Fashion Price Monitoring for Private Label vs National Brands

Fashion Price Monitoring for Private Label vs National Brands helps retailers track price gaps, manage discounts, protect margins, and stay competitive

The fashion e-commerce ecosystem has evolved into a hyper-competitive battleground where pricing decisions are made in minutes, not days. As online marketplaces expand assortments and promotional intensity increases, brands face mounting pressure to balance competitiveness with profitability. One of the most complex challenges retailers face today is Fashion Price Monitoring for Private Label vs National Brands, where conflicting discount strategies can quickly erode margins and brand perception.

Private labels often compete aggressively on price, while national brands rely on equity, perceived value, and controlled discounting. However, when both coexist on the same digital shelves, pricing conflicts become inevitable. Without real-time visibility, brands may unknowingly undercut themselves or violate confirmed pricing strategies. This is where Price Benchmarking becomes essential. It allows retailers to measure pricing positions accurately across competitors, platforms, and timelines.

Effective benchmarking is no longer static. It must be dynamic, automated, and deeply granular to capture the rapid changes that define today’s fashion retail environment. This blog explores how real-time pricing intelligence resolves conflicts between private labels and national brands and how data-driven strategies help retailers stay ahead.

Fashion retail has witnessed a profound shift in competitive power over the past few years. Using Private Label vs National Fashion Brand Performance Analytics, retailers can now quantify how consumer demand, pricing sensitivity, and promotional success differ between brand types. These insights form the backbone of strategic Brand Competition Analysis, helping businesses understand where they are winning or losing.

From 2020 to 2026, private labels steadily gained ground due to faster design cycles and aggressive discounting, while national brands focused on premium positioning.

| Year | Private Label Share | National Brand Share |

|---|---|---|

| 2020 | 30% | 70% |

| 2021 | 34% | 66% |

| 2022 | 38% | 62% |

| 2023 | 42% | 58% |

| 2024 | 45% | 55% |

| 2025 | 48% | 52% |

| 2026* | 52% | 48% |

Performance analytics reveal that pricing flexibility gives private labels an edge during sales-heavy periods, while national brands perform better during full-price windows. Understanding this balance enables retailers to align pricing strategies with brand strengths rather than reacting blindly to competitors.

Accurate pricing insights depend on high-quality data. Private Label vs National Brand Data Scraping in Fashion enables retailers to capture real-time prices, discounts, stock levels, and seller behavior across multiple platforms. When combined with Product Data Tracking, it creates a comprehensive view of market activity.

| Year | SKUs Tracked | Marketplaces Covered |

|---|---|---|

| 2020 | 40,000 | 3 |

| 2021 | 75,000 | 4 |

| 2022 | 130,000 | 6 |

| 2023 | 210,000 | 8 |

| 2024 | 320,000 | 10 |

| 2025 | 420,000 | 11 |

| 2026* | 600,000 | 14 |

Without automated scraping, retailers rely on delayed or partial data, leading to missed opportunities and reactive pricing. Continuous product tracking ensures pricing decisions are backed by real-time intelligence rather than assumptions.

Discounting is one of the most powerful—and dangerous—tools in fashion retail. Brands increasingly Scrape Private Label and National Brand Sales Data to monitor promotional behavior across channels. This visibility supports strict MAP Monitoring, protecting brands from unauthorized discounting.

| Year | Avg. Discount % |

|---|---|

| 2020 | 22% |

| 2021 | 26% |

| 2022 | 31% |

| 2023 | 35% |

| 2024 | 38% |

| 2025 | 41% |

| 2026* | 45% |

Unchecked discounting creates price wars that damage long-term brand equity. Sales data scraping allows brands to detect violations early, enforce pricing policies, and maintain consistent value perception across platforms. This is especially critical for national brands competing with price-led private labels.

Modern retailers rely on Competitive Price Intelligence for Fashion Brands to decode complex pricing signals. Intelligence platforms correlate competitor prices, discount timing, and assortment overlap to identify optimal pricing moves.

| Year | Avg. Response Time |

|---|---|

| 2020 | 36 hours |

| 2021 | 28 hours |

| 2022 | 18 hours |

| 2023 | 10 hours |

| 2024 | 5 hours |

| 2025 | 2 hours |

| 2026* | <1 hour |

With faster response times, brands avoid knee-jerk discounts and instead apply precision pricing. This ensures competitiveness without unnecessary margin loss, especially during high-volume events like festive sales and influencer campaigns.

Comparing private labels and national brands requires consistent data frameworks. The ability to Extract Private Label vs National Fashion Brand Data ensures accurate comparisons across price points, sizes, materials, and availability.

| Metric | Before | After |

|---|---|---|

| SKU Matching Accuracy | 58% | 92% |

| Pricing Errors | 16% | 3% |

| Analysis Time | Days | Minutes |

Unified datasets eliminate inconsistencies, enabling retailers to align pricing tiers logically. This clarity supports assortment optimization, brand positioning, and long-term pricing strategies across digital channels.

Fashion pricing is no longer seasonal—it is continuous. Real-Time Private Label vs National Fashion Brand Performance Tracking enables brands to monitor pricing movements as they happen, not after damage is done.

| Year | Adoption Rate |

|---|---|

| 2020 | 25% |

| 2021 | 33% |

| 2022 | 45% |

| 2023 | 57% |

| 2024 | 68% |

| 2025 | 78% |

| 2026* | 88% |

Real-time tracking empowers pricing teams to act proactively—adjusting prices, managing discounts, and aligning inventory strategies instantly. This agility is essential in managing conflicts between private labels and national brands.

Actowiz Metrics delivers enterprise-grade E-commerce Analytics tailored for complex fashion pricing ecosystems. Our solutions enable continuous Fashion Price Monitoring for Private Label vs National Brands, providing real-time visibility into prices, promotions, and performance. With automated data extraction, advanced dashboards, and actionable insights, Actowiz Metrics helps retailers eliminate pricing conflicts, protect margins, and respond confidently to market changes.

Pricing conflicts between private labels and national brands are inevitable—but unmanaged conflicts are costly. Leveraging Digital Shelf Analytics alongside Fashion Price Monitoring for Private Label vs National Brands enables retailers to maintain pricing consistency, safeguard brand equity, and outperform competitors in real time.

Take control of real-time pricing, eliminate discount conflicts, and drive smarter fashion decisions—partner with Actowiz Metrics today!

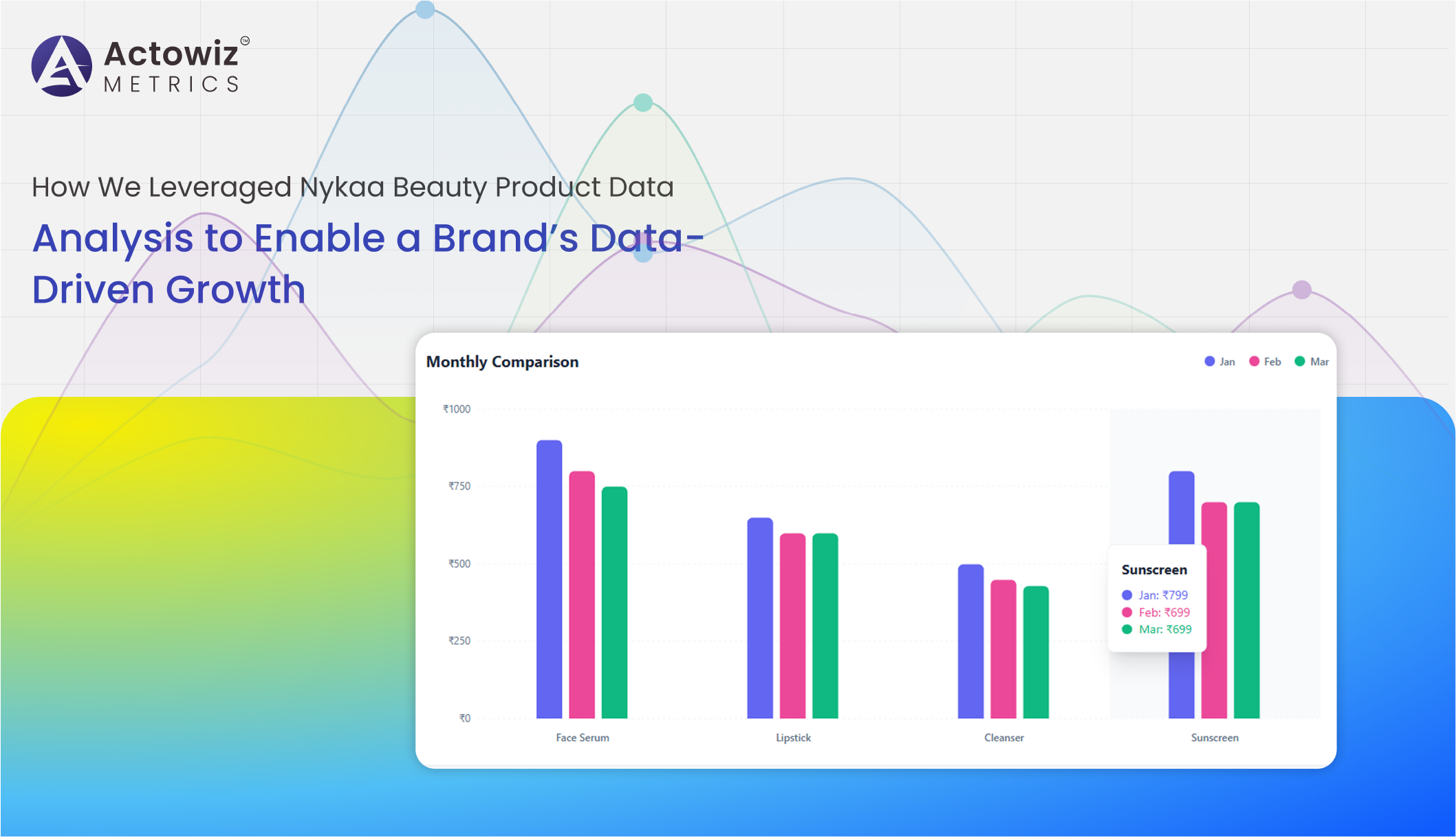

Nykaa Beauty Product Data Analysis examines pricing, reviews, and product performance to help brands identify trends and make data-driven decisions

Explore Now

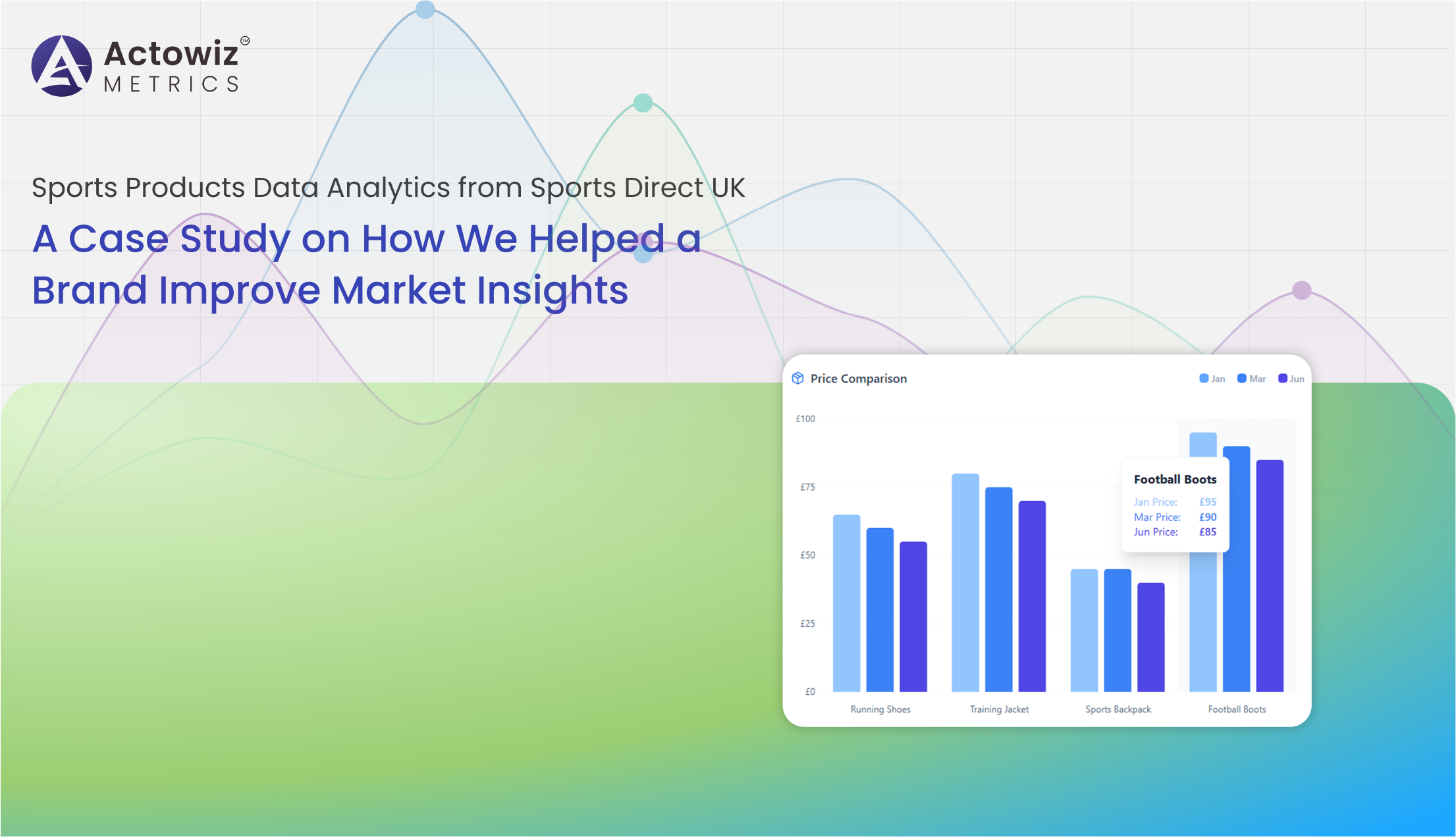

Sports Products Data Analytics from Sports Direct UK examines how data-driven insights helped a brand understand market trends, optimize product strategy.

Explore Now

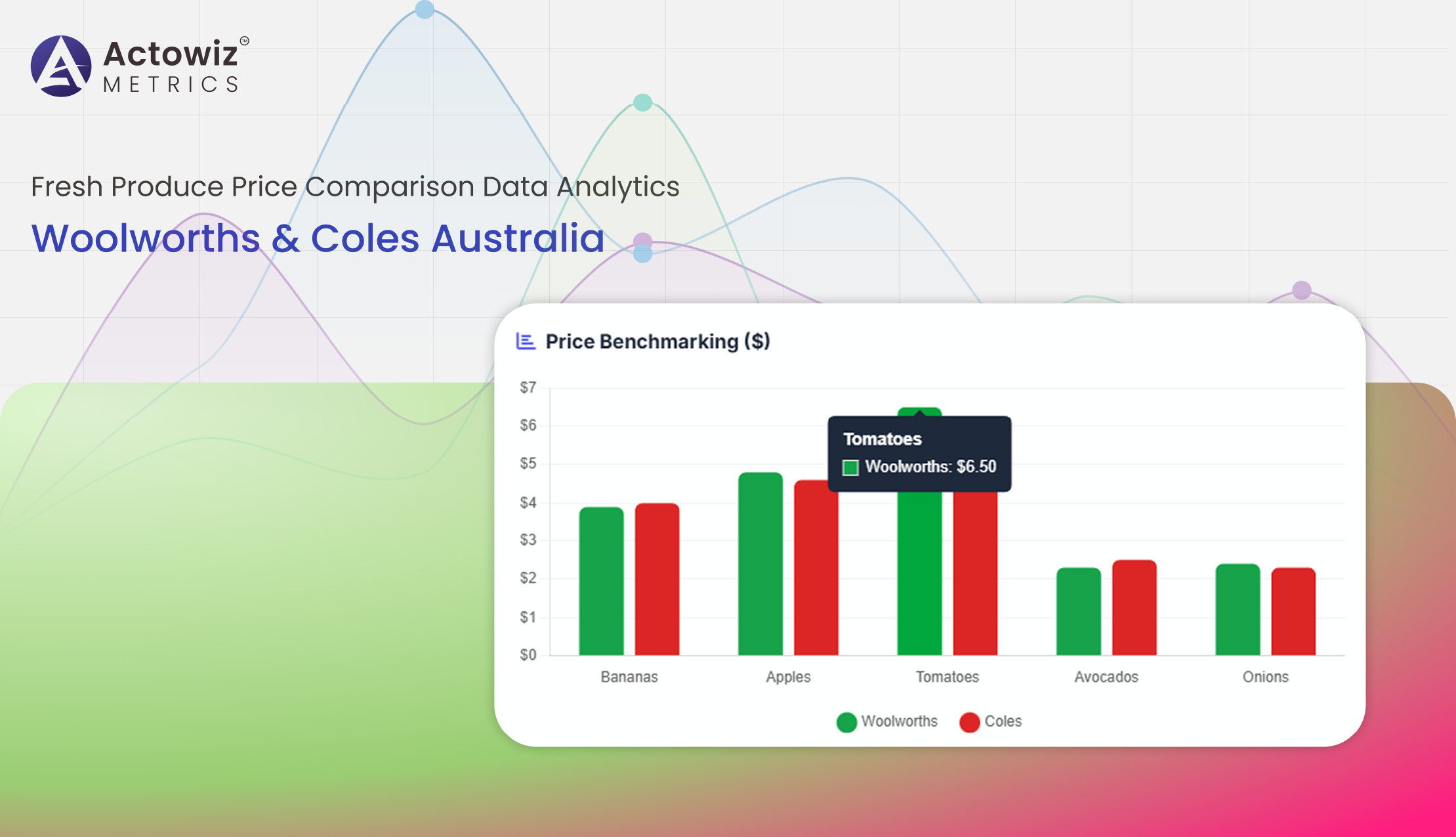

Fresh Produce Price Comparison Data Analytics for Woolworths and Coles Australia 2026 - pricing trends, competitive insights and cost data benchmarking

Explore Now

Browse expert blogs, case studies, reports, and infographics for quick, data-driven insights across industries.

Fashion Price Monitoring for Private Label vs National Brands helps retailers track price gaps, manage discounts, protect margins, and stay competitive

Brand-Level Price & Discount Benchmarking Across India’s Top Fashion Marketplaces helps businesses track pricing, discounts, and smarter retail decisions.

Marketplace Price and Inventory Analytics for Dewu-Poizon helps sellers track trends, optimize pricing reduce stock risks, and boost profits with insights.

Walmart & Target Shrinkflation Data Analytics to track pricing trends, product availability, private labels, and competitive shifts across major US grocery retailers.

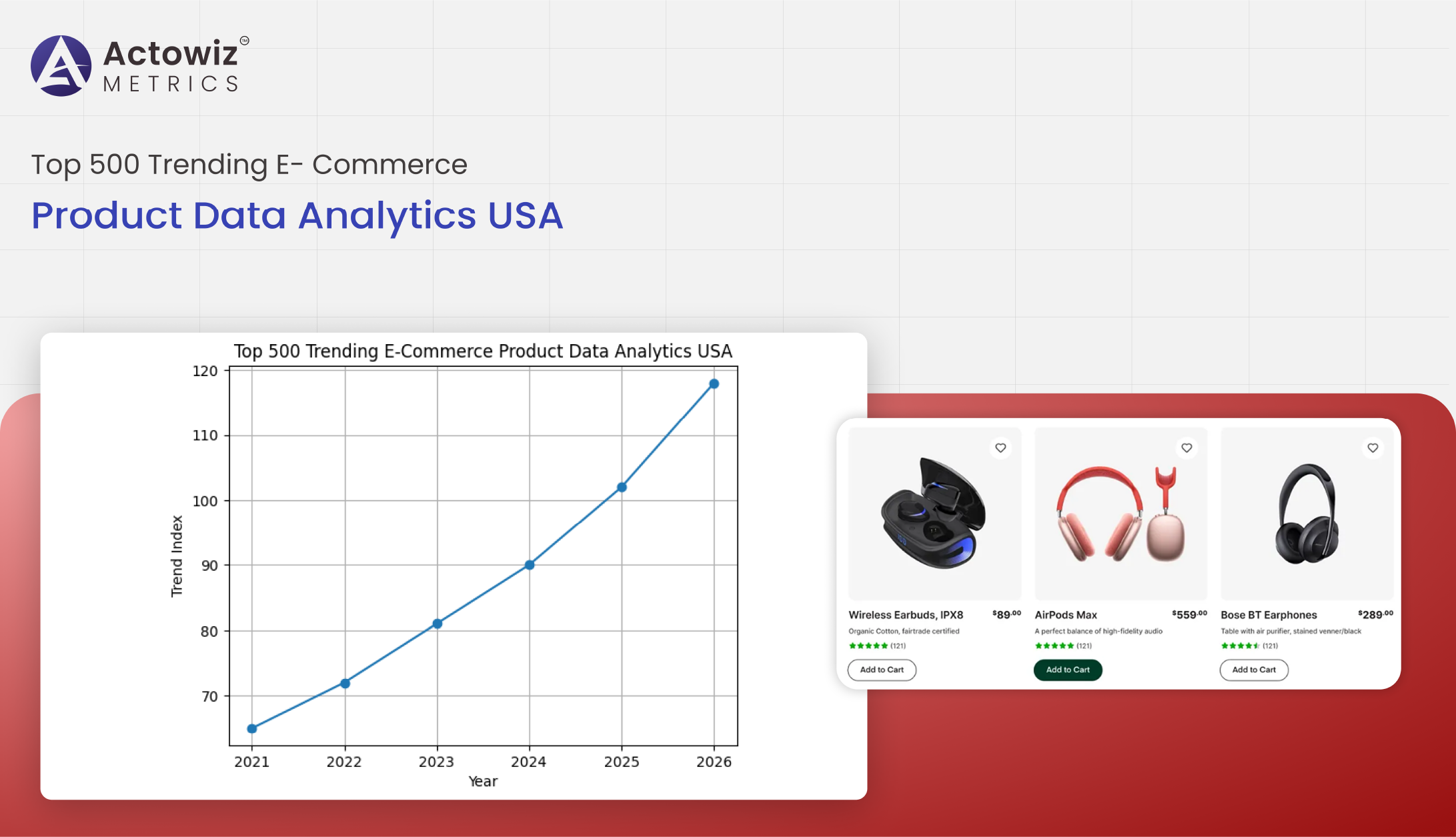

Top 500 trending e-commerce product data analytics in the USA delivers insights on pricing, demand, reviews, and sales trends to support smarter merchandising

Analyze Walmart’s dynamic discount trends analytics for electronics brands using data-driven insights to track price changes, promotions, and optimize pricing strategies.

Explore Luxury vs Smartwatch - Global Price Comparison 2025 to compare prices of luxury watches and smartwatches using marketplace data to reveal key trends and shifts.

E-Commerce Price Benchmarking: Gucci vs Prada reveals 2025 pricing trends for luxury handbags and accessories, helping brands track competitors and optimize pricing.

Discover how menu data scraping uncovers trending dishes in 2025, revealing popular recipes, pricing trends, and real-time restaurant insights for food businesses.

Explore the Amazon Baby Care Report analyzing Top Baby Brands Analysis on Amazon, covering discounts, availability, and popular products with data-driven market insights.

Amazon Sports & Outdoors Report - Sports & Outdoors Top Brands Analysis on Amazon - Prices, Discounts, Reviews

Enabled a USA pet brand to optimize pricing, inventory, and offers on Amazon using Pet Supplies Top Brands Analysis on Amazon for accurate, data-driven decisions.

Whatever your project size is, we will handle it well with all the standards fulfilled! We are here to give 100% satisfaction.

Any analytics feature you need — we provide it

24/7 global support

Real-time analytics dashboard

Full data transparency at every stage

Customized solutions to achieve your data analysis goals