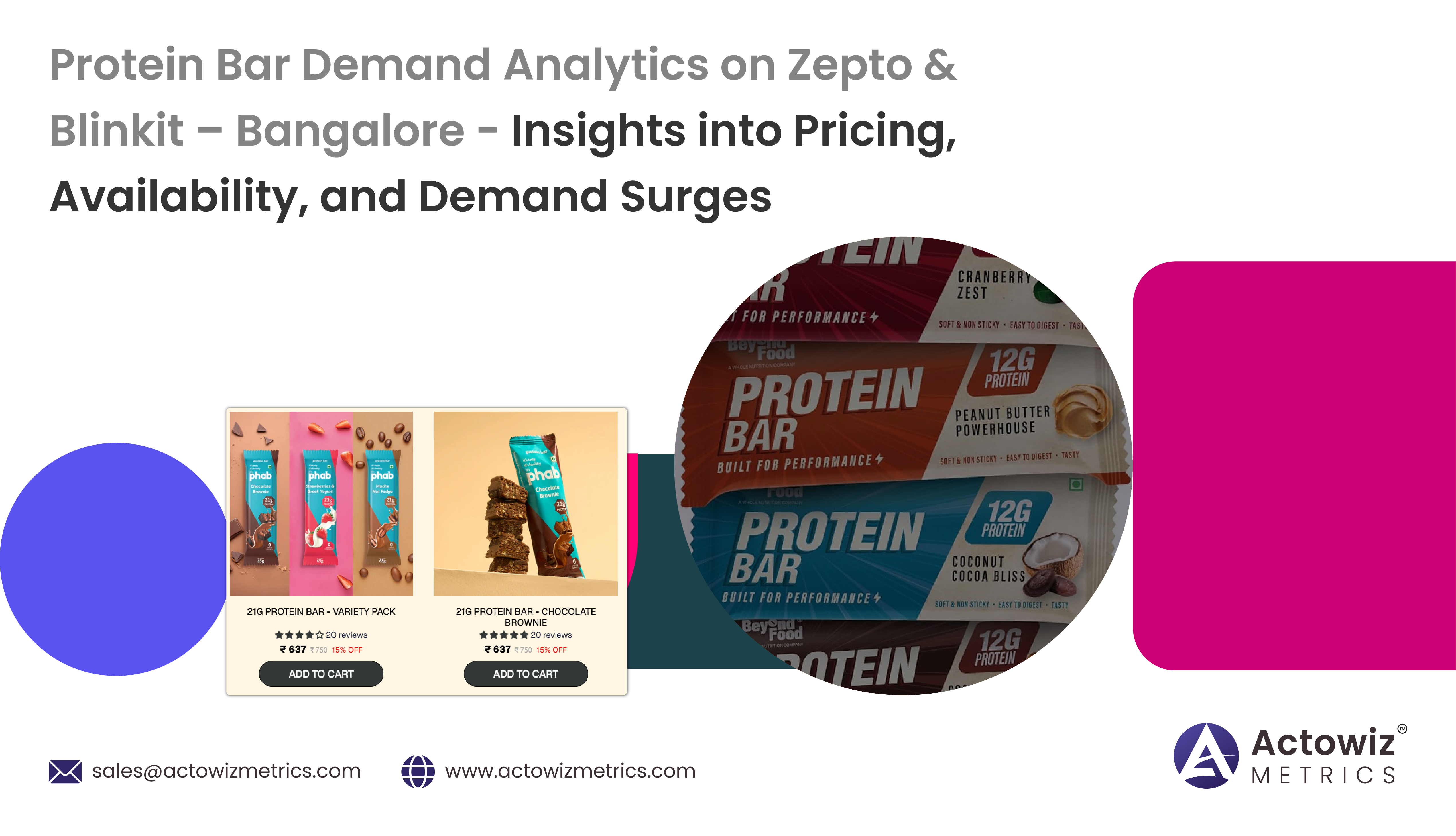

Protein Bar Demand Analytics on Zepto & Blinkit – Bangalore

Pringles Food Data Analytics 2026 reveals how data-driven insights improve pricing, demand forecasting, and supply chain efficiency in a dynamic snack market.

The global chocolate market has witnessed significant transformations over the last five years, with premium brands such as Lindt leading the evolution in consumer preferences. The Lindt Chocolate Consumer Preference Analysis focuses on understanding these shifts, examining flavor trends, seasonal demand, SKU performance, and purchasing behavior across key international markets.

Using advanced tools for Grocery Analytics and Food Analytics, Actowiz Metrics has consolidated data spanning 2020–2025 to provide actionable insights into global consumption patterns. The study integrates both structured datasets and unstructured feedback from reviews, social media, and e-commerce platforms to create a comprehensive view of the Lindt chocolate market.

Trends reveal that premium dark chocolate consumption has grown by 35% globally, while milk chocolate retains strong regional loyalty in North America and Europe. By Scraping Lindt Chocolate Consumer Trends Data, businesses can identify top-performing flavors, track changing purchasing behavior, and anticipate seasonal spikes in demand. The report also highlights SKU-level insights, enabling retailers to optimize inventory and marketing strategies.

The Lindt Chocolate Consumer Preference Analysis serves as a critical resource for chocolate manufacturers, retailers, and marketers to align offerings with consumer expectations, optimize sales strategies, and improve product visibility across global markets.

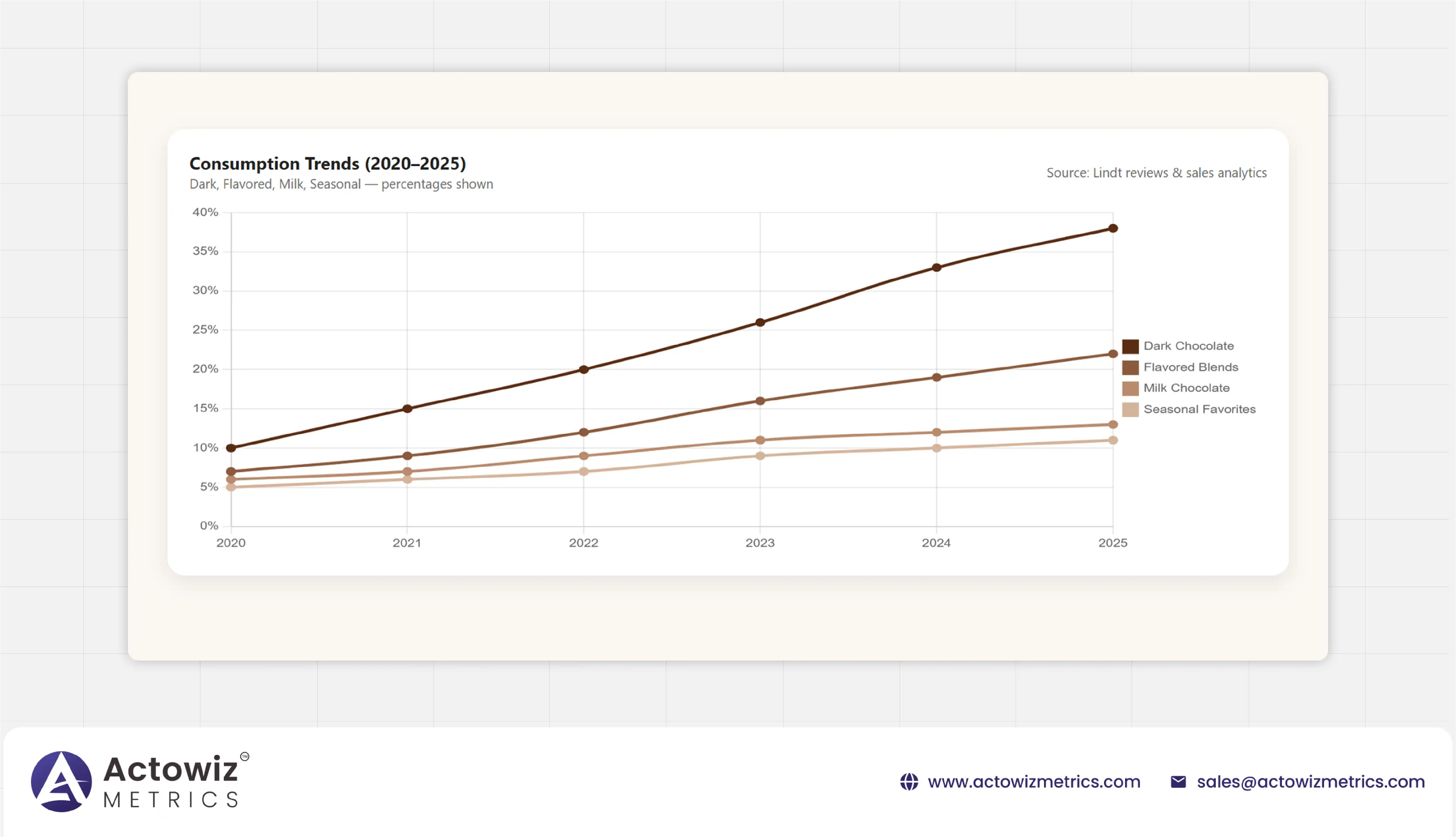

Analyzing flavor preferences has become a cornerstone of understanding the Lindt chocolate market. Using Lindt chocolate flavor Trend analytics, we tracked consumption patterns across North America, Europe, and Asia-Pacific from 2020–2025. Dark chocolate variants have shown the most significant growth, rising from 28% of global purchases in 2020 to 38% in 2025, representing a 35% increase in premium chocolate demand.

Milk chocolate remains dominant in the Americas, accounting for 40% of purchases in 2025, but shows slower growth (6% YoY) compared to dark chocolate. Seasonal flavors, such as hazelnut, caramel, and limited-edition holiday editions, drive short-term spikes in demand, particularly in Europe and Asia, where weekly sales during festive periods increased by 12–15%.

| Region | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|---|

| North America (Dark) | 25% | 27% | 30% | 33% | 36% | 38% |

| Europe (Hazelnut) | 15% | 16% | 18% | 19% | 21% | 22% |

| Asia-Pacific (Caramel) | 10% | 12% | 14% | 16% | 18% | 20% |

Insights reveal that retailers who optimize shelf space for dark chocolate and seasonal flavors see up to 12% higher revenue per SKU. By monitoring Lindt chocolate purchase trend analytics, businesses can anticipate shifts in consumer taste, prioritize high-demand products, and adjust marketing campaigns accordingly.

Top-performing products directly influence overall revenue. Using Lindt Best Selling SKU data Analytics, the study tracked SKU performance from 2020–2025, identifying consistent best-sellers such as Lindt Excellence 70% Cocoa and Lindt LINDOR Milk Chocolate Truffles. These SKUs accounted for 45–50% of total sales in premium chocolate segments globally in 2025.

Sales data shows that premium dark chocolate SKUs experienced an average annual growth of 7–9%, while seasonal SKUs such as Lindt LINDOR limited editions spiked 15%–18% during holiday periods. Tracking Lindt chocolate seasonal demand is critical for inventory management and marketing, enabling companies to prevent stockouts and capitalize on peak purchasing periods.

Retailers leveraging SKU-level insights saw inventory turnover improve by 8–10%, while average revenue per SKU increased by 5–7%. Scrape Lindt Chocolate Consumer Trends Data provides granular insights into SKU-specific popularity across markets, revealing which flavors resonate with local consumers.

Market segmentation analysis indicates that European consumers prefer hazelnut-based products, whereas Asia-Pacific markets increasingly favor caramel and dark chocolate blends. In North America, milk chocolate truffles maintain high loyalty, but growth opportunities exist in premium dark chocolate offerings.

By integrating SKU performance data with Lindt Chocolate Consumer Preference Analysis, businesses can develop targeted campaigns, optimize inventory allocation across regions, and forecast seasonal spikes with greater accuracy.

Global consumption patterns show significant variation across regions. Using Lindt Chocolate Consumption Trends Analytics, Actowiz Metrics observed that dark chocolate demand is strongest in Europe and North America, whereas Asia-Pacific shows rising interest in flavored blends and premium milk chocolates.

| Region | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|---|

| North America | 30% | 32% | 34% | 36% | 38% | 40% |

| Europe | 35% | 36% | 38% | 39% | 40% | 42% |

| Asia-Pacific | 15% | 18% | 20% | 22% | 25% | 28% |

Weekly and monthly consumption spikes correspond with holidays and festivals. Lindt chocolate purchase trend analytics reveals that Easter and Christmas drive a 12–15% increase in sales, while Valentine’s Day contributes an additional 8–10% lift. Understanding these regional nuances allows companies to allocate inventory efficiently and target promotional campaigns.

Consumer behavior studies also indicate increased preference for single-serve packaging and gifting sets in Asia-Pacific, while bulk packs remain popular in Europe and North America. Retailers incorporating these insights into merchandising strategies achieved 5–8% higher revenue per store in 2025.

Customer sentiment and product reviews are critical for understanding purchase decisions. Lindt chocolate reviews Analysis Tools were used to extract feedback from e-commerce platforms, social media, and survey data between 2020–2025. Positive sentiment for dark chocolate has increased by 10%, while flavored variants saw a 6–8% rise in positive reviews over five years.

Review analytics indicate that consumers increasingly value cocoa percentage transparency, ethical sourcing, and premium packaging. Advanced methodologies applied to chocolate reviews reveal recurring praise for Lindt’s smooth texture, flavor consistency, and seasonal variety. Negative feedback largely centers on stock availability during peak demand periods, highlighting the importance of Tracking Lindt chocolate seasonal demand.

Integrating review sentiment with sales data allows retailers to predict potential demand spikes. Products with high positive sentiment typically outperform other SKUs by 7–10%, demonstrating the ROI of monitoring consumer feedback alongside purchasing trends.

Seasonal demand plays a key role in revenue optimization. Tracking Lindt chocolate seasonal demand shows that Easter, Christmas, and Valentine’s Day account for nearly 30–35% of annual sales in premium chocolate segments. Data between 2020–2025 reveals that weekly sales during holiday campaigns increased by 12–18%, with limited edition flavors driving additional 5–7% growth.

Using Lindt chocolate flavor Trend analytics, Actowiz Metrics identified emerging trends such as hazelnut pralines in Europe and dark caramel blends in Asia-Pacific, informing promotional strategy. Retailers adopting these insights saw 10–12% higher conversion rates for holiday-focused campaigns.

Combining seasonal insights with Lindt Best Selling SKU data Analytics ensures that high-demand SKUs are prioritized in marketing campaigns and supply chain planning. Brands using these analytics improved stock allocation efficiency by 8–10%, minimizing lost sales due to stockouts.

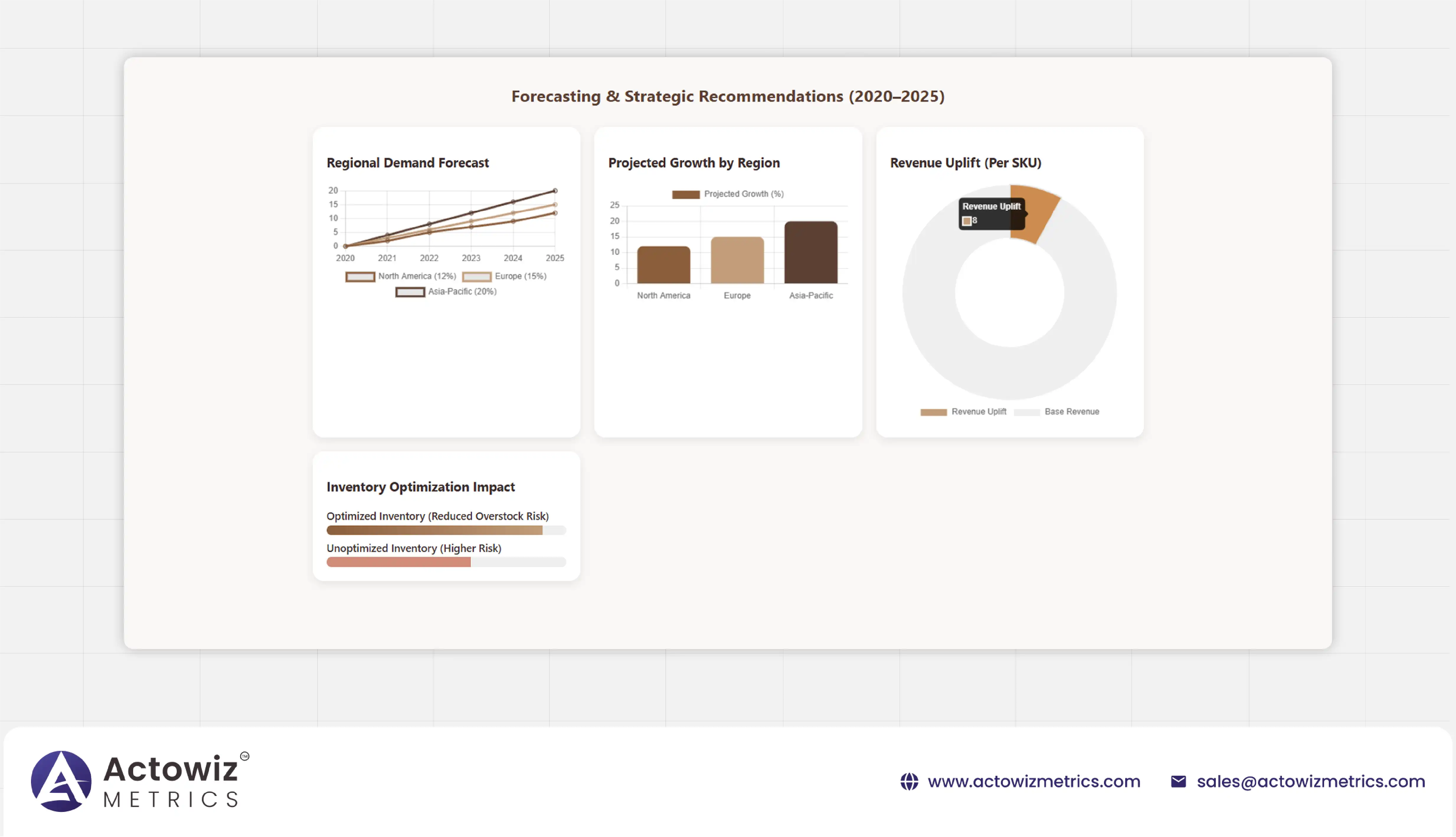

Predictive analytics is crucial for aligning product offerings with evolving consumer preferences. Using Lindt Chocolate Consumer Preference Analysis, businesses can forecast SKU demand, optimize inventory, and plan flavor rotations. By integrating Grocery Analytics and Food Analytics, retailers can model potential revenue growth and determine which products to promote in each region.

Data shows that dark chocolate demand is expected to rise by 12% in North America and 15% in Europe by 2025, while Asia-Pacific premium flavored chocolates are projected to grow 20%. Retailers leveraging these insights can preemptively adjust supply chain strategies, optimize promotions, and reduce overstock risks.

Seasonal forecasting combined with review sentiment analysis allows brands to anticipate consumer needs, plan limited-edition releases, and improve customer satisfaction. Early adoption of these insights leads to 5–10% higher revenue per SKU and increased market share.

Actowiz Metrics provides comprehensive solutions for analyzing Lindt Chocolate Consumer Preference Analysis at a global scale. Using advanced scraping tools and analytics platforms, businesses can track SKU performance, flavor trends, seasonal demand, and customer sentiment in real-time.

By leveraging Scrape Lindt Chocolate Consumer Trends Data, Actowiz Metrics enables retailers to optimize inventory allocation, plan promotional campaigns, and forecast seasonal spikes. Insights from Lindt chocolate purchase trend analytics and Lindt Chocolate Consumption Trends Analytics help brands make data-driven decisions to maximize revenue.

The Lindt Chocolate Consumer Preference Analysis highlights a 35% global increase in premium chocolate demand, underscoring the importance of data-driven decision-making. Flavor trends, SKU performance, seasonal demand, and consumer sentiment all influence purchasing behavior across regions.

Retailers leveraging Lindt chocolate flavor Trend analytics, Lindt chocolate reviews Analysis Tools, and predictive forecasting are better positioned to meet consumer expectations, optimize promotions, and increase revenue. Insights from Tracking Lindt chocolate seasonal demand allow proactive inventory management, ensuring top-selling SKUs are available when demand peaks.

Actowiz Metrics empowers chocolate brands and retailers with actionable analytics, combining Grocery Analytics and Food Analytics to provide a comprehensive understanding of market trends. By using Scrape Lindt Chocolate Consumer Trends Data and other advanced tools, businesses can anticipate shifts, plan campaigns, and enhance customer satisfaction.

Unlock actionable insights and stay ahead in the premium chocolate market with Actowiz Metrics – transform your strategy today!

Live Data Tracking Dashboard for Keeta Food Delivery App enables real-time order, pricing, and restaurant insights to optimize performance and decisions.

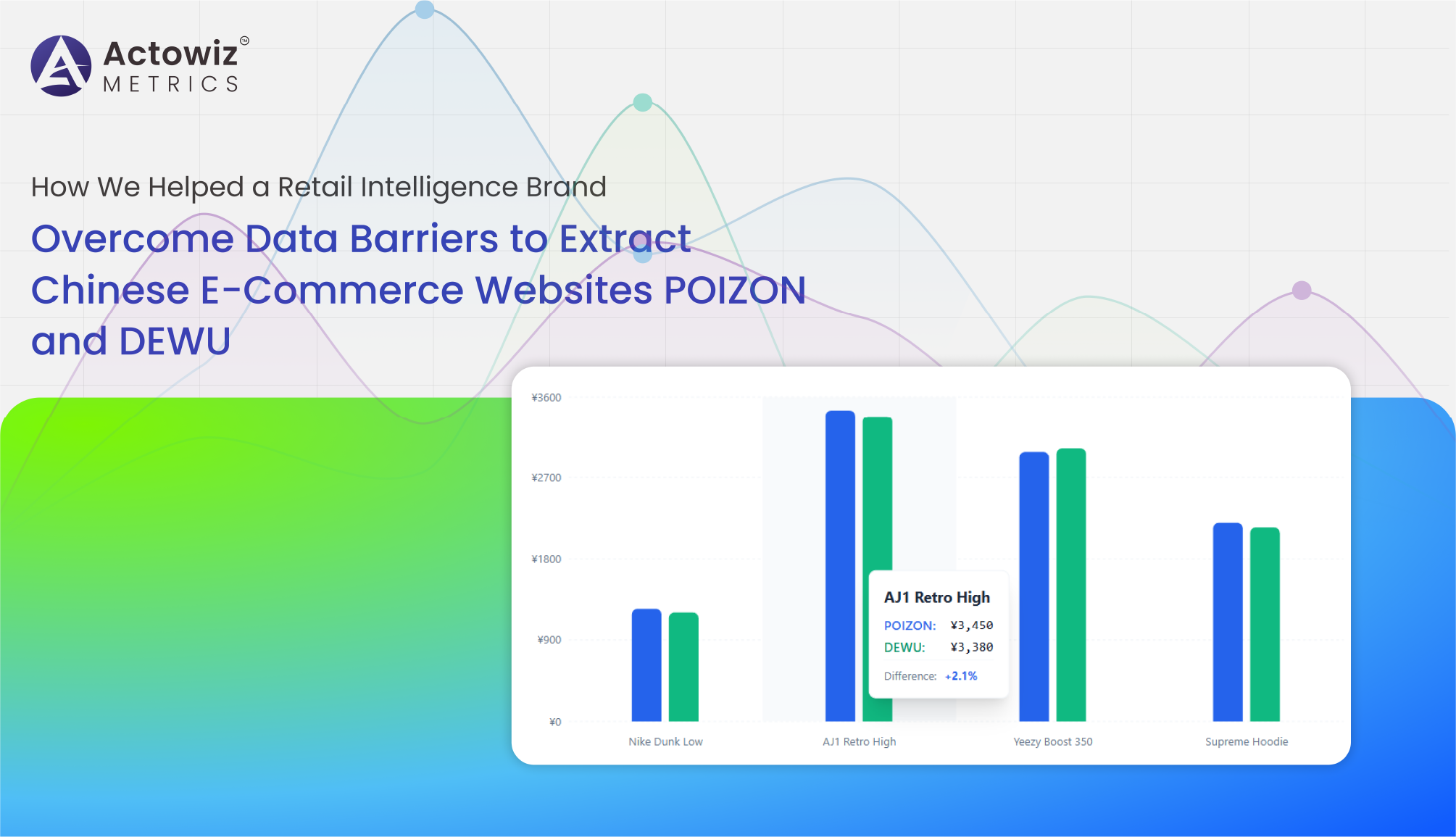

Explore NowHow We Helped a Retail Intelligence Brand Overcome Data Barriers to Extract Chinese E-Commerce Websites POIZON and DEWU for real-time pricing and market insights.

Explore Now

Price Changes Data Monitoring For Amazon & OnBuy UK enables real-time tracking of price movements to optimize promotions, protect margins, and improve pricing decisions.

Explore Now

Browse expert blogs, case studies, reports, and infographics for quick, data-driven insights across industries.

Pringles Food Data Analytics 2026 reveals how data-driven insights improve pricing, demand forecasting, and supply chain efficiency in a dynamic snack market.

KitKat Flavor and Product Trend Data Analysis uncovers consumer flavor preferences, product performance, and innovation trends across key markets.

Gain insights with Size-Level Availability & Demand Data Analytics for Apparel & Accessories to optimize inventory, track trends, and boost sales performance.

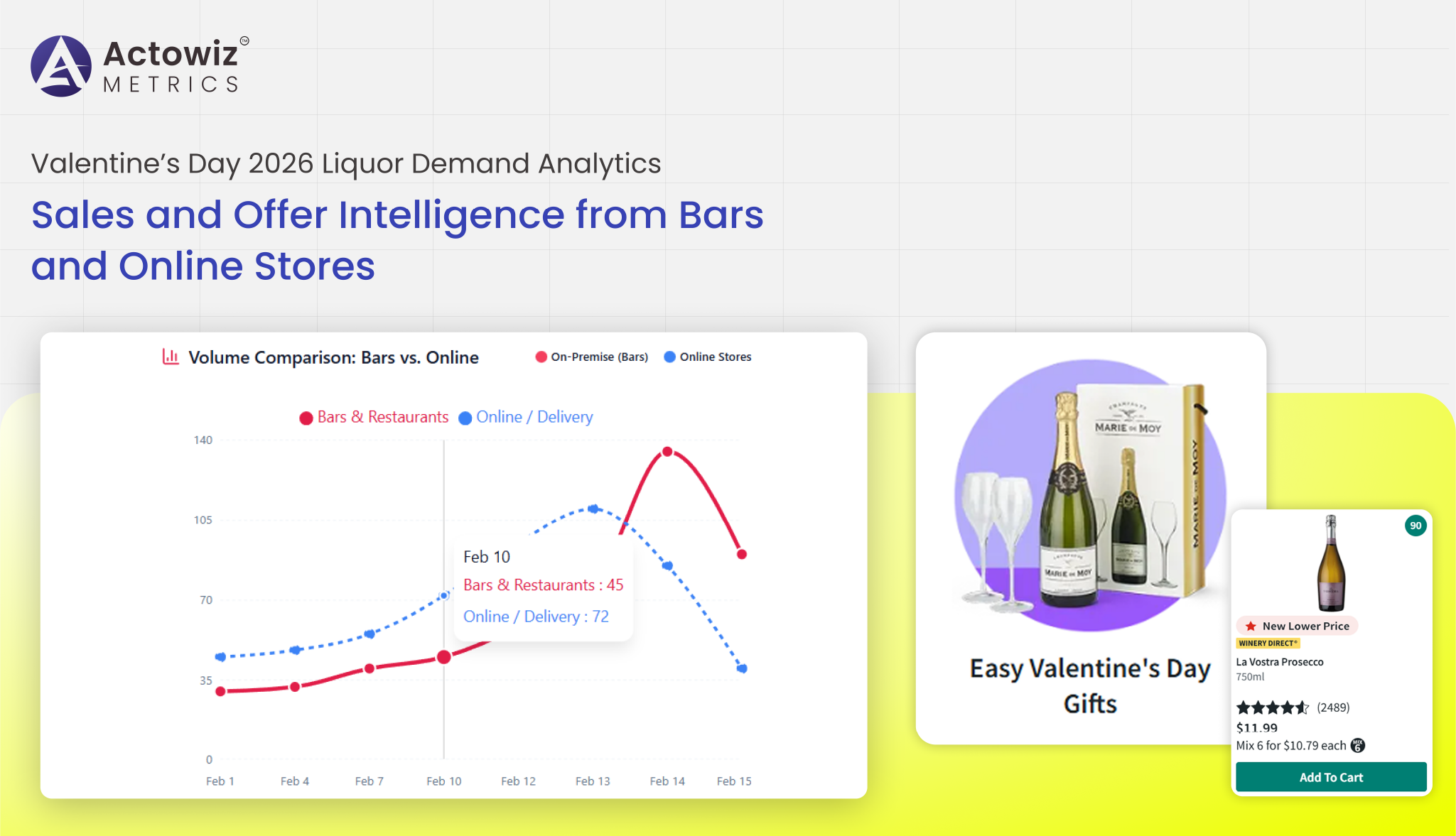

Valentine’s Day 2026 Liquor Demand Analytics highlight growing demand for premium wines, craft spirits, and curated alcohol gifting trends worldwide.

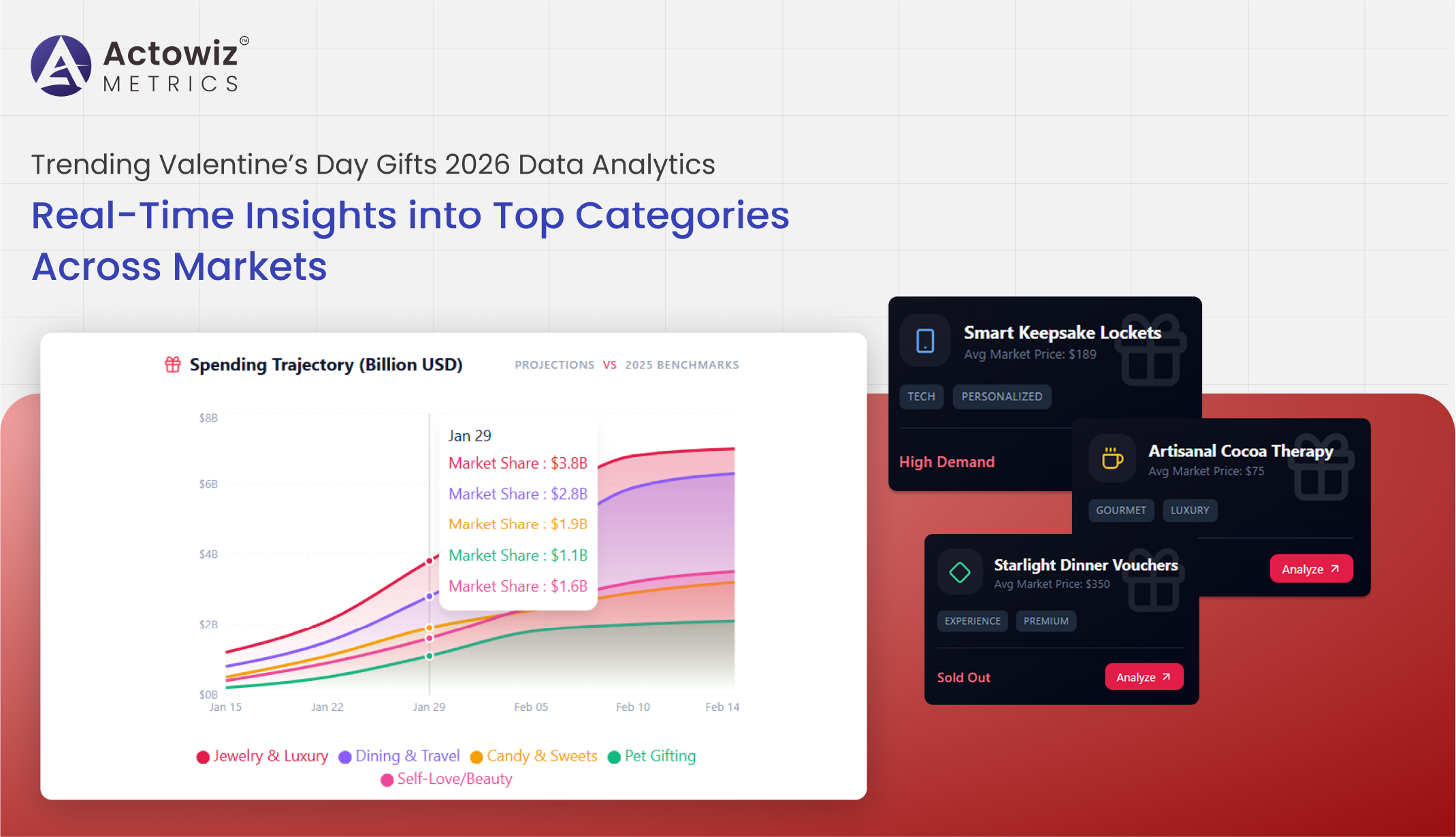

Analyze top-selling items with Trending Valentine’s Day Gifts 2026 Data Analytics to track demand, optimize inventory, and boost e-commerce sales.

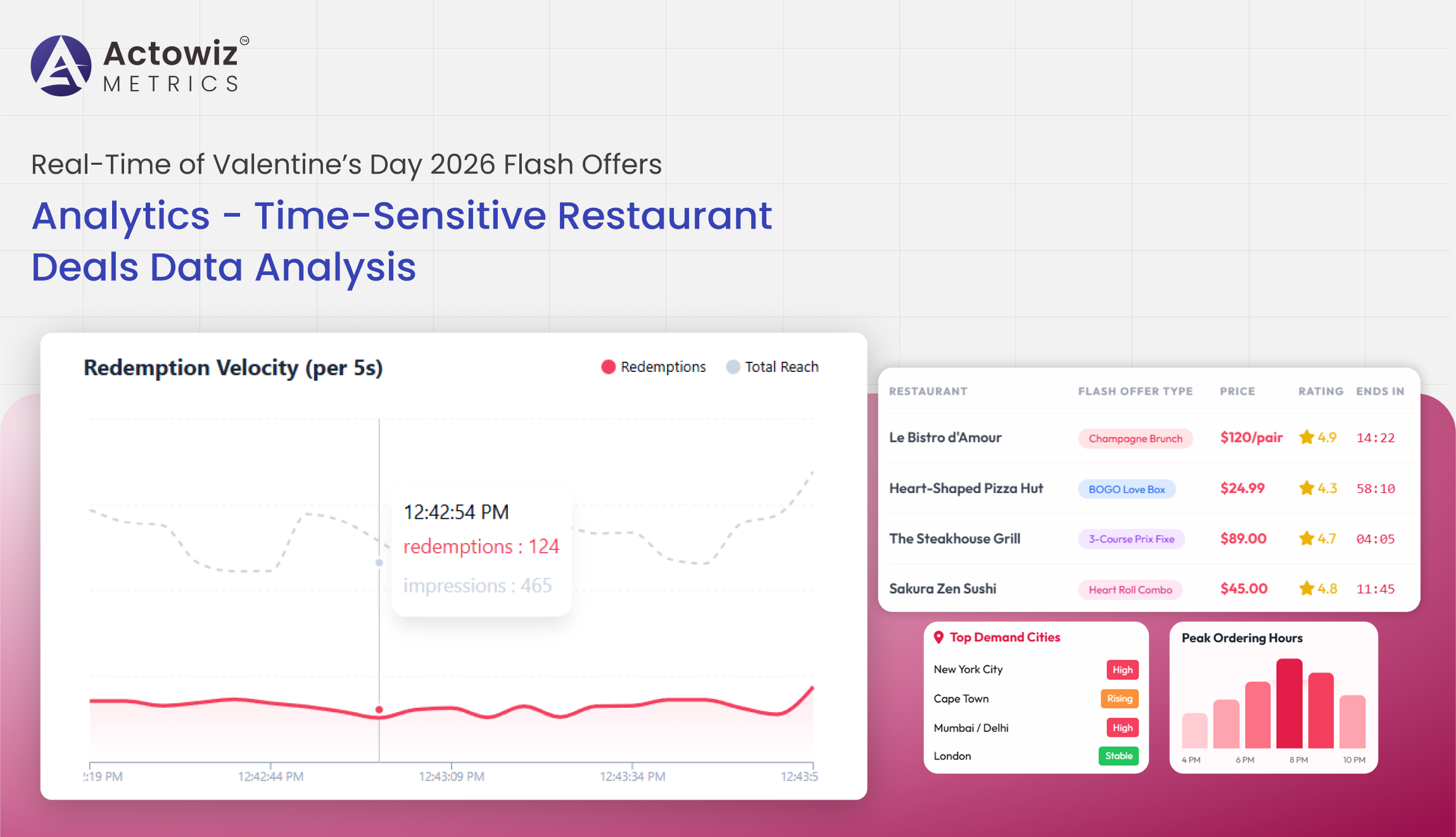

Real-Time of Valentine’s Day 2026 Flash Offers Analytics delivers instant insights on discounts, pricing trends, and offer performance across platforms.

Explore Luxury vs Smartwatch - Global Price Comparison 2025 to compare prices of luxury watches and smartwatches using marketplace data to reveal key trends and shifts.

E-Commerce Price Benchmarking: Gucci vs Prada reveals 2025 pricing trends for luxury handbags and accessories, helping brands track competitors and optimize pricing.

Discover how menu data scraping uncovers trending dishes in 2025, revealing popular recipes, pricing trends, and real-time restaurant insights for food businesses.

Explore the Amazon Baby Care Report analyzing Top Baby Brands Analysis on Amazon, covering discounts, availability, and popular products with data-driven market insights.

Amazon Sports & Outdoors Report - Sports & Outdoors Top Brands Analysis on Amazon - Prices, Discounts, Reviews

Enabled a USA pet brand to optimize pricing, inventory, and offers on Amazon using Pet Supplies Top Brands Analysis on Amazon for accurate, data-driven decisions.

Whatever your project size is, we will handle it well with all the standards fulfilled! We are here to give 100% satisfaction.

Any analytics feature you need — we provide it

24/7 global support

Real-time analytics dashboard

Full data transparency at every stage

Customized solutions to achieve your data analysis goals