Keeta Food Delivery App Data Analysis

How Keeta Food Delivery App Data Analysis solves demand forecasting gaps and delivery inefficiencies with real-time insights and smart optimization.

The London grocery market is increasingly competitive, with platforms like Amazon Fresh, Ocado, and Tesco vying for consumer attention. Price variations across categories and retailers have become a key factor influencing customer choice. By leveraging Scrape Grocery Prices Data in London - Amazon Fresh vs Ocado vs Tesco, brands can gain actionable insights into competitor strategies, promotional trends, and pricing gaps.

Actowiz Metrics partnered with leading grocery brands to provide structured, real-time datasets capturing product prices, discounts, and stock availability. Between 2020 and 2025, analysis revealed up to 20% price variation across major categories, including fresh produce, packaged foods, and household essentials. Through Grocery Data Analytics, retailers can track competitors’ pricing strategies, identify opportunities for margin optimization, and make informed decisions to retain market share.

This blog explores how data-driven insights, gathered via scraping and advanced analytics, empower grocery retailers to respond proactively to market shifts, optimize pricing dynamically, and maintain competitiveness in London’s hyper-competitive grocery landscape.

Accurate competitor price intelligence is essential for modern grocery retail. With Track Competitor Grocery Prices in London, retailers can identify pricing trends across Amazon Fresh, Ocado, and Tesco. Between 2020 and 2025, Actowiz Metrics collected over 1.5 million data points from these platforms, analyzing daily price fluctuations, promotional offers, and bestseller movements.

For example, fresh produce prices on Amazon Fresh were 12% higher on average than Tesco, while Ocado’s organic range commanded a 15% premium. Tracking pricing patterns enabled retailers to adjust their campaigns, ensuring competitive positioning and avoiding revenue loss due to overpricing. Using Scrape Grocery Prices Data in London - Amazon Fresh vs Ocado vs Tesco, companies created dashboards to monitor category-wise pricing in real time, capturing trends for seasonal variations, holiday promotions, and new product launches.

Structured datasets also allowed retailers to identify competitor discount cycles. In 2023, Tesco’s promotional bundles for pantry essentials lasted 14 days, whereas Ocado and Amazon Fresh ran weekly flash offers. By understanding these cycles, brands could synchronize their pricing and promotional efforts for maximum customer engagement.

This level of monitoring reduces manual effort, increases visibility, and ensures strategic responsiveness to market dynamics, enabling grocery retailers to maintain profitability while meeting consumer expectations.

Beyond tracking prices, analytics are critical for understanding market behavior. With Competitor Grocery Price Analytics in London, brands can benchmark their offerings against Amazon Fresh, Ocado, and Tesco. Between 2020 and 2025, category-wise analysis revealed that packaged snacks had the highest variability at 20%, while household essentials varied around 12%.

Using Scrape Grocery Prices Data in London - Amazon Fresh vs Ocado vs Tesco, retailers were able to extract insights such as frequency of discounts, product availability, and competitor price elasticity. Data showed that consumers were highly responsive to price reductions in the bakery and dairy segments, with a 25% increase in conversion rates during promotions.

Price analytics also revealed patterns in stock availability. Amazon Fresh consistently maintained higher stock levels for high-demand items, while Ocado’s organic range faced occasional shortages. Tesco maintained consistent inventory but varied prices regionally. This insight enabled brands to refine procurement, optimize stock allocation, and reduce lost sales.

By integrating analytics with Competitor Analysis for Brands, retailers could develop targeted strategies to remain competitive, improve margins, and deliver consistent value to consumers across London.

Automation is key to efficiently gathering competitor pricing data. Web Scraping London Supermarkets – Amazon Fresh vs Ocado vs Tesco allowed Actowiz Metrics to collect structured product and pricing information at scale. Over 2020–2025, automated scraping pipelines captured over 2 million product entries across grocery categories.

Scrape Grocery Prices Data in London - Amazon Fresh vs Ocado vs Tesco provided timely updates for promotional offers, bestseller shifts, and stock changes. For instance, dairy products showed weekly price changes aligned with competitor promotions, whereas pantry staples maintained stable pricing. By continuously monitoring these changes, retailers could anticipate competitor moves, adjust pricing dynamically, and protect market share.

This approach also reduced errors from manual data collection, enabling high-volume, accurate extraction for all three platforms. Retailers gained visibility into daily and weekly fluctuations, promotional overlaps, and pricing anomalies, forming a strong foundation for strategic pricing decisions and operational optimization.

Detailed product-level data provides actionable insights for category management. Scrape Tesco, Ocado, Amazon Fresh Product Grocery Listings enabled Actowiz Metrics to extract SKU-level information including price, discounts, brand, ratings, and availability.

Between 2020–2025, analysis showed top-selling grocery brands varied significantly in pricing. Amazon Fresh Bestselling Grocery Brands Analytics revealed that premium organic lines had a 15% higher average price compared to Tesco. Ocado Bestselling Grocery Brands Analytics highlighted strong pricing for vegan and specialty products. Tesco Bestselling Grocery Brands Analytics captured frequent discount cycles in packaged foods and beverages.

Structured insights enabled retailers to optimize assortment, adjust promotions, and identify opportunities for competitive advantage. Using Scrape Grocery Prices Data in London - Amazon Fresh vs Ocado vs Tesco, decision-makers could benchmark products, analyze category performance, and ensure pricing aligned with consumer expectations.

Price benchmarking provides visibility into relative positioning. Through Online Grocery Price Comparison Scraper London, retailers quantified price gaps and tracked category-level variances. Data from 2020–2025 revealed a 20% average variation across Amazon Fresh, Ocado, and Tesco for comparable items.

Scrape Grocery Prices Data in London - Amazon Fresh vs Ocado vs Tesco allowed detailed comparison for staples, fresh produce, and packaged goods. By integrating Price Benchmarking, brands could evaluate competitor discount strategies, identify undervalued products, and develop data-driven pricing approaches to maximize margins while remaining competitive.

Benchmarking enabled predictive insights into market trends, allowing grocery retailers to preempt competitor moves, anticipate seasonal spikes, and improve promotional planning. This structured approach transformed pricing from reactive to strategic, improving profitability and customer satisfaction.

Data-driven strategies rely on actionable insights. Using Grocery Data Analytics, retailers evaluated pricing, promotions, and bestseller trends for Amazon Fresh, Ocado, and Tesco. Historical data from 2020–2025 revealed category-specific pricing trends and promotional responsiveness.

Structured insights extracted via Scrape Grocery Prices Data in London - Amazon Fresh vs Ocado vs Tesco enabled retailers to predict competitor moves, optimize pricing in real time, and adjust assortments for maximum impact. Integration with Competitor Analysis for Brands helped identify market gaps, improve supply chain efficiency, and enhance customer experience.

Actowiz Metrics’ analytics empowered retailers to make informed pricing decisions, maintain competitive positioning, and optimize profit margins across London’s dynamic grocery sector.

In today’s competitive London grocery market, data-driven insights are essential to outperform rivals. Actowiz Metrics enables brands to Scrape Grocery Prices Data in London - Amazon Fresh vs Ocado vs Tesco with precision and scale. Our advanced scraping tools collect real-time pricing, promotional, and product availability information from leading grocery platforms, delivering actionable insights directly to your dashboards.

By combining Grocery Data Analytics with structured datasets, retailers can track competitor movements, identify category-specific price trends, and optimize assortment strategies. Our solutions support Competitor Analysis for Brands, allowing you to benchmark against Amazon Fresh, Ocado, and Tesco effectively. Additionally, predictive analytics help forecast market shifts, seasonal promotions, and emerging product trends, ensuring pricing strategies remain proactive rather than reactive.

With Actowiz Metrics, grocery retailers reduce manual effort, minimize errors, and gain continuous visibility into market dynamics. Whether it’s optimizing margin, improving promotional effectiveness, or understanding competitor behavior, our tools provide the intelligence required to make confident, revenue-boosting decisions.

The London grocery market is dynamic, and small pricing differences can significantly influence consumer choices. Through Scrape Grocery Prices Data in London - Amazon Fresh vs Ocado vs Tesco, Actowiz Metrics equips retailers with precise insights into competitor pricing, bestseller trends, and category-level variations. Historical data analysis from 2020–2025 revealed up to 20% price variation across key grocery categories, highlighting the importance of continuous market monitoring.

Our comprehensive solutions empower brands to benchmark prices, track promotions, and optimize assortment strategies in real time. By leveraging Competitor Analysis for Brands and Price Benchmarking, retailers can identify opportunities to maximize margins, reduce stock-outs, and enhance customer satisfaction.

Ready to gain a competitive edge in London’s grocery market? Partner with Actowiz Metrics to extract real-time competitor prices, track bestselling products, and implement data-driven pricing strategies that outperform Amazon Fresh, Ocado, and Tesco.

Case Study on how we enhanced pricing accuracy and local market insights using Extract API for Instacart Grocery Data from Houston, TX.

Explore Now

Woolworths.com.au Data Monitoring helps track pricing, promotions, stock availability, and competitor trends to drive smarter retail and eCommerce decisions.

Explore Now

UAE Supermarkets Data Analytics Including Items on Amazon helped our retail client optimize pricing, refine assortment, and improve market competitiveness.

Explore Now

Browse expert blogs, case studies, reports, and infographics for quick, data-driven insights across industries.

How Keeta Food Delivery App Data Analysis solves demand forecasting gaps and delivery inefficiencies with real-time insights and smart optimization.

How Etsy Product Data Intelligence API improves demand forecasting accuracy and enhances seller performance tracking with real-time insights.

Solving Real-Time Order Management Challenges with Restaurant Reservations & Orders Monitoring API - Zomato, Swiggy & EazyDiner for smarter tracking.

Dior Luxury Fashion Market Analysis explores global brand positioning, competitive landscape, market trends, revenue performance, and future growth outlook.

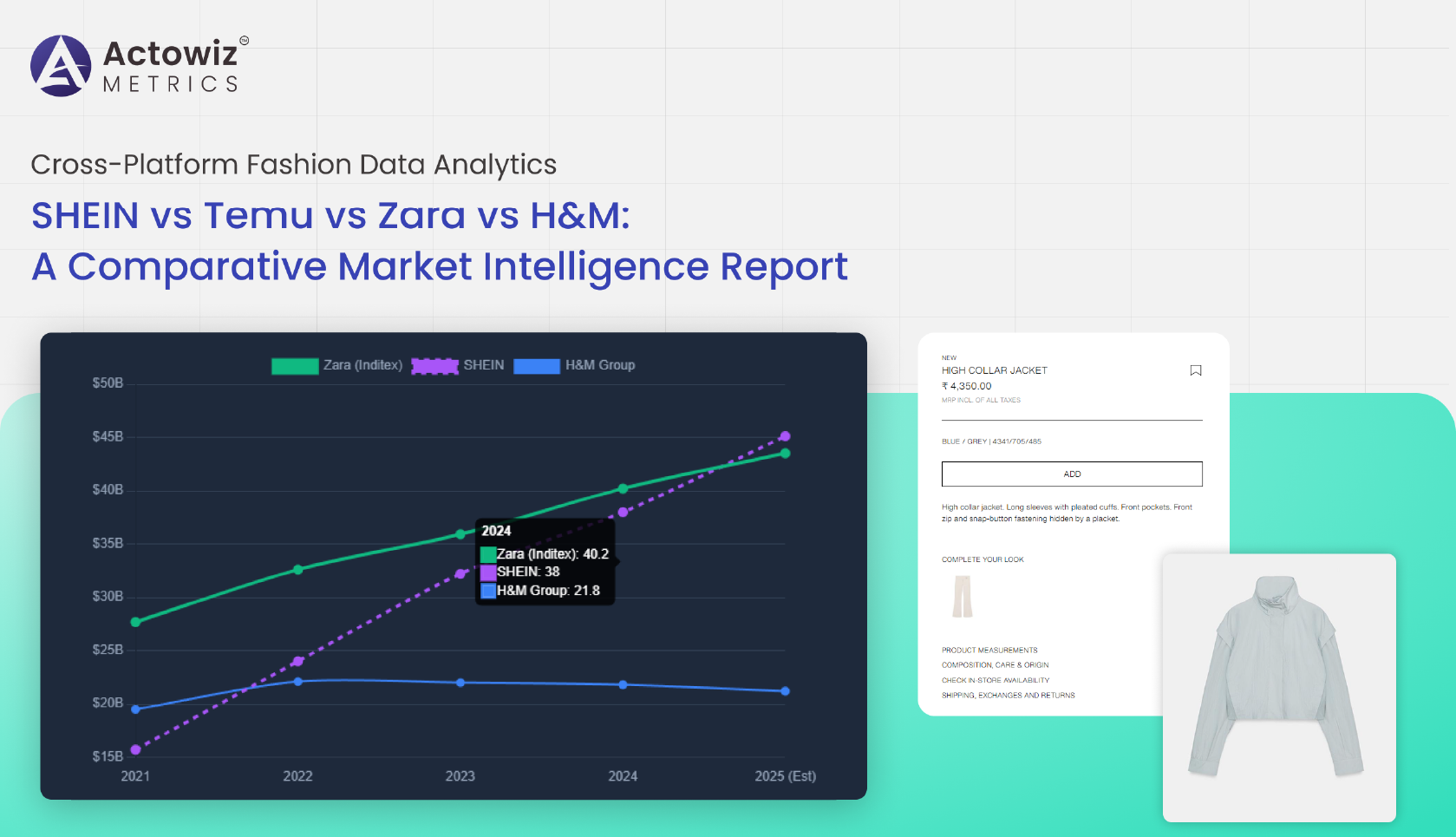

Cross-Platform Fashion Data Analytics - SHEIN vs Temu vs Zara vs H&M delivers actionable insights by comparing pricing, trends, inventory shifts, and consumer demand

Track and analyze the Number of Pizza Hut Locations Analytics in India 2026 to uncover expansion trends, regional distribution, and market growth insights.

Explore Luxury vs Smartwatch - Global Price Comparison 2025 to compare prices of luxury watches and smartwatches using marketplace data to reveal key trends and shifts.

E-Commerce Price Benchmarking: Gucci vs Prada reveals 2025 pricing trends for luxury handbags and accessories, helping brands track competitors and optimize pricing.

Discover how menu data scraping uncovers trending dishes in 2025, revealing popular recipes, pricing trends, and real-time restaurant insights for food businesses.

Explore the Amazon Baby Care Report analyzing Top Baby Brands Analysis on Amazon, covering discounts, availability, and popular products with data-driven market insights.

Amazon Sports & Outdoors Report - Sports & Outdoors Top Brands Analysis on Amazon - Prices, Discounts, Reviews

Enabled a USA pet brand to optimize pricing, inventory, and offers on Amazon using Pet Supplies Top Brands Analysis on Amazon for accurate, data-driven decisions.

Whatever your project size is, we will handle it well with all the standards fulfilled! We are here to give 100% satisfaction.

Any analytics feature you need — we provide it

24/7 global support

Real-time analytics dashboard

Full data transparency at every stage

Customized solutions to achieve your data analysis goals