Fashion Price Monitoring for Private Label vs National Brands

Fashion Price Monitoring for Private Label vs National Brands helps retailers track price gaps, manage discounts, protect margins, and stay competitive

Shrinkflation has become one of the most subtle yet impactful pricing strategies in modern retail, especially within large grocery chains. Instead of increasing shelf prices directly, brands reduce product quantity, weight, or count while keeping prices unchanged—or even increasing them marginally. This research report focuses on Walmart & Target Shrinkflation Data Analytics, Competitor Analysis, offering a detailed examination of how shrinkflation has evolved across grocery categories between 2020 and 2026.

Walmart and Target, as two of the most influential retailers in the U.S., shape pricing norms for both national brands and private labels. Monitoring shrinkflation across these retailers provides critical insight into supplier strategies, margin protection tactics, and consumer cost pressures. Traditional price tracking fails to capture these hidden changes, making advanced data analytics essential.

Actowiz Metrics applies large-scale data extraction and SKU-level analysis to detect packaging changes, unit-price inflation, and retailer-specific trends. This report equips retailers, brands, and market analysts with factual evidence to quantify shrinkflation, benchmark competitors, and anticipate future pricing behaviors in the grocery sector.

Shrinkflation trends accelerated after 2020 as supply chain disruptions and inflationary pressures intensified. Using Walmart & Target Shrinkflation Data Scraping, Digital Shelf Analytics, Actowiz Metrics tracked visible and hidden changes across thousands of grocery SKUs.

| Year | Walmart | Target |

|---|---|---|

| 2020 | 6% | 5% |

| 2021 | 11% | 9% |

| 2022 | 18% | 16% |

| 2023 | 24% | 22% |

| 2024 | 29% | 27% |

| 2025 | 33% | 31% |

| 2026* | 37% | 35% |

Shrinkflation is most prevalent in packaged foods, snacks, cereals, and frozen items. Digital shelf analytics reveal that reductions often occur alongside minor design refreshes, making detection difficult for consumers. Retailers benefit from maintaining price perception, while brands protect margins. Data-driven visibility ensures stakeholders recognize these changes early and respond strategically.

To quantify shrinkflation effectively, raw product data must be continuously captured and standardized. With Extract Walmart & Target Shrinkflation Data, Actowiz Metrics identifies changes in net weight, volume, pack count, and unit pricing across time.

| Year | Avg. Size Reduction (%) |

|---|---|

| 2020 | 1.2% |

| 2021 | 2.6% |

| 2022 | 4.1% |

| 2023 | 5.3% |

| 2024 | 6.4% |

| 2025 | 7.2% |

| 2026* | 8.0% |

This structured approach enables comparison across brands, categories, and retailers. It also highlights cumulative shrinkflation effects, where multiple small reductions over time result in significant value loss for consumers. For analysts and pricing teams, this data forms the foundation for evidence-based reporting and regulatory assessments.

Price alone no longer reflects true consumer cost. Through Walmart & Target Product Size & Price Analysis, Actowiz Metrics calculates effective price per unit to expose hidden inflation.

| Year | Avg. Unit Price Increase |

|---|---|

| 2020 | 2.4% |

| 2021 | 4.9% |

| 2022 | 7.8% |

| 2023 | 9.6% |

| 2024 | 11.2% |

| 2025 | 12.8% |

| 2026* | 14.1% |

Findings show that unit-price inflation often exceeds headline CPI figures. This gap highlights why consumers feel grocery inflation more intensely than reported. Brands that manage shrinkflation carefully can remain competitive, while retailers can assess private-label positioning more accurately.

Shrinkflation rarely occurs uniformly. With SKU-Level Shrinkflation Data Extraction from Walmart & Target, Actowiz Metrics isolates product-level changes across time.

| Year | % of Affected SKUs |

|---|---|

| 2020 | 4% |

| 2021 | 9% |

| 2022 | 15% |

| 2023 | 21% |

| 2024 | 26% |

| 2025 | 30% |

| 2026* | 34% |

Repeated reductions often signal margin pressure or strategic repositioning. This level of granularity supports brand audits, supplier negotiations, and compliance monitoring. It also helps retailers identify which brands rely most heavily on shrinkflation tactics.

Comparative analysis between Walmart and Target reveals distinct strategic approaches. Walmart tends to emphasize volume retention through private labels, while Target often balances shrinkflation with premium positioning.

| Year | Avg. Difference (%) |

|---|---|

| 2020 | 0.8% |

| 2021 | 1.5% |

| 2022 | 2.7% |

| 2023 | 3.6% |

| 2024 | 4.4% |

| 2025 | 5.1% |

| 2026* | 5.8% |

Such insights help brands optimize retailer-specific packaging strategies and allow analysts to benchmark shrinkflation intensity across channels.

By combining SKU-level intelligence with category-wide trends, Grocery Analytics delivers a holistic view of inflation drivers.

| Category | Avg. Size Reduction |

|---|---|

| Snacks | 9.2% |

| Frozen Foods | 8.7% |

| Breakfast Cereals | 8.1% |

| Packaged Meals | 7.6% |

| Dairy | 6.9% |

This macro view supports forecasting, policy evaluation, and long-term pricing strategy development across the grocery ecosystem.

Actowiz Metrics delivers precision-driven intelligence through Product Data Tracking and Walmart & Target Shrinkflation Data Analytics, empowering businesses to uncover hidden inflation and protect value.

Our solutions offer high-frequency data capture, SKU-level accuracy, and scalable analytics tailored for retailers, brands, and research firms. With advanced automation and quality controls, Actowiz Metrics ensures reliable insights that support competitive benchmarking and strategic decision-making.

Shrinkflation is reshaping grocery economics in ways that traditional price tracking cannot detect. Through advanced Price Benchmarking and Walmart & Target Shrinkflation Data Analytics, Actowiz Metrics provides unmatched visibility into product size changes, unit-price inflation, and retailer strategies.

Partner with Actowiz Metrics to uncover hidden shrinkflation, benchmark competitors accurately, and make data-backed pricing decisions with confidence.

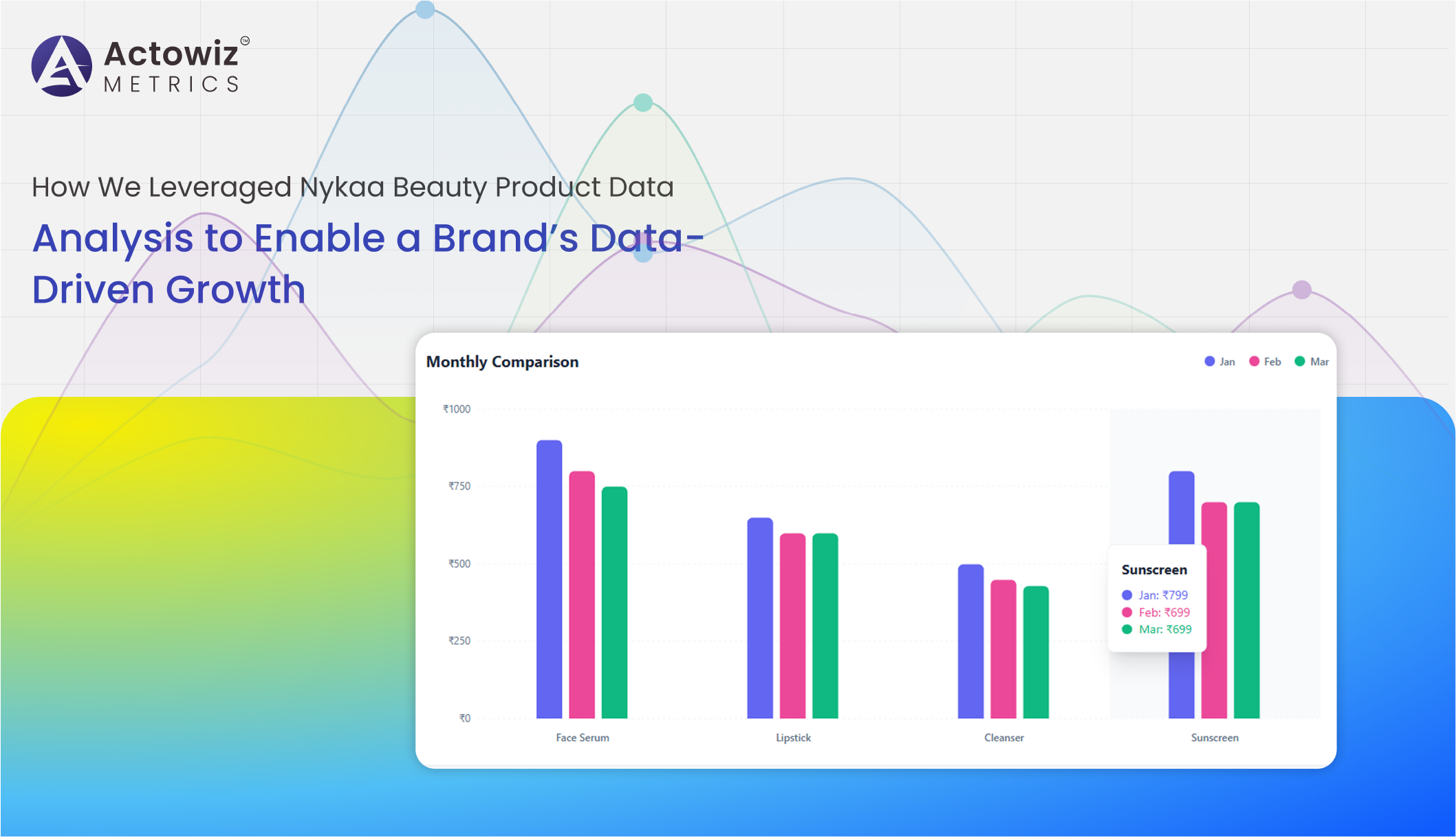

Nykaa Beauty Product Data Analysis examines pricing, reviews, and product performance to help brands identify trends and make data-driven decisions

Explore Now

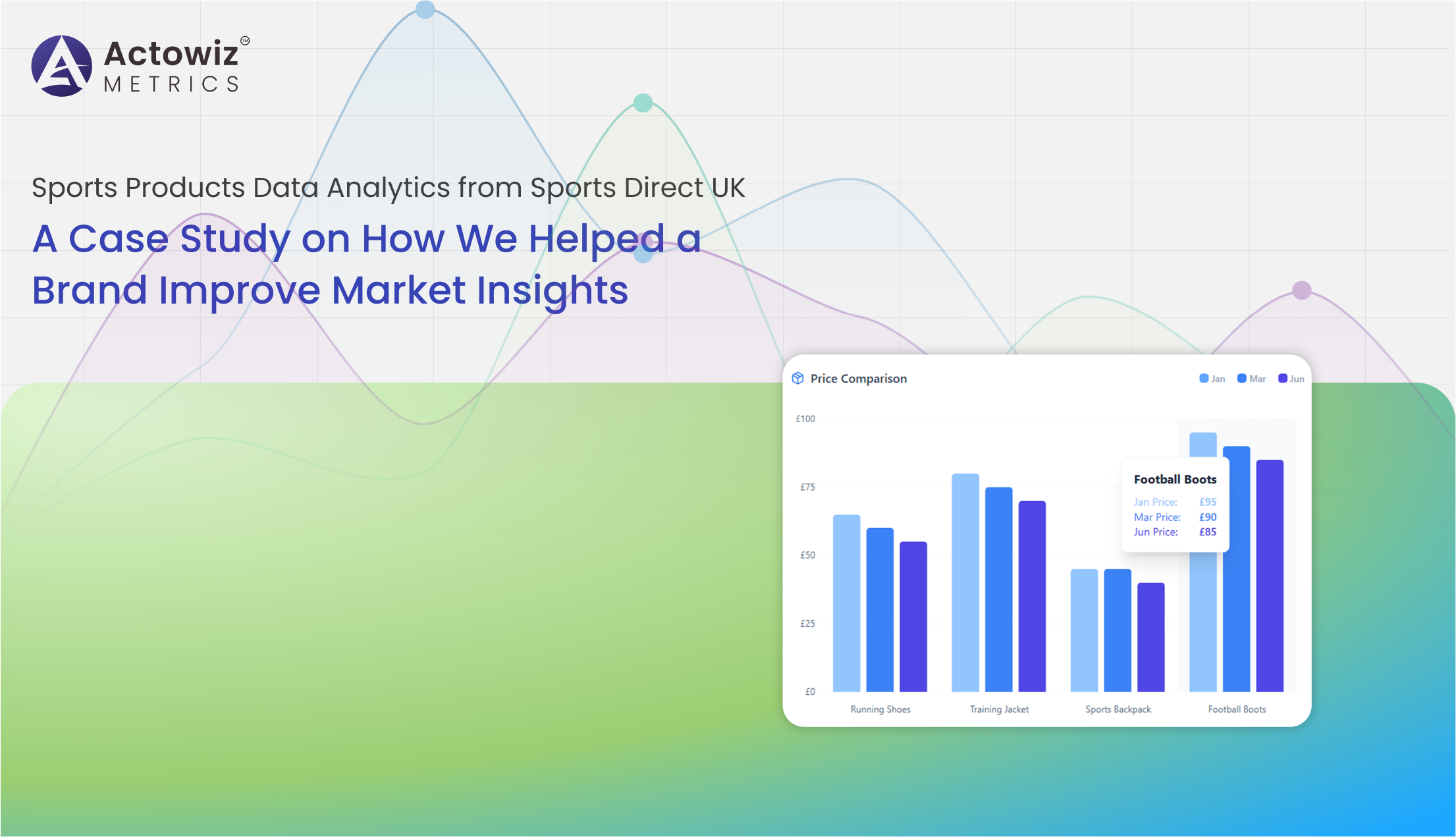

Sports Products Data Analytics from Sports Direct UK examines how data-driven insights helped a brand understand market trends, optimize product strategy.

Explore Now

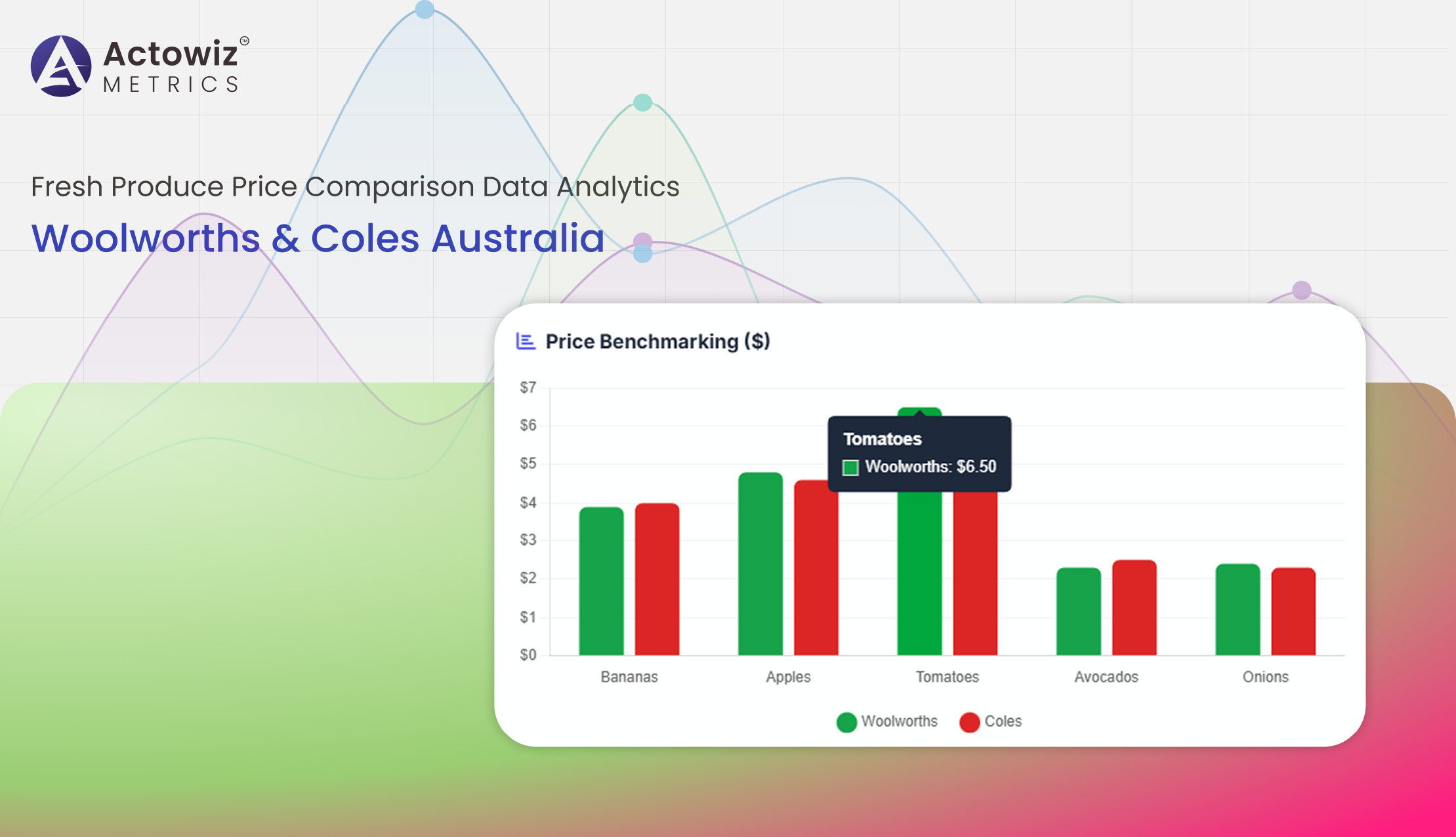

Fresh Produce Price Comparison Data Analytics for Woolworths and Coles Australia 2026 - pricing trends, competitive insights and cost data benchmarking

Explore Now

Browse expert blogs, case studies, reports, and infographics for quick, data-driven insights across industries.

Fashion Price Monitoring for Private Label vs National Brands helps retailers track price gaps, manage discounts, protect margins, and stay competitive

Brand-Level Price & Discount Benchmarking Across India’s Top Fashion Marketplaces helps businesses track pricing, discounts, and smarter retail decisions.

Marketplace Price and Inventory Analytics for Dewu-Poizon helps sellers track trends, optimize pricing reduce stock risks, and boost profits with insights.

Walmart & Target Shrinkflation Data Analytics to track pricing trends, product availability, private labels, and competitive shifts across major US grocery retailers.

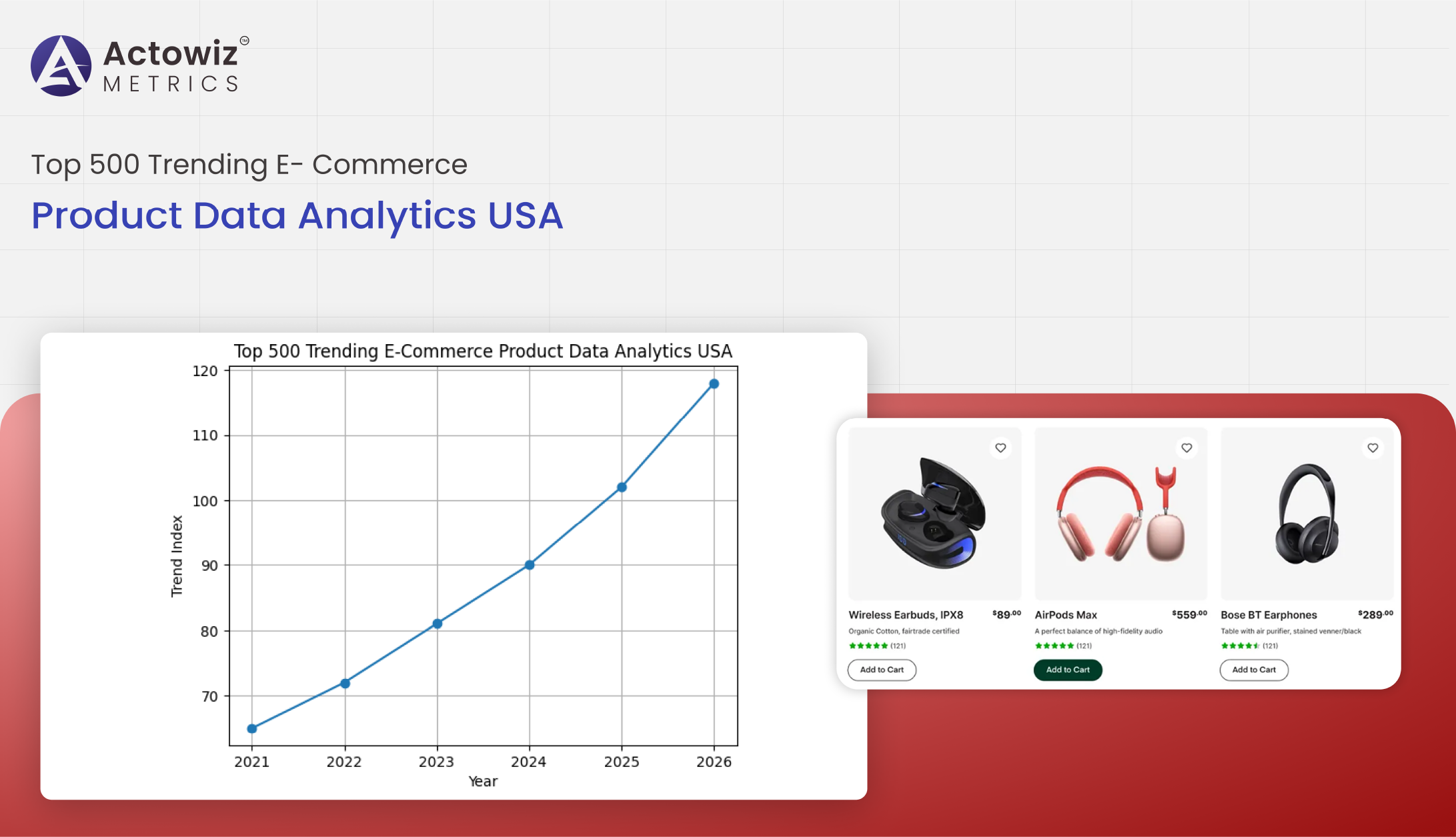

Top 500 trending e-commerce product data analytics in the USA delivers insights on pricing, demand, reviews, and sales trends to support smarter merchandising

Analyze Walmart’s dynamic discount trends analytics for electronics brands using data-driven insights to track price changes, promotions, and optimize pricing strategies.

Explore Luxury vs Smartwatch - Global Price Comparison 2025 to compare prices of luxury watches and smartwatches using marketplace data to reveal key trends and shifts.

E-Commerce Price Benchmarking: Gucci vs Prada reveals 2025 pricing trends for luxury handbags and accessories, helping brands track competitors and optimize pricing.

Discover how menu data scraping uncovers trending dishes in 2025, revealing popular recipes, pricing trends, and real-time restaurant insights for food businesses.

Explore the Amazon Baby Care Report analyzing Top Baby Brands Analysis on Amazon, covering discounts, availability, and popular products with data-driven market insights.

Amazon Sports & Outdoors Report - Sports & Outdoors Top Brands Analysis on Amazon - Prices, Discounts, Reviews

Enabled a USA pet brand to optimize pricing, inventory, and offers on Amazon using Pet Supplies Top Brands Analysis on Amazon for accurate, data-driven decisions.

Whatever your project size is, we will handle it well with all the standards fulfilled! We are here to give 100% satisfaction.

Any analytics feature you need — we provide it

24/7 global support

Real-time analytics dashboard

Full data transparency at every stage

Customized solutions to achieve your data analysis goals