Woolworths.com.au Data Tracking

How Woolworths.com.au Data Tracking helps monitor pricing shifts, stock levels, and promotions to improve retail visibility and decision-making.

Navratri, one of India’s most widely celebrated festivals, is not just a cultural and spiritual event—it has also evolved into a major driver of consumer demand, particularly in the grocery sector. As families prepare for nine days of fasting, feasting, and festive gatherings, grocery shopping becomes one of the top household priorities. Traditionally, local kirana stores dominated festive sales, but in recent years, digital transformation and quick commerce platforms have reshaped the way consumers shop.

According to the latest Navratri Grocery Basket Trends Analysis, nearly 48% of shoppers now prefer buying groceries online during the festival season. This is a remarkable shift, considering that just five years ago, less than a quarter of consumers turned to digital platforms for their festive needs. The rise of platforms such as Zepto, Blinkit, and Swiggy Instamart, along with increasing smartphone penetration and growing trust in online deliveries, has fueled this transformation.

By tapping into advanced methods like Extract Grocery Basket Trends Data and leveraging Grocery Data Analytics, brands and retailers can understand consumer behavior at a granular level. This blog explores six problem-solving areas, enriched with year-on-year statistics (2020–2025), that decode how Grocery festive sale analytics and Quick Commerce Analytics shape the Navratri economy.

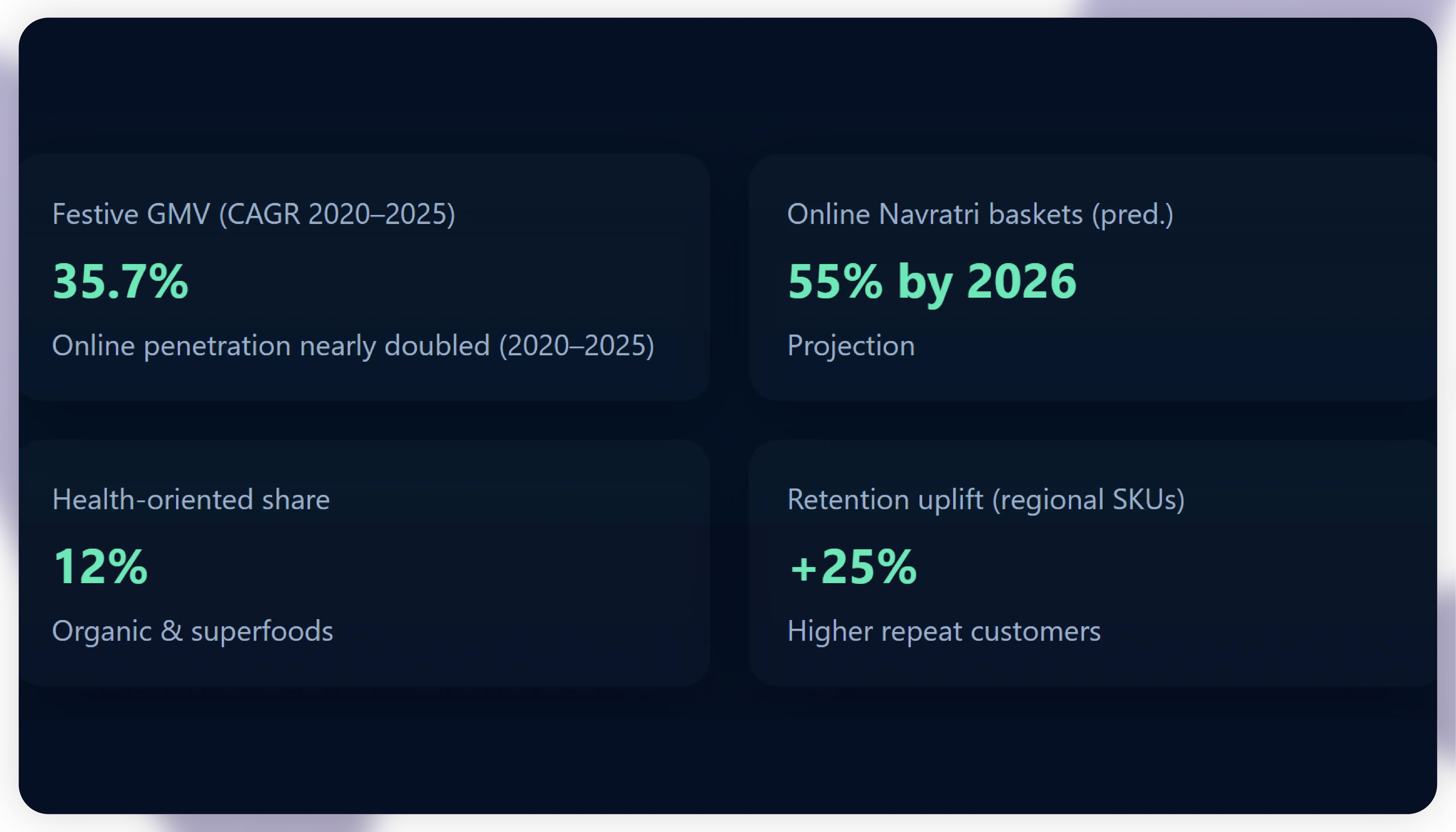

The adoption of online grocery shopping has seen exponential growth, particularly during the festive season. What was once considered a supplementary channel is now becoming the dominant force in festive grocery demand. The Navratri Grocery Basket Trends Analysis highlights this evolution clearly—while only 21% of grocery buyers opted for online platforms in 2020, the figure has reached 48% in 2025, showing a compounded annual growth rate of more than 20%.

| Year | % of Online Grocery Shoppers | Festive Grocery GMV (INR Cr) | YoY Growth % |

|---|---|---|---|

| 2020 | 21% | 2,300 | 12% |

| 2021 | 28% | 3,100 | 15% |

| 2022 | 34% | 4,250 | 18% |

| 2023 | 41% | 5,700 | 22% |

| 2024 | 45% | 6,950 | 21% |

| 2025 | 48% | 8,200 | 18% |

This consistent upward trend proves that online grocery shopping is no longer limited to urban millennials. Tier-2 and Tier-3 cities are now key contributors to the festive online grocery boom. Factors such as last-minute grocery demand analytics, improved delivery infrastructure, and the availability of local and regional festive products have built consumer trust.

The ability to scrape multi-platform grocery data has given businesses a competitive edge. By tracking transaction spikes across platforms, retailers can forecast demand on specific festival days such as Ashtami and Navami. For instance, demand for fruits and dairy products typically doubles on the first three days, while sweets and snacks peak during the last two days of Navratri.

The integration of festive season grocery basket intelligence into retail strategies helps companies avoid stockouts, reduce wastage, and optimize supply chains. By combining predictive Quick Commerce Analytics with real-time insights, businesses can ensure maximum Product availability, thus enhancing customer satisfaction and loyalty.

The shift towards online is not just a trend but a long-term transformation. Retailers that adapt early using advanced Grocery Data Analytics will dominate the festive economy, while those who resist digital adoption risk losing relevance.

Understanding what goes into a consumer’s festive grocery basket is essential for brands and retailers to align their supply chains and marketing strategies. The Navratri basket has always been diverse, containing essentials like grains, dairy, and fruits. However, from 2020 to 2025, consumer preferences have shifted significantly toward health-oriented, premium, and ready-to-consume products.

| Year | Top 3 Grocery Categories | Emerging Festive Basket Trends |

|---|---|---|

| 2020 | Grains, Fruits, Dairy | Traditional snacks |

| 2021 | Fruits, Dairy, Oils | Organic products |

| 2022 | Dairy, Fruits, Snacks | Ready-to-cook mixes |

| 2023 | Fruits, Dairy, Beverages | Plant-based foods |

| 2024 | Dairy, Fruits, Grains | Packaged festive sweets |

| 2025 | Fruits, Dairy, Snacks | Regional fasting recipes |

This shift shows that while staples remain strong, consumers are increasingly experimenting with innovative festive products. Grocery festive sale analytics indicates that plant-based dairy products recorded 27% YoY growth between 2022–2025, while packaged sweets grew by 31% in 2024. Similarly, regional fasting recipes such as millet khichdi mixes and rajgira ladoos saw a rise of 22% in 2025.

Insights from Blinkit Navratri grocery basket trends analytics further confirm that different product categories peak on different days. Fruits and dairy dominate the early days, while snacks, ready-to-cook mixes, and sweets surge closer to Navami. Such granular analysis is invaluable for platforms planning targeted discount campaigns or flash sales.

Another crucial observation is the rise in health-focused consumption. Consumers now prefer low-oil snacks, organic produce, and fortified beverages, aligning with a growing health-conscious lifestyle. This not only creates opportunities for premium brands but also pressures traditional FMCG players to diversify their portfolios.

The use of festive season grocery basket intelligence allows businesses to capitalize on these emerging patterns. By aligning production and inventory with real-time demand insights, brands can minimize losses and maximize profitability during the high-demand festive season.

Navratri shopping trends vary significantly across regions, influenced by local traditions, food habits, and festive rituals. For example, North India sees higher demand for dairy products, grains, and dry fruits, while Western India records higher consumption of snacks and sweets. South India, on the other hand, shows a growing preference for millet-based and ready-to-eat fasting foods.

But one of the most striking developments in recent years has been the rise of midnight shopping. With the growth of quick commerce analytics, platforms now operate round-the-clock, and data shows that 15% of all festive grocery orders in metro cities occur between 10 PM and 2 AM.

| Year | % Midnight Orders | Top Platforms Used |

|---|---|---|

| 2020 | 5% | Swiggy Instamart |

| 2021 | 8% | Blinkit |

| 2022 | 11% | Zepto |

| 2023 | 13% | Zepto, Blinkit |

| 2024 | 14% | All Platforms |

| 2025 | 15% | Zepto Dominant |

The rise of Midnight Navratri grocery basket insights highlights how consumer lifestyles are changing. Urban families with busy schedules prefer placing orders at night, ensuring delivery by morning. Platforms like Zepto have capitalized on this, making late-night delivery their USP.

Another regional insight comes from Swiggy Instamart festive sale trends analysis, which shows that demand for bulk fruits and dairy is highest in northern states, while packaged sweets dominate in Gujarat and Maharashtra. In South India, millet-based fasting foods saw a surge of 29% between 2023–2025, proving that localized preferences must drive inventory strategies.

For businesses, this means that one-size-fits-all campaigns no longer work. Leveraging festive season grocery basket intelligence with regional segmentation ensures better alignment with consumer expectations. Retailers can run localized promotions, introduce region-specific SKUs, and even adjust delivery schedules to meet late-night orders.

Such granular insights not only boost sales but also strengthen customer loyalty, as consumers feel platforms understand their specific needs.

One of the most persistent challenges for both retailers and platforms during Navratri is managing last-minute grocery demand. Despite better planning tools, many consumers still wait until the last moment to purchase items required for pujas, family gatherings, or fasting meals.

| Year | % Last-Minute Orders | Most Bought Items |

|---|---|---|

| 2020 | 19% | Fruits, Milk |

| 2021 | 22% | Dairy, Snacks |

| 2022 | 25% | Fruits, Beverages |

| 2023 | 27% | Dairy, Ready-to-cook |

| 2024 | 29% | Snacks, Grains |

| 2025 | 30% | Fruits, Dairy, Sweets |

The last-minute grocery demand analytics reveal that approximately 30% of all Navratri grocery orders in 2025 were placed within 24 hours of need. This creates immense pressure on supply chains, particularly dark stores and quick commerce warehouses.

Fruits and dairy consistently appear in the list of most-purchased last-minute items, reflecting their perishability and immediate use in rituals. Snacks and ready-to-cook products also dominate because families often host unexpected gatherings.

Retailers that harness Quick Commerce Analytics can predict these spikes by studying past order histories and consumer behavior. For example, data from 2023 showed that fruit demand doubled on the 8th day of Navratri across Delhi and Lucknow, leading platforms to pre-position extra inventory in local dark stores.

The challenge lies in balancing availability with wastage. Without predictive tools, retailers risk either overstocking perishable items or running out of critical SKUs. Platforms leveraging Grocery Data Analytics can strike this balance by creating accurate demand forecasts.

For brands, this is an opportunity to run micro-promotions targeting last-minute shoppers. For instance, discounts on ready-to-cook snacks or beverages offered 24 hours before Navami can significantly boost sales. This ensures that businesses turn last-minute urgency into a profitable revenue stream.

Different platforms cater to different consumer needs, and this is particularly evident during Navratri. A scrape multi-platform grocery data approach reveals how Zepto, Blinkit, and Swiggy Instamart dominate the landscape, each with unique strengths.

| Platform | Festive Order Share | Key Strength |

|---|---|---|

| Zepto | 34% | Midnight & ultra-fast delivery |

| Blinkit | 29% | Ready-to-eat festive foods |

| Instamart | 26% | Bulk & family orders |

| Others | 11% | Regional/local preferences |

The insights underline the importance of tailoring campaigns per platform. For example, a dairy brand may prioritize promotions on Swiggy Instamart, while a snack manufacturer may focus on Blinkit. Similarly, regional specialty brands may partner with Zepto for midnight promotions.

By leveraging festive season grocery basket intelligence, brands can optimize their platform strategies and reduce wasted ad spend. This ensures maximum impact and better ROI on festive campaigns.

As festive shopping behaviors become increasingly complex, businesses cannot rely on intuition alone. Advanced Grocery Data Analytics enables them to transform raw numbers into actionable insights. From tracking SKUs to predicting consumer demand across regions, analytics now drives the festive economy.

Between 2020–2025, predictive Quick Commerce Analytics showed that festive grocery GMV grew at a CAGR of 18–20%, with online penetration nearly doubling. This trend is expected to accelerate further in the next few years.

Key predictive insights include:

For instance, demand for organic fasting foods grew 33% YoY in Tier-1 cities between 2022–2025, while millet-based products surged in South India. Without analytics, such granular insights would remain invisible to brands.

By incorporating festive season grocery basket intelligence into their strategies, companies can stay ahead of the curve. The power of Quick Commerce Analytics ensures that businesses are no longer reactive but proactive in shaping festive demand.

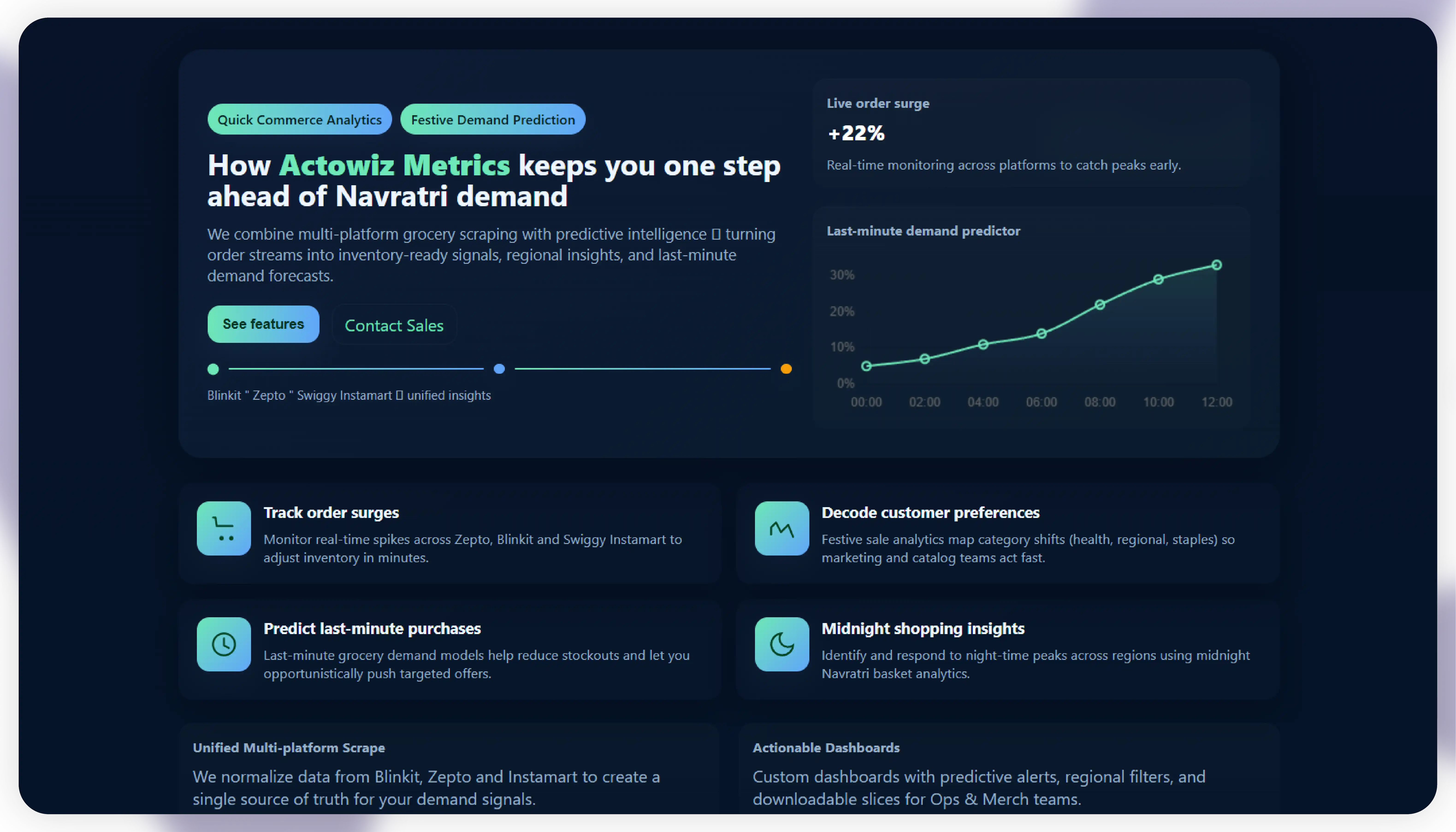

At Actowiz Metrics, we specialize in empowering businesses with data scraping, advanced analytics, and demand prediction models. Our tools don’t just collect numbers—they provide actionable insights to help you succeed during high-demand periods like Navratri.

Through solutions such as Extract Grocery Basket Trends Data, we help retailers and brands:

Our custom dashboards combine scrape multi-platform grocery data with predictive intelligence, enabling smarter inventory management, better regional targeting, and reduced supply chain risks.

From Blinkit Navratri grocery basket trends analytics to Quick Commerce Analytics, Actowiz Metrics ensures that you are always one step ahead of festive demand. With our support, you can convert complex consumer behavior into sustainable growth.

The evolution of Navratri grocery shopping reflects the larger shift in India’s consumer economy. What was once an offline-dominated activity has now moved online, with 48% of shoppers relying on digital platforms. The insights from our Navratri Grocery Basket Trends Analysis make it clear: platforms like Zepto, Blinkit, and Swiggy Instamart are not just delivery services—they are shaping consumer behavior with speed, convenience, and variety.

From regional and midnight insights to last-minute grocery demand analytics, the festive season offers immense opportunities for brands that harness data. Businesses that ignore these trends risk being left behind, while those leveraging Grocery Data Analytics and Quick Commerce Analytics will thrive.

At Actowiz Metrics, we empower retailers with festive season grocery basket intelligence, helping them transform raw numbers into growth strategies. Whether it’s predicting demand spikes, optimizing inventory, or running targeted promotions, our solutions are designed to make festive retail smarter.

Ready to transform your festive grocery strategy with data-driven insights? Partner with Actowiz Metrics today and unlock the true potential of Navratri grocery analytics.

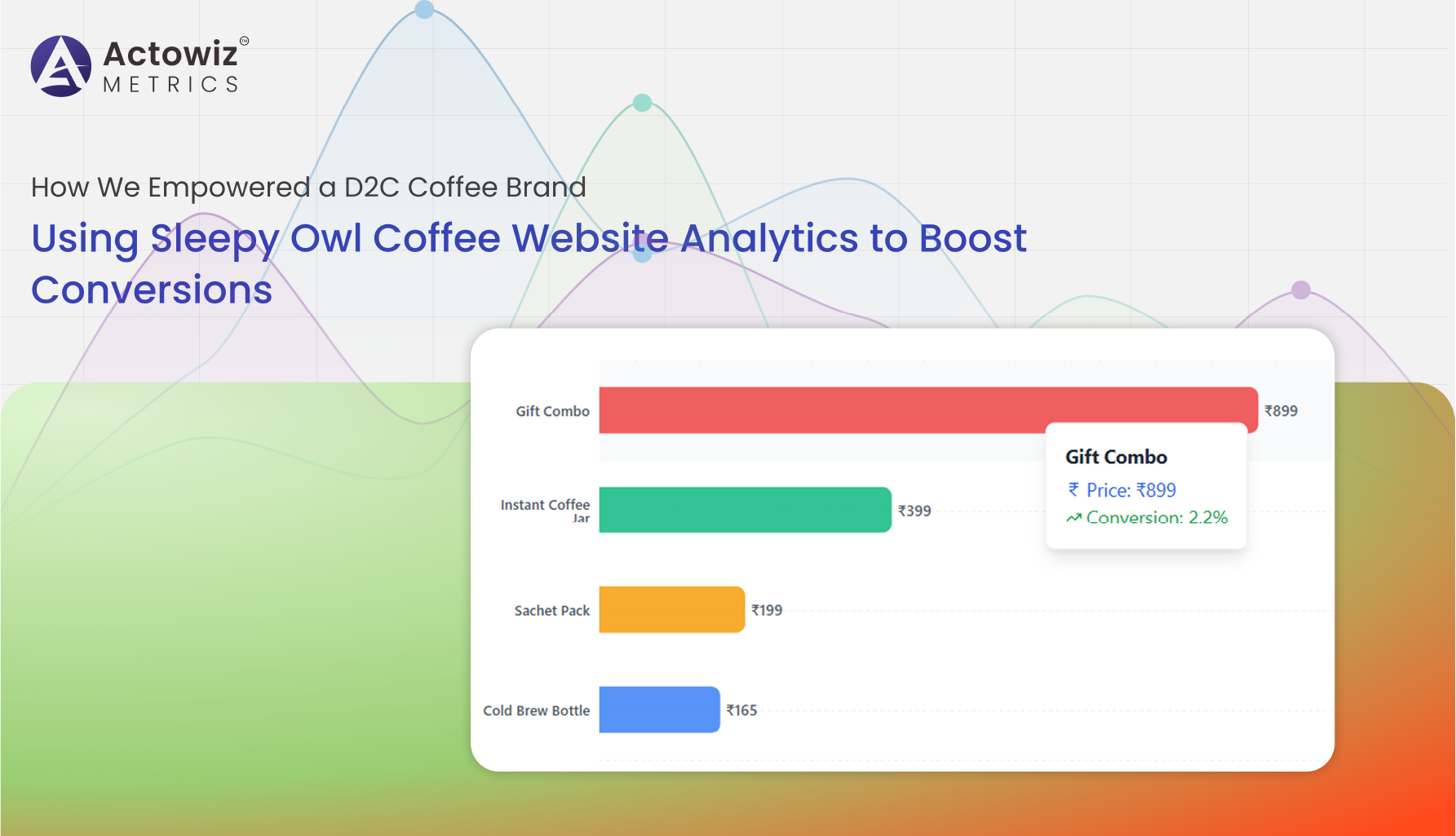

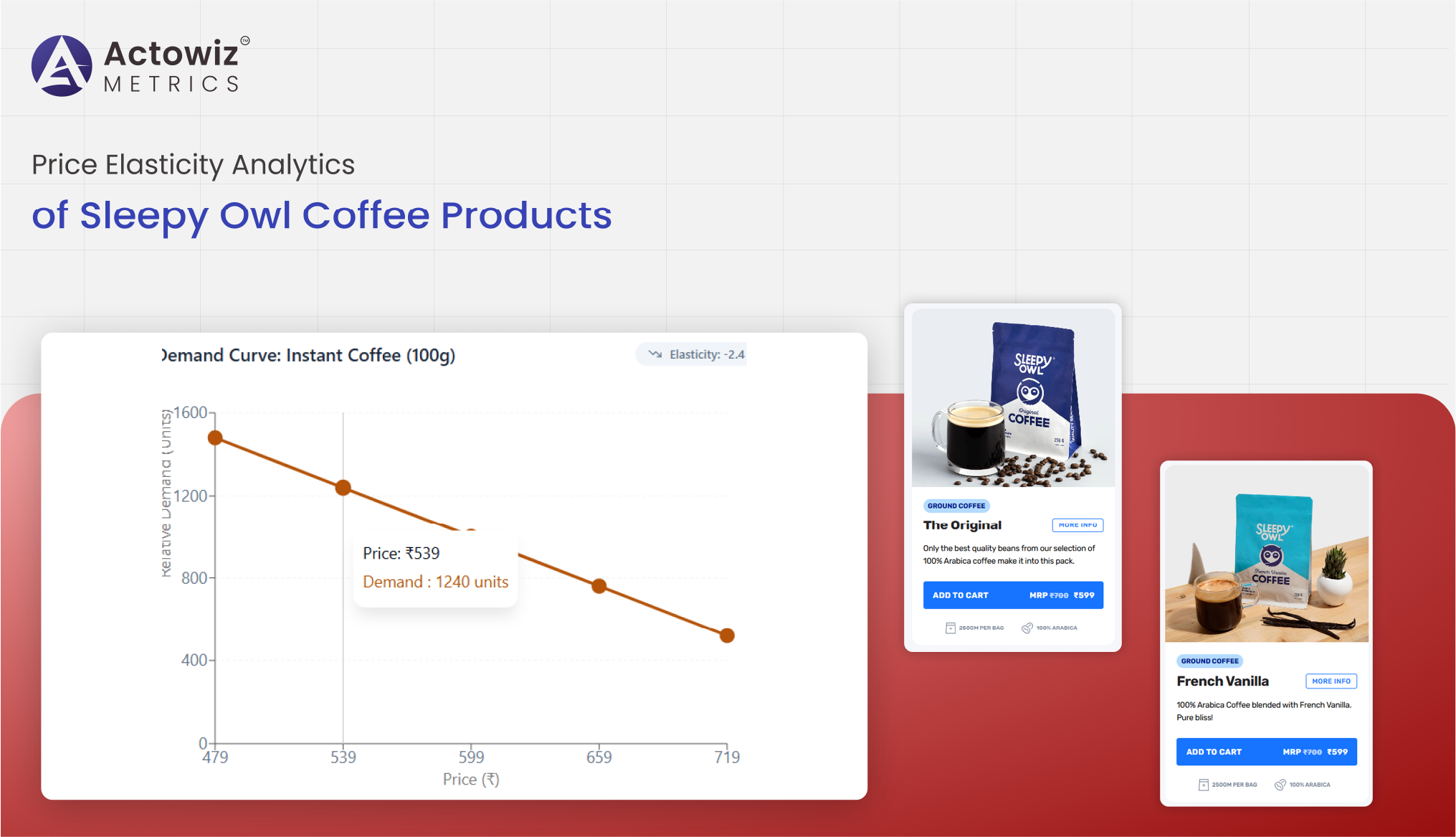

Sleepy Owl Coffee Website Analytics delivering insights on traffic, conversions, pricing trends, and digital performance optimization.

Explore Now

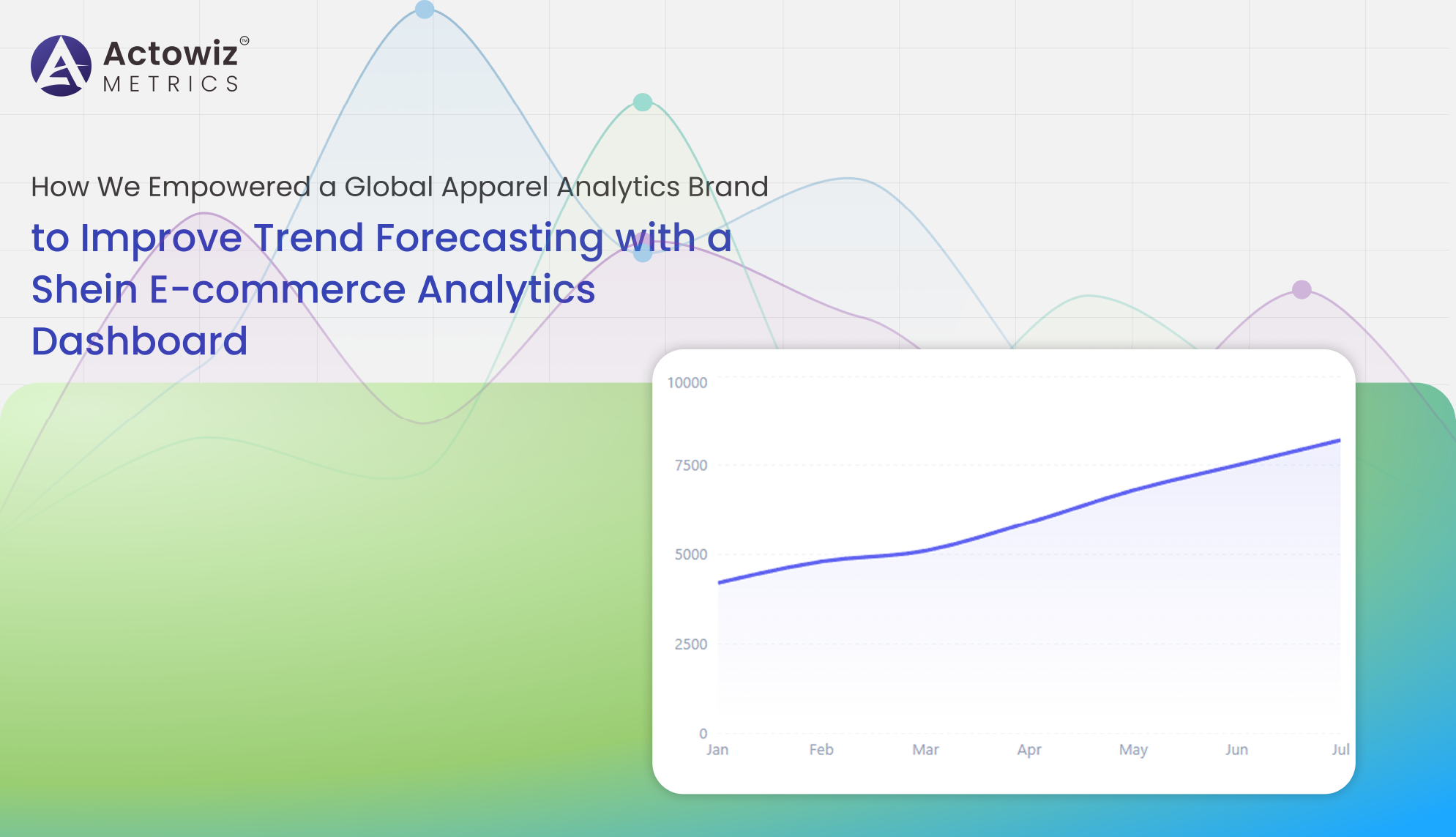

Shein E-commerce Analytics Dashboard delivers real-time pricing, trend, and competitor insights to optimize fashion strategy and boost performance.

Explore Now

Live Data Tracking Dashboard for Keeta Food Delivery App enables real-time order, pricing, and restaurant insights to optimize performance and decisions.

Explore NowBrowse expert blogs, case studies, reports, and infographics for quick, data-driven insights across industries.

How Woolworths.com.au Data Tracking helps monitor pricing shifts, stock levels, and promotions to improve retail visibility and decision-making.

Myntra Fashion Category Data Monitoring helps track trends, pricing, stock levels, and category performance to optimize sales and boost growth.

Pringles Food Data Analytics 2026 reveals how data-driven insights improve pricing, demand forecasting, and supply chain efficiency in a dynamic snack market.

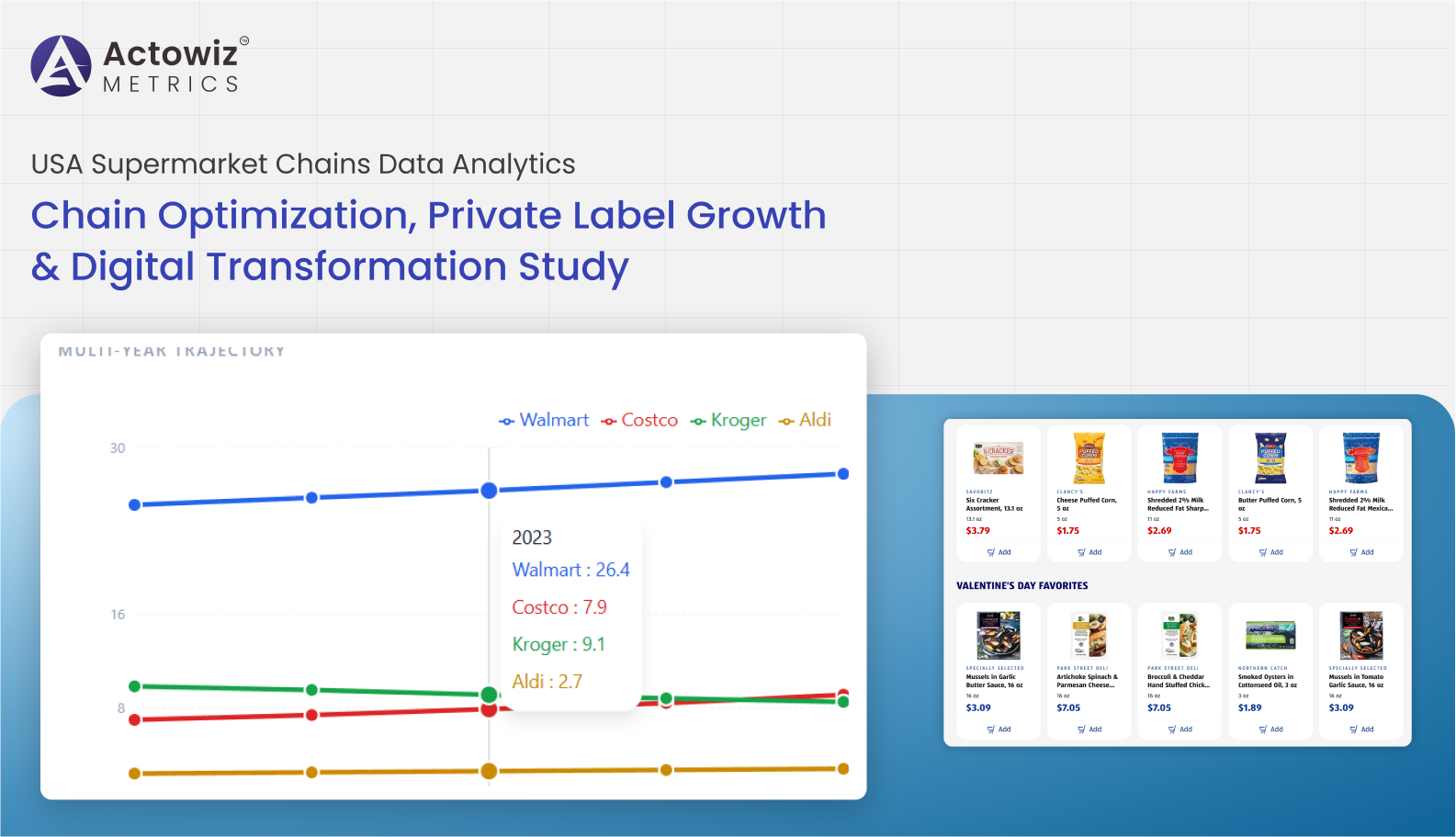

Research Report on USA Supermarket Chains Data Analytics covering chain optimization, private label growth, pricing trends, and digital transformation insights.

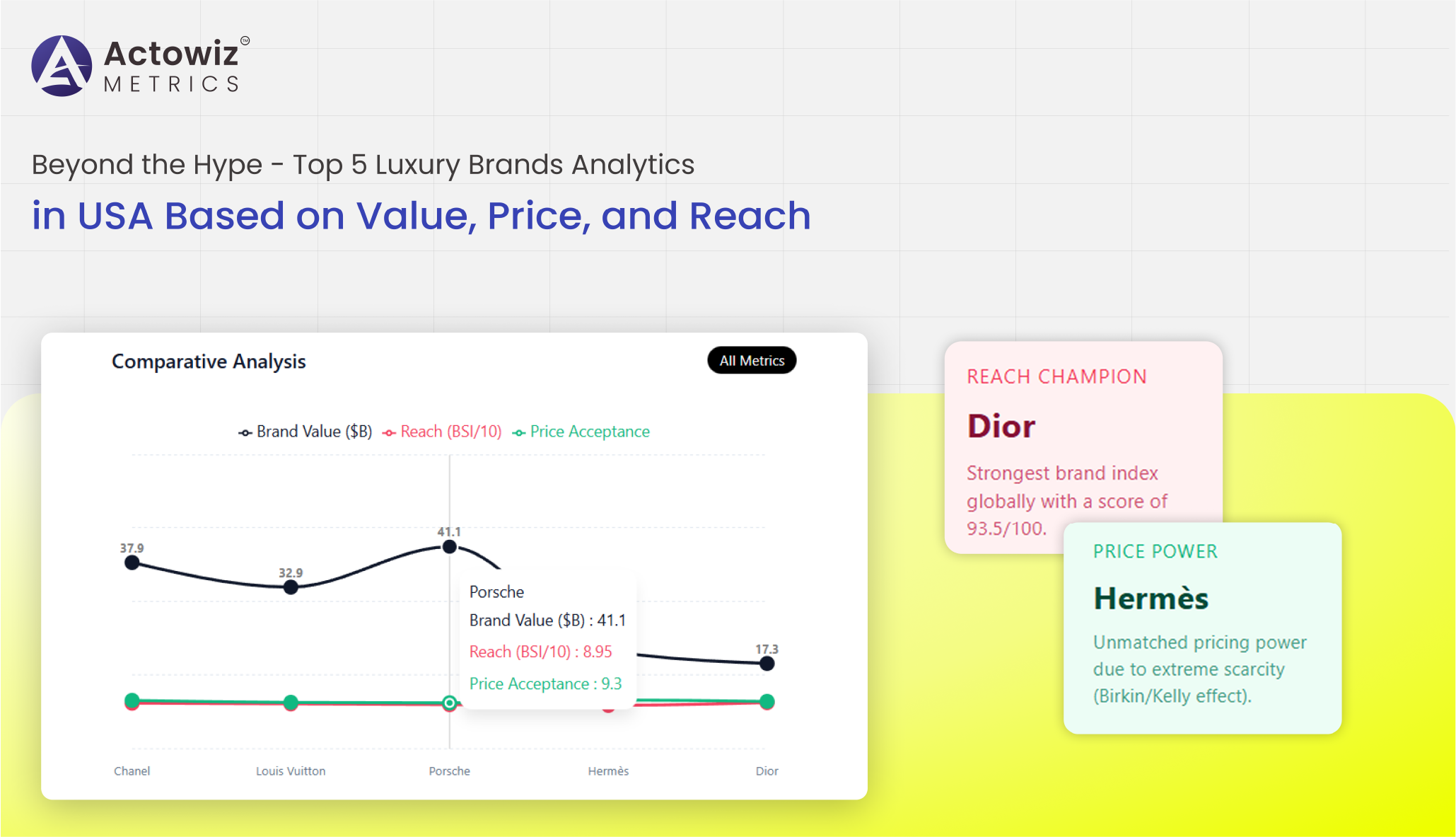

Top 5 Luxury Brands Analytics in USA delivering advanced market insights, consumer trends, and performance intelligence to drive premium brand growth.

Price Elasticity Analytics of Sleepy Owl Coffee Products revealing demand sensitivity, pricing impact, and revenue optimization insights across channels.

Explore Luxury vs Smartwatch - Global Price Comparison 2025 to compare prices of luxury watches and smartwatches using marketplace data to reveal key trends and shifts.

E-Commerce Price Benchmarking: Gucci vs Prada reveals 2025 pricing trends for luxury handbags and accessories, helping brands track competitors and optimize pricing.

Discover how menu data scraping uncovers trending dishes in 2025, revealing popular recipes, pricing trends, and real-time restaurant insights for food businesses.

Explore the Amazon Baby Care Report analyzing Top Baby Brands Analysis on Amazon, covering discounts, availability, and popular products with data-driven market insights.

Amazon Sports & Outdoors Report - Sports & Outdoors Top Brands Analysis on Amazon - Prices, Discounts, Reviews

Enabled a USA pet brand to optimize pricing, inventory, and offers on Amazon using Pet Supplies Top Brands Analysis on Amazon for accurate, data-driven decisions.

Whatever your project size is, we will handle it well with all the standards fulfilled! We are here to give 100% satisfaction.

Any analytics feature you need — we provide it

24/7 global support

Real-time analytics dashboard

Full data transparency at every stage

Customized solutions to achieve your data analysis goals