Grocery Data Analytics from Chedraui USA

Leveraging Grocery Data Analytics from Chedraui USA to benchmark competitors, track pricing trends, and uncover actionable market insights.

Every Diwali season, the demand for sweets and snacks in India surges dramatically across quick commerce platforms such as Blinkit, Zepto, Swiggy Instamart, and BigBasket. Consumers seek freshness, regional authenticity, and festive deals—all of which create massive fluctuations in pricing and availability. Businesses can gain an upper hand through Diwali sweets and snacks data analytics, enabling them to anticipate demand, track pricing changes, and optimize product placement.

Using Digital Shelf Analytics and price analytics, retailers can closely monitor fast-moving SKUs and competitor offers in real time. With Diwali grocery shopping analytics, brands can assess product trends, availability, and festive season engagement levels.

Between 2020 and 2025, the Indian festive FMCG market has seen over 22% growth, driven by digitization and real-time quick commerce analytics. Leveraging Diwali sweets and snacks data analytics helps retailers and brands forecast consumer demand, enhance supply chain performance, and boost overall profitability during the festive rush.

The Diwali season represents one of the largest consumption windows for India’s FMCG and grocery sectors. The fusion of tradition and convenience has led to a steep rise in orders through instant delivery apps. According to Festive season FMCG insights in India, sweets and snacks sales spike by an average of 35% between October and November each year.

Using Diwali sweets and snacks data analytics, brands can evaluate SKU-level performance across metros and Tier-2 cities. Data extracted from Scrape sweets & snacks price and stock data reveals that over 68% of Blinkit listings for festive sweets experience stockouts within the first five days of Diwali week.

| Year | FMCG Sales Growth (%) | Quick Commerce Order Growth (%) | Average Cart Value (INR) |

|---|---|---|---|

| 2020 | 10% | 8% | ₹450 |

| 2021 | 14% | 12% | ₹480 |

| 2022 | 18% | 20% | ₹520 |

| 2023 | 22% | 28% | ₹550 |

| 2024 | 25% | 33% | ₹580 |

| 2025 | 28% (Proj.) | 37% (Proj.) | ₹610 |

The rise in consumer reliance on quick commerce platforms signifies a major behavioral shift, with convenience taking precedence over traditional shopping.

Diwali is synonymous with competitive discounts and attractive combo deals. Through Sweets pricing analytics during Diwali, brands can monitor price drops, margin adjustments, and discount variations across competing platforms like Zepto, Blinkit, and Instamart.

Festival offer tracking on FMCG products reveals that festive discounts on sweets average between 10%–25%, while snacks witness sharper markdowns of 20%–35%.

| Year | Sweets Avg. Discount (%) | Snacks Avg. Discount (%) | Price Volatility (%) |

|---|---|---|---|

| 2020 | 10% | 15% | 3% |

| 2021 | 12% | 18% | 5% |

| 2022 | 15% | 20% | 7% |

| 2023 | 18% | 25% | 10% |

| 2024 | 20% | 30% | 13% |

| 2025 | 22% (Proj.) | 35% (Proj.) | 15% (Proj.) |

Real-time monitoring helps FMCG players leverage price analytics to identify optimal discount levels, maximize profit margins, and respond instantly to competitor price changes.

India’s cultural diversity reflects vividly in festive consumption trends. Using Regional sweets and snacks trends analysis, data reveals strong regional variations in product demand. For example, Kaju Katli and Ladoo dominate northern markets, while Mysore Pak and Soan Papdi hold higher preference in southern and western states.

Extract Top seller sweets & snacks data shows that Delhi, Mumbai, and Bengaluru collectively contribute over 55% of total Diwali sweet orders on quick commerce apps.

| Region | Top Selling Sweet | Demand Share (%) |

|---|---|---|

| North India | Kaju Katli | 25% |

| West India | Soan Papdi | 20% |

| South India | Mysore Pak | 15% |

| East India | Rasgulla | 12% |

| Central India | Ladoo | 10% |

| Others | Mix Combos | 18% |

Real-time Diwali sweets category analysis enables FMCG brands to customize packaging, offers, and availability according to regional preferences—enhancing customer experience and ensuring maximum shelf movement.

The digital shelf is now the battleground for visibility. Real-time Snacks Digital Shelf monitoring allows brands to assess online display placements, stock statuses, and competitor visibility in real time.

Grocery analytics reports indicate that Blinkit and Zepto maintained over 95% stock accuracy in 2024, while regional players struggled with replenishment delays during high-demand days.

| Platform | 2020 (%) | 2021 (%) | 2022 (%) | 2023 (%) | 2024 (%) | 2025 (Proj.) (%) |

|---|---|---|---|---|---|---|

| Blinkit | 82% | 85% | 90% | 94% | 95% | 97% |

| Zepto | 80% | 86% | 89% | 93% | 95% | 97% |

| Swiggy Instamart | 75% | 80% | 85% | 90% | 93% | 95% |

The combination of quick commerce analytics and Digital Shelf Analytics empowers FMCG brands to minimize lost sales opportunities and improve supply chain responsiveness.

By integrating Diwali sweets and snacks data analytics with behavioral datasets, brands can pinpoint what drives festive purchases. Factors like combo packaging, influencer promotions, and same-day delivery offers strongly influence conversion rates.

Data from Whole Foods Market Dataset-style models in India show that mid-range price categories (₹300–₹600) account for nearly 48% of total festive snack purchases.

| Price Range (INR) | Share of Orders (%) |

|---|---|

| Below 300 | 20% |

| 300–600 | 48% |

| 600–1000 | 22% |

| Above 1000 | 10% |

Understanding these price bands through Scrape sweets & snacks price and stock data and Whole Foods scraping services allows marketers to plan promotions around consumer budgets effectively.

With rising digital demand, predictive analytics is crucial for accurate forecasting. Using Extract Whole Foods grocery data for market research models adapted for Indian FMCG, businesses can predict product movement, shelf velocity, and optimal pricing windows.

Between 2020 and 2025, AI-based quick commerce analytics improved forecast accuracy from 70% to 88%, significantly reducing stock-outs and pricing mismatches.

| Year | Forecast Accuracy (%) | Stock-Out Reduction (%) |

|---|---|---|

| 2020 | 70% | 5% |

| 2021 | 74% | 7% |

| 2022 | 78% | 9% |

| 2023 | 82% | 11% |

| 2024 | 85% | 13% |

| 2025 | 88% (Proj.) | 15% (Proj.) |

This predictive Market Research approach ensures that sweets and snacks remain available, fresh, and competitively priced during the peak Diwali window.

Actowiz Metrics empowers FMCG brands and quick commerce platforms to make smarter decisions with Real-time Snacks Digital Shelf monitoring, grocery analytics, and custom Grocery Data Scraping API integrations. By automating Scrape sweets & snacks price and stock data, the platform delivers actionable insights across pricing, promotions, availability, and consumer sentiment.

Our tools help you track festival offer tracking on FMCG products, benchmark competitors in real time, and implement dynamic pricing strategies for maximum impact. Whether it’s Diwali sweets category analysis or Regional sweets and snacks trends analysis, Actowiz Metrics ensures your data-driven strategy stays ahead of the festive curve.

The evolution of India’s festive FMCG ecosystem is driven by data. From real-time pricing intelligence to inventory forecasting, Diwali sweets and snacks data analytics offers brands unparalleled insights to thrive during peak seasons.

As Blinkit, Zepto, and Swiggy Instamart redefine quick commerce delivery, leveraging Digital Shelf Analytics and price analytics becomes vital to remain competitive. Actowiz Metrics provides advanced scraping, visualization, and automation tools to help you track, predict, and act on festive trends effectively.

Ready to outsmart competition this Diwali? Empower your team with Actowiz Metrics’ Quick Commerce & Grocery Data Scraping Solutions — where data meets festive demand intelligence.

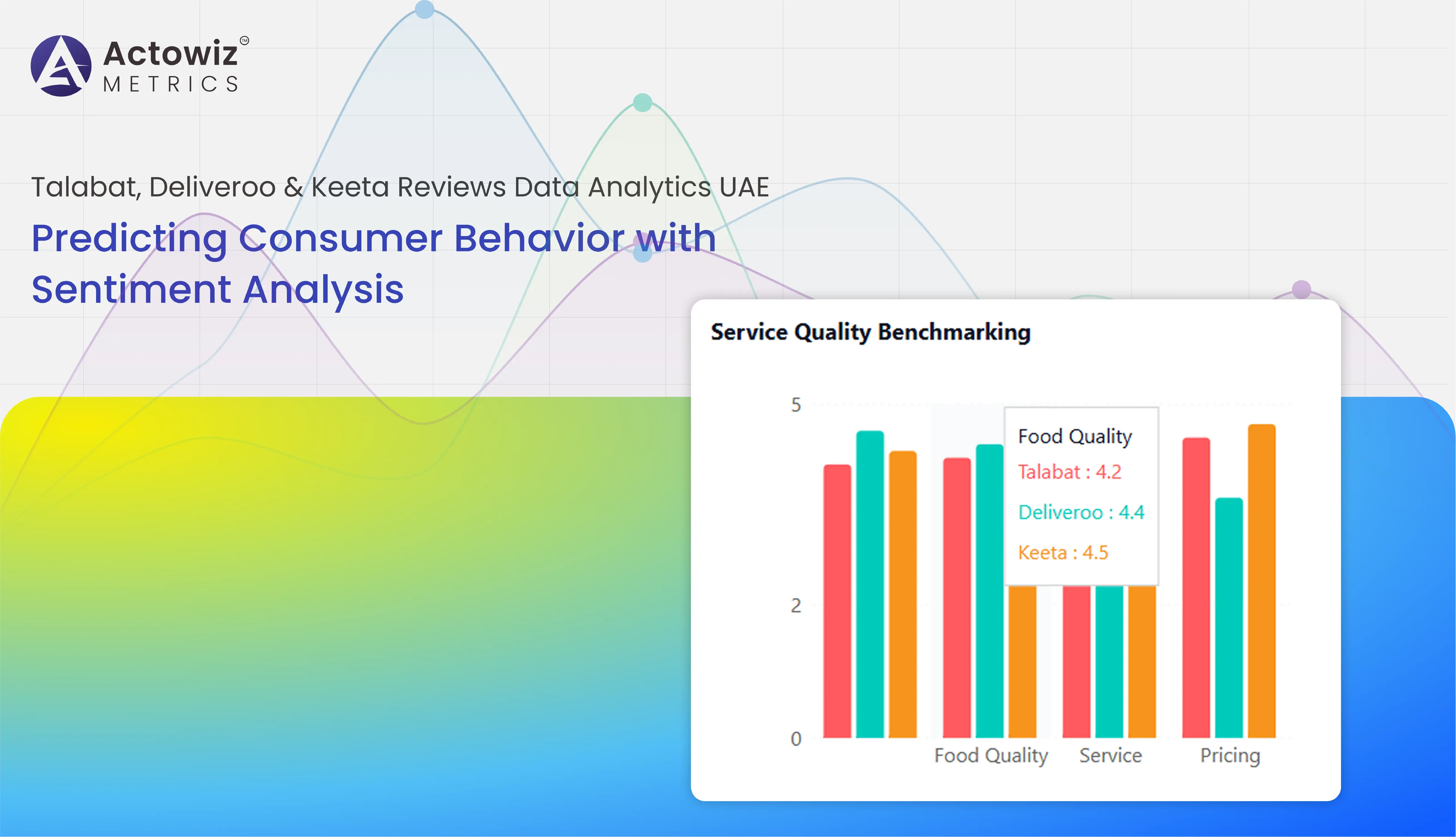

Talabat, Deliveroo & Keeta Reviews Data Analytics UAE – data-driven insights to optimize customer experience and service performance.

Explore Now

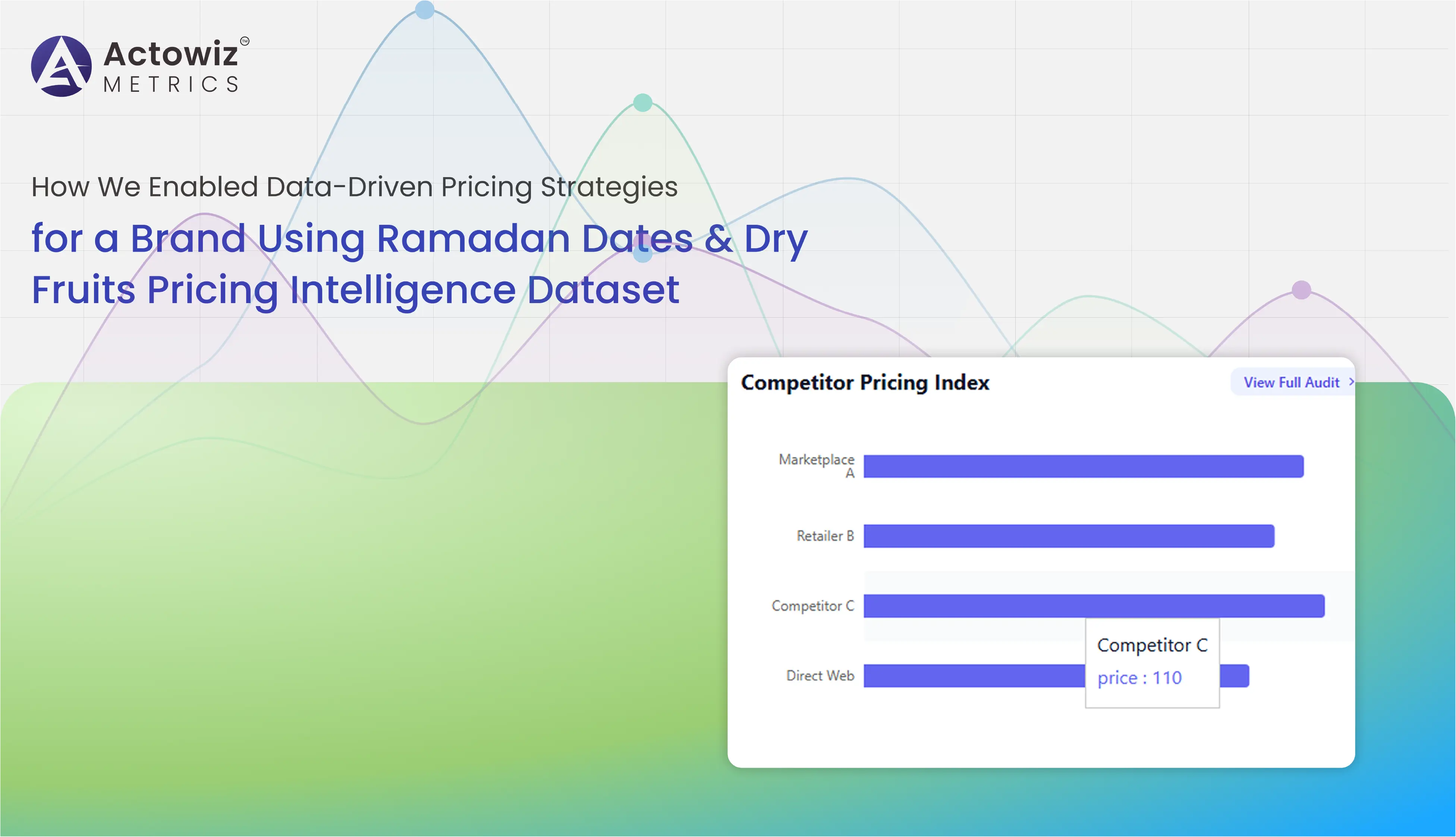

Data-driven pricing strategy case study using Ramadan Dates & Dry Fruits Pricing Intelligence Dataset to optimize revenue and competitive pricing.

Explore Now

Case study on how we enabled an FMCG brand to track competitor pricing on Shopee & Lazada in South East Asia to improve margins and pricing strategy.

Explore Now

Browse expert blogs, case studies, reports, and infographics for quick, data-driven insights across industries.

Leveraging Grocery Data Analytics from Chedraui USA to benchmark competitors, track pricing trends, and uncover actionable market insights.

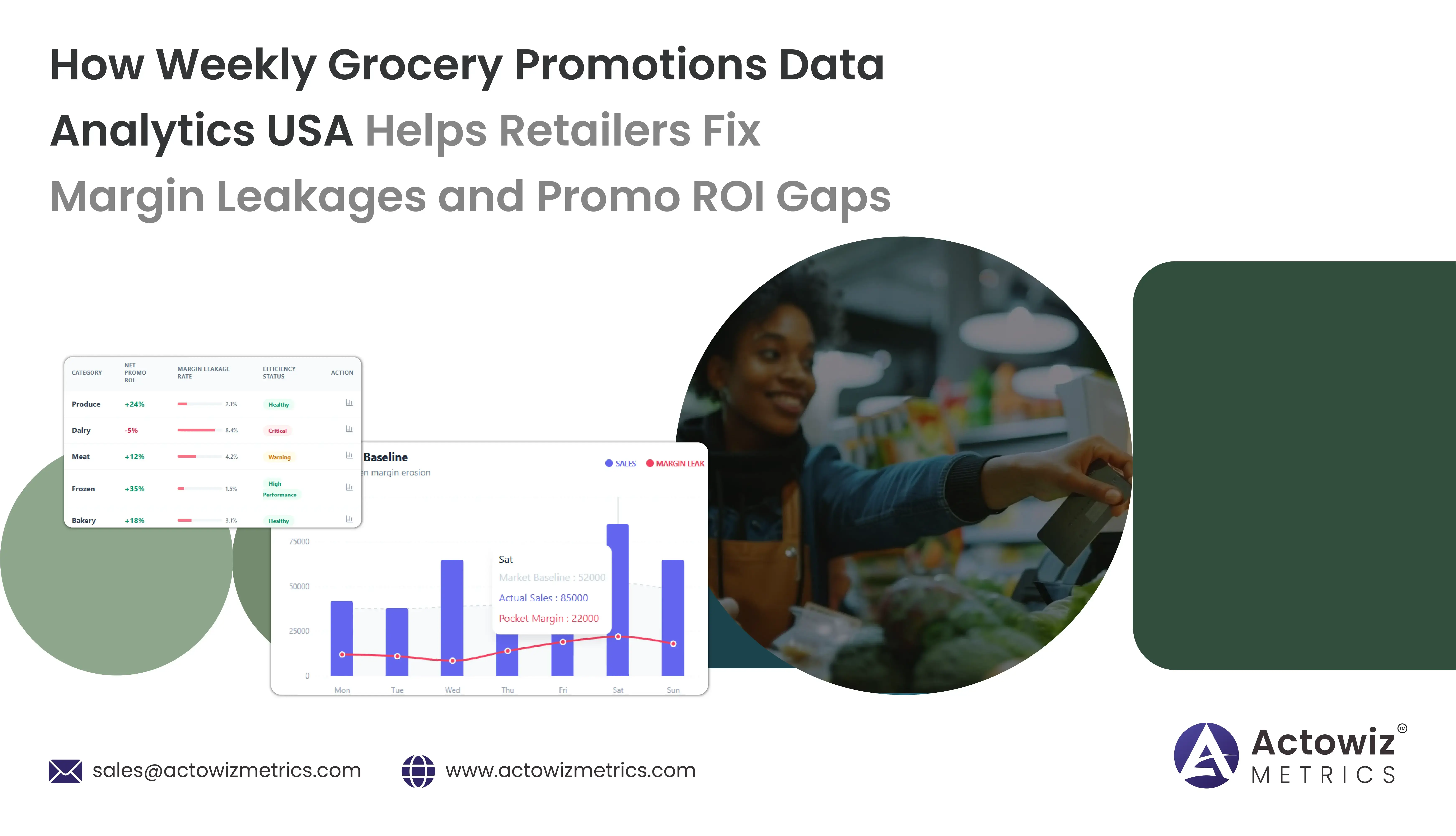

How Weekly Grocery Promotions Data Analytics USA uncovers margin leakages, tracks promo ROI gaps, and optimizes discount strategies for higher profits.

Leverage Poizon Product Stock, Listing & Price Tracking to gain competitive insights, optimize pricing strategies, and drive sustainable revenue growth.

Mini Perfumes Data Analytics on Walmart & Target delivers insights on pricing, discounts, SKU trends, and competitive positioning across both retailers.

Sehri Delivery Heatmap Data Analysis - UAE & Saudi Arabia.webp)

Late-Night (12 AM–4 AM) Sehri Delivery Heatmap Data Analysis across UAE & Saudi Arabia revealing peak demand zones, order spikes, and pricing trends.

Chinese E-Commerce Websites Data Tracking - POIZON & DEWU delivers insights on pricing trends, product demand, brand performance, and market competition in China.

This SMP tracks pricing, visibility, and Skittles Trends Market Performance And Demand to help brands optimize retail strategy and boost growth.

Explore Luxury vs Smartwatch - Global Price Comparison 2025 to compare prices of luxury watches and smartwatches using marketplace data to reveal key trends and shifts.

E-Commerce Price Benchmarking: Gucci vs Prada reveals 2025 pricing trends for luxury handbags and accessories, helping brands track competitors and optimize pricing.

Explore the Amazon Baby Care Report analyzing Top Baby Brands Analysis on Amazon, covering discounts, availability, and popular products with data-driven market insights.

Amazon Sports & Outdoors Report - Sports & Outdoors Top Brands Analysis on Amazon - Prices, Discounts, Reviews

Enabled a USA pet brand to optimize pricing, inventory, and offers on Amazon using Pet Supplies Top Brands Analysis on Amazon for accurate, data-driven decisions.

Whatever your project size is, we will handle it well with all the standards fulfilled! We are here to give 100% satisfaction.

Any analytics feature you need — we provide it

24/7 global support

Real-time analytics dashboard

Full data transparency at every stage

Customized solutions to achieve your data analysis goals