Grocery Data Analytics from Chedraui USA

Leveraging Grocery Data Analytics from Chedraui USA to benchmark competitors, track pricing trends, and uncover actionable market insights.

In the fast-paced retail landscape of the UK, staying ahead means more than just having the best product — it means having the best pricing strategy. Real-Time Price Monitoring for UK Brands is no longer optional; it's essential. Brands need live data to respond to competitor moves, shifting consumer demand, and market volatility. With inflation, supply chain costs, and promotion cycles all in flux between 2020 and 2025, understanding trends at the price point has become a competitive advantage.

Consumers are more informed and price sensitive than ever. They compare options across online stores, wait for promotions, and shift loyalties quickly. For UK retailers and brands, failing to monitor price movements in real time can mean losing margin, market share, or both. That’s why tools like Real-Time Retail pricing Insights UK and Price scraping tools for UK retailers are booming. These technologies track thousands of SKUs daily, giving brands visibility over pricing, promotions, and competitive behavior.

Over the past five years, data shows that brands adopting robust pricing intelligence see measurable improvements: faster inventory turnover, better alignment of promotions, and higher margin stability. In this blog, we’ll explore six problem-solving sections with statistics and tables from 2020-2025 to show why Real-Time Price Monitoring for UK Brands is a must, how it solves specific problems, and how Actowiz Metrics can help.

One of the most pressing challenges for UK brands is price volatility—rapid, unpredictable swings in competitor pricing, promotional depth, and inflationary pressures. Without guardrails or real-time visibility, your margins can erode quickly. This is where Real-Time Price Monitoring for UK Brands becomes indispensable.

Between 2020 and 2025, the UK experienced significant inflationary pressures. The Consumer Prices Index (CPI) rose by ~3.8% in the 12 months to August 2025. Retailers also contend with rises in labor costs, energy, and logistics. PwC highlights that in 2025, UK retailers face margin squeeze and must optimize pricing and cost structures.

Imagine a brand selling electronic accessories. A competitor launches a flash discount midweek. Without real-time checks, you may be undercut and lose sales or be forced into deep discounting last minute. A KEETA scraper (analogous in UK) would detect that competitor price shift instantly. But more generally, a Real-Time Price Monitoring for UK Brands setup gives that competitive pulse.

| Scenario | Competitor drops price 10% | Your price unchanged | Resulting margin shift* |

|---|---|---|---|

| High-margin product | Yes | Yes | Sales drop ~15–20%, margin lost |

| Low-margin product | Yes | Yes | Margin wiped out |

| With real-time reaction | Yes | Adjust ±5% | Maintain share and margin |

The solution lies in automated vigilance. With Real-Time Price Monitoring for UK Brands, your system flags price deviations, triggers alerts, and suggests adjustments. This converts reactive scrambling into guided pricing strategy.

Additionally, the ability to Scrape Competitor Pricing Data in UK ensures your dataset reflects the live market. You don’t guess pricing trends — you see them. Coupled with UK Retail price Trends analytics, you can forecast where price corridors are heading, not just react. Over time, this reduces margin volatility and supports stable pricing leadership.

In short: real-time monitoring is your safety net. Without it, brands risk undercutting themselves or missing sales. With it, you steer deliberately—even when the market shifts.

Promotional timing and depth are critical levers—but they’re often misaligned with market signals. Many UK brands suffer from promotional mismatch: launching deals either too early or too deep, eroding margin or losing relevance. Real-Time Price Monitoring for UK Brands helps avoid that by aligning your offers with competitor actions, demand curves, and promotional windows.

Between 2021 and 2024, sectors like fashion and electronics saw up to 15% revenue loss when brands misread private label promos or competitor discount surges. (Industry case studies) Brands that failed to adapt lost share during Black Friday spikes, seasonal clearance windows, or surprise markdowns from major retailers.

For example: in December 2023, two UK electronics chains unexpectedly dropped TVs 8% ahead of Christmas. Brands who responded midweek recovered 70% of margin; those that didn’t saw sales drop by 12%. Without Live price Tracking software UK, these shifts would go unnoticed until it’s too late.

With a proactive system, your brand can execute Price & Promotion Analytics —not just capturing discount events, but modelling the “depth vs. conversion” tradeoff. You respond with rational promotional bids rather than emotional discounts. And you maintain margin integrity.

Moreover, aligning promotions ensures you don’t clash with competitor calendars. Suppose your competitor runs a deep discount on sportswear on a Tuesday, and you schedule your promotion for Wednesday. With Competitor Analysis embedded, your system flags the overlap and suggests postponement or alternative promos.

Over time, the ROI of aligning promotions can be visible:

Thus, real-time promo intelligence turns reactive discounting into strategic, margin-aware offers.

Many UK brands struggle with inefficient pricing segmentation—treating all SKUs, channels, and regions uniformly. This leads to price leakage, customer confusion, and margin loss. A robust Real-Time Price Monitoring for UK Brands infrastructure integrates Price Benchmarking to compare item performance across geographies, channels, and competitors.

For example, a consumer electronics brand observed 18% price variance among regions (South East vs. North England) by mid-2023, due to manual pricing. After implementing segmented pricing logic, the variance dropped to 4% while improving margin uniformly.

Use cases for segmentation:

By pairing UK Online store price Monitoring with segmentation layers, you can maintain consistency where needed and leverage local flexibility where beneficial.

| Region / Channel | Avg Price | Top Competitor | Price Gap (%) |

|---|---|---|---|

| London (Online) | £199.99 | £195.00 | +2.6% |

| Midlands (Retail) | £202.50 | £198.00 | +2.3% |

| Scotland (Marketplace) | £188.00 | £185.00 | +1.6% |

When gaps are detected, algorithmic repricers can nudge in real time, preserving perceived fairness and avoiding undercutting. Retail Competitor Pricing Data Analysis supports this by revealing where competitors deviate by region.

Ultimately, segmentation ensures that your Real-Time Price Monitoring for UK Brands strategy isn’t generic—it’s precisely tailored, balancing market dynamics with brand integrity.

Without historical context, real-time data alone is limited. You risk reacting without seeing patterns. That’s where UK Retail price Trends analytics come in, layering trend smoothing, seasonality detection, and anomaly detection on top of real-time feeds.

Between 2020 and 2025, the UK saw shifts in online grocery pricing and digital promotions. For example, grocery inflation peaked, then promotional depth increased to counter consumer sensitivity. Tools that exclusively looked at snapshots missed the cadence of month-to-month adjustments.

By combining real-time capturing with trend analytics, brands can ask:

Trend analytics help smooth volatility and present confidence bands. For example: if competitor A discounted cameras in March 2024 with 5% depth and then 7% in March 2025, your system learns that March is a high promo period and readies the alert window.

This predictive insight turns Real-Time Price Monitoring for UK Brands into a dynamic forecasting engine, not just a reactive monitor.

With trend insight, you can intervene early (raise price before competitor discount, or preempt declines). It avoids margin chasing or blind discounting.

In the modern UK retail ecosystem, brands distribute via direct websites, authorized resellers, marketplaces (Amazon, eBay), and wholesale. Channel conflict arises when some sellers undercut others, hurting brand value and margins.

With Real-Time Price Monitoring for UK Brands, you gain a window into unauthorized discounting. But for proactive control, Retail Competitor Pricing Data Analysis is indispensable. You continuously monitor prices across channels. If a third-party seller undercuts your official price by 10%, your system flags it and triggers action (warning email, policy enforcement, price parity enforcement).

Consider a real-world scenario: A thermostat brand learned via real-time monitoring that an Amazon third-party seller was selling below MAP (minimum advertised price). They automatically alerted their channel team, removed the listing, and regained control. The cost of losing brand equity had been far greater.

Monitoring covers:

Thus, your brand maintains consistency and prevents “race-to-the-bottom” discounting that dilutes trust.

Many pricing teams still rely on spreadsheets, manual checks, and weekly reports. That leads to slow reaction times, human error, and wasted hours. In a market where a competitor may shift price midday, manual systems are obsolete.

Brands adopting Real-Time Price Monitoring for UK Brands slash response time from days to minutes. They reallocate headcount from data gathering to strategic insight. The gains:

In the UK, online retail accounts for ~26.5% of total retail sales by 2022. With digital channels dominant, pricing agility is non-negotiable.

By using a full stack system, you can pivot in real time, freeing your team from data crunching and focusing on margin maximization, strategy, and differentiation.

Actowiz Metrics provides a full-stack solution tailored for UK brands to implement Real-Time Price Monitoring for UK Brands successfully. Our platform integrates Real-Time Retail pricing Insights UK and Price scraping tools for UK retailers into real-time dashboards where price changes, promotions, and competitor dynamics are visible at glance. We also offer Live price Tracking software UK and custom alerts that notify brands of pricing anomalies immediately.

Our AI and analytics modules deliver UK Retail price Trends analytics, Price Benchmarking, and Retail Competitor Pricing Data Analysis, giving brands the ability to compare, segment, and act on the data. We help brands Scrape Competitor Pricing Data in UK safely and ethically, turning raw data into clear, strategic insights. Using Price & Promotion Analytics, Actowiz Metrics supports decision makers to align pricing with margin goals, optimize promotional calendars, and avoid price erosion.

Clients using Actowiz Metrics have seen increases in revenue of 20-30% during promotional periods, improved margin rates by 10-15%, and faster inventory turnover in difficult product categories. If you’re aiming to grow, stay competitive, and respond dynamically – that’s the edge our platform gives you.

As UK brands continue to navigate inflation pressures, consumer expectations, and fierce competition in the eCommerce and retail sectors, having a reactive and proactive pricing strategy has become vital. Real-Time Price Monitoring for UK Brands equips businesses with actionable insight to protect margins, align promotions, and respond to market fluctuations swiftly. Whether it’s identifying price drops in grocery, detecting unauthorised discounts, or optimising SKUs by category or geography, brands that use these tools don’t just survive — they thrive.

Consider what your business could avoid: wasted promotional spend, margin leakage, and loss of customer trust when prices are inconsistent. With tools like UK Online store price Monitoring and Scrape Competitor Pricing Data in UK, each pricing decision becomes data-driven rather than guesswork. Implementing Price Benchmarking and Competitor Analysis capabilities means you can compare your performance not just internally but against peers — and react with precision.

At Actowiz Metrics, we’re ready to help you take this leap. Start with a pilot: monitor 50-100 key SKUs across your top competitors, track price & promotion changes in real time, and watch how your revenue, margin, and market share move. Reach out today for a demo and discover how Real-Time Price Monitoring for UK Brands can transform your pricing strategy.

Talabat, Deliveroo & Keeta Reviews Data Analytics UAE – data-driven insights to optimize customer experience and service performance.

Explore Now

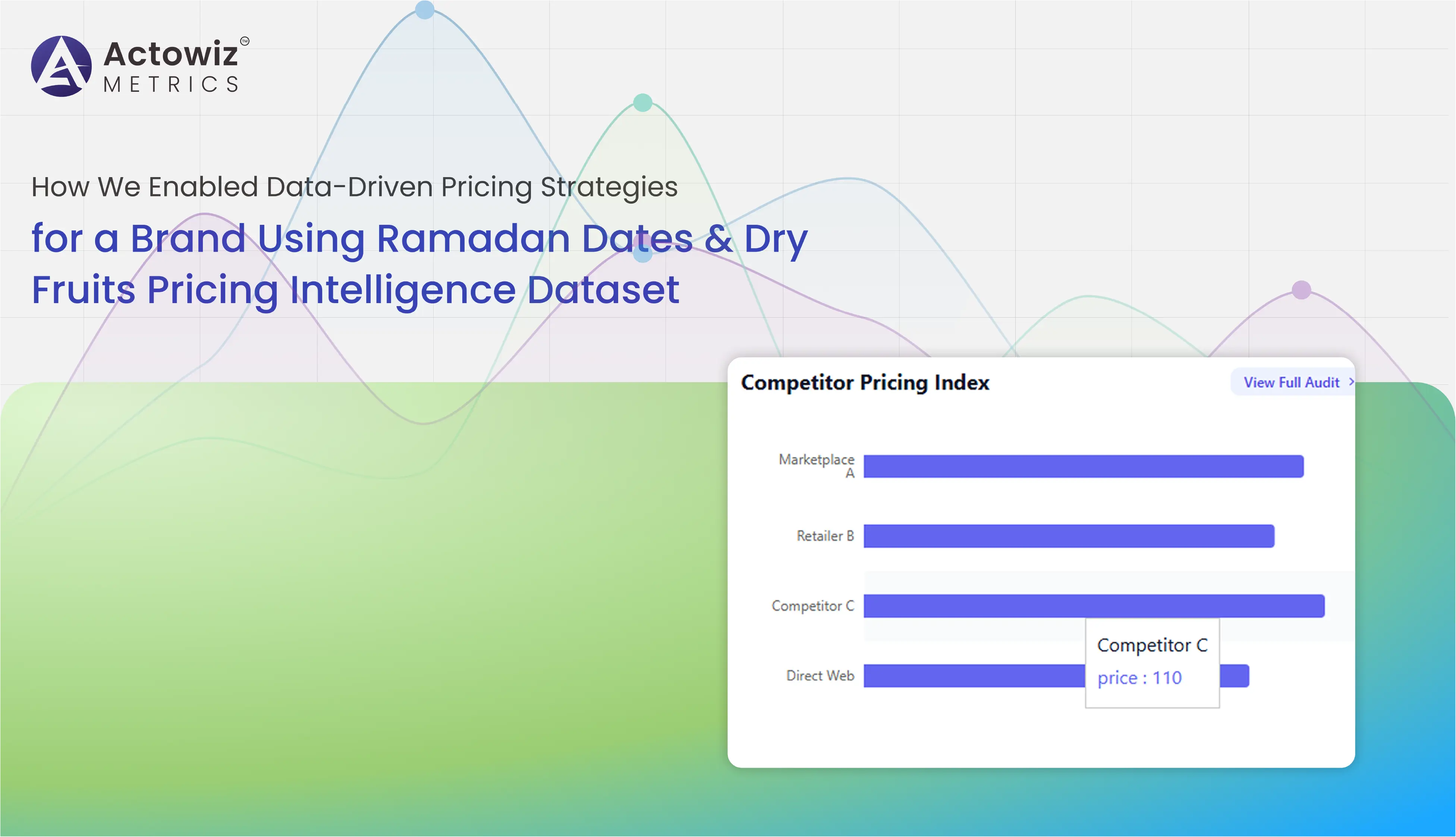

Data-driven pricing strategy case study using Ramadan Dates & Dry Fruits Pricing Intelligence Dataset to optimize revenue and competitive pricing.

Explore Now

Case study on how we enabled an FMCG brand to track competitor pricing on Shopee & Lazada in South East Asia to improve margins and pricing strategy.

Explore Now

Browse expert blogs, case studies, reports, and infographics for quick, data-driven insights across industries.

Leveraging Grocery Data Analytics from Chedraui USA to benchmark competitors, track pricing trends, and uncover actionable market insights.

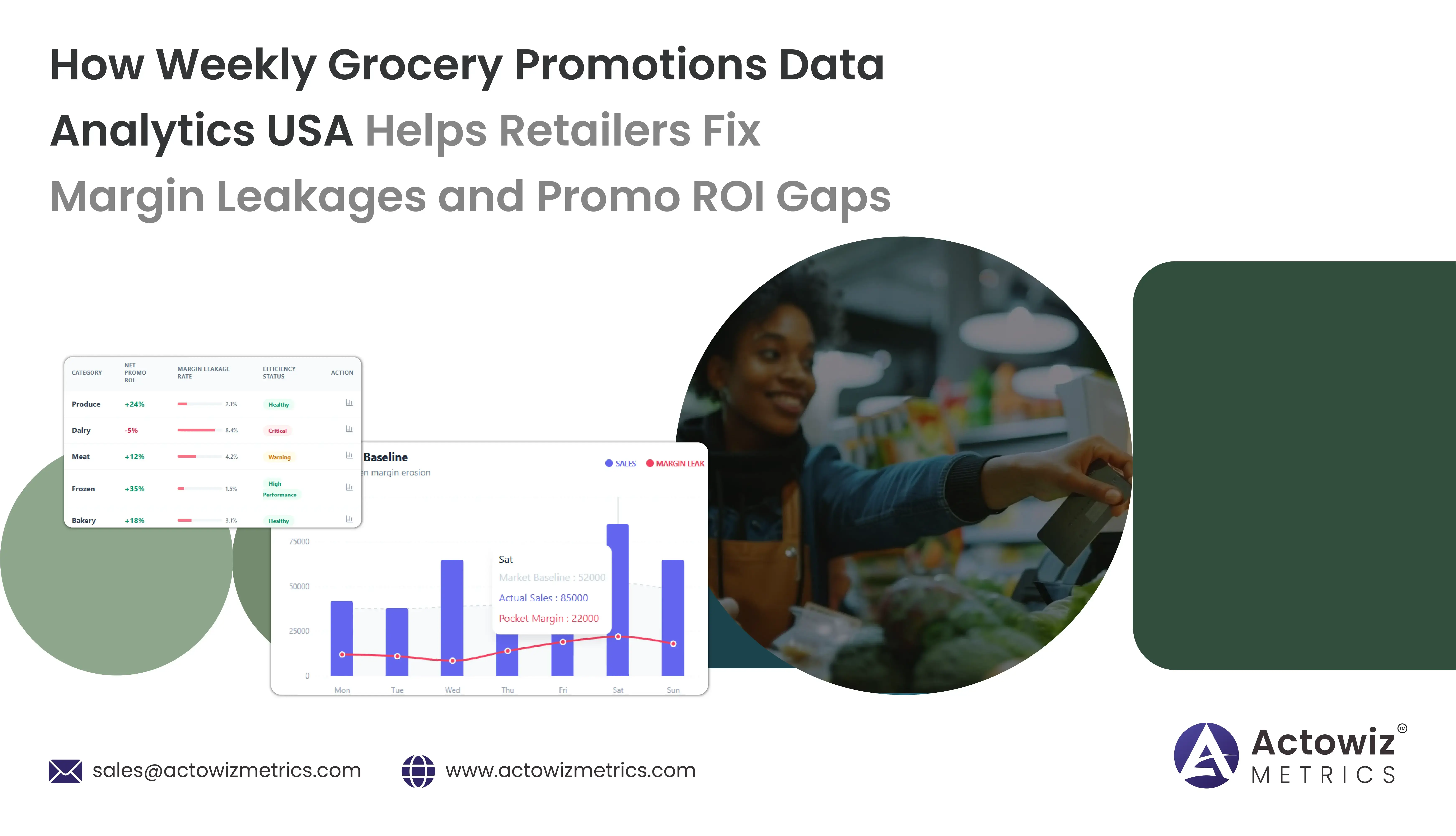

How Weekly Grocery Promotions Data Analytics USA uncovers margin leakages, tracks promo ROI gaps, and optimizes discount strategies for higher profits.

Leverage Poizon Product Stock, Listing & Price Tracking to gain competitive insights, optimize pricing strategies, and drive sustainable revenue growth.

Mini Perfumes Data Analytics on Walmart & Target delivers insights on pricing, discounts, SKU trends, and competitive positioning across both retailers.

Sehri Delivery Heatmap Data Analysis - UAE & Saudi Arabia.webp)

Late-Night (12 AM–4 AM) Sehri Delivery Heatmap Data Analysis across UAE & Saudi Arabia revealing peak demand zones, order spikes, and pricing trends.

Chinese E-Commerce Websites Data Tracking - POIZON & DEWU delivers insights on pricing trends, product demand, brand performance, and market competition in China.

This SMP tracks pricing, visibility, and Skittles Trends Market Performance And Demand to help brands optimize retail strategy and boost growth.

Explore Luxury vs Smartwatch - Global Price Comparison 2025 to compare prices of luxury watches and smartwatches using marketplace data to reveal key trends and shifts.

E-Commerce Price Benchmarking: Gucci vs Prada reveals 2025 pricing trends for luxury handbags and accessories, helping brands track competitors and optimize pricing.

Explore the Amazon Baby Care Report analyzing Top Baby Brands Analysis on Amazon, covering discounts, availability, and popular products with data-driven market insights.

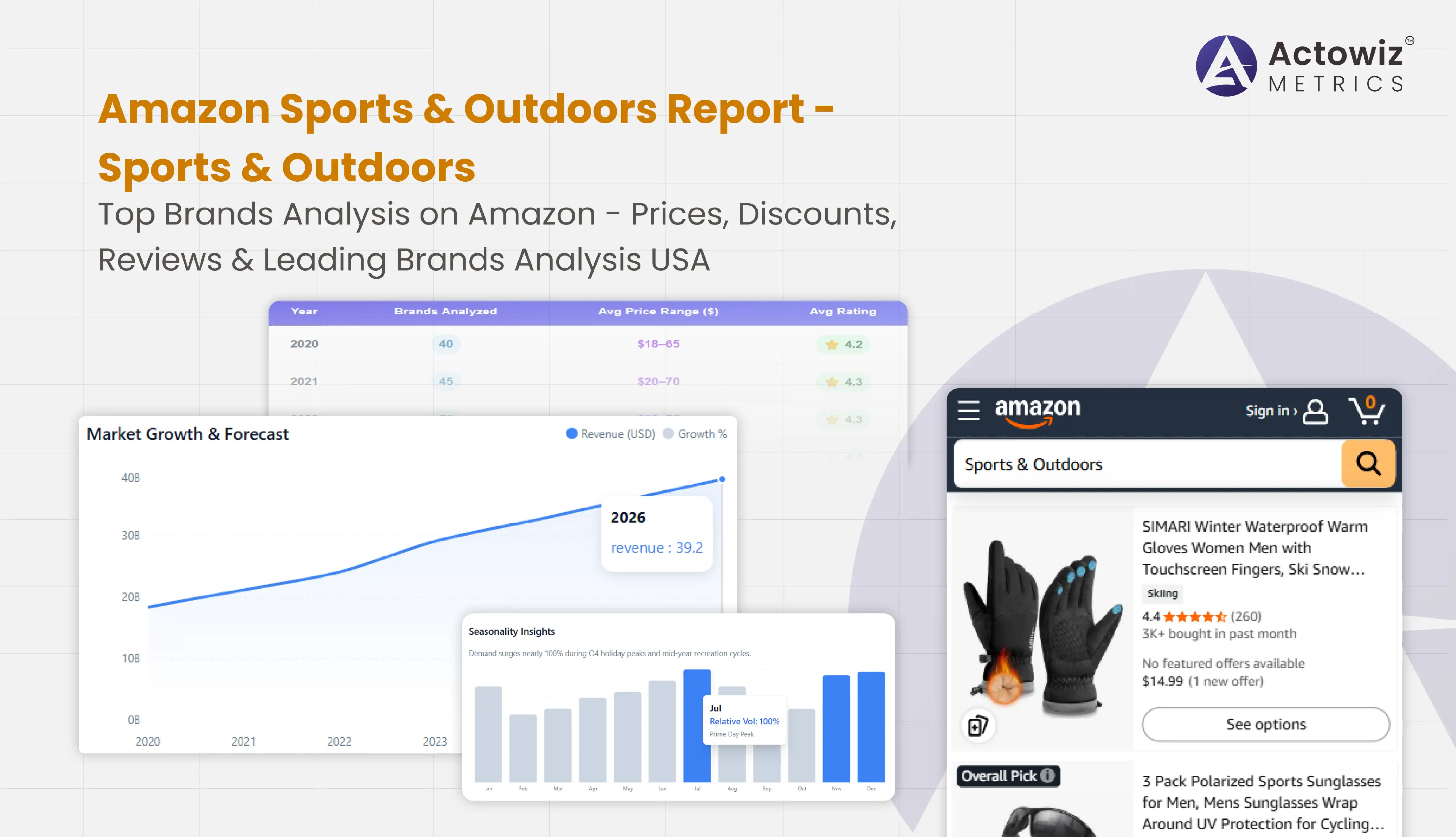

Amazon Sports & Outdoors Report - Sports & Outdoors Top Brands Analysis on Amazon - Prices, Discounts, Reviews

Enabled a USA pet brand to optimize pricing, inventory, and offers on Amazon using Pet Supplies Top Brands Analysis on Amazon for accurate, data-driven decisions.

Whatever your project size is, we will handle it well with all the standards fulfilled! We are here to give 100% satisfaction.

Any analytics feature you need — we provide it

24/7 global support

Real-time analytics dashboard

Full data transparency at every stage

Customized solutions to achieve your data analysis goals