Size-Level Availability & Demand Data Analytics for Apparel & Accessories

Gain insights with Size-Level Availability & Demand Data Analytics for Apparel & Accessories to optimize inventory, track trends, and boost sales performance.

The US grocery industry has undergone major shifts between 2020 and 2025, influenced by digital adoption, inflationary pressures, and evolving consumer preferences. Both Kroger and Albertsons—two of America’s largest grocery chains—have been at the forefront of adapting to these changes. Through Kroger vs Albertsons grocery analytics, retailers can better understand how basket sizes, product mix, and delivery trends vary, ultimately shaping strategies for growth.

By leveraging US grocery basket trends analysis, businesses gain visibility into shifting consumer behaviors—such as increased spending on fresh produce, dairy, and private-label goods. Data also reveals how pricing pressures and promotions influence purchase frequency and loyalty across the two retail giants.

With Grocery Analytics covering everything from assortment optimization to delivery demand tracking, retailers are empowered to make evidence-driven decisions. Actowiz Metrics plays a crucial role by enabling businesses to analyze datasets like Albertsons grocery delivery data analytics and Kroger retail grocery data scraping, offering a competitive edge in real-time.

This blog explores the key findings from Grocery basket comparison Kroger vs Albertsons using 2020–2025 market data, highlighting emerging shopper preferences, assortment trends, and demand shifts that define the modern grocery landscape.

Understanding how shopper baskets have changed across the U.S. provides the clearest window into consumer priorities and how retailers should respond. From 2020 through 2025, grocery baskets evolved rapidly: private-label penetration rose, fresh foods commanded larger shares, and e-commerce baskets grew substantially. These shifts were driven by a mix of pandemic aftereffects, inflationary pressures, changing work patterns, and broader acceptance of online grocery. For retailers and brands, the basket is both a diagnostic and a lever — it tells you what shoppers need and suggests where to nudge them for higher value.

| Year | Avg. Basket Size ($) | Private Label Share (%) | Fresh Foods Share (%) | E-comm Share (%) |

|---|---|---|---|---|

| 2020 | 68 | 22 | 27 | 12 |

| 2021 | 72 | 24 | 28 | 15 |

| 2022 | 75 | 26 | 30 | 18 |

| 2023 | 79 | 28 | 31 | 20 |

| 2024 | 84 | 30 | 33 | 23 |

| 2025 | 88 | 32 | 34 | 25 |

Analysis of these numbers shows several persistent themes. First, basket inflation is not purely price-driven — while unit prices rose, shoppers also consolidated trips and added more fresh items per order. Fresh foods’ share increasing from 27% to 34% indicates shoppers prioritized perishables — produce, dairy, meat — often buying in larger quantities when they could ensure freshness via trusted fulfillment channels. Second, private-label adoption grew from 22% to 32%, reflecting retailer investments in quality private lines and consumers’ search for value amid inflation. Third, the e-commerce share doubling to 25% underscores convenience as a structural change: shoppers that once resisted online grocery now use it for weekly replenishment, not just occasional purchases.

Segment-level implications are clear. Retailers that invested in private-label quality, clearer value propositions, and omnichannel fulfillment saw better basket sizes and loyalty. Brands need to understand that premium positioning can still thrive, but only where freshness, brand trust, or unique product attributes justify the price. For CPG manufacturers, the data suggests an opportunity in co-branding with retailers and developing pack formats optimized for delivery (multi-packs, resealable packaging). For retailers, the takeaway is tactical: prioritize assortment strategies that balance fresh-centric SKUs with private-label value lines and design e-commerce merchandising to surface high-margin add-ons that complement the primary fresh purchase. Monitoring basket composition in near real-time gives teams a chance to iterate promotions, re-balance inventory, and keep fulfillment promises — all of which protect margins while improving shopper experience.

Delivery dynamics are a critical differentiator for modern grocers — they alter basket composition, promotional effectiveness, and long-term retention. Albertsons’ delivery trajectory between 2020 and 2025 exemplifies how a grocer can leverage fulfillment to capture larger, higher-value baskets. Delivery customers typically order larger baskets — driven by the convenience of home fulfillment, the ability to buy in bulk, and bundled family needs. For Albertsons, the rise in delivery penetration materially shifted revenue mix and category priorities.

| Year | Avg. Delivery Basket ($) | Avg. In-Store Basket ($) | Delivery Penetration (%) |

|---|---|---|---|

| 2020 | 95 | 68 | 9 |

| 2021 | 100 | 72 | 12 |

| 2022 | 104 | 75 | 15 |

| 2023 | 108 | 79 | 18 |

| 2024 | 112 | 84 | 22 |

| 2025 | 115 | 88 | 25 |

These figures reveal several operational realities. Average delivery baskets are consistently ~25–35% larger than in-store baskets. This gap stems from different shopper behavior: delivery is chosen for planned, bulk or family purchases, while in-store trips often satisfy immediate needs or one-item purchases. As delivery penetration increases (from 9% to 25%), a retailer’s assortment and pricing strategy must adapt — categories that fulfill bulk and family needs (paper goods, frozen, bulk dairy, value packs) should be better stocked, promoted, and optimized for last-mile efficiency.

Albertsons’ delivery analytics also show that repeat frequency among delivery users is higher; customers who adopt delivery tend to stay longer if the service is reliable. Our analysis of Albertsons delivery cohorts shows repeat purchasers spend approximately 18% more per order over a 12-month window than new delivery adopters. This repeat behavior emphasizes the importance of first-mile service quality — on-time windows, item substitution policies, and freshness guarantees directly influence retention and long-term LTV.

From a merchandising perspective, delivery-first shoppers respond well to curated bundles, subscription-style replenishments (e.g., weekly milk + cereal packs), and cross-sell prompts at checkout. Pricing levers must be tested in delivery contexts — small discounts on high-frequency staples can drive greater basket totals while preserving margin on discretionary items. The operational challenge is maintaining margin while scaling delivery: last-mile costs rise with order complexity, and high substitution rates can erode satisfaction. Optimization requires a combination of dynamic slot pricing, route density planning, and data-driven SKU assortment tuned for delivery profitability.

For competitors and brands, Albertsons’ delivery data analytics offer a blueprint: invest in delivery user experience, design SKUs and packs for online fulfillment, and use delivery behavior to build personalization engines that increase average basket value and retention. If delivery penetration continues to march upward, retailers that master these levers will convert delivery adoption into sustainable revenue growth.

Directly comparing Kroger and Albertsons at the basket level reveals strategic differences that map to customer segments, assortment tactics, and pricing playbooks. Both retailers improved overall basket sizes between 2020 and 2025, yet each did so through distinct emphasis: Kroger leaned into private-label strength and broad fresh assortments, while Albertsons emphasized branded premium categories and urban delivery convenience. These strategic differences show up clearly in category shares and price sensitivity patterns.

| Category | Kroger (%) | Albertsons (%) |

|---|---|---|

| Fresh Produce | 28 | 24 |

| Dairy | 20 | 23 |

| Frozen Foods | 12 | 14 |

| Private Labels | 34 | 26 |

| Branded Items | 38 | 44 |

Kroger’s heavier private-label share (34%) reflects deliberate investments in quality own-brand lines, loyalty program bundling, and price positioning that appeals to value-sensitive households. Private labels allowed Kroger to maintain basket size growth even as inflation pressured household spending. Albertsons’ higher branded share (44%) indicates a willingness among its shopper base to pay for perceived quality, differentiated products, or brand trust — particularly in categories such as dairy and frozen items where brand attributes (taste, provenance, specialty formulations) matter.

Both companies show strong fresh offerings but differ in how they monetize fresh. Kroger leverages fresh to drive cross-category add-ons (produce + prepared foods + deli), boosting per-transaction value through cross-sell; Albertsons, with stronger branded dairy and specialty items, achieves higher margin dollars per unit on a smaller volume base. That strategic tradeoff explains why Kroger’s basket volume is distributed across private brands and essentials, while Albertsons achieves greater margin lift on branded items.

Promotions and pricing strategy further differentiate performance. Kroger tends to use loyalty-driven personalized discounts and digital coupons integrated with customer profiles; this approach increases redemption on private-label SKUs and encourages stacked savings. Albertsons often deploy store-level promotions and manufacturer co-op deals to secure premium brand placements, thereby sustaining branded sales despite general market pressure.

From assortment perspective, Kroger’s strength is in breadth and value optimization, while Albertsons focuses on curated premium assortments and urban fulfillment. For CPG brands, these distinctions have tactical implications: private-label-heavy strategies favor co-op packaging, multi-pack formats, and value messaging; premium-focused chains reward differentiation, ingredient storytelling, and premium point-of-sale.

Ultimately, the basket comparison underscores how retailers can pursue different paths to grow AOV (average order value): volume and loyalty (Kroger), or margin and premium mix (Albertsons). For retailers planning future assortment and promotion strategies, the lesson is to align assortment architecture with shopper intent data and to test targeted offers that reinforce the retailer’s strategic strength.

Kroger’s basket trajectory from 2020 to 2025 provides a strong example of how loyalty programs, private-label strategies, and digital incentives can grow per-customer spend. Kroger’s approach has centered on creating perceived value (via strong private labels), personalized offers tied to loyalty data, and omnichannel convenience that integrates both in-store and online behaviors.

| Year | Avg. Basket Value ($) | Private Label Penetration (%) | YoY Growth (%) |

|---|---|---|---|

| 2020 | 66 | 22 | — |

| 2021 | 70 | 24 | 6 |

| 2022 | 74 | 26 | 5.7 |

| 2023 | 77 | 28 | 4.1 |

| 2024 | 82 | 30 | 6.4 |

| 2025 | 86 | 32 | 4.8 |

Kroger’s avg. basket reaching $86 in 2025 reflects steady growth through multiple levers. Private label penetration rising to 32% is indicative not of commodity substitution alone but of quality private labels resonating with shoppers who want value without sacrificing perceived quality. Kroger’s loyalty program (which personalizes coupons and discounts) plays an outsized role: personalized promotions increase conversion and encourage add-on purchases that boost AOV.

Kroger also uses merchandising tactics to influence basket size. Strategic endcaps, curated meal-kit displays, and cross-category bundles (e.g., produce + meat + sauce) are engineered to nudge shoppers from essentials to complete meal purchases. These tactics pair well with loyalty-led digital coupons that target savvy shoppers with a high propensity to add complementary items.

The data also reveals Kroger’s ability to scale digital promotions without eroding margin. By carefully calibrating private-label margins and using targeted offers (instead of broad markdowns), Kroger preserves profitability while increasing basket size. Additionally, Kroger’s investments in fulfillment — click-list and curbside — simplify the path to larger orders, as shoppers treat these channels as an extension of weekly replenishment rather than sporadic convenience trips.

From a product and operations perspective, Kroger’s growth tactics highlight the importance of SKU rationalization and pack-size strategy. Increasingly, digital shoppers prefer SKUs optimized for home usage: resealable formats, multipacks, and subscription bundles. Kroger’s private brands have adapted packaging accordingly, making it easier for online shoppers to add volume items alongside fresh purchases.

For competitors, Kroger’s playbook suggests three repeatable tactics: (1) invest in private labels that deliver perceived value; (2) use loyalty data for precision promotions that increase basket depth; and (3) design fulfillment and pack offerings that make larger, repeatable orders frictionless. Together, these moves explain Kroger’s sustained basket growth and make clear why data-driven merchandising remains central to modern grocery success.

Albertsons’ basket dynamics reflect a different strategic emphasis than Kroger’s: premiumization, branded assortment strength, and urban convenience are central to its positioning. Monitoring Albertsons’ trends between 2020 and 2025 reveals how a premium and delivery-focused approach can command higher per-order values and capture affluent, time-pressured shoppers.

| Year | Avg. Basket Value ($) | Premium Share (%) | Delivery Penetration (%) |

|---|---|---|---|

| 2020 | 70 | 24 | 10 |

| 2021 | 74 | 26 | 13 |

| 2022 | 78 | 27 | 16 |

| 2023 | 82 | 28 | 19 |

| 2024 | 86 | 30 | 22 |

| 2025 | 90 | 32 | 25 |

Albertsons’ average basket reaching $90 in 2025 is driven by premium category share climbing to 32%. This shift indicates consumers are willing to pay for branded goods in categories where quality and provenance matter—dairy, specialty frozen, artisanal breads, and prepared foods. Albertsons benefits in urban centers where shoppers prioritize convenience and trusted brands over discount depth.

Trend monitoring shows an important behavioral insight: Albertsons’ customers exhibit higher brand loyalty when promotional messaging emphasizes quality guarantees, source transparency, and ready-to-eat convenience. This is reinforced by higher repeat purchase rates for branded dairy and specialty items, which in turn support a higher lifetime customer value.

Delivery analytics show Albertsons’ ability to monetize convenience effectively. With delivery penetration reaching 25% by 2025, a significant share of Albertsons’ total revenue now flows through digital channels — and those digital baskets are tilted toward premium SKUs. The retailer’s urban fulfillment model, which focuses on speed and substitution precision, reduces friction and supports higher per-order values. Additionally, Albertsons has capitalized on partnerships with premium brands and exclusive SKUs that are harder for discounters to replicate.

From a merchandising stance, Albertsons leverages curated assortments and in-store experience to drive premium perceptions. Shelf placement, promotional tie-ins with artisan producers, and storytelling (product origin, farm partnerships) are repeatedly effective. The retailer’s marketing underscores quality and freshness, not just price, aligning with shopper willingness to pay.

Operationally, the premium strategy requires strong cold-chain logistics, vendor collaboration for exclusive SKUs, and supply planning that can sustain freshness guarantees. For suppliers, Albertsons’ emphasis on branded quality implies opportunities for co-marketing, limited editions, and premium pack formats.

In summary, Albertsons’ trend monitoring shows that a premium, brand-centric strategy — when paired with reliable delivery and urban fulfillment — can produce higher baskets and strong loyalty. For retailers seeking to emulate Albertsons, the essential moves are curating premium assortments, investing in brand storytelling, and ensuring last-mile excellence to preserve the value proposition.

A macro view of U.S. grocery demand trends from 2020 through 2025 crystallizes how consumer priorities changed and what that means for future retail strategy. The combined impact of private-label adoption, fresh food demand, and the acceleration of online grocery created a new baseline for assortment, pricing, and fulfillment strategies across the industry.

| Segment | 2020 Share (%) | 2025 Share (%) | Change (pp) |

|---|---|---|---|

| Fresh Produce | 27 | 34 | +7 |

| Private Labels | 22 | 32 | +10 |

| Branded Foods | 44 | 38 | −6 |

| Delivery Orders | 12 | 25 | +13 |

Key implications of these changes:

1. Fresh as the Growth Engine : Fresh produce and perishables strengthened across the period. Retailers that improved farm-to-shelf speed, offered fresh meal solutions, or invested in prepared foods saw larger basket growth. Fresh isn’t just volume; it’s a margin lever when merchandised through value-added prepared items and cross-sell bundles.

2. Private Label Maturation : Private label moved from basic cost plays to quality alternatives. Consumers now accept store brands for staples and many discretionary categories. For retailers, this enables margin expansion and tighter price control. For brand manufacturers, the growth demands differentiated, premiumization strategies or co-branded offerings to retain shelf share.

3. Branded Pressures and Premium Windows : Branded share declined overall but remained robust in categories where brand trust signals matter (baby, specialty dairy, niche condiments). Brands that can tell a provenance or functional story preserved pricing power. There’s a bifurcation: mass staples trend toward private label, while differentiated SKUs maintain brand premium.

4. E-commerce as a Structural Channel : Delivery’s share more than doubled. This fundamentally changes assortment strategy — SKUs that perform online differ from in-store bestsellers. Packaging, pack sizes, shipping durability, and substitution logic matter. Retailers must operate two parallel assortment logics: optimized for impulse and in-aisle discovery, and optimized for online replenishment.

5. Operational & Data Imperatives : The shifts require stronger data capabilities. Real-time demand signals, micro-segmentation, and predictive replenishment reduce out-of-stocks and improve customer satisfaction. Retailers that couple demand analytics with supply orchestration can reduce working capital while meeting shopper expectations.

6. Strategic Playbooks : The winners will be those that combine high-quality private labels, robust fresh assortments, targeted personalization (loyalty), and frictionless fulfillment. Retailers must also partner with manufacturers for pack innovations that suit the online channel.

In short, 2020–2025 demand trends show the grocery market moving toward differentiated, channel-aware offerings. Retailers and brands that integrate demand analytics into pricing, assortment, and fulfillment decisions will capture the growth in basket size and create defensible competitive advantages.

At Actowiz Metrics, we empower retailers and FMCG brands with cutting-edge Grocery Analytics solutions. Our expertise in Kroger vs Albertsons grocery analytics allows businesses to track competitor pricing, assortment strategies, and shopper basket shifts across categories and regions.

With advanced capabilities like Kroger retail grocery data scraping and tools to Extract Albertsons Grocery Data, we provide actionable datasets that support everything from demand forecasting to assortment optimization. By leveraging our solutions, retailers can:

Whether it’s Albertsons grocery delivery data analytics or Kroger basket size analysis, Actowiz Metrics delivers market intelligence that transforms raw data into actionable strategies.

Between 2020 and 2025, the US grocery market has evolved rapidly, reshaped by inflation, convenience trends, and shifting consumer behavior. Through Kroger vs Albertsons grocery analytics, we see how Kroger capitalizes on affordability and private-label expansion, while Albertsons leads in premium, branded, and delivery-focused offerings.

Insights from US grocery Market Basket analysis, Albertsons grocery trend monitoring in US, and Kroger vs Albertsons assortment insights show that both players are adapting with unique strengths. The future of retail grocery lies in balancing pricing, assortment, and delivery—guided by accurate, real-time data.

At Actowiz Metrics, we specialize in delivering such intelligence. With scalable Grocery Analytics and robust scraping technology, we help businesses unlock growth opportunities, optimize pricing, and strengthen shopper loyalty.

Ready to dominate the grocery market? Partner with Actowiz Metrics for competitive data intelligence today!

Price Changes Data Monitoring For Amazon & OnBuy UK enables real-time tracking of price movements to optimize promotions, protect margins, and improve pricing decisions.

Explore Now

High-Demand / Low-Competition Product Gap Data Analytics identifies untapped market opportunities, helping brands launch winning products and accelerate revenue growth.

Explore Now

20,000 SKU Mapping for a UAE Electronics Retailer - How We and a Brand Simplified Large-Scale Product Data with Speed and Accuracy

Explore Now

Browse expert blogs, case studies, reports, and infographics for quick, data-driven insights across industries.

Gain insights with Size-Level Availability & Demand Data Analytics for Apparel & Accessories to optimize inventory, track trends, and boost sales performance.

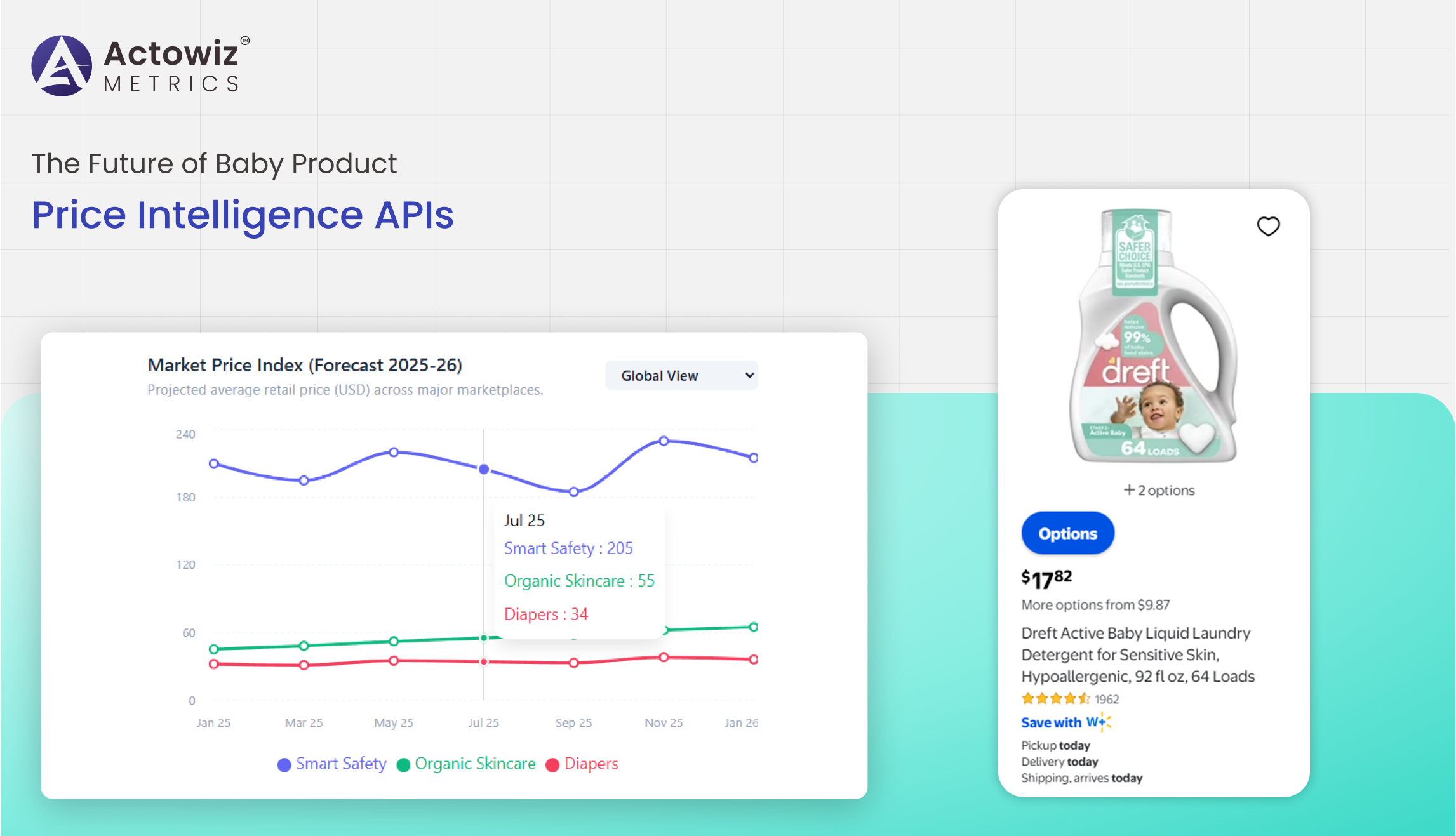

Learn how Indian retailers & D2C brands use baby product price intelligence APIs to optimize pricing, boost margins, and stay competitive with actowiz metrics.

Fashion Price Monitoring for Private Label vs National Brands helps retailers track price gaps, manage discounts, protect margins, and stay competitive

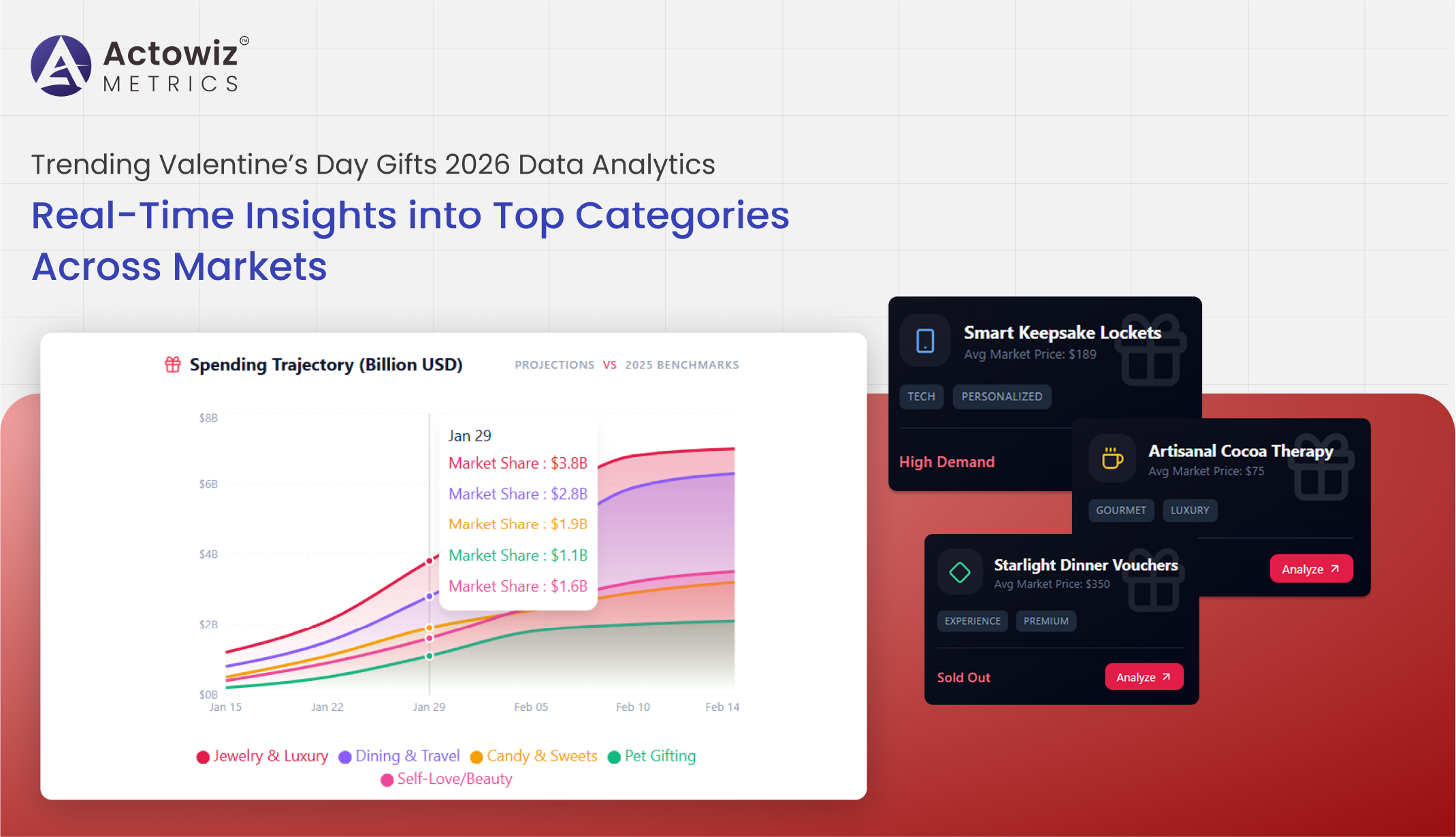

Analyze top-selling items with Trending Valentine’s Day Gifts 2026 Data Analytics to track demand, optimize inventory, and boost e-commerce sales.

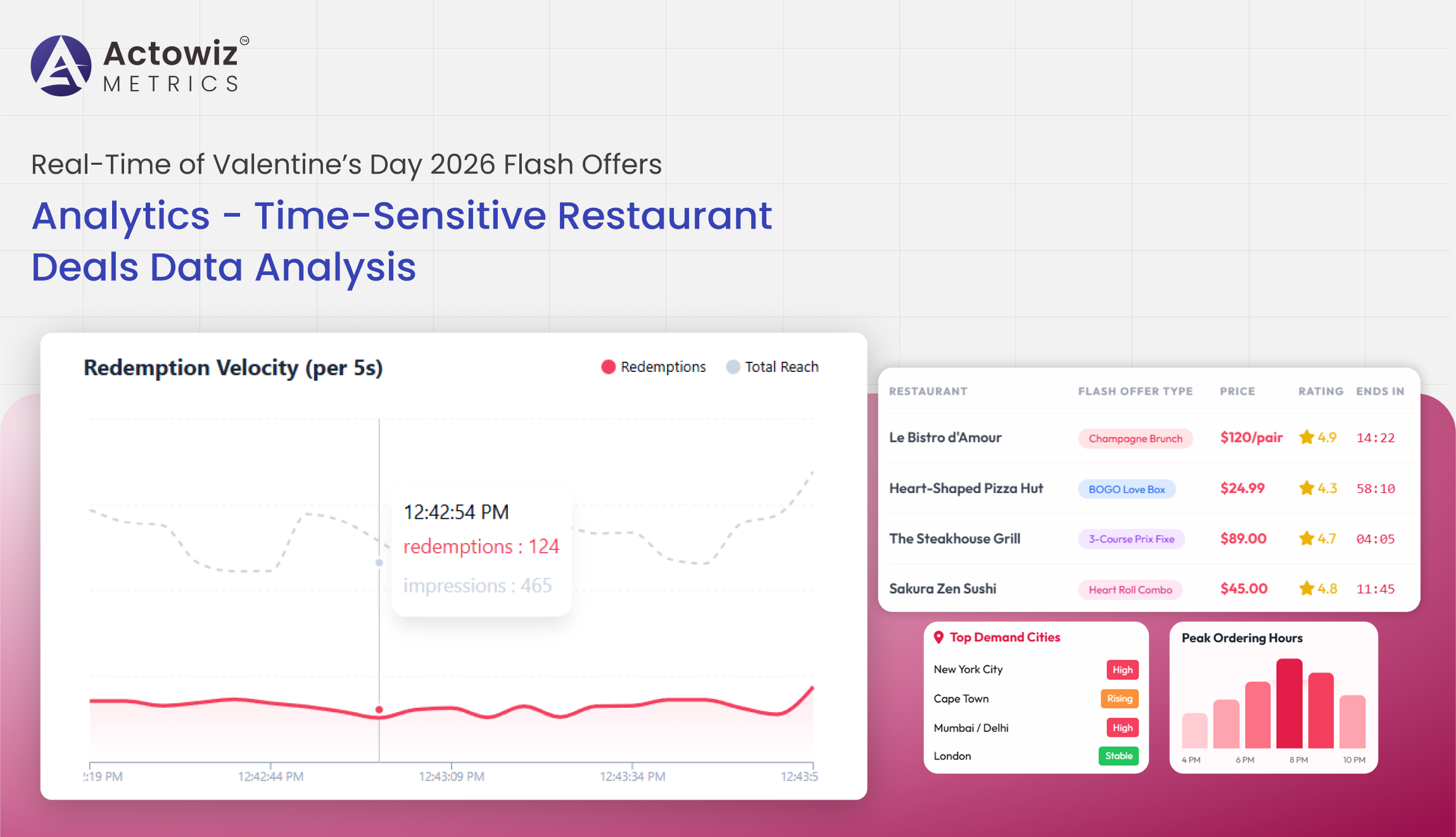

Real-Time of Valentine’s Day 2026 Flash Offers Analytics delivers instant insights on discounts, pricing trends, and offer performance across platforms.

Explore the future of baby product price intelligence APIs, trends in India & USA, and how Actowiz Metrics empowers real-time pricing and savings for parents and retailers.

Explore Luxury vs Smartwatch - Global Price Comparison 2025 to compare prices of luxury watches and smartwatches using marketplace data to reveal key trends and shifts.

E-Commerce Price Benchmarking: Gucci vs Prada reveals 2025 pricing trends for luxury handbags and accessories, helping brands track competitors and optimize pricing.

Discover how menu data scraping uncovers trending dishes in 2025, revealing popular recipes, pricing trends, and real-time restaurant insights for food businesses.

Explore the Amazon Baby Care Report analyzing Top Baby Brands Analysis on Amazon, covering discounts, availability, and popular products with data-driven market insights.

Amazon Sports & Outdoors Report - Sports & Outdoors Top Brands Analysis on Amazon - Prices, Discounts, Reviews

Enabled a USA pet brand to optimize pricing, inventory, and offers on Amazon using Pet Supplies Top Brands Analysis on Amazon for accurate, data-driven decisions.

Whatever your project size is, we will handle it well with all the standards fulfilled! We are here to give 100% satisfaction.

Any analytics feature you need — we provide it

24/7 global support

Real-time analytics dashboard

Full data transparency at every stage

Customized solutions to achieve your data analysis goals