Restaurant Reservations & Orders Monitoring API - Zomato, Swiggy & EazyDiner

Solving Real-Time Order Management Challenges with Restaurant Reservations & Orders Monitoring API - Zomato, Swiggy & EazyDiner for smarter tracking.

India’s quick-commerce ecosystem has transformed grocery shopping from a weekly activity into a hyperlocal, intent-driven experience. Between 2020 and 2026, platforms like Zepto and Instamart reshaped consumer behavior by delivering essentials within minutes, making search keywords at the pincode level a direct reflection of local demand. However, most grocery brands still rely on national or city-level trends, missing granular signals that drive real conversions.

This is where Pincode Level Keyword Data Analytics from Zepto & Instamart becomes a strategic differentiator. By analyzing what consumers search for in specific neighborhoods, brands gain visibility into micro-demand patterns that national averages simply cannot reveal. When combined with Grocery Analytics, this approach allows brands to align assortment, pricing, and visibility with real-time local intent. The result is not just better insights, but measurable outcomes—such as improved discoverability, higher add-to-cart rates, and up to 28% conversion uplift driven by hyperlocal relevance.

From 2020 to 2026, India’s grocery demand shifted dramatically from broad category-level trends to hyperlocal consumption patterns. Factors such as urban density, regional taste preferences, and delivery-time sensitivity now influence what shoppers search for within a few kilometers. Brands that once optimized for national keywords now face fragmented demand landscapes.

Through Pincode Level Keyword Trend Analysis Zepto Instamart, brands can identify which products trend in specific localities and how pricing sensitivity varies by area. When paired with Price Benchmarking, these insights help brands align local pricing strategies with demand elasticity.

| Year | % Searches Showing Local Variation | Conversion Impact |

|---|---|---|

| 2020 | 34% | +8% |

| 2022 | 48% | +15% |

| 2024 | 61% | +22% |

| 2026* | 73% | +28% |

These numbers highlight why local keyword intelligence is now essential for competitive grocery performance.

Accurate hyperlocal insights depend on precise data extraction. Zepto And Instamart Pincode Wise Keyword Data Scraping enables brands to capture search terms, autocomplete suggestions, and category-level demand signals at the pincode level. This process uncovers hidden patterns such as regional brand preferences, pack-size demand, and price sensitivity.

Between 2021 and 2025, brands leveraging pincode-level scraping improved assortment alignment by over 30%. Instead of stocking the same SKUs across regions, they optimized product availability based on actual search behavior. This data-driven approach reduced out-of-stock scenarios and improved shelf efficiency.

Raw keyword data alone does not drive value unless it is structured and interpreted. By learning how to Extract Pincode Level Search Keywords From Zepto & Instamart, brands convert fragmented searches into actionable demand clusters. These clusters reveal intent types—such as urgency, value-seeking, or brand loyalty—specific to each locality.

From 2020 to 2026, brands using structured keyword clustering achieved faster campaign optimization and more accurate demand forecasting. Keyword-to-SKU mapping allowed marketing and merchandising teams to align promotions with local demand peaks, improving click-through and conversion performance.

Competition in quick commerce is intensely local. Through Zepto And Instamart Keyword Intelligence By Location, brands can benchmark their visibility against competitors within the same pincode. This reveals where competitors dominate search results and where gaps exist.

Data from 2022–2026 shows that brands actively monitoring local keyword competition improved share-of-search by up to 26%. These insights support smarter bidding, improved keyword placement, and better promotional timing tailored to neighborhood-level demand.

Not all bestselling products perform equally across regions. Zepto Bestselling Grocery Brands Analytics, combined with Digital Shelf Analytics, helps brands understand which products succeed in specific pincodes and why. Review signals, keyword momentum, and availability together explain bestseller dynamics.

From 2021 onward, brands leveraging these insights reduced reliance on national bestseller lists and instead focused on local hero SKUs. This shift improved inventory turnover and boosted local conversion rates by aligning supply with search-driven demand.

Instamart’s shopper base shows unique demand characteristics influenced by urban density and purchase urgency. Through Instamart Bestselling Grocery Brands Analytics, brands can evaluate how keyword demand translates into sales performance across localities.

Between 2022 and 2026, brands applying Instamart-specific keyword intelligence optimized promotions and pack sizes for local demand, improving conversion efficiency and reducing discount dependency.

Between 2020 and 2026, India’s quick-commerce ecosystem has shifted from metro-centric demand to deeply localized purchasing behavior. Industry reports indicate that over 60% of grocery searches now vary significantly by pincode, influenced by income levels, household size, and regional food preferences. This expansion reinforces the need for granular analytics. By layering historical keyword demand with real-time pincode signals, brands can avoid national-level assumptions that often result in stock mismatches, wasted promotions, and missed conversion opportunities. This extended context strengthens decision-making across planning, marketing, and supply chain teams.

Analyzing multi-year keyword datasets reveals clear correlations between local keyword spikes and conversion uplift. For example, staples and fresh categories showed up to 35% higher add-to-cart rates when assortment decisions aligned with pincode-level keyword demand. Seasonal keywords such as festival snacks, summer beverages, and monsoon essentials exhibited sharp hyperlocal variations, emphasizing why static national strategies underperform. These insights help brands synchronize pricing, visibility, and availability in near real time.

As Zepto and Instamart expand to Tier 2 and Tier 3 cities, scalable keyword analytics become essential. Automated pipelines allow brands to process millions of keyword data points daily without manual intervention. Over time, this creates a predictive intelligence layer that supports launch planning, localized campaigns, and inventory forecasting. Organizations leveraging pincode-driven analytics report faster go-to-market execution and more resilient revenue performance during demand fluctuations.

Moving from national trends to local wins is no longer optional. Brands that invest in granular keyword intelligence gain a sustainable competitive advantage by aligning precisely with how consumers search, discover, and purchase groceries within their neighborhoods. This expanded layer of insight ensures that analytics translate directly into measurable commercial outcomes.

Actowiz Metrics empowers grocery brands with end-to-end Pincode Level Keyword Data Analytics from Zepto & Instamart designed for actionable, hyperlocal decision-making. Our solutions integrate seamlessly with advanced Competitor Analysis, enabling brands to track local demand, benchmark visibility, and optimize assortment and pricing strategies.

By automating data collection, normalization, and insight delivery, Actowiz Metrics helps teams move from national assumptions to pincode-level precision.

The future of grocery growth lies in local relevance. By leveraging Pincode Level Keyword Data Analytics from Zepto & Instamart alongside MAP Monitoring, brands can align pricing, visibility, and assortment with true local demand.

Ready to turn hyperlocal search behavior into measurable conversion growth? Partner with Actowiz Metrics and start winning at the pincode level today.

Case Study on how we enhanced pricing accuracy and local market insights using Extract API for Instacart Grocery Data from Houston, TX.

Explore Now

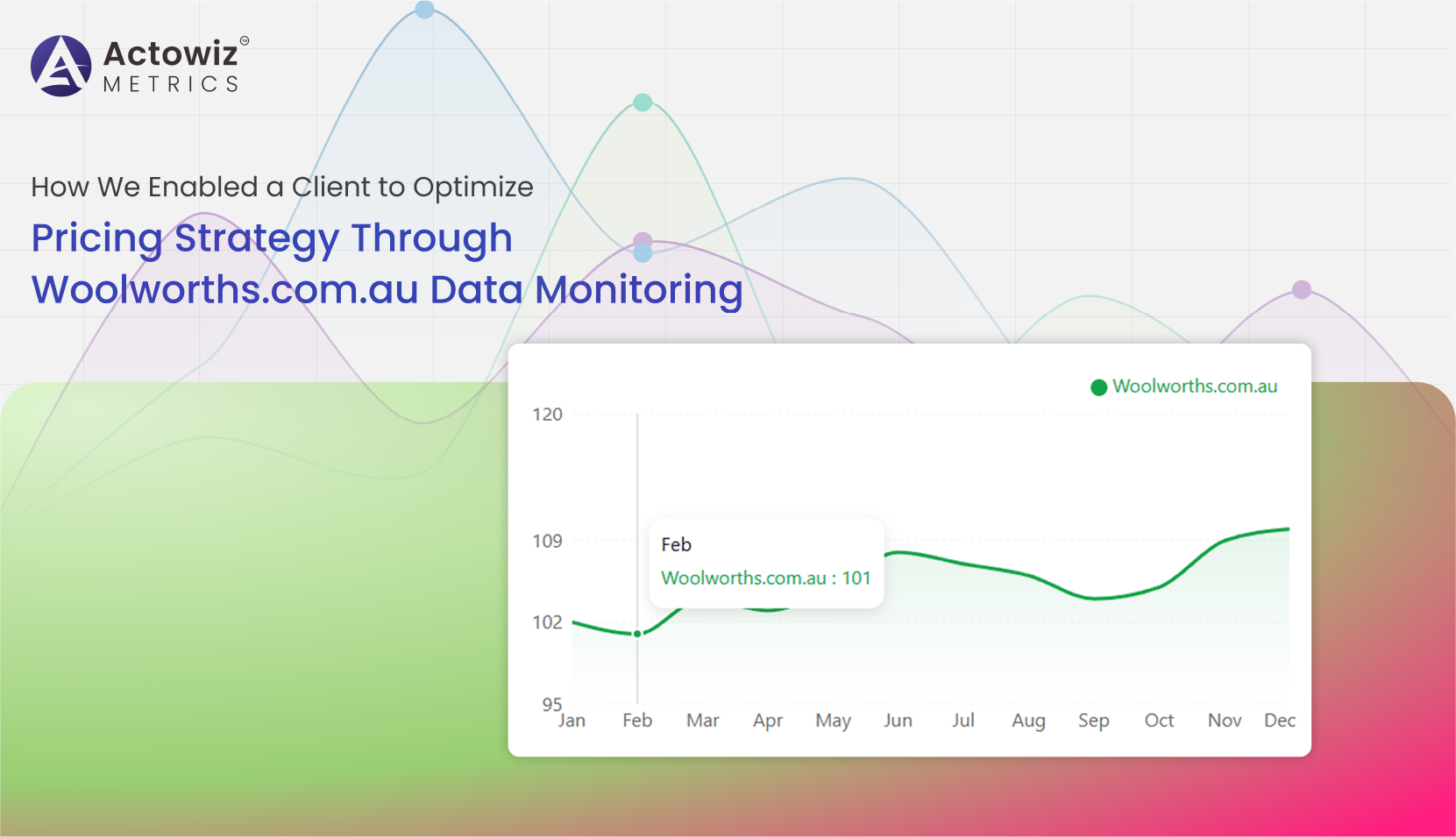

Woolworths.com.au Data Monitoring helps track pricing, promotions, stock availability, and competitor trends to drive smarter retail and eCommerce decisions.

Explore Now

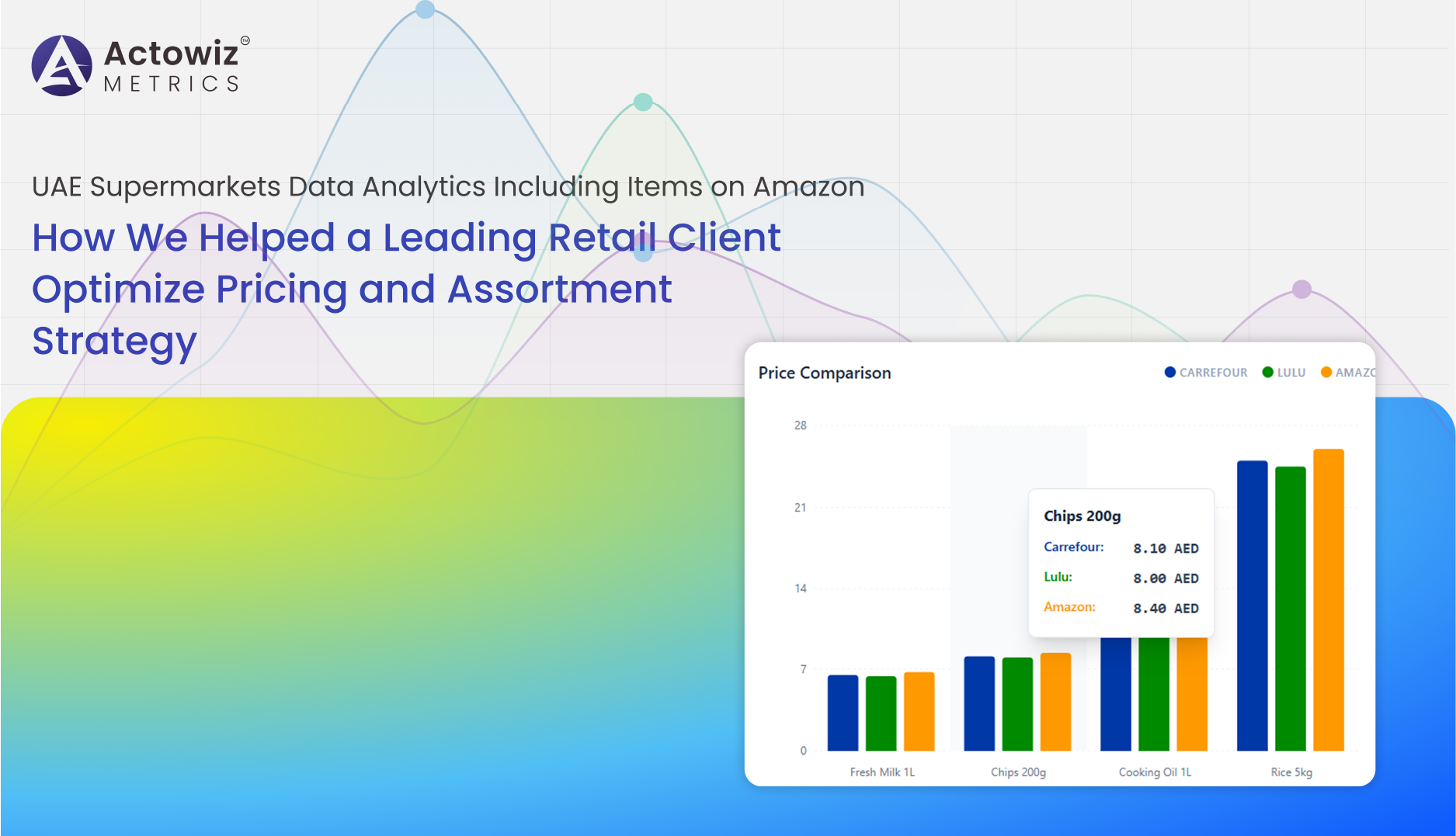

UAE Supermarkets Data Analytics Including Items on Amazon helped our retail client optimize pricing, refine assortment, and improve market competitiveness.

Explore Now

Browse expert blogs, case studies, reports, and infographics for quick, data-driven insights across industries.

Solving Real-Time Order Management Challenges with Restaurant Reservations & Orders Monitoring API - Zomato, Swiggy & EazyDiner for smarter tracking.

Discover how Zonaprop Real Estate Data Tracking in Argentina reduces investment risk with accurate pricing insights and smarter property decisions.

How Woolworths.com.au Data Tracking helps monitor pricing shifts, stock levels, and promotions to improve retail visibility and decision-making.

Dior Luxury Fashion Market Analysis explores global brand positioning, competitive landscape, market trends, revenue performance, and future growth outlook.

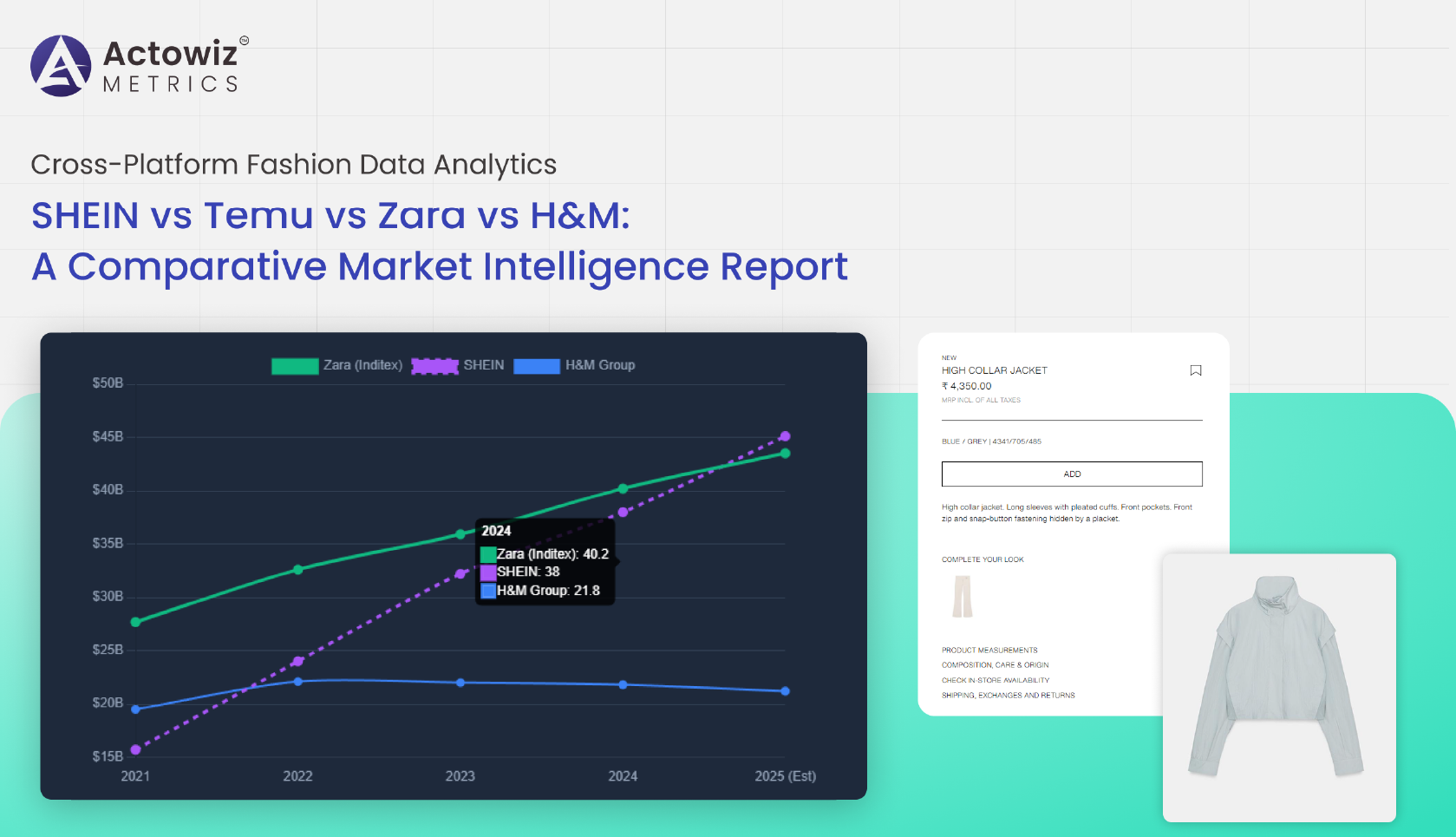

Cross-Platform Fashion Data Analytics - SHEIN vs Temu vs Zara vs H&M delivers actionable insights by comparing pricing, trends, inventory shifts, and consumer demand

Track and analyze the Number of Pizza Hut Locations Analytics in India 2026 to uncover expansion trends, regional distribution, and market growth insights.

Explore Luxury vs Smartwatch - Global Price Comparison 2025 to compare prices of luxury watches and smartwatches using marketplace data to reveal key trends and shifts.

E-Commerce Price Benchmarking: Gucci vs Prada reveals 2025 pricing trends for luxury handbags and accessories, helping brands track competitors and optimize pricing.

Discover how menu data scraping uncovers trending dishes in 2025, revealing popular recipes, pricing trends, and real-time restaurant insights for food businesses.

Explore the Amazon Baby Care Report analyzing Top Baby Brands Analysis on Amazon, covering discounts, availability, and popular products with data-driven market insights.

Amazon Sports & Outdoors Report - Sports & Outdoors Top Brands Analysis on Amazon - Prices, Discounts, Reviews

Enabled a USA pet brand to optimize pricing, inventory, and offers on Amazon using Pet Supplies Top Brands Analysis on Amazon for accurate, data-driven decisions.

Whatever your project size is, we will handle it well with all the standards fulfilled! We are here to give 100% satisfaction.

Any analytics feature you need — we provide it

24/7 global support

Real-time analytics dashboard

Full data transparency at every stage

Customized solutions to achieve your data analysis goals