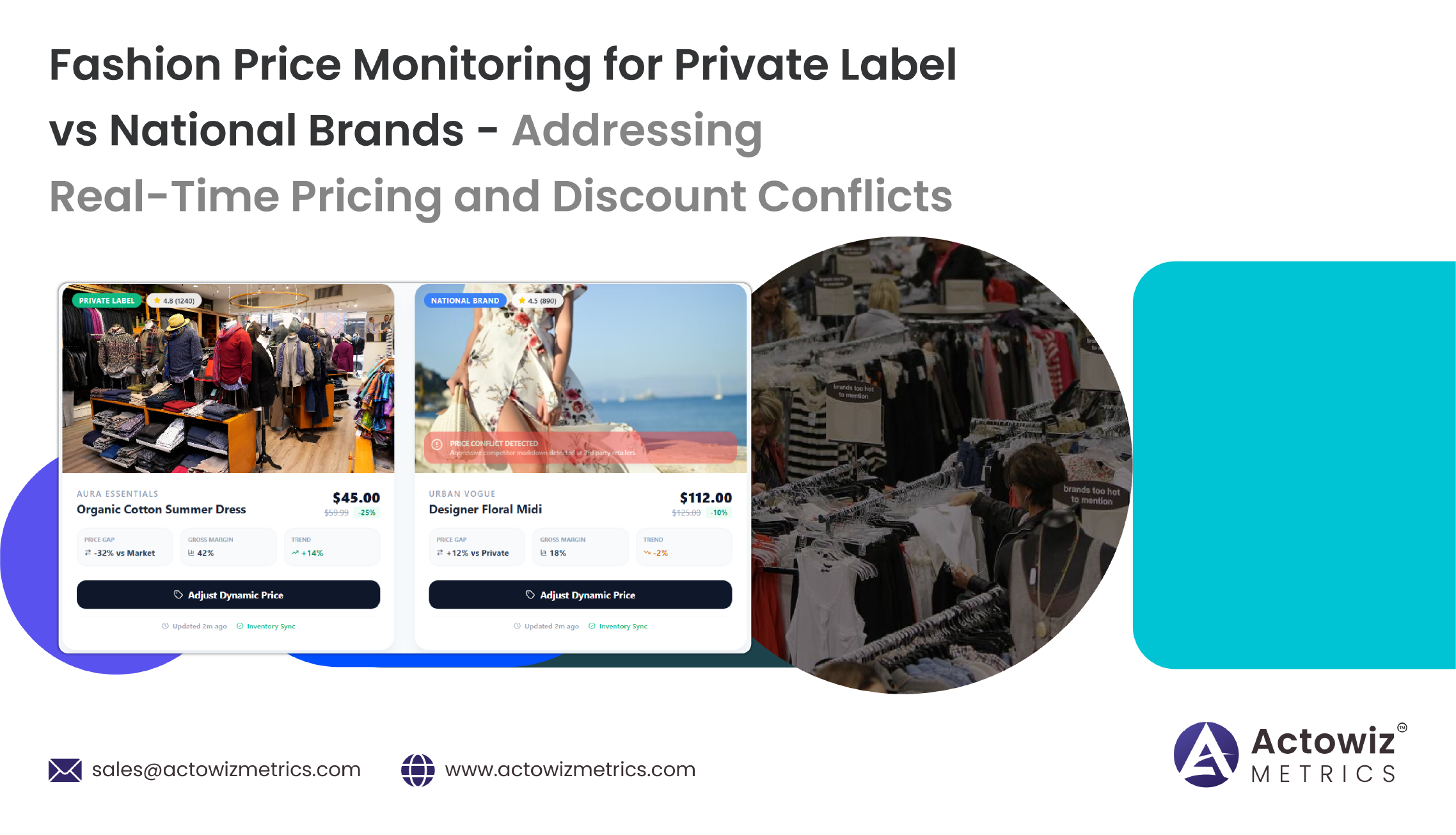

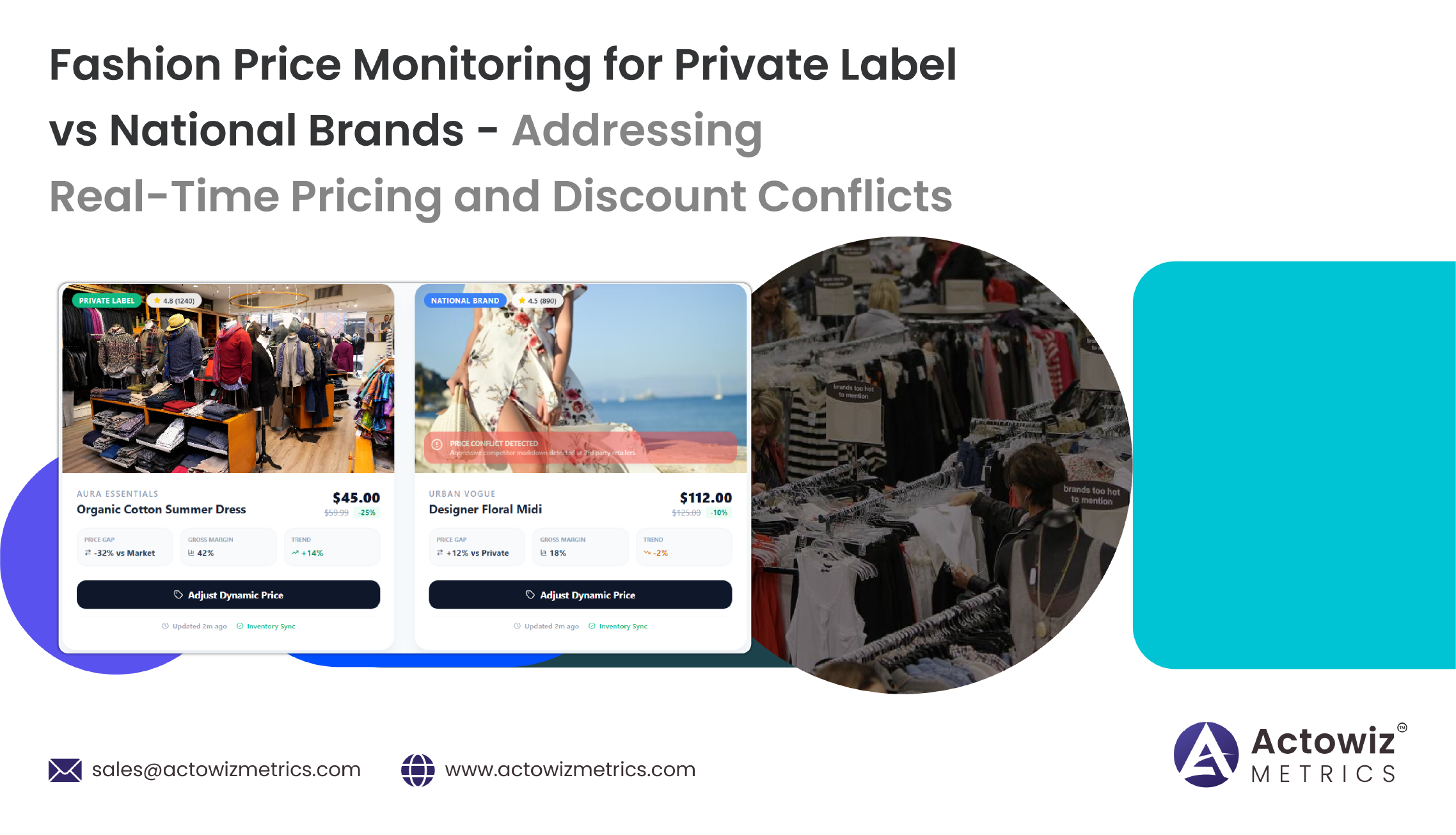

Fashion Price Monitoring for Private Label vs National Brands

Fashion Price Monitoring for Private Label vs National Brands helps retailers track price gaps, manage discounts, protect margins, and stay competitive

Halloween is one of the most exciting seasons for retailers, with candy, snacks, and festive treats driving significant sales growth. For consumers and businesses alike, understanding market trends and discounts is key to maximizing purchases and promotions. In 2025, with evolving consumer behavior and competitive offers, it is crucial to track seasonal pricing accurately. This is where the ability to Scrape Halloween Snacks Discount Trends on Walmart & Tesco becomes a game-changer. By automating the extraction of price and discount data, retailers can analyze promotions, plan marketing strategies, and benchmark their offerings against competitors.

Our study highlights how Halloween candy and snack pricing fluctuates across Walmart and Tesco from 2020 to 2025. Seasonal promotions, bundle deals, and limited-time discounts create opportunities for strategic purchasing and pricing decisions. Retailers implementing Halloween snacks discount trends analysis can detect patterns in sales and discount cycles, enabling smarter inventory planning and targeted campaigns.

Consumers also benefit by identifying the best deals in real-time. Through advanced Halloween retail promotion tracking on Walmart, shoppers can compare offers, while businesses leverage insights for pricing optimization. By combining historical and current data, stakeholders gain a clear picture of market dynamics and purchasing trends in the Halloween grocery segment.

The Halloween season drives significant sales spikes, particularly in candies, snacks, and treat bundles. Data from 2020–2025 shows that retailers like Walmart and Tesco adjust pricing and promotions strategically to maximize revenue. Using Extract Halloween candy & snacks deals data, we captured thousands of product listings, discount percentages, and bundle offers.

| Year | Walmart Avg Discount (%) | Tesco Avg Discount (%) | Top-Selling Category | Seasonal Price Range (USD) |

|---|---|---|---|---|

| 2020 | 12% | 10% | Candy | $2 – $25 |

| 2021 | 13% | 11% | Snack Packs | $3 – $28 |

| 2022 | 14% | 12% | Chocolate Boxes | $4 – $30 |

| 2023 | 15% | 13% | Candy Bundles | $5 – $32 |

| 2024 | 16% | 14% | Snack Assortments | $5 – $33 |

| 2025* | 17% (Proj.) | 15% (Proj.) | Treat Collections | $6 – $35 |

Insights from Halloween snacks price analytics on Tesco reveal that bundle deals dominate the pricing strategy, encouraging bulk purchases. The combination of price drops, in-store promotions, and festive packaging attracts consumers and increases overall basket size.

Through continuous Scrape Halloween Snacks Discount Trends on Walmart & Tesco, businesses can detect early-season markdowns, identify high-demand products, and adjust promotional strategies dynamically, ensuring both profitability and customer satisfaction.

Walmart and Tesco adopt unique promotional strategies during Halloween. Walmart tends to offer early discounts in September, while Tesco focuses on last-minute deals closer to October 31st. By performing Halloween treats price comparison Walmart vs Tesco, we identified pricing gaps and bundle variations across categories such as candy packs, chocolate assortments, and themed snacks.

| Retailer | Avg Discount 2020 | Avg Discount 2022 | Avg Discount 2024 | Best-Selling SKU |

|---|---|---|---|---|

| Walmart | 12% | 14% | 16% | Candy Bags |

| Tesco | 10% | 12% | 14% | Chocolate Box |

Web scraping Halloween Grocery data on Tesco & Walmart enabled extraction of SKUs, discounts, and stock availability in real-time. This data provides actionable insights for pricing strategy, inventory planning, and competitor benchmarking.

Analyzing Scrape Halloween Snacks Discount Trends on Walmart & Tesco also revealed patterns in promotional effectiveness. Early-season discounts increase pre-Halloween sales, while last-minute price reductions target budget-conscious shoppers. Retailers can use this intelligence for demand forecasting, targeted campaigns, and optimizing store layouts to increase conversion rates.

Candy and chocolate dominate Halloween sales, but snack packs, chips, and novelty treats also contribute significantly. Using Halloween snacks discount trends analysis, we tracked category-specific discounts from 2020–2025 to determine seasonal trends and forecast future sales.

| Category | Avg Discount 2020 | Avg Discount 2023 | Avg Discount 2025 (Proj.) |

|---|---|---|---|

| Candy Bags | 12% | 15% | 17% |

| Chocolate Boxes | 10% | 13% | 15% |

| Snack Packs | 8% | 11% | 13% |

| Chips & Treats | 7% | 10% | 12% |

Retailers using Halloween retail promotion tracking on Walmart can monitor trends like bundle pricing, limited-time offers, and cross-category discounts. Similarly, Halloween snacks price analytics on Tesco helps understand consumer preferences, such as the rising popularity of themed snack assortments and premium chocolate bundles.

This data supports pricing & promotions analytics, enabling both retailers and shoppers to plan strategically for higher profitability and better savings.

Halloween discount trends vary by region. Major US cities show larger discounts on candy and snack assortments compared to suburban stores. Using Extract Halloween candy & snacks deals data, we identified regions with high seasonal demand and peak promotional activity.

| Region | Walmart Avg Discount | Tesco Avg Discount | Popular Product |

|---|---|---|---|

| New York | 16% | 14% | Candy Bags |

| Los Angeles | 15% | 13% | Chocolate Box |

| Chicago | 14% | 12% | Snack Packs |

| Houston | 13% | 11% | Candy Bundles |

| Miami | 12% | 10% | Chocolate Box |

Scrape Halloween Snacks Discount Trends on Walmart & Tesco helps retailers identify city-specific sales opportunities, optimize inventory allocation, and implement regionally-targeted campaigns for maximum impact.

Using Grocery Analytics, businesses gain insights into local preferences, seasonal demand spikes, and optimal pricing strategies for competitive advantage.

Predictions for Halloween 2025 suggest continued growth in candy and snack promotions. Projected discounts show Walmart averaging 17% and Tesco 15% across top-selling categories. Halloween treats price comparison Walmart vs Tesco allows businesses to anticipate competitive pressures and adjust pricing strategies early.

Historical trends analyzed through Web scraping Halloween Grocery data on Tesco & Walmart indicate that early-season markdowns and bundle promotions will remain key drivers of sales. Insights from these datasets support price benchmarking, category-specific planning, and promotional forecasting.

| Category | Avg Discount 2024 | Projected Discount 2025 | Notes |

|---|---|---|---|

| Candy Bags | 16% | 17% | Early promotions |

| Chocolate Boxes | 14% | 15% | Bundle offers |

| Snack Packs | 12% | 13% | Mid-season discounts |

Extract Halloween candy & snacks deals data allows retailers to monitor pricing in real-time, adjust inventory, and execute data-driven marketing campaigns effectively.

Retailers can optimize inventory, pricing, and promotional strategies using insights from Scrape Halloween Snacks Discount Trends on Walmart & Tesco. Early access to pricing patterns enables better stocking, reduces waste, and improves sales.

Halloween snacks price analytics on Tesco helps identify fast-moving SKUs, top-performing categories, and profitable bundle combinations. Meanwhile, Pricing & Promotions Analytics supports dynamic pricing and competitor benchmarking.

Shoppers benefit by identifying best deals in real-time, ensuring smarter purchasing decisions. Combining historical and projected discount data ensures both retailers and consumers maximize value from Halloween 2025 promotions.

Actowiz Metrics enables businesses to Scrape Halloween Snacks Discount Trends on Walmart & Tesco with high accuracy and automation. Through Extract Halloween candy & snacks deals data, retailers gain real-time insights into pricing, promotions, and inventory across multiple regions.

Using Web scraping Halloween Grocery data on Tesco & Walmart, companies can track seasonal deals and bundle offers efficiently. Halloween snacks discount trends analysis supports dynamic pricing, forecasting, and category-specific planning. Insights from Halloween retail promotion tracking on Walmart and Halloween snacks price analytics on Tesco help optimize marketing strategies, promotions, and sales campaigns.

Additional services like Halloween treats price comparison Walmart vs Tesco, Pricing & Promotions Analytics, and Grocery Analytics provide a holistic view of the market, enabling smarter decisions. By leveraging these solutions, businesses can enhance revenue, improve inventory management, and gain a competitive advantage during Halloween 2025.

Halloween 2025 offers significant opportunities for both retailers and shoppers. By leveraging Scrape Halloween Snacks Discount Trends on Walmart & Tesco, retailers can identify optimal pricing strategies, forecast demand, and implement data-driven promotions.

Historical insights from 2020–2025 show that seasonal discounts, bundle deals, and early promotions drive consumer engagement. Using Extract Halloween candy & snacks deals data, retailers can analyze trends, optimize inventory, and improve sales performance. Halloween snacks discount trends analysis enables actionable insights for smarter decision-making.

Shoppers also benefit by comparing Halloween treats price comparison Walmart vs Tesco, ensuring they get the best deals. With services like Web scraping Halloween Grocery data on Tesco & Walmart and Halloween retail promotion tracking on Walmart, businesses can execute effective campaigns while consumers enjoy maximum savings.

Actowiz Metrics empowers retailers and shoppers to make smarter Halloween 2025 decisions. Start leveraging our Halloween snacks price analytics on Tesco and other analytics solutions today to maximize promotions, discounts, and festive sales opportunities!

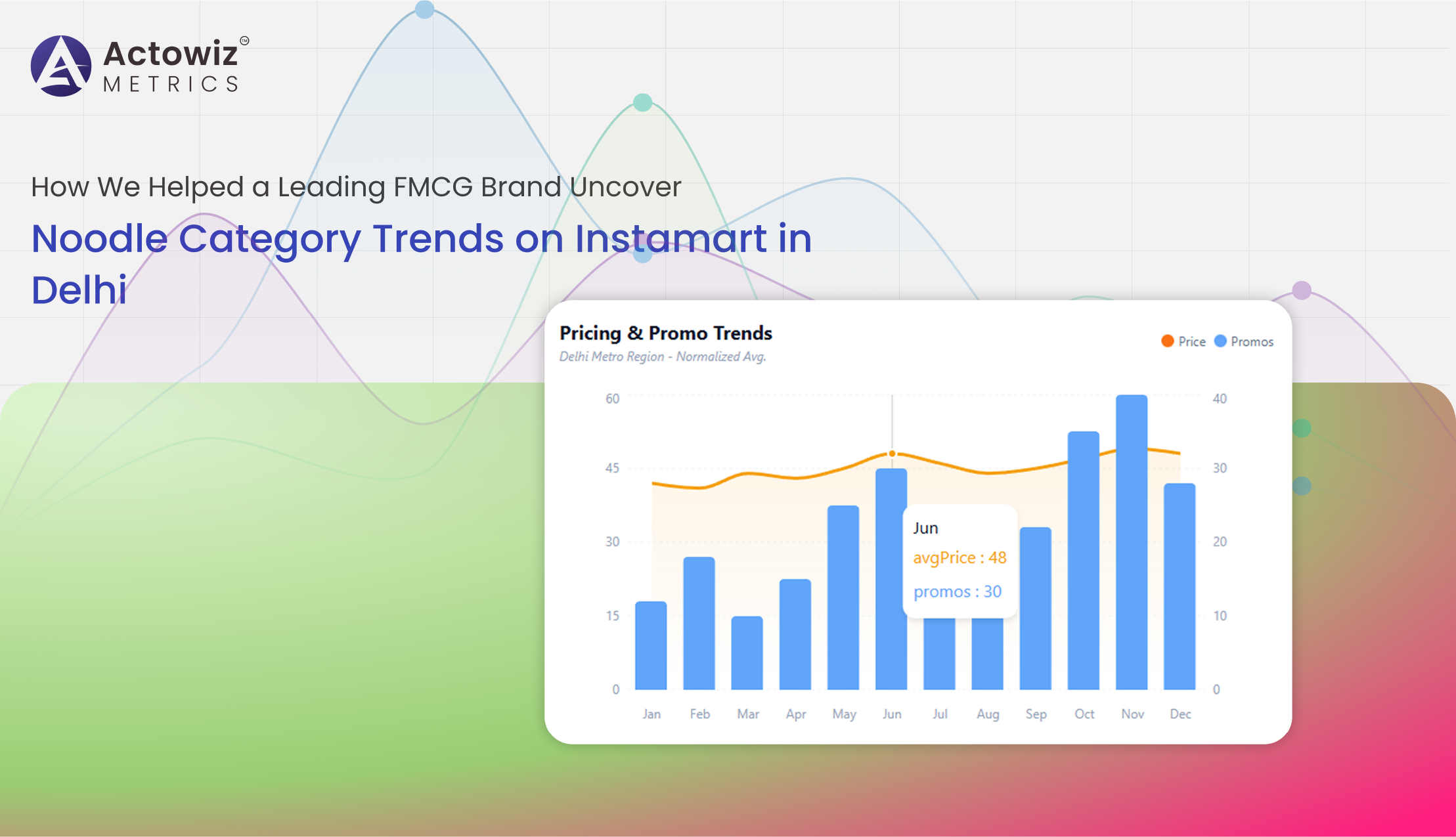

Noodle Category Trends Analytics on Instamart in Delhi delivers data-driven insights into pricing, availability, brand share, and consumer demand to support smarter FMCG strategies.

Explore Now

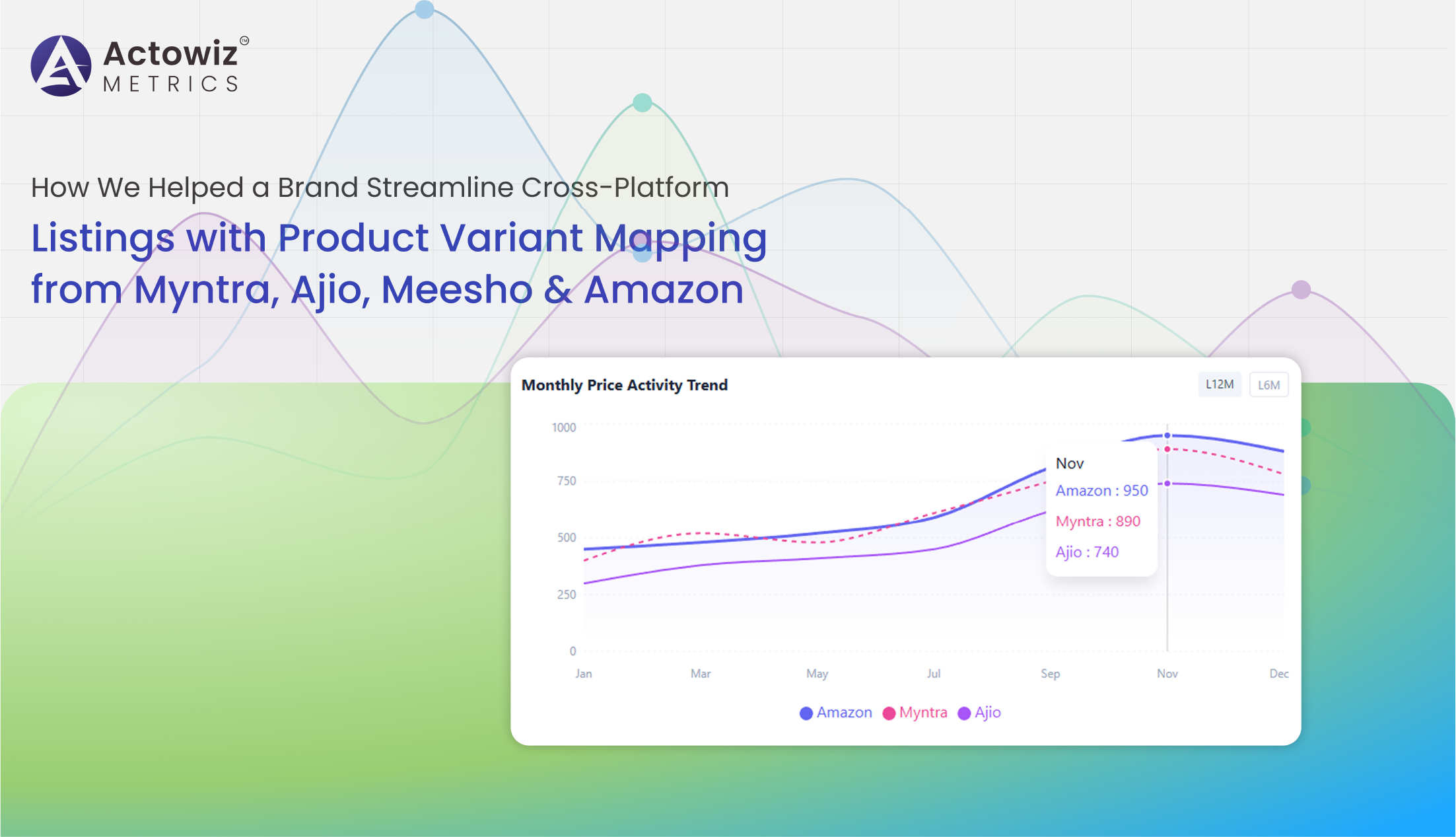

Product Variant Mapping from Myntra, Ajio, Meesho & Amazon helps brands unify listings, track SKUs, and optimize cross-platform e-commerce catalog management efficiently.

Explore Now

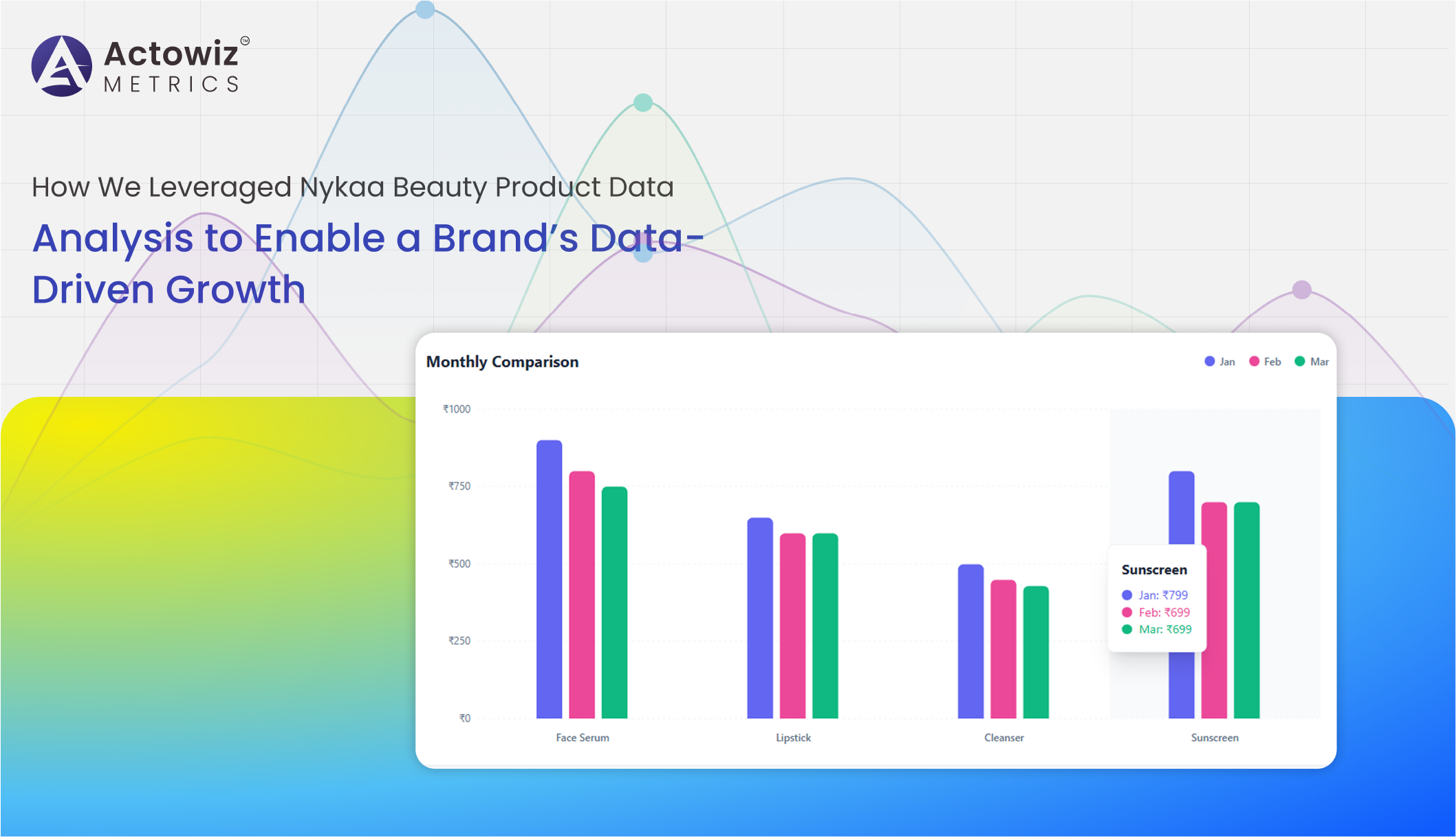

Nykaa Beauty Product Data Analysis examines pricing, reviews, and product performance to help brands identify trends and make data-driven decisions

Explore Now

Browse expert blogs, case studies, reports, and infographics for quick, data-driven insights across industries.

Fashion Price Monitoring for Private Label vs National Brands helps retailers track price gaps, manage discounts, protect margins, and stay competitive

Brand-Level Price & Discount Benchmarking Across India’s Top Fashion Marketplaces helps businesses track pricing, discounts, and smarter retail decisions.

Marketplace Price and Inventory Analytics for Dewu-Poizon helps sellers track trends, optimize pricing reduce stock risks, and boost profits with insights.

Walmart & Target Shrinkflation Data Analytics to track pricing trends, product availability, private labels, and competitive shifts across major US grocery retailers.

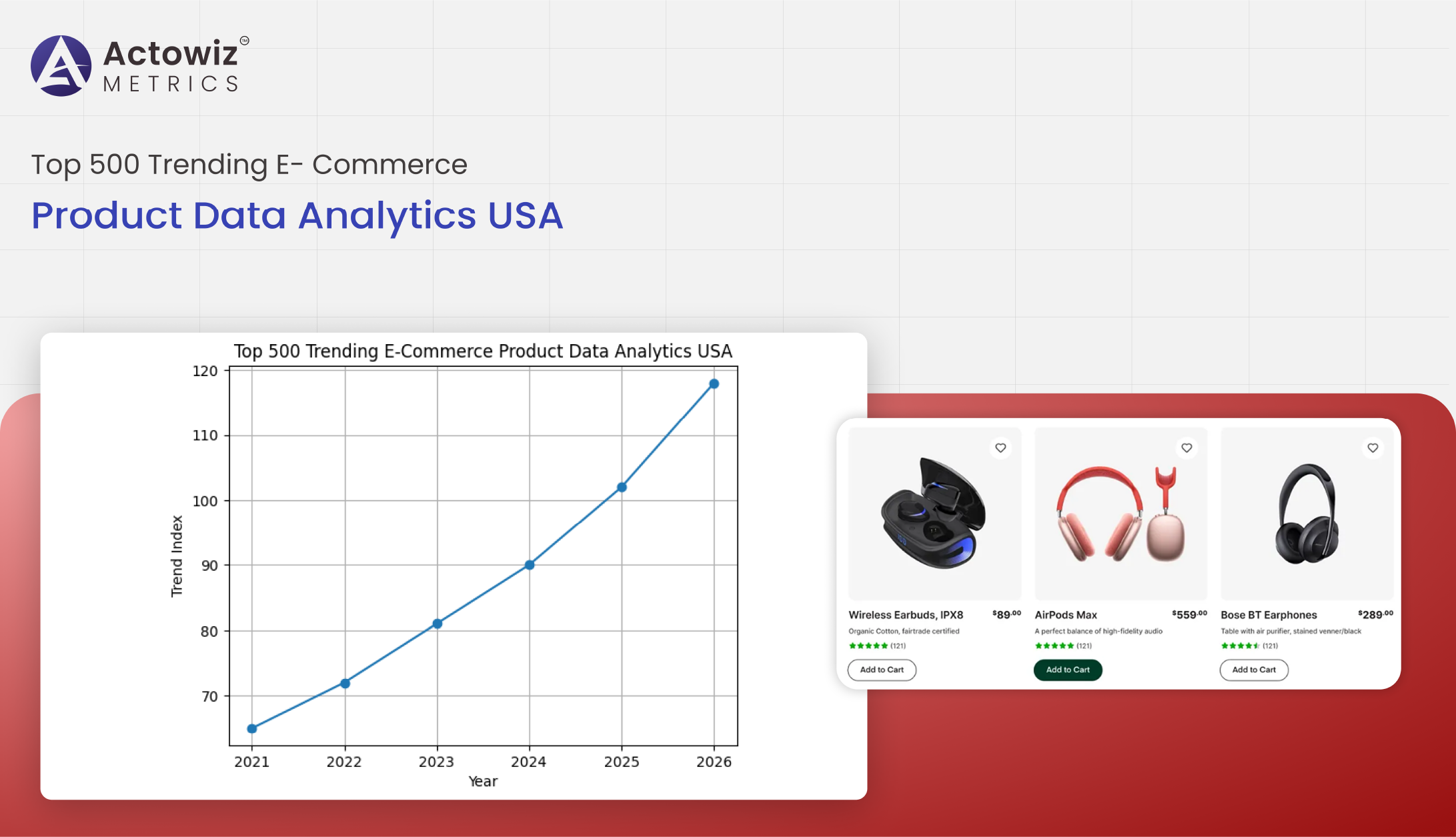

Top 500 trending e-commerce product data analytics in the USA delivers insights on pricing, demand, reviews, and sales trends to support smarter merchandising

Analyze Walmart’s dynamic discount trends analytics for electronics brands using data-driven insights to track price changes, promotions, and optimize pricing strategies.

Explore Luxury vs Smartwatch - Global Price Comparison 2025 to compare prices of luxury watches and smartwatches using marketplace data to reveal key trends and shifts.

E-Commerce Price Benchmarking: Gucci vs Prada reveals 2025 pricing trends for luxury handbags and accessories, helping brands track competitors and optimize pricing.

Discover how menu data scraping uncovers trending dishes in 2025, revealing popular recipes, pricing trends, and real-time restaurant insights for food businesses.

Explore the Amazon Baby Care Report analyzing Top Baby Brands Analysis on Amazon, covering discounts, availability, and popular products with data-driven market insights.

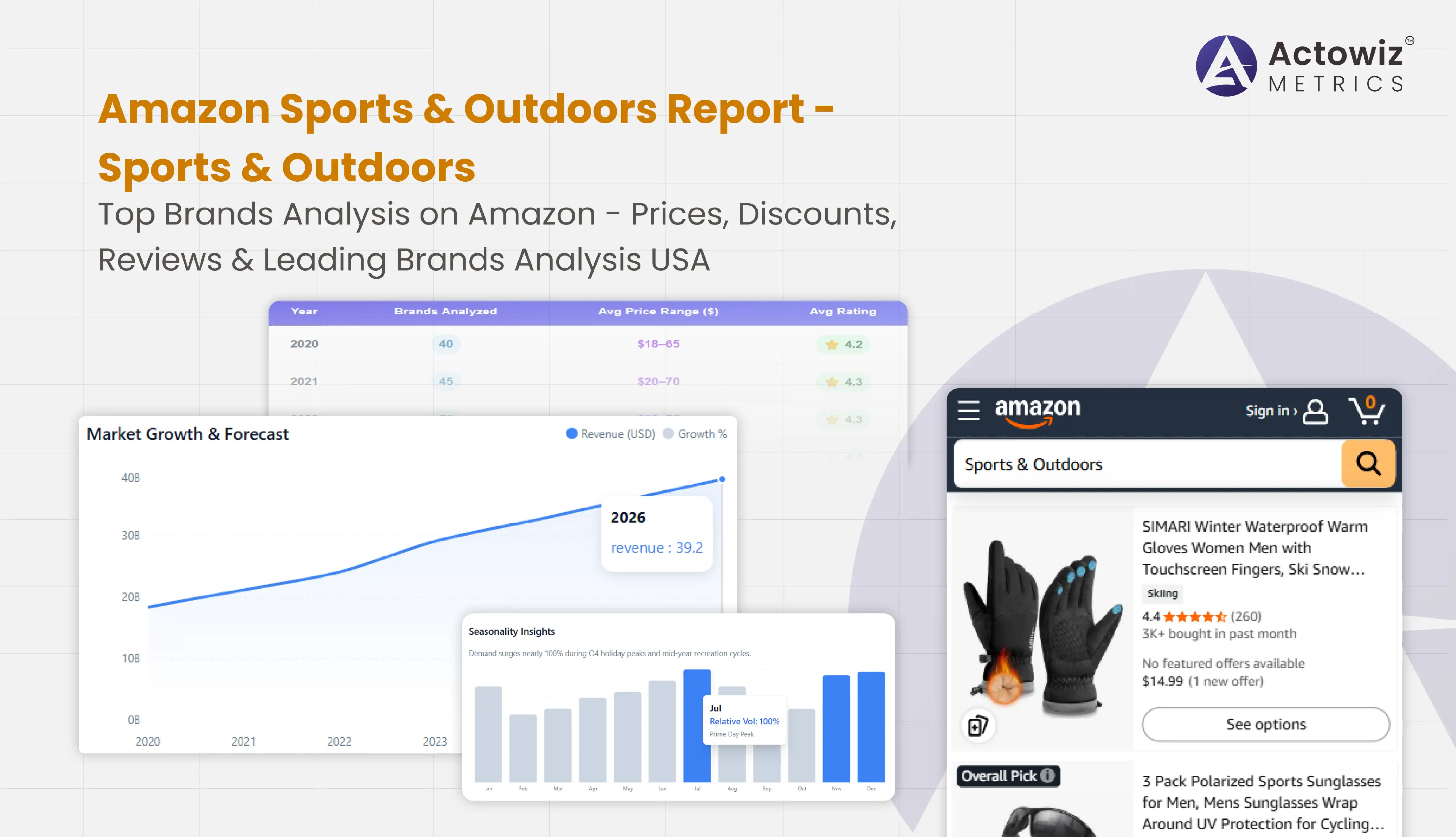

Amazon Sports & Outdoors Report - Sports & Outdoors Top Brands Analysis on Amazon - Prices, Discounts, Reviews

Enabled a USA pet brand to optimize pricing, inventory, and offers on Amazon using Pet Supplies Top Brands Analysis on Amazon for accurate, data-driven decisions.

Whatever your project size is, we will handle it well with all the standards fulfilled! We are here to give 100% satisfaction.

Any analytics feature you need — we provide it

24/7 global support

Real-time analytics dashboard

Full data transparency at every stage

Customized solutions to achieve your data analysis goals