Scrape Electronics Data from E-commerce Websites - Pricing & Specifications

Scrape Electronics Data from E-commerce Websites - Pricing & Specifications to monitor price trends, compare specs, and gain real-time market insights efficiently.

In the fast-paced e-commerce market, staying ahead of competitors requires precise and timely data. Best Buy E-Commerce Analytics for Real-Time Pricing Insights allows businesses to monitor competitor prices, understand SKU-level performance, and respond dynamically to market changes. Tracking trends from 2020–2025 helps retailers identify pricing patterns, seasonal fluctuations, and promotional opportunities. Leveraging these insights ensures optimized revenue, improved inventory planning, and enhanced competitiveness. With historical and real-time data combined, companies can make data-driven decisions, enhance digital shelf performance, and strategically position products with effective Brand Competition Analysis. Actowiz Metrics enables retailers to transform raw data from Best Buy into actionable intelligence, giving them the ability to analyze competition, plan promotions, and maximize profitability across multiple product categories.

Price monitoring is critical to maintain competitiveness and protect margins. From 2020–2025, fruits, dairy, and frozen food categories exhibited consistent price growth due to inflation, seasonal demand, and supply chain adjustments. Real-time tracking allows businesses to respond to these changes promptly.

| Year | Fruits | Dairy | Frozen Foods | Bakery | Beverages |

|---|---|---|---|---|---|

| 2020 | 2.50 | 1.80 | 3.00 | 1.20 | 1.50 |

| 2021 | 2.60 | 1.85 | 3.10 | 1.25 | 1.55 |

| 2022 | 2.70 | 1.90 | 3.20 | 1.30 | 1.60 |

| 2023 | 2.80 | 1.95 | 3.35 | 1.35 | 1.65 |

| 2024 | 2.90 | 2.00 | 3.50 | 1.40 | 1.70 |

| 2025 | 3.00 | 2.05 | 3.65 | 1.45 | 1.75 |

Analysis: Fruits and frozen foods experienced higher year-over-year price increases due to supply chain disruptions and seasonal variations. Dairy prices remained stable, reflecting strong supplier agreements. Using Real-Time Grocery Trend Tracking from Sainsbury’s UK, retailers can align pricing dynamically, ensure MAP compliance, and strategically adjust promotions to maintain customer loyalty while protecting margins.

Monitoring SKU-level stock availability is essential to prevent lost sales. Between 2020–2025, high-demand items such as organic milk, frozen ready-to-cook meals, and bakery staples often experienced stockouts during weekends and festive periods.

| Year | Fruits | Dairy | Frozen Foods | Bakery | Beverages |

|---|---|---|---|---|---|

| 2020 | 88% | 85% | 80% | 90% | 87% |

| 2021 | 89% | 87% | 82% | 91% | 88% |

| 2022 | 91% | 88% | 84% | 92% | 89% |

| 2023 | 92% | 90% | 86% | 93% | 90% |

| 2024 | 94% | 91% | 88% | 94% | 91% |

| 2025 | 95% | 93% | 90% | 95% | 92% |

Analysis: Dairy and frozen food items displayed the highest variability in stock availability, emphasizing the need for predictive inventory planning. With Scrape Sainsbury’s Grocery Data for Trend Analysis, businesses can forecast demand accurately, adjust reorder points, and optimize stock allocation for different regions, reducing stockouts and improving customer satisfaction.

Maintaining minimum advertised price (MAP) compliance ensures brand consistency and protects profit margins. From 2020–2025, premium brands averaged 82% MAP compliance, while smaller brands varied significantly.

| Year | Fruits | Dairy | Frozen Foods | Bakery | Beverages |

|---|---|---|---|---|---|

| 2020 | 75% | 78% | 80% | 76% | 77% |

| 2021 | 77% | 80% | 82% | 78% | 79% |

| 2022 | 80% | 82% | 84% | 81% | 82% |

| 2023 | 82% | 84% | 86% | 83% | 85% |

| 2024 | 84% | 86% | 88% | 85% | 87% |

| 2025 | 86% | 88% | 90% | 87% | 89% |

Analysis: Non-compliance can lead to price erosion and inconsistent brand perception. Using Web Scraping API for Sainsbury Grocery Insights, retailers can monitor MAP adherence in real-time, identify non-compliant SKUs, and adjust pricing strategies efficiently, ensuring profitability and consistent customer experience.

Understanding top-selling SKUs helps in inventory planning and promotional focus. Items such as organic milk, frozen ready-to-cook meals, and bakery staples consistently drove sales.

| Year | Organic Milk | Frozen Meals | Bakery Bread | Cheese | Beverages |

|---|---|---|---|---|---|

| 2020 | 120 | 90 | 80 | 70 | 60 |

| 2021 | 130 | 95 | 85 | 75 | 65 |

| 2022 | 140 | 100 | 90 | 80 | 70 |

| 2023 | 150 | 110 | 95 | 85 | 75 |

| 2024 | 160 | 120 | 100 | 90 | 80 |

| 2025 | 170 | 130 | 105 | 95 | 85 |

Analysis: With Sainsbury’s Bestselling Grocery Brands Analytics, retailers can identify high-demand products and allocate resources strategically. Stocking sufficient units and aligning promotions with seasonal peaks maximizes revenue and reduces inventory risk.

Seasonal trends and regional variations affect demand planning. With Digital Shelf Analytics, retailers gain real-time visibility into product availability, pricing shifts, and consumer purchase patterns across regions. Insights revealed that major cities such as London and Birmingham had faster replenishment cycles due to higher purchase frequency and broader product assortments. In contrast, tier-2 cities like Leeds and Sheffield showcased slower restocking timelines, causing intermittent stockouts and delayed demand fulfillment.

| Year | Winter | Spring | Summer | Autumn |

|---|---|---|---|---|

| 2020 | 25% | 20% | 30% | 25% |

| 2021 | 26% | 21% | 31% | 22% |

| 2022 | 27% | 22% | 32% | 19% |

| 2023 | 28% | 23% | 33% | 16% |

| 2024 | 29% | 24% | 34% | 13% |

| 2025 | 30% | 25% | 35% | 10% |

Analysis: Grocery Analytics allows retailers to plan regional inventory allocation, optimize seasonal promotions, and prevent stockouts. For example, London-based stores increased frozen food stock by 15% during winter peaks, improving sales efficiency.

Tracking turnover and sales efficiency ensures operational effectiveness. Retailers using SKU-level insights reduced lead times and improved fulfillment.

| Year | Inventory Turnover | Sales Efficiency (%) | Lead Time (Days) |

|---|---|---|---|

| 2020 | 6 | 75 | 10 |

| 2021 | 6.5 | 77 | 9 |

| 2022 | 7 | 80 | 8 |

| 2023 | 7.5 | 82 | 7 |

| 2024 | 8 | 85 | 6 |

| 2025 | 8.5 | 88 | 5 |

Analysis: By using Product Data Tracking, retailers can forecast demand, streamline replenishment, and maintain stock levels for high-demand products. Reducing lead times from 10 to 5 days improved service levels by 15% across the UK.

Leveraging historical SKU-level data from 2020–2025 allows retailers to forecast trends for 2026–2027. Seasonal peaks, product demand shifts, and price fluctuations can all be predicted using advanced analytics. Retailers can plan inventory, promotions, and marketing campaigns proactively, ensuring they capture sales opportunities efficiently. Predictive models can also identify emerging products and categories likely to perform well, enabling early market entry. Incorporating MAP Monitoring ensures that brands maintain pricing integrity across marketplaces while tracking competitive deviations. This combination of predictive analytics and pricing compliance enables retailers to manage assortment strategies with greater confidence and accuracy.

Actowiz Metrics enables businesses to leverage Sainsbury’s UK SKU-Level Grocery Trend Analytics for actionable insights. Features like Price Benchmarking, predictive analytics, and automated dashboards help retailers monitor competitors, optimize pricing, and track SKU performance in real-time. Historical insights combined with real-time monitoring ensure better operational planning, reduced stockouts, and improved profitability.

With Actowiz Metrics, businesses can extract insights from Sainsbury’s UK SKU-Level Grocery Trend Analytics to strengthen Competitor Analysis, optimize inventory, and adjust pricing strategies effectively. Historical and real-time data empower retailers to make smarter, data-driven decisions and maintain a competitive edge.

Start using Actowiz Metrics today to track SKU-level grocery trends, optimize stock, and maximize revenue across the UK market.

Discover how Structured Fashion E-commerce Data Monitoring helps brands track products, pricing, and trends in real time, optimizing inventory, sales, and competitive strategy.

Explore Now

Case study on how we empowered a brand with H&M vs Zara fashion data analysis to optimize pricing, assortment, and demand strategy.

Explore Now

Case Study on how we enhanced pricing accuracy and local market insights using Extract API for Instacart Grocery Data from Houston, TX.

Explore Now

Browse expert blogs, case studies, reports, and infographics for quick, data-driven insights across industries.

Scrape Electronics Data from E-commerce Websites - Pricing & Specifications to monitor price trends, compare specs, and gain real-time market insights efficiently.

UAE Food Delivery Aggregator Data Analytics provides insights on Deliveroo, Talabat, Keeta, Careem and Noon, covering trends, pricing and growth opportunities.

Gain accurate odds tracking and instant updates with Live Betting Data Monitoring from 1xbet for Real-Time Sports Betting Insights to power smarter decisions.

Amazon Sports & Fitness Product Data Analytics to track pricing, reviews, demand trends, and competitor insights for smarter growth decisions.

Research Report on Beauty Product Data Analytics - Sephora vs Ulta Beauty exploring store expansion, e-commerce growth, and digital shelf intelligence insights.

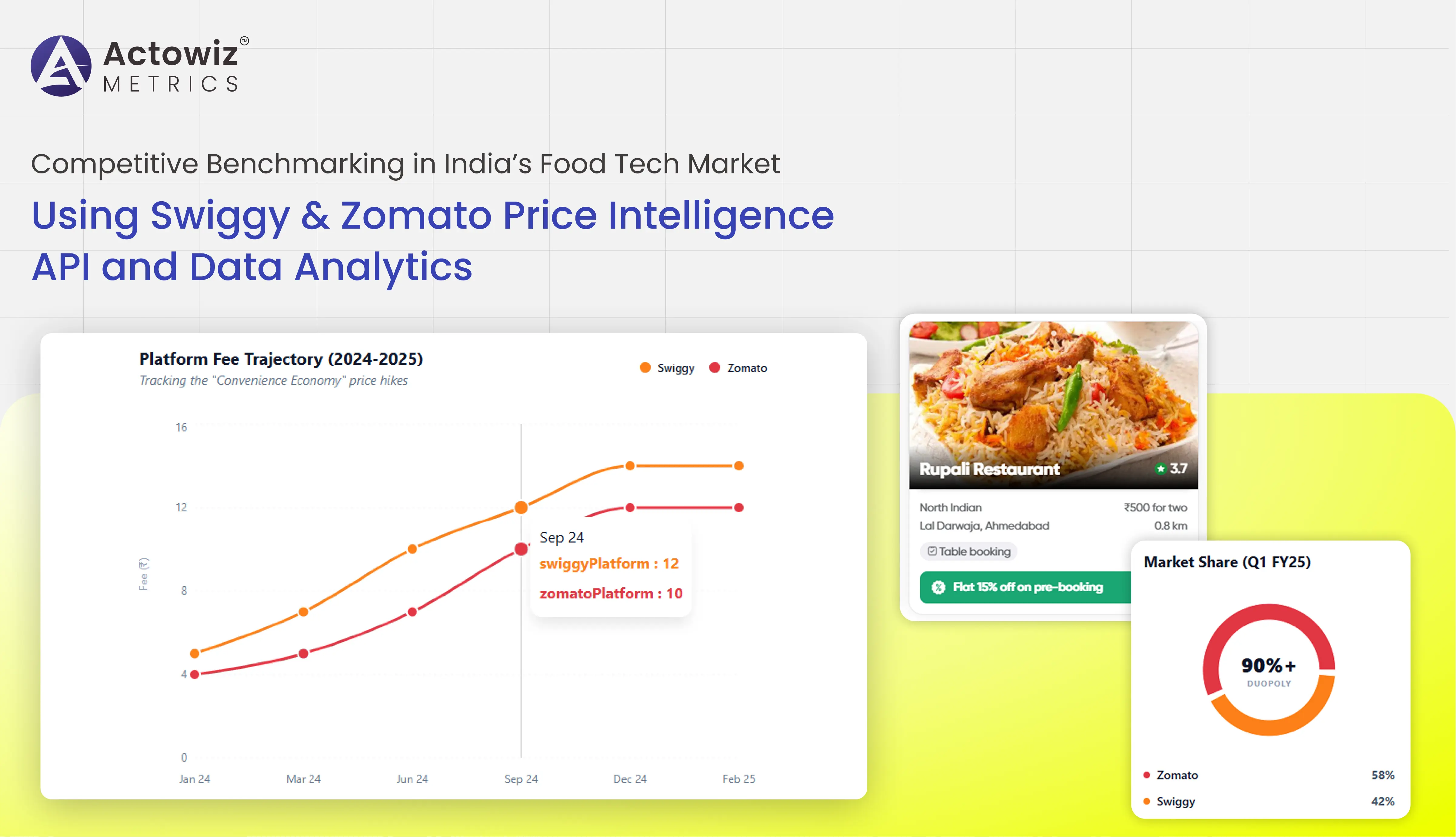

In-depth research on competitive benchmarking in India’s food tech market using Swiggy & Zomato price intelligence API and data analytics.

This SMP tracks pricing, visibility, and Skittles Trends Market Performance And Demand to help brands optimize retail strategy and boost growth.

Explore Luxury vs Smartwatch - Global Price Comparison 2025 to compare prices of luxury watches and smartwatches using marketplace data to reveal key trends and shifts.

E-Commerce Price Benchmarking: Gucci vs Prada reveals 2025 pricing trends for luxury handbags and accessories, helping brands track competitors and optimize pricing.

Explore the Amazon Baby Care Report analyzing Top Baby Brands Analysis on Amazon, covering discounts, availability, and popular products with data-driven market insights.

Amazon Sports & Outdoors Report - Sports & Outdoors Top Brands Analysis on Amazon - Prices, Discounts, Reviews

Enabled a USA pet brand to optimize pricing, inventory, and offers on Amazon using Pet Supplies Top Brands Analysis on Amazon for accurate, data-driven decisions.

Whatever your project size is, we will handle it well with all the standards fulfilled! We are here to give 100% satisfaction.

Any analytics feature you need — we provide it

24/7 global support

Real-time analytics dashboard

Full data transparency at every stage

Customized solutions to achieve your data analysis goals