Fashion Price Monitoring for Private Label vs National Brands

Fashion Price Monitoring for Private Label vs National Brands helps retailers track price gaps, manage discounts, protect margins, and stay competitive

The global beauty and personal care market has witnessed rapid growth over the past five years, with Amazon emerging as a leading platform for consumers seeking variety, convenience, and competitive pricing. Conducting a Beauty and personal care Analysis on Amazon provides businesses with critical insights into product trends, pricing, discounts, top brands, and consumer preferences. As e-commerce continues to dominate retail, sellers must leverage structured, real-time data to make informed decisions on product launches, inventory management, and promotions.

By using Scrape Amazon beauty products price data, companies can track historical pricing trends, monitor seasonal fluctuations, and identify high-demand products across categories like skincare, haircare, makeup, and fragrances. Beauty Products Discount & Deals analytics on Amazon provides insights into promotional effectiveness, helping brands adjust campaigns and maximize ROI. Real-time beauty product availability analysis ensures accurate stock monitoring, minimizing lost sales and improving fulfillment planning.

Additionally, Extract Top beauty & personal care Products data and Amazon's personal care product ratings analytics allow stakeholders to benchmark product performance, evaluate customer satisfaction, and make informed merchandising decisions. Amazon's Top beauty & personal care Brands analytics highlights market leaders, their pricing strategies, and market share, while Most & Least expensive Beauty products analysis on Amazon identifies the affordability spectrum and premium segments.

Historical data from 2020 to 2025 shows consistent growth in online sales, rising demand for premium skincare and health-focused products, and increasing customer preference for top-rated brands. By integrating Amazon Bestselling Beauty Brands Analytics with advanced E-commerce Analytics, businesses gain actionable intelligence to optimize portfolios, plan marketing campaigns, and achieve strategic growth in the competitive beauty sector.

| Category | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 (Projected) |

|---|---|---|---|---|---|---|

| Skincare | 12% | 14% | 16% | 18% | 19% | 20% |

| Haircare | 10% | 12% | 13% | 15% | 16% | 17% |

| Makeup | 8% | 10% | 11% | 13% | 14% | 15% |

| Fragrances | 9% | 11% | 12% | 14% | 15% | 16% |

The Amazon beauty and personal care catalog is extensive, with thousands of SKUs across multiple categories. Conducting a Beauty and personal care Analysis on Amazon helps businesses understand market saturation, identify category-specific trends, and determine opportunities for new product launches. Using Real-time beauty product availability analysis, companies can monitor stock levels, track seasonal variations, and maintain competitive pricing.

The total listings in 2025 show strong growth compared to 2020, reflecting both increasing consumer demand and vendor expansion. By employing Scrape Amazon beauty products price data, stakeholders can track SKU additions, monitor discontinued products, and analyze the distribution across subcategories like skincare, haircare, makeup, and fragrances.

| Subcategory | Total Listings | New Launches (2025) | Discontinued (2025) |

|---|---|---|---|

| Skincare | 1,250 | 120 | 30 |

| Haircare | 980 | 95 | 20 |

| Makeup | 1,100 | 110 | 25 |

| Fragrances | 430 | 50 | 10 |

Insights from Extract Top beauty & personal care Products data highlight the distribution of SKUs across price ranges, brands, and ratings. Monitoring the total listings helps businesses optimize their inventory strategy, adjust marketing campaigns, and target high-demand categories effectively.

Top brands account for a substantial share of Amazon’s beauty market. Amazon's Top beauty & personal care Brands analytics helps identify leaders and their relative positioning. L’Oreal, Nivea, Maybelline, and Lakme dominate key categories, while emerging brands show strong growth potential. Using Beauty Products Discount & Deals analytics on Amazon, businesses can track promotional strategies and consumer engagement.

| Brand | Total Listings | Average Rating | Market Share (%) | Top-Selling Subcategory |

|---|---|---|---|---|

| L’Oreal | 320 | 4.6 | 18% | Skincare |

| Nivea | 280 | 4.4 | 15% | Haircare |

| Maybelline | 250 | 4.5 | 13% | Makeup |

| Lakme | 220 | 4.3 | 11% | Makeup |

Brands leverage discounts, high ratings, and frequent product launches to maintain market share. Monitoring these trends through Amazon Bestselling Beauty Brands Analytics allows businesses to benchmark competitors, evaluate promotional efficiency, and identify partnership opportunities. Historical growth from 2020 to 2025 shows that top brands continue to consolidate market leadership, while niche players gradually capture emerging segments.

Pricing analysis is crucial to understand affordability and positioning. Most & Least expensive Beauty products analysis on Amazon provides clarity on entry-level and premium pricing trends. Price monitoring across 2020–2025 reveals gradual inflation, rising premium product adoption, and steady demand for mid-range offerings.

| Category | Min Price (₹) | Average Price (₹) | Max Price (₹) |

|---|---|---|---|

| Skincare | 150 | 950 | 4,500 |

| Haircare | 120 | 870 | 3,900 |

| Makeup | 200 | 1,050 | 4,200 |

| Fragrances | 450 | 1,450 | 5,800 |

Real-time beauty product availability analysis helps sellers adjust prices based on supply, competitor pricing, and seasonal trends. Scrape Amazon beauty products price data ensures accurate monitoring of dynamic price fluctuations, enabling competitive pricing strategies.

Examining extreme price points highlights market segmentation. Using Amazon's personal care product ratings analytics, businesses can correlate pricing with consumer perception and sales.

| Product | Brand | Price (₹) | Discount (%) | Rating |

|---|---|---|---|---|

| Luxe Face Cream | L’Oreal | 4,500 | 20% | 4.7 |

| Basic Hair Oil | Nivea | 120 | 5% | 4.2 |

| Premium Perfume | Gucci | 5,800 | 15% | 4.8 |

| Daily Lipstick | Lakme | 200 | 10% | 4.3 |

This analysis helps identify which products appeal to budget-conscious versus premium customers and informs pricing, promotion, and inventory strategies.

Brands target different segments to capture a broad audience. Amazon Bestselling Beauty Brands Analytics reveals how luxury brands like Gucci and Dior contrast with mass-market brands like Lakme and Nivea.

| Brand | Category | Min Price (₹) | Max Price (₹) |

|---|---|---|---|

| Lakme | Makeup | 200 | 2,500 |

| L’Oreal | Skincare | 300 | 4,500 |

| Nivea | Haircare | 120 | 3,900 |

| Gucci Beauty | Fragrances | 2,000 | 5,800 |

Understanding this distribution allows sellers to optimize assortments for different consumer segments and plan pricing strategies accordingly.

Monitoring discounts helps identify competitive promotions. Beauty Products Discount & Deals analytics on Amazon indicates which brands drive sales via discounts.

| Product | Brand | Original Price (₹) | Discount (%) | Final Price (₹) |

|---|---|---|---|---|

| Glow Serum | L’Oreal | 3,500 | 25% | 2,625 |

| Hair Shampoo | Nivea | 500 | 20% | 400 |

| Lipstick Set | Lakme | 1,200 | 30% | 840 |

| Perfume Gift Pack | Gucci | 5,800 | 15% | 4,930 |

These insights guide promotional planning, optimize inventory allocation, and enhance revenue through strategic discounting.

Quick commerce, or Q-commerce, has transformed the e-commerce landscape by enabling ultra-fast delivery of essential and high-demand products. With platforms like Swiggy Instamart, Amazon Now, Blinkit, and Dunzo leading the market, businesses must leverage Quick Commerce Category Reports to gain actionable insights into product performance, pricing trends, and consumer behavior. These reports provide granular data on category distribution, top-selling items, discount strategies, and inventory turnover, allowing retailers to optimize operations and boost profitability.

Through these reports, companies can track the total number of listings across various categories, analyze brand dominance, and monitor price spectra for budget and premium segments. Historical trends from 2020 to 2025 reveal significant growth in fast-moving categories like groceries, personal care, and packaged foods. For example, beauty and personal care products have seen an average annual growth of 15% in listing volume, while top brands leverage Q-commerce for rapid promotions and flash sales.

Tables within these reports often display metrics such as total SKUs, new launches, discontinued items, average prices, discount percentages, and availability rates, providing a complete snapshot of market dynamics. They also highlight top discounted brands, enabling businesses to evaluate promotional effectiveness and optimize pricing strategies in real time.

Additionally, insights from Q-commerce reports allow sellers to identify emerging trends, anticipate seasonal demand spikes, and monitor competitor strategies. By integrating Quick Commerce Category Reports and Insights with web scraping data services, companies can achieve a real-time understanding of market performance, product positioning, and pricing patterns.

In conclusion, Q-commerce category reports are indispensable for retailers aiming to remain competitive in the fast-paced, demand-driven e-commerce ecosystem. They provide the data intelligence needed to make informed inventory, pricing, and marketing decisions while maximizing customer satisfaction and revenue potential.

The Beauty and personal care Analysis on Amazon for August 2025 provides a comprehensive view of listings, pricing, discounts, and top brands. Leveraging Scrape Amazon beauty products price data, Extract Top beauty & personal care Products data, and Real-time beauty product availability analysis enables businesses to optimize strategies, improve inventory planning, and make informed product launch decisions. Insights from Amazon Bestselling Beauty Brands Analytics and Amazon's Top beauty & personal care Brands analytics allow for competitive benchmarking and promotional optimization. With this data-driven approach, retailers can maximize market penetration, improve ROI, and achieve sustained growth in the dynamic Amazon beauty and personal care segment.

Noodle Category Trends Analytics on Instamart in Delhi delivers data-driven insights into pricing, availability, brand share, and consumer demand to support smarter FMCG strategies.

Explore Now

Product Variant Mapping from Myntra, Ajio, Meesho & Amazon helps brands unify listings, track SKUs, and optimize cross-platform e-commerce catalog management efficiently.

Explore Now

Nykaa Beauty Product Data Analysis examines pricing, reviews, and product performance to help brands identify trends and make data-driven decisions

Explore Now

Browse expert blogs, case studies, reports, and infographics for quick, data-driven insights across industries.

Fashion Price Monitoring for Private Label vs National Brands helps retailers track price gaps, manage discounts, protect margins, and stay competitive

Brand-Level Price & Discount Benchmarking Across India’s Top Fashion Marketplaces helps businesses track pricing, discounts, and smarter retail decisions.

Marketplace Price and Inventory Analytics for Dewu-Poizon helps sellers track trends, optimize pricing reduce stock risks, and boost profits with insights.

Walmart & Target Shrinkflation Data Analytics to track pricing trends, product availability, private labels, and competitive shifts across major US grocery retailers.

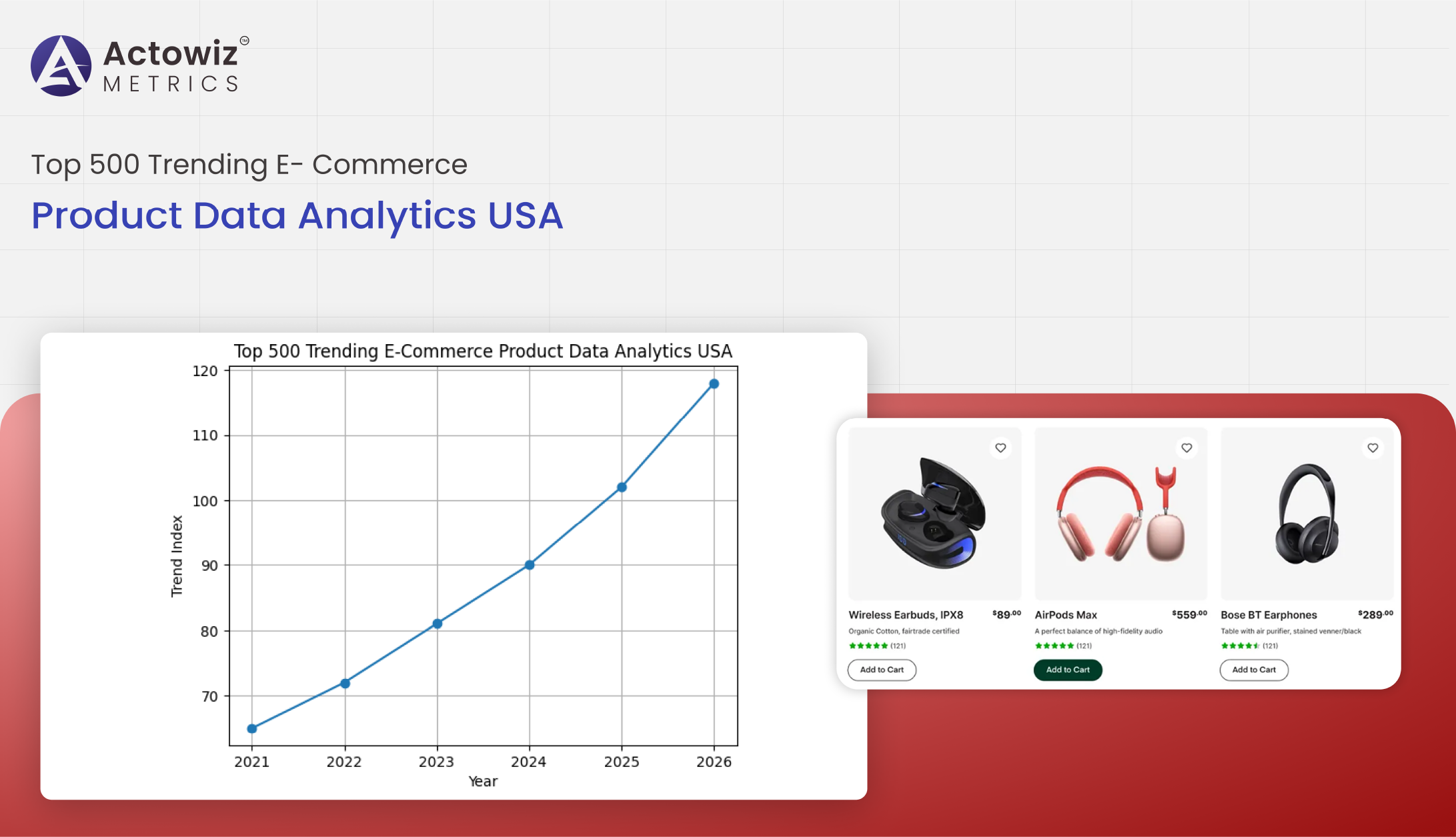

Top 500 trending e-commerce product data analytics in the USA delivers insights on pricing, demand, reviews, and sales trends to support smarter merchandising

Analyze Walmart’s dynamic discount trends analytics for electronics brands using data-driven insights to track price changes, promotions, and optimize pricing strategies.

Explore Luxury vs Smartwatch - Global Price Comparison 2025 to compare prices of luxury watches and smartwatches using marketplace data to reveal key trends and shifts.

E-Commerce Price Benchmarking: Gucci vs Prada reveals 2025 pricing trends for luxury handbags and accessories, helping brands track competitors and optimize pricing.

Discover how menu data scraping uncovers trending dishes in 2025, revealing popular recipes, pricing trends, and real-time restaurant insights for food businesses.

Explore the Amazon Baby Care Report analyzing Top Baby Brands Analysis on Amazon, covering discounts, availability, and popular products with data-driven market insights.

Amazon Sports & Outdoors Report - Sports & Outdoors Top Brands Analysis on Amazon - Prices, Discounts, Reviews

Enabled a USA pet brand to optimize pricing, inventory, and offers on Amazon using Pet Supplies Top Brands Analysis on Amazon for accurate, data-driven decisions.

Whatever your project size is, we will handle it well with all the standards fulfilled! We are here to give 100% satisfaction.

Any analytics feature you need — we provide it

24/7 global support

Real-time analytics dashboard

Full data transparency at every stage

Customized solutions to achieve your data analysis goals