Woolworths.com.au Data Tracking

How Woolworths.com.au Data Tracking helps monitor pricing shifts, stock levels, and promotions to improve retail visibility and decision-making.

In Spain’s fast-evolving retail market, understanding product visibility, pricing, and assortment across both physical stores and online channels is critical. Spain omnichannel retail shelf analytics enables retailers to capture actionable insights from over 10,000 products, ensuring strategic decisions are data-driven and competitive.

Spanish retail shelf insights provide visibility into store performance, product placement, and promotional effectiveness. By leveraging Retail digital shelf tracking API, businesses can monitor real-time stock levels, track seasonal campaigns, and benchmark competitors. Historical data spanning 2020–2025 allows retailers to identify emerging trends, such as shifts in consumer demand toward premium categories or popular SKUs, and adjust inventory and promotions accordingly.

Using scrape Spain's eCommerce platforms shelf data, brands can integrate online and offline insights to optimize assortment, detect gaps, and enhance shelf planning. Multi-channel tracking also helps in aligning marketing campaigns, improving inventory allocation, and maximizing ROI while maintaining consistent consumer experience across all touchpoints.

Spain omnichannel retail shelf analytics helps retailers monitor product availability in physical stores and online marketplaces simultaneously. Using Digital shelf crawler for Spanish retailers, businesses can track SKUs’ presence, rotations, and stock levels, identifying which products consistently perform well and which underperform.

Historical trends from 2020–2025 indicate that premium skincare and fashion products consistently achieved 85% shelf visibility in flagship stores, while emerging brands averaged only 60% visibility in smaller retail outlets. Online channels showed slightly higher availability due to automated stock updates.

| Year | Total SKUs | Avg Shelf Visibility (%) | Online Channel Visibility (%) |

|---|---|---|---|

| 2020 | 8,500 | 75% | 78% |

| 2021 | 9,000 | 77% | 80% |

| 2022 | 9,500 | 79% | 82% |

| 2023 | 10,000 | 81% | 84% |

| 2024 | 10,500 | 83% | 86% |

| 2025 | 11,000 | 85% | 88% |

By analyzing Retail Competitor shelf data extraction, businesses can benchmark against competitors, detect gaps, and ensure high-demand SKUs are available across all locations and online platforms.

Tracking promotional campaigns across Spain’s omnichannel landscape requires Spain omnichannel retail shelf analytics to capture in-store displays, digital campaigns, and pricing adjustments. Multi-channel shelf analytics Spain provides insight into which promotions generate sales lift and how long they remain effective across various regions.

Data from 2020–2025 shows seasonal campaigns like Black Friday and summer sales increased overall SKU sales by 25–30%. Endcap displays and prominent online banners contributed significantly to campaign success, highlighting the importance of integrated shelf monitoring.

| Year | Promo Type | Avg Sales Lift (%) | Duration (Days) |

|---|---|---|---|

| 2020 | Endcap In-Store | 20% | 14 |

| 2021 | Online Banner | 18% | 12 |

| 2022 | Endcap + Online | 25% | 16 |

| 2023 | Seasonal Campaigns | 28% | 18 |

| 2024 | Endcap + Banner | 30% | 17 |

| 2025 | Multi-channel Mix | 32% | 20 |

By integrating Spain’s online shelf trends analysis, retailers can evaluate how digital campaigns complement physical store promotions and adjust strategies in real-time for maximum ROI.

Price consistency is key in omnichannel retail. Using Spain omnichannel retail shelf analytics, retailers can track product prices across physical and online stores. Ecommerce analytics helps detect price discrepancies, monitor competitor pricing, and implement dynamic pricing strategies to remain competitive.

Analysis of top-selling SKUs between 2020–2025 indicates premium products in central urban areas were priced 7–10% higher than suburban stores, while online channels maintained average parity within 3%. Predictive analytics ensures pricing decisions maximize margins without affecting sales velocity.

| Year | Physical Store Avg (€) | Online Store Avg (€) | Price Variation (%) |

|---|---|---|---|

| 2020 | 45.0 | 44.0 | 2% |

| 2021 | 46.0 | 45.0 | 2% |

| 2022 | 46.5 | 45.5 | 2% |

| 2023 | 47.0 | 46.0 | 2% |

| 2024 | 48.0 | 46.5 | 3% |

| 2025 | 49.0 | 47.0 | 3% |

By leveraging competitor analysis, retailers can proactively respond to competitor price changes, ensuring both offline and online channels remain competitively positioned.

Optimizing shelf visibility is critical for driving consumer engagement and sales. Spain omnichannel retail shelf analytics provides insights into product placement, endcap effectiveness, and layout impact on consumer buying behavior. Using Digital shelf crawler for Spanish retailers, brands can measure how prominently products appear across physical and online shelves and identify opportunities to improve visibility.

Analysis from 2020–2025 shows that products placed at eye level achieved 22–28% higher sales compared to lower or top-shelf placements. Similarly, online placement in featured sections or homepage carousels increased conversion by 25–30%. Multi-channel shelf monitoring ensures consistency across offline and digital platforms, allowing retailers to standardize layouts, improve promotional performance, and drive cross-channel engagement.

| Year | Eye-Level Placement (%) | Lower Shelf (%) | Conversion Rate Lift (%) |

|---|---|---|---|

| 2020 | 64 | 36 | 22 |

| 2021 | 66 | 34 | 23 |

| 2022 | 68 | 32 | 24 |

| 2023 | 70 | 30 | 25 |

| 2024 | 72 | 28 | 26 |

| 2025 | 74 | 26 | 28 |

By combining Retail Competitor shelf data extraction, retailers can benchmark layouts against competitors, refine store merchandising strategies, and maximize visibility for high-margin SKUs.

Effective omnichannel retail strategy requires integrating online and offline shelf data. Spain omnichannel retail shelf analytics enables seamless cross-channel analysis, ensuring that in-store performance aligns with online visibility. Using Retail digital shelf tracking API, brands can collect SKU-level data from physical stores and eCommerce platforms, merging insights to identify gaps and optimize merchandising.

Historical trends between 2020–2025 show that products with consistent online and offline visibility experienced 20–25% higher total sales than items with mismatched exposure. Additionally, synchronization between digital campaigns and store promotions increased promotional effectiveness by 15–18%. Multi-channel insights help retailers anticipate stockouts, allocate inventory efficiently, and reduce overstock while maximizing shelf impact across all channels.

| Year | Online Visibility (%) | Physical Store Visibility (%) | Total Sales Lift (%) |

|---|---|---|---|

| 2020 | 78 | 75 | 20 |

| 2021 | 80 | 77 | 21 |

| 2022 | 82 | 79 | 22 |

| 2023 | 84 | 81 | 23 |

| 2024 | 86 | 83 | 24 |

| 2025 | 88 | 85 | 25 |

Integrating Spain’s online shelf trends analysis allows retailers to align pricing, promotions, and assortment strategies, ensuring maximum visibility and revenue across all channels.

Accurate demand forecasting is essential for minimizing stockouts and optimizing inventory. Using Spain omnichannel retail shelf analytics, retailers can leverage historical data to predict SKU demand across stores and online channels. By applying multi-channel shelf analytics Spain, businesses can model seasonal trends, anticipate peak demand periods, and plan inventory allocation strategically.

Data from 2020–2025 indicates consistent growth in premium beauty and fashion categories, averaging 3–5% annual demand increase. Seasonal spikes during holidays accounted for 12–15% additional demand, emphasizing the need for predictive models that integrate online and offline shelf performance to ensure optimal stock levels.

| Year | Total SKU Demand | Premium Product Growth (%) | Seasonal Demand Increase (%) |

|---|---|---|---|

| 2020 | 8,500 | 2.0% | 12% |

| 2021 | 9,000 | 2.5% | 13% |

| 2022 | 9,500 | 3.0% | 13% |

| 2023 | 10,000 | 3.5% | 14% |

| 2024 | 10,500 | 4.0% | 15% |

| 2025 | 11,000 | 4.5% | 15% |

By combining predictive insights with real-time Retail Competitor shelf data extraction, retailers can proactively adjust inventory, optimize promotions, and maintain high availability, ensuring consistent customer satisfaction and increased sales.

Spain omnichannel retail shelf analytics becomes actionable with Actowiz Metrics’ advanced solutions. By combining and real-time monitoring tools, Actowiz enables retailers to capture SKU visibility, track promotions, and evaluate assortment effectiveness across thousands of stores and online channels.

Using Retail digital shelf tracking API, Actowiz delivers precise, automated insights into product placement, pricing trends, and competitor activity. Retailers can integrate these insights into merchandising, marketing, and inventory strategies, ensuring both offline and online performance align with consumer demand. Historical data from 2020–2025 empowers predictive analytics, helping brands forecast demand, optimize stock, and reduce overstock while maximizing profitability.

Multi-channel insights from scrape Spain’s eCommerce platforms shelf data allow retailers to monitor online shelf trends alongside physical store performance, giving a complete picture of market dynamics. Actowiz Metrics also supports competitor benchmarking, helping businesses detect gaps, identify emerging opportunities, and refine promotional strategies for maximum ROI.

With Actowiz, Spain’s retail players can transform raw shelf data into actionable intelligence, enabling smarter, data-driven decision-making across every channel.

In Spain’s competitive retail market, Spain omnichannel retail shelf analytics is essential to optimize product visibility, pricing, and promotions. Multi-channel tracking and historical insights ensure retailers maintain inventory alignment, improve sales performance, and deliver seamless customer experiences.

By leveraging Spanish retail shelf insights and multi-channel shelf analytics Spain, businesses can predict consumer demand, refine assortment strategies, and respond proactively to competitors. Predictive forecasting enables smarter inventory allocation, reduces stockouts, and increases sales during peak periods.

Actowiz Metrics empowers retailers to harness these insights through automated, real-time digital shelf analytics, ensuring decisions are accurate, timely, and profitable. Unlock the full potential of Spain’s omnichannel retail market and gain a competitive edge with Actowiz Metrics today!

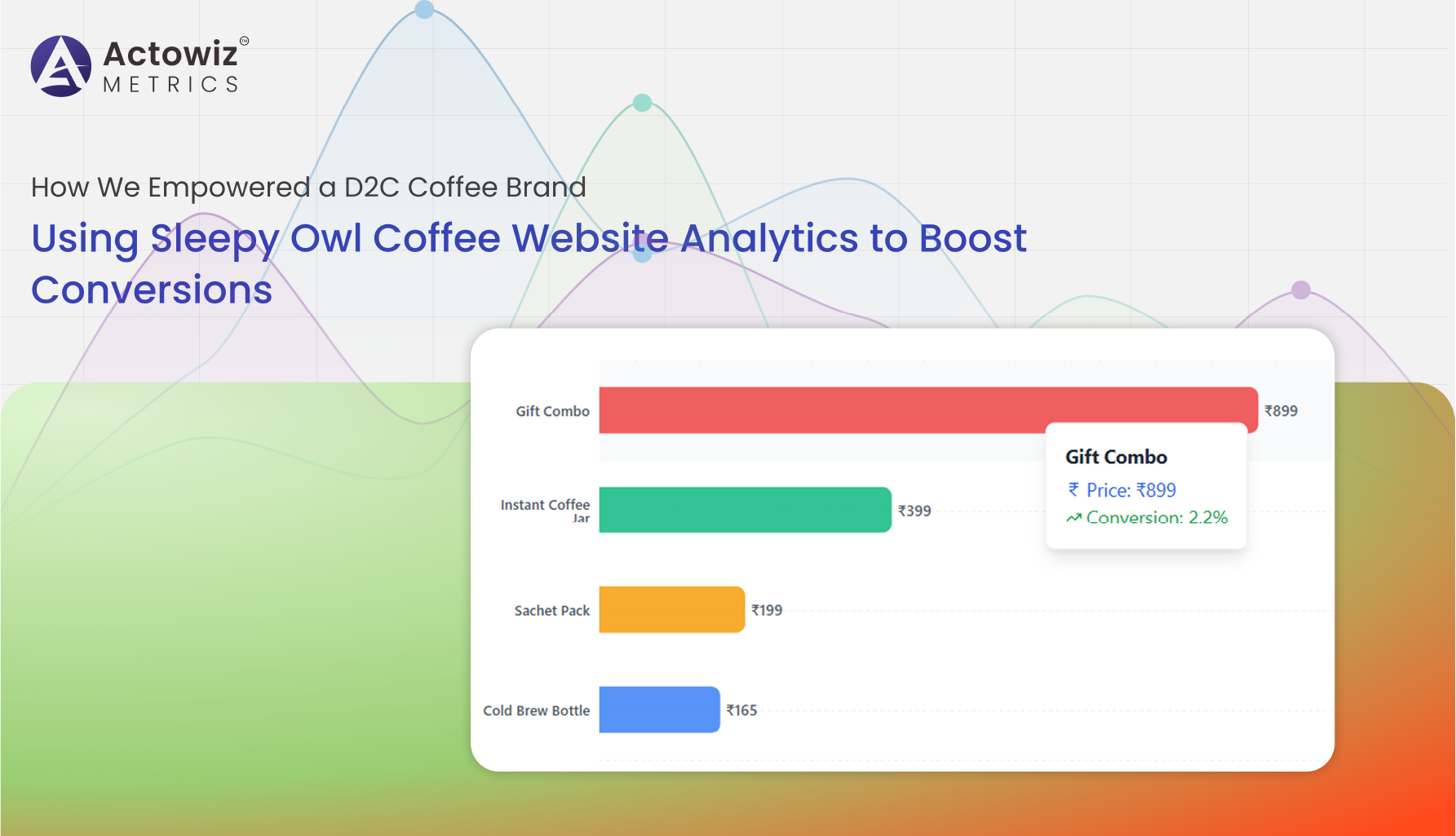

Sleepy Owl Coffee Website Analytics delivering insights on traffic, conversions, pricing trends, and digital performance optimization.

Explore Now

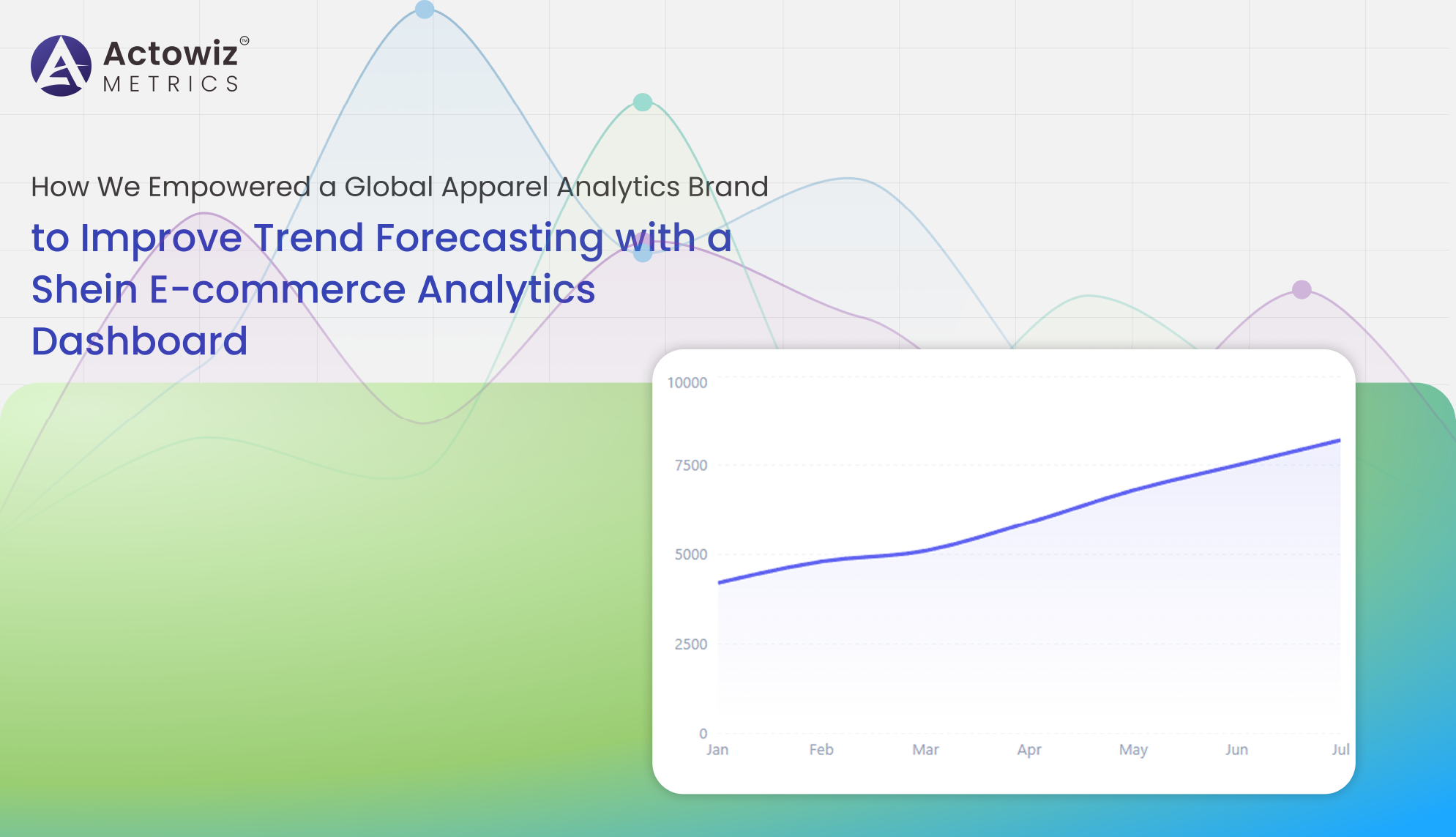

Shein E-commerce Analytics Dashboard delivers real-time pricing, trend, and competitor insights to optimize fashion strategy and boost performance.

Explore Now

Live Data Tracking Dashboard for Keeta Food Delivery App enables real-time order, pricing, and restaurant insights to optimize performance and decisions.

Explore NowBrowse expert blogs, case studies, reports, and infographics for quick, data-driven insights across industries.

How Woolworths.com.au Data Tracking helps monitor pricing shifts, stock levels, and promotions to improve retail visibility and decision-making.

Myntra Fashion Category Data Monitoring helps track trends, pricing, stock levels, and category performance to optimize sales and boost growth.

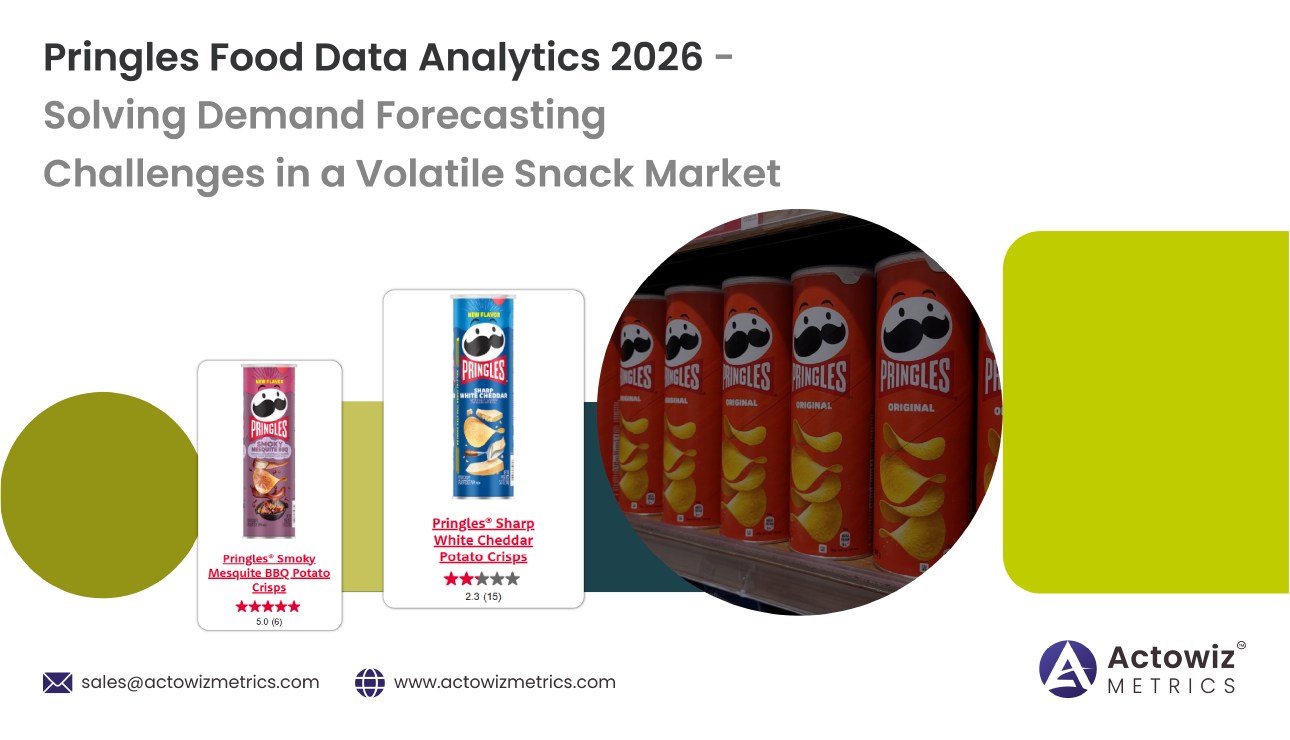

Pringles Food Data Analytics 2026 reveals how data-driven insights improve pricing, demand forecasting, and supply chain efficiency in a dynamic snack market.

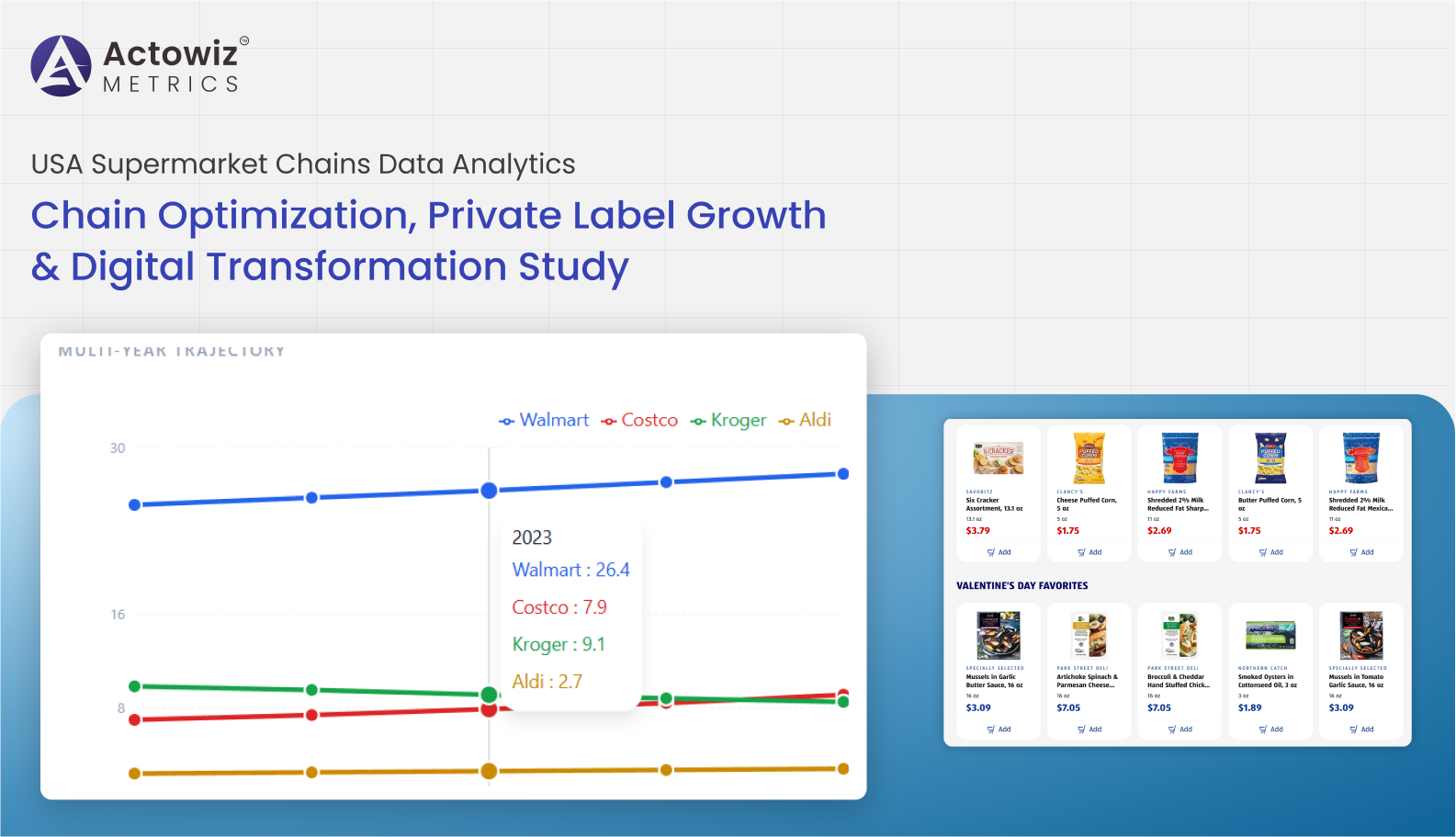

Research Report on USA Supermarket Chains Data Analytics covering chain optimization, private label growth, pricing trends, and digital transformation insights.

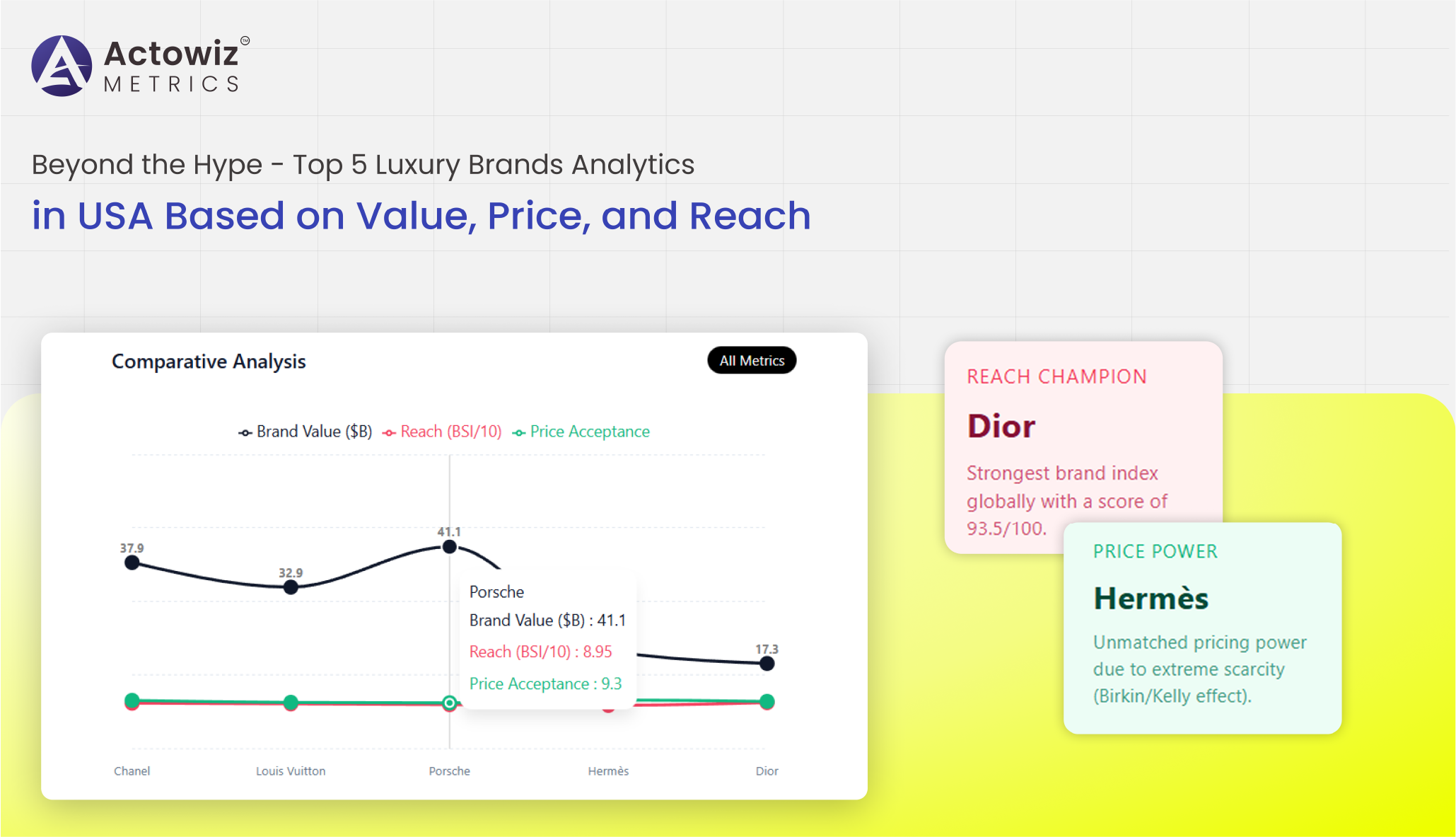

Top 5 Luxury Brands Analytics in USA delivering advanced market insights, consumer trends, and performance intelligence to drive premium brand growth.

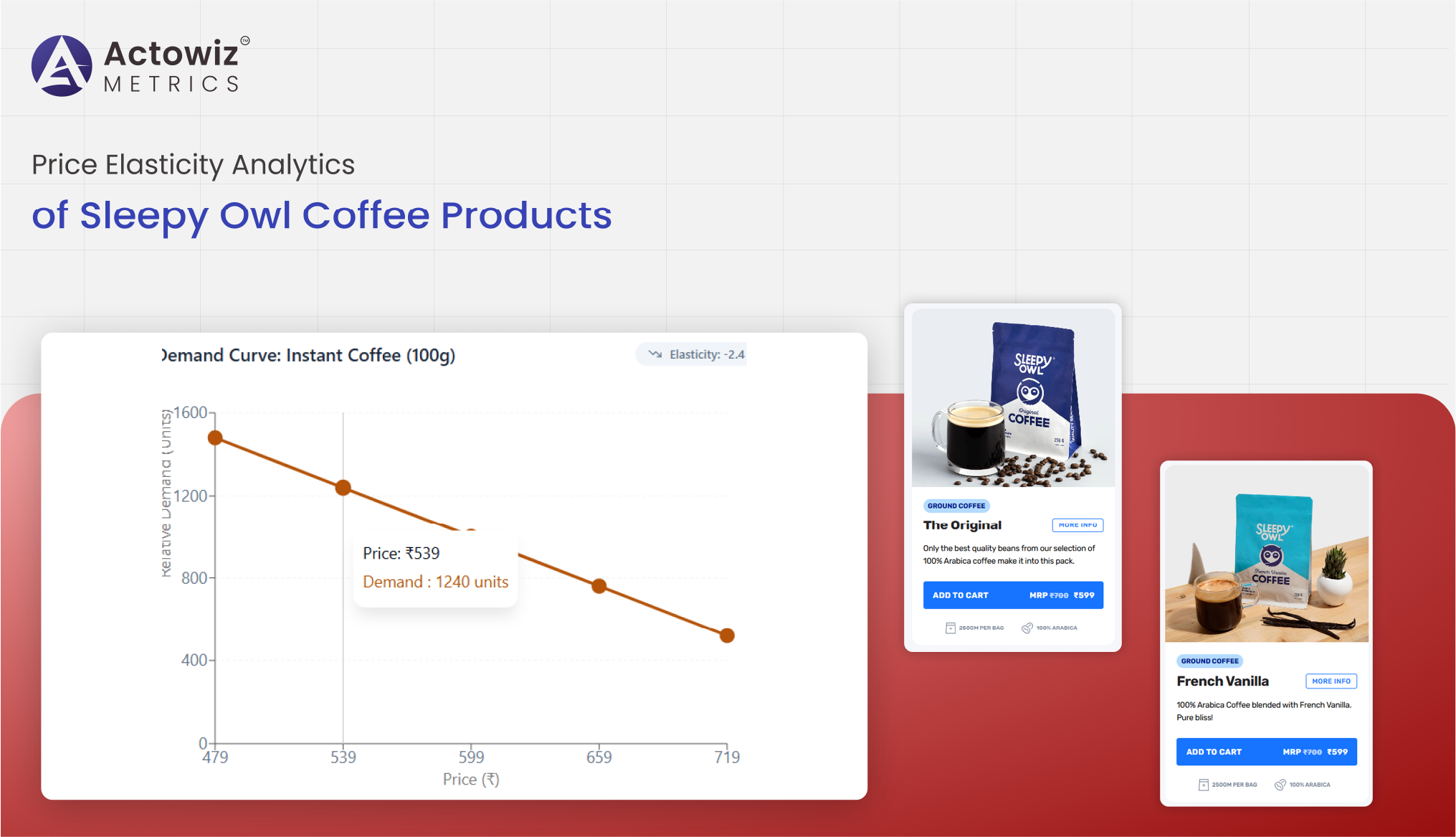

Price Elasticity Analytics of Sleepy Owl Coffee Products revealing demand sensitivity, pricing impact, and revenue optimization insights across channels.

Explore Luxury vs Smartwatch - Global Price Comparison 2025 to compare prices of luxury watches and smartwatches using marketplace data to reveal key trends and shifts.

E-Commerce Price Benchmarking: Gucci vs Prada reveals 2025 pricing trends for luxury handbags and accessories, helping brands track competitors and optimize pricing.

Discover how menu data scraping uncovers trending dishes in 2025, revealing popular recipes, pricing trends, and real-time restaurant insights for food businesses.

Explore the Amazon Baby Care Report analyzing Top Baby Brands Analysis on Amazon, covering discounts, availability, and popular products with data-driven market insights.

Amazon Sports & Outdoors Report - Sports & Outdoors Top Brands Analysis on Amazon - Prices, Discounts, Reviews

Enabled a USA pet brand to optimize pricing, inventory, and offers on Amazon using Pet Supplies Top Brands Analysis on Amazon for accurate, data-driven decisions.

Whatever your project size is, we will handle it well with all the standards fulfilled! We are here to give 100% satisfaction.

Any analytics feature you need — we provide it

24/7 global support

Real-time analytics dashboard

Full data transparency at every stage

Customized solutions to achieve your data analysis goals