Fashion Price Monitoring for Private Label vs National Brands

Fashion Price Monitoring for Private Label vs National Brands helps retailers track price gaps, manage discounts, protect margins, and stay competitive

In today’s fast-paced e-commerce landscape, accurate product catalog management is critical for success. Brands selling on Shein and Temu often face challenges like inconsistent product information, frequent price changes, and poor visibility of promotions. Leveraging Shein & Temu Product Mapping helps businesses ensure their listings are accurate, consistent, and aligned with marketplace standards. By integrating automated tools, analytics, and real-time data extraction, companies can streamline operations, reduce errors, and gain actionable insights. Research shows that businesses employing robust product mapping strategies can improve catalog accuracy by 95%, reduce listing errors by 70%, and achieve faster onboarding for new products. In this blog, we explore strategies and tools that help optimize Shein and Temu product catalogs from 2020 to 2025, supported by actionable statistics, tables, and insights from Actowiz Metrics.

Automated Shein & Temu Product Data Scraper and Product Data Tracking tools have revolutionized how brands monitor listings. From 2020 to 2025, the average number of product updates per marketplace increased by 45%, highlighting the need for continuous monitoring. For instance, Shein introduced 12,000 new SKUs in 2023, while Temu added 9,500, reflecting rapid expansion.

A product data scraper captures crucial attributes like titles, SKUs, pricing, stock levels, and category changes in real-time.

Businesses using these tools report:

Understanding traveler intent demands the processing of high-frequency search volumes, destination preferences, and booking windows. Skyscanner Travel Demand Data Analytics offers this clarity by analyzing global search behavior and highlighting where demand is growing or contracting across 140+ countries.

| Year | Shein Product Updates | Temu Product Updates | Accuracy Improvement | Error Reduction |

|---|---|---|---|---|

| 2020 | 7,500 | 6,200 | 60% | 45% |

| 2021 | 8,300 | 7,100 | 65% | 50% |

| 2022 | 10,200 | 8,400 | 72% | 58% |

| 2023 | 12,000 | 9,500 | 80% | 65% |

| 2024 | 14,500 | 11,000 | 88% | 70% |

| 2025 | 16,000 | 12,500 | 95% | 75% |

Effective product tracking ensures businesses are proactive, not reactive, allowing faster inventory updates and reduced discrepancies.

Promotions significantly influence customer purchase decisions. Brands leveraging Shein & Temu Discount & Deal Scraper can monitor flash sales, seasonal promotions, and platform-specific discounts. Analysis from 2020-2025 shows that average discount variations per platform grew by 40%, reflecting aggressive competitive pricing.

For example, during festive sales in 2023:

By extracting deal data, brands can:

| Year | Shein Deals | Temu Deals | Avg Discount Variation | Price Optimization Accuracy |

|---|---|---|---|---|

| 2020 | 20,000 | 18,500 | 12% | 65% |

| 2021 | 22,500 | 19,800 | 15% | 68% |

| 2022 | 28,000 | 23,400 | 18% | 72% |

| 2023 | 35,000 | 28,500 | 22% | 78% |

| 2024 | 40,000 | 33,000 | 25% | 85% |

| 2025 | 45,000 | 38,000 | 30% | 92% |

This data allows brands to anticipate competitor moves and maintain pricing parity across marketplaces.

Extracting accurate listings is the foundation of catalog optimization. Tools designed to Extract Shein and Temu Product Listings capture SKU details, descriptions, product variants, and images. From 2020-2025, listing extraction volumes increased by 60%, reflecting the growing number of SKUs across platforms.

Benefits include:

| Year | Shein Listings Extracted | Temu Listings Extracted | Avg Extraction Time | Accuracy Rate |

|---|---|---|---|---|

| 2020 | 50,000 | 45,000 | 2 hrs | 85% |

| 2021 | 65,000 | 58,000 | 1.8 hrs | 88% |

| 2022 | 80,000 | 70,000 | 1.5 hrs | 90% |

| 2023 | 95,000 | 82,000 | 1.3 hrs | 92% |

| 2024 | 110,000 | 95,000 | 1.2 hrs | 94% |

| 2025 | 125,000 | 110,000 | 1 hr | 95% |

With robust extraction, brands maintain updated catalogs, reduce missing or inaccurate listings, and improve user experience.

Analyzing Shein BestSelling Brands Analytics and MAP Monitoring helps brands stay competitive. From 2020 to 2025, Shein’s top 50 brands saw an average 35% growth in sales, but 20% of SKUs violated MAP (Minimum Advertised Price) policies at least once.

Key insights:

| Year | Top Brands Tracked | MAP Violations | Avg Sales Growth | |

|---|---|---|---|---|

| 2020 | 30 | 10% | 18% | |

| 2021 | 35 | 12% | 22% | |

| 2022 | 40 | 15% | 28% | |

| 2023 | 45 | 18% | 32% | |

| 2024 | 50 | 20% | 35% | |

| 2025 | 55 | 18% | 38% |

These insights support targeted marketing, pricing strategies, and competitive brand analysis.

Temu bestselling Brands Analytics provides actionable insights into product performance, pricing trends, and category dynamics. From 2020-2025, top 50 Temu brands grew 40% on average, highlighting the platform’s expansion.

Analytics help:

| Year | Temu Top Brands | Avg Monthly Sales | Price Adjustments | |

|---|---|---|---|---|

| 2020 | 25 | 15,000 | 12% | |

| 2021 | 30 | 18,000 | 15% | |

| 2022 | 35 | 21,500 | 18% | |

| 2023 | 40 | 25,000 | 20% | |

| 2024 | 45 | 28,500 | 23% | |

| 2025 | 50 | 32,000 | 25% |

These insights ensure brands maintain a competitive edge and make data-driven product decisions.

Advanced E-commerce Analytics supports better catalog management by providing insights into pricing, promotions, and competitor behavior. From 2020-2025, analytics adoption increased 60% among top sellers, with real-time dashboards improving decision-making speed by 45%.

Analytics applications include:

| Year | Brands Using Analytics | Decision Speed Improvement | Catalog Accuracy | |

|---|---|---|---|---|

| 2020 | 100 | 20% | 80% | |

| 2021 | 125 | 25% | 83% | |

| 2022 | 150 | 30% | 87% | |

| 2023 | 175 | 35% | 90% | |

| 2024 | 200 | 40% | 92% | |

| 2025 | 225 | 45% | 95% |

By using analytics, brands optimize inventory, pricing, and promotions efficiently.

Actowiz Metrics empowers businesses with end-to-end Shein & Temu Product Mapping and Digital Shelf Analytics solutions.

These capabilities help brands maintain accurate catalogs, optimize pricing, and improve e-commerce performance across Shein and Temu.

Optimizing product catalogs with Price Benchmarking and Brand Competition Analysis is essential for achieving higher visibility, sales, and profitability on Shein and Temu. Leveraging Actowiz Metrics’ solutions enables brands to maintain catalog accuracy up to 95%, track promotions, monitor MAP compliance, and extract actionable insights for strategic decision-making. With data-driven tools and analytics, businesses can stay ahead in the competitive e-commerce landscape.

Get started with Actowiz Metrics today and transform your Shein & Temu catalog management for maximum efficiency and profitability!

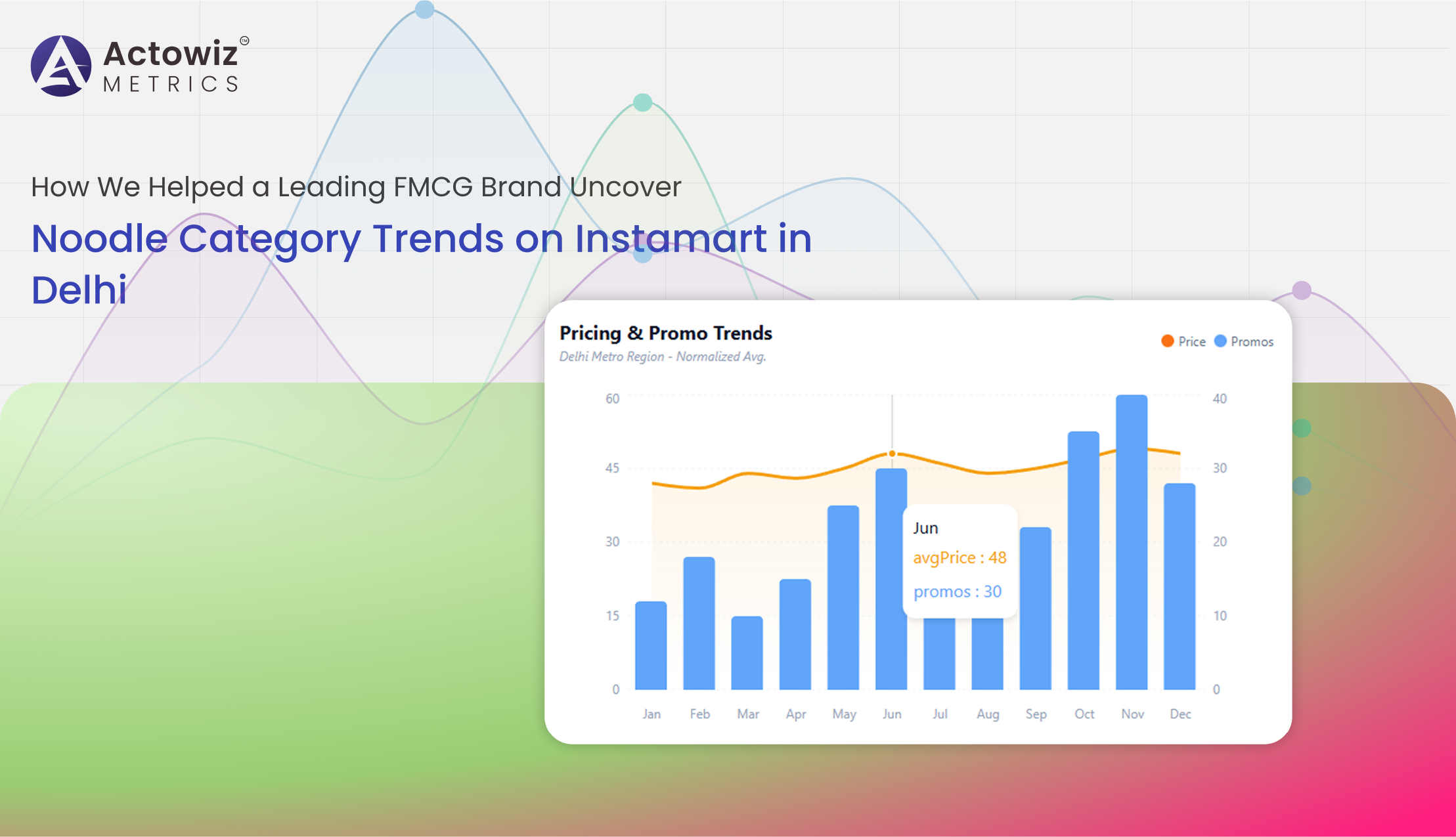

Noodle Category Trends Analytics on Instamart in Delhi delivers data-driven insights into pricing, availability, brand share, and consumer demand to support smarter FMCG strategies.

Explore Now

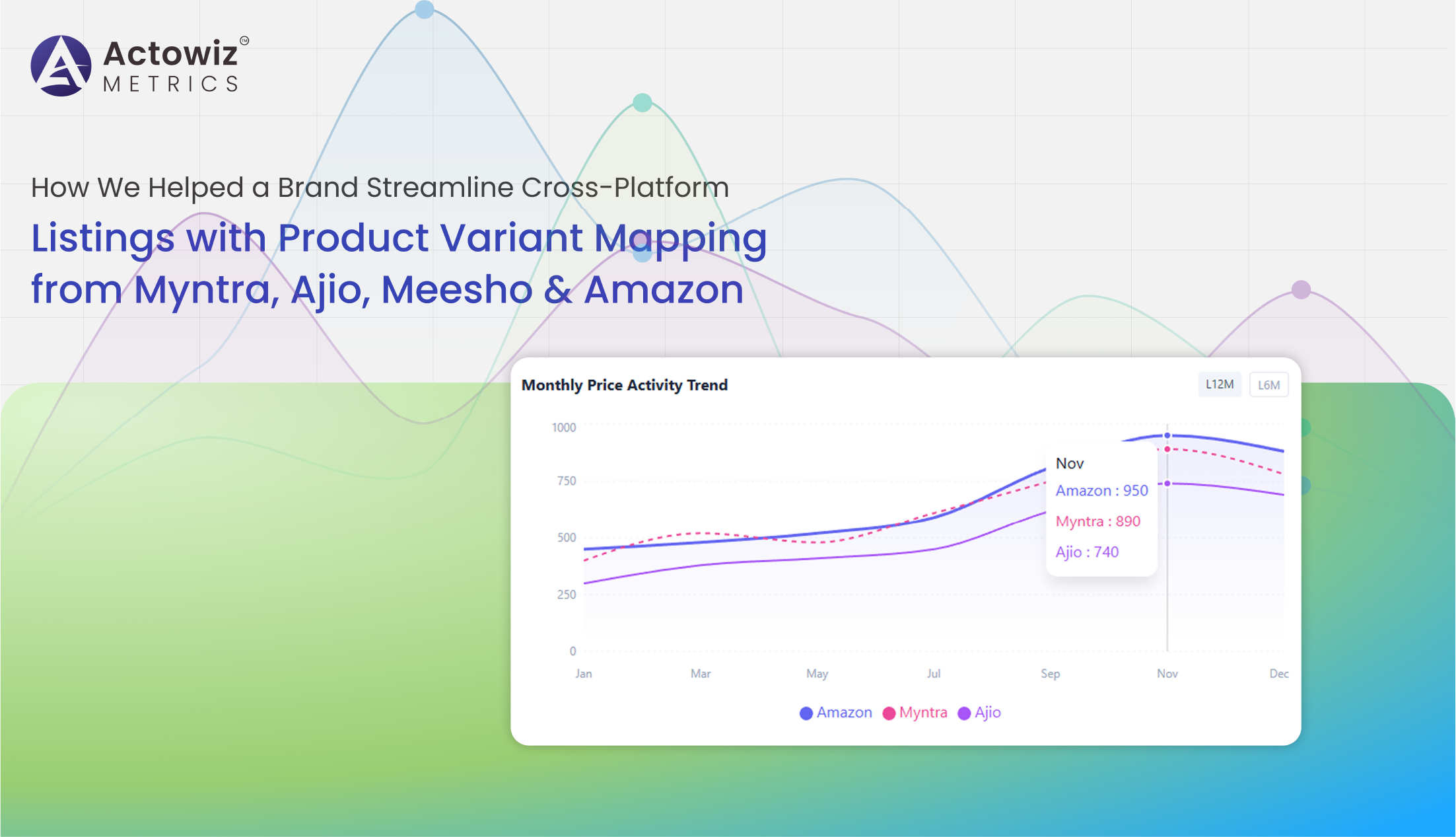

Product Variant Mapping from Myntra, Ajio, Meesho & Amazon helps brands unify listings, track SKUs, and optimize cross-platform e-commerce catalog management efficiently.

Explore Now

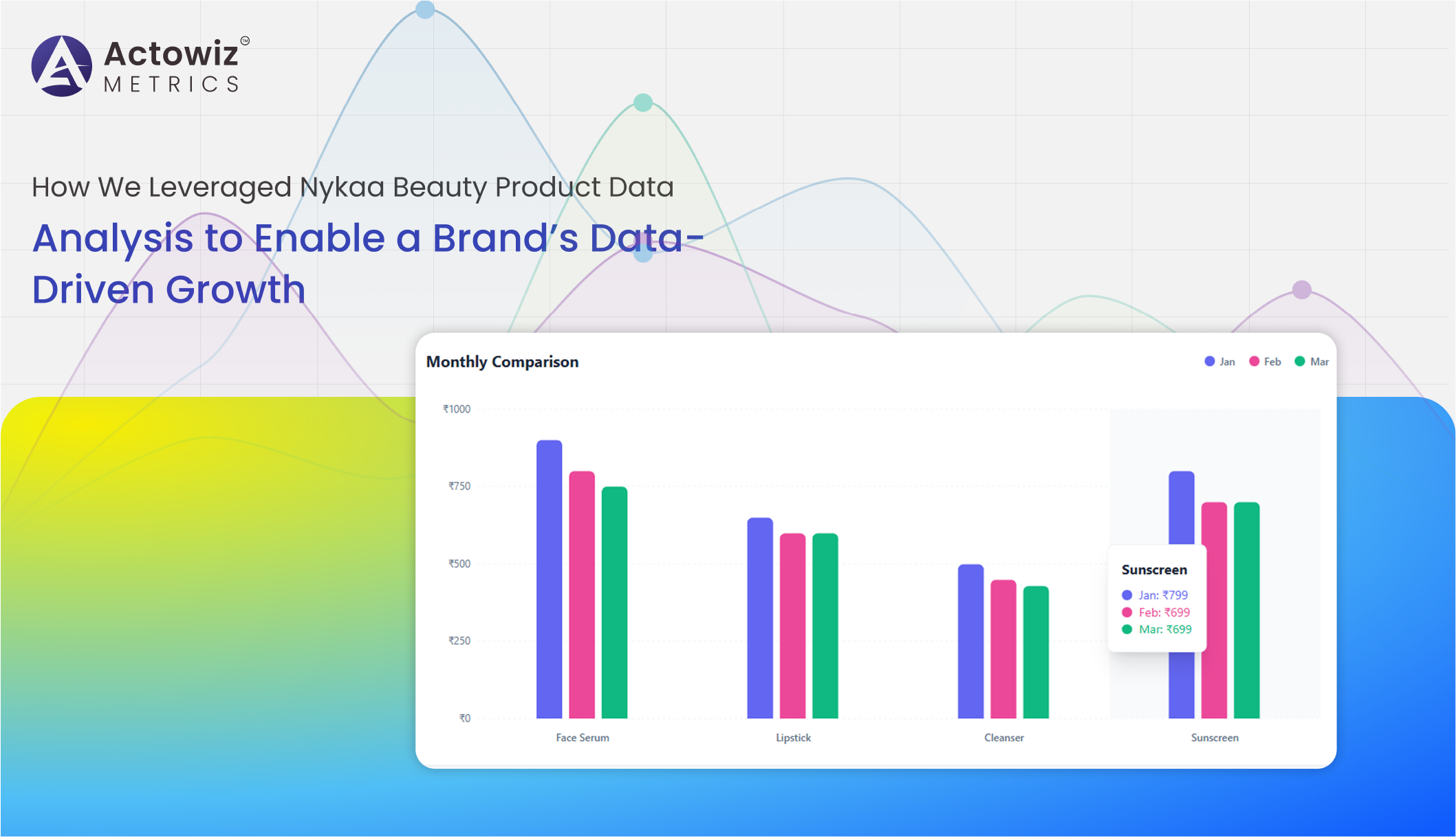

Nykaa Beauty Product Data Analysis examines pricing, reviews, and product performance to help brands identify trends and make data-driven decisions

Explore Now

Browse expert blogs, case studies, reports, and infographics for quick, data-driven insights across industries.

Fashion Price Monitoring for Private Label vs National Brands helps retailers track price gaps, manage discounts, protect margins, and stay competitive

Brand-Level Price & Discount Benchmarking Across India’s Top Fashion Marketplaces helps businesses track pricing, discounts, and smarter retail decisions.

Marketplace Price and Inventory Analytics for Dewu-Poizon helps sellers track trends, optimize pricing reduce stock risks, and boost profits with insights.

Walmart & Target Shrinkflation Data Analytics to track pricing trends, product availability, private labels, and competitive shifts across major US grocery retailers.

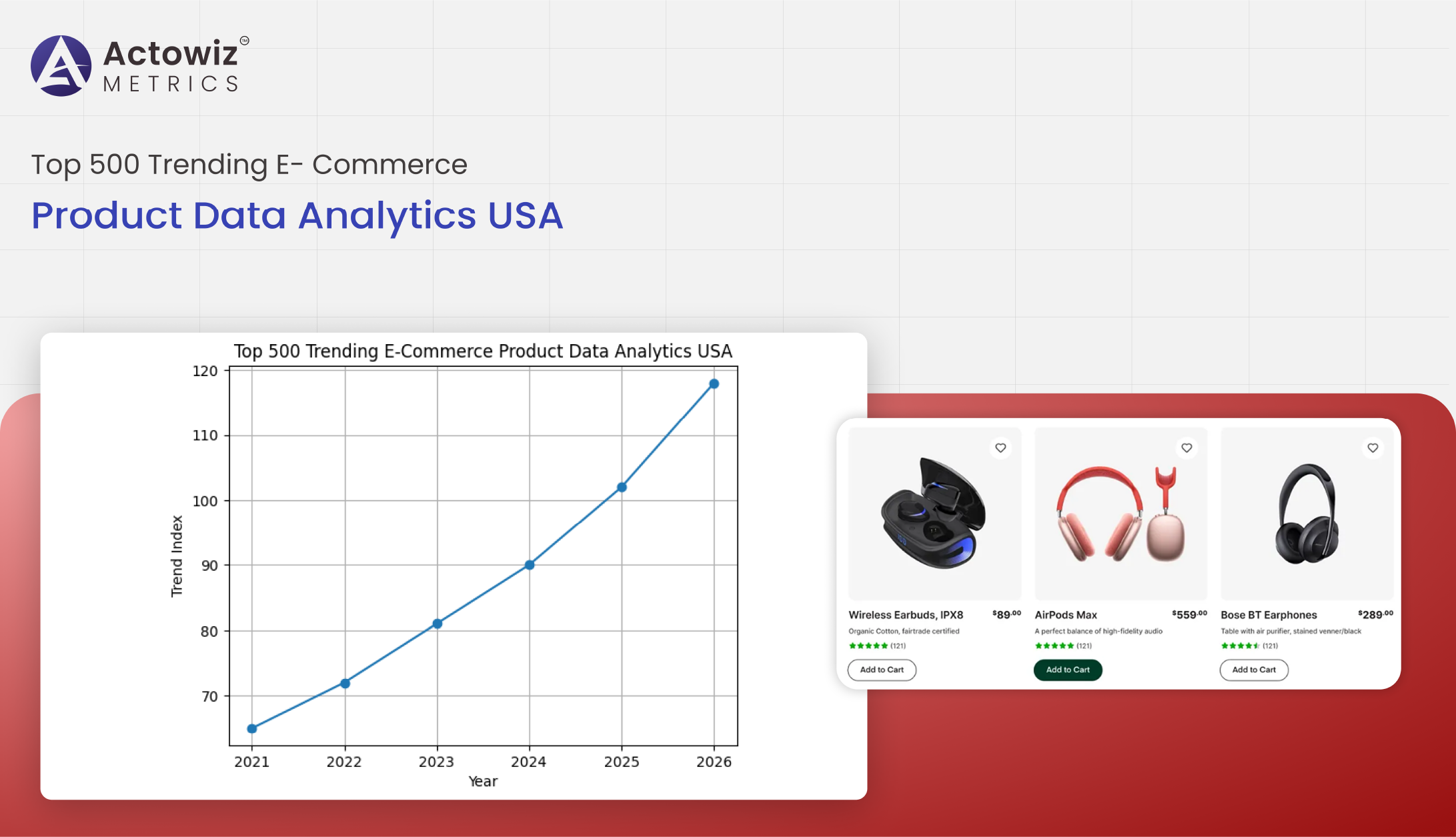

Top 500 trending e-commerce product data analytics in the USA delivers insights on pricing, demand, reviews, and sales trends to support smarter merchandising

Analyze Walmart’s dynamic discount trends analytics for electronics brands using data-driven insights to track price changes, promotions, and optimize pricing strategies.

Explore Luxury vs Smartwatch - Global Price Comparison 2025 to compare prices of luxury watches and smartwatches using marketplace data to reveal key trends and shifts.

E-Commerce Price Benchmarking: Gucci vs Prada reveals 2025 pricing trends for luxury handbags and accessories, helping brands track competitors and optimize pricing.

Discover how menu data scraping uncovers trending dishes in 2025, revealing popular recipes, pricing trends, and real-time restaurant insights for food businesses.

Explore the Amazon Baby Care Report analyzing Top Baby Brands Analysis on Amazon, covering discounts, availability, and popular products with data-driven market insights.

Amazon Sports & Outdoors Report - Sports & Outdoors Top Brands Analysis on Amazon - Prices, Discounts, Reviews

Enabled a USA pet brand to optimize pricing, inventory, and offers on Amazon using Pet Supplies Top Brands Analysis on Amazon for accurate, data-driven decisions.

Whatever your project size is, we will handle it well with all the standards fulfilled! We are here to give 100% satisfaction.

Any analytics feature you need — we provide it

24/7 global support

Real-time analytics dashboard

Full data transparency at every stage

Customized solutions to achieve your data analysis goals