Fashion Price Monitoring for Private Label vs National Brands

Fashion Price Monitoring for Private Label vs National Brands helps retailers track price gaps, manage discounts, protect margins, and stay competitive

The commercial real estate landscape is undergoing rapid transformation, driven by high-velocity data, shifting tenant behavior, and emerging investment hotspots. As market volatility increases, investors can no longer rely on static reports or outdated quarterly updates. They require live, actionable insights capable of tracking every price shift, occupancy trend, and asset-level change across all major U.S. regions. This is exactly where Real-Time Commercial Property Market Data Analytics USA becomes a game-changer. By incorporating granular, real-time datasets—combined with Pricing and Promotion intelligence—investors can assess thousands of commercial properties in seconds, compare state-level performance, and model returns with unparalleled accuracy.

This blog explores how modern real-time analytics empower investors to evaluate 120,000+ commercial assets across 50 states, detect micro-market movements, and reduce portfolio risk through data-driven decision-making.

The U.S. commercial real estate ecosystem is massive—and often fragmented. Each region exhibits different levels of demand, rental yields, cap rates, and vacancy cycles. To evaluate this efficiently, investors require continuous data capture across millions of datapoints.

In this context, systems built to Scrape Commercial Property Listings in the USA extract critical information such as price per sq. ft., property type, leasing cycle duration, and historical performance. Combined with Marketplace Data Tracking, the resulting dataset helps identify state-specific patterns, shifting demand clusters, and top-performing commercial zones.

| Year | Avg. Commercial Cap Rate | Price/Sq.Ft Growth | Vacancy Rate | Demand Surge (%) | |

|---|---|---|---|---|---|

| 2020 | 6.1% | -2% | 11.2% | -5% | |

| 2021 | 6.0% | 4% | 10.5% | 7% | |

| 2022 | 5.8% | 6% | 9.1% | 12% | |

| 2023 | 5.6% | 7% | 8.3% | 18% | |

| 2024 | 5.4% | 8% | 7.6% | 23% | |

| 2025 | 5.2% | 9% | 6.9% | 29% |

Paragraph Insights

Between 2020 and 2025, commercial assets across states saw a consistent improvement in demand, with vacancy rates sharply decreasing. Price growth accelerated year on year, reflecting renewed investor confidence, especially in logistics, retail complexes, and flexible commercial spaces. With real-time datasets, investors can detect which states are driving this upward momentum.

Commercial property performance varies dramatically between cities and sub-markets. From West Coast logistics hubs to Midwest manufacturing zones, understanding local patterns is key to better investment allocation.

Modern platforms utilize USA Real Estate Data Scraping Insights to gather hyperlocal insights such as market absorption rates, leasing velocity, and category-specific demand. Combined with Marketplace Data Tracking, these insights help investors detect regional shifts before they impact pricing.

| State | Avg Rental Growth | New Commercial Supply | Vacancy Decline | Investor Activity Index | |

|---|---|---|---|---|---|

| Texas | 12% | High | -3% | Very High | |

| Florida | 10% | Medium | -2.5% | High | |

| California | 9% | Low | -4% | Moderate | |

| New York | 7% | Low | -2% | Moderate | |

| Illinois | 6% | Medium | -1.8% | Growing |

Paragraph Insights

Texas leads national rental growth due to booming industrial and warehousing projects. Florida and California are attracting sustained commercial interest primarily due to demand from retail and mixed-use developments. These insights highlight how regional data scraping enables precision targeting of investment zones.

Investment decisions today must be faster, more accurate, and backed by continuous updates. Systems designed for Real-Time Commercial Property Data Scraping USA allow investors to automate property evaluations, compare thousands of listings, and run real-time ROI simulations.

Such systems retrieve leasing prices, historical price trends, zoning constraints, tenant data, area footfall, and local development metrics. Investors use this dataset to continuously calibrate valuation models and reduce acquisition risks.

| Metric | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|---|---|

| Avg Lease Duration | 42 mo | 40 mo | 39 mo | 38 mo | 37 mo | 35 mo | |

| Avg ROI | 8.1% | 8.5% | 9% | 9.4% | 9.8% | 10.2% | |

| Time-to-Contract | 70 days | 64 days | 59 days | 55 days | 50 days | 46 days | |

| New Buyers (YoY) | +6% | +8% | +11% | +13% | +18% | +21% |

Paragraph Insights

The increasing rate of new commercial buyers signals a rapidly growing asset market. Shorter lease durations highlight faster business turnover, especially in logistics and retail categories. Real-time scraping helps investors distinguish stable markets from speculative ones.

A robust commercial real estate strategy also depends on accurate monitoring of supply availability, property category mix, and occupancy patterns. Systems focused on Commercial Property Inventory Data Scraping USA extract data about active listings, removed properties, new supply launches, leasing cycles, and developer announcements.

Integrated with MAP Monitoring, these insights inform better pricing decisions by comparing commercial rental rates across similar asset classes in multiple geographies.

| Year | New Commercial Listings | Delisted Properties | Active Inventory Growth | Construction Pipeline Increase | |

|---|---|---|---|---|---|

| 2020 | 420K | 180K | -5% | -2% | |

| 2021 | 455K | 190K | 3% | 1% | |

| 2022 | 480K | 200K | 6% | 5% | |

| 2023 | 520K | 215K | 8% | 9% | |

| 2024 | 555K | 230K | 11% | 12% | |

| 2025 | 590K | 240K | 15% | 16% |

Paragraph Insights

The U.S. is experiencing rapid new commercial development, especially in industrial parks and mixed-use zones. Combined with live data scraping, investors can understand long-term cycles and pre-empt supply-demand imbalances.

In-depth property evaluation requires more than price and location. Today’s investors look at traffic availability, proximity to commercial districts, historical occupancy, and even demographic worthiness. Systems built to Extract Commercial Property Listings in the United States provide these granular attributes.

Additional metadata includes environmental impact zones, accessibility indices, commercial cluster scores, and projected 5-year development indexes. This holistic visibility empowers more informed investment decisions.

| Attribute | Impact on ROI | YoY Trend | Significance |

|---|---|---|---|

| Proximity to Highways | +18% | Up | Very High |

| Foot Traffic Index | +22% | Up | Critical |

| Industrial Zoning Score | +14% | Stable | Important |

| Local Employment Rate | +11% | Up | Important |

| Surrounding Business Density | +17% | Up | High |

Paragraph Insights

Listing attributes have become primary ROI drivers. High footfall areas yield significantly better returns for retail commercial assets, whereas industrial zoning and highway proximity fuel warehouse profitability.

Predictive analytics provides the highest strategic value for portfolio planning. With smart algorithms designed for Real Estate Data Analytics, investors can simulate future market behavior based on historical, real-time, and regional indicators.

Machine-learning-based models help forecast:

| Indicator | Trend | Forecast Accuracy | Impact |

|---|---|---|---|

| Cap Rate Forecast | Stable | 92% | High |

| Rental Demand Forecast | Rising | 89% | Very High |

| Market Saturation Model | Moderate | 87% | Medium |

| Supply Surge Prediction | Increasing | 90% | High |

| Vacancy Cycle Prediction | Declining | 95% | Very High |

Paragraph Insights

With predictive modeling, investors gain the advantage of early market detection. Low vacancy cycles and high rental forecasts suggest an excellent investment window for commercial properties between 2025 and 2030.

Actowiz Metrics specializes in providing enterprise-grade data intelligence solutions designed to power modern decision-making. With expertise in Real-Time Commercial Property Market Data Analytics USA, our systems deliver unparalleled visibility into nationwide commercial real estate trends. Combined with advanced Price Benchmarking, investors gain the ability to compare thousands of commercial listings, analyze asset-level pricing patterns, track leasing cycles, and explore competitive market behavior across all 50 states. Our scalable platform offers real-time alerts, historical trend simulations, demand forecasting, and automated data pipelines that contribute to smarter and faster acquisition strategies.

In a rapidly evolving property market, relying on outdated data leads to costly investment errors. Real-time visibility, continuous scraping, and intelligent analytics are now essential tools for every commercial real estate investor. By integrating Marketplace Data Tracking and powerful automation systems, businesses can uncover emerging opportunities across 50 states, evaluate 120,000+ properties, and build resilient portfolios. With Actowiz Metrics’ advanced Real-Time Commercial Property Market Data Analytics USA, investors gain unmatched competitive advantage, reduced risk, and higher long-term profitability.

Ready to transform your commercial property investment strategy? Contact Actowiz Metrics today for accurate, real-time insights that drive smarter decisions.

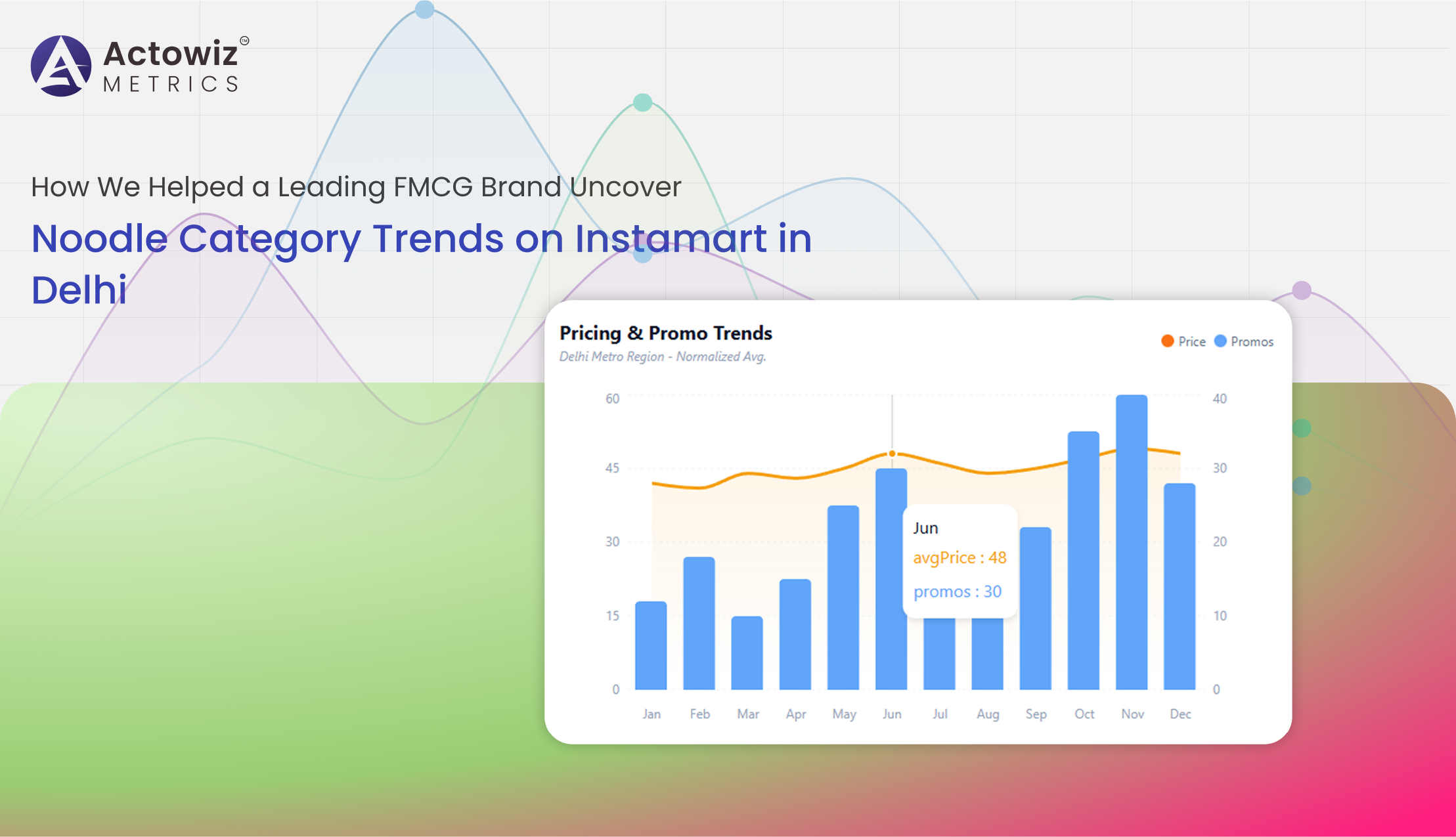

Noodle Category Trends Analytics on Instamart in Delhi delivers data-driven insights into pricing, availability, brand share, and consumer demand to support smarter FMCG strategies.

Explore Now

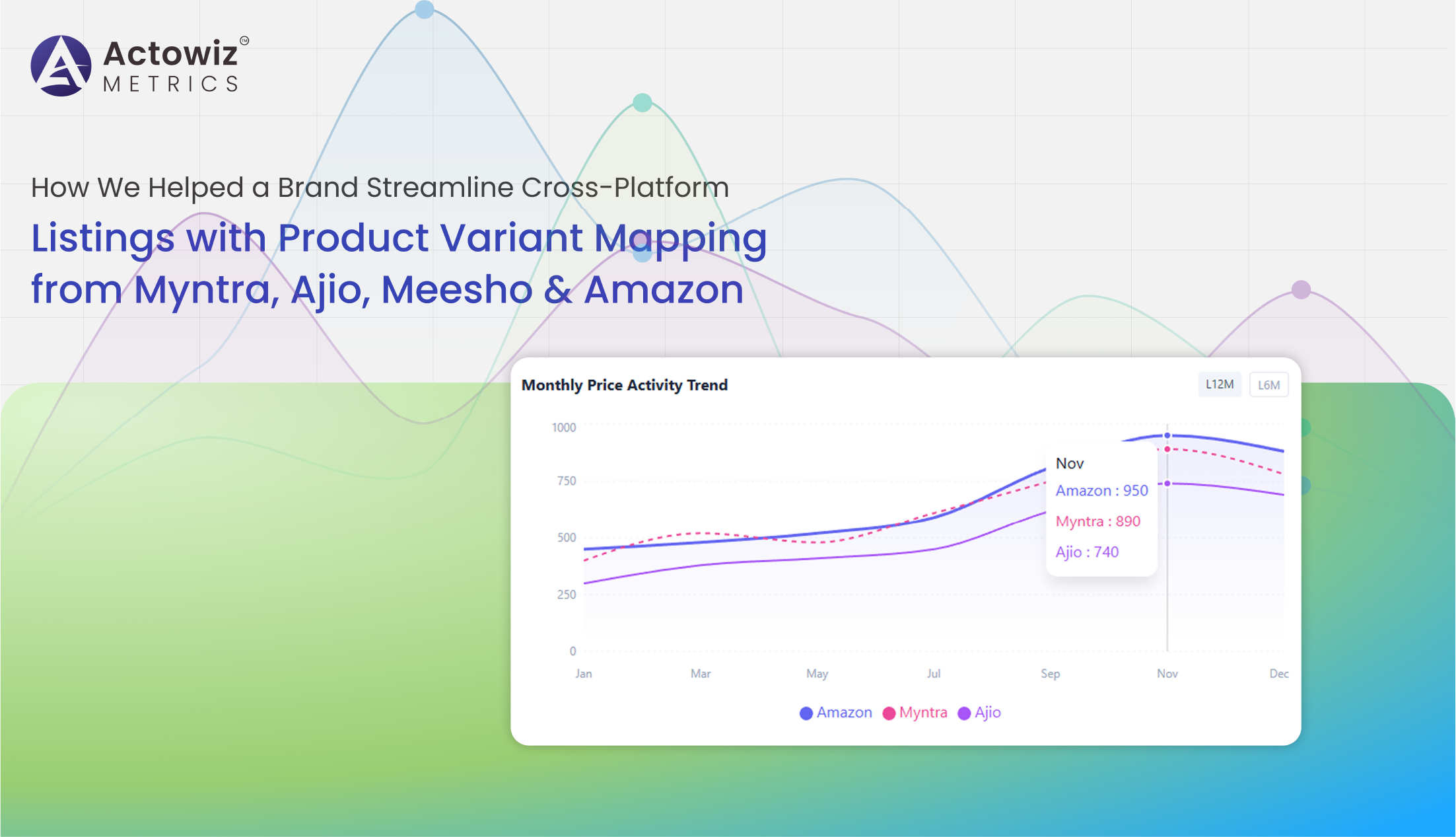

Product Variant Mapping from Myntra, Ajio, Meesho & Amazon helps brands unify listings, track SKUs, and optimize cross-platform e-commerce catalog management efficiently.

Explore Now

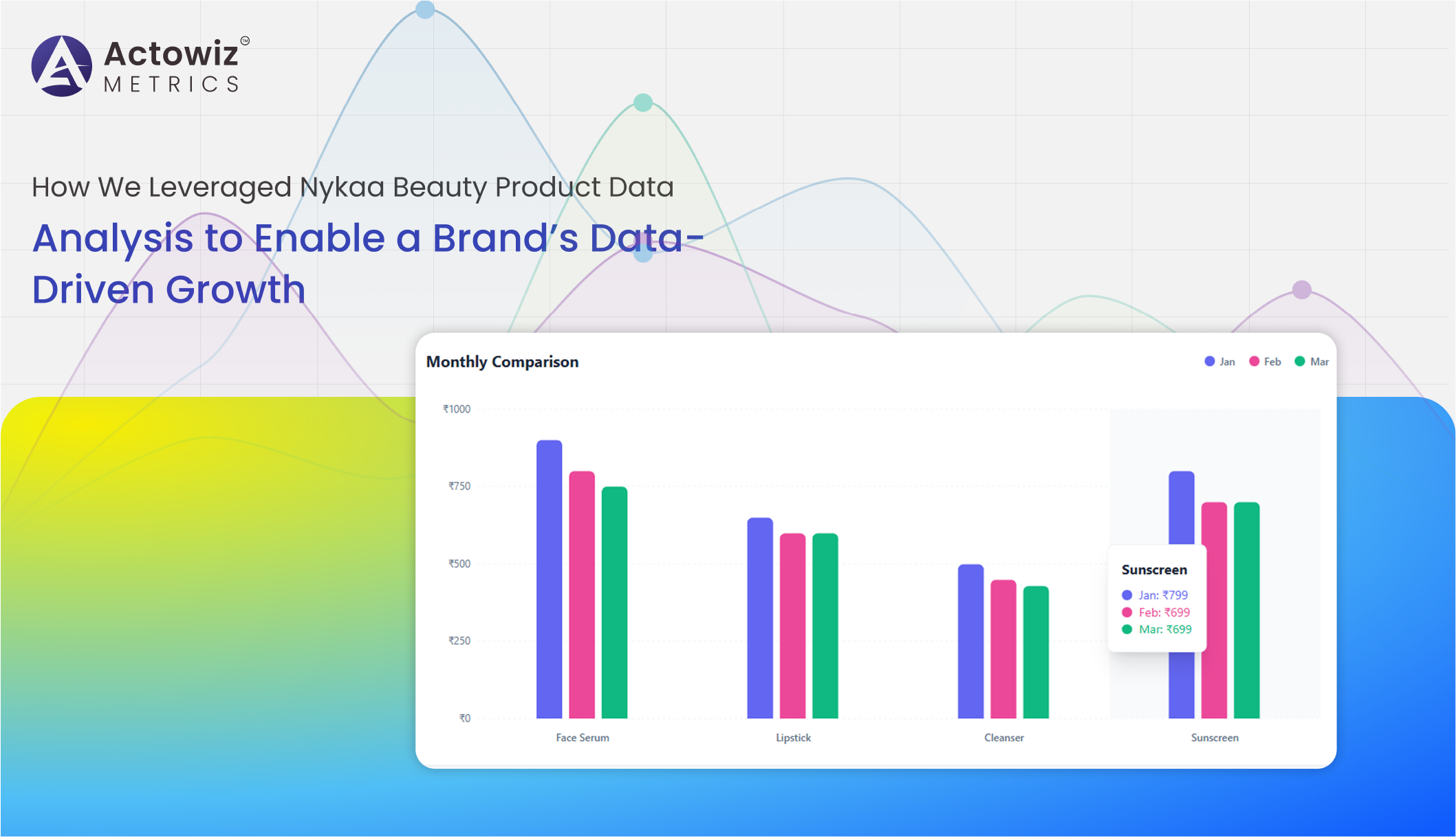

Nykaa Beauty Product Data Analysis examines pricing, reviews, and product performance to help brands identify trends and make data-driven decisions

Explore Now

Browse expert blogs, case studies, reports, and infographics for quick, data-driven insights across industries.

Fashion Price Monitoring for Private Label vs National Brands helps retailers track price gaps, manage discounts, protect margins, and stay competitive

Brand-Level Price & Discount Benchmarking Across India’s Top Fashion Marketplaces helps businesses track pricing, discounts, and smarter retail decisions.

Marketplace Price and Inventory Analytics for Dewu-Poizon helps sellers track trends, optimize pricing reduce stock risks, and boost profits with insights.

Walmart & Target Shrinkflation Data Analytics to track pricing trends, product availability, private labels, and competitive shifts across major US grocery retailers.

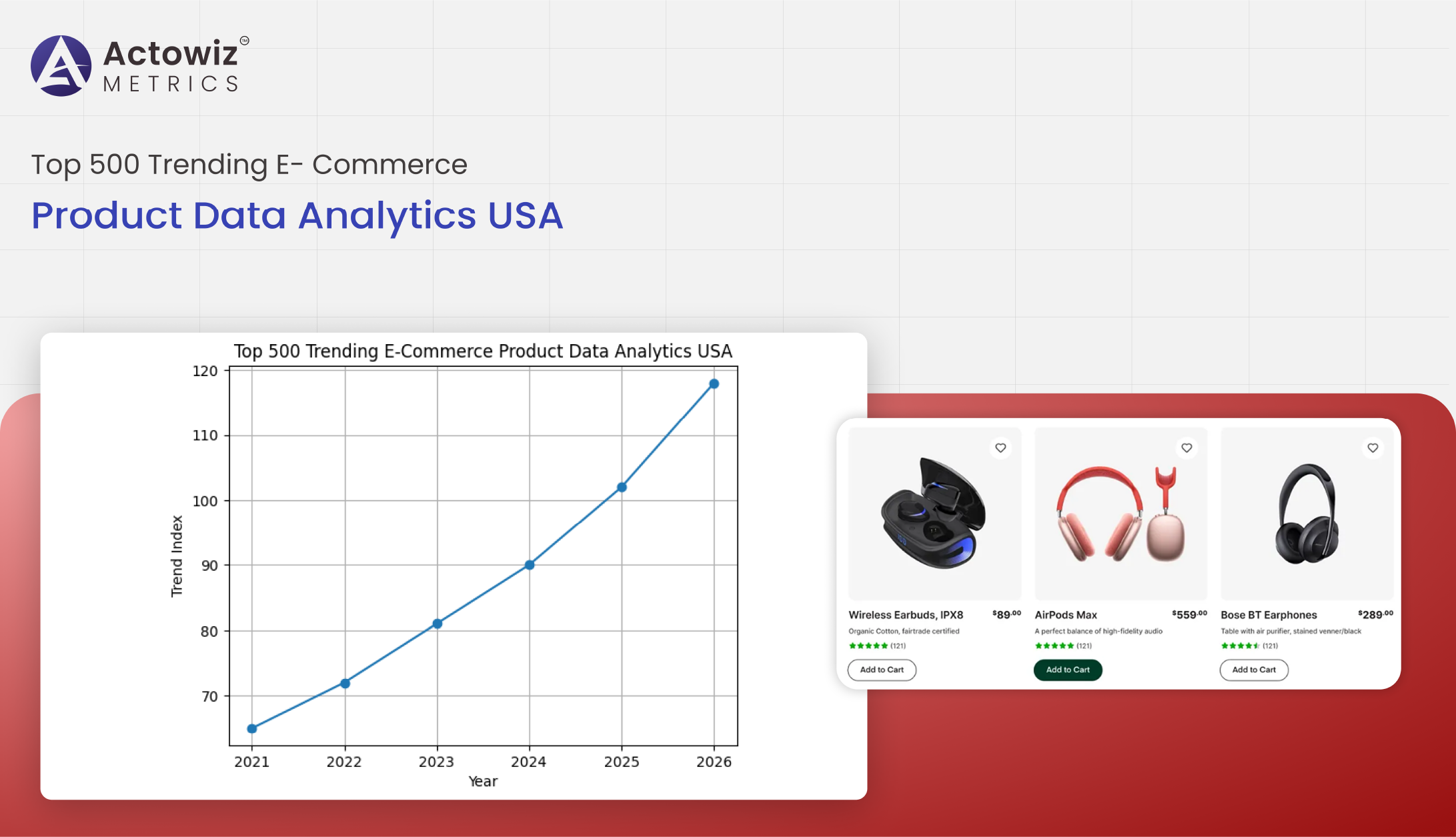

Top 500 trending e-commerce product data analytics in the USA delivers insights on pricing, demand, reviews, and sales trends to support smarter merchandising

Analyze Walmart’s dynamic discount trends analytics for electronics brands using data-driven insights to track price changes, promotions, and optimize pricing strategies.

Explore Luxury vs Smartwatch - Global Price Comparison 2025 to compare prices of luxury watches and smartwatches using marketplace data to reveal key trends and shifts.

E-Commerce Price Benchmarking: Gucci vs Prada reveals 2025 pricing trends for luxury handbags and accessories, helping brands track competitors and optimize pricing.

Discover how menu data scraping uncovers trending dishes in 2025, revealing popular recipes, pricing trends, and real-time restaurant insights for food businesses.

Explore the Amazon Baby Care Report analyzing Top Baby Brands Analysis on Amazon, covering discounts, availability, and popular products with data-driven market insights.

Amazon Sports & Outdoors Report - Sports & Outdoors Top Brands Analysis on Amazon - Prices, Discounts, Reviews

Enabled a USA pet brand to optimize pricing, inventory, and offers on Amazon using Pet Supplies Top Brands Analysis on Amazon for accurate, data-driven decisions.

Whatever your project size is, we will handle it well with all the standards fulfilled! We are here to give 100% satisfaction.

Any analytics feature you need — we provide it

24/7 global support

Real-time analytics dashboard

Full data transparency at every stage

Customized solutions to achieve your data analysis goals