Woolworths.com.au Data Tracking

How Woolworths.com.au Data Tracking helps monitor pricing shifts, stock levels, and promotions to improve retail visibility and decision-making.

French retailers operate in a fast-moving, margin-tight environment where on-shelf availability can make—or break—customer loyalty. In recent years, supply chain shocks (COVID-19 in 2020, microchip and logistics bottlenecks in 2021–2022, inflationary pressures 2022–2024) and the acceleration of omnichannel shopping have exposed weaknesses in traditional inventory practices. Retailers in France have responded by deploying data-driven approaches that shift decisions from reactive restocking to proactive prediction. Across grocery, pharmacy, and specialty stores, analytics that combine point-of-sale (POS) data, supplier ETAs, warehouse levels, and online demand signals now drive replenishment, promotions, and shelf execution. These tools don’t just reduce lost sales — they improve customer trust and reduce waste from poor transfers and over-ordering.

In this post we unpack practical, proven ways French retailers reduce stockouts and raise on-shelf availability using analytics. We’ll look at six problem-solving strategies (each with 2020–2025 trend points and a simple table), show where analytics delivers measurable ROI, and explain exactly how Actowiz Metrics helps retailers make those capabilities operational at scale. Throughout you’ll see the central role of Data Analytics to Reduce Stockouts in modern retail — the phrase that ties strategy, tools, and results together.

Accurate demand forecasts are the foundation for preventing stockouts. French retailers that moved from weekly, store-level replenishment plans to SKU-by-SKU probabilistic forecasting cut emergency shipments and lost sales. Forecasting models use historical POS, promotional calendars, local events, weather, and web search trends to anticipate demand spikes and dips. Between 2020 and 2025, adoption of machine-learning forecasting in European grocery chains rose sharply as retailers invested to protect margins and customer experience. For example, chain pilots showed forecast error reductions of 10–30% for fast-moving SKUs when ML models were applied, translating into lower stockout rates and fewer rush replenishments.

Key 2020–2025 trend points:

| Year | Typical Forecast Error (MAPE) before ML | After ML pilot |

|---|---|---|

| 2020 | 22% | 18% |

| 2021 | 21% | 15% |

| 2022 | 20% | 13% |

| 2023 | 19% | 12% |

| 2024 | 18% | 11% |

| 2025 | 17% | 10% |

How this reduces stockouts: better demand visibility reduces both under-ordering (causing stockouts) and over-ordering (tying up cash). Forecasting improvements concentrate on top-value SKUs and promotional windows where outages have highest revenue impact. Retailers using these approaches report measurable drops in lost sales and emergency freight costs.

Forecasts must feed replenishment rules. Automated reorder systems convert probabilistic demand into order quantities that respect supplier lead times, shelf space, and store service level targets. French retailers combining forecast outputs with supplier reliability scores and warehouse constraints achieve higher on-shelf availability with fewer manual overrides. Automation is particularly valuable for franchises and large regional chains where centralized planners cannot tune every SKU.

Key 2020–2025 trend points:

| Year | Manual reorder time per SKU (min) | % orders automated |

|---|---|---|

| 2020 | 12 | 15% |

| 2021 | 10 | 30% |

| 2022 | 8 | 50% |

| 2023 | 6 | 70% |

| 2024 | 5 | 82% |

| 2025 | 4 | 90% |

Benefits: automation reduces latency between demand signal and replenishment, lowers human error, and enforces consistent service levels across stores. When tied to supplier performance analytics, ordering systems dynamically shift safety stocks by SKU and by store to reflect reliability — cutting stockouts without excess inventory.

Monitoring competitor pricing is essential for electronics market strategy. Using Extract Unieuro & Amazon Italy electronics data, retailers can compare pricing for identical products across both platforms.

Key 2020–2025 trend points:

On-shelf availability improvements (example)

| Year | Baseline OSA (%) | After real-time visibility (%) |

|---|---|---|

| 2020 | 86% | 88% |

| 2021 | 85% | 89% |

| 2022 | 84% | 90% |

| 2023 | 83% | 91% |

| 2024 | 82% | 92% |

| 2025 | 81% | 93% |

Practical steps: connect POS with shelf-scan results, prioritize interventions by revenue impact, and close the loop with store teams via mobile tasking. The net effect: fewer “phantom” inventory situations and faster resolution of shelf gaps that would otherwise turn into stockouts. ry.

Stockouts often originate upstream: variable lead times, partial shipments, and supplier capacity issues. Analytics that score suppliers for delivery reliability and predict ETA deviations allow retailers to adapt orders and safety stocks proactively. From 2020 to 2025, French retailers shifted from penalizing suppliers after failures to co-managed planning based on shared dashboards and exception alerts. This collaborative model reduces both stockouts and expediting costs.

Key 2020–2025 trend points:

| Year | Avg lead time | Std dev (days) |

|---|---|---|

| 2020 | 7.0 | 3.5 |

| 2021 | 8.2 | 3.8 |

| 2022 | 7.5 | 3.2 |

| 2023 | 6.8 | 2.7 |

| 2024 | 6.5 | 2.2 |

| 2025 | 6.2 | 1.9 |

How analytics helps: by predicting which deliveries are at risk and increasing safety stock selectively (SKU-by-SKU and store-by-store), retailers lower overall safety inventory while protecting availability for high-impact items. Supplier collaboration also shortens the “time to correct” for late or short shipments.

The rise of omnichannel (click-and-collect, ship-from-store, home delivery) created internal competition for scarce SKUs. Analytics that perform dynamic allocation — deciding whether a unit should remain for in-store sale, be reserved for online pickup, or be shipped to a customer — reduce the chance a visible shelf shows empty while an allocated e-order sits in the back. Between 2020 and 2025, allocation logic matured to prioritize revenue, margin, and lifetime value across channels.

Key 2020–2025 trend points:

| Year | % orders fulfilled from store | % C&C success rate |

|---|---|---|

| 2020 | 12% | 78% |

| 2021 | 18% | 82% |

| 2022 | 25% | 86% |

| 2023 | 30% | 89% |

| 2024 | 34% | 91% |

| 2025 | 36% | 93% |

Allocation analytics reduce “on-shelf but not sellable” situations and make omnichannel profitable by reducing cancellations and returns. Smart allocation also improves customer experience by honoring pickup windows and accurate stock promises.

Detecting problems is only half the battle — the other half is diagnosing and fixing them quickly. Advanced alerting (thresholds, anomaly detection, and root-cause pipelines) allows French retailers to move from “we had a stockout” to “we prevented the next five from happening.” Modern analytics platforms correlate POS drops, delivery shortfalls, and shelf sensor anomalies to present actionable root causes to planners and store managers.

Key 2020–2025 trend points:

| Year | False positive alerts (%) | Average time to resolve (hrs) |

|---|---|---|

| 2020 | 65% | 48 |

| 2021 | 55% | 40 |

| 2022 | 42% | 30 |

| 2023 | 30% | 18 |

| 2024 | 22% | 12 |

| 2025 | 15% | 8 |

Result: stores spend less time chasing noise and more time on high-value interventions. Root-cause analytics also feed continuous improvement — e.g., changing pick patterns in the DC, renegotiating minimums with suppliers, or changing planogram layouts to reduce shelf outs.

Actowiz Metrics brings these six capabilities together into a single, operational platform tailored for French retailers. Our solution ingests POS, inventory, supplier EDI, and online channel feeds to deliver SKU-level recommendations and real-time alerts. We combine probabilistic forecasting, automated replenishment, and allocation engines with a lightweight mobile tasking app that closes the loop with store teams. The result: measurable improvements in on-shelf availability and reduced emergency logistics spend.

Practical differentiators:

Actowiz Metrics’ pilots in France showed typical uplifts in on-shelf availability of 3–12 percentage points and ROI payback in under 12 months when combined with targeted process changes — validating the power of Data Analytics to Reduce Stockouts in live operations.

Reducing stockouts in French retail is no longer a matter of luck or spreadsheet heroics. The winning retailers combine probabilistic forecasting, automated replenishment, real-time visibility, supplier collaboration, omnichannel allocation, and modern alerting to create a resilient, efficient inventory engine. The industry trends from 2020 through 2025 — from pandemic shocks to the mainstreaming of ML forecasting and on-shelf analytics — make this transformation urgent and achievable. Data Analytics to Reduce Stockouts isn’t just a tactical fix; it’s a strategic capability that protects margin, increases sales, and builds customer loyalty.

Ready to turn insights into on-shelf reality? Contact Actowiz Metrics to request a demo, start a pilot, or discuss an integration roadmap. Let us show you how to convert data into availability — and keep your customers coming back.

Data Analytics to Reduce Stockouts — the practical, measurable way to keep shelves full and customers happy. Data Analytics to Reduce Stockouts — start today with Actowiz Metrics.

Sleepy Owl Coffee Website Analytics delivering insights on traffic, conversions, pricing trends, and digital performance optimization.

Explore Now

Shein E-commerce Analytics Dashboard delivers real-time pricing, trend, and competitor insights to optimize fashion strategy and boost performance.

Explore Now

Live Data Tracking Dashboard for Keeta Food Delivery App enables real-time order, pricing, and restaurant insights to optimize performance and decisions.

Explore NowBrowse expert blogs, case studies, reports, and infographics for quick, data-driven insights across industries.

How Woolworths.com.au Data Tracking helps monitor pricing shifts, stock levels, and promotions to improve retail visibility and decision-making.

Myntra Fashion Category Data Monitoring helps track trends, pricing, stock levels, and category performance to optimize sales and boost growth.

Pringles Food Data Analytics 2026 reveals how data-driven insights improve pricing, demand forecasting, and supply chain efficiency in a dynamic snack market.

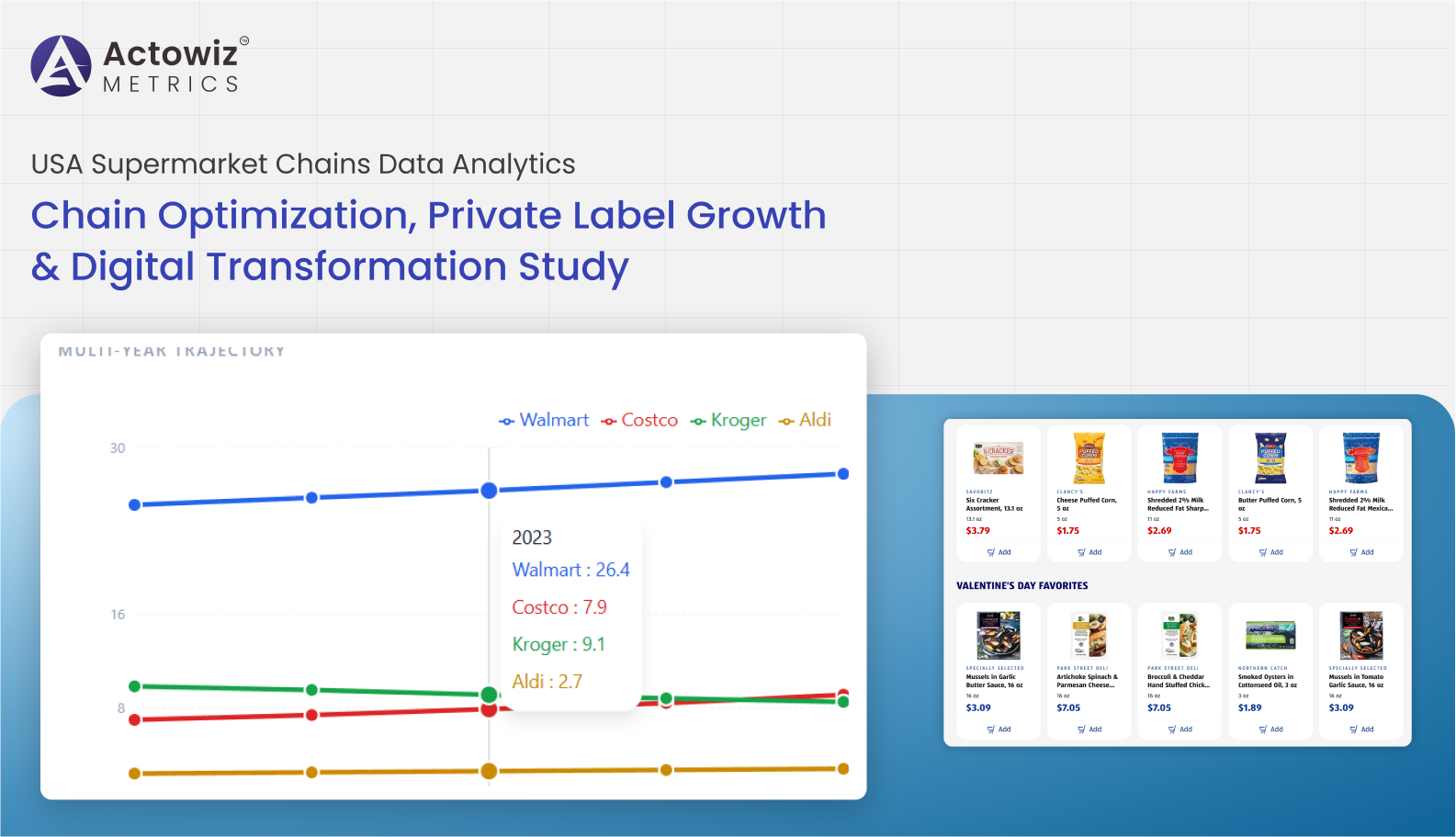

Research Report on USA Supermarket Chains Data Analytics covering chain optimization, private label growth, pricing trends, and digital transformation insights.

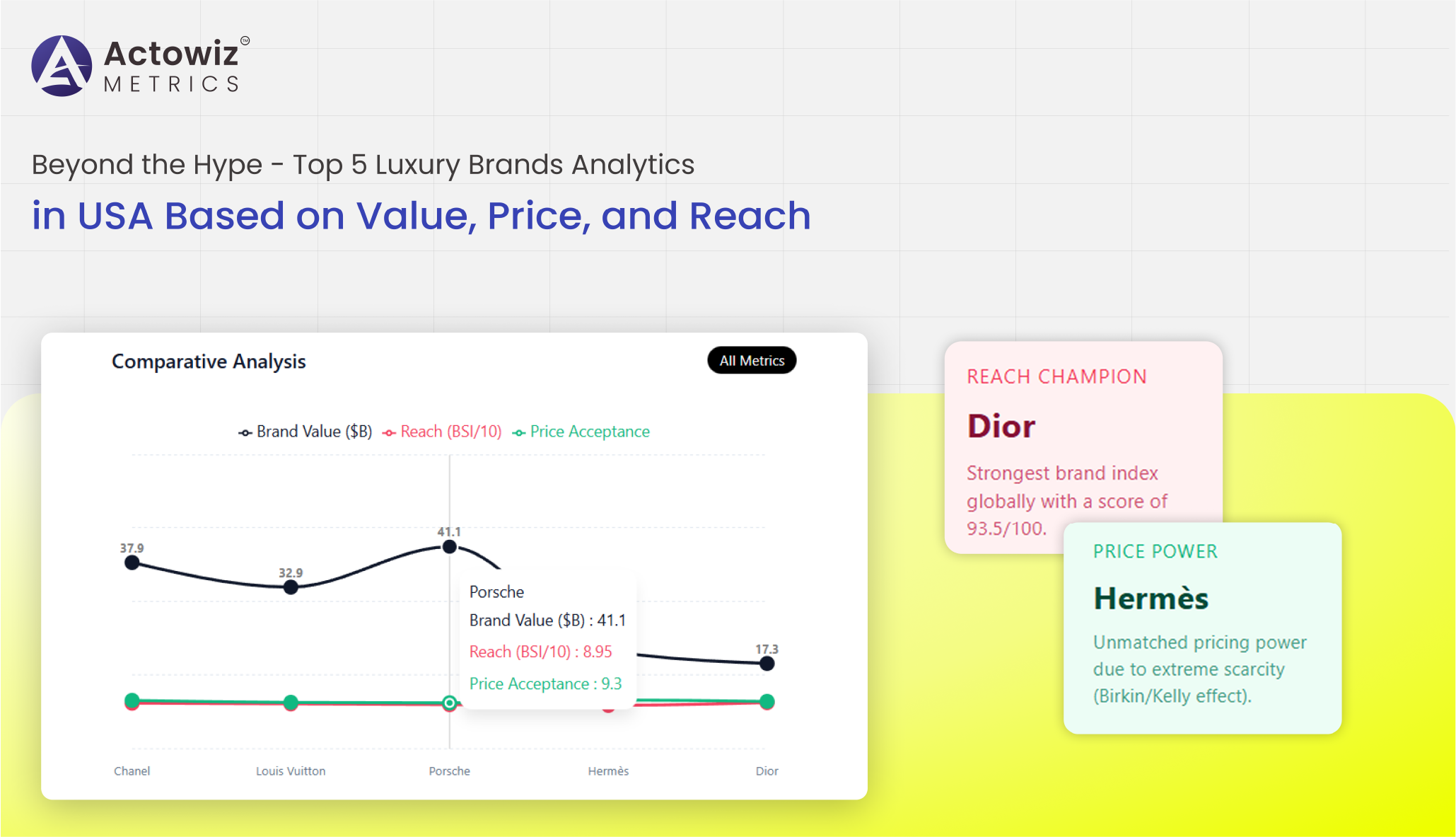

Top 5 Luxury Brands Analytics in USA delivering advanced market insights, consumer trends, and performance intelligence to drive premium brand growth.

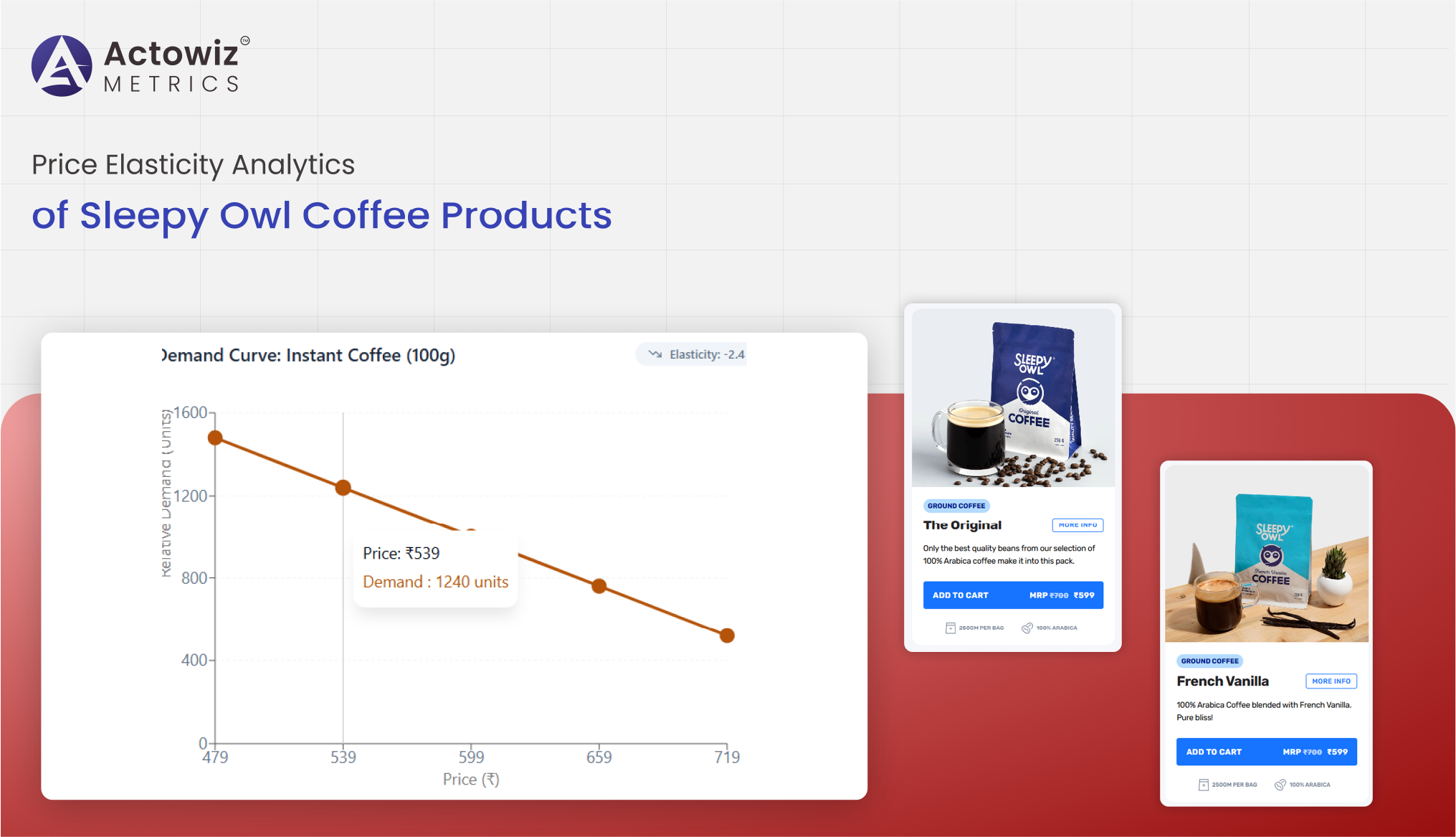

Price Elasticity Analytics of Sleepy Owl Coffee Products revealing demand sensitivity, pricing impact, and revenue optimization insights across channels.

Explore Luxury vs Smartwatch - Global Price Comparison 2025 to compare prices of luxury watches and smartwatches using marketplace data to reveal key trends and shifts.

E-Commerce Price Benchmarking: Gucci vs Prada reveals 2025 pricing trends for luxury handbags and accessories, helping brands track competitors and optimize pricing.

Discover how menu data scraping uncovers trending dishes in 2025, revealing popular recipes, pricing trends, and real-time restaurant insights for food businesses.

Explore the Amazon Baby Care Report analyzing Top Baby Brands Analysis on Amazon, covering discounts, availability, and popular products with data-driven market insights.

Amazon Sports & Outdoors Report - Sports & Outdoors Top Brands Analysis on Amazon - Prices, Discounts, Reviews

Enabled a USA pet brand to optimize pricing, inventory, and offers on Amazon using Pet Supplies Top Brands Analysis on Amazon for accurate, data-driven decisions.

Whatever your project size is, we will handle it well with all the standards fulfilled! We are here to give 100% satisfaction.

Any analytics feature you need — we provide it

24/7 global support

Real-time analytics dashboard

Full data transparency at every stage

Customized solutions to achieve your data analysis goals