Grocery Data Analytics from Chedraui USA

Leveraging Grocery Data Analytics from Chedraui USA to benchmark competitors, track pricing trends, and uncover actionable market insights.

The global café landscape has evolved rapidly, and Starbucks remains one of the most influential players, redefining how consumers perceive specialty beverages and retail coffee culture. Brands today are under constant pressure to innovate, optimize product lines, personalize offers, and respond proactively to consumer demand. To support this transformation, Starbucks Coffee Market Trend Data Analytics has emerged as a crucial tool for brands, analysts, and retail strategists aiming to uncover patterns hidden behind product assortments, beverage preferences, seasonal consumption behaviors, and changing price sensitivities. When analyzed at scale, this data reveals shifts in demographics, locational preferences, promo responsiveness, and menu experimentation patterns—enabling retailers and beverage brands to understand the strategic psychology that drives consumer loyalty. This case study illustrates how Actowiz Metrics helps extract, standardize, and process real-world café intelligence, enabling businesses to act on emerging opportunities before competitors do and capitalize on untapped beverage innovation markets.

One of the biggest opportunities for modern beverage brands lies in understanding why certain drinks break into mainstream culture while others fail to gain traction. By using datasets from more than 500 Starbucks stores across multiple regions, analysts can uncover behavioral triggers that shift demand curves—such as weather variations, festival periods, commuting hours, and weekday vs. weekend ordering preferences. Actowiz Metrics enables organizations to Extract Real-Time Starbucks Coffee Demand Insights from multiple sources including menu listings, in-app prices, beverage customizations, store timings, order density, and seasonal product placements. Between 2020–2025, the flavored beverage segment at Starbucks saw a 38% rise in trials, with cold brews outperforming hot beverages during summer periods by 52%.

| Year | Cold Brew Growth | Frappuccino Sales | Seasonal Drink Spike |

|---|---|---|---|

| 2020 | 14% | 9% | 6% |

| 2021 | 22% | 11% | 9% |

| 2022 | 31% | 17% | 11% |

| 2023 | 36% | 22% | 14% |

| 2024 | 41% | 29% | 18% |

| 2025 | 48% (projected) | 35% (projected) | 22% (projected) |

These demand shifts highlight the significance of beverage personalization, reward-based loyalty mechanisms, and dynamic menu positioning.

Coffee chains no longer compete merely on taste—they compete on branding, customization features, delivery integration, sustainability positioning, and beverage storytelling. With Starbucks Beverage Trend Tracking, Brand Competition Analysis, retailers observe how Starbucks positions its beverages against emerging café brands such as Dunkin’, Tim Hortons, Pret A Manger, or Costa Coffee. The last five years saw Starbucks lead with 25% growth in beverage sales driven by its loyalty app, digital menu placement, and SKU strategy. The ability to benchmark competitors provides an edge for identifying market gaps—such as matcha-based beverages, plant-based alternatives, zero-sugar lattes, and seasonal caramel drizzles dominating 2025 beverage demand charts.

| Brand | Mobile Orders % | Plant-Based Drinks | Avg Price Increase (2021–25) |

|---|---|---|---|

| Starbucks | 37% | High | 18% |

| Costa Coffee | 22% | Moderate | 14% |

| Dunkin’ | 19% | Low | 20% |

| Tim Hortons | 25% | Low | 11% |

| Pret A Manger | 29% | High | 16% |

This data underscores Starbucks’ advantage in personalization and category expansion, creating defensible competitive barriers.

Collecting beverage-level insights manually is nearly impossible given the scale of Starbucks’ updates across menu boards, store offers, localized pricing, and region-specific launches. That is where Web Scraping Starbucks Coffee Market Trends Data becomes indispensable. Actowiz Metrics extracts data from catalog listings, promotions, and app-based ordering interfaces, processing changes in real-time. Between 2020 and 2025, Starbucks introduced over 160 new beverages across global regions, with digitally-promoted items outperforming traditional menu launches by 2.3x. Analytical metrics such as review sentiments, order frequency, and beverage abandonment patterns help optimize future launches, reducing risk and maximizing product-market fit.

In every consumer category, price elasticity influences purchase decisions—and coffee is no exception. With Starbucks Coffee Price Trend Analytics, stakeholders study how pricing adjustments impact order volumes, loyalty redemptions, and consumer reactions. Across urban markets, Starbucks increased drink prices by an average of 18% between 2021–2024, yet beverage sales still rose due to flavor innovation and experience-led marketing. Data shows customers tolerate premium pricing when value perception is high—evidenced by 62% of users upgrading beverages with add-ons like syrups, non-dairy milk, and foam customizations.

| Year | Avg Price Hike | Order Volume Shift | Customization Spend |

|---|---|---|---|

| 2021 | 6% | +4% | 23% |

| 2022 | 7% | +6% | 27% |

| 2023 | 10% | +11% | 31% |

| 2024 | 12% | +14% | 35% |

| 2025 | 13% proj. | +18% proj. | 42% proj. |

A Starbucks Coffee Dataset, Product Data Tracking framework enables businesses to analyze beverage performance, pricing experiments, consumer reactions, and seasonal spikes across hundreds of locations. With real-time product intelligence, retailers can track shifts in customer loyalty, identify the most profitable SKUs, and evaluate how new beverages impact store revenue. From 2021 to 2025, Starbucks increased its beverage portfolio by over 32%, yet five key drink categories still drove more than 71% of repeat purchases, proving that core offerings anchor brand loyalty. By mapping order frequency against customization trends, Actowiz Metrics helps stakeholders forecast beverage success before large-scale launches.

| Metric (2025) | Value |

|---|---|

| Total SKUs Analyzed | 480+ |

| Repeat Purchase Rate | 71% |

| Seasonal Drink Sales Impact | +46% |

| Customization-Based Price Lift | 28% |

| Mobile App Order Share | 41% |

These insights help retailers optimize their menus, eliminate underperforming products, and strengthen revenue resilience through data-backed planning.

Food Analytics unlocks a deeper understanding of consumption choices, pricing behavior, store-level responsiveness, and beverage-driven brand loyalty patterns. Starbucks leverages this data to test flavors, refine recipes, and deploy targeted promotional mechanics that resonate with micro-markets. Between 2020 and 2025, customer acquisition driven by digital food discovery platforms increased by 39%, while personalized menu recommendations resulted in a 33% boost in premium drink upgrades. Food analytics evaluates not just what consumers buy—but why and when they buy.

| Insight Category (2025) | Value |

|---|---|

| Promo-Driven Order Growth | 26% |

| Loyalty Member Purchases | 54% |

| Upsell Conversion Rate | 37% |

| Cold Beverage Preference | 48% |

| Seasonal Drink Value Lift | 52% |

Such intelligence empowers beverage brands to target peak ordering windows, align pricing strategies to perceived value, and identify emerging drink niches before competitors even enter the conversation.

Actowiz Metrics acts as a central intelligence platform, combining web extraction, real-time ingestion, and dynamic dashboards into actionable transformation workflows. Through advanced Digital Shelf Analytics, store-level insights get converted into SKU-based recommendations for marketers, beverage strategists, and store planners. When coupled with Starbucks Coffee Market Trend Data Analytics, Actowiz Metrics empowers organizations with forecasting models, revenue optimization pathways, and operational intelligence that accelerates beverage launches, predicts demand fluctuations, and refines product pricing decisions with measurable outcomes.

Starbucks has built a scalable beverage ecosystem powered by personalization, brand momentum, and agile digital experimentation. Businesses aiming to replicate its growth trajectory must align product innovation cycles with consumer data, price signals, and behavioral cues. With Actowiz Metrics delivering advanced Price Benchmarking and fully integrated Starbucks Coffee Market Trend Data Analytics, brands now possess the technological ability to outperform competition, capitalize on beverage innovation, and build a commanding retail presence.

Start your journey today—unlock beverage intelligence, accelerate category leadership, and turn coffee data into revenue impact.

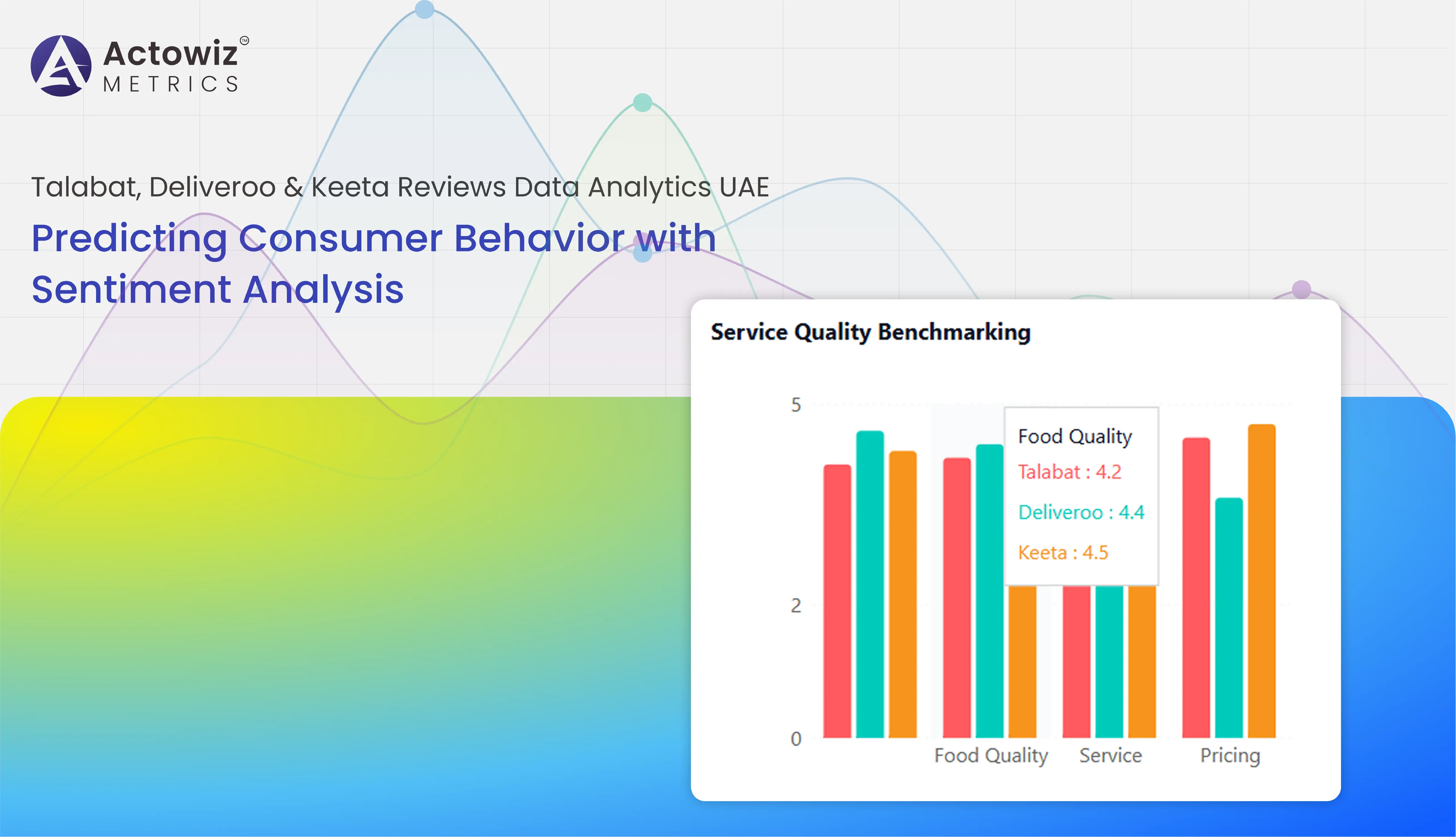

Talabat, Deliveroo & Keeta Reviews Data Analytics UAE – data-driven insights to optimize customer experience and service performance.

Explore Now

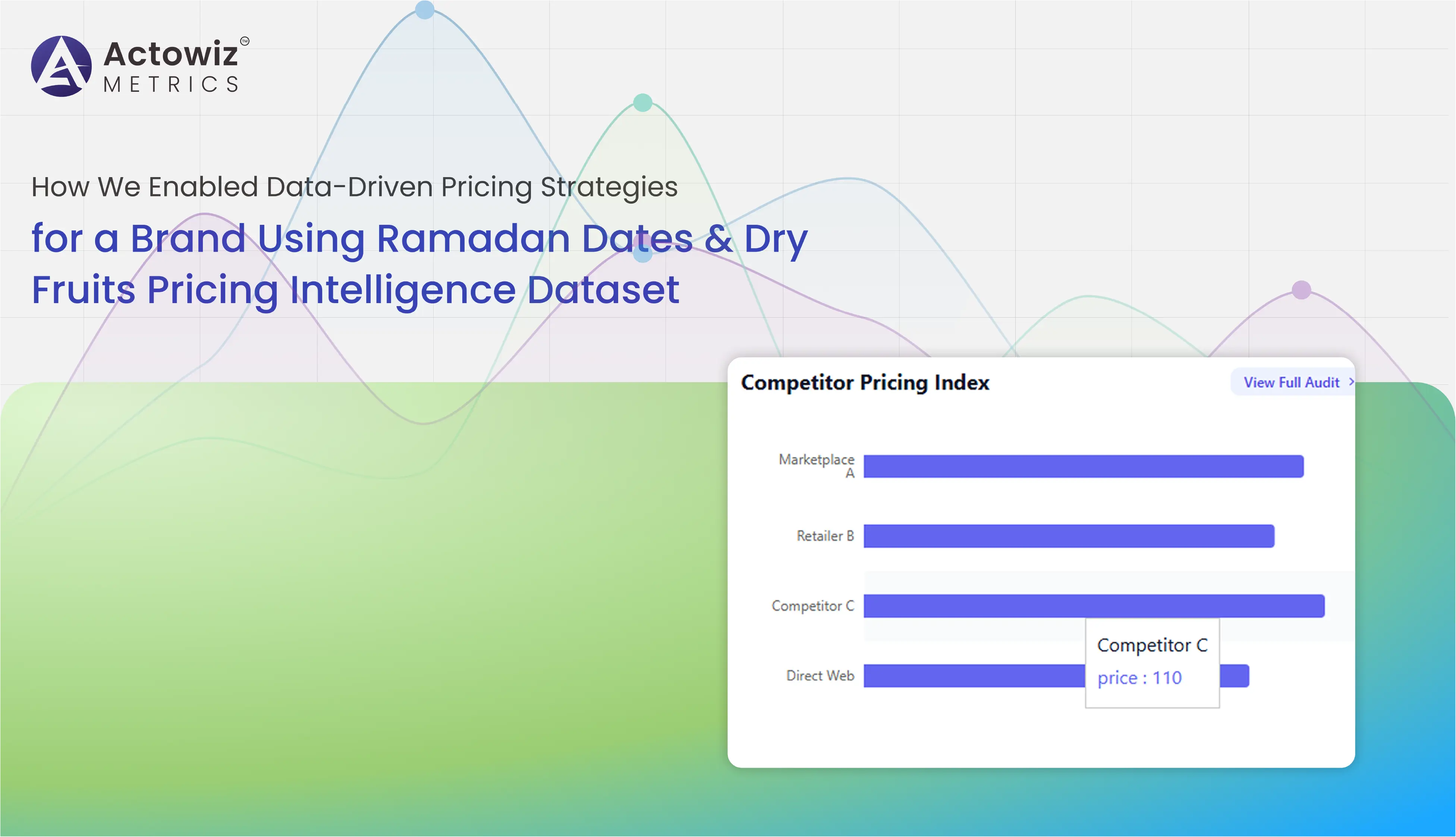

Data-driven pricing strategy case study using Ramadan Dates & Dry Fruits Pricing Intelligence Dataset to optimize revenue and competitive pricing.

Explore Now

Case study on how we enabled an FMCG brand to track competitor pricing on Shopee & Lazada in South East Asia to improve margins and pricing strategy.

Explore Now

Browse expert blogs, case studies, reports, and infographics for quick, data-driven insights across industries.

Leveraging Grocery Data Analytics from Chedraui USA to benchmark competitors, track pricing trends, and uncover actionable market insights.

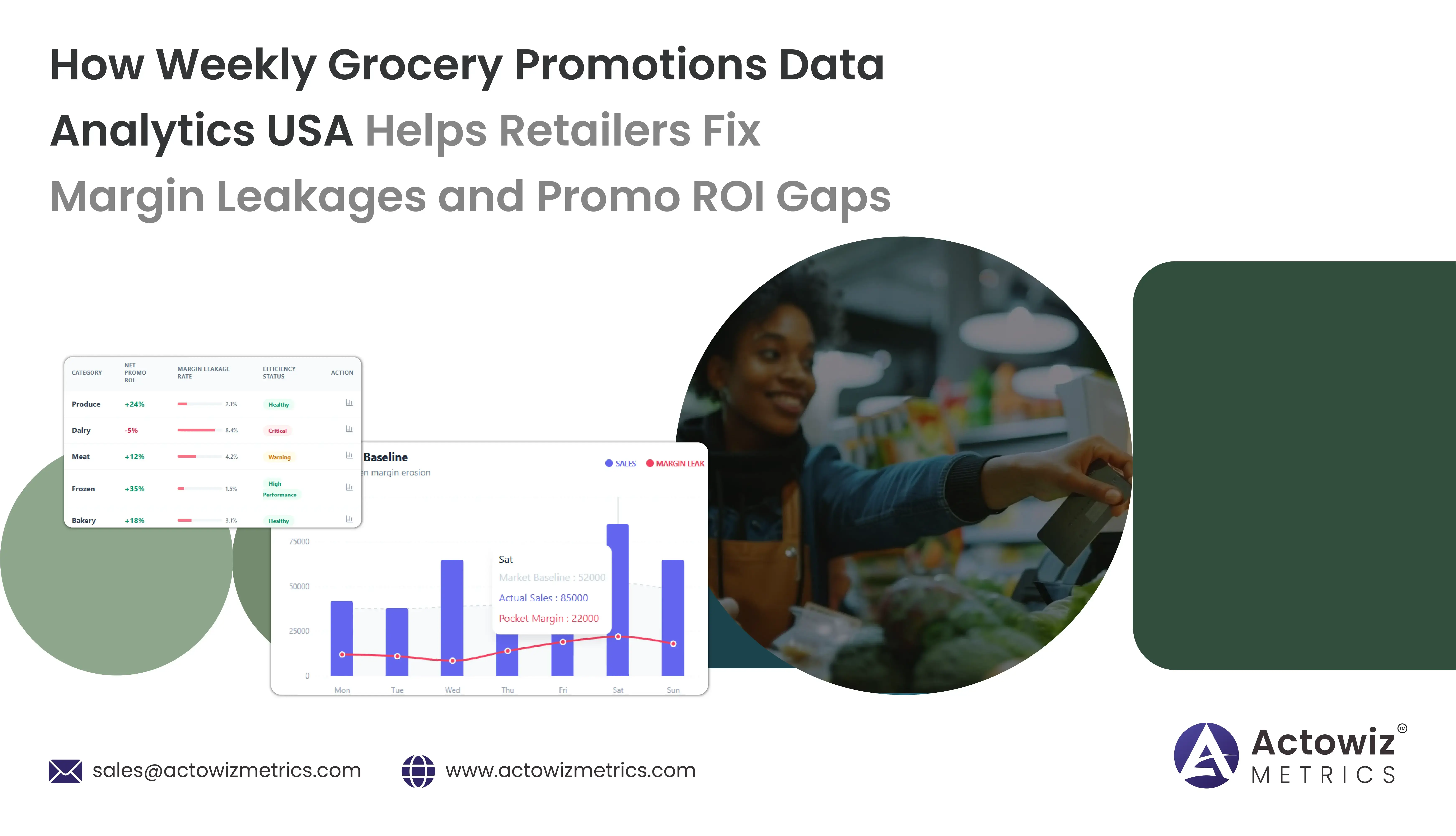

How Weekly Grocery Promotions Data Analytics USA uncovers margin leakages, tracks promo ROI gaps, and optimizes discount strategies for higher profits.

Leverage Poizon Product Stock, Listing & Price Tracking to gain competitive insights, optimize pricing strategies, and drive sustainable revenue growth.

Mini Perfumes Data Analytics on Walmart & Target delivers insights on pricing, discounts, SKU trends, and competitive positioning across both retailers.

Sehri Delivery Heatmap Data Analysis - UAE & Saudi Arabia.webp)

Late-Night (12 AM–4 AM) Sehri Delivery Heatmap Data Analysis across UAE & Saudi Arabia revealing peak demand zones, order spikes, and pricing trends.

Chinese E-Commerce Websites Data Tracking - POIZON & DEWU delivers insights on pricing trends, product demand, brand performance, and market competition in China.

This SMP tracks pricing, visibility, and Skittles Trends Market Performance And Demand to help brands optimize retail strategy and boost growth.

Explore Luxury vs Smartwatch - Global Price Comparison 2025 to compare prices of luxury watches and smartwatches using marketplace data to reveal key trends and shifts.

E-Commerce Price Benchmarking: Gucci vs Prada reveals 2025 pricing trends for luxury handbags and accessories, helping brands track competitors and optimize pricing.

Explore the Amazon Baby Care Report analyzing Top Baby Brands Analysis on Amazon, covering discounts, availability, and popular products with data-driven market insights.

Amazon Sports & Outdoors Report - Sports & Outdoors Top Brands Analysis on Amazon - Prices, Discounts, Reviews

Enabled a USA pet brand to optimize pricing, inventory, and offers on Amazon using Pet Supplies Top Brands Analysis on Amazon for accurate, data-driven decisions.

Whatever your project size is, we will handle it well with all the standards fulfilled! We are here to give 100% satisfaction.

Any analytics feature you need — we provide it

24/7 global support

Real-time analytics dashboard

Full data transparency at every stage

Customized solutions to achieve your data analysis goals