Keeta Food Delivery App Data Analysis

How Keeta Food Delivery App Data Analysis solves demand forecasting gaps and delivery inefficiencies with real-time insights and smart optimization.

Manchester has become a leading hub for fast-fashion, with global giants like H&M and Zara dominating the market. Leveraging digital channels is key, and Web Scraping H&M and Zara Fashion Data in Manchester allows brands to monitor pricing, promotions, and product availability in real time.

By combining H&M and Zara Fashion Data Extraction for Market Insights with Web Scraping Fashion Trends in Manchester, retailers can analyze seasonal trends, track top-selling items, and assess local consumer behavior. These dual insights help brands optimize pricing strategies, improve inventory management, and execute targeted marketing campaigns.

This blog demonstrates the power of Web Scraping H&M and Zara Fashion Data in Manchester to provide brands with detailed insights into product availability, pricing trends, and seasonal collections. By systematically collecting this data, businesses can monitor competitors, track consumer preferences, and identify emerging fashion trends in Manchester’s dynamic market.

Paired with Fashion Data Analytics from H&M and Zara in Manchester, these insights become actionable, allowing brands to interpret raw data, forecast demand, and optimize merchandising strategies. Combining scraping with analytics ensures a holistic understanding of both H&M and Zara’s market performance.

Moreover, this approach supports advanced E-commerce Analytics, giving retailers the ability to analyze online sales patterns, conversion rates, and digital shelf performance.

Using Product Data Tracking, brands can monitor SKU-level performance, track new product launches, and detect shifts in top-selling items across categories.

Price Benchmarking becomes effortless, enabling businesses to compare pricing strategies against competitors and adjust discounts or promotions in real time.

Finally, Brand Competition Analysis allows companies to evaluate market share, promotional campaigns, and overall competitive positioning, helping them make data-driven decisions that improve profitability and market presence.

Understanding Manchester’s fashion market requires analyzing both apparel categories and pricing strategies. Using Extract Apparel Categories & Prices from Zara and H&M alongside Scrape Clothing & Apparel Data from H&M Websites Manchester, retailers can track product launches, stock availability, and pricing trends simultaneously. This dual approach ensures data is actionable for inventory management, merchandising, and competitive benchmarking.

From 2020 to 2025, Manchester’s fast-fashion market experienced consistent growth. Women’s wear remained the largest segment, with a CAGR of 5%, while men’s wear and accessories saw 3% and 2% annual growth, respectively. The rise of eco-friendly fashion and athleisure drove engagement, with online searches for sustainable clothing increasing by 28% year-on-year.

| Year | Women’s Wear (%) | Men’s Wear (%) | Accessories (%) | Avg. Price H&M (USD) | Avg. Price Zara (USD) |

|---|---|---|---|---|---|

| 2020 | 45 | 35 | 20 | 35 | 38 |

| 2021 | 47 | 34 | 19 | 36 | 39 |

| 2022 | 48 | 33 | 19 | 37 | 40 |

| 2023 | 50 | 32 | 18 | 38 | 41 |

| 2024 | 52 | 30 | 18 | 39 | 42 |

| 2025 | 53 (Proj) | 29 (Proj) | 18 (Proj) | 40 (Proj) | 43 (Proj) |

By combining Extract Apparel Categories & Prices from Zara and H&M with Scrape Clothing & Apparel Data from H&M Websites Manchester, retailers can identify high-demand categories and optimize product assortment for maximum profitability. Data-driven insights enable predictive inventory planning, seasonal assortment strategies, and targeted marketing campaigns to capitalize on trends like athleisure, sustainable fashion, and accessories.

This combination also facilitates competitor benchmarking. Retailers can track the frequency of new product launches, SKU-level pricing adjustments, and promotion strategies. For instance, Zara introduced 10–15% more SKUs per year than H&M between 2021–2024, emphasizing trend adaptation speed. Integrating category extraction with pricing data ensures retailers can adjust strategies proactively, reducing overstock risks and maximizing sales margins.

Price monitoring is crucial in fast fashion, where even a slight adjustment can influence sales. By combining Scrape Fashion Trends and Product Pricing Data in Manchester with Web Scraping H&M and Zara Fashion Data in Manchester, retailers gain a holistic view of pricing strategies, discount patterns, and competitor positioning.

Between 2020–2025, seasonal discounts increased from 10% to 18% on average across H&M and Zara collections. Retailers leveraging real-time data could align pricing strategies with competitors while maintaining margin goals. For example, during winter sales 2023, Zara’s discounts averaged 16%, while H&M offered 14%, demonstrating the need for competitive intelligence.

| Year | H&M Avg. Price (USD) | Zara Avg. Price (USD) | H&M Avg. Discount (%) | Zara Avg. Discount (%) |

|---|---|---|---|---|

| 2020 | 35 | 38 | 10 | 12 |

| 2021 | 36 | 39 | 11 | 13 |

| 2022 | 37 | 40 | 12 | 14 |

| 2023 | 38 | 41 | 14 | 15 |

| 2024 | 39 | 42 | 16 | 17 |

| 2025 | 40 (Proj) | 43 (Proj) | 18 (Proj) | 18 (Proj) |

Using Scrape Fashion Trends and Product Pricing Data in Manchester together with Web Scraping H&M and Zara Fashion Data in Manchester, retailers can implement dynamic pricing models, forecast demand for discounted products, and adjust promotions to capture market share. Integration with analytics dashboards ensures automated alerts for price fluctuations, enabling immediate reactions to competitor strategies.

Moreover, the dual keyword approach supports segmentation. Retailers can track pricing for specific categories such as women’s tops, men’s outerwear, and accessories, understanding where to apply discounts or premium pricing. Historical pricing patterns combined with trend monitoring allow predictive analytics for seasonal launches, maximizing revenue and minimizing inventory risks.

Stock management is essential for customer satisfaction. Scrape Zara and H&M Product Catalog Data in Manchester combined with Fashion Data Analytics from H&M and Zara in Manchester allows retailers to track stock levels, SKU availability, and replenishment schedules in real time.

Between 2020–2025, stockouts increased by 20% during high-demand periods like summer and holiday seasons, particularly for accessories and footwear. Retailers using both Scrape Zara and H&M Product Catalog Data in Manchester and Fashion Data Analytics from H&M and Zara in Manchester can forecast stock requirements and avoid lost sales.

| Category | H&M Stock-Out Rate (%) | Zara Stock-Out Rate (%) | Avg. Replenishment Time (Days) |

|---|---|---|---|

| Women’s Wear | 12 | 10 | 5 |

| Men’s Wear | 10 | 8 | 6 |

| Accessories | 15 | 12 | 7 |

| Footwear | 8 | 6 | 4 |

Combining catalog scraping with analytics supports inventory optimization, enabling automated alerts for low stock and tracking top-performing SKUs. Brands can plan replenishments in advance, adjust marketing campaigns for popular items, and align supply with anticipated demand spikes.

Additionally, this dual approach informs assortment planning. Retailers can identify trends in stockouts across categories, predict seasonal demand, and make strategic ordering decisions. For instance, Zara’s footwear category often faced 6–8% higher stockouts than H&M in 2023, prompting inventory adjustments based on trend analysis.

Trend tracking is critical in fast fashion. Web Scraping Fashion Trends in Manchester combined with Scrape Fashion Trends and Product Pricing Data in Manchester enables retailers to monitor emerging styles, popular colors, and fabric preferences.

From 2020–2025, athleisure adoption grew from 25% to 45%, sustainable fashion from 10% to 35%, and minimalist clothing from 15% to 30%. Tracking these trends alongside pricing data allows retailers to adjust product offerings and marketing strategies in real time.

| Trend | Adoption Rate 2020 (%) | 2025 Projected (%) |

|---|---|---|

| Sustainable Apparel | 10 | 35 |

| Athleisure | 25 | 45 |

| Minimalist Styles | 15 | 30 |

| Accessories Focus | 20 | 32 |

Dual keyword integration ensures brands can simultaneously track product performance and pricing competitiveness, aligning stock and promotions with consumer demand. For example, sustainable athleisure items priced competitively performed 15% better in 2024 than premium-priced equivalents.

Trend analytics combined with price monitoring enables proactive strategy planning, from launch timing to targeted promotions, ensuring maximum ROI and market share growth.

Continuous tracking provides competitive advantage. Using Product Data Tracking alongside H&M and Zara Fashion Data Extraction for Market Insights, retailers can monitor SKU performance, new product launches, and bestseller trends.

From 2020–2025, Zara introduced 15% more SKUs annually than H&M, focusing on trend adaptation, while H&M emphasized core products. Dual integration of Product Data Tracking and H&M and Zara Fashion Data Extraction for Market Insights enables brands to optimize inventory and merchandising strategy efficiently.

| Year | H&M New SKUs | Zara New SKUs | Avg. Price Change (%) |

|---|---|---|---|

| 2020 | 2000 | 2200 | 3 |

| 2021 | 2100 | 2300 | 3.5 |

| 2022 | 2200 | 2500 | 4 |

| 2023 | 2300 | 2700 | 4.2 |

| 2024 | 2400 | 2900 | 4.5 |

| 2025 | 2500 (Proj) | 3100 (Proj) | 5 |

This combined approach helps brands anticipate top sellers, optimize assortment, and align pricing with competitor strategy for maximum profitability.

For market positioning, Web Scraping H&M and Zara Fashion Data in Manchester combined with Brand Competition Analysis provides insights into market share, promotional strategies, and SKU launches.

| Metric | H&M | Zara |

|---|---|---|

| Market Share (%) | 52 | 48 |

| Avg. Price (USD) | 40 | 42 |

| Discount Frequency (%) | 18 | 20 |

| New SKUs Introduced | 2500 | 3100 |

Integrating both keywords allows retailers to make strategic decisions based on competitors’ moves, forecast demand, and plan assortments, ensuring a leading position in Manchester’s fast-fashion market.

Actowiz Metrics offers solutions to scrape, track, and analyze fashion data. By combining Web Scraping H&M and Zara Fashion Data in Manchester with Product Data Tracking, retailers gain actionable insights into pricing, stock levels, and new product launches.

Integrating E-commerce Analytics and Price Benchmarking allows brands to respond to competitor moves and optimize inventory efficiently. Actowiz empowers businesses to forecast trends, enhance merchandising, and improve profitability, keeping them ahead in Manchester’s competitive fashion market.

Manchester’s fashion market is rapidly evolving, with H&M and Zara shaping trends. Using Web Scraping H&M and Zara Fashion Data in Manchester combined with H&M and Zara Fashion Data Extraction for Market Insights, retailers gain a competitive edge by monitoring pricing, inventory, and trends in real time.

Brands leveraging this data can optimize stock, forecast demand, and execute targeted marketing campaigns. Actowiz Metrics transforms raw data into actionable intelligence, enabling businesses to outperform competitors and capitalize on emerging opportunities.

Elevate your Manchester fashion strategy — harness Actowiz Metrics to scrape, track, and analyze H&M and Zara data for actionable market insights today!

Case Study on how we enhanced pricing accuracy and local market insights using Extract API for Instacart Grocery Data from Houston, TX.

Explore Now

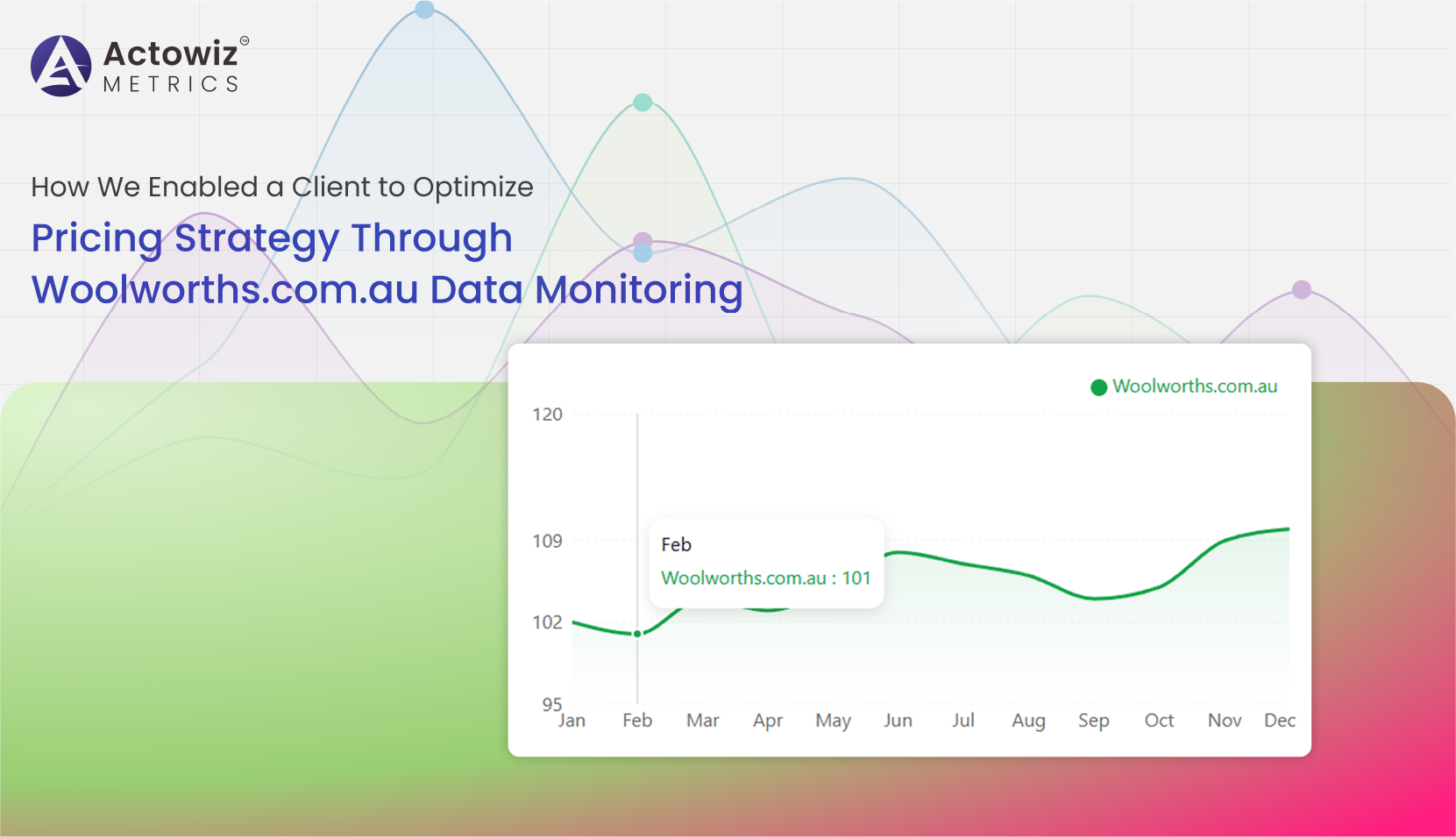

Woolworths.com.au Data Monitoring helps track pricing, promotions, stock availability, and competitor trends to drive smarter retail and eCommerce decisions.

Explore Now

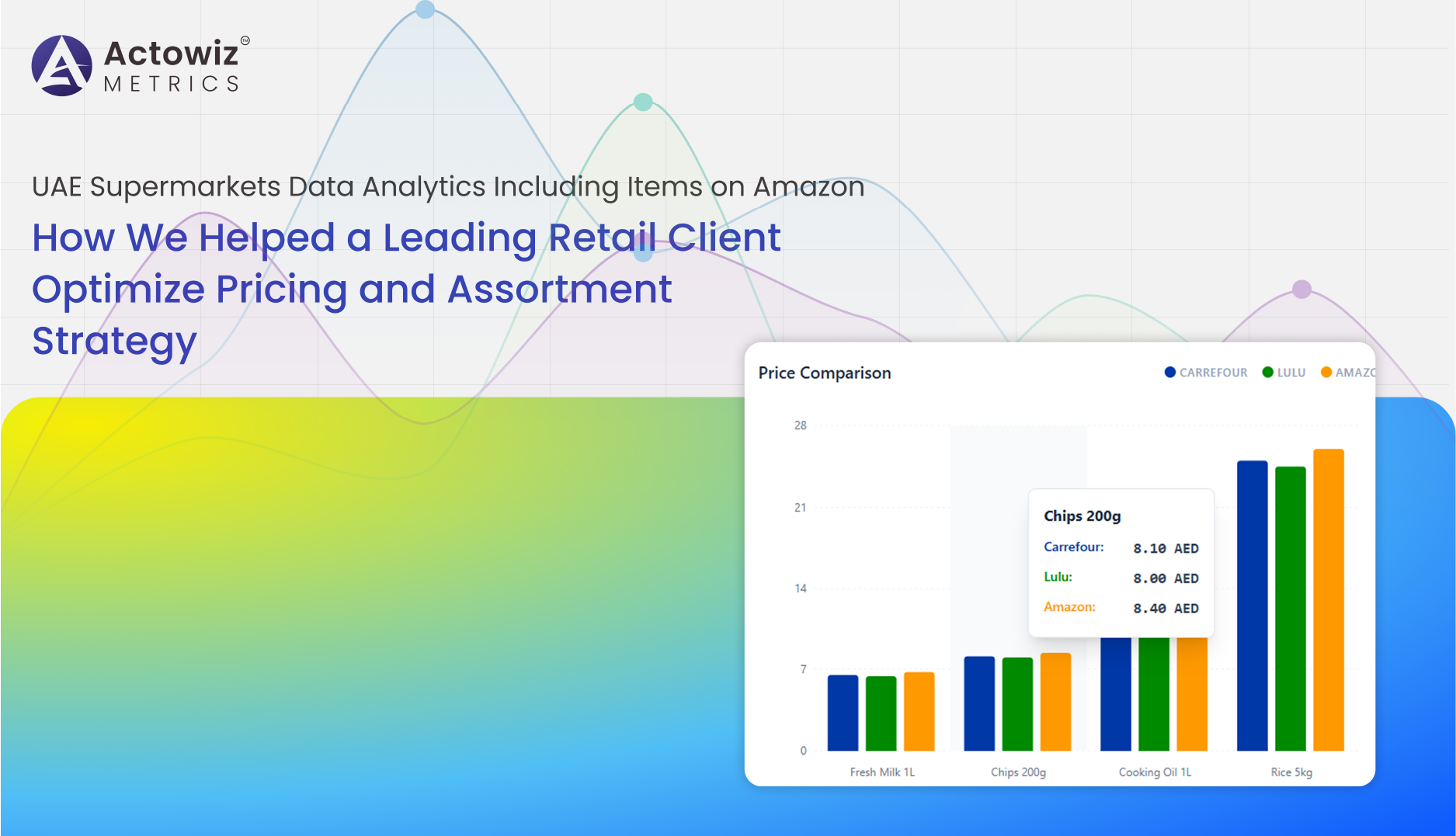

UAE Supermarkets Data Analytics Including Items on Amazon helped our retail client optimize pricing, refine assortment, and improve market competitiveness.

Explore Now

Browse expert blogs, case studies, reports, and infographics for quick, data-driven insights across industries.

How Keeta Food Delivery App Data Analysis solves demand forecasting gaps and delivery inefficiencies with real-time insights and smart optimization.

How Etsy Product Data Intelligence API improves demand forecasting accuracy and enhances seller performance tracking with real-time insights.

Solving Real-Time Order Management Challenges with Restaurant Reservations & Orders Monitoring API - Zomato, Swiggy & EazyDiner for smarter tracking.

Dior Luxury Fashion Market Analysis explores global brand positioning, competitive landscape, market trends, revenue performance, and future growth outlook.

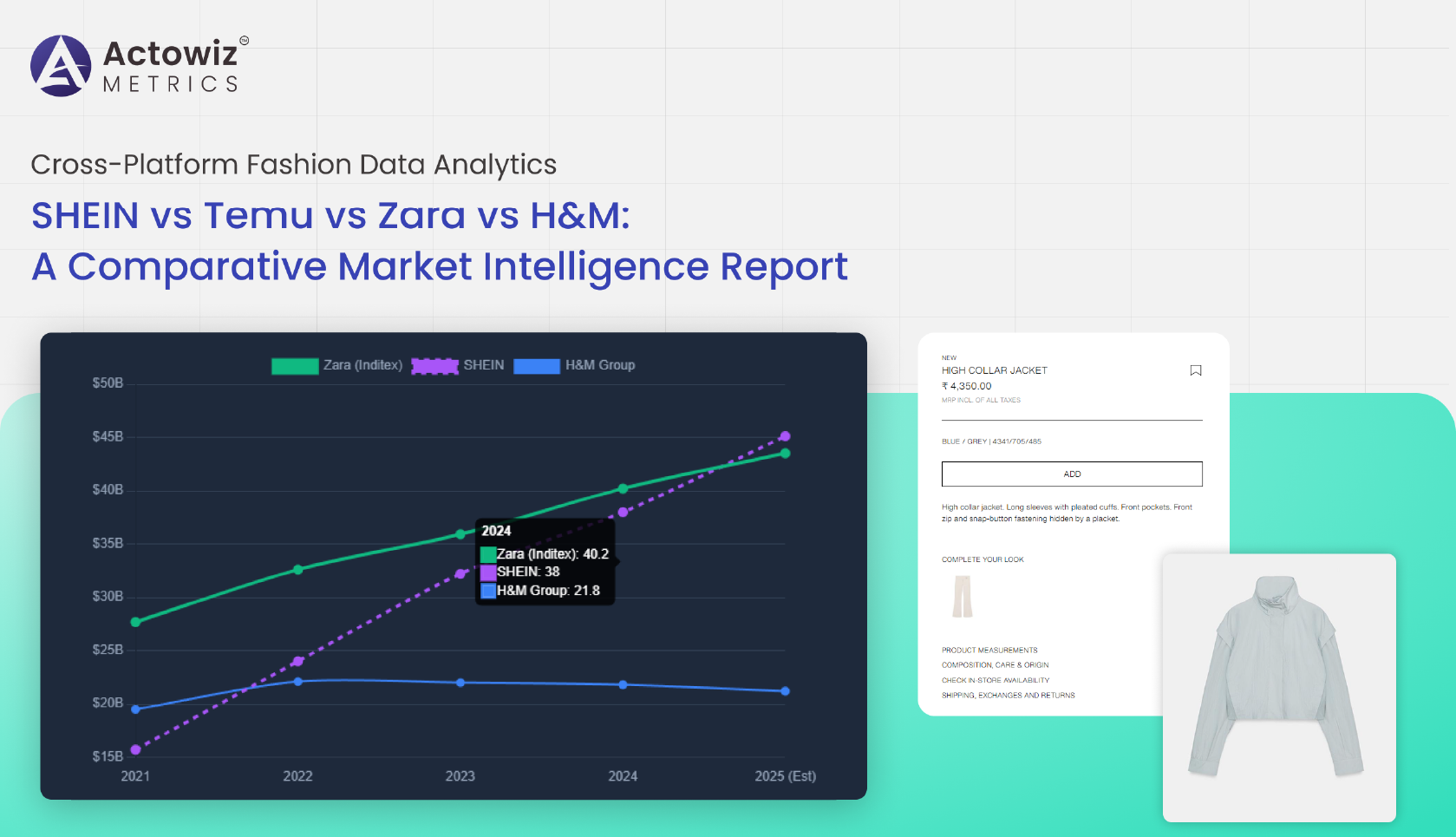

Cross-Platform Fashion Data Analytics - SHEIN vs Temu vs Zara vs H&M delivers actionable insights by comparing pricing, trends, inventory shifts, and consumer demand

Track and analyze the Number of Pizza Hut Locations Analytics in India 2026 to uncover expansion trends, regional distribution, and market growth insights.

Explore Luxury vs Smartwatch - Global Price Comparison 2025 to compare prices of luxury watches and smartwatches using marketplace data to reveal key trends and shifts.

E-Commerce Price Benchmarking: Gucci vs Prada reveals 2025 pricing trends for luxury handbags and accessories, helping brands track competitors and optimize pricing.

Discover how menu data scraping uncovers trending dishes in 2025, revealing popular recipes, pricing trends, and real-time restaurant insights for food businesses.

Explore the Amazon Baby Care Report analyzing Top Baby Brands Analysis on Amazon, covering discounts, availability, and popular products with data-driven market insights.

Amazon Sports & Outdoors Report - Sports & Outdoors Top Brands Analysis on Amazon - Prices, Discounts, Reviews

Enabled a USA pet brand to optimize pricing, inventory, and offers on Amazon using Pet Supplies Top Brands Analysis on Amazon for accurate, data-driven decisions.

Whatever your project size is, we will handle it well with all the standards fulfilled! We are here to give 100% satisfaction.

Any analytics feature you need — we provide it

24/7 global support

Real-time analytics dashboard

Full data transparency at every stage

Customized solutions to achieve your data analysis goals