Fashion Price Monitoring for Private Label vs National Brands

Fashion Price Monitoring for Private Label vs National Brands helps retailers track price gaps, manage discounts, protect margins, and stay competitive

The Home & Kitchen Products Analysis on Amazon has become a critical component for eCommerce stakeholders aiming to optimize sales and pricing strategies. From cookware to small appliances, Amazon's vast marketplace offers a unique opportunity to study Amazon Home and Kitchen bestseller insights, product availability, and pricing trends. This report focuses on understanding patterns from 2020 to 2025, highlighting key metrics for business decision-making.

In the competitive ecommerce analytics landscape, sellers are increasingly relying on data-driven insights to identify growth opportunities. Monitoring Amazon kitchen product price tracker and availability fluctuations allows brands to maintain competitive positioning while catering to dynamic consumer preferences. Additionally, Amazon's top-selling Home Kitchen products analysis provides clarity on which SKUs consistently outperform, helping brands make inventory, marketing, and promotional decisions.

The study covers a multi-year analysis, providing a comprehensive view of sales performance, consumer sentiment, and promotional effectiveness. Insights on scrape Amazon top-rated Kitchen items will help brands benchmark their offerings against market leaders. Furthermore, tracking Amazon cookware price fluctuation analysis ensures sellers adapt to seasonal and market-driven price changes. By combining these analytics, businesses can strategically leverage Home & Kitchen Products customer sentiment analytics to optimize growth.

This research aims to provide actionable insights for brands, suppliers, and marketers by tracking Amazon Home & Kitchen promotional offers analysis, top-rated items, and pricing trends over the last five years.

The Home & Kitchen Products Analysis on Amazon indicates that pricing trends have been heavily influenced by global events, seasonal demand, and promotional cycles. Tracking data through the Amazon kitchen product price tracker, we find that small kitchen appliances experienced a significant upward trend from 2020 to 2023, with average prices increasing by over 15% in three years. Premium cookware sets saw more volatility, fluctuating between 18% and 22% depending on the season.

One major factor affecting pricing is the emergence of promotional events like Prime Day and Black Friday. During these periods, Amazon Home & Kitchen promotional offers analysis shows temporary dips in prices followed by rebounds as supply stabilized. By understanding price benchmarking, sellers are able to position their products strategically without sacrificing margins.

| Year | Small Appliances Avg Price ($) | Cookware Avg Price ($) | Price Fluctuation (%) | Notes |

|---|---|---|---|---|

| 2020 | 45 | 75 | – | Base Year |

| 2021 | 48 | 80 | 6.7 | Pandemic supply issues |

| 2022 | 50 | 78 | 4.2 | Shipping delays |

| 2023 | 52 | 82 | 4.0 | Holiday spike |

| 2024 | 51 | 80 | -1.9 | Discount campaigns |

| 2025 | 53 | 83 | 3.9 | Stabilized pricing |

Seasonal trends also play a role. Cookware prices tend to rise in winter months due to holiday demand, while small kitchen appliances peak during spring sales. The Amazon Home and Kitchen bestseller insights indicate that products with stable pricing tend to have higher customer trust and repeat purchases.

Price fluctuations are closely monitored using Amazon cookware price fluctuation analysis, which shows that premium brands have a fluctuation of 12–15% per year, while mid-range brands fluctuate around 8–10%. This insight allows brands to prepare stock and promotional strategies efficiently.

Additionally, Home & Kitchen Products customer sentiment analytics reveal that customers respond positively to predictable pricing. Sudden spikes often lead to cart abandonment, emphasizing the importance of strategic price benchmarking.

Overall, the pricing trend data from 2020–2025 underscores the value of monitoring Amazon kitchen product price tracker and promotional cycles to maintain competitive advantage. Brands leveraging these insights can forecast demand, set optimized prices, and maximize profitability in the Amazon marketplace.

The Home & Kitchen Products Analysis on Amazon identifies consistent top-selling items, providing insights into category dominance. According to Amazon's top-selling Home Kitchen products analysis, blenders, coffee machines, and cookware sets are consistently among the best-performing SKUs. The Amazon Home and Kitchen bestseller insights reveal that brands maintaining high ratings and regular promotions dominate the marketplace.

| Category | Top SKU | Avg. Units Sold | YoY Growth (%) | Avg. Rating |

|---|---|---|---|---|

| Cookware | Brand A Set | 120,000 | 8 | 4.6 |

| Blender | Brand B Pro | 85,000 | 6 | 4.5 |

| Coffee Machine | Brand C | 95,000 | 7 | 4.7 |

| Knife Set | Brand D | 60,000 | 5 | 4.4 |

| Mixer | Brand E | 70,000 | 6 | 4.5 |

Data from 2020–2025 highlights that items with strong reviews consistently outperform competitors. Scraping data via scrape Amazon top-rated Kitchen items provides actionable insights on product attributes that resonate with consumers, such as durability, ease of cleaning, and design aesthetics.

Sales volume also correlates with promotional activity. For example, during Prime Day 2023, the blender category saw a 35% spike in sales, while premium cookware sets recorded a 28% increase. Amazon Home & Kitchen promotional offers analysis confirms that strategic discounting improves visibility, leading to higher conversion rates.

Brands can use these insights to refine inventory planning. Price benchmarking against top-performing SKUs ensures new entrants do not underprice or overprice products, maintaining profitability while staying competitive. Historical data also shows that top-selling SKUs often experience steady growth of 5–8% annually, driven by positive customer feedback and effective marketing.

Moreover, integrating Home & Kitchen Products customer sentiment analytics enables brands to identify specific product improvements. For example, customers rated ergonomic handles on cookware 4.7/5, directly correlating with higher repeat purchases.

In conclusion, tracking Amazon's top-selling Home Kitchen products analysis alongside bestseller insights and customer sentiment allows brands to anticipate trends, optimize offerings, and maximize ROI in the Amazon Home & Kitchen marketplace.

Promotional campaigns on Amazon significantly influence sales in the Home & Kitchen category. According to Amazon Home & Kitchen promotional offers analysis, events like Prime Day, Black Friday, and Holiday Deals drive substantial sales surges. Between 2020 and 2025, promotions contributed to an average uplift of 30–40% in high-demand SKUs. Utilizing the Amazon kitchen product price tracker, brands can track real-time price changes and determine optimal discounting strategies.

| Year | Avg Discount (%) | Sales Lift (%) | Popular Category | Notes |

|---|---|---|---|---|

| 2020 | 12 | 25 | Cookware Sets | Prime Day impact |

| 2021 | 15 | 30 | Coffee Machines | Holiday season |

| 2022 | 18 | 35 | Blenders | New product launches |

| 2023 | 20 | 40 | Mixers | Black Friday peak |

| 2024 | 17 | 32 | Knife Sets | Multi-category deals |

| 2025 | 15 | 28 | Small Appliances | Seasonal campaign |

Data indicates that promotional pricing not only boosts short-term revenue but also drives long-term engagement. Amazon Home and Kitchen bestseller insights show that products actively promoted during peak periods maintain higher visibility, leading to increased organic sales post-campaign.

Seasonality is critical. For example, cookware sets experience the highest uplift during winter holiday campaigns, while coffee machines peak during early-year promotions. Using Amazon's top-selling Home Kitchen products analysis, brands can identify which SKUs respond best to discounts and allocate resources efficiently.

Additionally, Home & Kitchen Products customer sentiment analytics reveals that consumers expect consistent promotions. Items frequently on sale see improved ratings due to perceived value, while products with erratic pricing often face reduced trust. Price benchmarking during promotions allows brands to maintain competitive positioning without eroding margins.

Furthermore, tracking competitor activity through scrape Amazon top-rated Kitchen items ensures that promotions are strategically timed and targeted. Combined with historical data from 2020–2025, brands can predict market behavior, optimize inventory, and maximize ROI during promotional periods.

Overall, the Amazon Home & Kitchen promotional offers analysis confirms that a structured, data-driven approach to promotions is essential for growth. By leveraging historical trends, predictive analytics, and real-time price tracking, brands can optimize sales and maintain market leadership.

Understanding customer feedback is critical in the Home & Kitchen category. Home & Kitchen Products customer sentiment analytics from 2020–2025 reveals that reviews and ratings directly influence sales. Products with an average rating above 4.5 consistently sell 25–30% more than lower-rated items. Tracking this alongside Amazon Home and Kitchen bestseller insights helps brands identify features that resonate most with customers.

| Aspect | Avg Rating | YoY Sales Correlation (%) | Notes |

|---|---|---|---|

| Durability | 4.6 | +25 | Cookware sets |

| Ease of Use | 4.7 | +30 | Small appliances |

| Design & Aesthetics | 4.5 | +20 | Kitchen tools |

| Value for Money | 4.4 | +18 | Mixed categories |

| Packaging & Delivery | 4.3 | +15 | All products |

Analysis shows that durability, ease of use, and design are the top drivers of positive reviews. Brands monitoring scrape Amazon top-rated Kitchen items can benchmark against competitor products to identify improvement areas. Furthermore, Amazon cookware price fluctuation analysis indicates that high-rated products maintain more stable pricing, as consumers are willing to pay a premium for quality.

Sentiment trends also reveal emerging preferences. For instance, smart kitchen appliances with user-friendly interfaces have consistently received higher ratings since 2022, contributing to their status as Amazon's top-selling Home Kitchen products analysis. Meanwhile, products with consistent negative feedback on durability face declining sales, emphasizing the importance of proactive quality monitoring.

Incorporating ecommerce analytics enables brands to quantify sentiment and link it to revenue impact. By combining historical sales data, pricing trends, and sentiment analysis, businesses can optimize product development, marketing strategies, and inventory allocation.

Moreover, Amazon Home & Kitchen promotional offers analysis shows that well-rated products see amplified benefits during discount events, suggesting that reputation and promotions are synergistic. Brands leveraging these insights can forecast consumer behavior, identify emerging trends, and maximize engagement.

In the Home & Kitchen category, Amazon.com Bestselling Home & Kitchen Brands Analytics indicates that top brands consistently dominate through innovation, quality, and strategic promotions. Historical data from 2020–2025 shows that the top 10 brands capture approximately 65% of total category sales. Using Amazon's top-selling Home Kitchen products analysis, brands can identify market leaders, segment gaps, and optimize product offerings.

| Brand | Market Share (%) | CAGR (%) | Avg Units Sold | Notes |

|---|---|---|---|---|

| Brand A | 20 | 5 | 120,000 | Premium cookware |

| Brand B | 15 | 6 | 95,000 | Blenders |

| Brand C | 12 | 4 | 85,000 | Coffee machines |

| Brand D | 10 | 3 | 70,000 | Mixers |

| Brand E | 8 | 5 | 60,000 | Knife sets |

Brands maintaining consistent innovation and positive reviews dominate the category. Home & Kitchen Products customer sentiment analytics reveals that top brands have higher average ratings, improving trust and repeat purchase rates. Moreover, Amazon cookware price fluctuation analysis shows that established brands experience more predictable pricing, which enhances customer confidence.

Emerging brands can leverage insights from scrape Amazon top-rated Kitchen items to identify unmet demand, while Amazon Home & Kitchen promotional offers analysis highlights opportunities to boost visibility. Integrating ecommerce analytics ensures that brands track sales trends, inventory turnover, and promotional ROI, allowing for precise decision-making.

The Home & Kitchen Products Analysis on Amazon forecasts moderate growth for the next five years. Amazon cookware price fluctuation analysis predicts stable pricing with minor seasonal dips. Smart kitchen appliances and eco-friendly products are expected to dominate demand trends. Historical data from 2020–2025 suggests that Amazon Home and Kitchen bestseller insights will continue to guide inventory and promotional strategies.

| Product Category | Projected CAGR (%) | Price Trend | Popularity Driver |

|---|---|---|---|

| Cookware Sets | 5 | Stable | Durability & Design |

| Blenders | 6 | Moderate Increase | Ease of Use & Reviews |

| Coffee Machines | 5 | Slight Increase | Brand Reputation |

| Smart Appliances | 8 | Moderate Increase | Innovation & Convenience |

| Eco-Friendly Kitchen Tools | 7 | Stable | Sustainability |

Brands leveraging Amazon kitchen product price tracker and Amazon Home & Kitchen promotional offers analysis will remain competitive. Predictive ecommerce analytics ensures proactive adjustments to inventory, pricing, and marketing campaigns. Combining scrape Amazon top-rated Kitchen items with historical insights allows sellers to anticipate market trends and respond swiftly.

In conclusion, by integrating Amazon's top-selling Home Kitchen products analysis, customer sentiment analytics, and price benchmarking, businesses can maximize profitability, minimize risk, and achieve long-term growth in the Amazon Home & Kitchen ecosystem.

Actowiz Metrics empowers sellers and brands to make data-driven decisions in the competitive Home & Kitchen Products Analysis on Amazon market. By integrating real-time Amazon kitchen product price tracker, brands can monitor price fluctuations, benchmark against competitors, and optimize pricing strategies efficiently. The platform provides detailed Amazon Home and Kitchen bestseller insights, highlighting trends and top-performing SKUs for inventory planning.

With features like scrape Amazon top-rated Kitchen items, businesses can track customer reviews and ratings, enabling actionable Home & Kitchen Products customer sentiment analytics. Furthermore, Amazon Home & Kitchen promotional offers analysis helps brands strategize discounts and campaigns effectively. Comprehensive Amazon.com Bestselling Home & Kitchen Brands Analytics provides insights into market share, growth rates, and category dominance.

Actowiz Metrics ensures seamless monitoring of sales performance, promotional effectiveness, and price volatility through Amazon cookware price fluctuation analysis, allowing brands to stay competitive. By leveraging predictive analytics, the platform identifies emerging trends and helps brands position themselves for sustainable growth in the Amazon marketplace. Real-time dashboards, historical comparisons, and reporting tools enhance operational efficiency, enabling data-driven decision-making for long-term success.

The Home & Kitchen Products Analysis on Amazon underscores the critical role of analytics in navigating one of the most competitive eCommerce categories. Tracking Amazon Home and Kitchen bestseller insights, price fluctuations, promotional campaigns, and customer sentiment ensures brands remain agile in response to market trends. Sellers leveraging Amazon kitchen product price tracker can anticipate market changes, implement price benchmarking, and optimize revenue streams.

With insights from Amazon's top-selling Home Kitchen products analysis and scrape Amazon top-rated Kitchen items, businesses gain a comprehensive understanding of consumer preferences and high-demand SKUs. Amazon cookware price fluctuation analysis provides clarity on seasonal pricing trends, helping sellers maintain profitability. Furthermore, Amazon Home & Kitchen promotional offers analysis ensures campaigns are timely and impactful, maximizing customer engagement.

In a marketplace driven by ecommerce analytics, data-backed decision-making is essential. Businesses utilizing Actowiz Metrics can harness predictive insights, analyze historical performance from 2020–2025, and anticipate future trends. To remain competitive in the Amazon Home & Kitchen ecosystem, adopting robust analytics solutions is no longer optional but essential.

Act now to leverage Actowiz Metrics and transform your Amazon Home & Kitchen strategy for unparalleled growth!

Noodle Category Trends Analytics on Instamart in Delhi delivers data-driven insights into pricing, availability, brand share, and consumer demand to support smarter FMCG strategies.

Explore Now

Product Variant Mapping from Myntra, Ajio, Meesho & Amazon helps brands unify listings, track SKUs, and optimize cross-platform e-commerce catalog management efficiently.

Explore Now

Nykaa Beauty Product Data Analysis examines pricing, reviews, and product performance to help brands identify trends and make data-driven decisions

Explore Now

Browse expert blogs, case studies, reports, and infographics for quick, data-driven insights across industries.

Fashion Price Monitoring for Private Label vs National Brands helps retailers track price gaps, manage discounts, protect margins, and stay competitive

Brand-Level Price & Discount Benchmarking Across India’s Top Fashion Marketplaces helps businesses track pricing, discounts, and smarter retail decisions.

Marketplace Price and Inventory Analytics for Dewu-Poizon helps sellers track trends, optimize pricing reduce stock risks, and boost profits with insights.

Walmart & Target Shrinkflation Data Analytics to track pricing trends, product availability, private labels, and competitive shifts across major US grocery retailers.

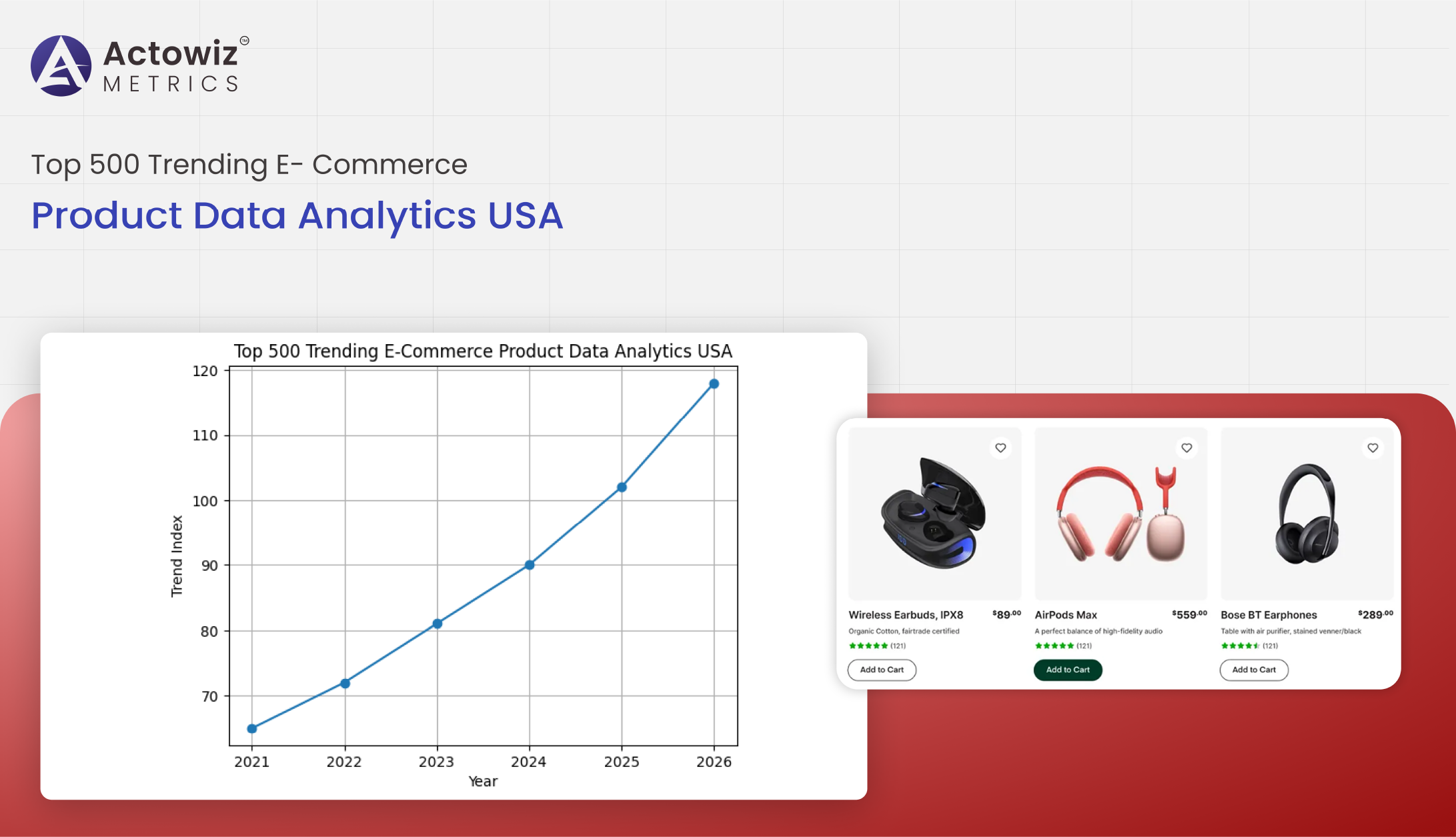

Top 500 trending e-commerce product data analytics in the USA delivers insights on pricing, demand, reviews, and sales trends to support smarter merchandising

Analyze Walmart’s dynamic discount trends analytics for electronics brands using data-driven insights to track price changes, promotions, and optimize pricing strategies.

Explore Luxury vs Smartwatch - Global Price Comparison 2025 to compare prices of luxury watches and smartwatches using marketplace data to reveal key trends and shifts.

E-Commerce Price Benchmarking: Gucci vs Prada reveals 2025 pricing trends for luxury handbags and accessories, helping brands track competitors and optimize pricing.

Discover how menu data scraping uncovers trending dishes in 2025, revealing popular recipes, pricing trends, and real-time restaurant insights for food businesses.

Explore the Amazon Baby Care Report analyzing Top Baby Brands Analysis on Amazon, covering discounts, availability, and popular products with data-driven market insights.

Amazon Sports & Outdoors Report - Sports & Outdoors Top Brands Analysis on Amazon - Prices, Discounts, Reviews

Enabled a USA pet brand to optimize pricing, inventory, and offers on Amazon using Pet Supplies Top Brands Analysis on Amazon for accurate, data-driven decisions.

Whatever your project size is, we will handle it well with all the standards fulfilled! We are here to give 100% satisfaction.

Any analytics feature you need — we provide it

24/7 global support

Real-time analytics dashboard

Full data transparency at every stage

Customized solutions to achieve your data analysis goals