Real Estate Data Analytics from Property24 South Africa

Real Estate Data Analytics from Property24 South Africa delivers insights on pricing trends, demand shifts, listings, and investment opportunities.

In today’s hyper-competitive eCommerce environment, success is no longer driven by intuition—it’s driven by intelligence. Brands selling on Pinduoduo face intense pressure to continuously optimize pricing, inventory, and product positioning. This is where Pinduoduo SKU-Level Products Analytics becomes a game-changer, enabling sellers to isolate weak-performing SKUs and transform them into growth opportunities. By combining granular SKU data with Price Benchmarking, businesses can uncover pricing gaps, demand fluctuations, and competitor strategies that directly impact profitability.

Instead of relying on surface-level metrics, advanced analytics helps brands zoom into each product’s lifecycle—from listing to conversion—so corrective actions are taken faster and more effectively. Whether it’s eliminating dead stock, reworking discount strategies, or reallocating marketing spend, SKU-level intelligence is now essential for sustainable growth on China’s fastest-moving social commerce platform.

Brands today are no longer competing only on price—they are competing on precision. With Pinduoduo Website Products Data Monitoring and Brand Competition Analysis, sellers gain a structured view of how their product catalog performs against market leaders.

Between 2020 and 2026, the number of active sellers on Pinduoduo grew by over 180%, while product listings increased nearly 2.4x. This explosion made manual tracking impossible. Businesses now rely on structured dashboards that compare SKU-level impressions, clicks, and conversions with competitors’ metrics.

| Year | Active Sellers | Avg SKUs per Seller | Competitive Price Gaps |

|---|---|---|---|

| 2020 | 4.2M | 18 | 12% |

| 2022 | 6.1M | 24 | 18% |

| 2024 | 7.8M | 31 | 23% |

| 2026 | 9.4M | 38 | 27% |

By aligning internal data with market signals, brands can detect declining SKUs before revenue drops become irreversible. Sellers that adopted competitive analytics between 2021 and 2024 reported a 34% faster response time to market changes—reducing markdown losses and improving campaign ROI. This shift from reactive to proactive decision-making defines the new standard for product success on Pinduoduo.

Discounting works—but only when it’s intelligent. With Pinduoduo Products Pricing & Discount Data Scraping, brands gain real-time visibility into competitor promotions and seasonal pricing strategies.

From 2020 to 2026, promotional campaigns on Pinduoduo increased by nearly 65%, but profit erosion rose simultaneously. Why? Because many sellers discounted blindly. Data-driven discount analysis changed this pattern.

| Year | Avg Discount Rate | Revenue Lift | Margin Impact |

|---|---|---|---|

| 2020 | 18% | +12% | -9% |

| 2022 | 22% | +19% | -7% |

| 2024 | 25% | +28% | -4% |

| 2026 | 27% | +35% | -2% |

By tracking real-time competitor offers, sellers learned when to undercut, match, or hold price. Brands that implemented pricing intelligence tools between 2022 and 2025 saw a 31% increase in conversion while preserving margins.

The biggest win? Eliminating underperforming SKUs that only sold during deep discounts. These products often consumed warehouse space while delivering minimal long-term value. Data-driven pricing helped sellers identify which products deserved reinvestment—and which should be retired.

Demand forecasting has moved beyond historical averages. Using Pinduoduo Sales & Demand Insights Data combined with Product Data Tracking, brands now predict trends before they fully emerge.

Between 2020 and 2026, category demand volatility increased by 48%, driven by flash sales, influencer promotions, and group-buy campaigns. Brands that depended solely on past sales data consistently overstocked slow SKUs and understocked trending ones.

| Year | Forecast Accuracy | Stockout Rate | Overstock Loss |

|---|---|---|---|

| 2020 | 62% | 18% | 14% |

| 2022 | 71% | 14% | 10% |

| 2024 | 82% | 9% | 6% |

| 2026 | 89% | 6% | 4% |

Advanced analytics now integrates behavioral signals—wishlist adds, page dwell time, and repeat views—to forecast SKU momentum. This shift enables sellers to invest more confidently in winners and phase out declining products early.

The result is not just better forecasting, but a cleaner catalog—where underperforming SKUs no longer drain resources but instead make room for higher-impact products.

Inconsistent data leads to inconsistent decisions. That’s why businesses increasingly rely on systems that Extract Pinduoduo Website Products Data to create a unified product intelligence layer.

From 2020 to 2026, multi-store sellers grew by nearly 72%, creating challenges in standardizing product data across accounts. Without centralized extraction, teams worked in silos—marketing optimized one SKU, while operations phased it out unknowingly.

| Year | Stores per Seller | Data Errors | Decision Lag |

|---|---|---|---|

| 2020 | 1.8 | 22% | 14 days |

| 2022 | 2.6 | 16% | 10 days |

| 2024 | 3.4 | 9% | 6 days |

| 2026 | 4.1 | 5% | 3 days |

Automated product extraction ensures that pricing, availability, and performance metrics are always aligned across teams. With reliable SKU-level visibility, businesses can confidently eliminate products that consistently underperform across regions, channels, or campaigns—freeing resources for innovation and expansion.

Aggressive pricing can boost volume—but it can also damage brand perception. By using Pinduoduo Website Products Data Scraper along with MAP Monitoring, brands now protect their minimum advertised pricing strategies while staying competitive.

Between 2020 and 2026, unauthorized discounting incidents increased by over 90%, particularly during mega-sale events. This led to brand dilution and channel conflicts.

| Year | MAP Violations | Avg Price Erosion | Brand Trust Score |

|---|---|---|---|

| 2020 | 12% | -8% | 78 |

| 2022 | 18% | -12% | 73 |

| 2024 | 24% | -15% | 69 |

| 2026 | 29% | -18% | 65 |

With automated monitoring, brands now flag violations instantly and take corrective actions. This ensures that premium SKUs retain their perceived value, while low-performing discount-only products are systematically eliminated.

The outcome is a healthier catalog—one that prioritizes long-term brand equity over short-term sales spikes.

Success leaves patterns. Through Pinduoduo Bestselling Brands Analytics, sellers decode what top performers do differently—from pricing cadence to SKU bundling strategies.

From 2020 to 2026, top 5% brands consistently outperformed others by 2.6x in revenue per SKU. What set them apart was not just marketing spend, but smarter product lifecycle management.

| Year | Avg Revenue per SKU | Time to Optimize | SKU Churn Rate |

|---|---|---|---|

| 2020 | ¥18,000 | 90 days | 34% |

| 2022 | ¥24,500 | 70 days | 28% |

| 2024 | ¥31,000 | 50 days | 22% |

| 2026 | ¥38,000 | 35 days | 17% |

By benchmarking against leaders, brands identify which product attributes drive conversions—be it packaging, pricing tiers, or delivery speed. This insight helps eliminate underperforming SKUs that fail to match winning formulas, replacing them with higher-potential alternatives that align with proven success models.

Actowiz Metrics empowers brands with advanced E-commerce Analytics solutions designed specifically for fast-moving marketplaces like Pinduoduo. Our data-driven approach transforms raw SKU-level information into actionable intelligence—helping you identify weak performers, protect margins, and scale profitably.

With automated data extraction, pricing intelligence, competitor benchmarking, and demand forecasting, Actowiz enables sellers to stop guessing and start optimizing. Whether your goal is to streamline product portfolios or strengthen your competitive edge, our analytics framework ensures every SKU works harder for your business.

In an ecosystem as dynamic as Pinduoduo, success is no longer about having more products—it’s about having the right products. By leveraging Digital Shelf Analytics, brands gain the clarity needed to identify underperforming SKUs, eliminate inefficiencies, and reinvest in high-impact opportunities.

The future belongs to sellers who act on insights, not assumptions. With the right analytics partner, every data point becomes a strategic advantage—turning product intelligence into sustainable growth.

Ready to transform your Pinduoduo performance? Partner with Actowiz Metrics today and start converting data into decisive action!

Built a brand-centric JioHotstar Streaming Data Analysis Dashboard to unlock real-time viewer insights and optimize content performance metrics.

Explore Now

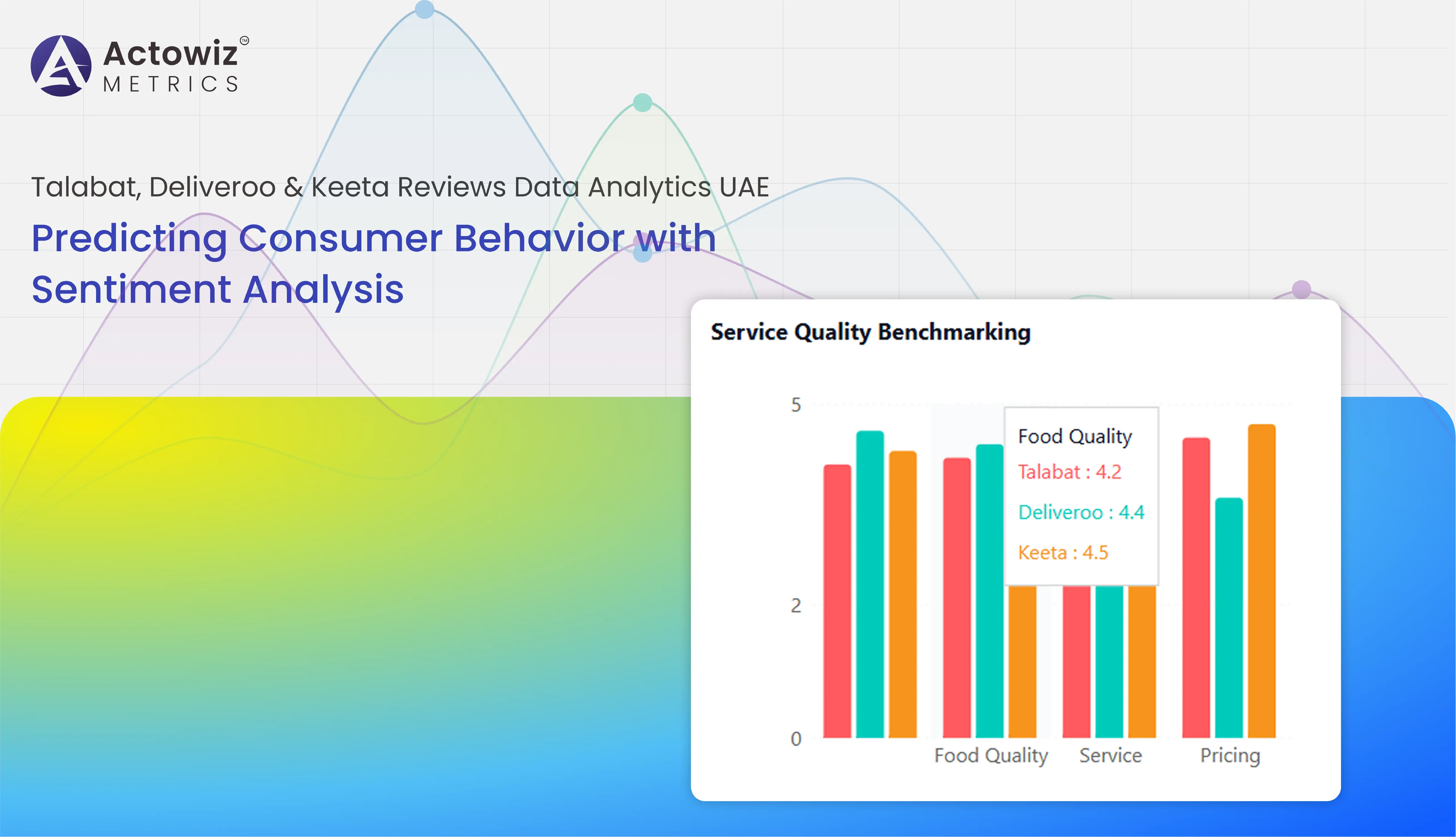

Talabat, Deliveroo & Keeta Reviews Data Analytics UAE – data-driven insights to optimize customer experience and service performance.

Explore Now

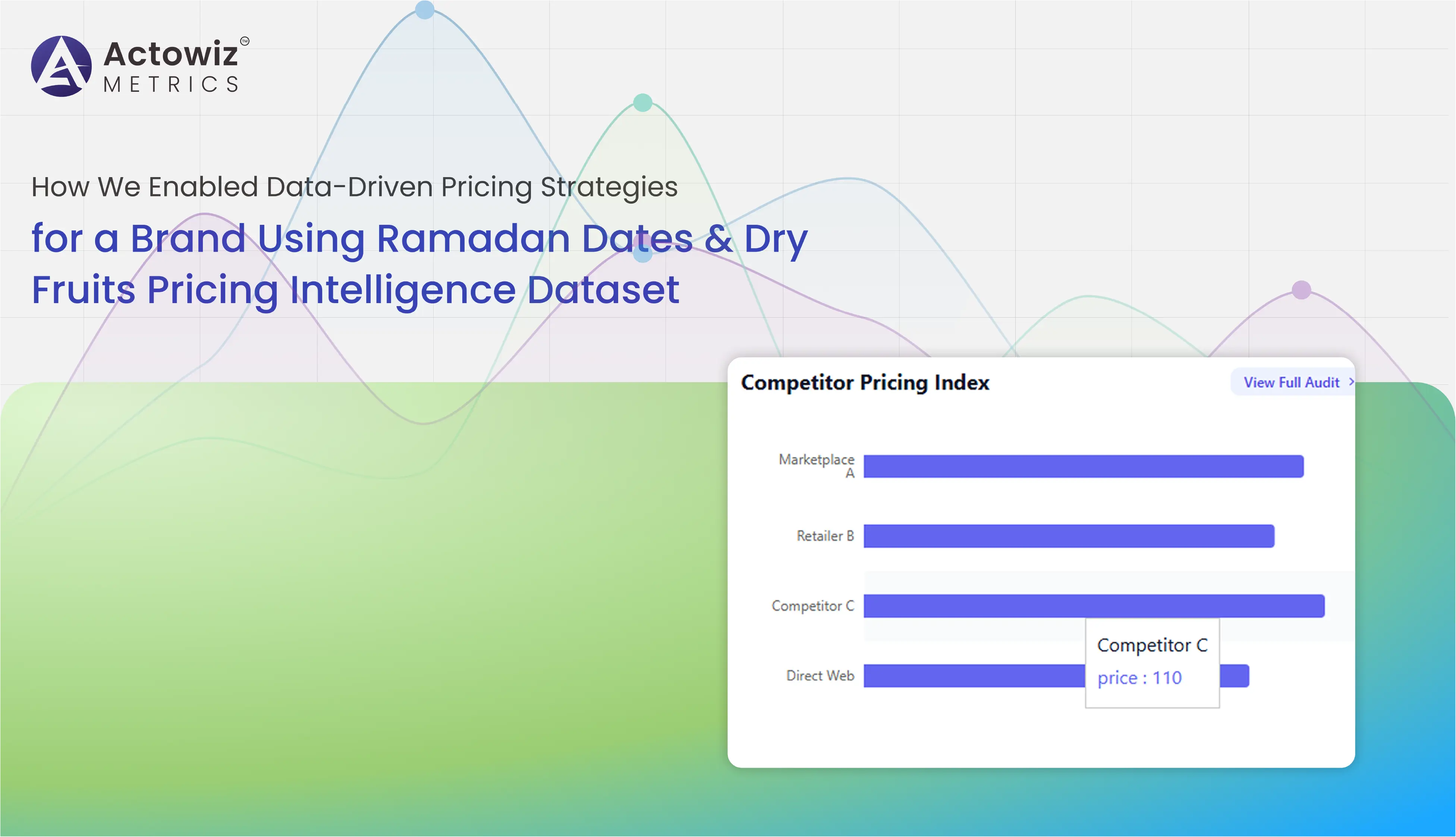

Data-driven pricing strategy case study using Ramadan Dates & Dry Fruits Pricing Intelligence Dataset to optimize revenue and competitive pricing.

Explore Now

Browse expert blogs, case studies, reports, and infographics for quick, data-driven insights across industries.

Real Estate Data Analytics from Property24 South Africa delivers insights on pricing trends, demand shifts, listings, and investment opportunities.

Leveraging Grocery Data Analytics from Chedraui USA to benchmark competitors, track pricing trends, and uncover actionable market insights.

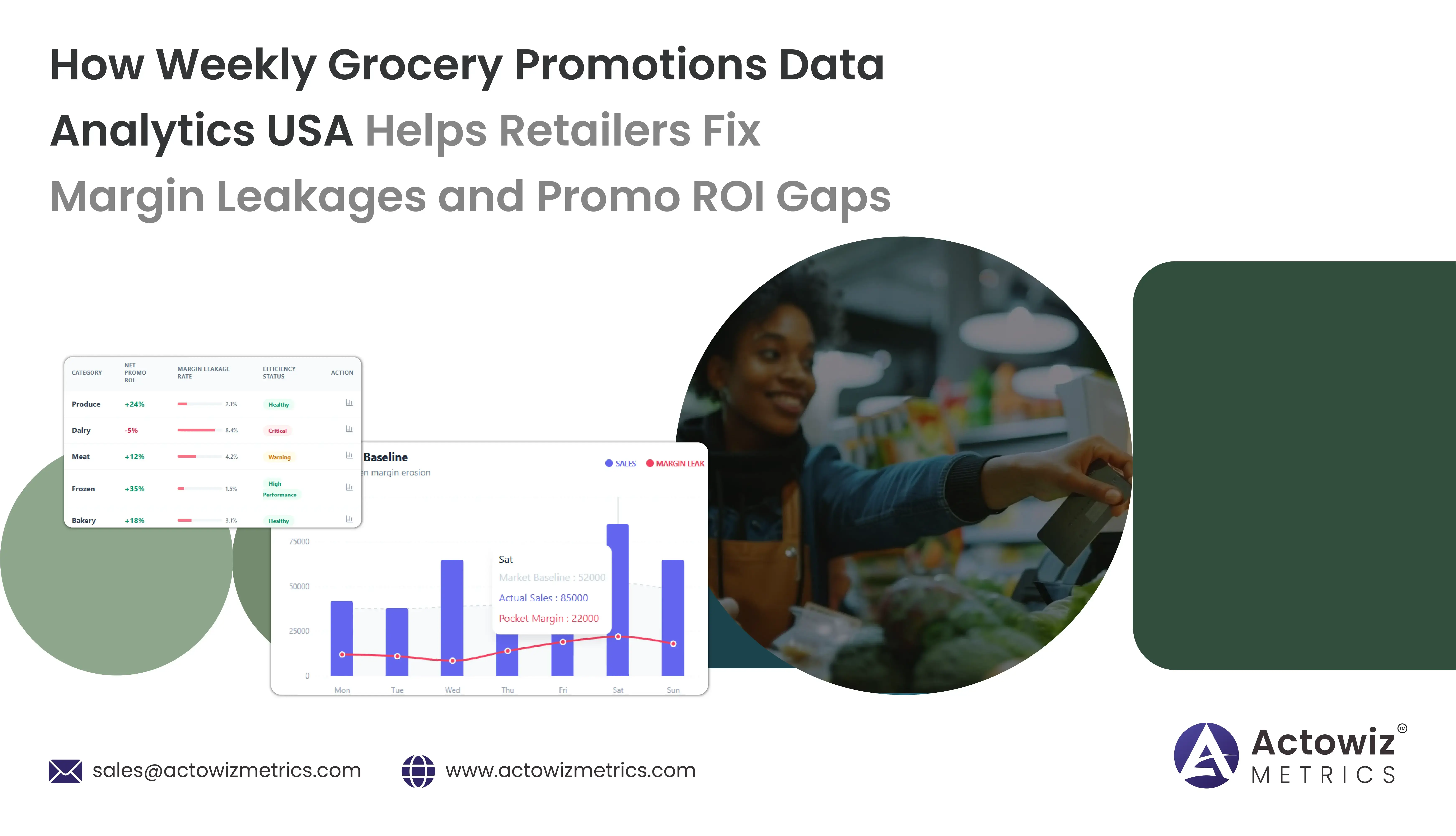

How Weekly Grocery Promotions Data Analytics USA uncovers margin leakages, tracks promo ROI gaps, and optimizes discount strategies for higher profits.

Mini Perfumes Data Analytics on Walmart & Target delivers insights on pricing, discounts, SKU trends, and competitive positioning across both retailers.

Sehri Delivery Heatmap Data Analysis - UAE & Saudi Arabia.webp)

Late-Night (12 AM–4 AM) Sehri Delivery Heatmap Data Analysis across UAE & Saudi Arabia revealing peak demand zones, order spikes, and pricing trends.

Chinese E-Commerce Websites Data Tracking - POIZON & DEWU delivers insights on pricing trends, product demand, brand performance, and market competition in China.

This SMP tracks pricing, visibility, and Skittles Trends Market Performance And Demand to help brands optimize retail strategy and boost growth.

Explore Luxury vs Smartwatch - Global Price Comparison 2025 to compare prices of luxury watches and smartwatches using marketplace data to reveal key trends and shifts.

E-Commerce Price Benchmarking: Gucci vs Prada reveals 2025 pricing trends for luxury handbags and accessories, helping brands track competitors and optimize pricing.

Explore the Amazon Baby Care Report analyzing Top Baby Brands Analysis on Amazon, covering discounts, availability, and popular products with data-driven market insights.

Amazon Sports & Outdoors Report - Sports & Outdoors Top Brands Analysis on Amazon - Prices, Discounts, Reviews

Enabled a USA pet brand to optimize pricing, inventory, and offers on Amazon using Pet Supplies Top Brands Analysis on Amazon for accurate, data-driven decisions.

Whatever your project size is, we will handle it well with all the standards fulfilled! We are here to give 100% satisfaction.

Any analytics feature you need — we provide it

24/7 global support

Real-time analytics dashboard

Full data transparency at every stage

Customized solutions to achieve your data analysis goals