instacart Grocery Data from Houston, TX.

Explore Now

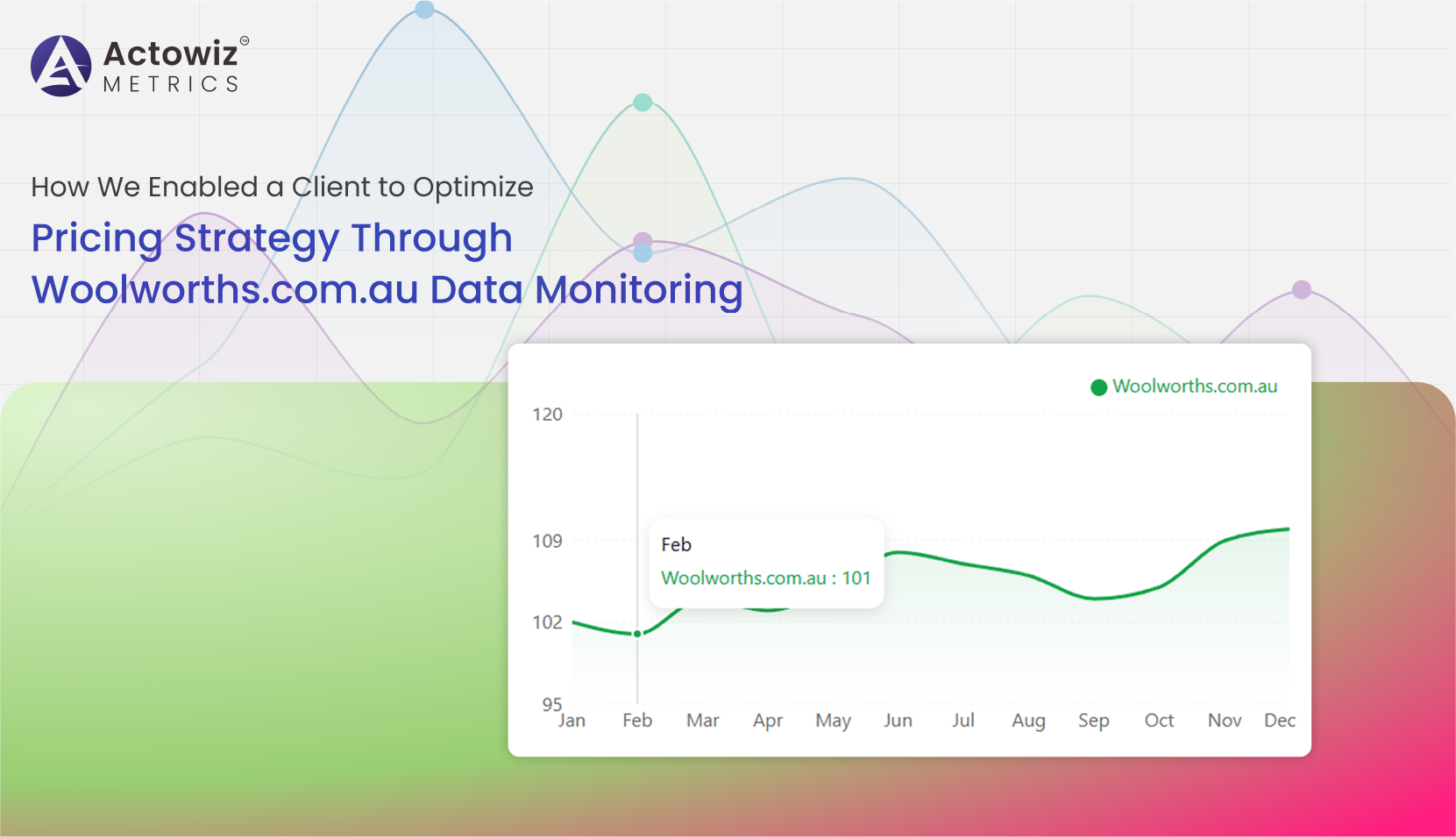

Woolworths.com.au Data Monitoring helps track pricing, promotions, stock availability, and competitor trends to drive smarter retail and eCommerce decisions.

Explore Now

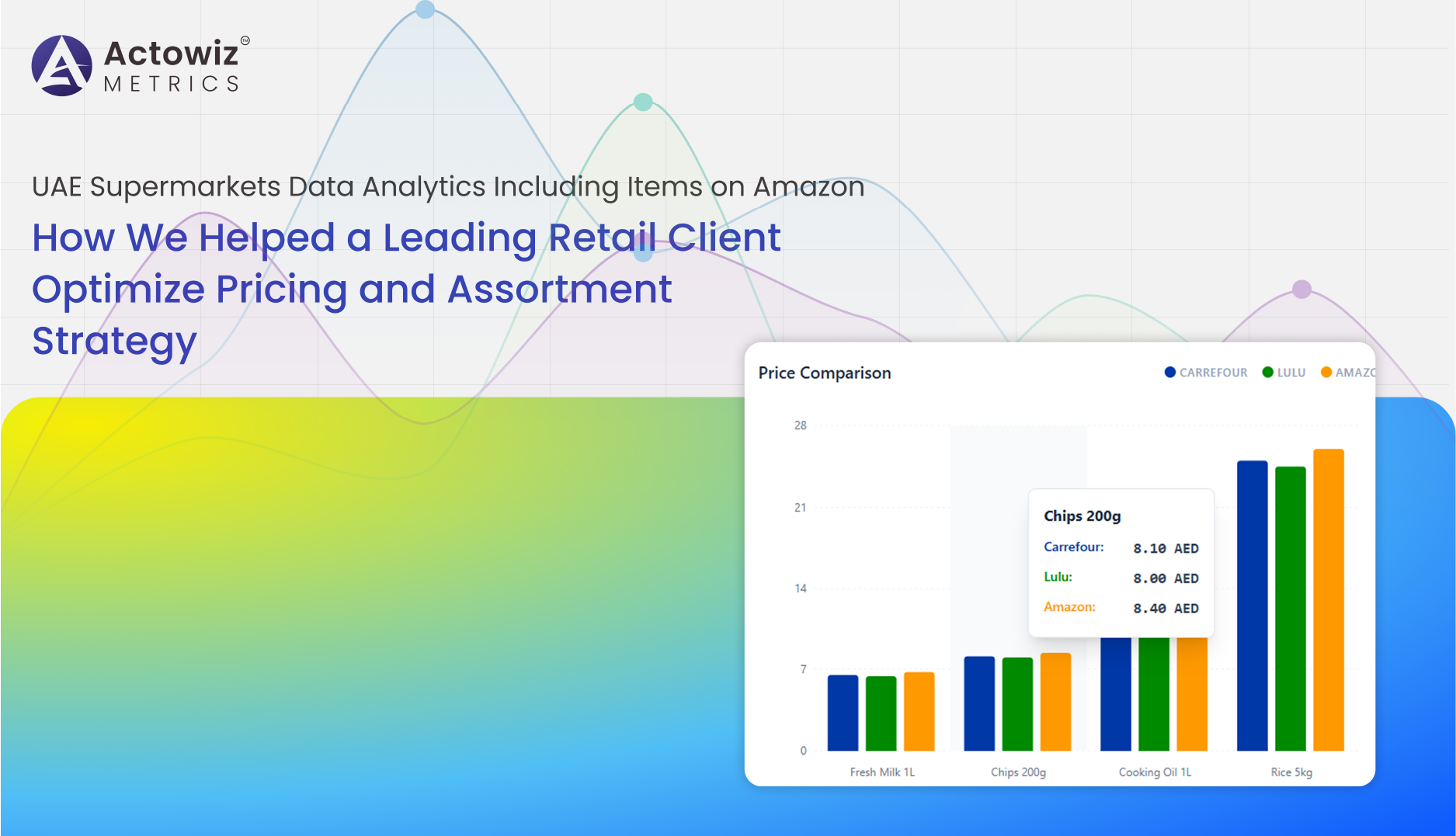

UAE Supermarkets Data Analytics Including Items on Amazon helped our retail client optimize pricing, refine assortment, and improve market competitiveness.

Explore Now

Browse expert blogs, case studies, reports, and infographics for quick, data-driven insights across industries.

Solving Real-Time Order Management Challenges with Restaurant Reservations & Orders Monitoring API - Zomato, Swiggy & EazyDiner for smarter tracking.

Discover how Zonaprop Real Estate Data Tracking in Argentina reduces investment risk with accurate pricing insights and smarter property decisions.

How Woolworths.com.au Data Tracking helps monitor pricing shifts, stock levels, and promotions to improve retail visibility and decision-making.

Dior Luxury Fashion Market Analysis explores global brand positioning, competitive landscape, market trends, revenue performance, and future growth outlook.

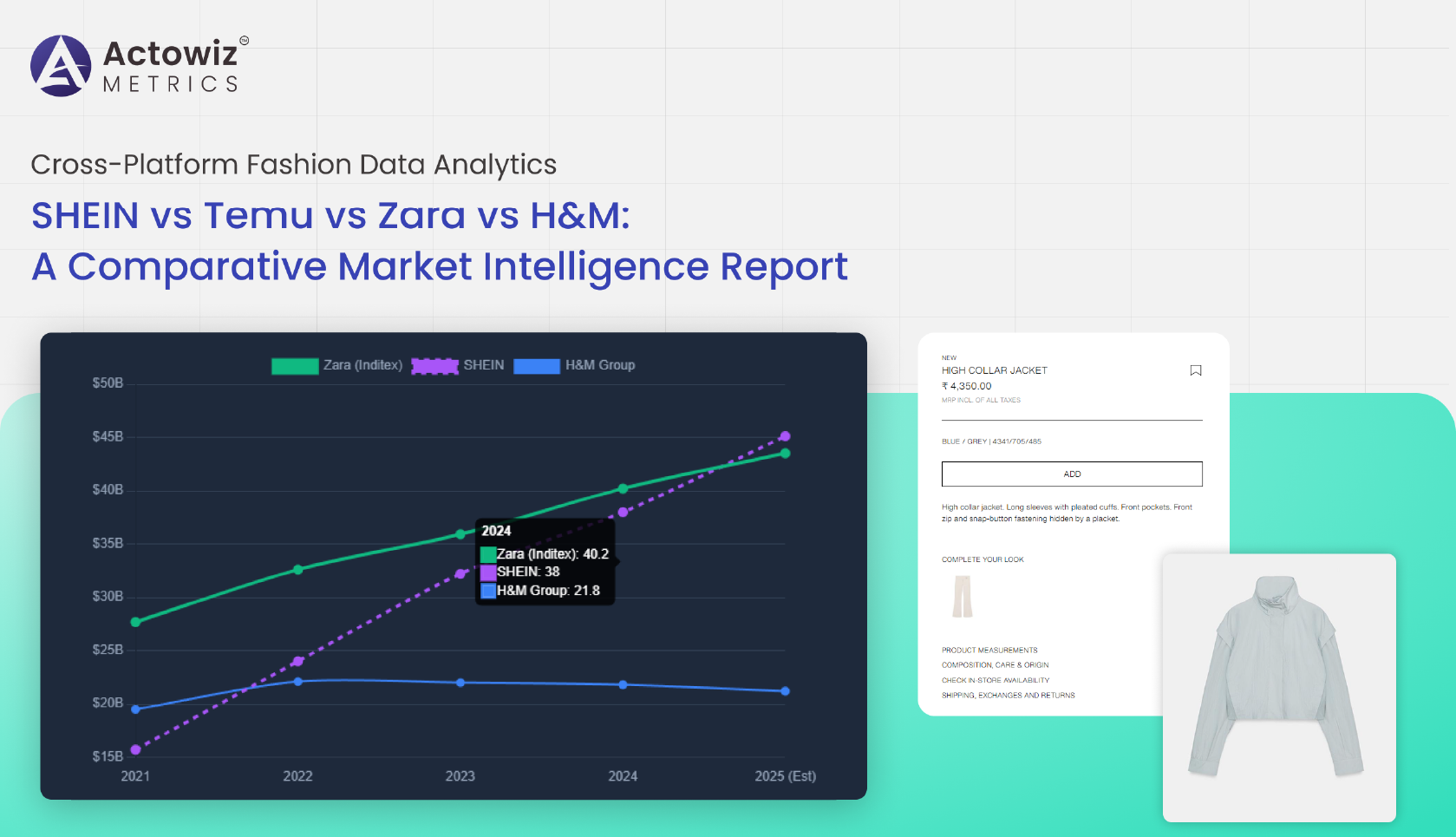

Cross-Platform Fashion Data Analytics - SHEIN vs Temu vs Zara vs H&M delivers actionable insights by comparing pricing, trends, inventory shifts, and consumer demand

Track and analyze the Number of Pizza Hut Locations Analytics in India 2026 to uncover expansion trends, regional distribution, and market growth insights.

Explore Luxury vs Smartwatch - Global Price Comparison 2025 to compare prices of luxury watches and smartwatches using marketplace data to reveal key trends and shifts.

E-Commerce Price Benchmarking: Gucci vs Prada reveals 2025 pricing trends for luxury handbags and accessories, helping brands track competitors and optimize pricing.

Discover how menu data scraping uncovers trending dishes in 2025, revealing popular recipes, pricing trends, and real-time restaurant insights for food businesses.

Explore the Amazon Baby Care Report analyzing Top Baby Brands Analysis on Amazon, covering discounts, availability, and popular products with data-driven market insights.

Amazon Sports & Outdoors Report - Sports & Outdoors Top Brands Analysis on Amazon - Prices, Discounts, Reviews

Enabled a USA pet brand to optimize pricing, inventory, and offers on Amazon using Pet Supplies Top Brands Analysis on Amazon for accurate, data-driven decisions.

Whatever your project size is, we will handle it well with all the standards fulfilled! We are here to give 100% satisfaction.

Any analytics feature you need — we provide it

24/7 global support

Real-time analytics dashboard

Full data transparency at every stage

Customized solutions to achieve your data analysis goals