Restaurant Reservations & Orders Monitoring API - Zomato, Swiggy & EazyDiner

Solving Real-Time Order Management Challenges with Restaurant Reservations & Orders Monitoring API - Zomato, Swiggy & EazyDiner for smarter tracking.

Copenhagen’s food delivery market is experiencing rapid growth, with platforms like Wolt and Just Eat dominating consumer demand for restaurant meals and quick-service dining. For restaurants, optimizing menu prices while remaining competitive across platforms is critical. This is where Wolt vs Just Eat restaurant price comparison Copenhagen becomes a powerful tool to uncover pricing gaps, promotional strategies, and competitive opportunities.

Actowiz Metrics implemented advanced Food Analytics to analyze pricing patterns across both platforms, capturing insights into category-level menu prices, meal deals, combos, and seasonal promotions. Using automated scraping and structured datasets, the analysis tracked fluctuations in pricing between 2020 and 2025, identifying which platform offered better deals in specific categories such as pizzas, sushi, and vegan options.

The study further leveraged Wolt restaurant menu price analytics and Scrape Just Eat restaurant menus data to compare individual restaurant listings, providing valuable intelligence for eateries aiming to balance customer value with profitability.

The Copenhagen online food delivery sector has grown at a CAGR of 14.5% between 2020 and 2025, driven by consumer demand for convenience, affordability, and variety. Platforms like Wolt and Just Eat have become household names, accounting for over 65% of total delivery orders in the city by 2024.

The Wolt vs Just Eat restaurant price comparison Copenhagen offers a deep look into how each platform adjusts prices to attract customers. Restaurants often list the same items at slightly different prices on Wolt and Just Eat, creating a fragmented pricing landscape.

| Year | Delivery Market Size (USD Bn) | YoY Growth % | Wolt Share % | Just Eat Share % |

|---|---|---|---|---|

| 2020 | 1.1 | 10% | 42% | 38% |

| 2021 | 1.3 | 15% | 44% | 37% |

| 2022 | 1.6 | 18% | 45% | 39% |

| 2023 | 1.9 | 16% | 47% | 40% |

| 2024 | 2.3 | 17% | 48% | 41% |

| 2025* | 2.7 | 18% | 49% | 42% |

With Wolt restaurant data analytics Copenhagen, Actowiz Metrics discovered that Wolt’s competitive edge lies in premium categories such as sushi and plant-based options, where consumers are willing to pay slightly higher prices. Meanwhile, Just Eat retains an advantage in fast-food combos and bulk meal deals.

This price divergence illustrates how platform strategies impact restaurant margins and consumer choice. For restaurants, having access to Wolt & Just Eat restaurant price monitoring tools is vital to strike the right balance between profitability and competitiveness.

Understanding category-specific pricing dynamics is key for restaurants to adapt strategies. Using Wolt vs Just Eat category-level food pricing insights, Actowiz Metrics compared major categories such as pizzas, burgers, Asian cuisine, vegan meals, and beverages.

Between 2020 and 2025, pizza remained the most competitive segment, accounting for nearly 28% of total orders across both platforms. However, pricing analysis revealed that Wolt’s pizza prices were 8–12% higher on average than Just Eat’s. Despite this, Wolt saw higher order volumes in premium restaurants, suggesting customers valued brand reputation and faster delivery over discounts.

| Category | Avg. Wolt Price (DKK) | Avg. Just Eat Price (DKK) | Price Difference % | Consumer Preference % |

|---|---|---|---|---|

| Pizza | 105 | 95 | +10.5% | Wolt 54% / Just Eat 46% |

| Burgers | 89 | 85 | +4.7% | Just Eat 52% / Wolt 48% |

| Sushi | 155 | 140 | +10.7% | Wolt 58% / Just Eat 42% |

| Vegan | 120 | 110 | +9.1% | Wolt 55% / Just Eat 45% |

| Beverages | 28 | 26 | +7.6% | Equal (50/50) |

These insights highlight how Just Eat meal deal & combo price analytics reflect stronger discount strategies, while Wolt positions itself as a premium marketplace. For restaurants, this indicates an opportunity to adjust category-specific pricing on each platform to maximize reach.

Both platforms use promotional tactics to retain customers. Actowiz Metrics employed Wolt vs Just Eat data-driven insights to analyze discounts, combos, and limited-time deals.

From 2020 to 2025, Just Eat increased its promotional campaigns by 32%, heavily targeting family meal combos and bulk orders. Wolt, on the other hand, focused on delivery fee discounts and exclusive offers from premium restaurants.

| Year | Avg. Just Eat Discount % | Avg. Wolt Discount % | Promotions Volume Index (JE=100) | Promotions Volume Index (W=100) |

|---|---|---|---|---|

| 2020 | 9% | 6% | 100 | 80 |

| 2021 | 11% | 7% | 112 | 85 |

| 2022 | 12% | 8% | 120 | 90 |

| 2023 | 13% | 9% | 128 | 95 |

| 2024 | 14% | 9% | 132 | 95 |

| 2025* | 15% | 10% | 140 | 100 |

Restaurants benefit by syncing promotions across platforms, but discrepancies in discount rates often confuse customers. A Wolt vs Just Eat price comparison dashboard consolidates this data, enabling eateries to maintain consistency and ensure they don’t undercut their own pricing strategies.

The need for Extract Food Delivery platform pricing data in real-time has never been greater. With dynamic consumer preferences, restaurants risk losing customers if they don’t adjust prices quickly.

Actowiz Metrics created a real-time system to track menu changes across both Wolt and Just Eat. This enabled restaurants to respond to competitor moves instantly, ensuring they maintained visibility in search results and captured demand surges during peak hours.

The system integrated delivery fees, minimum order values, and promotional campaigns, which often influenced the final price perception more than menu base prices. Over the 2020–2025 period, restaurants using these monitoring tools increased competitive order volumes by 15–20% compared to those without real-time analytics.

This approach also helped identify cases where platforms applied hidden markups, ensuring restaurants had full visibility into how their brand was represented.

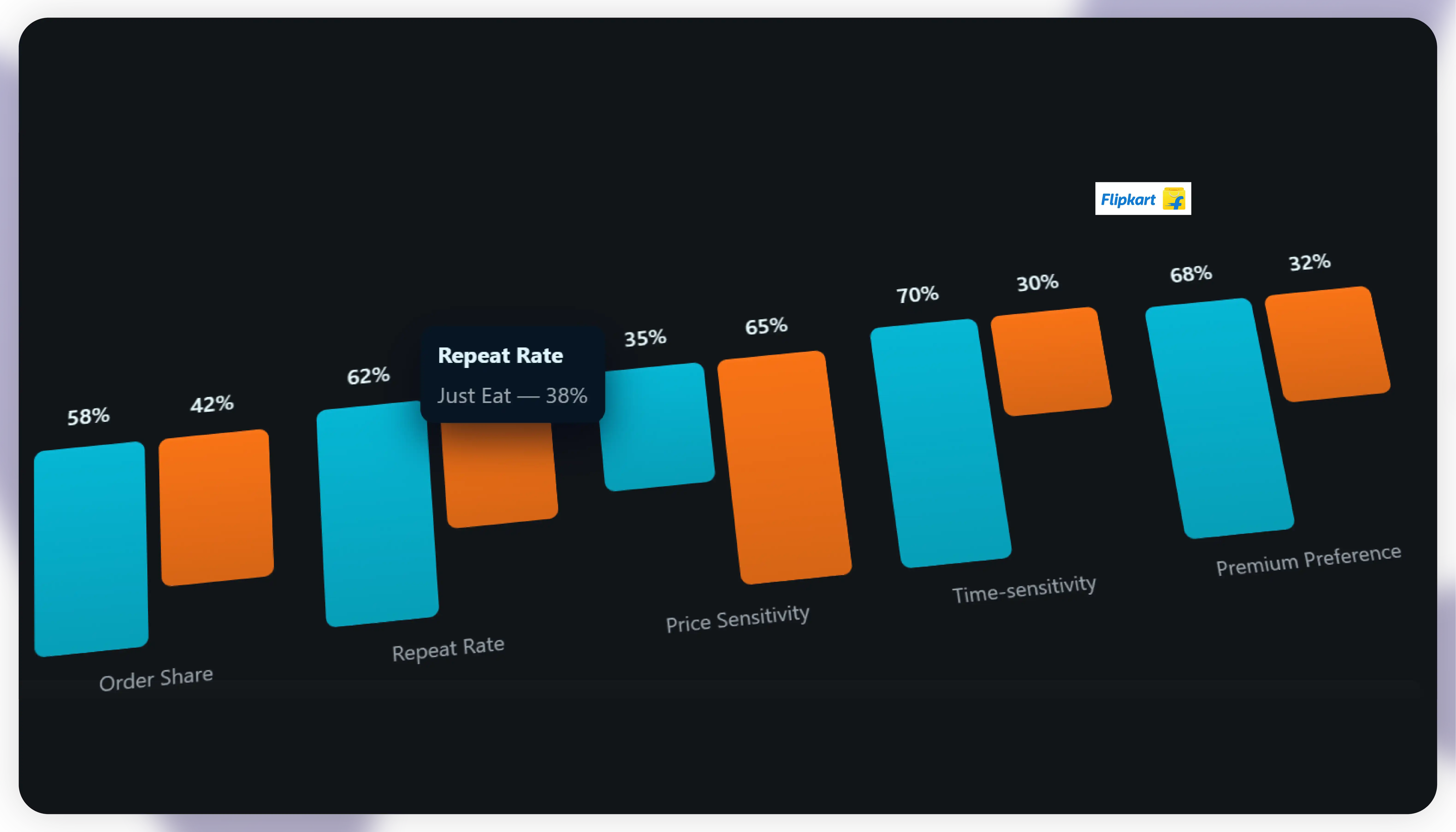

The final piece of Wolt vs Just Eat restaurant price comparison Copenhagen is understanding consumer preferences. Actowiz Metrics analyzed customer order volumes, repeat rates, and price sensitivity to reveal valuable patterns.

Between 2020 and 2025, 66% of Copenhagen consumers reported comparing both platforms before ordering, while 34% had strong loyalty to one app. Interestingly, Just Eat retained price-sensitive customers, while Wolt attracted time-sensitive and premium-focused users.

Restaurants using Wolt & Just Eat restaurant price monitoring tools could adjust menu strategies to target specific demographics. For example, burger restaurants saw better ROI by offering meal deals on Just Eat, while vegan restaurants gained more traction on Wolt.

This behavior-based segmentation, when paired with data, gave restaurants clarity on how to maximize revenue across platforms without diluting brand identity.

From 2025 onward, competition in Copenhagen’s delivery market is expected to intensify. Platforms will expand features like personalized AI-based recommendations, dynamic delivery fees, and subscription models.

Restaurants leveraging Wolt vs Just Eat data-driven insights will be better positioned to thrive. By adopting Wolt restaurant data analytics Copenhagen and combining it with real-time dashboards, eateries can automate pricing strategies, track competitor promotions, and adjust dynamically.

This future-driven approach ensures that restaurants don’t just survive but actively capitalize on shifting consumer preferences in a highly digitalized food ecosystem.

At Actowiz Metrics, we specialize in helping restaurants, delivery platforms, and market researchers unlock powerful pricing insights. By implementing advanced scraping tools such as Scrape Just Eat restaurant menus data and Wolt restaurant menu price analytics, we ensure businesses have access to real-time, accurate, and actionable datasets.

Our tailored systems include real-time monitoring dashboards, competitor tracking solutions, and category-level analytics that empower restaurants to identify gaps, capture market opportunities, and optimize promotions. With experience in building robust, automated pipelines for data collection, we help clients reduce manual efforts and unlock true value from their data.

Whether you’re a restaurant owner looking to increase profitability, or a platform strategist analyzing competitor moves, Actowiz Metrics provides end-to-end solutions to keep you ahead in the evolving digital food delivery space.

The Wolt vs Just Eat restaurant price comparison Copenhagen demonstrates how data-driven strategies help restaurants maintain competitiveness in one of Europe’s most dynamic food delivery markets. Pricing differences, category-specific insights, and promotional strategies show that success requires not just offering good food, but aligning with consumer expectations on value and convenience.

By leveraging Wolt vs Just Eat price comparison dashboard, restaurants can continuously monitor and refine their pricing strategies, balancing profitability with customer satisfaction. Insights from MatHem Grocery Item Price Analytics to competitor-focused tools provide a roadmap for long-term growth.

Actowiz Metrics empowers restaurants with powerful tools, ensuring data is not just collected but transformed into actionable insights. In a marketplace driven by choice and convenience, those who adapt with data will always lead.

Ready to gain an edge? Connect with Actowiz Metrics today to unlock food delivery pricing intelligence for maximum impact.

Case Study on how we enhanced pricing accuracy and local market insights using Extract API for Instacart Grocery Data from Houston, TX.

Explore Now

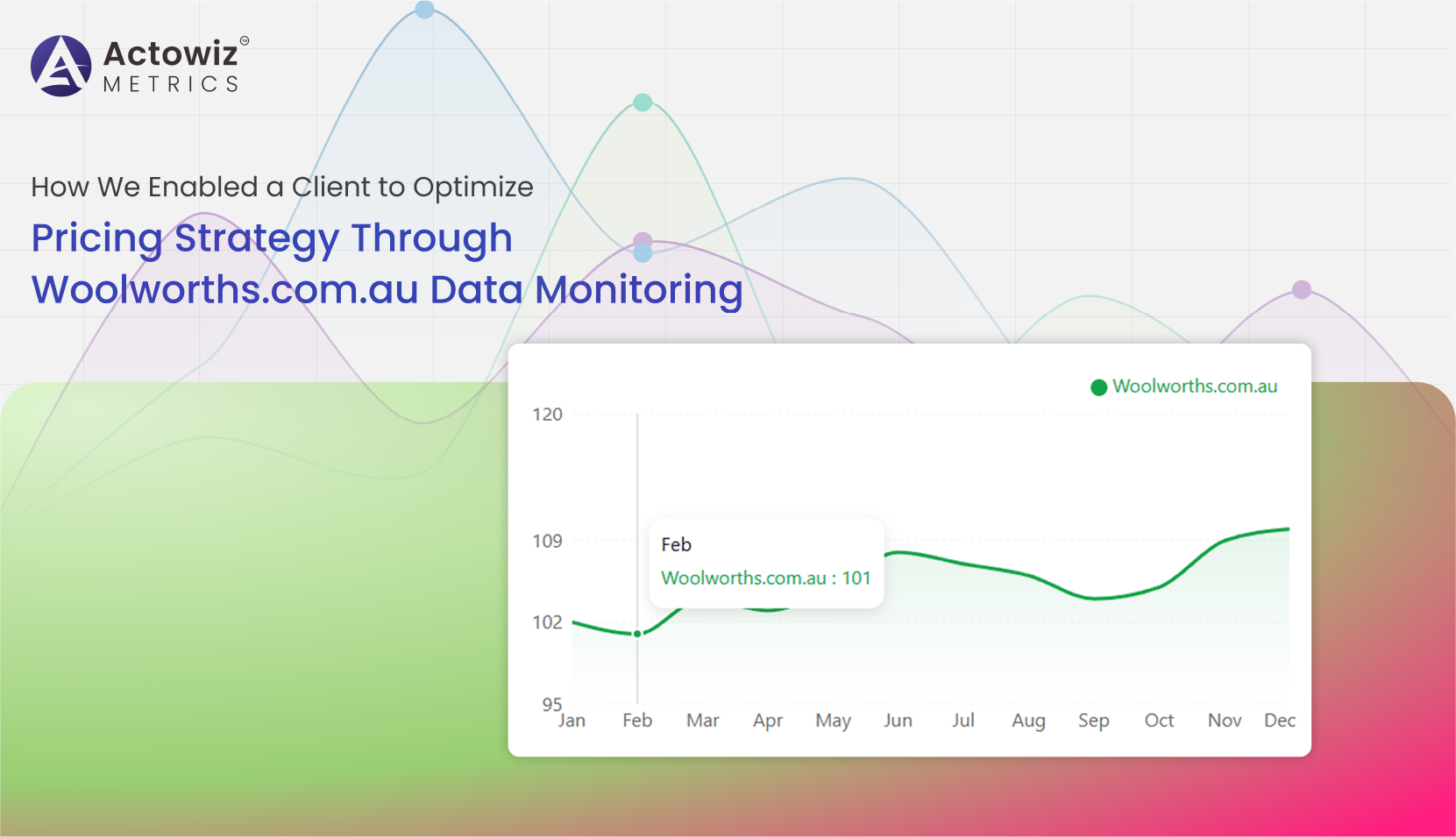

Woolworths.com.au Data Monitoring helps track pricing, promotions, stock availability, and competitor trends to drive smarter retail and eCommerce decisions.

Explore Now

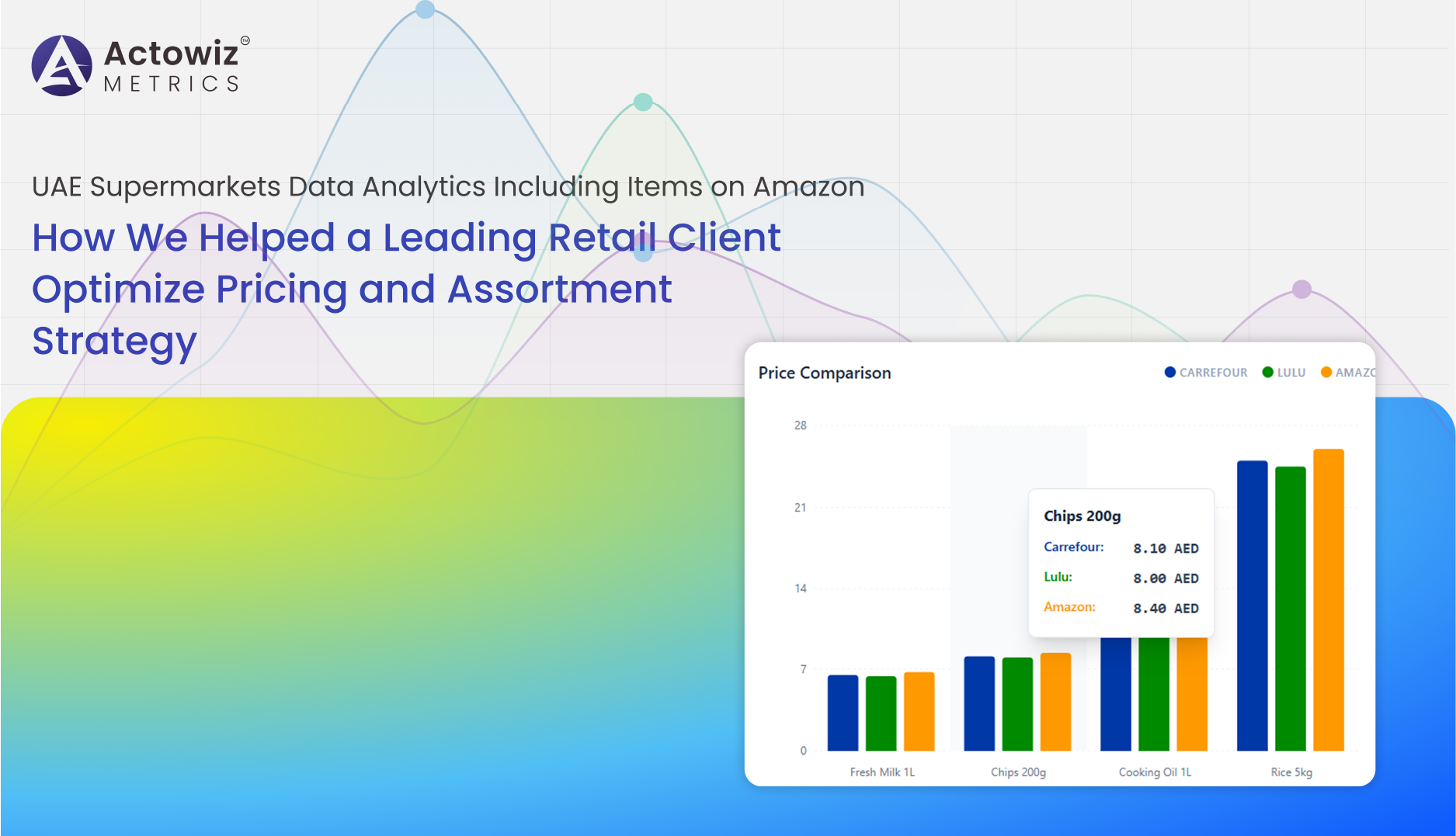

UAE Supermarkets Data Analytics Including Items on Amazon helped our retail client optimize pricing, refine assortment, and improve market competitiveness.

Explore Now

Browse expert blogs, case studies, reports, and infographics for quick, data-driven insights across industries.

Solving Real-Time Order Management Challenges with Restaurant Reservations & Orders Monitoring API - Zomato, Swiggy & EazyDiner for smarter tracking.

Discover how Zonaprop Real Estate Data Tracking in Argentina reduces investment risk with accurate pricing insights and smarter property decisions.

How Woolworths.com.au Data Tracking helps monitor pricing shifts, stock levels, and promotions to improve retail visibility and decision-making.

Dior Luxury Fashion Market Analysis explores global brand positioning, competitive landscape, market trends, revenue performance, and future growth outlook.

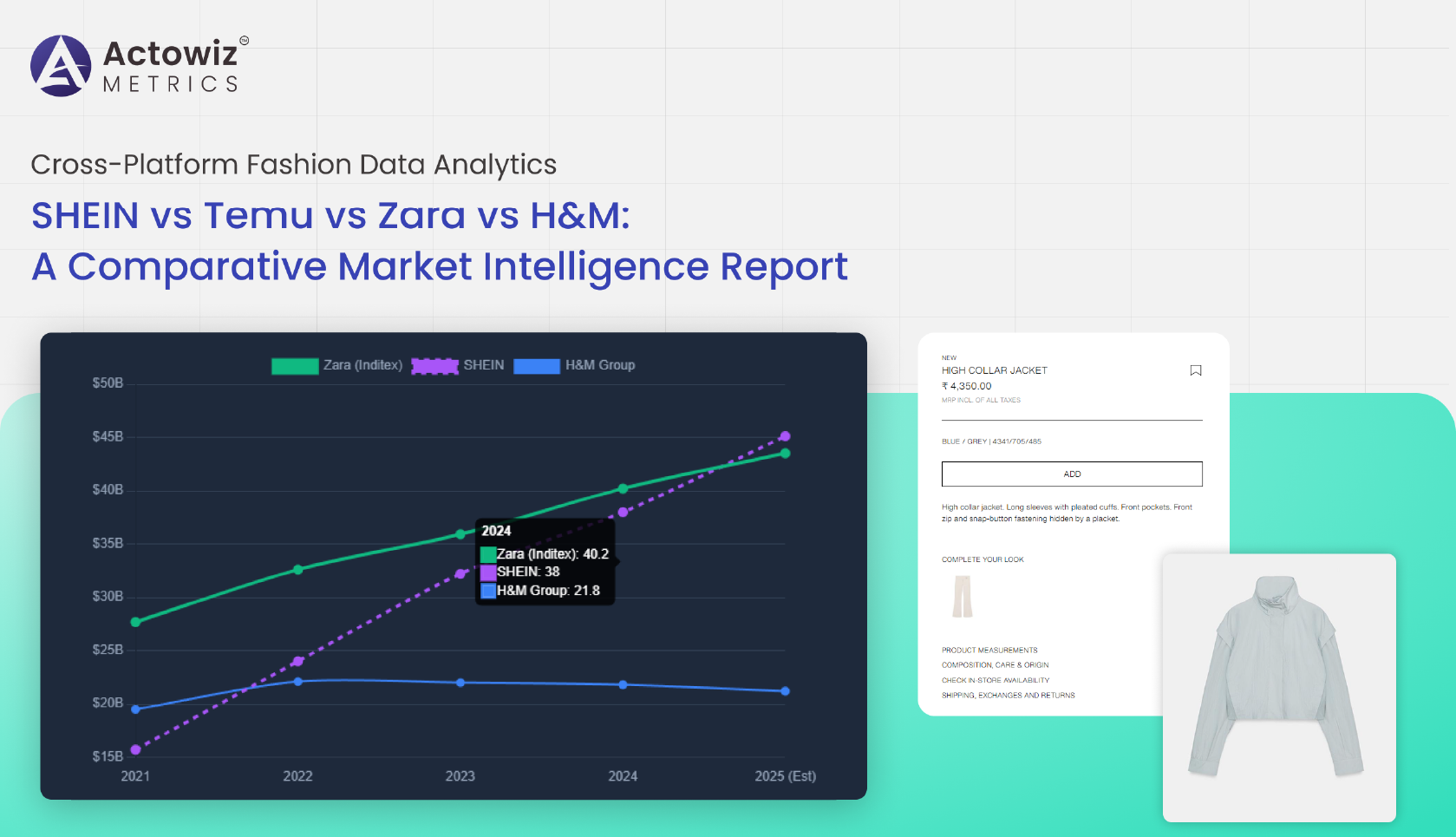

Cross-Platform Fashion Data Analytics - SHEIN vs Temu vs Zara vs H&M delivers actionable insights by comparing pricing, trends, inventory shifts, and consumer demand

Track and analyze the Number of Pizza Hut Locations Analytics in India 2026 to uncover expansion trends, regional distribution, and market growth insights.

Explore Luxury vs Smartwatch - Global Price Comparison 2025 to compare prices of luxury watches and smartwatches using marketplace data to reveal key trends and shifts.

E-Commerce Price Benchmarking: Gucci vs Prada reveals 2025 pricing trends for luxury handbags and accessories, helping brands track competitors and optimize pricing.

Discover how menu data scraping uncovers trending dishes in 2025, revealing popular recipes, pricing trends, and real-time restaurant insights for food businesses.

Explore the Amazon Baby Care Report analyzing Top Baby Brands Analysis on Amazon, covering discounts, availability, and popular products with data-driven market insights.

Amazon Sports & Outdoors Report - Sports & Outdoors Top Brands Analysis on Amazon - Prices, Discounts, Reviews

Enabled a USA pet brand to optimize pricing, inventory, and offers on Amazon using Pet Supplies Top Brands Analysis on Amazon for accurate, data-driven decisions.

Whatever your project size is, we will handle it well with all the standards fulfilled! We are here to give 100% satisfaction.

Any analytics feature you need — we provide it

24/7 global support

Real-time analytics dashboard

Full data transparency at every stage

Customized solutions to achieve your data analysis goals