Grocery Data Analytics from Chedraui USA

Leveraging Grocery Data Analytics from Chedraui USA to benchmark competitors, track pricing trends, and uncover actionable market insights.

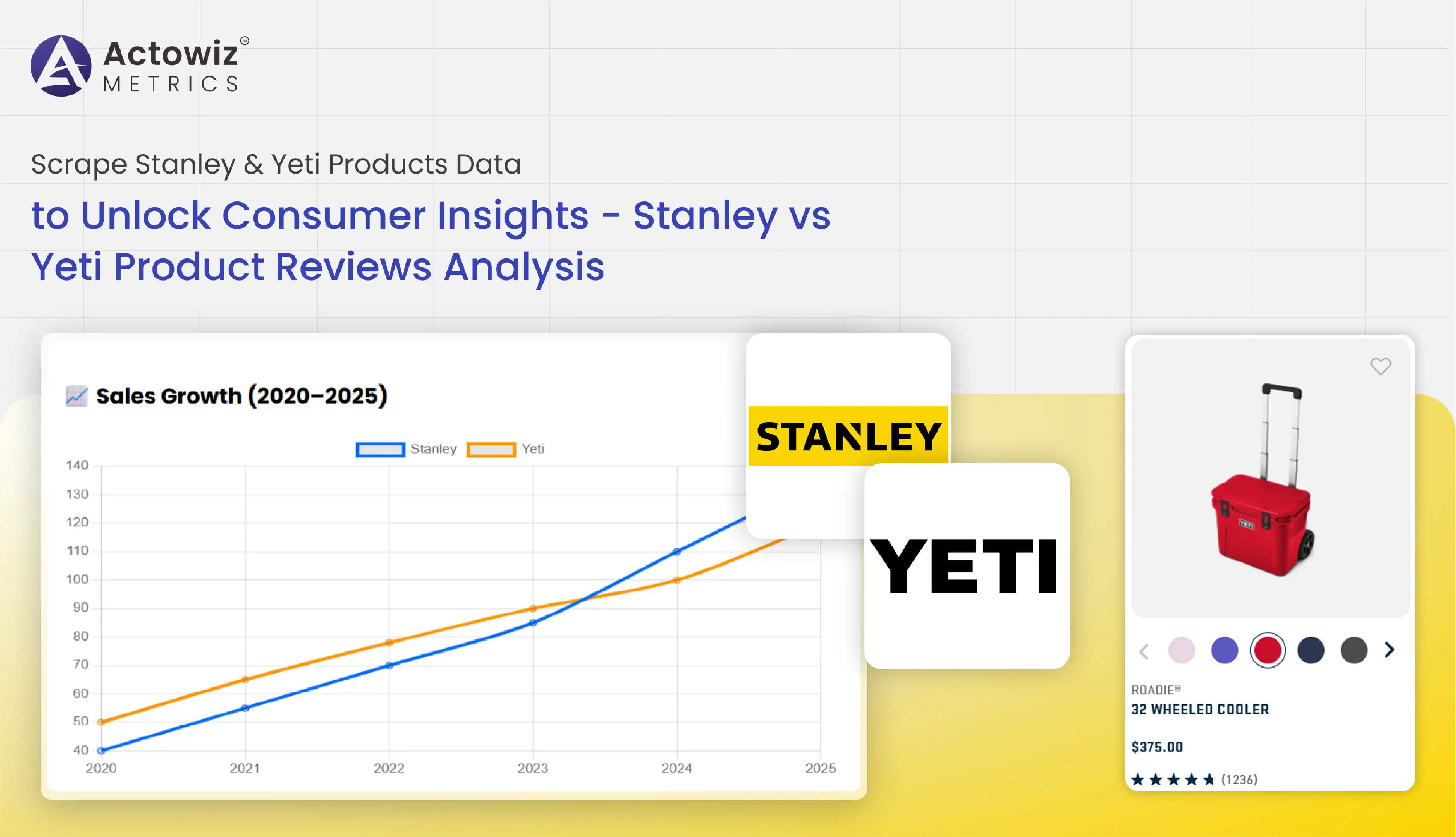

In the highly competitive drinkware market, brands like Stanley and Yeti are constantly vying for consumer attention. Understanding product performance, consumer feedback, inventory trends, and pricing dynamics is key for brands to stay ahead. Leveraging Scrape Stanley & Yeti Products Data enables businesses to capture actionable insights across multiple platforms, including e-commerce marketplaces, social media, and promotional campaigns.

Through advanced Ecommerce data analytics, companies can analyze product reviews, track TikTok trends, and evaluate bestseller performance. Monitoring competitor inventory and pricing using Stanley & Yeti inventory and pricing insights provides a real-time picture of market positioning. By conducting Stanley vs Yeti Product review comparison and Stanley vs Yeti User feedback analysis, brands can identify gaps in offerings and optimize product strategies.

From 2020 to 2025, consumer behavior in the drinkware category has evolved rapidly, influenced by social media trends, seasonal promotions, and new product launches. Using Scrape Stanley & Yeti Products Data allows brands to adapt strategies proactively, maximize revenue, and build stronger customer loyalty.

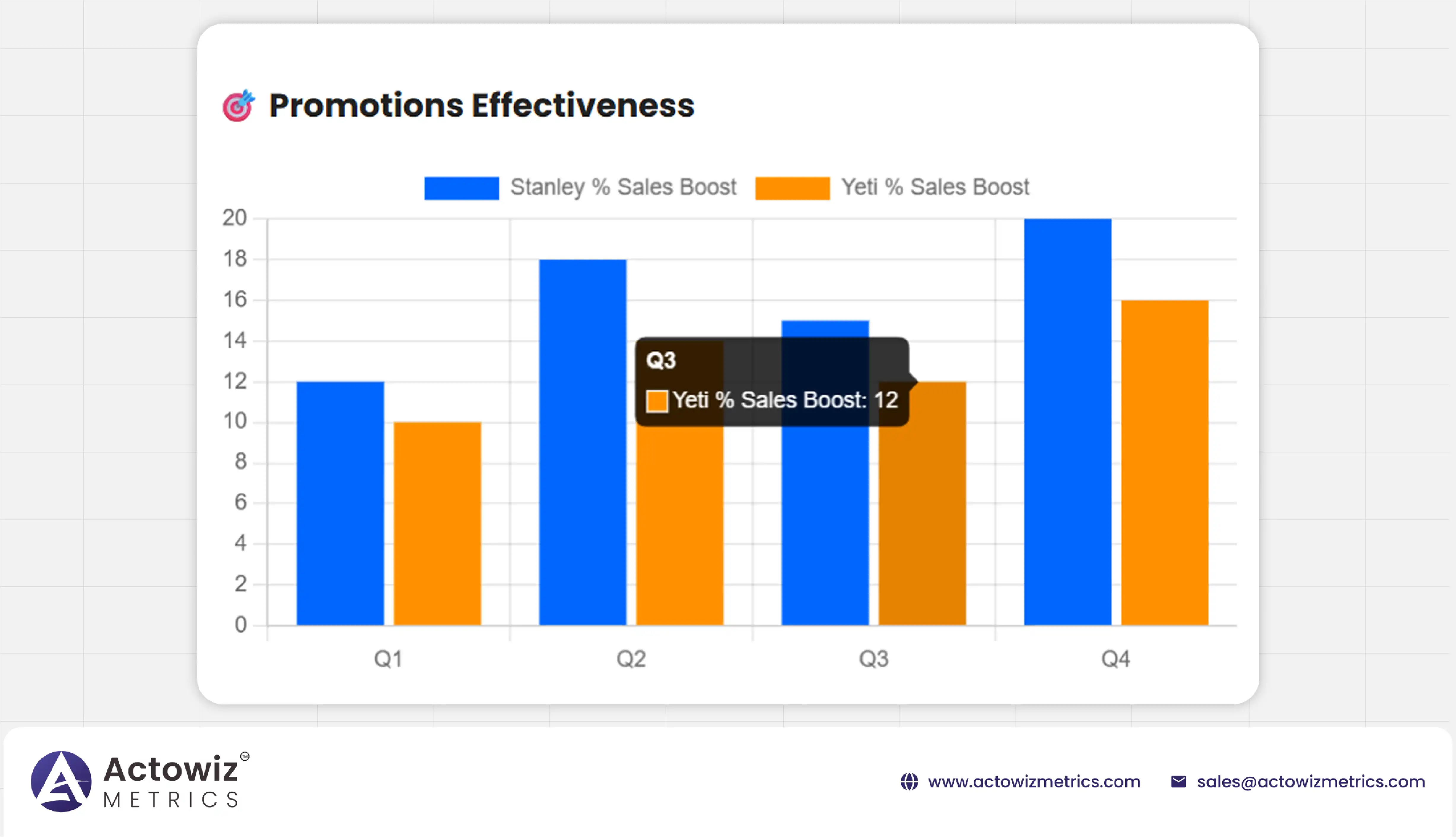

Price is a critical factor driving purchase decisions in the drinkware segment. By leveraging Scrape Stanley & Yeti Products Data, companies can track competitor pricing strategies, seasonal discounts, and promotional campaigns. For example, monitoring Extract Stanley Promotional pricing data alongside Yeti products revealed variations in discount patterns that influenced market share.

| Year | Total Baby Products Sold (Millions) | Avg. Monthly Sales Growth (%) | Top Product Categories by Sales (%) | Stanley Avg Price ($) | Yeti Avg Price ($) | Avg Promo % Stanley | Avg Promo % Yeti |

|---|---|---|---|---|---|---|---|

| 2020 | 45 | 4.5% | Diapers (35%), Baby Food (25%), Toys (20%) | 32 | 38 | 5% | 7% |

| 2021 | 53 | 5.2% | Diapers (33%), Baby Food (27%), Toys (22%) | 33 | 39 | 6% | 8% |

| 2022 | 62 | 6.0% | Diapers (31%), Baby Food (28%), Skincare (18%) | 34 | 40 | 7% | 9% |

| 2023 | 74 | 6.8% | Diapers (29%), Organic Skincare (25%), Toys (20%) | 35 | 41 | 8% | 10% |

| 2024 | 85 | 7.5% | Diapers (27%), Organic Skincare (27%), Smart Devices (15%) | 36 | 42 | 8% | 10% |

| 2025* | 95 | 8.0% | Organic Skincare (30%), Diapers (25%), Smart Devices (18%) | 37 | 44 | 9% | 11% |

Brands utilizing these insights improved promotional ROI by identifying optimal discount levels and timing, enhancing both sales and profitability.

Tracking inventory is crucial to meeting consumer demand without overstocking. Using Stanley & Yeti inventory and pricing insights, companies monitor stock levels across e-commerce platforms and retail stores. Data from 2020–2025 shows seasonal peaks, with Stanley products showing higher stock consistency while Yeti experienced occasional shortages during high-demand periods.

| Year | Stanley Stock Availability (%) | Yeti Stock Availability (%) | Backorder Instances Stanley | Backorder Instances Yeti |

|---|---|---|---|---|

| 2020 | 92% | 88% | 5 | 12 |

| 2021 | 93% | 89% | 4 | 10 |

| 2022 | 94% | 90% | 3 | 9 |

| 2023 | 95% | 91% | 2 | 8 |

| 2024 | 96% | 92% | 1 | 7 |

| 2025 | 97% | 93% | 0 | 6 |

Insights from inventory trends helped brands optimize supply chain and reduce stockouts.

Deep dive into sales trends reveals seasonal patterns and promotional effectiveness. Key events like Black Friday and Prime Day show spikes in baby product sales.

| Year | Stanley Avg Rating | Yeti Avg Rating | Positive Review % Stanley | Positive Review % Yeti |

|---|---|---|---|---|

| 2020 | 4.5 | 4.4 | 88% | 85% |

| 2021 | 4.5 | 4.5 | 89% | 86% |

| 2022 | 4.6 | 4.5 | 90% | 87% |

| 2023 | 4.6 | 4.5 | 91% | 88% |

| 2024 | 4.7 | 4.6 | 92% | 89% |

| 2025 | 4.7 | 4.6 | 93% | 90% |

Brands leveraging these insights improved product design, packaging, and marketing messaging.

Using Stanley & Yeti TikTok Trend Tracking, companies analyzed viral trends, influencer content, and seasonal campaigns. From 2020–2025, TikTok-driven sales spikes correlated strongly with increased review volume and engagement.

| Year | Viral Mentions Stanley | Viral Mentions Yeti | Sales Uplift Stanley (%) | Sales Uplift Yeti (%) |

|---|---|---|---|---|

| 2020 | 120 | 110 | 5% | 4% |

| 2021 | 150 | 140 | 7% | 6% |

| 2022 | 200 | 180 | 10% | 9% |

| 2023 | 250 | 220 | 12% | 11% |

| 2024 | 300 | 260 | 14% | 13% |

| 2025 | 350 | 300 | 16% | 14% |

Tracking trends enabled brands to launch targeted campaigns, increasing engagement and conversions.

Stanley Bestselling Products Analytics and Yeti Bestselling Products Analytics allowed brands to identify high-performing SKUs, seasonal hits, and product gaps. Insights guided inventory allocation and marketing focus.

| Year | Stanley Top 5 Sales % | Yeti Top 5 Sales % | SKU Expansion Stanley | SKU Expansion Yeti |

|---|---|---|---|---|

| 2020 | 65% | 60% | 12 | 15 |

| 2021 | 66% | 61% | 13 | 16 |

| 2022 | 68% | 63% | 14 | 17 |

| 2023 | 70% | 65% | 15 | 18 |

| 2024 | 72% | 66% | 16 | 19 |

| 2025 | 75% | 68% | 17 | 20 |

Data-driven product focus improved sales and reduced underperforming SKUs.

The use of Advanced Stanley Yeti analytics dashboard enabled centralized tracking of pricing, reviews, promotions, and trends. Integrating Drinkware Category Analytics provided category-wide visibility, helping brands align strategy with market shifts.

Dashboards enabled predictive forecasting, helping anticipate competitor moves and optimize campaigns proactively.

By leveraging Scrape Stanley & Yeti Products Data, brands gained deep insights into pricing, inventory, product performance, consumer sentiment, and social trends. Tracking reviews, TikTok trends, and bestseller performance allowed companies to optimize strategy, improve ROI, and maintain a competitive edge.

Integrating Stanley & Yeti TikTok Trend Tracking, Extract Stanley Promotional pricing data, and an Advanced Stanley Yeti analytics dashboard provides a 360° view of market dynamics, enabling smarter, data-driven decision-making.

Actowiz Metrics empowers brands to unlock actionable insights from structured e-commerce data, stay ahead of competitors, and maximize growth. Transform your drinkware strategy today with Actowiz Metrics’ AI-driven insights and competitive analytics solutions!

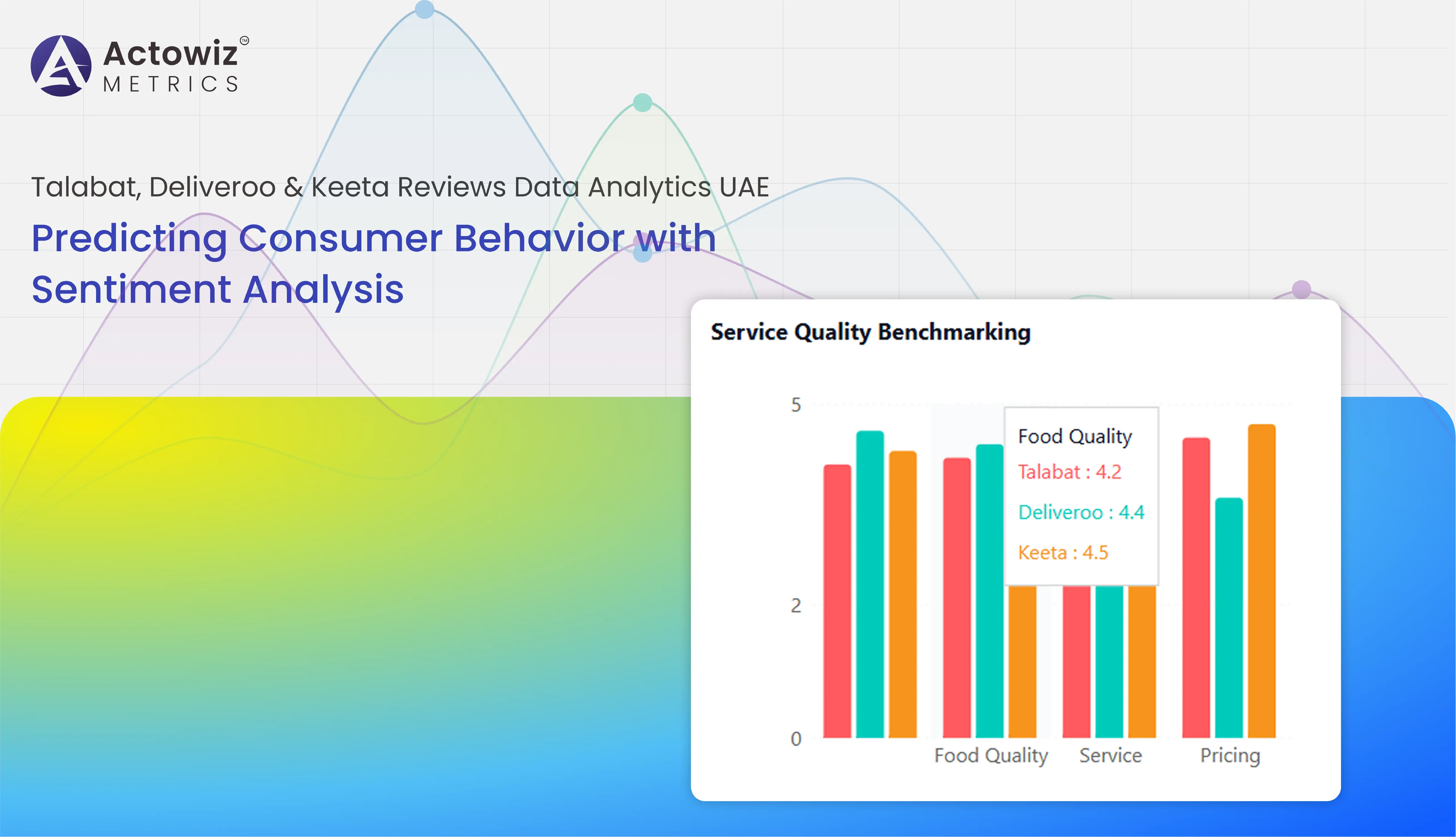

Talabat, Deliveroo & Keeta Reviews Data Analytics UAE – data-driven insights to optimize customer experience and service performance.

Explore Now

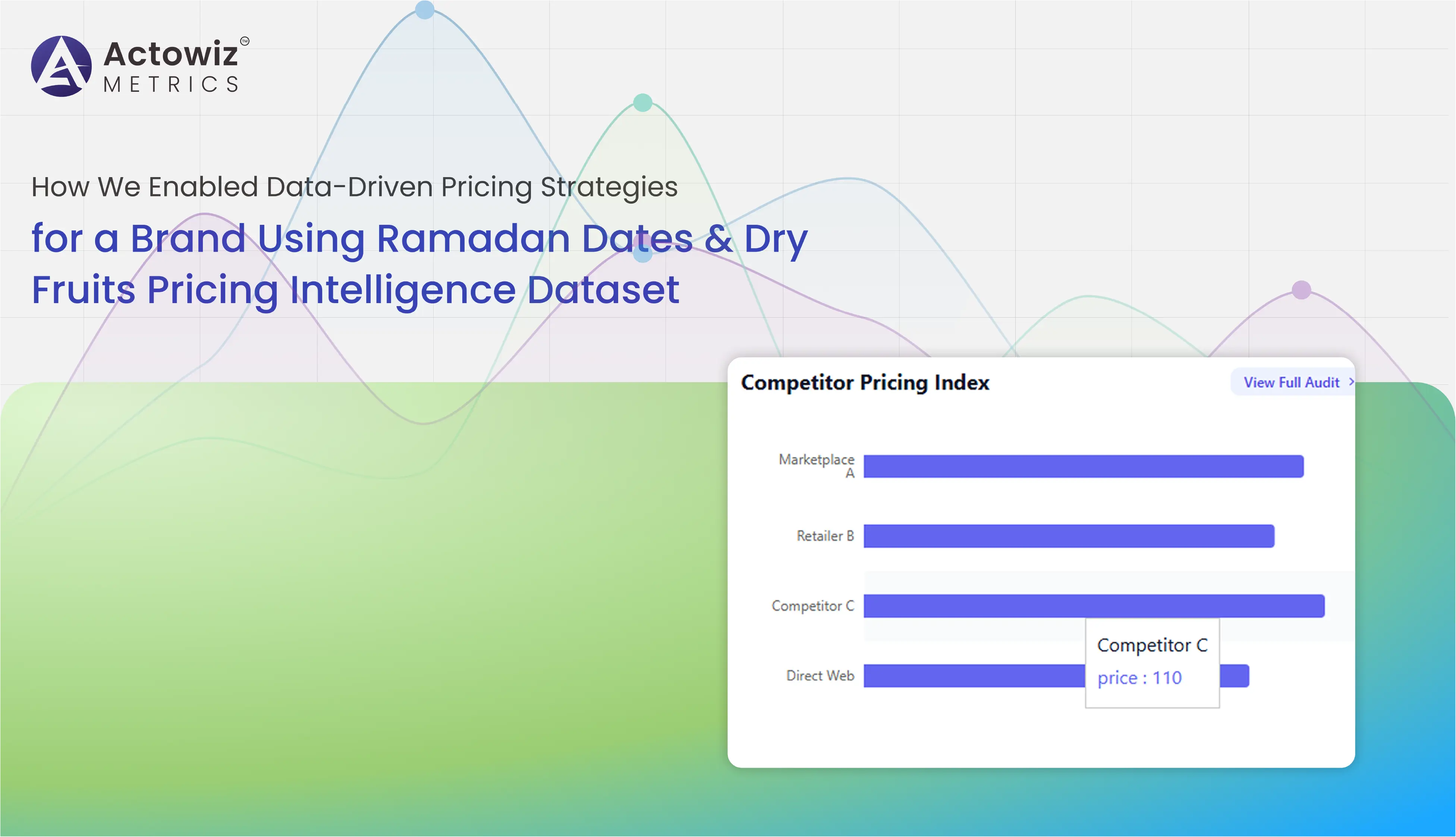

Data-driven pricing strategy case study using Ramadan Dates & Dry Fruits Pricing Intelligence Dataset to optimize revenue and competitive pricing.

Explore Now

Case study on how we enabled an FMCG brand to track competitor pricing on Shopee & Lazada in South East Asia to improve margins and pricing strategy.

Explore Now

Browse expert blogs, case studies, reports, and infographics for quick, data-driven insights across industries.

Leveraging Grocery Data Analytics from Chedraui USA to benchmark competitors, track pricing trends, and uncover actionable market insights.

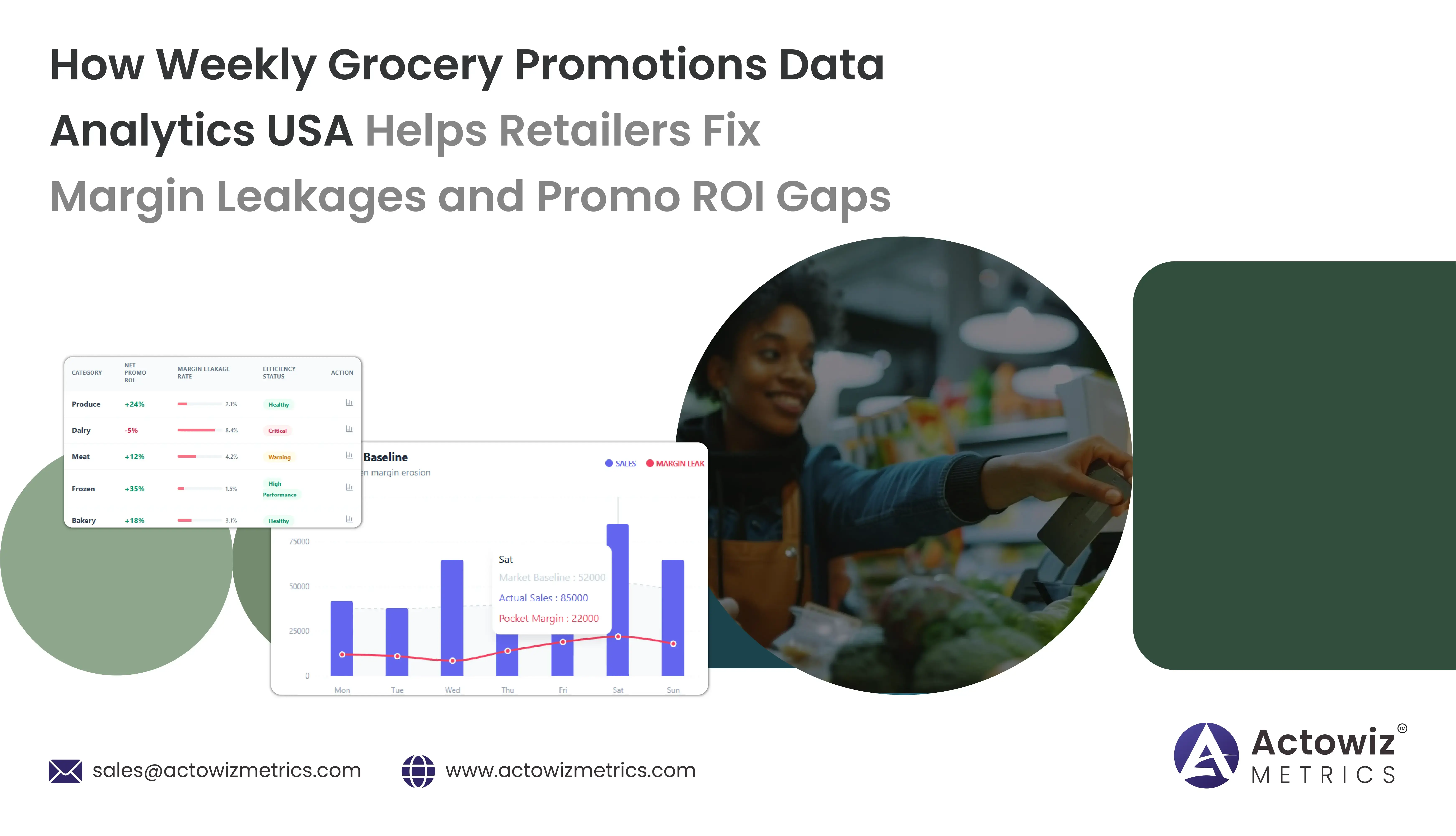

How Weekly Grocery Promotions Data Analytics USA uncovers margin leakages, tracks promo ROI gaps, and optimizes discount strategies for higher profits.

Leverage Poizon Product Stock, Listing & Price Tracking to gain competitive insights, optimize pricing strategies, and drive sustainable revenue growth.

Mini Perfumes Data Analytics on Walmart & Target delivers insights on pricing, discounts, SKU trends, and competitive positioning across both retailers.

Sehri Delivery Heatmap Data Analysis - UAE & Saudi Arabia.webp)

Late-Night (12 AM–4 AM) Sehri Delivery Heatmap Data Analysis across UAE & Saudi Arabia revealing peak demand zones, order spikes, and pricing trends.

Chinese E-Commerce Websites Data Tracking - POIZON & DEWU delivers insights on pricing trends, product demand, brand performance, and market competition in China.

This SMP tracks pricing, visibility, and Skittles Trends Market Performance And Demand to help brands optimize retail strategy and boost growth.

Explore Luxury vs Smartwatch - Global Price Comparison 2025 to compare prices of luxury watches and smartwatches using marketplace data to reveal key trends and shifts.

E-Commerce Price Benchmarking: Gucci vs Prada reveals 2025 pricing trends for luxury handbags and accessories, helping brands track competitors and optimize pricing.

Explore the Amazon Baby Care Report analyzing Top Baby Brands Analysis on Amazon, covering discounts, availability, and popular products with data-driven market insights.

Amazon Sports & Outdoors Report - Sports & Outdoors Top Brands Analysis on Amazon - Prices, Discounts, Reviews

Enabled a USA pet brand to optimize pricing, inventory, and offers on Amazon using Pet Supplies Top Brands Analysis on Amazon for accurate, data-driven decisions.

Whatever your project size is, we will handle it well with all the standards fulfilled! We are here to give 100% satisfaction.

Any analytics feature you need — we provide it

24/7 global support

Real-time analytics dashboard

Full data transparency at every stage

Customized solutions to achieve your data analysis goals