Protein Bar Demand Analytics on Zepto & Blinkit – Bangalore

Pringles Food Data Analytics 2026 reveals how data-driven insights improve pricing, demand forecasting, and supply chain efficiency in a dynamic snack market.

The global smart home ecosystem has been expanding rapidly, fueled by growing consumer demand for connected security and automation solutions. Amazon, a dominant e-commerce marketplace, plays a central role in shaping this segment’s growth. Among its most prominent brands, Blink has become a key player with its security cameras, video doorbells, and bundled monitoring kits. Understanding Blink’s performance requires a data-driven approach that captures both macro market movements and micro-level customer behavior.

Businesses increasingly rely on Blink Products Analytics on Amazon to extract meaningful insights into sales, pricing, and reviews. By examining customer sentiment, monthly revenue trends, SKU-level performance, and competitive positioning, organizations can develop stronger go-to-market strategies. Insights such as Amazon Smart Home Category Analysis, Real-time Blink product sales tracking, and Blink’s product assortment Analysis provide a holistic view of the brand’s trajectory.

In addition, the ability to Extract Blink Products pricing Trends Data and Scrape Blink reviews on Amazon enables real-time benchmarking, while Blink’s Top selling SKUs Analysis and Blink smart home category share analysis highlight where Blink dominates versus where competition is intensifying.

This research report leverages advanced E-commerce Analytics to assess Blink’s progress between 2020–2025, presenting actionable intelligence for brands, analysts, and investors alike.

The Amazon smart home category has consistently demonstrated double-digit growth rates since 2020, with security cameras and video doorbells leading demand. Blink, as Amazon’s in-house brand, benefits from native platform visibility and competitive pricing that undercuts many rivals. The analysis shows how Amazon’s ecosystem advantages translate into share gains for Blink.

From 2020–2025, total smart home device sales on Amazon are projected to grow from $5.4 billion to $11.8 billion, representing a CAGR of 16.7%. Blink has captured a steadily rising share of this market, climbing from 9% in 2020 to an estimated 14% by 2025.

| Year | Amazon Smart Home Sales ($Bn) | Blink Sales ($Bn) | Blink Market Share (%) |

|---|---|---|---|

| 2020 | 5.4 | 0.49 | 9.0% |

| 2021 | 6.6 | 0.66 | 10.0% |

| 2022 | 7.9 | 0.87 | 11.0% |

| 2023 | 9.4 | 1.13 | 12.0% |

| 2024 | 10.6 | 1.38 | 13.0% |

| 2025* | 11.8 | 1.65 | 14.0% |

Blink’s growing penetration highlights its strong positioning, but it also underscores competitive pressures. Rivals such as Ring, Arlo, and Wyze continue to innovate with AI-driven features. Nevertheless, Blink’s affordability and seamless Amazon integration give it an edge.

Real-time tracking of Blink sales reveals patterns that are critical for understanding consumer behavior. Seasonal surges around Prime Day, Black Friday, and holiday periods often account for 35–40% of Blink’s annual unit sales. Between 2020 and 2025, Actowiz Metrics’ tracking shows an average 18% month-over-month sales spike during promotional events.

| Year | Peak Month Index | Average Month Index | Holiday Spike (%) |

|---|---|---|---|

| 2020 | 155 | 100 | +55% |

| 2021 | 178 | 118 | +60% |

| 2022 | 190 | 127 | +65% |

| 2023 | 215 | 143 | +72% |

| 2024 | 240 | 161 | +78% |

| 2025* | 265 | 177 | +80% |

These spikes reveal that Blink’s buyers are highly price-sensitive and respond strongly to bundled promotions (e.g., camera + doorbell kits). The insights gained through Blink sales Data scraping on Amazon allow businesses to plan inventory and optimize marketing spend accordingly.

Blink’s assortment strategy has steadily expanded from core indoor cameras to outdoor, mini, and doorbell variations. By 2025, Blink offers 18 active SKUs, compared to just 7 in 2020. This expansion highlights a shift towards catering to diverse consumer needs – from budget-friendly single cameras to complete security ecosystems.

| Year | Active SKUs | Notable Launches | Avg. Price Range ($) |

|---|---|---|---|

| 2020 | 7 | Blink Mini | 29–99 |

| 2021 | 9 | Blink Outdoor 2nd Gen | 39–119 |

| 2022 | 12 | Blink Video Doorbell | 49–129 |

| 2023 | 15 | Solar Mount Accessories | 59–139 |

| 2024 | 17 | Blink Floodlight Mount | 69–149 |

| 2025* | 18 | AI-enabled Camera Kit | 79–169 |

Expanding SKUs not only increases consumer options but also boosts cross-selling opportunities. Blink’s Top selling SKUs Analysis shows that 70% of sales are concentrated among three core items: Blink Outdoor, Blink Mini, and Blink Doorbell.

Price positioning is a cornerstone of Blink’s success. A comparative pricing analysis between 2020 and 2025 reveals that Blink has consistently undercut rivals by 10–20% while maintaining healthy volume growth.

| Year | Blink Avg. Price ($) | Category Avg. Price ($) | Price Gap (%) |

|---|---|---|---|

| 2020 | 59 | 72 | -18% |

| 2021 | 61 | 74 | -17% |

| 2022 | 63 | 77 | -18% |

| 2023 | 66 | 81 | -19% |

| 2024 | 68 | 83 | -18% |

| 2025* | 70 | 86 | -19% |

This affordability strategy, supported by Blink’s Monthly Sales Data Insights, has been instrumental in capturing budget-conscious customers. While rivals focus on AI and premium features, Blink anchors itself in value-driven pricing, which ensures scalability.

Consumer reviews provide vital feedback loops for product innovation. By 2025, Blink products collectively surpass 2.1 million verified reviews on Amazon, with an average rating of 4.3/5.

| Year | Total Reviews | Avg. Rating | Top Positive Themes | Key Negative Themes |

|---|---|---|---|---|

| 2020 | 420k | 4.2 | Easy setup, affordability | Limited features |

| 2021 | 720k | 4.3 | Battery life, Alexa sync | Connectivity drops |

| 2022 | 1.05M | 4.3 | Outdoor durability | App performance |

| 2023 | 1.45M | 4.4 | Video clarity | Subscription cost |

| 2024 | 1.8M | 4.3 | Value bundles | Delayed alerts |

| 2025* | 2.1M | 4.3 | Smart home integration | AI limitations |

These insights from Scrape Blink reviews on Amazon reveal that while pricing and ease-of-use drive customer satisfaction, recurring complaints about advanced features highlight areas for product roadmap improvements.

A final assessment of Blink’s market positioning shows clear upward momentum within Amazon’s smart home ecosystem. By 2025, Blink controls 14% of Amazon’s smart home sales, trailing Ring (18%) but ahead of Arlo (9%) and Wyze (7%).

Smart Home Category Share (Amazon, 2020–2025)

| Year | Blink (%) | Ring (%) | Arlo (%) | Wyze (%) | Others (%) |

|---|---|---|---|---|---|

| 2020 | 9 | 20 | 12 | 8 | 51 |

| 2021 | 10 | 19 | 11 | 8 | 52 |

| 2022 | 11 | 19 | 10 | 8 | 52 |

| 2023 | 12 | 18 | 10 | 8 | 52 |

| 2024 | 13 | 18 | 9 | 7 | 53 |

| 2025* | 14 | 18 | 9 | 7 | 52 |

Blink’s steady share gain suggests successful penetration in the mass-market segment. However, its lag behind Ring in premium categories implies untapped opportunities in AI-enabled and professional-grade security systems.

Actowiz Metrics provides advanced E-commerce Analytics solutions that empower businesses to capture and act upon real-time insights. For brands, retailers, and analysts seeking to evaluate Blink’s performance, Actowiz offers automated pipelines to Extract Blink Products pricing Trends Data, perform Real-time Blink product sales tracking, and enable Blink sales Data scraping on Amazon without manual overhead.

Through customizable dashboards, stakeholders can access Blink’s Monthly Sales Data Insights, SKU-level breakdowns, and review sentiment analysis. This helps companies not only monitor Blink’s category position but also benchmark against competitors across the Amazon Smart Home Category Analysis.

With its ability to capture market signals instantly, Actowiz ensures businesses stay ahead of changing trends—whether through tracking Blink’s product assortment Analysis or conducting deep Blink smart home category share analysis. The platform transforms raw data into actionable business intelligence, giving decision-makers a competitive edge.

The analysis of Blink Products Analytics on Amazon from 2020–2025 highlights how affordability, strategic assortment, and Amazon ecosystem integration have propelled Blink’s rise in the smart home category. With market share expanding from 9% to 14%, Blink has cemented its role as a major force in connected home security. Key insights on Blink’s Top selling SKUs Analysis, pricing trends, and consumer reviews underscore both strengths and areas for growth.

For businesses, the opportunity lies in leveraging advanced E-commerce Analytics to replicate Blink’s success strategies or to position competitively within Amazon’s marketplace. Whether it’s through SKU-level performance tracking, customer review scraping, or pricing benchmarks, actionable intelligence is the key to staying competitive.

Actowiz Metrics empowers organizations with the data-driven clarity needed to navigate Amazon’s dynamic smart home category. By integrating real-time monitoring, pricing insights, and category share analytics, businesses can convert market signals into growth strategies.

Ready to gain an edge? Contact Actowiz Metrics today to unlock Amazon intelligence and turn insights into measurable results.

Live Data Tracking Dashboard for Keeta Food Delivery App enables real-time order, pricing, and restaurant insights to optimize performance and decisions.

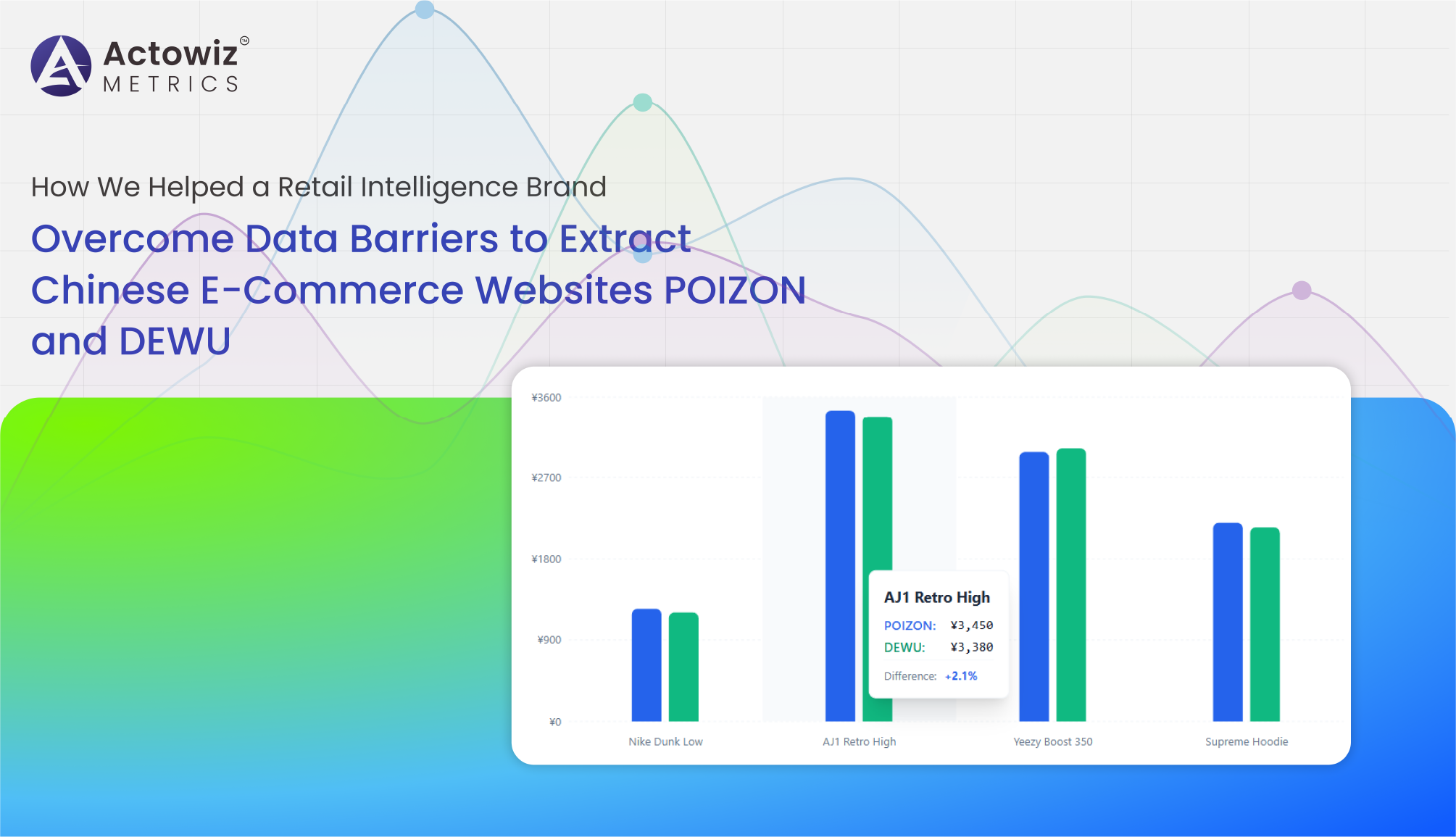

Explore NowHow We Helped a Retail Intelligence Brand Overcome Data Barriers to Extract Chinese E-Commerce Websites POIZON and DEWU for real-time pricing and market insights.

Explore Now

Price Changes Data Monitoring For Amazon & OnBuy UK enables real-time tracking of price movements to optimize promotions, protect margins, and improve pricing decisions.

Explore Now

Browse expert blogs, case studies, reports, and infographics for quick, data-driven insights across industries.

Pringles Food Data Analytics 2026 reveals how data-driven insights improve pricing, demand forecasting, and supply chain efficiency in a dynamic snack market.

KitKat Flavor and Product Trend Data Analysis uncovers consumer flavor preferences, product performance, and innovation trends across key markets.

Gain insights with Size-Level Availability & Demand Data Analytics for Apparel & Accessories to optimize inventory, track trends, and boost sales performance.

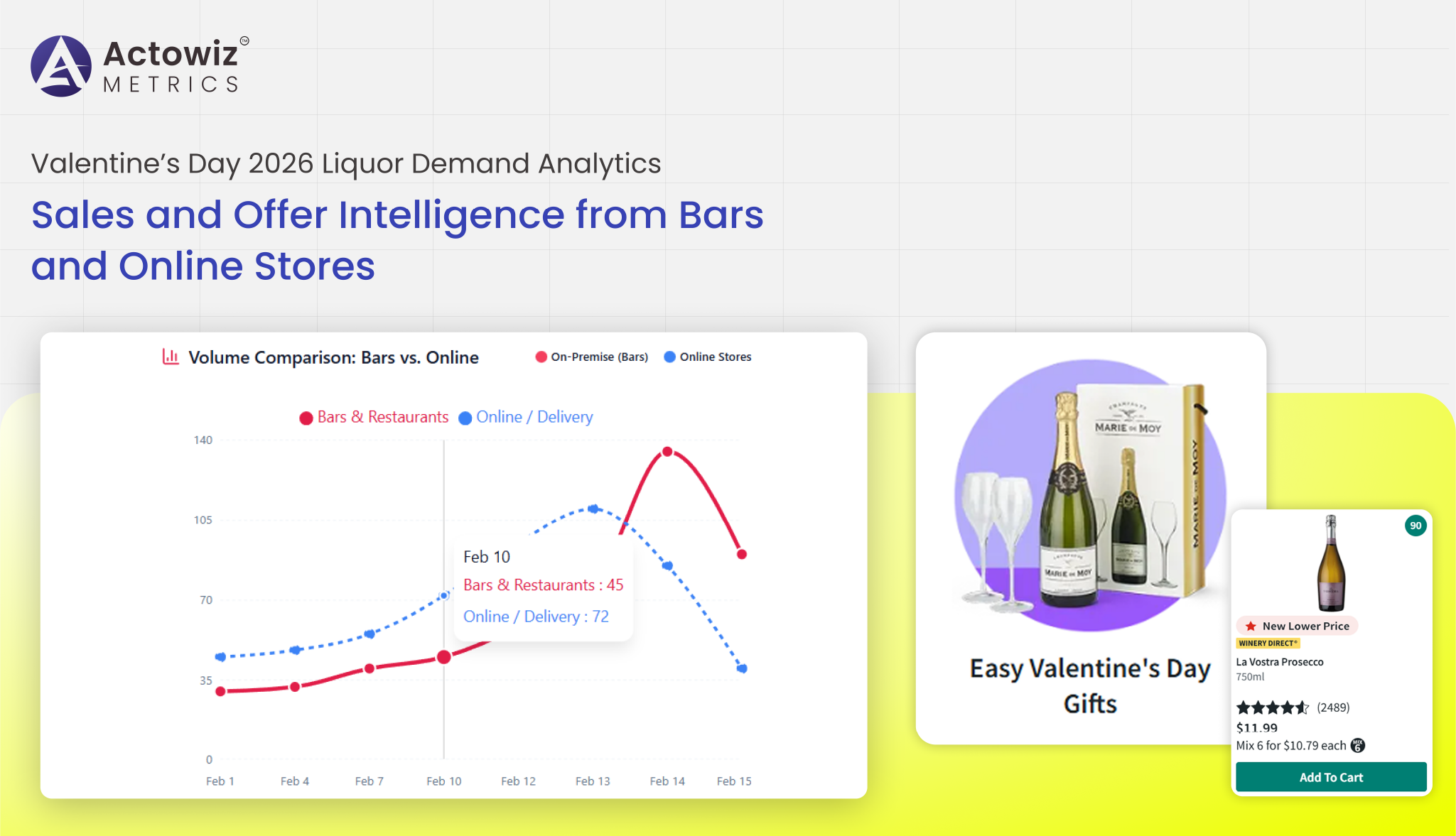

Valentine’s Day 2026 Liquor Demand Analytics highlight growing demand for premium wines, craft spirits, and curated alcohol gifting trends worldwide.

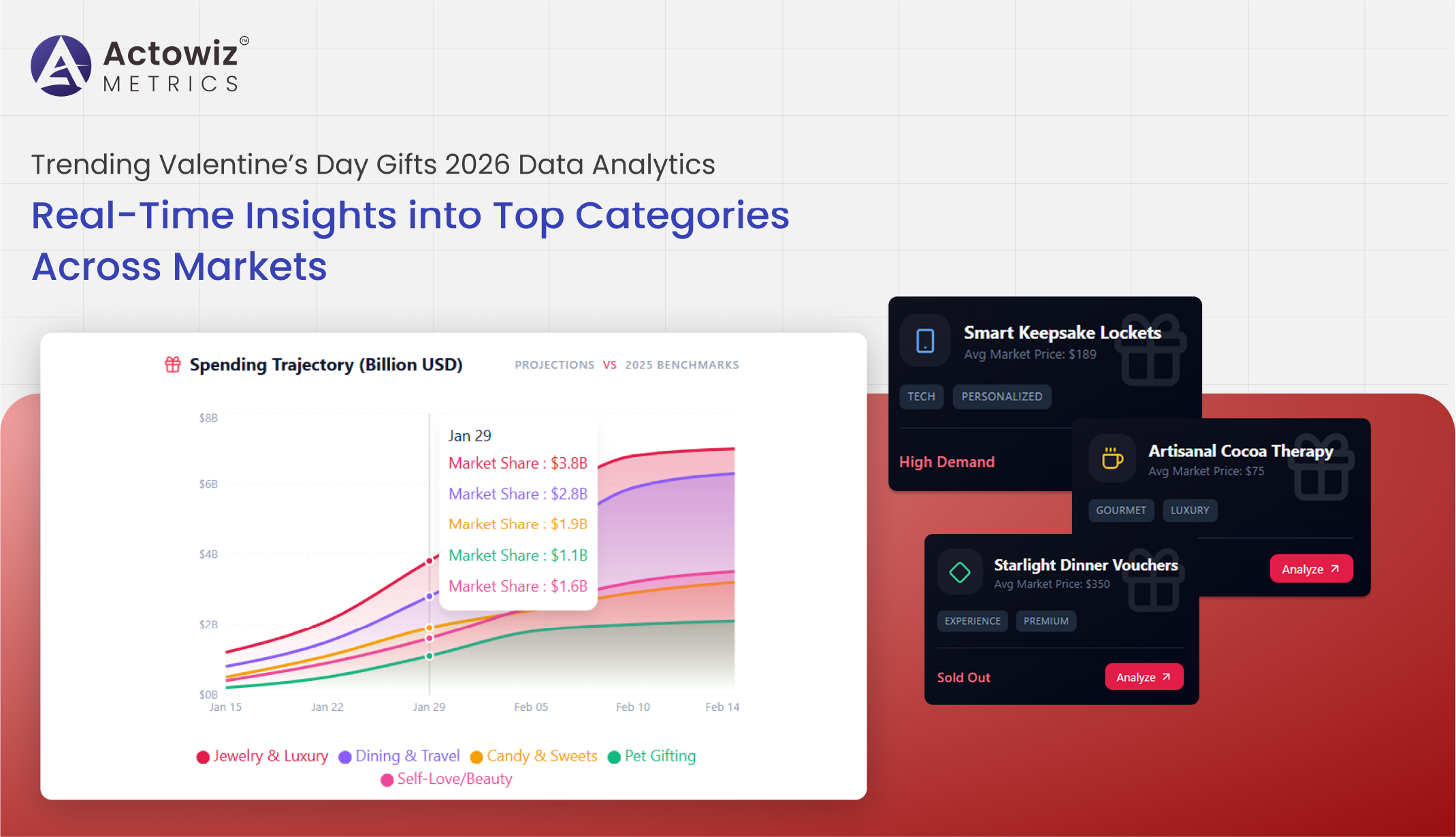

Analyze top-selling items with Trending Valentine’s Day Gifts 2026 Data Analytics to track demand, optimize inventory, and boost e-commerce sales.

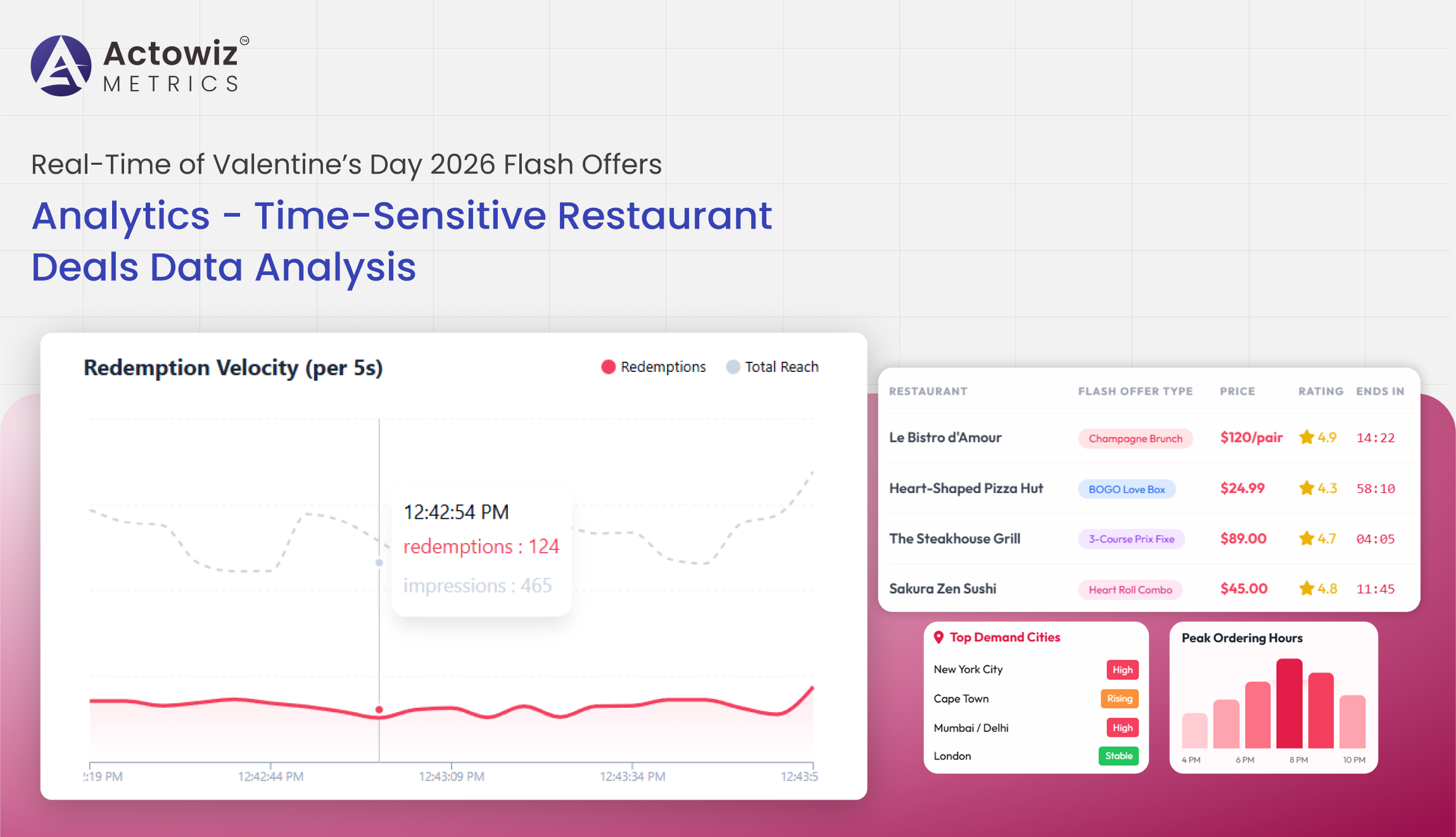

Real-Time of Valentine’s Day 2026 Flash Offers Analytics delivers instant insights on discounts, pricing trends, and offer performance across platforms.

Explore Luxury vs Smartwatch - Global Price Comparison 2025 to compare prices of luxury watches and smartwatches using marketplace data to reveal key trends and shifts.

E-Commerce Price Benchmarking: Gucci vs Prada reveals 2025 pricing trends for luxury handbags and accessories, helping brands track competitors and optimize pricing.

Discover how menu data scraping uncovers trending dishes in 2025, revealing popular recipes, pricing trends, and real-time restaurant insights for food businesses.

Explore the Amazon Baby Care Report analyzing Top Baby Brands Analysis on Amazon, covering discounts, availability, and popular products with data-driven market insights.

Amazon Sports & Outdoors Report - Sports & Outdoors Top Brands Analysis on Amazon - Prices, Discounts, Reviews

Enabled a USA pet brand to optimize pricing, inventory, and offers on Amazon using Pet Supplies Top Brands Analysis on Amazon for accurate, data-driven decisions.

Whatever your project size is, we will handle it well with all the standards fulfilled! We are here to give 100% satisfaction.

Any analytics feature you need — we provide it

24/7 global support

Real-time analytics dashboard

Full data transparency at every stage

Customized solutions to achieve your data analysis goals