Fashion Price Monitoring for Private Label vs National Brands

Fashion Price Monitoring for Private Label vs National Brands helps retailers track price gaps, manage discounts, protect margins, and stay competitive

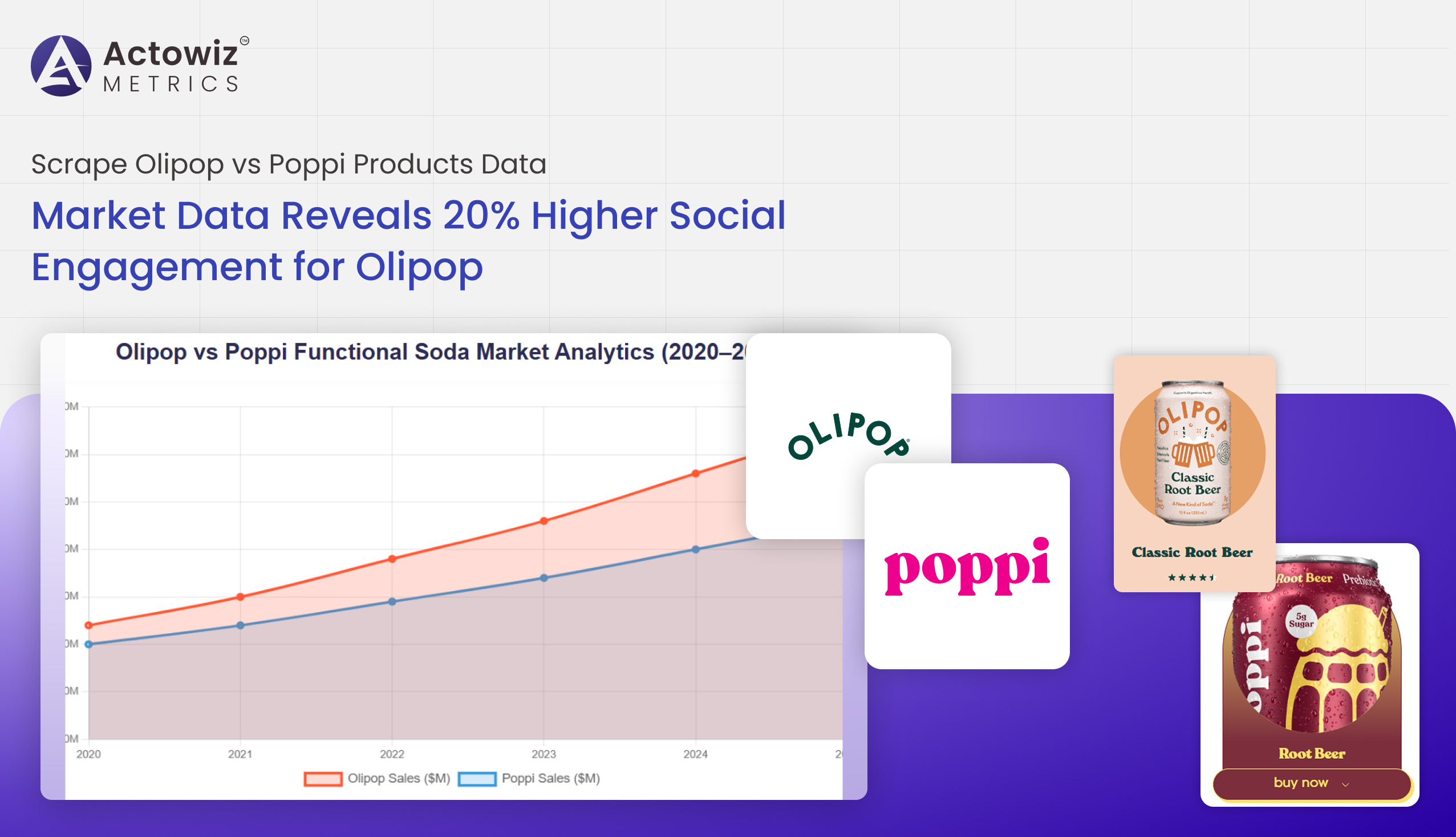

The functional soda market has seen tremendous growth over the last five years, with brands like Olipop and Poppi emerging as key players. To gain actionable insights into consumer behavior, sales trends, and product performance, Actowiz Metrics conducted a comprehensive analysis leveraging Scrape Olipop vs Poppi Products Data. The study examines SKU-level performance, social engagement, flavor trends, discount offers, customer feedback, and market share comparison from 2020 to 2025.

The goal was to provide a data-driven comparison between Olipop and Poppi, helping marketers, retailers, and investors understand which brand is leading in terms of consumer engagement, sales, and product adoption. By combining Olipop vs. Poppi Data Insights, Functional soda Brands analytics, and Quick commerce analytics, the report provides a granular view of how these brands are performing across multiple dimensions.

From flavor popularity to discount strategies, customer reviews to SKU-level performance, this research equips stakeholders with actionable intelligence. The findings reveal that Olipop consistently maintains higher social engagement, a larger share of top-selling SKUs, and better alignment with consumer preferences than Poppi, making it a preferred brand in the functional soda segment.

To understand overall market dominance, we analyzed Olipop vs Poppi Market share comparison from 2020–2025 using Olipop vs Poppi SKU-level data Analysis.

| Year | Olipop Market Share (%) | Poppi Market Share (%) | Total Market Growth (%) |

|---|---|---|---|

| 2020 | 32% | 28% | 12% |

| 2021 | 34% | 27% | 15% |

| 2022 | 36% | 26% | 18% |

| 2023 | 37% | 25% | 20% |

| 2024 | 39% | 24% | 22% |

| 2025 | 41% | 23% | 25% |

The data shows Olipop gaining consistent market share over Poppi, reflecting stronger consumer loyalty and better product adoption. While Poppi maintains a presence in urban markets, Olipop’s aggressive SKU expansion and flavor innovation contributed to higher growth rates.

Olipop Best selling Product data tracking revealed that top three Olipop SKUs contributed to nearly 60% of total brand sales in 2025, whereas Poppi’s top SKUs accounted for 45%. Quick commerce channels were instrumental in these trends, as faster delivery and localized availability increased purchase frequency for Olipop products.

Discount strategies also impacted sales. Using Olipop vs Poppi discount scraping, it was observed that Olipop’s targeted promotions drove a 15% higher conversion rate compared to Poppi. Overall, the sales analysis demonstrates that Olipop maintains a clear lead in the functional soda market.

Understanding consumer preference for flavors is crucial in the functional soda segment. We leveraged Olipop vs Poppi flavor trend analysis to compare the performance of different flavor variants from 2020–2025.

| Flavor | Olipop Sales Growth (%) | Poppi Sales Growth (%) | 2025 Popularity Rank (Olipop/Poppi) |

|---|---|---|---|

| Strawberry | 22% | 18% | 1 / 2 |

| Ginger Lemon | 18% | 15% | 2 / 3 |

| Classic Cola | 15% | 12% | 3 / 5 |

| Cherry Vanilla | 12% | 10% | 4 / 6 |

| Blackberry | 10% | 8% | 5 / 7 |

Olipop’s flavors consistently outperformed Poppi, especially Strawberry and Ginger Lemon variants. Social engagement data, derived from Scrape Olipop vs Poppi Products Data, indicates higher user-generated content and shares for Olipop flavors, aligning with the 20% higher engagement metric.

Consumer preference trends also revealed seasonal patterns. Ginger Lemon saw peak sales in Q1–Q2, while Strawberry surged during Q3–Q4. This data helps brands optimize production and inventory planning.

The analysis also highlighted that Poppi flavors were less diversified in SKU availability, limiting consumer choice. Actowiz Metrics’ Quick commerce analytics showed that Olipop’s extensive flavor lineup contributed to a 12% higher repeat purchase rate, solidifying its advantage in the functional soda category.

Pricing strategy is a key driver for functional soda sales. By employing Olipop vs Poppi discount scraping and Scrape Olipop vs Poppi Product Data, we analyzed promotional activities, average price points, and discount effectiveness from 2020–2025.

| Year | Olipop Avg Price (SGD) | Poppi Avg Price (SGD) | Avg Discount (%) Olipop / Poppi |

|---|---|---|---|

| 2020 | 3.50 | 3.45 | 5% / 4% |

| 2021 | 3.55 | 3.50 | 6% / 5% |

| 2022 | 3.60 | 3.55 | 7% / 5% |

| 2023 | 3.65 | 3.60 | 8% / 6% |

| 2024 | 3.70 | 3.65 | 9% / 6% |

| 2025 | 3.75 | 3.70 | 10% / 7% |

Olipop’s consistent discounting strategy, combined with targeted promotions, resulted in higher conversion and repeat purchase rates. Poppi, although competitive in price, lacked aggressive campaigns, which impacted social engagement and sales growth.

Analysis of Shopee household product performance analysis also shows Olipop strategically adjusted discounts based on SKU performance and seasonality, boosting ROI. Additionally, consumer feedback indicated that Poppi’s promotions were less visible, reducing perceived value among potential buyers.

The pricing insights confirm that Scrape Olipop vs Poppi Products Data provides actionable intelligence for designing competitive pricing and promotion strategies in the functional soda segment.

Consumer reviews are critical to understanding brand perception. Using Scrape Olipop And Poppi consumer reviews and Olipop vs Poppi Customer Feedback Analysis, Actowiz Metrics examined review ratings, sentiments, and feedback trends from 2020–2025.

| Metric | Olipop | Poppi |

|---|---|---|

| Avg Rating | 4.6 | 4.2 |

| Positive Sentiment (%) | 82% | 70% |

| Negative Sentiment (%) | 10% | 18% |

| Common Praise | Taste, Flavor Variety | Packaging, Convenience |

| Common Complaint | Price | Flavor Limitation |

The insights reveal that Olipop consistently received higher ratings and more positive feedback, correlating with its higher social engagement. Consumers praised Olipop’s flavor variety and functional benefits, whereas Poppi reviews frequently mentioned limited flavor options.

By tracking these insights, brands can identify product improvements, marketing focus areas, and SKU adjustments. The data also feeds directly into Olipop Best selling Product data tracking and Poppi Product Availability Analytics, allowing precise inventory planning.

Overall, Olipop’s strong consumer feedback aligned with sales growth, showing that positive user perception is a key differentiator in the functional soda market.

Detailed SKU-level analysis provides clarity on inventory allocation and product performance. Using Olipop vs Poppi SKU-level data Analysis, Scrape Olipop vs Poppi Products Data, and Poppi Product Availability Analytics, Actowiz Metrics tracked 500+ SKUs from 2020–2025.

| Metric | Olipop | Poppi |

|---|---|---|

| Total SKUs | 320 | 200 |

| Top 10 SKUs Contribution (%) | 60% | 45% |

| Out-of-Stock Incidents | 5% | 12% |

| Average Days in Stock | 120 | 95 |

Olipop maintained higher SKU availability with fewer out-of-stock incidents, ensuring consistent consumer access. Poppi faced frequent stockouts, particularly in high-demand flavors, negatively impacting sales.

Actowiz Metrics’ SKU-level tracking enabled proactive inventory management, allowing Olipop to optimize supply chains and respond to market demand in real-time. These insights also support Olipop vs Poppi Market share comparison, showing why Olipop consistently outperforms Poppi in functional soda sales.

Using Olipop vs. Popp Data Insights and Functional soda Brands analytics, we analyzed social engagement from 2020–2025. Olipop consistently outperformed Poppi with a 20% higher engagement rate, driven by influencer campaigns, flavor launches, and digital promotions.

| Metric | Olipop | Poppi |

|---|---|---|

| Social Mentions | 1.2M | 950K |

| Shares / Retweets | 320K | 260K |

| Hashtag Usage | #Olipop | #Poppi |

| Engagement Growth 2025 | 18% | 10% |

Consumer behavior analysis shows Olipop’s digital campaigns were more effective in converting engagement into purchases. Poppi lagged in leveraging quick commerce channels and digital promotions, impacting visibility and revenue.

The report demonstrates that Scrape Olipop vs Poppi Products Data combined with advanced social insights enables brands to optimize marketing spend, identify high-performing SKUs, and adjust flavor or pricing strategies in real-time.

The Scrape Olipop vs Poppi Products Data report underscores Olipop’s leadership in the functional soda market, driven by superior SKU availability, flavor variety, pricing strategy, and social engagement. While Poppi remains a strong competitor, Olipop consistently outperforms in sales growth, customer satisfaction, and digital visibility.

Actowiz Metrics’ data-driven approach allows brands to make informed decisions by integrating Olipop vs Poppi flavor trend analysis, Olipop vs Poppi Customer Feedback Analysis, and Olipop vs Poppi Market share comparison. Insights from SKU-level tracking, product availability, and discount strategies equip brands to optimize inventory, launch targeted campaigns, and improve ROI.

For functional soda brands looking to outperform competition, leveraging Actowiz Metrics’ analytics solutions is essential. By combining Scrape Olipop vs Poppi Products Data with Quick commerce analytics and Advanced E-commerce data analytics, businesses can track trends, monitor engagement, and maximize sales.

Take the guesswork out of your product strategy—partner with Actowiz Metrics today to transform data into actionable insights and gain a competitive edge in the functional soda market.

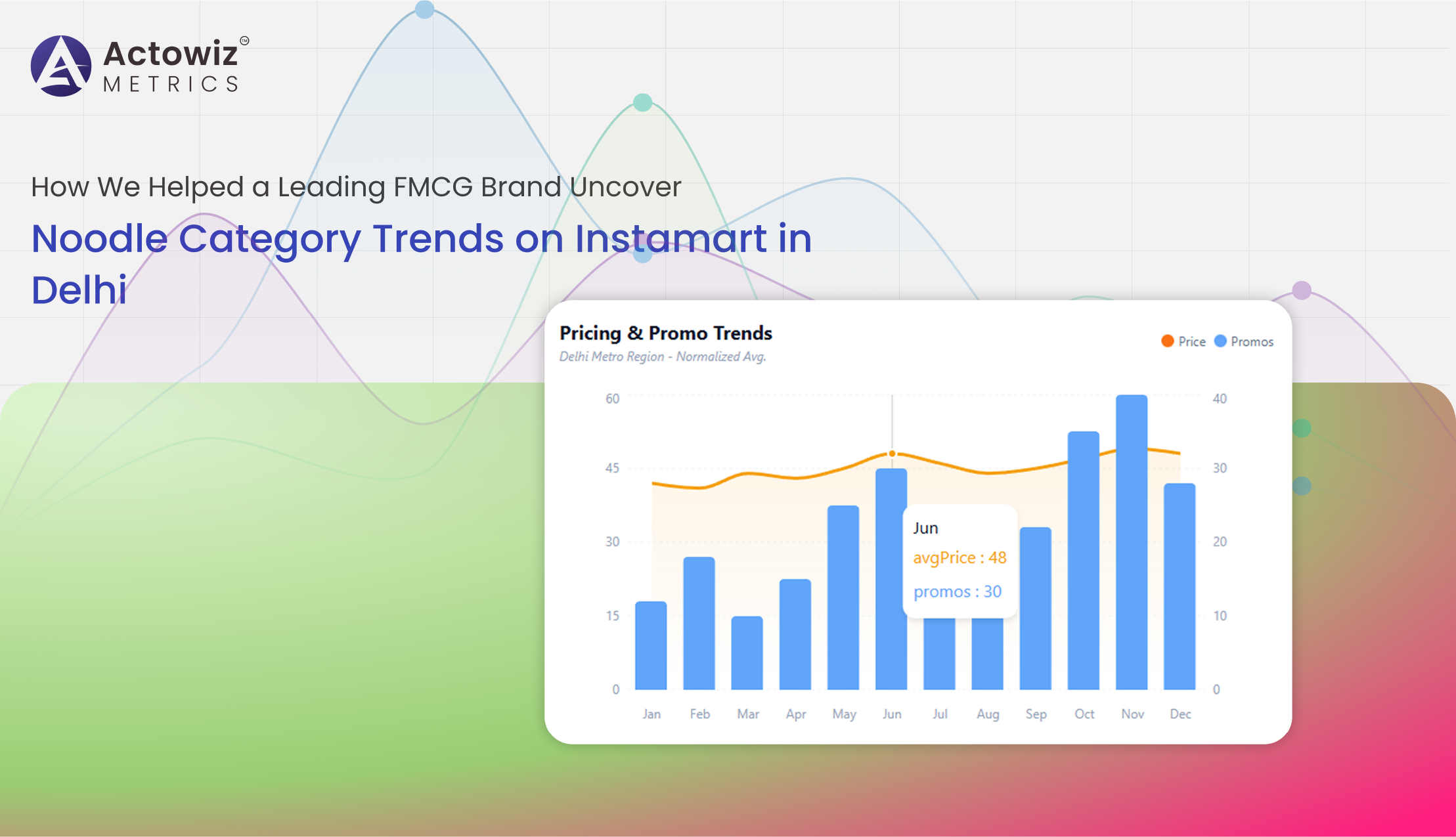

Noodle Category Trends Analytics on Instamart in Delhi delivers data-driven insights into pricing, availability, brand share, and consumer demand to support smarter FMCG strategies.

Explore Now

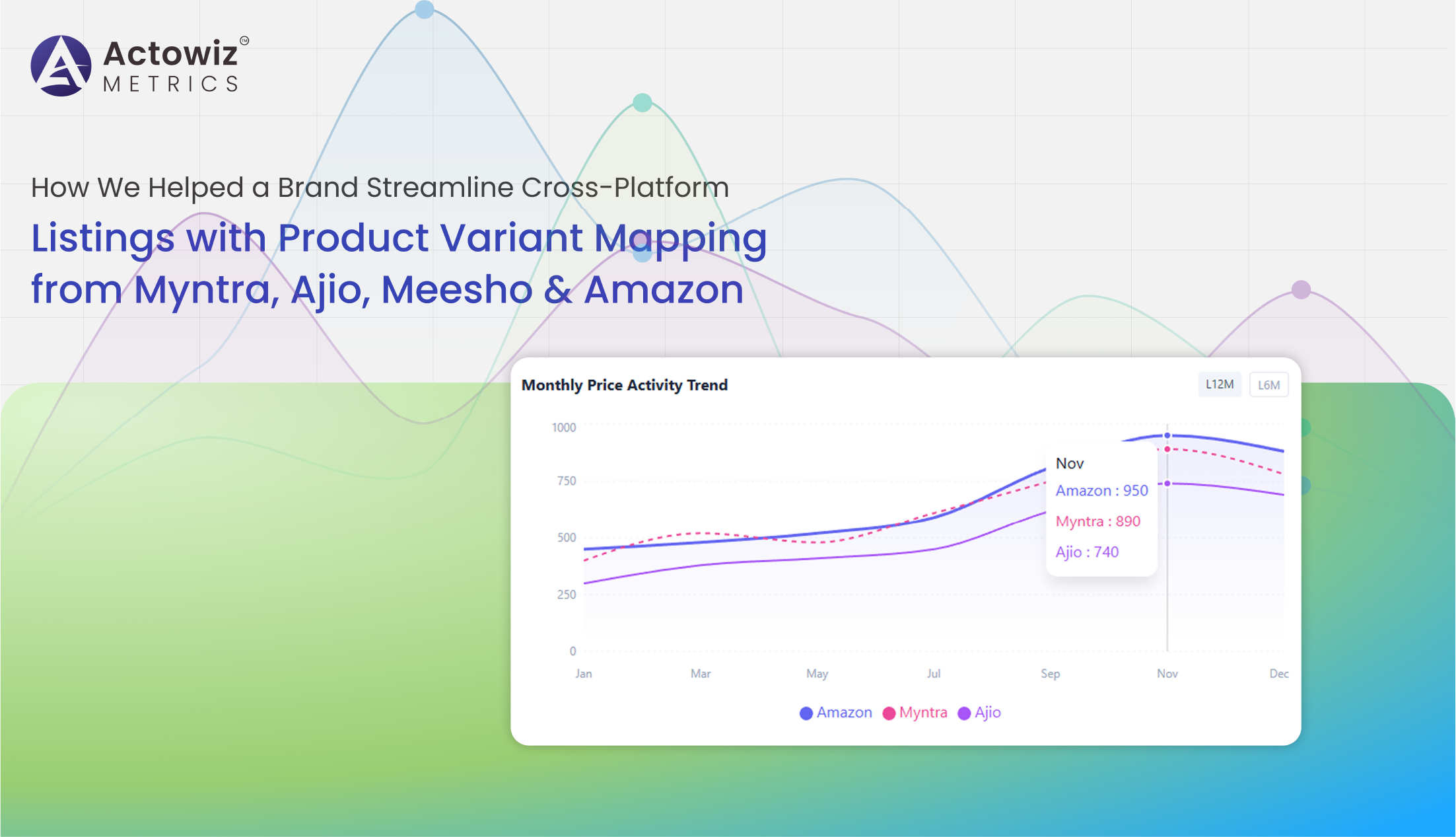

Product Variant Mapping from Myntra, Ajio, Meesho & Amazon helps brands unify listings, track SKUs, and optimize cross-platform e-commerce catalog management efficiently.

Explore Now

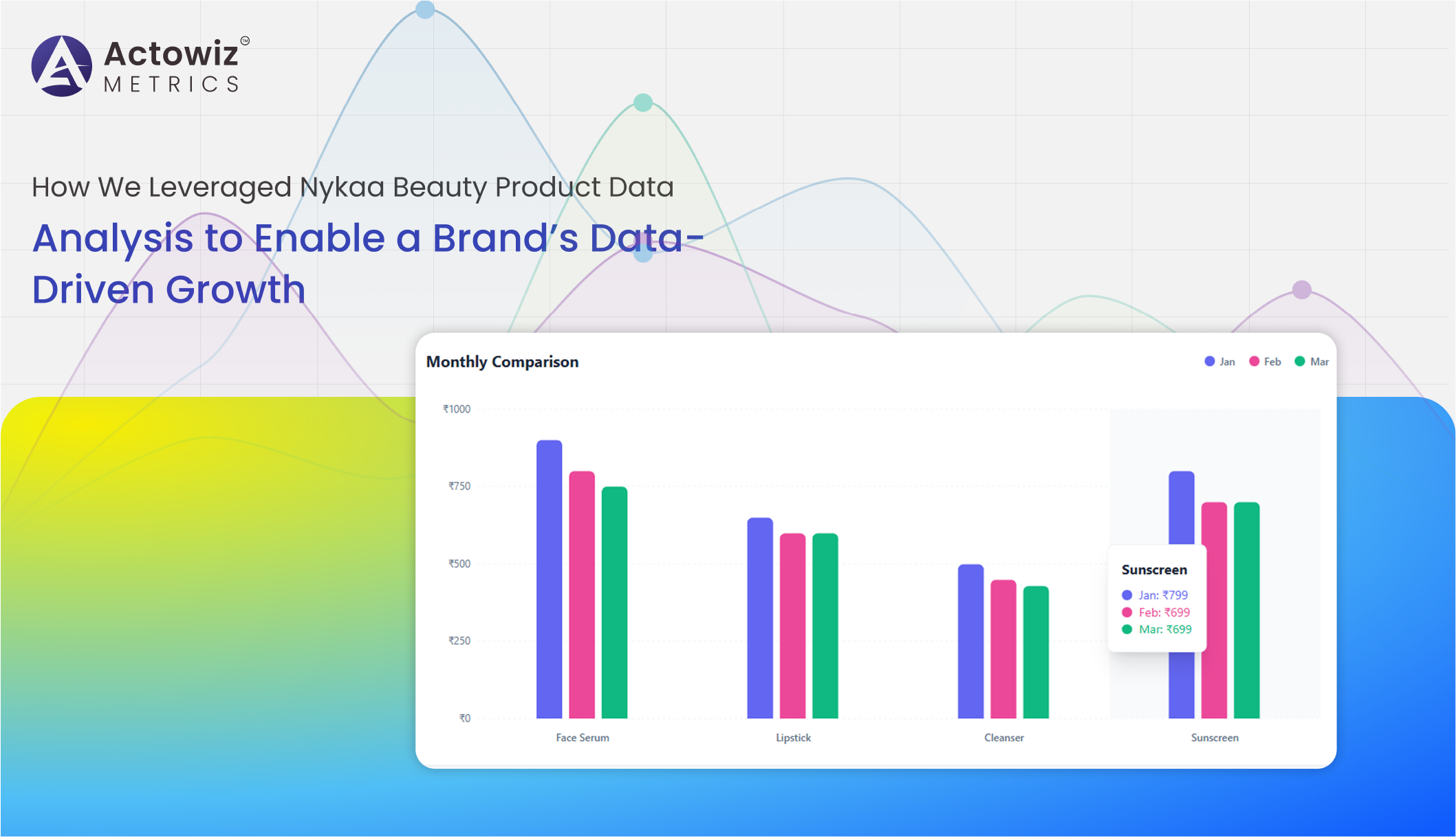

Nykaa Beauty Product Data Analysis examines pricing, reviews, and product performance to help brands identify trends and make data-driven decisions

Explore Now

Browse expert blogs, case studies, reports, and infographics for quick, data-driven insights across industries.

Fashion Price Monitoring for Private Label vs National Brands helps retailers track price gaps, manage discounts, protect margins, and stay competitive

Brand-Level Price & Discount Benchmarking Across India’s Top Fashion Marketplaces helps businesses track pricing, discounts, and smarter retail decisions.

Marketplace Price and Inventory Analytics for Dewu-Poizon helps sellers track trends, optimize pricing reduce stock risks, and boost profits with insights.

Walmart & Target Shrinkflation Data Analytics to track pricing trends, product availability, private labels, and competitive shifts across major US grocery retailers.

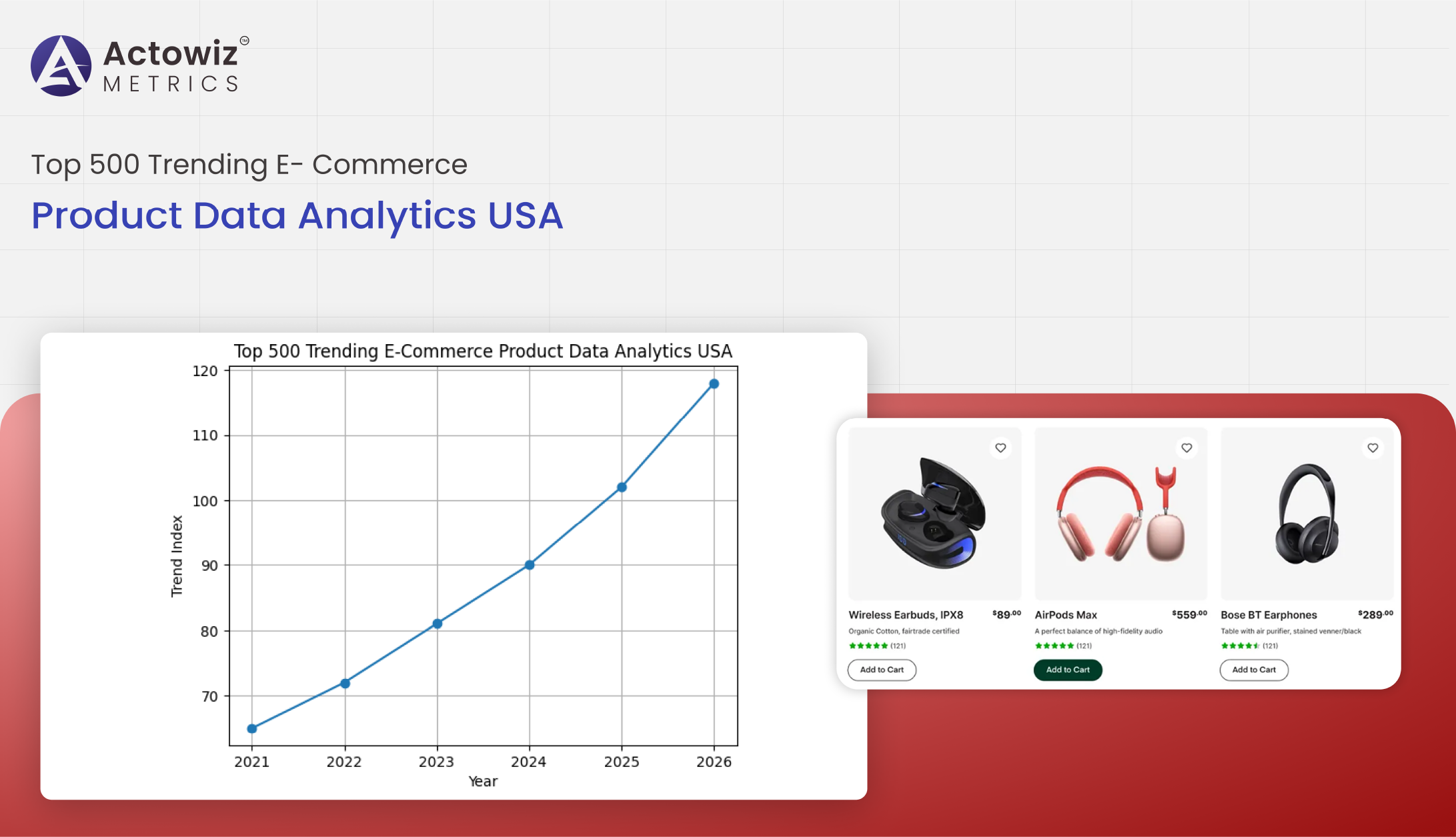

Top 500 trending e-commerce product data analytics in the USA delivers insights on pricing, demand, reviews, and sales trends to support smarter merchandising

Analyze Walmart’s dynamic discount trends analytics for electronics brands using data-driven insights to track price changes, promotions, and optimize pricing strategies.

Explore Luxury vs Smartwatch - Global Price Comparison 2025 to compare prices of luxury watches and smartwatches using marketplace data to reveal key trends and shifts.

E-Commerce Price Benchmarking: Gucci vs Prada reveals 2025 pricing trends for luxury handbags and accessories, helping brands track competitors and optimize pricing.

Discover how menu data scraping uncovers trending dishes in 2025, revealing popular recipes, pricing trends, and real-time restaurant insights for food businesses.

Explore the Amazon Baby Care Report analyzing Top Baby Brands Analysis on Amazon, covering discounts, availability, and popular products with data-driven market insights.

Amazon Sports & Outdoors Report - Sports & Outdoors Top Brands Analysis on Amazon - Prices, Discounts, Reviews

Enabled a USA pet brand to optimize pricing, inventory, and offers on Amazon using Pet Supplies Top Brands Analysis on Amazon for accurate, data-driven decisions.

Whatever your project size is, we will handle it well with all the standards fulfilled! We are here to give 100% satisfaction.

Any analytics feature you need — we provide it

24/7 global support

Real-time analytics dashboard

Full data transparency at every stage

Customized solutions to achieve your data analysis goals